- home

- Reference

- Non-state pension provision

Since March 2020, the joint stock company “non-state pension fund StalFond” has been reorganized by merging with JSC “NPF “FUTURE”, previously called OJSC “NPF “BLAGOSOSTOYANIE OPS”.

Accordingly, from that time on the organization ceased to operate as an independent one. This fund will be discussed in the article, where we will consider the main indicators of its activity, and also evaluate its reliability and the feasibility of transferring pension savings under the management of this organization.

About the fund

“Stalfond” is a fairly large organization, and this increases the level of citizens’ trust in it. The structure sets itself the task of improving service for clients and maintaining the position of one of the leaders in its segment.

Initially, the organization was called “Sheksna-Hephaestus” and was known as the “metallurgists’ fund.” This is due to the development of pension programs for industrial enterprises of Severstal, with which the work of this structure began. But after 5 years, branches began to open in different regions of the country, and 40 thousand people became clients of the fund.

The name “Stalfond” appeared in 2004; a special competition was even held to select the name. At the same time, pension reform took place, and new opportunities opened up for organizations in this area. This concerns, first of all. provision of OPS services.

During 2007-2014, Stalfond managed to increase the number of contracts for compulsory pension insurance by more than 33 times to 1.002 million. The volume of pension savings increased to 34.8 billion rubles, i.e. 86 times. The foundation has been repeatedly awarded prestigious awards, including international ones, and high ratings.

Reliability rating and profitability by year

Reliability of the fund by year, according to the Expert RA agency, which evaluates NPFs using special methods.

- 2015: A+, stands for “very high level of reliability.” Forecast: “stable” – there is a high probability of maintaining the current level.

- 2016: A, “High level of reliability.” The forecast changes: “developing”, i.e. In the future, the assessment is likely to change in a positive or negative direction, as well as maintaining the current one. Assigned the status “Under supervision”.

- 2017, August: ruBB-, “moderately low financial stability.” The fund depends on negative situations in the economy. Forecast: “stable”.

- 2017, August: withdrawn at the request of the foundation.

In 2020, it does not participate in the Expert RA reliability rating.

Profitability:

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| -25,35 | 26,89 | 12,39 | 0,91 | 7,15 | 8,23 | 1,47 | 5,58 | 4,08 | 3,88 |

Accumulated profitability 2013-2017 - 20.7.

For reference. 304 billion pension funds and 4.6 million people who have entered into an agreement with “FUTURE” are the main indicators of the fund, allowing it to be one of the three largest non-state pension funds.

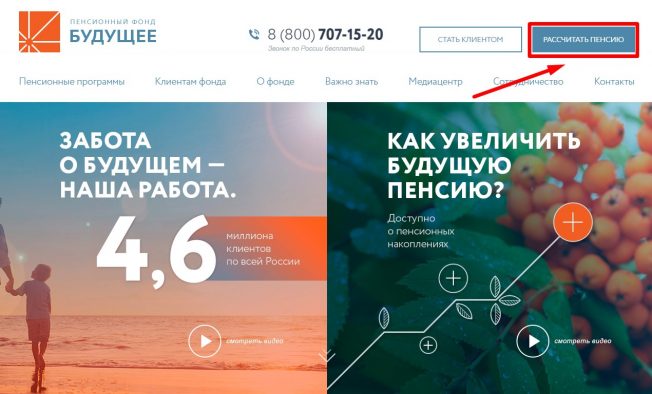

Official website

The official website of NPF "Stalfond" futurenpf.ru provides access to information about the work of the fund, areas of activity, cooperation with partners. Here you can:

- Calculate pension according to compulsory pension insurance;

- Submit a request for information;

- Choose an individual pension plan;

- and necessary documents;

- Learn about the procedure for inheriting funds.

On the official website of OJSC NPF Stalfond there are complete conditions for registering an individual pension plan. Moreover, clients of the fund can fill out an online application for the development of such a plan by specialists. In this case, all the capabilities and needs of the citizen will be taken into account.

Necessary information

Similar structural funds began to form in Russia back in the 90s of the last century.

The reason was presidential decree of 1992 No. 1077 “On Non-State Pension Funds”. Today, the affairs of non-state funds are regulated by Federal Law No. 75 “On NFP”.

Advantages of NPF Stalfond

Just recently, more than 150 non-state pension structures were registered in Russia. Now there are about 30 of them left. They are responsible for the savings of Russians.

