In 2020, it became known that insurance premiums will be replaced by a new unified insurance fee. In essence, the country had to return to paying the unified social tax (UST), which accountants said goodbye to in 2010. Ultimately, the government decided not to change the name of the payment. As before, policyholders calculate insurance premiums, but pay them to the Federal Tax Service. There is one exception: as before the change of the contribution administrator, you need to pay contributions from industrial accidents to the Social Insurance Fund.

For simplicity, many accountants among their colleagues refer to insurance premiums as UST. In this article we will also use this concept. But it is worth remembering that the Tax Code of the Russian Federation does not contain such a term.

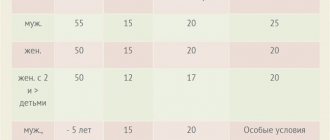

Contribution rates in 2020 (table)

Insurance premiums in 2020 include four types of contributions:

- in case of maternity and illness;

- medical;

- pension;

- for injuries.

The general rate of contributions in 2020 is 30% plus the rate of insurance premiums for accidents (the value is variable and depends on the danger of production). Tariffs in 2020 directly depend on the maximum value of the base for calculating insurance premiums. The tariff rates for the majority of payers (Article 425 of the Tax Code of the Russian Federation) are shown in the table.

Tariffs table

| Contributions to compulsory pension insurance, % | Contributions for insurance in case of temporary disability and maternity, % | Contributions for compulsory health insurance, % | ||

| If the amount of payments to an individual employee does not exceed 1,292,000 rubles | If the amount of payments to an individual employee exceeds 1,292,000 rubles | If the amount of payments to an individual employee does not exceed 912,000 rubles | If the amount of payments to an individual employee exceeds 912,000 rubles | 5,1 |

| 22 | 10 | 2,9 | 0 | |

Submit a single calculation of insurance premiums on time and without errors! Use Kontur.Extern for 3 months for free!

Try it

Maximum base of insurance premiums in 2020

Annual confirmation of the main type of economic activity of policyholders - legal entities, as well as types of economic activity of the policyholder's divisions, which are independent classification units, is necessary for the Social Insurance Fund of the Russian Federation to determine the professional risk class of the type of economic activity that corresponds to the main type of economic activity of the policyholder (the policyholder's division) , and the amount of the insurance tariff corresponding to this class for compulsory social insurance against accidents at work and occupational diseases.

The procedure for confirming the main type of economic activity of the insurer for compulsory social insurance against industrial accidents and occupational diseases - a legal entity, as well as the types of economic activity of the insurer's divisions, which are independent classification units, was approved by order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55 (as amended orders of the Ministry of Health and Social Development of Russia dated 01.08.2008 No. 376n, dated 22.06, 25.10.2011 No. 606n).

It should be noted that the main type of economic activity of the insurer - an individual employing persons subject to compulsory social insurance against industrial accidents and occupational diseases - must correspond to the main type of activity specified in the Unified State Register of Individual Entrepreneurs (USRIP). In this case, annual confirmation by the policyholder of the main type of activity is not required.

In 2020, to confirm the main type of economic activity, policyholders - legal entities submit the following documents to the regional office no later than April 15, 2020:

- application for confirmation of the main type of economic activity,

- certificate confirming the main type of economic activity,

- a copy of the explanatory note to the balance sheet for 2017.

In these documents, the codes and their decoding by type of economic activity must comply with the new OKVED 2; information about new codes is received by a legal entity from the Federal Tax Service.

Documents by the regional branch of the Fund are accepted in the form of an electronic document using a single Portal of state and municipal services

https://www.gosuslugi.ru/

Registration of legal entities on the Portal of state and municipal services is free of charge.

Where to submit reports

In 2020, contributions must be reported to the Federal Tax Service and the Social Insurance Fund.

The calculation of insurance premiums is submitted to the Federal Tax Service quarterly before the 30th day of the month beginning immediately after the reporting period.

How to fill out a contribution calculation

In addition to this calculation, policyholders need to submit Form 4-FSS. Since 2020, the form has become more simplified and contains figures only for “traumatic” contributions. The paper version of the form must be submitted by the 20th day, and the electronic version - by the 25th day of the month following the reporting period.

When can you avoid paying fixed fees?

Clause 7 of Article 430 of the Tax Code of the Russian Federation gives the right in some situations not to pay contributions.

This includes caring for a child up to one and a half years old, military service, caring for a disabled person, living with a diplomat spouse abroad or with a military spouse in places where it is impossible to conduct activities. In order to receive an exemption, you need to submit an application and supporting documents to the tax office.

The exemption only applies if the entrepreneur did not run a business. If the activity was carried out, even if the listed factors are present, he is obliged to pay contributions.

Generate calculations for individual entrepreneur insurance premiums online

How to calculate income for an additional contribution

If you work for the simplified tax system Income, then this question will not even arise. The basis for calculating the additional contribution in this mode is the same as for calculating the single tax. All income received will be taken into account with some exceptions (for example, personal funds of individual entrepreneurs transferred for business development). But in other tax regimes the situation is not so obvious, and in some ways it is not even related to the real income of the entrepreneur.

First, let's look at the modes where income received by calculation is taken into account, rather than real income. These are UTII and PSN. It is no secret that the popularity of these systems is explained by the fact that in reality an entrepreneur often earns more than is established by local regulations.

| ✏ Thus, in some regions, the potential annual income of an individual entrepreneur on a patent for many types of activities is set at 150-180 thousand rubles. Based on this, it is assumed that the monthly income is only 12-15 thousand rubles. It is from this estimated amount that the base for the additional contribution will be calculated, even if the actual income is much higher. That is, individual entrepreneurs on a patent, for which the potential annual income is set at up to 300,000 rubles, will not pay an additional fee at all. |

As for entrepreneurs working on the simplified tax system Income minus expenses, Unified Agricultural Tax and OSNO, then for them, expenses incurred are taken into account when calculating the tax. But to calculate the additional contribution, expenses are taken into account only in the general taxation system.

