The Russian Pension Fund has the opportunity to deliver to a pensioner the monthly payment due to him in various ways. A bank card is one of the most convenient for pensioners: payments are made automatically, without charging commissions, and you can withdraw money from ATMs for free and at a convenient time.

From July 1, 2020, cards of the national Russian payment system “Mir” began to be mandatory for public sector employees receiving social payments, including pensions. Cards are issued by default at the time of registration of any benefits. According to information from the organization’s website, the system has already issued more than 70,000,000 cards throughout the country.

But is the new MIR pension card from Sberbank as good as the media are talking about it today? What are the reasons for the transfer, its obligatory nature, the advantages and disadvantages of switching to MIR are of interest to many people who are accustomed to using Visa and MasterCard cards. Those citizens who have already issued a Sberbank card share their feedback on the innovation.

Own payment system

At the height of the sanctions campaign initiated by the United States, this fact made itself felt: Visa and MasterCard cards issued by Russian banks stopped working, and such incidents occurred more than once. It turns out that the United States has the ability at any time to interfere in the work of Russian banks of its choice and ruin the lives of their clients.

This first happened in 2014, and it was then that the decision was made to launch our own payment system in order to protect citizens from troubles inspired from abroad.

Then it was decided to organize our own MIR banking payment system in order to insure Russian citizens against unpleasant surprises when using card accounts.

The two main reasons for transferring bank payments to a sovereign system are:

- US sanctions in the spring of 2014 – financial transactions in the Visa and MasterCard networks of some banks began to be blocked;

- termination of services by foreign bank card systems in December of the same year in Crimea and the city of Sevastopol.

Already in 2020, the project was launched. The provisions of the law on the Russian payment system are intended: firstly, to ensure the independence of cash flows from the impact of situations in foreign policy. Secondly, to guarantee the secrecy of users’ financial transactions and the status of their accounts within the borders of Russia.

The name of the new multinational payment system was given a very symbolic one - “WORLD”, with a logo in the form of a globe, with corporate colors of green and blue. The name of the system was chosen as a result of an all-Russian creative competition in 2020, and practical work on its creation began much earlier, with the formation of JSC NSPK - the National Payment Card System - on June 23, 2014.

This is the operator of PS MIR, and all payments by cards within Russia, including Visa and MasterCard, go through NSPK.

Law No. 161-FZ of June 27, 2011 “On the National Payment System” obliges all banks that are recognized as significant in the payment services market to join the MIR system, and this has already been practically done. Payments to citizens from extra-budgetary and budgetary funds will be transferred to SP MIR cards.

Law No. 2300-1 (as amended on July 3, 2016) “On the Protection of Consumer Rights,” for its part, requires that each bank ensure the processing of Mir cards at the retail outlets that it serves. At the same time, it is necessary to accept them in the ATM networks of all banks, and this has now been completed by 97.3%.

Many Russian banks have already joined the issue of Mir payment cards, and their mass issue has been launched since 2020. Thus, according to NSPK data, by February 1, 2017, banks had issued 2.5 million Mir cards.

At the same time, contactless payment options for services and goods will be enabled. Over time, it will be possible to pay for the use of transport, including the metro.

MIR card in Sberbank

In 2020, Sberbank of Russia also joined the issue of Mir cards. So, with their help, transfers, non-cash payments are already made, and the account is managed remotely around the clock.

Today the bank provides the following Mir cards:

- debit classic, similar to Visa Classic and MasterСard Standard;

- pension, intended for clients of the appropriate age, in order to receive pension payments.

Both types have a validity period of 3 years and work only in one currency - rubles.

Debit card

Since 2020, the State Duma in the first reading adopted a bill on transferring public sector employees to the Mir salary project.

From July 1, 2020, new state employees and newly minted pensioners will be issued Mir cards.

Before July 1, 2020, a transfer to PS MIR and existing public sector employees was carried out. According to the amendments adopted by the State Duma, only the “Mir” card was linked to the state employee’s account.

For pensioners receiving pensions through other payment systems, the transition to MIR will occur naturally: as soon as the validity period of the working pension card expires, another one will be issued in its place, already within the MIR PS. This process was designed to last 3 years and be completed by October 1, 2020.

