( 10 ratings, average: 5.00 out of 5)

The right to choose a pension is provided for by the current pension legislation, which, on the one hand, allows for a choice, and on the other, obliges the citizen to make it in favor of a specific type of security. And then about how the choice of pension is carried out, in favor of what type of payments it can be made, and also a little about what awaits pensioners in 2020 in connection with the reform of the system.

- Types of pensions in the Russian Federation

- What to choose: insurance or savings?

- Who has the right to choose to retire?

- Pension reform 2018/2019

General provisions

The formation and issuance of pensions is regulated by Federal Law No. 173-FZ of December 17, 2001, which spells out all the provisions regarding the establishment of volumes and amounts of payments, assignment and accrual to certain categories of citizens, as well as their implementation through authorized bodies.

Basic provisions of the law on pension insurance

The legislation provides for several types of pension payments depending on the type of accrual. These are labor, social and government. Each of them has subcategories depending on the reason for retirement: old age, disability, in case of loss of a breadwinner.

This article deals exclusively with the calculation of old-age pensions, i.e. labor in old age, social in old age, state in old age.

According to the pension reform, the beginning of which dates back to 1990 and is still being improved, a single payment in the amount of 22% of the monthly salary is divided into funded and insurance, the concepts of individual pension coefficient, pension points, etc. were introduced.

In addition to the basic definitions of the formation of pension payments, the legislation also regulates issues that relate to:

- Conditions for receiving pension accruals.

- The procedure for calculating pensions and delivery conditions.

- Calculation.

- Formation of pension payments (amounts).

The section of legislation on pensions consists of 7 chapters and 32 parts. In addition to the general provisions and mechanism for calculating pensions, it also provides for the concept of insurance length, the types of pension contributions that were mentioned earlier and the determining points for which categories of citizens are assigned this or that type of pension.

Basic concepts in legislation

The legislation of the Russian Federation provides for the following concepts:

- A labor pension is a monthly payment to persons who made contributions to a pension account during active work and retired due to old age or disability. (No. 213-FZ).

- Insurance experience is the total number of years worked on the basis of official employment or activities under an agreement/contract. During this period, pension contributions were made to the Pension Fund.

- Estimated pension capital is the total amount of pension contributions to the Pension Fund.

- Establishment of a labor pension - assignment, recalculation and adjustment of the amount of pension payments, transition from one type of pension to another. (No. 142-FZ).

- An individual personal account is a collection of information on pension contributions by the insured person (future pensioner). This provision is regulated by the Federal Law “On individual accounting in the pension insurance system” (No. 198-FZ). When registering a pension account, SNILS is assigned.

- A special part of an individual personal account is the formation of payments according to the division of accounts into compulsory pension insurance, the funded part of the pension, receiving interest on investments in both parts if the insured person agrees to the circulation of his funds, receiving income from Maternity capital if the funds were directed to the funded part of the pension (Law No. 256-FZ “On additional measures of state support for families with children”), and on payments made from the pension.

- Pension savings - all payments made and deductions from an individual pension account (No. 421-FZ).

- The expected period for payment of old-age labor pension payments is an indicator that determines payments for the insurance and funded part of the pension.

Types of pensions in Russia

The model of the pension structure of the Russian Federation includes four types of mandatory payments:

- Insurance.

- Cumulative.

- Provided by the state.

- Provided by non-state pension funds.

The legislation defines:

- insurance pension , as a regularly paid material benefit designed to compensate for lost income, as well as financial support for disabled relatives who have lost their sole breadwinner;

- accumulative investments as monthly payments formed from insurance contributions and profit from investing funds;

- government payments in the form of compensation payments in case of loss of income, after retirement due to old age or disability;

- non-state - material funds paid by a non-governmental fund in accordance with the pension agreement.

Until 2020, both parts complemented each other and constituted a single pension. After the reform, insurance and savings capital are separate types of pension accumulation of funds.

Accrual conditions

The conditions for calculating pension payments depend on the length of service, type of activity, and state of health of the person.

According to the law, the following types of pensions are distinguished:

- by old age;

- on disability;

- for the loss of a breadwinner.

These types are provided for in all forms of pension contributions.

A labor pension may consist of a funded and insurance component.

Labor

An old-age labor pension is assigned when a person reaches a certain age (55/60 years of age for women and men) and if he has at least 5 years of insurance experience.

A labor pension can be assigned for old age, disability and loss of a breadwinner.

This provision is regulated by the Law “On Labor Pensions in the Russian Federation”, Chapter I “General Provisions”, Art. 3.

Category of persons entitled to receive an insurance pension:

- Employees carrying out activities under an employment contract.

