What periods are included in the insurance period?

The insurance period does not include periods of unemployment, but in addition to work under employment contracts, it includes other periods (according to Federal Law No. 400 of December 28, 2013 “On insurance pensions”). An important condition: these periods must be preceded or followed by periods of work. If the periods coincide, then only one of them will be included in the length of service.

- The employee served in the military or served in law enforcement;

- the employee received compulsory social insurance benefits for temporary disability;

- the entrepreneur worked for himself and paid his own fees, the same applies to notaries, lawyers, detectives;

- the person worked as a deputy or clergyman, a member of a collective farm or production cooperative;

- mother or father cared for a child up to 1.5 years old (but no more than 6 years in total);

- the unemployed received benefits at the labor exchange, participated in paid public works, and traveled to another area for employment in the direction of the labor exchange;

- the employee was unjustifiably prosecuted, suspended from work and placed in custody;

- the convicted person worked in prison and fulfilled his quota; the employee cared for a disabled person of group 1, an elderly person over 80 years old or a disabled child;

- the spouse of a contract serviceman lived in an area where it was impossible to get a job (but not more than 5 years in total);

- for spouses of consuls and employees of diplomatic services and missions abroad - periods of residence in another country, but not more than 5 years.

Categories

In practice, we very often come across the concepts of “general work experience”, “special work experience”, “continuous work experience”. Let's figure out how they differ.

The term “work experience” can be understood as follows:

▪ total work experience

(insurance period), taking into account which an old-age pension is established, and, in appropriate cases, a disability pension and a survivor’s pension;

▪ special work experience

, taking into account which an old-age pension is established in connection with special working conditions, work in the Far North, a long-service pension, and a license may also be issued to carry out a particular activity (for example, the provision of paid legal services);

▪ continuous work experience

, which is important when paying for periods of temporary disability (sick leave).

Thus, the amount of continuous work experience is important when determining the amount of temporary disability benefits and receiving wage supplements for work at enterprises located in the Far North and equivalent areas. Continuous work experience affects the receipt of a lump sum payment for length of service and a percentage increase for length of service to official salaries.

In accordance with paragraph 30 of the resolution of the All-Russian Central Council of Trade Unions of November 12, 1984 No. 13-6 “On approval of the regulations on the procedure for providing benefits for state social insurance”

Temporary disability benefits in other cases, except for work injury or occupational disease, are issued:

a) in the amount of 100 percent of earnings:

workers and employees with continuous work experience of 8 or more years;

workers and employees whose temporary disability occurred as a result of injury, concussion, injury or illness received while performing international duty;

workers who became ill and suffered radiation sickness caused by the consequences of the accident at the Chernobyl nuclear power plant, as well as those who took part in the work to eliminate the consequences of this accident within the exclusion zone in 1986–1989 or were employed during the specified period in operation or other work at the Chernobyl nuclear power plant;

working disabled people for whom a causal connection between their disability and the Chernobyl disaster has been established;

workers under 18 years of age living in resettlement and residence zones with the right to resettle as a result of the Chernobyl disaster or evacuated and resettled from zones of radioactive contamination, with diseases of the hematopoietic organs (acute leukemia), thyroid gland (adenomas, cancer), malignant tumors;

for the care of sick children under 14 years of age in the areas indicated in the previous paragraph;

b) in the amount of 80 percent of earnings:

workers and employees with continuous work experience of 5 to 8 years;

workers and employees from among orphans who have not reached 21 years of age and have a continuous work experience of up to 5 years;

c) in the amount of 60 percent of earnings:

workers and employees with continuous work experience of up to 5 years.

Working disabled people of the Patriotic War and other disabled people who are equal in terms of benefits to disabled people of the Patriotic War are given benefits in the amount of 100 percent of earnings in all cases of temporary disability.