The number of such NPFs already includes and, since from March 2020 all clients of NPFs on issues of compulsory pension insurance and non-state provision will continue to be serviced by NPF “Future”.

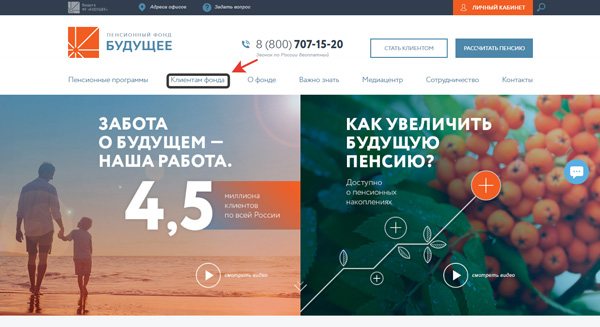

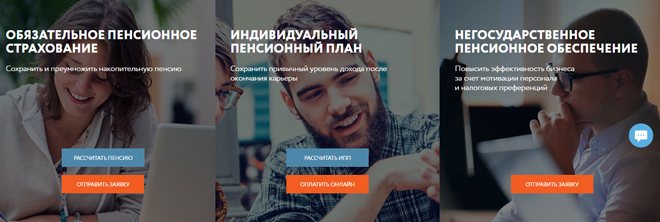

Photo: current programs of NPF Stalfond for clients

Clients will not have to renew previously concluded contracts with a new company. If we compare the conditions of the Russian Pension Fund and non-state pension funds, then when collaborating with the latter, the citizen clearly benefits.

The only problem is the lack of clear guarantees that by the time a person reaches old age (retirement age), the company will still exist.

The problem was solved at the state level. NPFs were forced to officially insure themselves. However, people prefer to enter into agreements only with proven and reliable organizations, so as not to doubt their well-being in old age.

One of such companies is considered to be NPF Stalfond, which was formed in 1996. At the beginning of its work, the structure was classified as a corporate fund, the client base of which was the companies of the Severstal group, specializing in the metallurgical industry.

Over the 18 years of its existence, the organization, once considered a non-departmental structure, has grown to one of the main players in the Russian pension market.

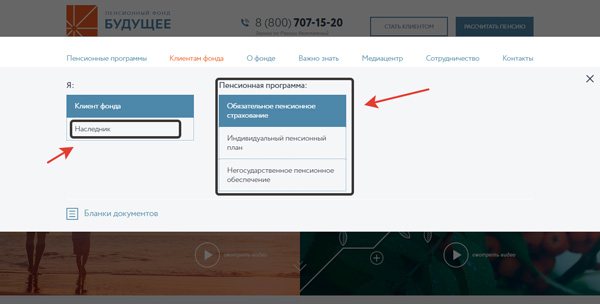

Photo: choice of NPF Stalfond program

Now NPF Stalfond rightfully occupies one of the leading positions in Russia when comparing performance indicators. There are 14 branches and more than 240 points of sale throughout the country.

The company's activities cover most of the country and serve about 1,000,000 citizens. The National Rating Agency assigned the Stalfond pension fund an “AA+” rating in its rating.

This indicates a high degree of confidence in the work of first-level advises. You can reflect the effectiveness of an organization in simple numbers. During the operation of the NPF:

| Number of insured individuals | Passed the mark of 1.4 million citizens |

| Total amount of pension funds | Exceeded the figure of 60 billion rubles |

| Approximate profitability | More than 120% annually |

| Profit from investment activities for 2020 | 8% |

Each client of the organization receives a “personal account” for use. This is a section on the site where the user can at any time get acquainted with the amount of profit from his investments or use the “Feedback” form to ask questions to a technical support specialist.

Detailed information about the activities of NPF Stalfond can be found on the official website of the non-state fund.

Online registration procedure

To register a personal account, you need to go to the Stalfond website. However, since March 2020, the company was merged with NPF Future.

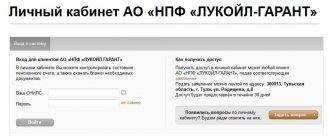

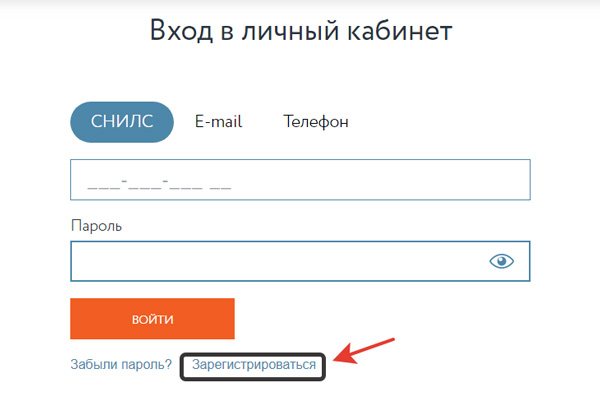

Photo: registration on the Stalfond website (step 1)

As a result, Stalfond clients must register on the Future website. When going to the official website, the user will be automatically redirected to. Registration:

- Go to the official website of the company.

