Home / Labor Law / Labor Code / Work experience

Back

Published: 05/31/2016

Reading time: 6 min

0

9478

A pressing and controversial question is how years of study affect the registration of a pension.

Labor legislation changes regularly, some changes also affect the calculation of length of service.

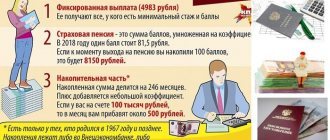

Today, the opinions of legislators are such that in order to obtain a pension, you need to accumulate five years of insurance experience.

- Legislation on pensions

- Accounting for study periods

- Training and title of labor veteran

- Training in military schools and universities

- When do study periods still count?

Legislation on pensions

The main legal act regulating the calculation of pensions is Law No. 173 (on

pensions). It is under this legal act that the pension fund operates. According to the norm of Article 7 of the law, in order to receive a pension in old age, it is necessary that the official length of service accepted for registration be at least 5 years.

But what kind of experience? Continuous or general?

Today, the concept of “continuous service” has been excluded from the laws; only “insurance” is used. What is included in the insurance period by law? Let us turn to Article 10 of the law.

Experience is the period of a person’s activity on the territory of the Russian Federation (or Soviet Russia), when contributions to the pension fund were transferred from his income.

It is calculated in total, that is, all periods taken into account are added up.

Until recently, there was a rule according to which the following periods were included in the total length of service:

- training in schools;

- at retraining and retraining courses;

- in universities;

- in graduate school, doctoral studies.

Today such a rule does not apply. But with a caveat. It is possible to include some time periods in which training was combined with other circumstances.

Is study included in the total work experience in 2020?

Reading time: 4 minutes(s) Many citizens quite naturally have a question: is study included in their work experience? It is relevant both for students who are currently studying and for those who are soon to retire. Let's look at this in more detail.

What is total work experience?

Current legislation does not define the concept of length of service. However, based on the provisions of Article 20 of the Federal Law “On State Pension Security,” we can conclude that it is the time during which the citizen carried out labor and other socially useful activities.

It should be noted that the concept of “work experience” is gradually becoming a thing of the past and is a kind of atavism in Russian legislation. After the pension reform, a different type of experience began to play a leading role in calculating pensions - insurance, which is understood as the periods during which the employer transferred legally established insurance contributions to the Pension Fund of the Russian Federation, and, more recently, to the Federal Tax Service. Labor without it actually does not play a role in assigning payments and determining their size, since only those periods that are also periods of insurance coverage are counted in it. The exception is cases of preferential retirement provided for in Article 27 of the Federal Law “On Labor Pensions” - in some situations provided for by this rule of law, the insurance period does not matter.

Is training included in the experience?

Before the 2002 reform, studying at a higher educational institution or technical school was included in the work experience. After the reform, it was not taken into account, with certain exceptions (for example, such an exception was training in some higher educational institutions).

After the adoption of the Federal Law “On Insurance Pensions” in 2013, exceptions allowing the inclusion of study time in the total duration of working activity became even fewer (for example, periods of study in higher educational institutions were not taken into account at all). This is primarily due to the fact that currently only those periods of work during which the insurance period is valid are considered to be work experience. And while a person is studying, his insurance experience is not counted, since at this time no one is paying insurance premiums for him, from which the citizen’s pension will subsequently be formed.

Despite this, for those who studied before the reform, the years of study are included in the total length of service and are taken into account when assigning payments and calculating the total duration of a citizen’s working life.

Let's look in more detail at whether work experience is included when studying in:

- school;

- technical school;

- vocational school;

- college;

- higher education institution;

- military and departmental educational institutions.

At school

Years of study in college are not counted towards work experience. However, in this case there are exceptions. Thus, persons studying in medical schools can count on including their studies in the preferential length of service for the appointment of an early pension for a medical worker. However, this exception applies only under one condition: before entering study, the citizen must already be working in a medical institution. If he enters a medical school immediately after school, the time spent studying there will not be counted towards his length of service. In addition, while studying there is no insurance period, which ultimately will also affect the doctor’s final pension.