In accordance with paragraph 32 of the above resolution, continuous work experience when determining the amount of benefits is calculated by the day of the onset of incapacity in accordance with the Rules for calculating the continuous work experience of workers and employees when assigning benefits for state social insurance

, approved by Resolution of the Council of Ministers of the USSR of April 13, 1973 No. 252 (hereinafter referred to as the Rules).

According to the Rules, when assigning state social insurance benefits to workers and employees, continuous work experience is determined by the duration of the last continuous work at a given enterprise, institution, or organization. In some cases, the time of previous work or other activity is also included in the continuous work experience.

When moving from one job to another, continuous work experience is maintained provided that the break in work does not exceed one month, unless otherwise established by the Rules and other norms of current legislation.

In case of dismissal after September 1, 1983 at one's own request without good reason, continuous work experience is maintained provided that the break in work did not exceed three weeks.

Example.

The employee left the company of his own free will without good reason on 03/31/03. He will continue to have continuous work experience only if he gets another job no later than 04/21/03.

The reasons recognized as valid for voluntary dismissal are determined by the legislative bodies.

If the break in work did not exceed two months, then continuous work experience is maintained only in the following cases:

a) upon admission to another job of persons who worked in the regions of the Far North and equivalent areas, after dismissal from work upon expiration of the employment contract#S;

b) when joining the CCCP (now Russia) after being released from work in institutions, organizations and enterprises of the CCCP (Russia) abroad or in international organizations;

c) upon admission to work in the CCCP (Russia) of citizens who have moved from countries with which the CCCP (Russia) has entered into agreements or treaties on social security, after being released from work in institutions, organizations and enterprises of these countries. The two-month period in this case is calculated starting from the day of arrival in CCCP (Russia).

If persons who are released from enterprises, institutions and organizations are hired in connection with their reorganization or liquidation, or with the implementation of measures to reduce the number or staff of workers, as well as when workers and employees who are dismissed from units, institutions, organizations and from enterprises of the Armed Forces of the CCCP (RF) in connection with the implementation of measures to reduce them in accordance with decisions of the Government of the CCCP (RF), then continuous work experience is maintained if the break in work does not exceed three months.

The same rules apply when entering a job after dismissal due to the discovery that the employee is not suitable for the position held or the work performed due to health conditions that prevent the continuation of this work (according to a medical report issued in the prescribed manner) and when entering the work of primary school teachers in secondary schools exempt from work at school in connection with the transfer of fourth grades to systematic teaching of the basics of science and a temporary reduction in the number of primary school students.

In cases of entry to work after the end of temporary disability, which, in accordance with current legislation, resulted in dismissal from the previous job, as well as when entering work after dismissal from work due to disability or after dismissal of disabled people for other reasons for which more preferential conditions are not established , the three-month period of maintaining continuous work experience is calculated starting from the day of restoration of working capacity. The day of restoration of working capacity is considered to be the day the medical advisory commission (MCC) issued an opinion on this, or the day on which disability was established.

When an employment contract is terminated by pregnant women or mothers who have children (including adopted children or those under guardianship or trusteeship) under the age of 14 years or a disabled child under the age of 16 years, continuous work experience is maintained provided that they enter work before the child reaches specified age.

Let's consider the situation: a mother sits with a child without support for up to 10 years. Will the internship be interrupted?

In accordance with Art. 256 of the Labor Code of the Russian Federation, at the request of women, they are granted leave to care for a child until the child reaches the age of 3 years. When a child reaches 3 years of age, a woman has the right to quit her job at her own request (Article 80 of the Labor Code of the Russian Federation).

In accordance with paragraph 5 of the Rules, if a woman goes to work before the child reaches the age of 14, the continuity of length of service for the payment of state social insurance benefits is maintained, but this period is not counted in the total length of service.

In addition, there is Decree of the President of the Russian Federation of November 5, 1992 No. 1335, according to which pregnant women and women with children under three years of age, dismissed due to the liquidation of organizations, if it is impossible to find suitable work for them and provide assistance in employment by employment service bodies, the time from the date of their dismissal until the child reaches the age of 3 years is included in the continuous work experience for the assignment of state social insurance benefits.