Pension card

The Mir pension card is issued and serviced free of charge. ATMs do not charge cash withdrawal fees, but you can only withdraw money from the Sberbank ATM network.

Interest is charged on the balance at the rate of 3.5% per annum.

Paid services are also available:

- Mobile Bank service (full package) costs 30 rubles. per month; Having a computer at home, you can be aware of the status of your pension account via the Internet and perform some operations; There is also an economical package that works for free, but a commission is charged for requests;

- possible for 150 rubles. order an additional card; For a pensioner, this is not only convenient, but sometimes necessary.

Possible reasons for the delay in transferring pension to the card.

One of the key advantages of receiving money in non-cash form is that the schedule for payment of pensions to the Sberbank card is strictly observed. Transfers occur on the day the benefits are calculated in the Pension Fund. The likelihood of delays is quite low.

However, not everything depends solely on Sberbank, since financial transactions go through several stages. If your pension does not arrive on time, there may be a number of reasons for this:

- The traditional date of receipt coincided with a weekend and shifted during the working period;

- Technical malfunctions and interruptions in the operation of systems and equipment involved in money transfers;

- An error made by employees when generating payment orders, as well as other human factors;

- An error in the details or data of the recipient when drawing up and submitting an application to the Pension Fund.

Unfortunately, in case of unusual situations and the return of payment to the sender, no provision is made for informing the client. As a result, the citizen will have to clarify the reason for the delay on his own.

You can find out at what stage the money is stuck in the following sequence:

Check balance.

First of all, it is better to check the card balance, since SMS about the receipt of funds do not always reach the card owner. It can be done:

- Via telephone, sending a request to number 900: Balance 1111, where 1111 is the four outer digits of the card number;

- Using an ATM or Sberbank terminal;

- Via the Internet in your Sberbank Online personal account;

If the funds have not arrived on the card, you must contact the bank.

Visit a Sberbank branch.

You must have your passport, card and account details with you. Through the office staff, you can clarify whether there was an attempt to transfer from the bank, check the details and find out the possible reasons for the lack of money. If an error is made on the bank’s side, it will be corrected as soon as possible and the transfer will be repeated.

Contact the Pension Fund.

If there are no errors on the bank’s side, then most likely the reason for the delay is at the Pension Fund. When visiting a branch, you must take your bank details with you and check them with the data at the government agency. In addition, the fund’s specialists will be able to check the shipments on their part, as well as make a request to the bank to find out where the transferred amounts are located.

It is worth noting that delays in benefits by more than 3 days are quite rare. If the pension payment schedule at Sberbank is violated, then it is better to find out the reason as quickly as possible and not put it off “on the back burner.”

Mandatory use of the domestic system

The Bank of Russia planned to carry out a complete transition to its cards before July 1, 2020. The schedule for transferring cardholders to Mir is fixed by law. Most citizens have already made a replacement due to the expiration of the previous one, but there are still those who continue to use MasterCard, Maestro, VISA and other payment systems that are subject to US sanctions.

Due to the difficult epidemiological situation, the mass transfer was forced to be extended until 10/01/2020. Until October, delivery of the card can be ordered to your home to comply with self-isolation rules. This was stated by the leadership of the Central Bank of Russia represented by Alla Bakina.

It is reported that those who do not have time to replace their card with a new one before October will not be able to receive a pension. The money will be frozen and returned to the sender, in this case to the Pension Fund. In the future, they will only be available in person at regional centers.

It is also noted that there will be no forced transfer to non-cash payments for those who prefer to receive money in cash. For them, the payment procedure will remain the same. The rule applies only to bank card holders.

The introduction of a national payment network is a requirement of federal law, its implementation is mandatory, but this does not mean that every pension recipient is obliged to receive a pension only in this network.

The regulations for the transition to MIR assume that these cards will be received by users of other payment banking systems after the deadline, but no later than October 1, 2020. If a pensioner did not use a bank card to receive a pension, he can continue to receive money by mail or with home delivery - whatever suits him.

The transition to MIR plastic is mandatory for pensioners of the state's law enforcement agencies: the Russian Guard, the Federal Penitentiary Service, drug control, and former military personnel.

