- home

- Reference

- Laws

In the Russian Federation, citizens retire when they reach a certain age. But some people are forced to work in difficult conditions that affect their health.

Therefore, on the basis of Resolution No. 781, a certain list of professions is established for which citizens have the right to retire early. At the same time, two lists are presented, each of which offers different types of benefits and concessions.

WHAT IS IMPORTANT TO KNOW ABOUT THE NEW PENSIONS BILL

When assigning pensions to medical workers, the Lists of Positions and Institutions and the Rules for Calculating Work Periods, approved by the Decree of the Government of the Russian Federation dated October 29, 2002, are applied. No. 781. According to the List, medical specialists of all titles (except for statisticians), including medical heads of institutions (their structural divisions) carrying out medical activities, and nursing staff with a list of specific positions have the right to early retirement. For example, nurse, paramedic, midwife, x-ray technician.

Almost two thousand medical workers in the Kaliningrad region receive early retirement pension. This was announced on the eve of Doctor's Day by the head of the group for assessing the pension rights of insured persons of the regional branch of the Pension Fund of the Russian Federation, Igor Burmatov. He recalled that early pension for medical workers is a special category of pensions, the assignment of which is carried out earlier than the generally established retirement age for long-term professional activity in protecting public health in healthcare institutions. In this case, the following conditions must be met simultaneously: carrying out medical activities in certain positions and healthcare institutions and having at least 25 years of experience in such work in rural areas and urban-type settlements or at least 30 years in cities, rural areas and urban-type settlements (working village) or only in cities.

10. Work in the positions of assistant director for the regime, senior duty officer for the regime, duty officer for the regime, organizer of extracurricular and out-of-school educational work with children, teacher-methodologist, hearing room instructor, parent-educator, as well as in the positions specified in the list, in family-type orphanages are counted towards work experience for the period before November 1, 1999.

4. Periods of work performed before September 1, 2000 in positions in institutions specified in the list are counted towards the length of service, regardless of the conditions for fulfilling the working time norm (teaching or educational load) during these periods, and starting from September 1, 2000, when subject to fulfillment (in total for the main and other places of work) of the standard working time (teaching or educational load) established for the wage rate (official salary), with the exception of cases determined by these Rules.

Criteria for "preferential"

The state establishes these “certain positions” and “certain places of work” in the relevant regulations. Anyone can familiarize themselves with them in Decree of the Government of Russia No. 781 of October 29, 2002.

The general criteria for “preferentiality” are:

- the organizational and legal form of a healthcare enterprise cannot be other than an “institution”;

- the name of the enterprise must contain the words specified in Resolution No. 781, for example: “hospital”, “hospital”, “medical hospital”. part", "orphanage" and others;

- if a medical worker carried out his activities not in a healthcare enterprise, but in medical structural divisions of individual organizations, then this activity is counted towards the “preferential length of service” on a general basis. For example, such organizations may include: clinics at medical universities, sanitary units, laboratories at military units, military institutes, etc. (for more details, see clause 6 of the Rules for calculating the periods of work of doctors of Resolution No. 781).

- the position held by an individual medical employee must be listed in the relevant list of Resolution No. 781.

All the features of the new government decree No. 781

It is worth noting that the name of the institution may change at any time, as well as the title of the position. But this does not mean that as a result, the duration of the work will simply be lost and, as a result, it will not be possible to restore it. Government Decree 516 of the Russian Federation ensured the identity of some professions and organizations. Accordingly, if there is a specialty “paramedic in narcology”, it will be replaced by “paramedic-narcologist”. Similar identity is provided for most medical institutions. The government chose the right approach, which made it possible to take into account all the nuances, so that employees will not lose the experience they have gained.