Regardless of the duration of the break in work, continuous work experience is maintained in the following cases:

a) upon entering a job after dismissal of one’s own free will in connection with the transfer of the husband or wife to work in another locality;

b) upon entry to work after dismissal of one’s own free will in connection with old-age retirement or after the dismissal of an old-age pensioner for reasons other than those listed in subparagraph. “a”–“z” clause 7 of the Rules. This rule also applies to pensioners receiving pensions on other grounds (for example, for long service), if they are simultaneously entitled to an old-age pension.

Example.

An employee of an enterprise at the age of 62 resigns of his own free will due to retirement. Five months later, he gets a job at this company again. Five months of absence of an employee from the enterprise will not interrupt his work experience.

If an employee starts work after termination of an employment contract due to systematic failure to fulfill, without good reason, the duties assigned by the internal labor regulations; due to absenteeism without good reason, showing up at work while drunk, dismissal as a disciplinary sanction and other reasons listed in clause 7 of the Rules, then continuous work experience is not maintained.

It is very important to note the periods that count towards continuous work experience other than work as a worker or employee. These include:

a) service in the Armed Forces, if the interval between the day of release from service and the day of entry to work or study did not exceed three months.

b) time of work or practical training in paid jobs and positions during the period of study at a higher or secondary specialized educational institution, postgraduate study and clinical residency, regardless of the length of breaks caused by training;

c) the time of study in colleges and schools of vocational education (technical, vocational schools, maritime schools, factory training schools, etc.), if the break between the day of graduation from college or school and the day of entry to work did not exceed three months;

d) time of forced absence in case of improper dismissal, if the employee is reinstated, etc.

The time of study at a higher or secondary specialized educational institution (including at the preparatory department) or stay in graduate school or clinical residency, if the break between the day of release from work and the day of enrollment did not exceed the deadlines established by the Rules depending on the reason for dismissal, and the break between the day of graduation or early dismissal from an educational institution (graduate school, clinical residency) and the day of entry to work did not exceed three months; it is not included in the continuous work experience, although it does not interrupt it.

Example.

An accounting employee is sent to study at a higher educational institution without work. In accordance with the order, the employee began work on March 23, 1998. Thus, on the date of release from work for study (09/01/02), the continuous work experience is 2 years 5 months and 9 days. The training will continue until June 30. 05. Let's assume that the day of enrollment will be 07/01/05. Therefore, as of 08/01/05, the employee’s continuous work experience will be 2 years 6 months and 9 days.

The off-season break also does not interrupt, but is included in the length of service, if the employee at a given enterprise, institution, organization worked the previous season in full, entered into an employment contract to work in the next season and returned to work within the period established by the contract. I would like to answer that not every job “for a season” will be seasonal in accordance with the law.

Example.

An employee (cleaner) works permanently at the enterprise according to a work book. In fact, its working season lasts from September to May. Further, upon her application, the next vacation and leave without pay are issued. Leave without pay does not interrupt the length of service, since Art. 293 of the Labor Code of the Russian Federation, seasonal work is recognized as work that, due to climatic and other natural conditions, is carried out during a certain period (season) not exceeding six months. Considering that seasonality is determined by climatic and other natural conditions, this article is not applicable for organizing the work of cleaners.

According to the Resolution of the Council of Ministers of the RSFSR dated July 4, 1991 No. 381 “On approval of the List of seasonal work and seasonal industries, work in enterprises and organizations of which, regardless of their departmental affiliation, for a full season is counted towards the length of service for granting a pension for a year of work”

seasonal work includes, for example, work in peat mining (swamp preparation work, extraction, drying and harvesting of peat, repair and maintenance of technological equipment in the field), work in logging and timber rafting, work in enterprises of the seasonal industries of fisheries, meat and dairy industry, work at enterprises of the sugar and canning industries.