Convenient services from Sberbank for informing about the transfer of benefits

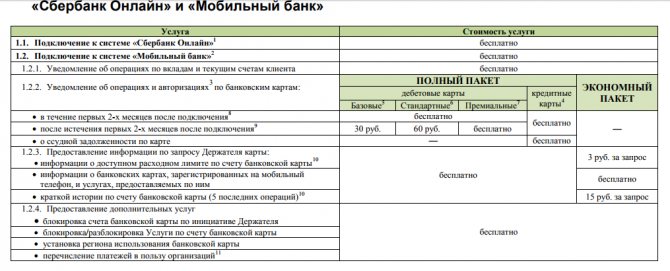

Sberbank of Russia offers its clients a service of SMS notification about credits to the card. Before connecting it, you need to familiarize yourself with the tariff plans.

Today we have:

- "Economy";

- "Full package".

The full tariff plan includes the following features:

- receiving SMS notifications about funds being credited to the card;

- obtaining information regarding each completed procedure for writing off or spending funds;

- providing information regarding the current balance;

- the ability to send a request for a statement that contains information regarding the latest financial transactions made using a bank card.

If you use an economical tariff plan, the last 2 requests can only be made on a paid basis. Their price varies from 5 to 15 rubles for each request.

The economical package is provided free of charge, which makes it quite attractive to customers. However, it is impossible to receive SMS using it.

The full tariff plan includes the service in question, and the cost is:

- for instant and non-personal cards – 30 rubles;

- for classic bank cards – 60 rubles;

- for gold and premium – the full package is provided free of charge.

For this reason, if you need to receive alerts on the transactions in question, the best and only option would be to connect to a full tariff plan. Thanks to this, it is possible to promptly learn about possible actions of fraudsters and, if necessary, immediately take action to ensure the protection of your current account.

Additionally, you need to remember that each client can change the tariff using a regular SMS message.

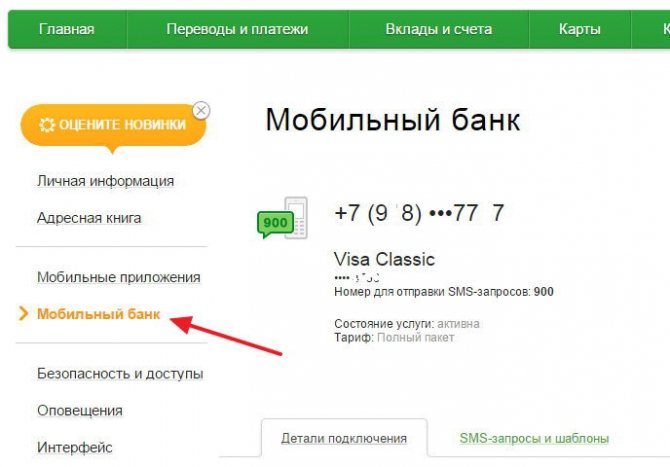

In order to activate the service in question, it is possible to use one of several options. Using the Sberbank Online service is considered to be the most optimal and at the same time convenient. Additionally, you need to connect Mobile Banking.

The sequence of actions is as follows:

- In your personal account, you need to select the “Mobile Bank” category, located on the right side.

- Next, the user selects the “Connection Details” section.

- Select one of the tariff plans. To receive SMS alerts, there is only one option left - a full package of services.

- In the newly opened window, you need to specify the necessary parameters for activation - in most cases, some fields are already filled in by default. In particular: mobile phone number and other data. The user just has to select a bank card from the proposed list (if there are several of them).

- Press the service connection button.

READ Nuances of transferring funds abroad using Sberbank Online

In a newly opened window, the service will offer to re-check the previously specified information. If everything is correct, all that remains is to confirm your intentions.

Based on the generated request, an SMS notification from Sberbank arrives on the pensioner’s phone, information from which is recorded in the appropriate fields.

After completing the procedure, the system redirects the user to a list of generated requests. The newly generated application will have the status “Under consideration”. After changing it, it will be corrected to “Confirmed”, which is why the service is considered connected, and you can now use all the functionality.

