- home

- Reference

- Maternal capital

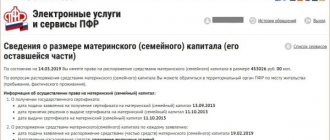

If a citizen has received the right to a maternity capital certificate and the payment itself, it is necessary to familiarize yourself in advance with the situations when a return of this amount, even partial, is acceptable. The rules often apply to funds already invested in the mortgage.

If the agreement between the parties is terminated, the money is returned, because the main goals were not achieved. The procedure differs in some nuances, which cannot be avoided without studying.

Is it possible to return maternity capital back to the Pension Fund and how to do it

Law No. 256 Federal Law does not specify the exact conditions under which funds must be returned. But maternity capital is considered a targeted government support program. And the owner of such assistance is obliged to pay the state if for some reason he was unable to use it in one of the areas that is also established by current legislation.

Most often, the return procedure is associated with the following circumstances:

- Housing purchased with a loan and repaid with maternity capital is sold.

- The inability to pay off debts, which is why property is seized.

- The contract is terminated, or the homeowner simply leaves the housing cooperative.

- It was decided to use the money for other purposes.

If the main goal is still achieved, then it is no longer possible to return the money.

Compensation is also transferred to the Pension Fund if the main housing transaction is declared invalid. Each party is obliged to reimburse the other for all expenses that were associated with certain actions. Maternity capital is paid from the federal budget, which is why it is so important to repay it on time.

It is also useful to read: Sample application for disposal of maternity capital funds

When they go to court

If one of the spouses officially refuses to allocate 2 or more children a specific living space, they go to the local court. Moreover, after the dissolution of the marriage, but before the division of certain common property, the claim indicates a requirement for the allocation of property shares to the divorced wife and husband, and to the minor son and daughter.

On a note! Sometimes, during a divorce, children are not allocated property shares after the entire mortgage has been officially repaid using maternity capital. This is possible when an apartment or other property of a debtor’s ex-husband or wife is seized.

In order to prevent the situation described above, during a divorce, they immediately find out the presence or absence of an official seizure of real estate or other legal grounds for which property is not registered.

Such a ban on the disposal of an apartment can only be lifted by a court order.

Statute of limitations

A claim in a local court is filed within a specific limitation period. When dividing jointly acquired (common) property, a statement of claim is drawn up and registered for 3 years (Clause 7, Article 38 of the RF IC).

Important! The statute of limitations does not count from the date of the official divorce, but from the moment the former spouse is notified of his violated rights.

The last date, for example, is considered to be a written appeal to the ex-husband or wife about the division of their common property.

State duty amount

When dividing a private home or other mortgaged housing in court, a certain state fee is paid. The amount of such a fee is calculated taking into account the market value of a particular property.

Example!

The spouses have a common two-room apartment worth 3,000,000 rubles. Their common son and daughter were allocated 1/4 of the property share, and their ex-wife - 2/4. Thus, the tax base for state duty = ((3,000,000:4) *2):2 = 750,000 rubles.

Contents of the lawsuit

The statement of claim must indicate the reason for going to court. The claim consists of 4 parts:

- Preamble (plaintiff, defendant, third party, price).

- Descriptive part.

- Motivational block.

- The pleading part.

The descriptive block of the claim sets out the essence of the specific problem and other various circumstances. The motivation block reflects legally significant actions, documentation and possible 1 or more witnesses. The last section of the claim sets out in detail certain claims.

Statement of claim for division of property

What difficulties may arise when returning

The process is quite complex, and serious obstacles arise during its implementation. When purchasing a residential property, each family member becomes a shared owner. Therefore, the sale of property, if necessary, becomes more difficult.

It is necessary to obtain permission from the creditor bank if there is a need to sell an object for which the debts have not yet been partially repaid. Therefore, agreements often include provisions related to early termination of contracts.

The legislation does everything possible to protect against the misuse of maternity capital funds. Therefore, it is prohibited to receive money in the form of cash, regardless of the chosen method.