- Self-sufficient individuals (individual entrepreneurs, notaries, etc.).

- Employees who make their own contributions.

- Working abroad and paying contributions to the Pension Fund.

- Individuals who carry out work activities on the territory of Russia and are not its citizens, but have a pension account and contributions.

The following categories of citizens can receive early payments:

- Those with special experience, i.e. working under unfavorable working conditions.

- Having a certain total work experience (length of service, etc.).

These categories include citizens working on list 1 and list 2.

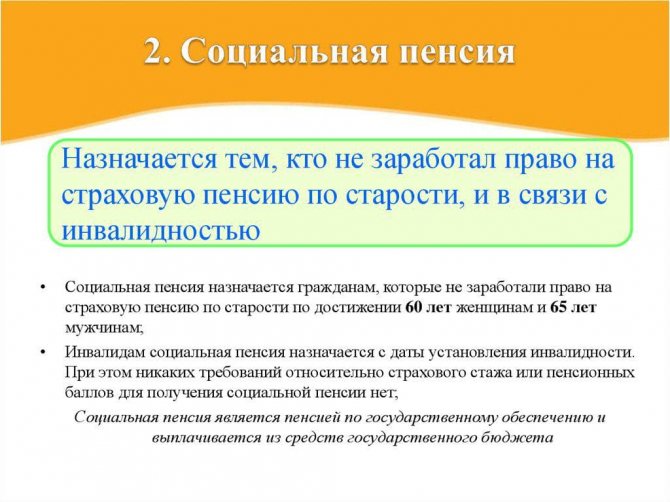

Social

There is also a social old age pension. Conditions for obtaining include permanent residence in the territory of the Russian Federation and belonging to the category of “disabled citizens”. Also, a social pension is issued to persons living in the Far North.

State

A state old-age pension is also awarded if a person is a participant in man-made and radiation disasters. State seniority is assigned to military personnel, government representatives, cosmonauts, and test pilots.

Social unemployment pension is paid if a person, due to reasons, does not have work (insurance) experience, and did not have any other benefits. In this case, he is paid a living wage.

What pension is due if there is no work experience?

Material support for people who work for private companies or entrepreneurs, and who do not have a record of this in their work books, is vital. The state provides for the payment of a minimum amount to citizens who do not have a sufficient number of years of work experience. The amount of such social benefits is minimal. Before the last indexation in April 2020, its amount was about 3.5 thousand rubles, and after indexation it increased to 8.6 thousand rubles .

Video review

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- 8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

By old age

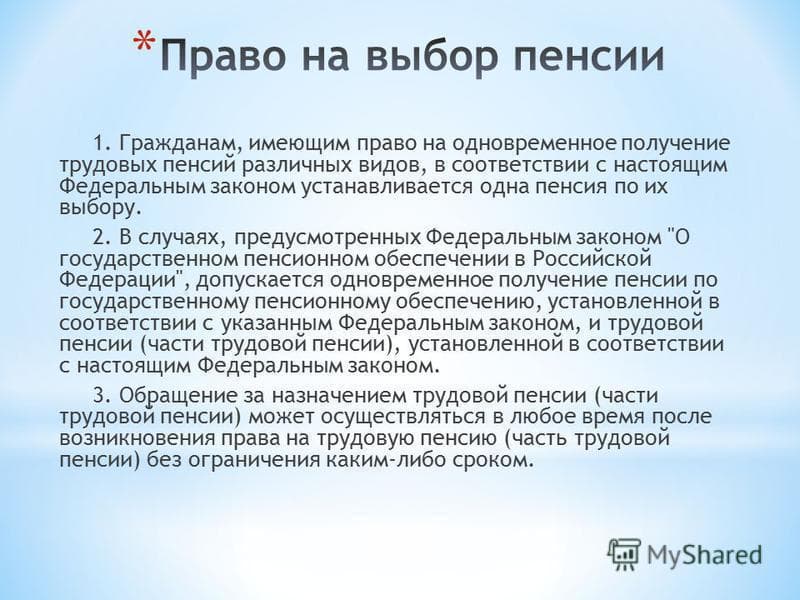

Right to choose a pension

According to Article 4 of the Law “On Labor Pensions”, a citizen of the Russian Federation can apply for a state pension in accordance with the Federal Law “On State Pensions in the Russian Federation” and a labor pension. This is allowed in the following cases:

- the size of the social benefit is small, it barely exceeds the minimum subsistence level, it is established by the state, while the size of the insurance pension depends on the person’s earnings and his length of service;

- social benefits are financed by the state, and the insurance pension is paid from the Pension Fund.

If these conditions are not met, then the person is obliged to choose the type of pension provision in accordance with the above-mentioned article of the law.

