Can a military man receive a regular pension?

Let's take a closer look at whether a military pensioner can receive two pensions - military and civil, and also when he can become entitled to a second pension

General concepts

Military personnel have the right to retire upon reaching a certain length of service.

According to regulations, to retire, military personnel must have completed 20 years of military service. Also, this right can be exercised by persons whose length of service in military service is 12.5 years, and the total length of service is 25 years. Therefore, military personnel can retire as early as 45 years old.

At the same time, the size of the pension depends on the amount of allowance they receive and their experience and rank.

The law also sets a service age limit for ordinary military personnel and those with a high rank.

Such retirees can continue to work in the civil service. They gain experience that allows them to apply for a pension like an ordinary pensioner.

The legislation allows military retirees to keep their military pension and earn a second pension in civilian life. However, for its registration it is necessary to meet certain requirements.

Legislative regulation of the issue

When regulating the issue of assigning a pension, the norms of the following legislative acts are taken into account:

- Russian Law No. 4468-1, adopted on February 12, 1993.

- Russian Law No. 400-FZ, adopted on December 289, 2013.

The first regulates the procedure for calculating military pensions, the norms of the second act establish the procedure for calculating pensions in the civil service.

If a military pensioner earns the right to a civilian pension, then it is not calculated according to the general rules; a fixed part is excluded from it. The pension for length of service depends entirely on the number of years worked by the military pensioner and contributions made by the employer.

Mandatory conditions for provision

To be able to receive a second pension, a military retiree must meet certain conditions.

First of all, he needs to get SNILS. That is, to obtain the status of an insured person in the compulsory pension insurance system.

After this, he must officially register for work under an employment contract. That is, have official earnings, on which the employer calculates and pays insurance premiums.

Attention! There are also a number of requirements under which a second civil pension for a military pensioner can be assigned after 60 years of age, and they must be met.

Where and when to apply for a second pension

A month before the pensioner reaches the generally accepted age, you can begin the procedure for obtaining financial insurance.

The second pension for military personnel is not mandatory, and therefore is impossible without submitting an application in convenient ways:

- personally or with the help of a trusted person in a PF located by registration or residence;

- to any branch of the MFC;

- through the personnel service at the place of work;

- through the post office;

- using the State Services Internet portal.

For your information. Payment of insurance coverage begins from the day the application is submitted, if by that time the necessary conditions are met.

Pension amount:

Formula for calculations

The amount of the additional pension is calculated using the following formula:

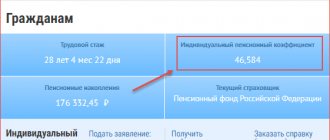

Pension size = IPK x Cost of 1 point

In this formula, the IPC is the individual pension coefficient, an indicator that is calculated based on the number of insurance contributions transferred by the employer.

In turn, the amount of contributions depends on the amount of salary received. The coefficient is formed according to the funded system, which means that if the pensioner continues to work, then when paying contributions his coefficient will increase.

The cost of 1 point is reviewed annually by the Government of the country. In 2020, the value was 87.24 rubles. The second pension for military personnel after 60 years of age in 2020 will be calculated based on the cost of a pension point of 93 rubles.

Calculation example

Let's calculate the size of the second labor pension for a military pensioner.

During his working career, he earned 31.25 pension points.

The size of the civil pension in 2020 will be: 31.25 x 87.24 = 2726.25 rubles.

Insurance civil pension for military pensioners in 2020, due to an increase in the value of the pension point, its payment will be: 31.25 x 93 = 2906.25 rubles.

Calculation example

For clarity of calculations, let’s imagine a situation with such data.

The law enforcement officer was recognized as a pensioner in 2008 for his length of service. Wasting no time, he got a civilian job with a standard employment contract. In 2020, this person retires by age, having completed 10 years of insurance coverage.

The average monthly salary of a former military man was 25 thousand rubles, and over 10 years 480 thousand rubles were transferred to the Pension Fund.

In 2020, the level of payment of pension contributions is 1,021,000 rubles.

We count:

- 480000/1021000*10=4,701 — Civil Procedure Code,

- 4,7*10=47,01 — IPC,

- 47,01*81,49=3841,06 — insurance pension.

General data from the example established by the state can be found on the official website of the Pension Fund, where there is also a function for quickly calculating the annual IPC. To more accurately calculate the amount of future security, it is convenient to contact any branch of the pension fund.

How is the second pension calculated for employees of the Ministry of Internal Affairs?

To calculate civil payments, the standard formula is used in a reduced version, that is, without accruing a fixed constant part. Only the number of pension points earned multiplied by their value at the time of payment is taken into account.