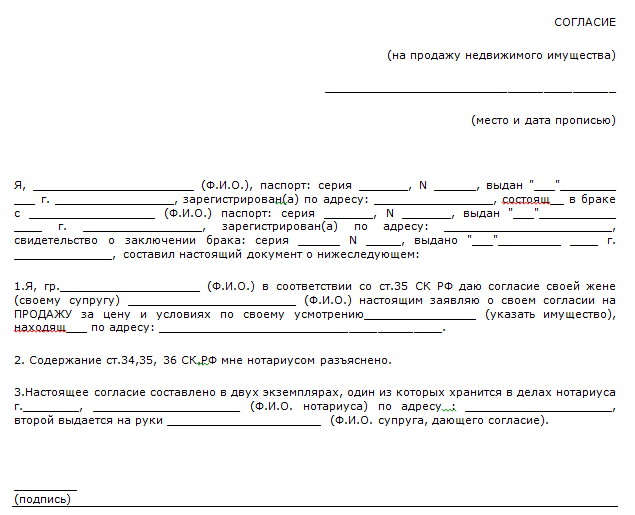

It is especially difficult when the sale is related to divorce. It is necessary to obtain consent not only from the financial organization, but also from social authorities that control relationships between citizens. A new transaction is concluded with the terms of the Agreement that was in force earlier. After this, the maternity capital is returned back to the Fund.

The same conditions are observed when an exchange is organized.

All possible return methods

The choice of the appropriate method for a particular situation depends on whether the money was transferred to the account or not.

- If the funds have not yet been received , the certificate owner personally submits an application to the Pension Fund employees with a request to terminate the current agreement. This must be done no later than 10 days after the relevant decision is made. If the funds are used to create a pension, the woman can refuse compensation at any time before the payments are scheduled.

- Another thing is when the money is transferred to the account, but the transaction does not take place. In this case, return to the Pension Fund is required. In most cases, after termination of the transaction, the money is returned to the certificate owner. The citizen is obliged to return an amount equal to what was spent. If necessary, a clause related to the transfer of money on behalf of the seller or developer is included in the termination agreement.

Sometimes it is possible not to return maternity capital to the Pension Fund, but simply use the available finances for their intended purpose. The main thing is not to forget to inform employees about the decision made. Otherwise, there is a high probability that they will sue. Separately, they ensure the preservation of written evidence in favor of completing a new transaction.

The difference between the total amount and the services actually provided is returned to the child if the following circumstances exist:

- A minor citizen dies.

- Termination of the hostel rental agreement.

- Deduction.

You must submit an application to refuse assistance so that the money is no longer transferred to the educational institution.

How mortgage property is divided after an official divorce

When divorcing, the court takes into account the specific legal interests of both the wife and husband, and their 2 or more children. A lot of controversy often arises in a lawsuit like this. When the mortgage is officially divided, divorced spouses and parents, as well as their youngest and eldest children, are allocated specific property shares in a private house or apartment.

Read also: Registration of marriage with a foreign citizen in Russia

Parents' shares

During the division of a private house or other mortgaged housing, the acquisition of which was made using maternal capital, the spouses are initially allocated equal property shares.

Such living space is considered common (jointly acquired). As a result, an apartment or private house is divided in the same way as all other joint purchases of a divorced family.

Children's shares

The procedure for registering specific shared ownership for 2 or more children is established in paragraph 4 of Article 10 of Federal Law No. 256 of December 29, 2006. In this situation, an agreement is drawn up, which is certified by a notary.

Such a document is called a notarized obligation to allocate certain shares of maternal capital. Attention! The obligation is often issued to the mother, the owner of the mortgage apartment and the personal certificate.

Sometimes such a document is issued to both parents who own the property. In this situation, the notary is provided with firm guarantees of the allocation of specific property to all children in the future.

What to do if one of the divorced spouses refuses a property share

If one of the divorced spouses officially renounces his specific share in a private house or apartment, such mortgaged property is automatically issued to the divorced wife or husband. However, in this situation, the interests of children are also taken into account. Children's property shares are indicated in the obligation.

If circumstances change and if the former spouse refuses a mortgage, such information must be provided to the court. In this situation, the property share is often returned back.

By agreement of the parties

In a formal divorce, by mutual consent, the former spouses draw up a formal written agreement on the division of a common mortgaged apartment.