According to the government decision, traditionally in the Russian Federation, retirement occurs at the age of 55/60 for women and men, respectively. As for the insurance period, its duration must be at least 5 years. But there are a number of exceptions - the required years of work vary depending on the profession. Medical workers must work for at least 25 years, and for employees of children's institutions this bar is reduced to 17 years. But it is important to focus on the list of professions, which is established by government decree No. 781, current as of October 29, 2002. For some of them, the PP sets a reduced production rate, which can range from 36 to 39 hours per week.

Decree of the Government of the Russian Federation dated July 11, 2002 No. 516

Approved by Decree of the Government of the Russian Federation of July 11, 2002 No. 516

Rules for calculating periods of work giving the right to early assignment of an old-age labor pension in accordance with Articles 27 and 28 of the Federal Law “On Labor Pensions in the Russian Federation”

1. These Rules establish the calculation procedure periods of work giving the right to early assignment of an old-age labor pension in accordance with Articles 27 and 28 of the Federal Law “On Labor Pensions in the Russian Federation” (hereinafter referred to as the Federal Law).

Along with the procedure for calculating periods of work established by these Rules, the procedure for calculating periods of work giving the right to early assignment of an old-age labor pension in accordance with subparagraphs 11 and 13 of paragraph 1 of Article 27 and subparagraphs 10 - 12 of paragraph 1 of Article 28 of the Federal Law is regulated by the rules calculation of periods of work giving the right to early assignment of the specified labor pension, approved upon adoption in the prescribed manner of lists of relevant works, industries, professions, positions, specialties and institutions (hereinafter referred to as lists).

2. When assigning an old-age labor pension to citizens early in the manner prescribed by these Rules, the periods of the following work are summed up:

1) underground work, work with hazardous working conditions and in hot shops;

2) work under difficult working conditions;

3) the work of women as tractor drivers in agriculture and other sectors of the economy, as well as as drivers of construction, road and loading and unloading machines;

4) the work of women in the textile industry in jobs with increased intensity and severity;

5) work as working locomotive crews and workers of certain categories who directly organize transportation and ensure traffic safety on railway transport and the subway, as well as as truck drivers directly in the technological process in mines, open-pit mines, mines or ore quarries for export coal, shale, ore, rock;

6) work in expeditions, parties, detachments, on sites and in teams directly on field geological exploration, search, topographic and geodetic, geophysical, hydrographic, hydrological, forest management and survey work;

7) work as workers and foremen (including senior workers) directly at logging and timber rafting sites, including servicing mechanisms and equipment;

9) work as a crew member on ships of the sea, river fleet and fishing industry fleet (with the exception of port ships constantly operating in the port water area, service and auxiliary and traveling ships, suburban and intracity traffic vessels);

10) work as drivers of buses, trolleybuses and trams on regular city passenger routes;

11) work in the Far North and equivalent areas;

12) work of citizens (including those temporarily sent or sent on business) in the exclusion zone to eliminate the consequences of the disaster at the Chernobyl nuclear power plant;

13) work as a civil aviation flight crew;

14) work on direct control of civil aviation flights;

15) work in the engineering and technical staff for direct maintenance of civil aviation aircraft;

16) work as rescuers in professional emergency rescue services, professional emergency rescue units of the Ministry of the Russian Federation for Civil Defense, Emergencies and Disaster Relief (subparagraph additionally included on May 19, 2006 by Decree of the Government of the Russian Federation dated May 2, 2006 year No. 266);

17) work with convicts as workers and employees of institutions executing criminal penalties in the form of imprisonment (the subparagraph was additionally included on May 19, 2006 by Decree of the Government of the Russian Federation of May 2, 2006 No. 266);

18) work in positions of the State Fire Service (fire protection, fire-fighting and emergency rescue services) of the Ministry of the Russian Federation for Civil Defense, Emergencies and Disaster Relief (sub-item additionally included on May 19, 2006 by Decree of the Government of the Russian Federation dated May 2 2006 No. 266).