When determining length of service, one should be guided by clause 1 of the Rules, according to which, when assigning state social insurance benefits to workers and employees, continuous work experience is determined by the duration of the last continuous work at a given enterprise, institution, or organization. There is no statutory definition of what is meant by continuous operation. Therefore, since in accordance with Art. 66 of the Labor Code of the Russian Federation, a work book of the established form is the main document about the employee’s work activity and work experience; continuous work experience should include all the time when the employee is on the staff of the organization, with the exception of cases specifically specified in the legislation. Due to the fact that the law does not indicate that the length of service is interrupted during unpaid leave, the length of service of a cleaner in this case is not interrupted.

In all cases when the place of residence changes when moving from one job to another, the permitted break in work is extended by the time necessary to travel to the new place of residence.

Example.

The employee left the company of his own free will due to moving to another area on 08/31/03. To ensure that his work experience is not interrupted, he needs to get a job within three weeks. Since moving to a new place of residence takes two days, the deadline for getting a job is 09.23.03 (21 days + two days).

If during the period of admission to a new job, which determines the maintenance of continuous work experience, the employee was temporarily incapacitated and presented a certificate about this issued by the medical institution with the signatures of the attending physician and the chief physician, certified by a seal, then this period is extended by the number of days of incapacity.

Example.

The employee left the company of his own free will without good reason on 02/05/03. To maintain continuous service, he needs to get a job within a month, i.e. until 03/06/03. However, from 02/10/03 to 02/18/03 (inclusive) he was sick with the flu. A certificate issued by the clinic signed by the attending physician and chief physician, certified by a seal, is available. Thus, the period for getting a job is extended by 9 days (until March 15, 2003).

In conclusion, I would like to note that in accordance with the letter of the Social Insurance Fund of the Russian Federation dated October 25, 2002 No. 02-18/05-7418, since the latest changes and additions to the Rules were made in 1991, they should be applied taking into account what was adopted in subsequent legislation of the Russian Federation, as well as international agreements (treaties) with the participation of the Russian Federation.

In this regard, issues of calculating continuous work experience when assigning temporary disability benefits are currently regulated not only by the Rules, but also by other regulatory legal acts of the Russian Federation listed in the letter.

So, for example, on the basis of Art. 64 of the Regulations on Service in the Internal Affairs Bodies of the Russian Federation, approved by Resolution of the Supreme Court of the Russian Federation dated December 23, 1992 No. 4202-1, the time employees spend in service in the internal affairs bodies is counted towards their total and continuous work experience, as well as into their specialty experience in the following preferential conditions: one year of service for one and a half years of work experience. At the same time, for employees dismissed from the internal affairs bodies and admitted to work or study, their length of service is not interrupted if more than 3 months have not passed since the date of dismissal, not counting the time of moving to the place of work or service.

In accordance with Art. 16 of the Federal Law of July 31, 1995 No. 119-FZ “On the Fundamentals of the Civil Service of the Russian Federation”

upon dismissal due to the liquidation of a government agency or staff reduction, a civil servant is paid the average salary for the previously held position for three months (without taking into account severance pay). If a civil servant is not provided with work in accordance with his profession and qualifications, the civil servant remains in the register of civil servants (with an indication in the reserve) while maintaining continuous work experience in the civil service for a year.

According to Art. 25 of the Federal Law of July 5, 1994 No. 3-FZ “On the status of a member of the Federation Council and the status of a deputy of the State Duma of the Federal Assembly of the Russian Federation”

The term of office of a deputy of the State Duma is counted towards the total and continuous length of service or service life, length of service in the specialty. At the same time, continuous work experience is maintained provided that he enters work or service within six months after the termination of parliamentary powers. The spouse of a State Duma deputy (on the basis of clause 5 of Article 25 of the said Law), who was dismissed in connection with the deputy’s relocation to exercise his powers in the State Duma, the break in work is counted towards the total continuous length of service (service).