- In the upper right corner there is an inscription - “Personal Account” - you need to click on it.

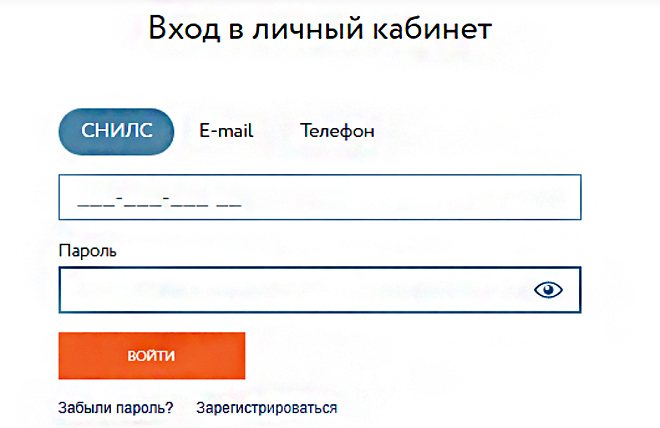

- The user will be presented with an account login form. You can log into your account via SNILS, phone number or email address. Click “Register”.

- A page with a registration form will open. The user must indicate his full name, passport details (optional), SNILS, email address, phone number, agree to the terms of the agreement and click “Register”.

- You need to come up with a password.

Photo: registration on the Stalfond website (step 2)

Legal basis

The structures of compulsory and voluntary pension insurance are an important part of the entire pension system of the modern Russian Federation. An important place is given to non-state pension education.

Over the past few years, the overall value of Russian non-state pension funds in the pension and compulsory insurance system has increased significantly and continues to grow.

The work of non-state funds is under the control of specially designated federal bodies that supervise financial markets as a whole.

In fact, the NPF is considered a collective investor, therefore, at the moment, control and supervision is entrusted to the Department of Collective Investments and Trust Management of the Central Bank of Russia.

Also, NPFs are considered active participants in the entire financial market. As a collective investor, companies accumulate investor money for the implementation of portfolio investments.

Unlike investment funds, the main goal of non-state pension funds is to increase and save citizens’ pension savings, which means reducing risks for investors and clients.

The entire regulation on assets in which NPFs have the right to invest is described in parts 3 and 4 of Federal Law No. 111-FZ.

You can also find requirements for the structure of the investment package there. Federal Law of 1998 No. 75-FZ “On Non-State Pension Funds” is responsible for the activities of NPFs.

Pension plans

According to the plan, upon the occurrence of appropriate grounds, the NPF client receives a non-state pension plus income from the investment of funds that he contributed in the form of contributions.

Important! Additional income is a social tax deduction - 13% of the amount of contributions for the year. This rule applies to amounts within 120 thousand rubles.

When making contributions, the frequency can be any. The first payment is from 1 thousand rubles. This approach allows you to effectively manage savings and provide additional protection in retirement age. There are various ways to deposit funds, from enterprise accounting and Sberbank branches to online services.

Helpful information! You can become a client of the NPF at any time. To do this, it is enough to transfer the pension savings collected in the account until the end of 2020 to a non-state fund. The funded pension will be paid from this amount.

The fund's clients are given the opportunity to increase their pension. The employer transfers to the Pension Fund 22% in excess of the salary, of which 6% are savings until the specified date, 16% are deductions towards the insurance pension, formed in points.

How to check your pension savings in Stalfond/Future

By registering a personal account, you can always be aware of the status of your hard-earned savings, and you will also know the investment rates with which the fund works. Directly in your personal account there is a specialized “pension savings” tab, which will allow you to keep everything under control.

You can obtain data on savings in three ways:

- online - you have this information directly in your account and you can immediately see it with your own eyes;

- by email - if you wish, you can order an extract to the e-mail specified during registration;

- by mail - if you need a practically official document, you can request an extract, which will be sent to you by mail to your post office. Perhaps this document may be required by the Pension Fund when calculating a pension.