3. The summation of the periods of work specified in paragraph 2 of these Rules is carried out in the following order by adding:

to the periods of work specified in subparagraph 1 - periods of work specified in subparagraph 12;

to the periods of work specified in subparagraph 2 - the periods of work specified in subparagraph 1, as well as the periods of work specified in subparagraphs 5 - 7, 9, 12, in case of early assignment of an old-age pension in accordance with paragraph one of subparagraph 2 of paragraph 1 Article 27 of the Federal Law (paragraph as amended, put into effect on May 19, 2006 by Decree of the Government of the Russian Federation of May 2, 2006 No. 266 - see the previous edition);

to the periods of work specified in subparagraph 3 - periods of work specified in subparagraphs 1, 2, 5 - 10, 12;

to the periods of work specified in subparagraph 4 - periods of work specified in subparagraphs 1, 2, 3, 5 - 10, 12;

to the periods of work specified in subparagraph 5 - periods of work specified in subparagraphs 1, 2, 6, 7, 9, 12;

to the periods of work specified in subparagraph 6 - periods of work specified in subparagraphs 1, 2, 5, 7, 9, 12;

to the periods of work specified in subparagraph 7 - periods of work specified in subparagraphs 1, 2, 5, 6, 9, 12;

to the periods of work specified in subparagraph 8 - periods of work specified in subparagraphs 1, 2, 3, 5 - 7, 9, 10, 12;

to the periods of work specified in subparagraph 9 - periods of work specified in subparagraphs 1, 2, 5 - 7, 12;

to the periods of work specified in subparagraph 10 - periods of work specified in subparagraphs 1, 2, 3, 5 – 9, 12;

to the periods of work specified in subparagraph 11 - periods of work specified in subparagraphs 1 - 10, 16 - 18 (paragraph as amended, put into effect on May 19, 2006 by Decree of the Government of the Russian Federation of May 2, 2006 No. 266, - see .previous edition);

to the periods of work specified in subclause 14 - periods of work specified in subclause 13;

to the periods of work specified in subparagraph 15 - the periods of work specified in subparagraphs 13, 14.

4. The length of service that gives the right to early assignment of an old-age labor pension (hereinafter referred to as length of service) includes periods of work performed continuously for a full working day, unless otherwise provided by these Rules or other regulatory legal acts, subject to payment for these periods of insurance contributions to the Pension Fund of the Russian Federation.

When applying these Rules to the payment of insurance contributions to the Pension Fund of the Russian Federation, the payment of contributions to state social insurance before January 1, 1991, the unified social tax (contribution) and the unified tax on imputed income for certain types of activities are equated.

5. Periods of work that give the right to early assignment of an old-age labor pension, which was performed continuously during a full working day, are counted towards length of service in calendar order, unless otherwise provided by these Rules and other regulatory legal acts.

At the same time, the length of service includes periods of receiving state social insurance benefits during the period of temporary disability, as well as periods of annual paid leave, including additional ones.

6. Periods of work giving the right to early assignment of an old-age labor pension, which was performed in a part-time working week, but full-time due to a reduction in production volumes (with the exception of work giving the right to early assignment of an old-age labor pension in accordance with subparagraph 13 of paragraph 1 of Article 27 and subparagraphs 10 - 12 of paragraph 1 of Article 28 of the Federal Law), as well as periods of work determined by the Ministry of Labor and Social Development of the Russian Federation in agreement with the Pension Fund of the Russian Federation or provided for by lists that, due to labor organization conditions, cannot performed continuously, calculated based on actual time worked.

7. In case of early assignment of an old-age labor pension in connection with field geological exploration, prospecting, topographic-geodetic, geophysical, hydrographic, hydrological, forest management and survey work in expeditions, parties, detachments, on sites and in brigades, the periods of said work directly in field conditions are taken into account in the following order:

work from 6 months to one year – as one year;

work less than 6 months - according to actual duration.

8. Periods of work on a rotational basis, giving the right to early assignment of an old-age labor pension, include the time of work performed at the site, the time of rest between shifts in the rotation camp, the travel time from the location of the employer or from the collection point to the place of work and back, as well as the time of inter-shift rest in a given calendar period of time. In this case, the total working time (normal or reduced) for the accounting period (for a month, quarter or other longer period, but not more than one year) should not exceed the normal number of working hours established by the Labor Code of the Russian Federation.