Do not confuse insurance and work experience

The concepts of insurance and work experience are often confused, but they differ fundamentally:

The insurance period is the time when insurance premiums were paid for the employee (plus the periods listed above).

Work experience is the sum of all periods of an employee’s work activity.

The main difference is that the length of service includes all vacation periods at your own expense. They will not be included in the insurance period, because at that time no insurance premiums were deducted for the employee.

Basic definition and legal concept according to the Labor Code of the Russian Federation

Continuous work experience (NTS) is the period of service under a contract at the last place of work. To maintain the NTS upon dismissal, a person must find a job within 30 calendar days. Under certain special conditions, this period can be increased by 2-3 times.

Previously, in the Soviet Union, continuity of work guaranteed salary increases, vouchers to sanatorium-resort institutions or children's camps.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Now, from the point of view of legislation, this concept does not play a significant role. Some organizations provide a corresponding clause guaranteeing incentives.

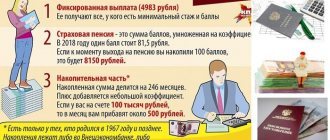

How to calculate the insurance period

You will find the legislative basis for calculating the insurance period in Art. 13 of the Federal Law “On Insurance Pensions” No. 400-FZ dated December 28, 2013. All the nuances for calculating the insurance period, including astronauts, military personnel, sailors, and workers in hazardous industries, are listed here.

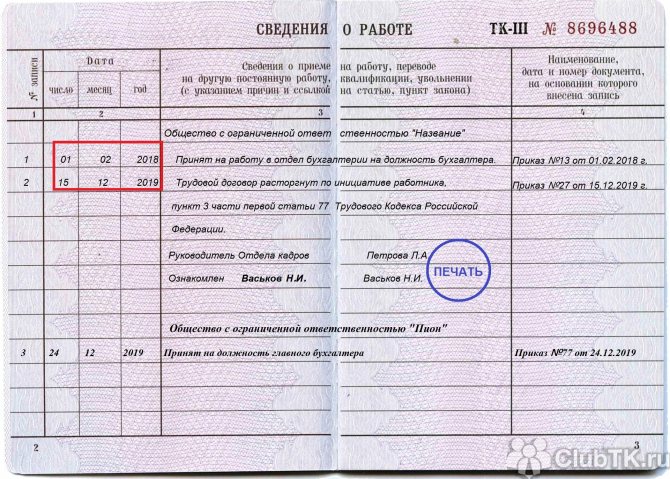

For calculations, you need a work book with all inserts. If the book is lost, the employee can provide all employment contracts with employers or confirm his work activity in court with the help of two or more witnesses. When calculating work experience, certificates from the place of work about periods of work, certificates from archives about periods of work, a military ID, and an extract from the terms of work of an individual entrepreneur are also accepted.

To calculate experience, you need:

- calculate the length of service using the work book;

- exclude periods of work abroad from the length of service;

- include in the insurance period periods when a person worked as an individual entrepreneur or farmer and paid insurance premiums for himself;

- exclude periods when the employee received a pension - for disability or labor;

- If the periods coincide, count only one.

Today, calculating the insurance period is not so difficult: data on insurance contributions is available in the Pension Fund and is stored on electronic media.

Counting Features

When calculating (using an online calculator or manually, it doesn’t matter), the employer must adhere to the established requirements:

- Maintaining calendar order. The dates that are included in the work book (for individual entrepreneurs - in the tax return) are taken into account. If two or more periods coincide, the most profitable one is taken into account.

- Citizenship of the Russian Federation. If a person has the right to payment under the laws of a foreign state and there is no correlation with the norms of the Russian Federation, the period will not be taken into account in the calculation.