Electronic versions of the information will become available almost within a couple of minutes, but the postal item will have to wait and the time depends on the Russian Post.

NPF rating

Earlier, RA “Expert” confirmed the rating of “Stalfond”, assessing its reliability at the “A+” level. This is a high figure, and the forecast for it was stable. After the reorganization, the rating was withdrawn. The fund received an 'AA' rating from the National Rating Agency in 2011, but this was withdrawn after the end of the contract period.

What it is?

NPF "Stalfond" dates back to 1996. True, now by typing the word "Stalfond" into a search engine, you will be redirected to the website of NPF "Future", don't worry, this is not a hoax or other tricks, it's just in 2020. Stalfond merged with NPF “Welfare OPS” and became “Future”. The result turned out to be quite confident and successful, since as of April 2020. this fund is one of the three largest pension funds; this rating is based on data from the Bank of Russia.

At the same time, it is worth remembering the origins of Stalfond; its development began with a narrow profile focus; the programs were prepared only for Severstal employees. Over the seven years of its existence from 2007 to 2014. The steel fund has grown so much that it has increased its financial performance by 86 times. These qualities of the enterprise contributed to the receipt of prestigious awards, not only in the domestic but also in the international market.

Free legal consultation by phone

For Moscow and the Moscow region St. Petersburg and the region Federal number

All this allows the fund, even in a new form, to win the trust of citizens.

Contact Information

All clients who have entered into contracts with NPF "Stalfond" are currently serviced by the "Future" fund.

Important! All agreements remain valid and there is no need to re-issue them.

In Moscow, the fund's representative office is located on Tsvetnoy Boulevard. D.2, checkpoint D. You can contact the unified information service by phone: 8-800-707-15-20, the call is free from anywhere in Russia. Customer requests are accepted at:

Offices and branches operate in other cities of the country. You can find your nearest representative office on the official website of NPF "Stalfond".

What does the fund promise to pensioners?

Like any other NPF, “FUTURE” strives to attract as many clients as possible, therefore it declares the reliability of investment instruments, the reliability of deposits and high profitability. Whether this is really so, we will consider on the basis of specific indicators, which, in accordance with the law, are open information and are subject to disclosure (periodic publication).

Reliability and profitability rating

The main indicators on the activities of non-state pension funds are checked and published on its official website by the regulator, the Bank of Russia. One of these indicators is the profitability of placing funds from pension reserves minus remuneration to management companies, a specialized depository and a fund.

According to the information posted by the Central Bank, it is clear that in 2020 the efficiency of placing funds in this fund went into the negative . The return on savings management became negative and amounted to -13.35%. This is one of the worst indicators among all non-state pension funds; according to it, “FUTURE” takes 6th position from the bottom of the list.

During the first half of 2020, the fund’s investment activities were also unsuccessful. According to the interim information provided, the loss in placing citizens' savings amounted to 7.43%, i.e. The fund again turned into a major minus.

Attention! The profitability indicator is objective based on its calculation for the calendar year. Therefore, the figures given for the 1st half of 2020 are largely for reference and demonstrate dynamics. It will be possible to estimate the profitability for 2019 after the Central Bank publishes data for the calendar year.

There are no official ratings of the reliability of a particular fund in Russia, therefore this indicator can only be assessed by ratings of independent agencies established on the basis of various indicators of their performance.

Unfortunately, the only major rating agency in the country, RA Expert, due to the refusal of the fund itself, does not evaluate its performance indicators. The last rating of the NPF was assigned in 2020, according to the national scale - ruBB- with a stable outlook.

Personal account on the official website

A personal account on the Internet resource of NPF “FUTURE” opens up a standard list of opportunities for the owner:

- familiarization with the accumulated amount;

- studying the results of deduction management;

- correction of personal data if they change;

- calculation of the potential size of a funded pension, etc.

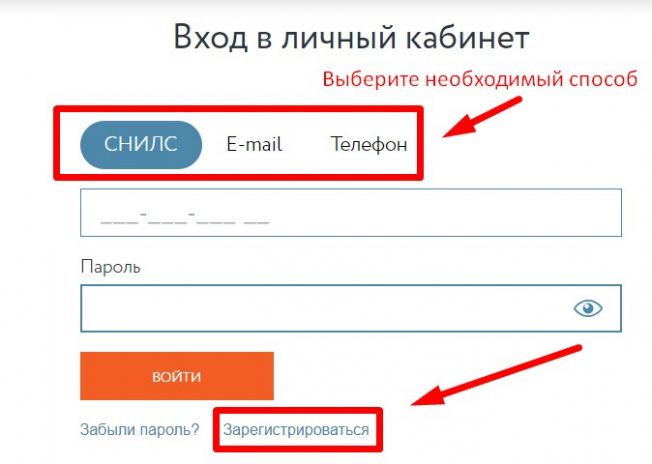

How to create a personal account and how to use it

The personal account of the insured person is created on the official website. To do this you need to follow a few simple steps:

- In the upper right corner, click “Personal Account”.