Some persons who have a special status may receive, in addition to old-age insurance payments, a long-service pension; these categories of citizens include:

- military personnel, with the exception of those who served as ordinary soldiers or sailors;

- test pilots;

- federal government employees;

- astronauts.

Regarding federal civil servants, it is necessary that they have at least 25 years of work experience and retire from this service, and if before retirement age they worked in the state civil service, then this period must be at least 7 years.

The long-service pension is paid together with disability or old-age insurance, which is assigned in accordance with the Federal Law “On Insurance Pensions”.

Some citizens may qualify for two pensions: social and insurance, both of these pensions are due:

- parents and widows (provided that they have not remarried) of military personnel who died during their service;

- participants of the Great Patriotic War;

- family members of deceased cosmonauts;

- those who received the distinction “Resident of besieged Leningrad”.

What to choose an insurance or funded pension

The ability to choose a savings method expands the possibilities of citizens and allows them to determine the most effective option.

According to Federal Law No. 351, which contains reformed articles of pension reform, citizens of the Russian Federation born in 1967 and later are required to choose one of two security options:

- Remain on the old option with 6% insurance premium rate.

- Direct contributions in full to insurance coverage.

Since the moratorium announced by the government does not allow the formation of pension savings, the deducted payments will go towards the insurance pension and will be transferred as an individual pension plan. Previous savings are invested by the same financial entities and paid to citizens after receiving a pension.

According to current regulations, a person participating in the organization of pension capital is assigned financial support when going on vacation, regardless of the availability of a funded pension, for which one should contact his policyholder.

Comparative analysis

The main difference between savings savings and insurance savings is the ability to manage capital for pensioners through a personally selected non-state pension fund. Thus, savings investments have the qualities of a bank deposit that can bring both profit and loss.

Advantages and disadvantages of types of pensions:

| Kinds | Cumulative | Insurance |

| Advantages |

|

|

| Flaws |

|

|

The choice of type of pension savings is a purely personal decision, determined by working conditions and the level of salary received.

Important! Before you finally choose a method for accumulating retirement savings, carefully study the available offers and only then make your final decision.

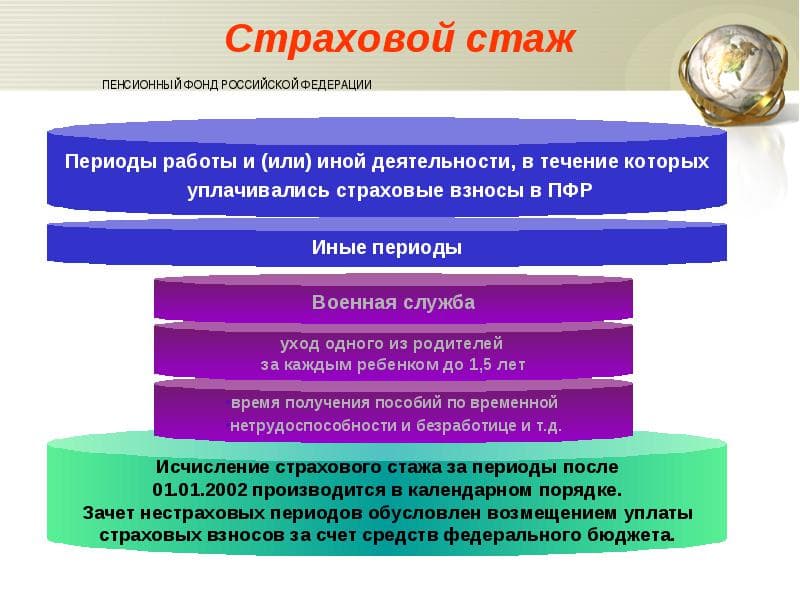

Insurance experience

The insurance period includes the period when a working person participates in state compulsory pension insurance, for which certain fees are paid monthly, the amount of which should not be less than the minimum insurance contributions. Confirmation that a person participates in such insurance is a document that can be obtained from the Pension Fund.

What does it include

The insurance period includes only the months for which insurance premiums were paid. When assigning a pension, only the citizen’s legal income is taken into account. And his work experience is confirmed by a documented work book, so it is worth carefully checking all the entries in it when moving from one job to another.

The rules for calculating work experience are described here.

It is worth considering one more nuance: if the contribution amount for one month was below the established minimum, then it is not taken into account in the length of service.

The length of service for calculating a pension includes time:

- work under an employment contract, in which case all state contributions must be collected;

- being on sick leave;

- voluntarily paid labor contributions;

- carried out during maternity age, caring for a baby under 3 years of age or a child under 6 years of age, if there are medical indicators for this.