However, if at the time of annulment the mortgage has not been repaid, then in this situation they go to court. Attention! If the agreement between the former spouses contains clauses that violate certain terms of the mortgage agreement, then such a document is considered invalid.

In this situation, they go to court and divide the jointly acquired property into specific shares.

Will it be possible to receive it again after returning it?

The answer to this question will be yes. To resolve the issue, simply write a statement about the reuse of funds. If the application is approved, the funds will be directed only to solving issues specified in the Legislation. Often there are no legal proceedings; citizens have no other way to return the money in question.

If finances are returned back to the fund, the state places them under special control. Such situations are associated with circumstances that are beyond the control of either party. For example, when sellers or real estate developers turn out to be unscrupulous. And the facts of fraud are revealed after the initial agreements are signed. Voluntary return under such circumstances should only be encouraged.

The ban on re-use of assistance applies in the following situations:

- The documents indicated one university, but in fact the training takes place in another.

- Funds are allocated for the child’s education, but the child himself is expelled for one reason or another.

- The transaction was considered fictitious due to the fact that it was concluded between close relatives who paid additional compensation.

Part of the living space must be registered for children. If this is not done, the regulatory authorities will issue a warning in which they will ask to eliminate existing violations. Then comes a resolution with the punishment itself, if no action was taken from the other party.

Who gets permission to sell housing?

When selling a specific mortgaged home, spouses receive permission to conduct such a transaction in the following 2 authorities:

- in the bank where you previously received a mortgage;

- at the local Department of Social Protection of the Population (guardianship authorities).

When considering all the circumstances, the bank and local guardianship authorities take into account the rights of two or more children when selling mortgaged housing. If the interests of minors are not violated, then the spouses are given official permission to conduct such a transaction.

Consent to sell housing

What happens if the funds are not returned?

If the Pension Fund does not receive the required amount, its representatives have the right to file a claim with a corresponding demand for return. The regional prosecutor's office may also become a participant in the proceedings.

According to established judicial practice, the situation can develop in one of three directions:

- Recognition by the court of evidence that the funds were used for the intended purpose. The main thing is that the other party provides as many documents as possible in support of its position. The judge has the right to check the condition of the housing and whether there are improvements to the current living conditions. Location also plays a role. Regulatory authorities separately study the level of infrastructure development.

- Collection of the amount of maternity capital with a compulsory procedure. This happens if it is proven that the funds were not used for the specified purposes. The payer can only ask for a delay in the execution of this penalty.

- Return of funds on a voluntary basis. In this case, the defendant can expect to reuse the amount when the need arises. It is enough to agree with the requirements of the regulatory authority. Criminal liability threatens those who choose fictitious methods to cash out government assistance.

It is imperative to keep all receipts and payment documents in the case of repair work aimed at expanding the living space and improving current conditions. Then it will be easier to maintain your reputation and obtain additional evidence.

The recipient of the grant always bears the greatest responsibility. Even if he suffered from fraudsters, then only the citizen himself will be responsible to the regulatory authorities. The imperfection of the legal system in this direction is the most common problem encountered in practice.

It is also useful to read: Maternity capital for the purchase of secondary housing

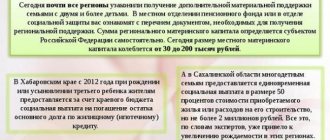

Reasons for returning maternity capital

- The construction company went bankrupt and was unable to fulfill its contractual obligations. Then the family has the right to seek to receive government assistance again, but only through the court;

- The capital was invested in the acquisition (construction, completion, purchase) of residential real estate, which had to be sold; Then you need to invest in purchasing another home as soon as possible. The law stipulates exactly how much shares should be transferred to children. After all, the situation in the family may become more complicated, and the parents will file for divorce. Property assets will have to be divided.

- Parents spent certificate funds for other purposes. Eg:

- on holiday abroad;

- for the purchase of electronics;

- to develop your business;

- to buy a car;

- for other household needs.

Then the maternity capital can be returned to the Pension Fund. Again, solely by court decision. When spouses spend government assistance, they should understand that these funds are intended specifically for their children. The personal needs of parents are not taken into account here.