At the technical school

As a general rule, studying at a technical school is not included in the periods of a citizen’s working life.

In vocational school

The time during which a citizen studies at a vocational technical school, or vocational school, is also not included in the length of service.

In college

Studying in college is not considered a period of a citizen’s working life, and therefore is not taken into account when assigning pension payments to him.

At a university (institute, university, graduate school)

Higher education institutions include:

- institutions;

- universities;

- academy.

Training in them is also not taken into account when determining the total length of work experience. This rule also applies to postgraduate training (for example, postgraduate studies).

For medical workers studying at the relevant universities, the same rule applies as for students of medical schools: the period of receiving education is included in the preferential medical period, but only on the condition that before admission the citizen had already worked in a medical institution.

True, in all of the above cases, inclusion in the length of study in various educational organizations occurs if the student, while undergoing training:

- officially works under an employment contract in his free time from studies;

- serves in state civil service or municipal service;

- is an individual entrepreneur and pays insurance premiums for himself;

- is self-employed and also pays insurance premiums for himself.

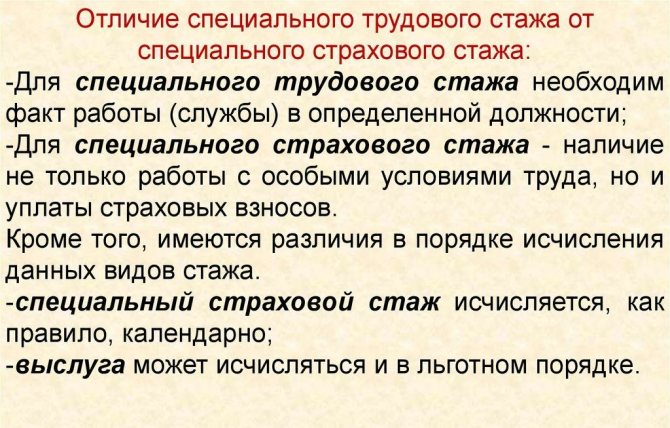

In the Ministry of Internal Affairs

When studying at various departmental educational institutions (universities of the Ministry of Defense, Ministry of Internal Affairs, Federal Penitentiary Service), cadets have the right to include the training period in their total service time. True, such inclusion occurs on the basis of one year of study for six months of full-time service. Include no more than five years of study. That is, if a cadet decides to continue his postgraduate studies with the aim of obtaining an academic degree, this time will not be counted towards his length of service.

Another benefit is provided for law enforcement officers and military personnel. If they graduated from a civilian university, and not a departmental one, and after that entered the service, the period of study at this university will also be included in their length of service (remember that for all other citizens it is not included in the total length of service). Time spent studying at a civilian university is added to length of service on the same basis as studying at a departmental educational institution - at the rate of one year of study for six months of service. At the same time, it is not at all necessary that the university where the citizen studied has a military department.

You can learn about what is included in the length of service for granting a pension and in what cases studies are included in it from this video:

Thus, as of 2020, periods of study are not included in the length of service and are not taken into account when assigning a pension. The exception is departmental and military universities - for their cadets, the period of training in these educational organizations is added to their length of service. Also, some relaxations apply to medical workers. However, those who studied before the 2002 pension reform have the right to count on the inclusion of periods of study in the total time of working activity.

Did this article help you? We would be grateful for your rating:

6 1

Accounting for study periods

Exactly which periods are included in the length of service, that is, those that influence the registration of a pension, are indicated in Articles 10 and 11 of the law on pensions. These are the following periods:

- official work in Russia with a work book;

- entrepreneurship;

- work abroad.

In this case, it is mandatory that contributions be transferred to the Pension Fund (from income or voluntarily). If a person worked for an unscrupulous employer who, in order to save money, did not spend money on contributions and taxes, such periods may be excluded from the length of service.

But Article 11 lists periods not related to work activity, but included in the length of service:

- military service;

- sick leave;

- caring for a child up to one and a half years old (in total - no more than 4.5 years);

- registration at the labor exchange;

- illegal detention;

- caring for a disabled person of group 1 (also for a disabled child and pensioners over 80 years old);

- living with a military husband (or wife), if there are no jobs in the town (no more than 5 years are taken into account);

- living abroad with a husband (wife) consul, ambassador, trade representative, diplomatic representative (a period of no more than 5 years is also taken into account).