Calculation order

The insurance period greatly influences the calculation of the final pension. The fact is that pension payments grow annually by a certain percentage of earnings. There is not only a minimum size, but also a maximum. All citizens who have joined the compulsory pension system are considered insured by the country's Pension Fund.

To find out the amount of the insurance pension (SP), you can use the following formula:

SP = FV+IPK x SPK,

in it:

- FV - the size of the fixed payment;

- SPK - the cost of the personal coefficient;

- IPK - number of pension points.

The latter indicator is calculated for an individual year of work; it is influenced by the amount of insurance payments, as well as what type of pension a person has chosen for himself. Its maximum value is 10, and when calculating a funded pension it is now 6.25. There are some nuances when calculating it; the IPC can be charged in some cases, although citizens do not pay contributions; such exceptions include:

- care for young children and disabled children;

- Military service;

- looking after disabled people of group I.

To calculate this coefficient there is a special formula:

IPC = SV / SMV x 10

designation of the components of the formula:

- SMV – the amount of contributions from the maximum contributory part of the salary;

- SV - those contributions that were transferred to the pension.

When calculating the disability insurance pension, a slightly different approach is used; its minimum amount is set one and a half times higher than the minimum social payment in a certain region. The funded part of such benefits depends on deductions and length of service; it is calculated in the same way as for other segments of the population.