- Farming. Citizens working on private farms who are farmers will be able to include the time of such activity in their length of service, subject to contributions to the funds.

- Activities for an individual - subject to the implementation of activities under an agreement and payment of fees.

- Copyright agreement - subject to deduction of contributions to the funds.

- No retroactive effect. This means that if previously the period was included in the length of service, if the legislation changes, it may be included in the insurance period.

Why calculate insurance experience?

The size of the pension depends on the insurance period; it is calculated upon retirement. The amount of sick leave benefits also depends on the length of insurance coverage. The length of sick leave is calculated on the day of the onset of temporary disability:

- for less than 5 years of experience, the benefit is 60% of the salary;

- with 5-8 years of experience, the benefit is 80% of the salary;

- with more than 8 years of experience, the benefit is 100% of the salary.

But keep in mind: the insurance period for calculating sick leave does not include periods of child care up to 1.5 years.

How does it affect retirement?

This condition practically does not affect the receipt or size of pension payments. The only exception is the accrual of social benefits. The basis for such material payments will be obtaining the status of a labor veteran.

However, this is only possible if a total continuous work history is required to obtain this status.

Each region of the Russian Federation independently establishes a list of requirements for obtaining the status of a labor veteran.

This aspect is regulated by Law No. 5-FZ, paragraph 4, article 7 of January 12, 1995. Now, the amount of pension benefits received is affected by the period during which the employee paid insurance contributions.

Additional contributions to the funded part of the pension will help increase the amount of benefits received in the future, as well as count on additional payments to the pension.

Examples of calculating insurance period

Example 1 . An employee applies for a pension upon reaching retirement age. The work experience according to the work book is 28 years, during which time she once went on maternity leave for three years. Before that, she was an entrepreneur for 5 years.

The insurance period for calculating the pension includes only child care leave of up to 1.5 years, so we will subtract the period from 1.5 to 3 years from the insurance period. And let’s add 5 years of entrepreneurship:

28 - 1.5 + 5 = 31.5 years.

This length of service will be used to calculate the insurance part of the pension.

Example 2 . With the help of a work book, extracts from the state register and other certificates, we know about the employee’s working periods:

- length of service until 2002 is 20 years;

- from January 1, 2002 to May 16, 2009 he worked at Sosna and Oliva LLC;

- from May 25, 2009 to October 14, 2014 he worked at Melchior JSC;

- from June 10, 2014 to February 5, 2020 he worked as an individual entrepreneur.

We sum up the working periods, take into account the overlap, we get 37 years, 29 days.

How to count

From time to time there is a need to calculate how much time you work in total or in a particular place. To do this, you will need a work book and an online calculator for calculating work experience for 2020. It's easy to use.

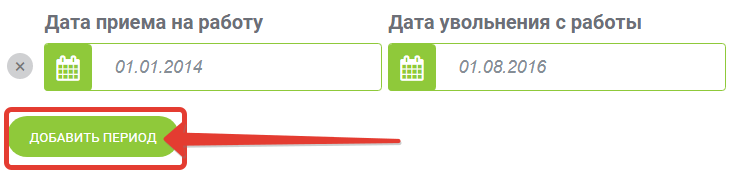

Step 1

In the first window, indicate the date of employment in accordance with the entry in the documents that confirm employment. In the work book, the dates of employment are usually located next to each other.

Hint: Enter dates using the drop-down calendar.

Step 2

In the second window, indicate the date you left your job.

Step 3

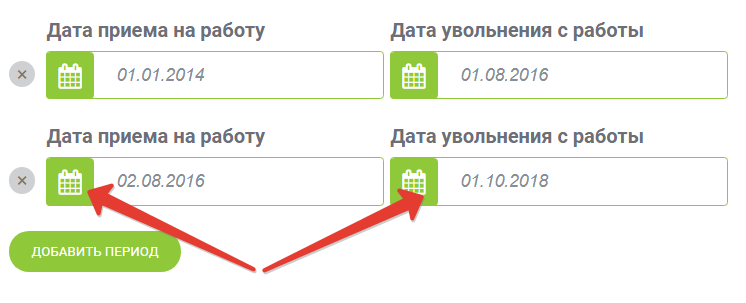

If you need to add several work periods, click “Add period”.