But any reason must be documented.

Hence the conclusion: if training was combined with the listed periods, then it is included in the insurance period.

Training and title of labor veteran

Article 7 of the law on veterans specifies the grounds for conferring the title of labor veteran. Thus, a citizen is recognized as a labor veteran if:

- have a “Veteran of Labor” certificate or awards in the labor field (including Soviet-style ones);

- the man has 40 years of insurance experience, and the woman 35.

Again, periods of training are not included in the length of service. However, there is a caveat: the procedure for assigning such a title can be changed by the laws of regional authorities (regional, regional, city halls of Moscow and St. Petersburg).

According to the norms of regional laws, periods of training may well be counted towards length of service.

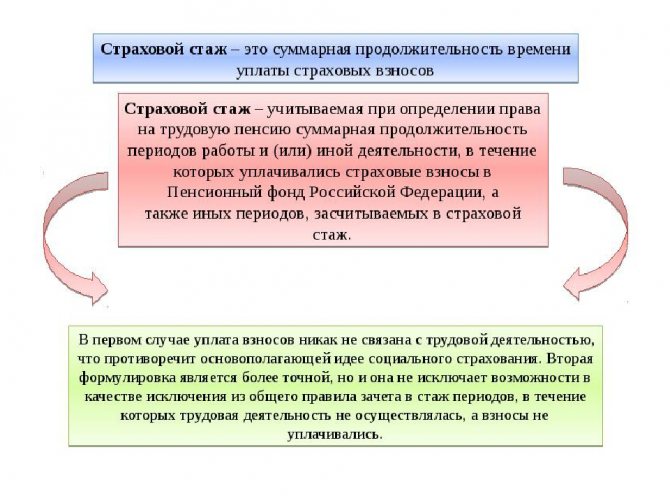

Definition of the concept of insurance experience

The definition and characteristics of this concept are given in Federal Law No. 400-FZ. In accordance with the document, the insurance period is the period of time during which transfers were made from the worker’s earnings to extra-budgetary funds.

However, there are exceptions here and the state, in addition to the specified periods, counts as length of service the time when a person was not able to perform labor functions. For example, such intervals include performing public service, performing military duties, or caring for a small child.

Differences between insurance and work experience

The concept of insurance experience was introduced after the entry into force of Federal Law No. 173-FZ in 2002. Before this, in Soviet times, only the term “work experience” was used. It included all the time of employment and study at universities, vocational schools and other vocational educational institutions.

IMPORTANT! The insurance period focuses not on the duration of employment, but on the availability of transfers to the funds. They can be done either by the employer or independently, even without official employment.

The main differences between the presented concepts are indicated in the table.

| Criterion | Labor period | Insurance period |

| The meaning of the indicator | Helps in estimating the amount of support payments for people who worked before 2002 | Used to calculate pension payments and sick leave payments |

| What does it consist of? | Duration of work and study | Periods when transfers to funds took place + some non-insurance periods of time |

| Is education included? | Yes | No |

| What is regulated | Federal Law No. 340-FZ | Federal Law No. 400-FZ, Federal Law No. 167-FZ |

Thus, the concept of seniority is currently practically not used. It has been completely replaced by the term insurance period, on the basis of which payments are calculated upon reaching a certain age and sick leave.

Related article: Confirmation and calculation of insurance experience

More information about the differences between insurance and work experience can be found here.

Training in military schools and universities

Although cadets and cadets are recognized as military personnel, military training, according to the law on pensions, is not included in the insurance period. The pension reform has led to the fact that only those who can prove the receipt of contributions to the Pension Fund from their income for 5 years (in total) can count on a pension.

Duration of paid leave according to the Labor Code of the Russian Federation - find out more! Got sick on vacation? Do you want to apply for sick leave? Read here how to do it correctly.

You can find out the competent advice and information you need on calculating maternity benefits in our article.