New law on insurance pensions From January 1, 2020, the Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation” became invalid. In its place, the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” was adopted and came into force. Thus, a new procedure for calculating pensions has been introduced - the so-called new pension formula. Its main goal is to ensure financial balance of the pension system and increase the joint responsibility of the state, employers and employees themselves for the level of pension provision. The essence of the new pension formula comes down to the following. The retirement age remains the same: for men - 60 years; for women - 55 years. The minimum insurance period (length of payment of insurance premiums) to acquire the right to a pension will increase from 5 to 15 years. It will increase annually by 1 year starting from 2020. The insurance period will include the same “non-insurance periods” as before. At the same time, the period of childcare taken into account until they reach 1.5 years of age will be no more than 6 years in total (previously it was no more than 3 years). The size of the pension depends on the amount of individual pension coefficients (IPC) accumulated during the insurance period and the cost of 1 pension coefficient in the year the pension was assigned. The IPC for the corresponding year of insurance experience is calculated based on the ratio of the insurance premiums actually accrued for the employee during the year and their standard amount (calculated from the maximum annual salary base subject to contributions). The cost of 1 pension coefficient will be determined annually by the federal law on the Pension Fund budget. The right to early retirement for workers in harmful, hazardous industries and other categories of citizens is retained, but subject to the availability of a certain amount of IPC. Thus, the size of your future pension will directly depend on your salary. The higher and more legal it is, the larger the pension will be. To encourage citizens to retire at a later age, increasing coefficients are provided. Moreover, the later a person applies for a pension, the greater it will be. A fixed payment of 3,935 rubles is established for the insurance pension. per month. It will also increase if you retire later. For some categories of citizens (persons over 80 years of age, disabled people of group I, etc.), an increased amount of fixed payment is provided. The new pension formula retains the recalculation of pensions for working pensioners. The mechanism for indexing pensions will remain the same. The procedure for calculating disability and survivors' insurance pensions is generally similar to the previous one, taking into account the introduction of an individual pension coefficient to replace the calculated pension capital. Pensioners receiving labor pensions will be transferred to a new procedure for calculating pensions from January 1, 2020. At the same time, the amount of the insurance pension determined according to the new rules cannot be lower for them than what they received previously. It is planned that the new pension formula will allow the average old-age insurance pension to be increased by 2030 to the level of 2.5-3 subsistence minimums for a pensioner. Provided that insurance premiums have been paid for at least 35 years and with an average salary, the pension will be up to 40% of earnings. Since today innovations in pension legislation, in particular, Federal Law No. 400-FZ, do not yet have legally substantiated comments, for more detailed explanations we will turn to the information of the Ministry of Labor and Social Protection of the Russian Federation on the general provisions of the new pension formula, on the new rules for calculating pensions by old age. The previously existing procedure for calculating old-age labor pensions was unfair to the most economically active category of the population, to those who plan to lead an active working life for a long time. The egalitarian principle of calculating pensions led to the fact that the labor pensions of citizens with little work experience were approximately equal to the pensions of citizens with a long insurance period. The new procedure for the formation of pension rights and the calculation of pensions will ensure the adequacy of pension rights to wages and increase the importance of the insurance period in the formation of pension rights and calculation of the pension amount. First of all, let us explain that the full insurance pension will be formed according to the new rules for citizens who will begin working in 2020. For future pensioners who have insurance coverage until 2015, all formed pension rights are recorded, preserved and guaranteed to be fulfilled. In 2014, they were converted into individual pension coefficients - a new tool for accounting for a citizen’s pension rights. For current pensioners, when switching to the new calculation procedure, the size of their pension will not decrease. It can increase for pensioners who have periods of non-insurance. After the introduction of a new procedure for calculating pensions, the old-age labor pension is transformed into an insurance pension and a funded pension. A fixed payment will be established for the insurance pension (analogous to today's fixed base amount of the insurance part of the old-age labor pension). The size of the funded pension will be calculated by dividing the amount of pension savings by a statistical value - the expected payment period, determined by federal law. Annual pension coefficient When calculating the insurance pension according to the new rules, the concept of “annual pension coefficient” is introduced for the first time, which evaluates each year of a citizen’s work activity. The annual individual pension coefficient is equal to the ratio of the amount of insurance contributions paid by the employer (employers) for the formation of the insurance part of the pension at the rate of 10% or 16% chosen by the citizen, to the amount of insurance contributions from the maximum legally taxable salary paid by the employer at the rate of 16%, multiplied by on 10: The amount of insurance contributions for the formation of the insurance part of the pension, paid by your employer from your salary at a rate of 10% or 16%* Annual PC = —————————————————————— —————— x 10 The amount of insurance contributions from the maximum legally taxable salary, paid by the employer at a rate of 16% ** * If a citizen refuses to form pension savings in the compulsory pension insurance system (0%), then the employer will pay insurance contributions for him for the formation of his insurance part of the pension at a rate of 16% If a citizen chooses a 6% tariff for the formation of the funded part of the pension, then insurance premiums will be sent for the formation of his insurance part of the pension at a rate of 10%. ** The maximum annual salary (payment fund there), from which employers pay insurance contributions to the compulsory health insurance system, is established annually by federal law. *** The rate at which employers pay insurance contributions to the compulsory health insurance system is 22% of the employee’s wage fund. 6% of the tariff of insurance contributions from the compulsory pension insurance system goes to finance a fixed payment, and 16% is an individual tariff, the paid contributions for which, at your choice, can either be completely directed towards the formation of pension rights in the insurance part of the pension, or 6% can be directed towards the formation pension savings of a citizen, and 10% - for the formation of pension rights in the insurance part of the pension. The higher the salary, the higher the annual pension coefficient! The annual pension coefficient with equal salary will always be higher for a citizen who has refused to form pension savings. When calculating the annual PC, only the official salary before deduction of personal income tax (13%) is taken into account. From 2021, with an annual increase in the level of contributory wages to 2.3 of the average Russian salary, the maximum value of the annual PC will reach 10 from 7.39 in 2020. The maximum annual coefficient is accrued to a citizen if his salary, from which insurance premiums are paid, is not lower than the maximum salary from which employers, by law, pay insurance contributions to the mandatory pension insurance system, and the citizen has refused to form pension savings. The cost of the pension coefficient is determined annually by the Government of the Russian Federation in accordance with federal law. When calculating the insurance pension, all annual pension coefficients are summed up, including special coefficients for socially significant periods. Next, the resulting amount of annual pension coefficients is multiplied by the coefficient for the deferred pension and the cost of the annual pension coefficient, which is annually established by the Government of the Russian Federation in accordance with federal law. A fixed payment is added to the resulting value, increased by the size of the bonus coefficient for applying for a pension at a later date after reaching retirement age or becoming entitled to a pension (early). “Non-insurance periods” counted towards length of service In the new rules for calculating labor pensions, the following socially significant periods of a person’s life are counted towards length of service: - the period of military service, as well as other equivalent service provided for by the Law of the Russian Federation “On pension provision for persons who served in military service” service, service in the internal affairs bodies, the State Fire Service, agencies for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families”; - the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years; — the period of receiving compulsory social insurance benefits during the period of temporary disability; - the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than 4.5 years in total; - the period of receiving unemployment benefits, participation in paid public works and the period of moving or relocating in the direction of the state employment service to another area for employment; - the period of detention of persons who were unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, and the period of serving their sentences in places of imprisonment and exile; - the period of residence of spouses of military personnel performing military service under a contract, together with their spouses, in areas where they could not work due to lack of employment opportunities, but not more than five years in total; - period of residence abroad of spouses of diplomats and consuls, but not more than five years in total. For these so-called “non-insurance periods”, special annual coefficients are assigned if the citizen did not work during these periods. Thus, for the period of compulsory military service, 1.8 pension coefficients are accrued - for each year of compulsory military service. Periods of child care (up to 1.5 years for each child) are also counted towards the length of service. Thus, for each child the following is accrued: - 1.8 pension coefficient per year of leave - for the first child, - 3.6 pension coefficient per year of leave - for the second child, - 5.4 pension coefficient per year of leave - for the third child. Calculation of insurance pension Calculation of old-age insurance pension will be made according to the following formula: SP = (FV x CPV) + (IPK x CPV) x SPK, where: SP - insurance pension in the year the pension was assigned; FV - fixed payment; IPC is an individual pension coefficient equal to the sum of all annual pension coefficients of a citizen; SPK - the cost of one pension coefficient in the year the pension was assigned; CPV - bonus coefficients for retiring later than the generally established retirement age (has different meanings for FV and SP!). Please note that under the new rules, retiring later will be beneficial! For each year of later application for a pension, the insurance pension will increase by the corresponding premium coefficients. For example, if you apply for a pension 5 years after reaching retirement age, the fixed payment will increase by 36% and the insurance pension by 45%; if after 10 years, the fixed payment will increase by 2.11 times, the insurance part - by 2.32 times. Coefficients for calculating an insurance pension when applying for a pension is delayed after reaching retirement age:

| Insurance work experience without applying for a pension (No more than 10 years. If more, then the coefficient for 10 years is applied) | Fixed payment | Insurance part of pension |

| 0 | 1 | 1 |

| 1 | 1,056 | 1,066 |

| 2 | 1,12 | 1,15 |

| 3 | 1,19 | 1,24 |

| 4 | 1,27 | 1,34 |

| 5 | 1,36 | 1,45 |

| 6 | 1,46 | 1,59 |

| 7 | 1,58 | 1,74 |

| 8 | 1,73 | 1,9 |

| 9 | 1,9 | 2,09 |

| 10 | 2,11 | 2,32 |

Another feature: in 2025, the minimum total length of service to receive an old-age pension will reach 15 years (6 years in 2020, it will gradually increase over 10 years - 1 year per year).

Those whose total length of service by 2025 will be less than 15 years have the right to apply to the Pension Fund for a social pension (women at 60 years old, men at 65 years old). In addition, a social supplement to the pension is made up to the subsistence level of the pensioner in the region of his residence.

The second condition for assigning a pension upon reaching retirement age is the need to create pension rights in the amount of 30 pension coefficients.

The conditions for granting a disability and survivors' pension remain the same.

For citizens with work experience: disabled people of group I, citizens who have reached 80 years of age, citizens who worked or lived in the Far North and equivalent areas, the pension will be assigned in an increased amount due to an increased amount of a fixed payment, or the use of “northern” coefficients

Funded pension

A funded pension is a monthly payment of pension savings formed from insurance contributions from your employers and income from their investment. Today, employers pay insurance contributions to the mandatory pension system at a rate of 22% of the employee’s wage fund. Of this, 6% of the tariff can go to the formation of pension savings, and 10% - to the formation of an insurance pension, or maybe - at the choice of the citizen - all 16% can go to the formation of an insurance pension.

If a citizen was born in 1967 or older, then his old-age pension will not contain the funded part of the pension, because his employers contribute the entire amount of insurance contributions only to the insurance part of the pension.

If a citizen was born in 1967 and later, until December 31, 2015, he will additionally be given the opportunity to choose the rate of insurance contribution for the funded part of the pension: either leave 6% as it is today, or refuse to form pension savings, thereby significantly increasing the formation of pension rights in the insurance pension.

When choosing an insurance premium rate, you need to remember that by deciding to form a funded pension, you reduce your pension rights to form the insurance part, and vice versa. Which option is more profitable - you decide for yourself. When making a decision on your choice, it is worth remembering that the insurance pension is guaranteed to be increased by the state through annual indexation at a level not lower than inflation. While a funded pension is pension savings that are transferred from the Pension Fund to the management of a non-state pension fund or management company and are invested by them in the financial market. The funded pension is not indexed by the state. The profitability of pension savings depends solely on the results of their investment, that is, there may be losses. In case of losses, only the payment of the amount of paid insurance contributions to the funded part of the pension is guaranteed.

According to the new calculation rules, the size of the funded pension will also be higher if you apply for a pension later than the generally established retirement age: 60 years for men and 55 years for women. After all, to calculate a funded pension, the amount of pension savings is divided by the so-called. The period of expected pension payment is 228 months. And if, for example, you apply for a pension three years later, then the amount of pension savings is divided into 192 months.

Thus, the higher the salary and the longer the total length of service, the higher the old-age pension will be!