Periods of work on a rotational basis in the regions of the Far North and equivalent areas in case of early assignment of an old-age labor pension in accordance with subparagraphs 2 and 6 of paragraph 1 of Article 28 of the Federal Law are calculated in calendar order, including working time directly at the site, rest time between shifts in the rotation camp and the travel time from the employer’s location or from the collection point to the place of work and back (paragraph as amended, put into effect on May 19, 2006 by Decree of the Government of the Russian Federation dated May 2, 2006 No. 266 - see previous editor).

The provision of paragraph two of paragraph 8 of these Rules, to the extent that it does not include the period of inter-shift rest in the length of service in the regions of the Far North and equivalent areas, necessary for the early assignment of an old-age pension, due to the legal positions of the Constitutional Court of the Russian Federation , expressed in decisions that remain in force, loses force and cannot be applied by courts, other bodies and officials as inconsistent with Articles 19 (Part 2) and 39 (Parts 2 and 3) of the Constitution of the Russian Federation (Determination of the Constitutional Court of the Russian Federation of July 12 2006 No. 261-O).

9. When an employee is transferred from a job that gives the right to early assignment of an old-age labor pension to another job that does not give the right to the specified pension, in the same organization for production reasons for a period of no more than one month during a calendar year, such work is equivalent to work preceding translation.

Periods of suspension from work (non-admission to work) are not included in periods of work that give the right to early assignment of an old-age pension if the employee was suspended for the following reasons:

showing up at work under the influence of alcohol, drugs or toxic substances;

on the basis of a medical report in connection with identified contraindications for performing the work provided for by the employment contract (except for the case provided for in paragraph two of clause 12 of these Rules);

at the request of bodies and officials authorized by federal laws and other regulatory legal acts;

if the employee has not undergone training and testing of knowledge and skills in the field of labor protection in the prescribed manner;

if the employee has not undergone a mandatory preliminary or periodic medical examination in accordance with the established procedure;

in other cases provided for by federal laws and other regulatory legal acts.

Periods of downtime (both due to the fault of the employer and the fault of the employee) are not included in periods of work that give the right to early assignment of an old-age pension.

10. The probationary period when hiring a job that gives the right to early assignment of an old-age pension is included in the length of service regardless of whether the employee passed the test.

11. The period of initial vocational training or retraining (on-the-job) at workplaces in accordance with an apprenticeship contract is included in periods of work that give the right to early assignment of an old-age labor pension, in cases where in Articles 27 and 28 of the Federal Law or in the lists indicate production or certain types of work without listing the professions and positions of workers, or provide for employees performing certain work without indicating the names of professions or positions.

12. When transferring, in accordance with a medical report, a pregnant woman at her request from a job that gives the right to early assignment of an old-age labor pension to a job that excludes the impact of unfavorable occupational hazards, such work is equal to the work preceding the transfer.

The periods when the pregnant woman did not work until the issue of her employment was decided in accordance with the medical report are calculated in the same manner.

13. Periods of work during the full navigation period on water transport and during the full season in organizations of seasonal industries, the list of which is determined by the Government of the Russian Federation, are taken into account in such a way that when calculating the length of service giving the right to early assignment of an old-age pension , the length of service in the relevant types of work in the corresponding calendar year was a full year (the clause was additionally included from May 19, 2006 by Decree of the Government of the Russian Federation of May 2, 2006 No. 266).

14. The length of service that gives the right to early assignment of an old-age labor pension includes the time of paid forced absence in the event of illegal dismissal or transfer to another job and subsequent reinstatement to the previous job, which gives the right to early assignment of an old-age labor pension (the clause is additionally included with May 19, 2006 by Decree of the Government of the Russian Federation of May 2, 2006 No. 266).