This calculation applies regardless of whether the pensioner continues to work or retires, but provided that he receives benefits through the law enforcement agency. If the Ministry of Internal Affairs pension is not paid, the payment is increased by the amount of the fixed payment, which in 2020 is 5,334 rubles. 19 kopecks

When calculating the size of the pension coefficient, only the period of civilian labor activity is taken into account, when taxes were deducted from the salary to the Pension Fund. The period of work in the police is not included in the insurance period, since insurance pension contributions were not deducted from the salary.

An increase in the calculated benefit is due to pensioners:

- who are dependent on disabled people;

- who have reached 80 years of age.

The payment increases by the regional coefficient for pensioners:

- belonging to the small peoples of the north;

- living in areas of the Far North.

Methods for issuing funds

When applying for an insurance payment for military pensioners, one of the convenient ways to receive it is indicated:

- Banks often choose to transfer funds to a bank card;

- Russian Post, in addition to personal receipt, home delivery is possible;

- Organizations that deliver pensions to your home every month.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer can advise you free of charge - write your question in the form below:

Required documents for payment

To obtain insurance coverage, military pensioners must prepare the following documents:

- Passport;

- Insurance certificate;

- Employment history;

- Documents confirming payment of a military pension;

- Data on the presence and maintenance of children under 18 years of age;

- Certificate from employer confirming salary for 60 consecutive months.

Elena Koshereva

Pension lawyer, ready to answer your questions.

Ask me a question

If there are special provisions related to the change of personal data, the presence of preferential service or incapacity for work, documents confirming these facts are needed.

Second pension for pensioners of the Ministry of Internal Affairs in 2020 and its calculation

You need to know that the second pension for retired former police officers is calculated and paid without taking into account the fixed payment. A fixed payment or fixed additional payment (FSD) is a federal social supplement to a pension up to the subsistence level - this is an additional payment that is paid to those pensioners whose pension is below the subsistence level in a given region. Accordingly, pensioners of the Ministry of Internal Affairs do not have the right to this additional payment when they are assigned an old-age insurance pension.

Like other pensioners, police pensioners will have their basic pension increased in 2020.

Where to contact

If a former police officer has reached the required age and has a minimum length of work experience in civilian life, he needs to go personally to the nearest Pension Fund office to receive a second old-age pension.

If a pensioner of the Ministry of Internal Affairs had periods of work in civilian institutions before 2002, for them he has the right to provide documents confirming the average monthly salary for any 60 consecutive months before January 1, 2002.

To accrue a second pension, you must submit the following documents:

- Application of the established form (the form is issued and filled out on site);

- Passport of a citizen of the Russian Federation;

- a certificate from the Ministry of Internal Affairs or another law enforcement agency through which the citizen receives his basic pension;

- SNILS;

- work record book and employment contracts;

- other documents confirming “civilian” experience (certificates from employers or relevant government agencies).

How to get a pension

To receive civil benefits, you need to contact the regional department of the Pension Fund or MFC. Before applying for an insurance payment, it is worth checking your IPC and clarifying the length of your work experience. It often does not include compulsory military service and periods of work before joining the ranks of the Ministry of Internal Affairs.

Pensioners of the Ministry of Internal Affairs are equal to military pensioners.

According to the new legislation, pension points are also awarded for non-insurance periods. For example, for 1.5 years of caring for the first child, an employee receives 2.7 points, and for a year of conscription service - 1.8 points.

Required package of documents

To apply for insurance benefits you need:

- passport;

- SNILS;

- certificates of payment of social insurance contributions, work book, employment contract and other documents confirming work experience outside the internal affairs department;

- certificate of receipt of a departmental pension indicating the date of its appointment, duration of work, etc.;

- salary data for 5 years before 01/01/2002, if before that time the employee worked outside the internal affairs department;

- military ID or certificate from the military registration and enlistment office (to increase the number of IPC points);

- application for benefits.

Military service upon conscription is not included in the preferential length of service, and therefore must be taken into account when assigning civilian benefits.

Registration process

How to get a second pension for a pensioner of the Ministry of Internal Affairs:

- Prepare data on work experience.

- Submit an application and papers to the Pension Fund through the district office of the Fund or the MFC. You can submit documents both at your place of permanent registration and at your place of residence.

- You can send an application through your Personal Account on the website of the Pension Fund of Russia, a representative or the Russian Post. Documents are sent by registered mail. The date on which the application is submitted is considered to be the date on the stamp. To transfer papers through another person, a power of attorney is issued to him.

- Wait for a response from the Pension Fund. The application review period is 10 days. If the package of documents is incomplete, the citizen must be notified within 3 days.

The former employee of the Ministry of Internal Affairs will receive the second pension on a general basis.

If the decision is positive, benefits will begin to be paid from the next month after the papers are submitted. If refused, the applicant is sent a written notice, which can be appealed in court within 3 years.

If the district branch of the Pension Fund makes an unlawful decision, you can send a complaint to the city branch of the Fund, attaching copies of the refusal and all documents that confirm the right to receive payment. The period for consideration of a complaint is up to 30 days.