The main parameters influencing the calculation of pensions

The size of the pension will primarily be affected by:

- salary: the higher the salary, the higher the pension. If the employer has not made contributions for his employee to the compulsory pension insurance system in full (for example, in the case of paying “gray” wages), this earnings do not participate in the formation of pension capital;

— length of insurance experience: the longer a citizen’s insurance experience, the more pension rights he will have, and for each year of work activity a certain number of pension coefficients will be accrued;

- age of application for a labor pension: the pension will be significantly increased for each year that elapses after reaching retirement age before applying for a pension.

The new rules for calculating pensions include such socially significant periods of a person’s life as military service, caring for a child, a disabled child, or a citizen over 80 years of age. For these so-called “non-insurance periods”, special annual coefficients are assigned if the citizen did not work during these periods.

What types of pensions are covered by the new procedure?

The new procedure for the formation of pension rights and the calculation of insurance pensions will apply to all types of labor pensions - old age, disability and survivors' pensions.

The grounds (conditions) for assigning an insurance pension for disability and loss of a breadwinner will not change. To assign these types of insurance pensions, it is enough to have at least 1 day of work experience.

The new procedure for the formation of pension rights and the calculation of insurance pensions does not apply to the formation and assignment of pensions for state pension provision (social pensions, long service, old age, disability, loss of a breadwinner). For citizens with work experience: disabled people of group I, citizens who have reached 80 years of age, citizens who worked or lived in the Far North and equivalent areas, the pension will be assigned in an increased amount due to an increased amount of a fixed payment, or the use of “northern” coefficients

What will happen to the funded pension and existing pension savings?

All already generated pension savings remain with the citizen. They will be paid in full, taking into account the income from their investment, when a citizen becomes entitled to an insurance pension and applies for it.

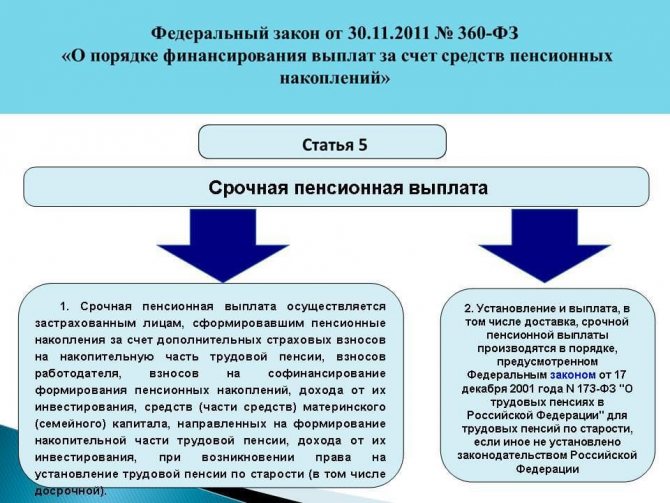

The procedure for assigning and paying out pension savings does not change. To calculate the funded pension, the amount of pension savings is divided by the expected period of payment of the funded part of the labor pension. The period of expected pension payment is established by Federal Law. The procedure for paying pension savings will also remain the same (one-time payment, urgent pension payment, payment of the funded part of the labor pension).

The funded pension is not indexed by the state. The profitability of pension savings depends solely on the results of their investment, that is, there may be losses. In case of losses, only the payment of the amount of paid insurance contributions to the funded part of the pension is guaranteed.

To which part of the pension is it better to allocate more contributions from the employer's insurance contributions - to the insurance or savings? Which tariff should I choose: 0 or 6%?

Citizens born in 1967 and younger in 2014-2015. provided the opportunity to choose the rate of the insurance contribution for the funded part of the labor pension: either leave 6%, as it is today, or refuse to further form the funded part of the pension, thereby increasing the tariff for the insurance pension from 10% to 16%.

By increasing the percentage of the tariff for the formation of a funded pension, a citizen reduces the pension rights to the formation of the insurance part, and vice versa.

Which option is more profitable is decided by the citizen himself. When deciding on your choice, it is first of all important to remember that the insurance pension is guaranteed to increase due to annual indexation at a level not lower than inflation. While a funded pension is pension savings that are transferred from the Pension Fund to the management of a non-state pension fund or management company and are invested by them in the financial market.

The funded part is not indexed by the state. The profitability of pension savings depends solely on the results of their investment, that is, there may be losses. In case of losses, only the payment of the amount of paid insurance contributions to the funded part of the pension is guaranteed.

If a citizen refuses to form pension savings, the rate of insurance contributions of his employer to the Pension Fund of Russia in the amount of 16% will be used to form his insurance pension. It is important to note that even in this case, all pension savings of citizens generated at this time will continue to be invested and paid in full, taking into account investment income, when citizens become eligible to retire and apply for it.