15. When calculating periods of underground work, which gives the right to an old-age pension regardless of age if there are at least 25 years of such work in accordance with subparagraph 11 of paragraph 1 of Article 27 of the Federal Law, persons who have not completed the underground work experience provided for in this subparagraph, but those with at least 10 years of experience in underground work are taken into account in the following order:

every full year of work as a longwall miner, drifter, jackhammer operator, mining machine operator - for 1 year and 3 months;

every full year of underground work provided for by List No. 1 of production, work, professions, positions and indicators in underground work, in work with particularly harmful and especially difficult working conditions, employment in which entitles the right to an old-age pension (old age) on preferential terms , approved by Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10, - for 9 months.

(The paragraph was additionally included on May 19, 2006 by Decree of the Government of the Russian Federation of May 2, 2006 No. 266.)

Early pensions for medical workers

Clarification 4. A rule has been established on a preferential procedure for calculating special length of service when working in certain positions in certain structural units of healthcare institutions, for which one year of work is counted as a year and six months.

Thus, even after graduating from a university, a graduate does not have the right to work as a doctor without, among other things, completing internship or residency training. Therefore, work as an intern and a trainee doctor should be counted towards special experience, but time spent in residency training should not.

b) work performed under normal or reduced working hours as provided for by labor legislation, work in the positions of director (chief, manager) of orphanages, including sanatoriums, special (correctional) for children with developmental disabilities, as well as deputy director (chief, head) for educational, educational, educational, production, educational and other work directly related to the educational (educational) process, institutions specified in paragraphs 1.1-1.7, 1.9 and 1.10 of the section “Name of institutions” of the list, regardless of the time when this work was performed, as well as the teaching work;

5. Periods of work in educational institutions for children in need of psychological, pedagogical and medical-social assistance specified in paragraph 1.11 of the section “Name of institutions” of the list, in social service institutions specified in paragraph 1.13 of the section “Name of institutions” of the list, as well as periods of work in the position of a music director are counted towards the length of service provided that (in total for the main and other places of work) the standard working time (teaching or educational load) established for the wage rate (official salary) is fulfilled, regardless of the time when this work was performed .

Federal Law 781 list of health worker positions

Reforms in pension legislation contribute to the emergence of many questions among citizens, including those that affect preferential pensions for medical workers. In this article we will try to answer the main ones.

Law 781-FZ on preferential pensions for medical workers

So, doctors in the Russian Federation can go on vacation under special conditions. Moreover, the concept of “preferential medical experience for retirement” does not mean any compensation or payments, but the opportunity to go on vacation and receive appropriate payments ahead of schedule.

That is, reducing the required number of working years to retire. The main aspects of the issue of preferential pensions for medical workers, such as the list of positions, institutions and structural units whose employees are entitled to this social guarantee, are determined by Law 781 “On preferential pensions for medical workers.”

List of health worker positions for preferential pensions

Who is entitled to such a pension in medicine? The Government of the Russian Federation has clearly established a list of specialties, types of medical organizations and positions that can go on vacation on special grounds (specified in Federal Law 781).

Not all doctors have the right, but only those who worked in certain positions specified in the list of positions of medical workers for a preferential pension, namely:

- medical specialists of any description (except for statisticians);

- heads of medical institutions;

- nursing staff (paramedics, nurses, obstetric staff, dentists, laboratory workers, disinfectors).

IMPORTANT! Employees of medical institutions, regardless of their form of ownership, have the right to such conditions for retirement. That is, doctors from private clinics work on an equal basis with employees of government institutions.

These institutions include hospitals, drug treatment clinics, juvenile rehabilitation centers, emergency departments, etc.

Is junior medical staff entitled to a preferential pension?

As you can see, employees related to junior medical staff are not listed in the list.

However, they also have the right to leave for medical workers if they worked in the following departments:

- resuscitation;

- surgery;

- prosektury department;

- infectious diseases or anti-tuberculosis departments;

- psychiatric department;

- in the intensive care unit, etc.