Step 4

Add sequentially as many periods as required (simply repeating steps 1-3).

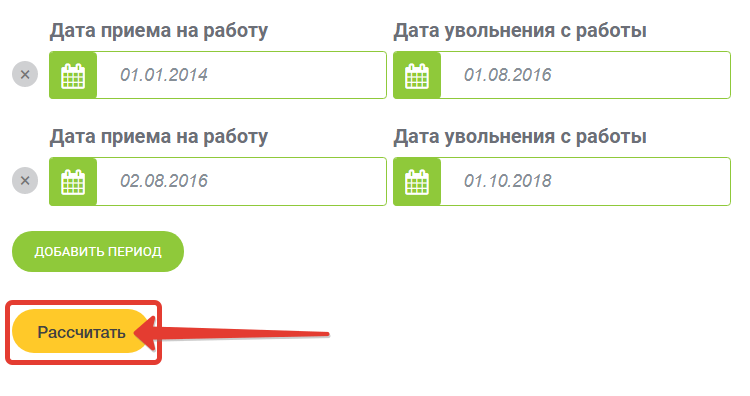

Step 5

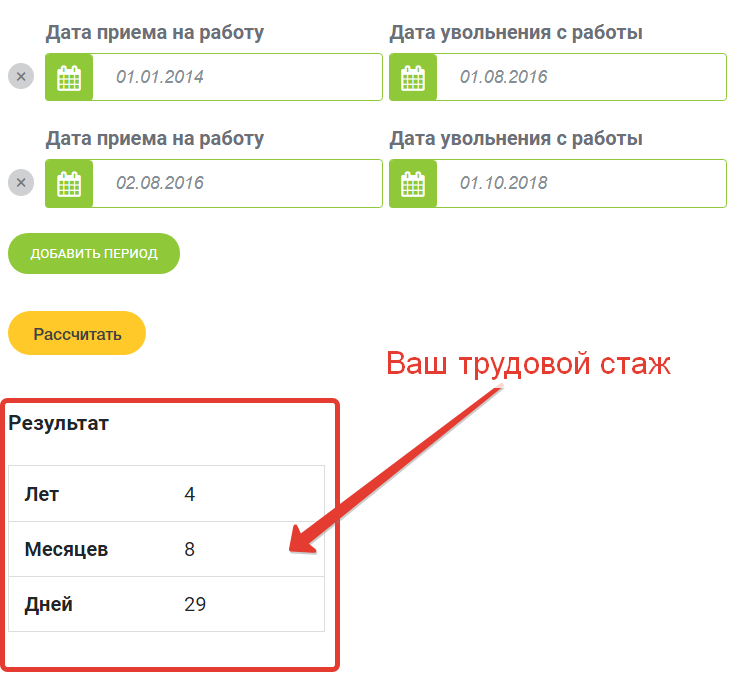

After entering all the dates, click “Calculate”.

Step 6

The result in years, months and days that the online insurance period calculator gives is the desired value. The program automatically converts 30 days into a month, and 12 months into a year.

Let us note that the service is intended primarily for determining benefits for temporary disability and maternity, although our online calculator of work experience based on a work record book will help calculate the period of employment, for example, for assigning pensions. But the result will be approximate, for reference.