- On the login page to your personal account, select “Register”.

- In the window that loads, enter the necessary data (full name, passport number and series, SNILS, email address and phone number).

- Agree to the processing of the submitted data.

- Enter the so-called captcha, referred to here as the “verification code”.

- Click the “register” button.

After sending the data, the user will receive a password to log into the system.

Important! Only its clients can register a personal account on the official website of NPF “FUTURE”. Accordingly, this can be done by a person who has entered into an agreement with this organization, and the citizen’s data has already been processed by the company along with consent to the processing of personal data.

After registration, the client has all the opportunities to control and manage the account, edit his data, interact with the fund manager, etc. To do this, from now on, on the main page of the site, you will also need to click on “Personal Account” and log in using any of the presented methods (SNILS, e-mail or phone number with a password).

Personal Area

To register a personal account, you will need to pass authorization. To do this, you need to enter your passport and SNILS details, as well as contact information. After registration, the fund's clients have access to:

- Information about the account status (provided within a few seconds);

- Free consultations for employees of the organization;

- Intuitive interface;

- Interest rate data.

By providing the required information, the client agrees to the processing of his personal data.

How to register on the official website

To create your personal account, you will need to fill out the registration form on the website by clicking on the active button personal account - register, and then fill out the information in the appropriate fields (full name, passport details, e-mail, contact phone number, SNILS).

Please note that it is not necessary to check all the boxes provided in the form, for example, if you are not interested in information from the fund, do not check the box to receive newsletters. But without checking the box for consent to process your personal data, the registration process will not go further, because this consent is required by law. After going through the entire above procedure and clicking on the “register” button, you should expect your registration data to be sent to the specified e-mail; by activating the registration, you become a full user of the system.

Reviews about the fund

Reviews about the work of NPF "Stalfond" are quite contradictory. You can often find stories about fraudulent methods of concluding contracts.

It happens that agents introduce themselves as employees of the Pension Fund and do not clearly explain to people the conditions for transferring funds to the fund. However, such costs are more likely associated with the lack of competence and integrity of the agents themselves.

In general, the fund fulfills its obligations and pays all amounts on time. This is confirmed by many years of successful work in this market and not the last positions of “Stalfond”.

( 6 ratings, average: 3.33 out of 5)

NPF "Stalfond", Russia

One day, when I was sitting at home with a sick child, the apartment rang. Usually I don’t approach doors at all, but here I was waiting for the doctor, so I approached. The lady behind the door asked a question: “is there anyone at home from... to... years old.” I don't remember the exact age range. But in general, people are of working age and not of pre-retirement age. I answered that there is. The lady started talking about the fact that she was a representative of a pension fund and asked if I was receiving notification letters. She said that the state pension fund was transferring deposits, and it was necessary to put some kind of signature on duty. She emphasized in her speech the state pension fund. The word “Stalfond” was not mentioned at all. Which gave the impression that she was a representative of a government agency.

To be honest, at that moment I had no time to delve into the essence of the issue. Moreover, I was not interested in the pension sector at all. In general, right in the corridor (the lady was in a hurry, like “so as not to detain me”), I filled out a couple of pieces of paper that she slipped me, just to get rid of it. Well, what can I say, yes, I acted like an idiot. Oh, and my husband scolded me for this later.

In the evening I read the papers and for the first time saw the word “Stalfond”. I typed the name into a search engine, and only then did it dawn on me that I had been scammed. There were many such victims. They advised me to go to the police, the prosecutor's office... I decided to contact Stalfond to cancel the contract. I found their website. It turned out that the representative offices of this office are located in Moscow and Cherepovets. And I'm in St. Petersburg. I wrote a letter to the specified email. In response, they promised to consider my situation.