An employee can retire 5 years earlier, provided that he has worked in such a department for at least 20 years.

How is the preferential length of service for a pension for medical workers calculated?

Federal Law 781 stipulates how many years such workers must work at their jobs:

- doctors from rural settlements – 25 years;

- medical workers from cities – 5 years longer.

To calculate the length of service for medical workers to retire, we take only the period when the doctor worked full-time (with the exception of junior medical personnel).

The periods subject to exclusion from the length of service are also taken into account:

- leaves without pay;

- child care up to one and a half or three years;

- resident activity;

- work with established violations (drunk, etc.).

The following are not deducted from medical experience:

- leave due to disability (sickness or maternity leave);

- paid annual leave;

- probation;

- training and retraining.

If a medical worker worked both in a village and in a city, then when determining the length of service, the following coefficient is used: a working year in a village is counted as a year and three months.

Important! When calculating a physician’s length of service, you need to be especially careful and take into account all included and excluded periods. If you have a controversial situation in this matter, you can defend your rights in court.

In addition, there are features of calculating length of service for medical workers working in such structural units as:

- surgery;

- resuscitation;

- examinations;

- forensic examination.

To calculate their length of service, the following rule is used: one year of work is equal to a year and six months.

IMPORTANT! If a doctor is entitled to a preferential pension for several positions, then the coefficients are summed up. For example, to calculate the length of service of a surgeon working in a village, a coefficient of 1.9 is used.

Shortening the work week due to public holidays does not affect the length of service.

How to calculate a preferential pension for a health worker

The amount of payment for each employee is calculated individually by pension fund specialists after submitting all the necessary documents.

The amount of security will depend on several factors, such as:

- salary size;

- place of work;

- type of activity performed;

- position held, etc.

And yet, the main criterion for calculation is the size of his average monthly salary. As a rule, the amount is 55% of the amount received.

IMPORTANT! To determine the average monthly salary, you need to add up your entire salary for the last five years and divide the resulting amount by the number of months (that is, 60).

How to apply for a preferential pension

In order to apply for a preferential retirement, a medical worker must first report to the personnel department of the organization in which he works. There he will be able to obtain the necessary documents to present to the Pension Fund, as well as receive assistance in calculating his work experience.

Latest news about superannuation for doctors

Some citizens have the right to claim benefits upon retirement. This right is enshrined in Federal Law 400 of December 28, 2013. Early old age insurance pensions are provided for medical workers, educational workers and a number of other labor categories (Article 30-32 400-FZ).

The right to early retirement of medical workers, as well as the list of positions of medical workers, are determined by Federal Law, 781 Government Decree of October 29, 2002 and RF Government Decree No. 449 of May 26, 2009.

The possibility of early assignment of an insurance pension is provided by length of service for health workers. After a citizen has worked in a medical position for a certain number of years and acquired special experience, he can apply to the Pension Fund to receive benefits. In this case, the employee’s total length of service and his age at the time of application do not matter.

Read more: Internet portal for public discussion of projects

In 2020, a pension reform was carried out in Russia - Federal Law 350-FZ dated October 3, 2108 came into force. The updated legislation does not abolish the possibility of early retirement, but some innovations have appeared. There is now a deferment period for the retirement benefit period for healthcare employees. Health workers cannot apply for a pension immediately after completing their preferential service. The employee himself chooses whether to work during the deferment or not. The deferment periods are set out in Appendix No. 7 400-FZ. This delay is expected to be five years in 2023. That is, medical workers who complete the required medical experience in 2023 will be able to exercise their pension rights only in 2028. While the transition period is in effect, the deferment will increase annually.