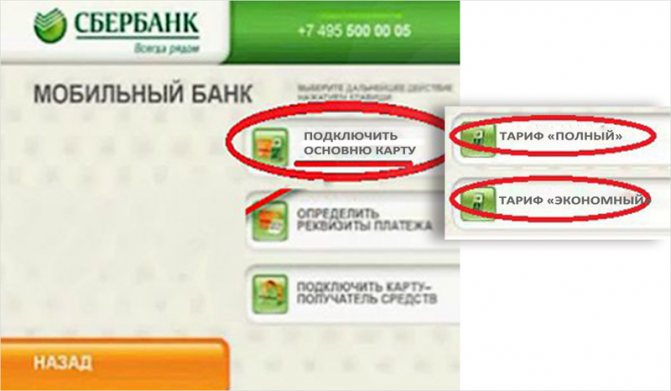

If desired, pension recipients can activate the SMS information service using a self-service terminal or ATM. The connection is carried out according to the standard principle.

In this case, you should find the nearest ATM location and insert a personal bank card and indicate the PIN code. After this, the user will be directed by the system to the main menu.

Further sequence of actions:

- It is necessary to switch to the “Mobile/Online Bank” category.

- After this, the client clicks on the card connection item.

- The user clicks on the selected tariff plan that requires activation (for SMS notification of receiving a pension, “Full” is selected).

- After this, the service redirects the pension recipient to a page with the specified connection information: established tariffs, phone number, card details.

Please note: the activation procedure is only possible for a card that is built into the ATM reader.

The mobile phone number is taken from the client database, information in which is placed when signing a service agreement.

Activation confirmation is a notification message received on your phone. On average, this will take up to 2 days.

What to do for pensioners

Go to the MIR map in advance. Regardless of the pensioner’s employment, if he has not issued a card within the prescribed period, the bank’s actions will be carried out in the following order:

- The pension is credited to a special account.

- A notice of the need to come within 10 working days is sent to the pension recipient by the financial institution. It is proposed to receive money in cash or write an application for a MIR card.

- Failure to appear on notice within the prescribed period will result in the return of the pension from the special account to the Pension Fund.

The pensioner himself chooses the delivery method that is convenient for him; he may not use the card, but switch to receiving money at home or use another method. An application to the Pension Fund for changing the option can be submitted electronically from your personal account on the Pension Fund website, State Services, or completed through the MFC - Document Center.

To get a MIR card, you need to contact your nearest bank. At Pochta Bank, the conditions for working and non-working pensioners are equal: the issue of plastic and services are free for both categories of people.

IS IT POSSIBLE TO REFUSE THE CARD AND HOW TO DO IT

Older people are not supporters of innovation - the habit of using the Sberbank Maestro pension card makes them wonder whether they need to change it to MIR plastic. For them, an excerpt from the rules enshrined in Federal Law No. 88-FZ of 05/01/2017 is provided:

all pensions must be paid to cards of the Russian payment system from 07/01/2020;

Maestro cards can only be replaced with MIR;

switching from domestic plastic to others is prohibited.

It follows from the provisions of the law that all state employees and pensioners are required to change cards from other payment systems to MIR: all transfers from the treasury will be carried out within the national banking network.

You can refuse to receive plastic if you take money from the state in cash. Those people who often travel outside the country are recommended to additionally issue a Visa/MasterCard debit card. Within the bank, transferring funds from one account to another is free.

Possible reasons for pension delay

In many Russian regions, the procedure for crediting pension payments is fully automated, but this is not the case everywhere.

Some localities use only a partially automated process, which can lead to errors in financial transactions.

The main reasons for delayed benefits include:

- mistakes made by Sberbank employees;

- errors were made by representatives of the Pension Fund, which are manifested in an incorrectly formed payment order. In this case, the money is credited back from Sberbank to the Pension Fund;

- the pensioner himself made a mistake when specifying personal bank details when forming an application to receive money;

- recipients provided incorrect information to Sberbank when applying for a bank card.

If transfers are not made at the appointed time and if the delay period exceeds 3 days, recipients are strongly advised to do the following:

- You must contact one of the Sberbank branches at your place of residence and obtain a printout of the transactions that were previously carried out with your personal account.

- If during the verification it turns out that money has not been credited to the account, you need to take bank details and personal current account number to contact the regional representative office of the Pension Fund.