Read more: Work experience for retirement: frequently asked questions

How to use the insurance period calculator

The instructions for using the calculator are simple:

- enter the periods of work from the employee’s work book in the “Periods for calculation” fields;

- if the employee was on parental leave, then to calculate the pension, take into account only a period of up to 1.5 years, and to calculate sick leave payments and child benefits - both periods up to 1.5 years and from 1.5 to 3 years ;

- if the person worked as an entrepreneur, notary, private detective or farmer, take into account the period from the date of registration to the date of deregistration;

- include in the calculation the periods from the section “What periods are included in the length of service”, if any;

- if only the years of the beginning or end of work are known without exact dates, July 1 is taken as the date; if only the months of the beginning or end of work are known, the date is taken as the 15th (according to clause 27 of the Order of the Ministry of Health and Social Development of the Russian Federation of February 6, 2007 No. 91);

- if it is known that before 2007, for the same period, the insurance period was less than the continuous work experience calculated according to the Federal Law-255 algorithm, continuous work experience is taken into account for the calculation (resolution of the Federal Antimonopoly Service of the West Siberian District dated September 29, 2011 in case No. A70-1657 /2011).

The calculator automatically summarizes the periods, takes into account overlaps and shows the total duration of the insurance period.

If there is no labor

An employer may be faced with a situation in which:

- no workbook;

- the work book is available, but there are no records in it for any periods of the person’s work;

- erroneous or incorrect information has been entered.

In the listed cases, in order to calculate the length of service correctly and confirm the period, you need a written work agreement. It must be drawn up in accordance with the laws in force at that time;

- collective farmer's workbook;

- certificate provided by the employer (or government agencies);

- extracts from orders;

- extracts from personal accounts;

- salary slip.

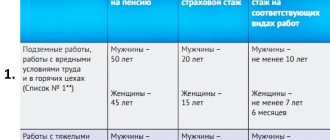

Northern pension calculation: calculator

- the age when a citizen plans to retire (please note that when working in the northern regions of the country and in areas equivalent to them, you can retire earlier than throughout Russia);

- monthly salary;

- in a letter from the Russian Pension Fund you will need to find the amount of existing savings for a future pension.

All residents of the northern regions of the country have the right to retire at the age of 55 years (for men) or 50 years (for women). If the work was associated with difficult or dangerous activities, then early payments of pension savings are possible: at 45 years old and at 50 years old. As a last resort, you need to work in the North for at least 7.5 years in order to qualify for certain benefits when retiring.

Labor service calculation

Individual episodes from people's lives can play in certain cases the role of overall experience. These include:

- Studies. You need to know that school time is not taken into account in the total work experience. All other educational institutions are recorded only in the total length of service for calculations. During training, the person did not pay insurance premiums; therefore, he is not included in the insurance account.

- Baby care. Both the mother and the father can be credited as seniority. This length of service is also not covered by insurance, because There were no deductions while the employee was on such leave.

- Civil service. Such entries in the work book can be a good bonus when calculating the employee’s total length of service. This is due to the fact that in addition to the fact that this period will be an insurance period, the employee will have additional benefits.

- Jail. While a person is in prison, he does not have a single day of service credit. Exceptions are made only to those who are involved in work while serving their sentence. Only this type of activity can be recorded as a work experience.

- Serving in the army. Experience is counted if you have been in service for more than six months. Military service or recall of a conscript for other reasons is not included.

In conclusion, it must be said that in order to receive pension accruals, a person only needs to work for at least five years. However, these calculations will be appropriate in the presence of other indicators, regardless of human activity.

What's happened

Work experience is the duration of any activity, calculated in accordance with the procedure established by law.

Now, in order to receive a labor pension, you must work for at least six years at an official place of work.

In addition to the main job, experience includes:

- military service, both fixed-term and contract;

- receiving social benefits due to temporary inability to work;

- receiving unemployment benefits;

- public Works;

- the period of serving a sentence by a court decision in a colony;

- period of care for an incapacitated disabled person.

These periods can be taken into account, but only if before that you were officially employed and constantly contributed fees to the pension fund. There is some special experience for working in difficult conditions. For example, working in an area with a high radioactive background or working in the north of the country. This includes working in hazardous industries.