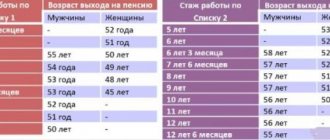

In the table you will find the deferment limits starting from 2020:

| Retirement of doctors under the old legislation | Grace period | Retirement after pension reform |

| First half of 2020 | Six months | Second half of 2020 |

| Second half of 2020 | Six months | First half of 2020 |

| First half of 2020 | One and half year | Second half of 2021 |

| Second half of 2020 | One and half year | First half of 2022 |

| 2021 | Three years | 2024 |

| 2022 | Four years | 2026 |

| 2023 | Five years | 2028 |

Principles for calculating length of service

We have already briefly mentioned the rules by which the duration of medical activity is calculated - they are all listed in the same Resolution No. 781. However, we will help you figure out what’s what.

So, the “preferential length of service” includes the full 25 or 30 years of service in a preferential position, including mixed ones (part of the service in the village, part in the city). If an employee changes jobs several times during his working career, then all “grace periods” are considered and confirmed.

Each “preferential” year of work in the city is counted towards the total length of service in a 1:1 ratio. That is, for one year of work - one year of service. But village employees have the right to relief. They receive “preferential seniority” in a ratio of 1:1.25. In other words, for each working year - one year and three months of service.

Also, at an accelerated pace, the length of service goes to medical workers - surgeons, anesthesiologists, forensic experts, pathologists and other health care workers from the corresponding list (see the same Resolution). They are credited with 1.5 years of service per year of work.

An important point: during the “preferential period”, starting from November 1, 1999, only full rates are taken. Until this date, all places of work are included in the length of service, regardless of the rate. Afterwards - only complete ones or complete ones obtained by addition. For example, if a health worker worked in two “preferential places” at the same time, in each at half the rate.

If you are applying for a preferential pension for a medical worker, you need to come to the Pension Fund of the Russian Federation in advance, about six months to a year before your expected retirement, with your passport, work record book and SNILS. An employee of the Pension Fund of Russia will review the documents you brought and tell you what else is needed to calculate the preferential pension for a health worker. The procedure for checking, confirming and crediting work experience is not a quick process, so you need to prepare for the fact that you will most likely have to prove your right to benefits.

By the way, keep in mind that the benefit only applies during retirement. They do not affect the size in any way and do not increase it.

We hope that we were useful to you. All the best!

Conditions for early retirement for medical workers

Law 781 on preferential pensions for medical workers is not exactly a law, but a Government Decree. RF PP No. 781 establishes a list of job categories in the field of healthcare that can apply for an early long-service insurance pension. Conditions that are the basis:

- Medical experience - the standard is defined in clause 20, part 1, art. 30 400-FZ. To calculate special length of service, only those positions and healthcare institutions that are approved by pension legislation are taken into account.

- Individual pension coefficient - IPC (Part 3 of Article 8 400-FZ). It must be no lower than the permissible value, which grows by 2.4 points annually. For example, in 2020 the IPC was 13.8 points, in 2020 the index is 16.2 points. From 2025, the coefficient will be equal to 30 points.

List of positions

But not all medical employees can apply for a long-service benefit. The list of positions for early retirement for health workers is strictly regulated. To receive a preferential pension, you must officially work in certain types of healthcare organizations, and the job position must be included in the list of positions for medical workers in Federal Law 781 (RF PP No. 781). It indicates the positions and health care institutions for which the pension benefit applies. Please check this list before making an early exit.

| Job title | Type of medical facility | Branch |

Medical specialists of all types (except statisticians)

Chief nurse, nurse

Heads of a paramedic-midwife station, a paramedic health center, a medical center

Nurse, paramedic, medical assistant

Medical technologist, medical laboratory technician

Assistant doctors: epidemiologist, parasitologist, entomologist, sanitary doctor

Instructor-disinfector, medical disinfector, etc.

Psychiatric hospitals, rehabilitation centers, drug treatment clinics

Ambulance stations

Children's rehabilitation centers and boarding homes

Sanatoriums and resorts

Bureau: pathoanatomical (institute), forensic medical examination

Disinfection, anti-plague stations, etc.

Intensive Care Unit

Prosectura, etc.