The opportunity to choose your tariff plan (all 16% of the tariff to be used to form an insurance pension or 6% of them to be used to form a funded pension) has been extended until December 31, 2015. You can submit an application for refusal to form the funded part of your pension until December 31, 2020 inclusive.

Will the social pension be affected by changes and will social supplements to pensions remain at the subsistence level?

The new pension formula will not apply to the assignment of pensions under state pension provision - it is intended exclusively for the assignment of pensions to citizens with work experience.

Moreover, if the total amount of material support for a non-working pensioner does not reach the cost of living of a pensioner in the region of his residence, he will continue to be provided with a social supplement to his pension up to the PMS in the region. When calculating the total amount of financial support for a pensioner, all types of pensions, monthly cash payments (including the cost of a set of social services), additional material support and other social support measures are taken into account.

Will the expected period of pension payment change in the new pension formula?

The “expected payment period” indicator will not be used when calculating the insurance pension for periods of insurance coverage after January 1, 2020.

In this case, the procedure for calculating the funded pension will remain the same, and the expected payment period will be used. To calculate the funded pension for citizens retiring upon reaching the established age, it is currently 228 months. If, for example, you apply for the funded part of your labor pension three years later than reaching retirement age, then the amount of pension savings is divided by the expected period of pension payment, reduced by 36 months. This indicator is approved annually by federal law.

In conclusion, we would like to remind you that all pension rights of citizens formed to date will be preserved, and in no case will their size be reduced. This is the basic approach that guided the development of a new procedure for the formation of pension rights and calculation of pensions.

In order to introduce a new procedure for the formation of pension rights of citizens and the assignment of pensions from January 1, 2020, during 2014 the conversion of pension rights of citizens formed before January 1, 2020 was carried out.

The conversion was carried out by the Russian Pension Fund without application. Citizens do not need to contact the Pension Fund for this!

The PFR personalized accounting database contains all the necessary information about the estimated pension capital, length of service and salary of each participant in the compulsory pension insurance system in order to recalculate his already formed pension rights into pension coefficients.

Branches of the Pension Fund of the Russian Federation in the North Caucasus Federal District

Stavropol Territory 355000, Stavropol, st. Sovetskaya, 11 Contact phone: (8652) 94-21-15 https://www.pfrf.ru/ot_stavrop

Regulation of accrual, recalculation and indexation

New laws on pensions (Chapter 5, Articles 18-26 of the Law “On Labor Pensions”) have changed the previously recognized indicators. Now the minimum length of service for receiving an insurance pension will increase by a year, after each year, and the number of points will increase to 2.4 for the same period. When calculating a pension, you need to calculate all indicators at the time of its establishment.

Accrual

Insurance payments are calculated according to the above formula, but there are groups of people who receive it with an increased fixed surcharge:

- people over 80;

- disabled people of group I;

- citizens working or living in the North.

If you do not immediately apply for old-age benefits, their amount will increase and after five years it can increase by 36%.

The social pension depends on the cost of living, but it can change due to indexing. In 2020, the indexation coefficient is 1.5, and in 2020 the government plans to make it 1.2%.

If, as a result of calculations, the social payment turns out to be lower than the minimum, then the pensioner is charged an additional payment up to the established minimum.

If a pensioner supports dependents, then he is given an increase: for one person - 32%, for two - 64%, but for three or more - 100%.

When calculating a funded pension, income is divided into 240 months, and if you apply for it later, you will need to divide it into fewer months and the payments will be larger.

Recalculation

The state provides an increasing coefficient; it applies to working pensioners who should already be receiving an old-age pension, but are postponing receiving it; for a certain period of deferment, additional points and funds are calculated.

Also read about what valorization is and what kind of pension pensioners who completed their main service under the USSR can count on.

Indexing

They relate to the pension coefficient; every year its cash equivalent grows as the cost of living increases. Indexation of pensions is carried out only for non-working pensioners. From February 1, 2020, this figure is 4%.

How to choose

A citizen needs to make a decision when applying for the social guarantees under consideration. The selection criterion is usually one: the amount of payments. The procedure is standard: documents are submitted to the Pension Fund in accordance with the choice made.

For example, victims of the Chernobyl nuclear power plant can choose from two options: a choice between government payments (for old age, disability) and an insurance type (also disability, old age). Their size differs because the amounts are calculated differently. Of course, it is advisable to choose the option with a larger amount.

The fact of receiving one type or another does not in any way affect other social guarantees; for example, a Chernobyl survivor can receive insurance payments, taking advantage of privileges for his category of the population. Citizens of a certain age who are already using the disability insurance system can instead be assigned a payment of the same type, but for old age.

If the recipient is not satisfied with his choice, then he can switch from one security to another an unlimited number of times at any time without being tied to a time frame.