- By contacting the Pension Fund, you need to find out if they have a completed application from a potential pension recipient, and then double-check the personal data specified in it (bank card details).

- If there are no identified errors in the application, it is necessary to check whether deductions have been made to a personal account in Sberbank by Pension Fund employees.

- If the results of the check do not reveal any errors, it becomes necessary to contact the local branch of the banking institution with a corresponding application to receive an explanation of why the benefit was not transferred and how much longer you need to wait.

READ Methods of transferring funds from Yota to a Sberbank card

As a rule, the matter does not reach the final stages, and the money is transferred at the initial stages.

The procedure for transferring pensions to new plastic

You can use Visa and MasterCard cards until their expiration date, after which international plastic cards are automatically replaced by a sovereign financial instrument - no application required. This procedure is valid only until July 1, 2020.

Regulations for self-transfer of pension to MIR plastic:

- Go to the bank whose client is a pensioner and submit an application for a Russian card. Bring your passport and pension card or SNILS with you.

- Accept from the bank employee a new card, a sheet with information about it and account details.

- Bring a bank certificate to the Pension Fund office and inform the employee about your desire to receive a pension using MIR plastic, starting from the next month.

You can do without going to the Pension Fund if your bank account number has not changed when you changed your card.

How is the pension payment date set?

To be able to independently determine the timing of accrual of pension payments, you should familiarize yourself with the generally accepted principles:

- the Pension Fund has developed a special transfer schedule, which is why the money must be received on the same day, except in situations in which it falls on a holiday or day off;

- money can be credited to a Sberbank card earlier than the established schedule for up to 3 days or delayed for the same period;

- most regional branches of the Pension Fund give preference to transferring funds to pensioners before the 15th, since the benefits are due for the current and not the next reporting month;

- often the period for receiving funds is set individually and directly depends on the time of first receipt;

- If the regional Pension Fund accepts the date for transfers of benefits before the 15th, the deadline for enrollment is considered to be the 21st of the current month.

These features indicate that it is impossible to clearly say when a pension is transferred to a Sberbank card.

Profits from enrollments in the Russian MIR

You can receive a pension without participating in the payment system, for example, by postal delivery to your home. In this case, some of the advantages of transferring money to the MIR card will not be available:

- the opportunity to receive income on the card account balance: in Sberbank - 3.5% per annum, and Post Bank sets the percentage depending on the size of the unclaimed amount;

- There is no charge for the release and maintenance of plastic;

- protection from fraudsters, double payment;

- The card is valid throughout the entire territory of the Russian Federation.

The disadvantages of this method of receiving money for pensioners are not significant: payments are made only in rubles, and not in all countries you can use MIR plastic.

How is a pension card convenient?

The process of receiving a pension on a card is absolutely superior in all respects to visiting a post office. Therefore, those who have not yet transferred their pension to a card should definitely take advantage of this opportunity.

The main advantages of receiving a pension on a bank card:

- Convenience and ease of receiving funds. You don’t need to go anywhere to get money, stand in long lines and waste your time. On a certain day of the month, funds will be credited to the card. You can remove them at any convenient time and in the right quantity. And the necessary ATMs are often even closer than the post office.

- Calculation of interest on the cash balance. It is not valid in all banks and not for all debit cards, but you can find an option with such charges.

- All kinds of discounts, cashbacks and bonuses. Some banking organizations offer pensioners more profitable shopping opportunities and also provide various discounts at partner stores.

- Easy process of paying utility bills and other bills. All utility bills can be paid through your personal online banking account very quickly. There is no need to knock on the doorsteps of various payment branches.

- Possibility of receiving quick money transfers from family and friends. Using bank cards, this procedure is carried out instantly - regardless of the time of day or distance.

- Relative safety of pension funds. The risk of cash theft is significantly reduced, since money does not need to be carried with you at all times.

Pros and cons of the MIR card

Over time, the MIR system will have only advantages, but we must wait for this moment.

TODAY THERE ARE FEW ADVANTAGES, ALTHOUGH THEY ARE VERY SIGNIFICANT

1ST PLUS – RELIABILITY

For this reason, the MIR system was created to protect its own citizens from the arbitrariness of foreign operators. Now the card cannot be blocked from the outside, by someone’s whim or ill will. As long as the Central Bank functions normally, everything will work as expected.