RF PP No. 781 has been in force since 2002. For earlier periods of work, you need to be guided by other standards. Let's present them in the table:

| Work period | Legal act |

| Until 01/01/1992 | Resolution of the Council of Ministers No. 1397 of December 17, 1959 |

| 01.01.1992–31.10.1999 | Resolution of the Council of Ministers of the RSFSR No. 464 of 09/06/1991 |

| 01.11.1999–31.12.2001 | RF PP No. 1066 dated 09.22.1999 |

| From 01/01/2002 to present V. | RF PP No. 781 dated October 29, 2002 |

How to calculate the preferential length of service of medical workers

Preferential length of service is a social standard that allows employees to receive a benefit when applying for an insurance pension (173-FZ of December 17, 2001), that is, to declare their intention to retire early without reaching the legal age.

For employees in the field of healthcare from the list approved by RF PP No. 781, the special output is (clause 20, part 1, article 30 400-FZ):

Preferential calculation of length of service for medical workers begins with determining the type of medical institution. For some organizations, a special calculation is applied (clause 5 of PP Rules No. 781):

- The preferential pension for a rural health worker is calculated as one calendar year for the actual one year and three months. If during the period of service a citizen worked both in a village and in a city, then when calculating the length of service, a coefficient of 1.3 is used.

- A year of work as one and a half years of preferential length of service is established for a narrow circle of specialists: ambulance officers, forensic experts, specialists in microsurgical and burn departments, surgery, intensive care, etc. For surgical employees in rural areas, when calculating length of service, an index of 1.9 must be used, so how the exception positions are summarized.

- For employees of military medical institutes, medical companies, medical research organizations and a number of other military units, special experience is recalculated by a factor of 1.6.

For all other categories of health workers, 1 actual year is equal to 1 calendar year.

Medical internship is a period of continuous work of a health worker in healthcare institutions. The billing period includes those moments when the employee worked at a full rate or a reduced rate, if provided for by law. For part-time work, periods of employment are summed up. The calculation of length of service includes periods of temporary disability, maternity leave, advanced training, and probationary periods when hiring.

The accrual procedure for medical workers during their studies (internship, residency) provides for a complete break from work. During training, health workers do not engage in practical activities, therefore, these periods are not included in the calculation of length of service. The same applies to vacations at your own expense and child care up to 1.5 and up to 3 years.

Categories of health workers entitled to early retirement

So, Law No. 400-FZ of December 28, 2013, regulating the pension provision of Russians, included in a separate chapter provisions on the preservation of benefits for special categories of workers. Thus, according to paragraph 20 of Article 30 of the above-mentioned legislative act, healthcare workers still have the right to early retirement.

How early can such an exit be?

Unlike some other preferential categories, doctors are not tied to a specific age. For medical workers, the main requirement to ensure the right to receive a preferential pension is length of service, position and place of work.

Minimum period of work for early retirement for:

- workers of healthcare institutions located in villages or urban-type settlements (urban-type settlements) must be 25 years old;

- workers of healthcare institutions located in the city - 30 years;

- employees of healthcare institutions with mixed work experience (both in rural areas and in cities) - 30 years.

How to apply for a preferential pension

The total pension for health workers and other citizens consists of a fixed amount and payment based on points. The cost of one point is fixed - 81.49 rubles. The general IPC is determined for each employee individually - based on the total length of service and salary.

Early retirement pension is issued in the same way as upon reaching retirement age. You need to fill out an application in the Pension Fund form and attach the required package of supporting documents:

- passport of a citizen of the Russian Federation;

- work book (its copy) or other document confirming preferential service;

- certificate of average salary.

In some cases, Pension Fund employees may require confirmation of work in rural areas, change of surname, place of residence, certificate of period of incapacity for work, etc.

The health worker must personally contact the territorial office of the Pension Fund. The appeal is reviewed within 10 days. The pension is accrued from the date of the medical worker’s direct application to the Pension Fund.