Then that same agent called me, indignant that it was me who was complaining, she told me everything honestly and I voluntarily signed the documents. I would argue about “honestly”, but I didn’t see the point in sorting things out with her. Yes, I really signed everything voluntarily. She said that I wanted to terminate the contract. She started telling lies to me that I was the only one who was so dissatisfied with her, I didn’t understand my happiness. What if I write a refusal, all my savings will be reset to zero and other “sucker” horror stories.

In general, not seeing the point in such a conversation, I headed to the Pension Fund. Where the problem was solved in a minute!

It turns out, given the frequent cases of fraud, since 2013 (if my memory serves me correctly) the transfer of funds to non-state funds is possible only if a written application is submitted to the Pension Fund. Roughly speaking, if there is no such statement, the cunning agent can go to the toilet with the contract. He has no power. Whether the agent knew about this or not remained a mystery. After all, no one asked me to write a statement. Perhaps she received a percentage from the contract and then she doesn’t care. Or she really turned out to be illiterate in her field.

Recently I heard outside the door again how they were looking for citizens “from... to...”. I was getting ready to send, but they didn’t ring my doorbell))

I don't know if this fund is actually good or profitable, but the way they act to get victims of clients does not inspire either trust or desire to do business with them.

How to use the service

First of all, potential or current clients of the non-state company in question need to go through a mandatory online registration procedure.

To do this, enter the following data in special sections of the site:

- SNILS number;

- passport information;

- personal email address;

- contact phone number.

When you go to the official portal of Stalfond, you are automatically redirected to the website of the organization “Future”. All data can be requested by users in electronic format. The information will be presented on the screen or sent to the specified email address.

In addition to the main amount of pension savings, you can view current information about the circulation of funds in the account for the entire period from the moment of concluding an agreement with a non-state fund.

The search time frame can be customized using filters. Also, all interested parties can find out what kind of profitability the NPF receives from the personal funds of citizens.

On termination of the contract with NPF "Future"

The procedure for terminating the contract is quite simple. Nuances can be specified in the relevant paragraphs of the document. If there are none, you simply need to notify the fund of your intention to terminate cooperation.

Important! Russian legislation prohibits changing funds more than once a year. It can be withdrawn to a bank account (card), transferred to another NPF

Within three months after submitting the application, savings are transferred to another fund or to the account specified in the application

It can be withdrawn to a bank account (card) or transferred to another NPF. Within three months after submitting the application, savings are transferred to another fund or to the account specified in the application.

It is worth remembering that termination of the contract entails certain consequences:

- loss of income from investing savings;

- taxation of withdrawn funds;

- payment of a commission for transferring the amount to the account.

General information about Stalfond

The history of the development of the fund goes back 15 years, since it appeared back in 2004 under the name “BLAGOSOSTOYANIE”, but NPF “StalFond” became part of this organization only in 2016.

More on the topic Minimum pension from January 1, 2020: table by region, how much will be the cost of living and what is the amount of social supplement

But at the time of its merger, StalFond itself was a fairly large company, operating in the pension insurance market for 18 years. By the end of the same 2020, the combined fund also included NPF Uralsib and NPF OUR FUTURE.

The non-state pension fund "FUTURE" as of 2020 occupies one of the leading positions in this industry. The number of citizens insured by it is more than 4.3 million people, which allows it to occupy 4th place in this indicator among all such organizations.

In terms of the volume of all pension savings, this NPF is also not far behind, occupying 5th position with a total amount of more than 252 billion rubles. The organization is part of the deposit insurance system, therefore, savings funds placed in it are reliably protected, and their safety is guaranteed by the state.

NPF "FUTURE", as required by law, carries out only activities in the field of pension insurance, in particular in its mandatory part (OPS). The fund manages pension savings of citizens, investing them in various projects and areas. The ultimate owners of the joint stock fund are Russian citizens.

Similar structural funds began to form in Russia back in the 90s of the last century.

The reason was presidential decree of 1992 No. 1077 “On Non-State Pension Funds”. Today, the affairs of non-state funds are regulated by Federal Law No. 75 “On NFP”.

How to check the correctness of pension calculations through Gosuslugi

Many people are interested in the question of how to check whether their pension was calculated correctly. This is due to the complexity and complexity of the procedure for calculating payments due, especially after the introduction of the point system. You can check the accuracy of the accruals using the State Services portal. This is done as follows:

- After logging into the site, select the “Pensions and Benefits” section.

- In the tab that opens, select the pension calculator.

- In the electronic form that appears, fill out all sections, ensuring that the information entered is correct.

- Next, the calculator independently makes all the necessary calculations and issues the due amount of pension payments.