2ND PLUS – SAFETY

In mid-2020, the production of cards for the MIR PS with a Russian-made chip (“Mir-Maestro”) began. The Russian chip fully meets international standards, and at the same time runs its own operating system.

It is resistant to external penetration, electrical influences and climatic changes, has 100,000 rewrite cycles and stores information for 10 years. Having passed all the required tests, the chip was certified by MasterCard and found suitable for use in international payment systems.

3rd PLUS – PRICE

When compared with the usual, standard cost of Visa and MasterCard, the cost of servicing Mir cards can be considered insignificant.

As for the pension card, its price is really low, while the cost of a debit card is still at the level of Visa and MasterCard.

The priority is the mass launch of pension and salary cards for testing and further expansion of the infrastructure. As soon as it reaches the required level of development, service tariffs will immediately be reduced several times.

The advantages of the developed MIR system will appear a little later.

4TH PLUS – ACCESS TO USE OF RESOURCES OF ISSUING BANKS

On the territory of Russia, all possibilities for using Mir cards will be used, regardless of which bank services the networks. These include purchases, services, use of transport, and so on. Including cashing out at terminals of all banks, without any commissions.

5TH PLUS – WIDENESS OF USE

Today in Russia there is a wide network of accepting bank cards, including in Crimea. All that remains is to adapt it to work with JV MIR.

Internet access for MIR cards will soon open, that is, it will be possible to make purchases using the MIR PS in online stores. For this purpose, the necessary measures are already being taken today, in particular, a special 3D-Secure protection system is being introduced.

DISADVANTAGES OF PUNISHMENT AS THEY ARE PRESENTED TODAY

1ST MINUS – LACK OF PREVALENCE

This is, strictly speaking, a growing pain, it is gradually leveled out. Preliminary testing of the MIR system is being carried out in Moscow, and regions will be connected as soon as they are ready.

2ND MINUS – HIGH TARIFF FOR THE CLASSIC DEBIT CARD

Today, this means that there is no motivation for switching to the “World” card. Users of other operators have no economic reasons to prefer the Mir card. Even if this was done for reasons of prioritization, nevertheless, today this is a clear disadvantage.

3RD MINUS – IMPOSSIBILITY TO USE THE CARD OUTSIDE THE COUNTRY

Outside Russia there are no points of acceptance of Mir cards yet. They will appear, but not today and perhaps not tomorrow. We must wait for this moment.

REACTION TO THE IMPLEMENTATION OF JV MIR FROM DIFFERENT LEVELS OF RUSSIAN SOCIETY

The State Duma has an unambiguously positive attitude towards the creation of its own payment system. The Mir card, its widespread use, will serve as the basis for the creation of independent processing of bank cards in Russia; the confidentiality of financial transactions will truly be ensured.

As part of stimulating the implementation of the MIR joint venture, the leadership of the State Duma decided to transfer their salaries to Mir payment cards. Most likely, the entire apparatus will follow the leadership’s example.

The opinion of the population can be found out by visiting numerous forums and discussions. There are many complaints about the current inconsistencies, but the leitmotif of most comments is that such a system, internal to Russia, should have been put into effect long ago, without waiting “until your overseas partners grab you by the scruff of the neck.” By today, all the nuances would have been sorted out.

Experts evaluate the Sberbank-MIR payment card as a promising product for both clients and banks.

As part of the project, a bonus program from developers (NSCP) has been launched, which is very pleasant for clients. They will receive a deferred discount (cashback) of 10-15% of the purchase amount.

In order for the MIR JV to operate at full capacity, it is necessary to significantly expand the ATM network, and banks must be charged with servicing the Mir card. It is expected to issue about 60 million cards to cover pensioners and state employees throughout the country (there are more than 60 million people - the same figure).

This huge number of people will receive social benefits and wages in the MIR system. Many of them will stop using the Visa and MasterCard product, and this will be a noticeable blow to the business of these companies in Russia. At the same time, this will make the Russian economy more durable, and it will become more difficult to harm it from the outside. Yes, and from the inside too.

Thus, Sberbank’s MIR card enters the Russian plastic card market as a worthy national product.