As a result, entrepreneurs on the simplified tax system Income minus expenses and unified agricultural tax found themselves in the most disadvantageous position. For them, the additional contribution is calculated on all income, excluding expenses.

For example, an individual entrepreneur on Income minus expenses is engaged in wholesale trade. Turnover for the year amounted to 10 million rubles, but 9 million rubles of this were expenses for the purchase and delivery of consignments of goods to customers. That is, the entrepreneur’s net income is only 1 million rubles, but he must calculate the additional pension contribution from 10 million rubles. The courts have repeatedly pointed out the injustice of this approach, but the Federal Tax Service and the Ministry of Finance do not agree to change the procedure for calculating contributions for these taxpayers.

Thus, when calculating insurance premiums in 2020 for yourself, be guided by Article 430 of the Tax Code of the Russian Federation, which indicates the base for an additional 1% payment in different modes.

| Mode | Basis for calculating the additional pension contribution of individual entrepreneurs for themselves |

| UTII | Imputed income calculated using the UTII formula |

| PSN | Potential annual income |

| simplified tax system | Sales and non-operating income excluding expenses |

| BASIC | Income reduced by business deductions |

| Unified agricultural tax | Sales and non-operating income excluding expenses |

Payment procedure

There are 3 types of insurance pensions:

- disability pension for citizens with serious health problems and established disabilities;

- a pension in the event of deprivation of a breadwinner is provided for the dependents of a deceased person, from whose salary deductions were made to the Pension Fund of the Russian Federation;

- Old-age pensions are received by citizens who have lost the ability to work due to reaching a specified age.

Disability pension payments

When an officially working person loses his ability to work due to disability from the first to the third group inclusive, he is entitled to a disability insurance pension.

A pension is assigned, regardless of the cause and time of onset of disability; a mandatory condition is an insurance period of at least one day. It doesn't matter whether a disabled person works or not.

At the beginning of 2020, the payment towards the pension of the 1st disability group was fixed at around ten thousand rubles, for the 2nd group it was almost five thousand rubles, and for the 3rd group it was two and a half thousand rubles.

An increased fixed payment is provided for pensioners who have worked for a long time in the Far North, as well as for persons with dependents.

Disabled people who have no experience receive a social disability pension.

Payments of survivors' pensions

A survivor's pension is awarded after the death of a working person who supported disabled relatives (this includes children, disabled relatives, pensioners). In addition to disabled parents, adoptive parents, stepmothers or stepfathers have the right to a pension. In addition to natural children, an adopted child, stepdaughter or stepson can receive a pension.

At the beginning of 2020, the payment for the survivor's pension is almost two and a half thousand rubles for each dependent. Orphans are entitled to a double pension payment and amount to about five thousand monthly.

For the Far North, the amount increases by the regional coefficient.

Old age pension payments

An old-age pension is granted if three conditions are met simultaneously.

Firstly, women retire at fifty-five, men at sixty. Some have a lower retirement age in accordance with the approved lists of professions and work performed for early retirement. A complete list is available on the Pension Fund website.

For state civil servants, starting from 2020, the retirement age is increased annually by six months until the threshold reaches 65 years for men and 63 years for women.

The second condition is an insurance experience of at least 9 years in 2020, and the requirements for experience increase annually and in 2024 its amount will be 15 years.

The insurance period is formed over the course of work, during which deductions from salary were made for compulsory pension insurance; other socially significant periods are included in the length of service.

A parent caring for a child under one and a half years old is annually credited with 1.80 points for one child, 2 times more for the second, and increased points for the third and fourth child - 5.40. During the period of job search with mandatory registration at the Employment Center, as well as during military service, 1.80 points per year appear on the personal account. When caring for a patient with the first group of disability, for a child with a disability, the Pension Fund awards points in the amount of 1.80 per year, the same number of points is awarded to persons caring for a citizen 80 years of age and older.

How is the insurance pension calculated?

When retiring on time, its value is calculated according to the algorithm: B × C + B, the number of pension points (B) is multiplied by the value of the point (C) and the amount of the fixed payment (C) is added to the resulting value.

The state annually increases the fixed payment and the value of pension points. For 2020, the cost of a pension point in rubles is 81.49, the fixed payment is 4,982.90.

The amount of accumulated pension points is displayed in your personal account on the official website of the Pension Fund.

To calculate pension points, you need to divide your monthly earnings by the maximum earnings from which contributions to the compulsory pension insurance system are made, and multiply the resulting number by ten.

Compulsory pension insurance system

The maximum amount of monthly earnings from which contributions are paid is 85,083 rubles in 2020.

Tariff changes in 2020

Speaking about the future, in principle, you don’t have to worry too much, because it seems that all existing tariffs will generally be maintained or somehow transferred to the new reporting period. So today it is impossible to know specifically what awaits us, which is why it may not be worth looking into the distance and thinking ahead right away. But for those who are very interested in some information, of course, you can still find it.

As has already been said, no one yet knows what 2020 will bring us, so it’s too early to judge anything, but many publications and government departments report the absence of major changes. Rumors are circulating almost everywhere that nothing will be changed, but this is still far from official information, so we can’t relax completely yet.