The current pension legislation gives citizens the right to place the funded part of their pension at their choice. A future pensioner can entrust his funds to a state management company or place them in one of the non-state pension funds (NPF). Often a person has a desire to transfer his funds under the management of another organization - for example, if he is not satisfied with the profitability of the current fund or has doubts about its reliability. Previously, to do this, you had to personally contact the fund or the Pension Fund branch, fill out paperwork, etc. Now there is an easier way to manage your retirement savings without leaving home. Let's look at how to change a pension fund through the government services portal.

Where can you form a funded pension?

Today, funded pensions can be formed for people born in 1967. both in the non-state pension fund and in the good old Pension Fund. Many believe that it would be better to leave this amount in the State Pension Fund, since in this case nothing will happen to it.

This judgment is, in fact, a fallacy - non-state funds have learned to cope with their responsibilities over the course of their existence.

A tangible advantage of forming a funded pension in a non-state pension fund is that in this case the amount can grow quite significantly. Each fund offers a certain annual percentage for trust and keeping money in its assets.

Accordingly, if a person has a sufficiently long period of time before retirement - about 10-15 years - then he can almost double the amount of savings, despite the fact that people in the Pension Fund do not have such an opportunity.

True, at the same time, many say that non-state pension funds are unreliable and are subject to ruin and liquidation. This is undoubtedly true. But this only applies to young funds - those that have existed for more than 10 years already have excellent experience working with civil money, therefore, they will not be able to “burn out.”

In addition, even if the fund goes bankrupt and is liquidated, the money that a person transferred to it will not go anywhere - it will return to the Pension Fund of the Russian Federation, since it was insured by the DIA. True, he will not receive the interest that the fund promised.

This suggests a conclusion - if a person intends to increase the amount of his savings, then he should transfer his private equity to a fund that has a high reliability class.

The fund that has the most assets and the largest client base is unlikely to be liquidated - at least, such cases have not yet happened in history.

If the NPF license is revoked

The bank that was the agent for investing the funded portion of the pension may have its license revoked. In this case, there is no need to switch to another NPF either through State Services or in any other way. Insurance obligations are sent to the Pension Fund by default, and the transfer is carried out by the Central Bank.

From the moment the license is revoked, the Pension Fund becomes the new insurer, where all accumulated funds are transferred. In this case, only an amount equal to the amount of contributions paid monthly by the employer is returned. Investment income is not taken into account. In cases of successful sale of NPF assets, a partial restoration of lost investment income can be made.

The procedure for formation in a non-state pension fund or management company

So, when a person transfers his funds to a management company or non-state pension fund, the following happens to his money:

- They are insured by the Deposit Insurance Agency (DIA).

- During the financial year they are transferred to the account of the selected insurer.

- For each year the funds are maintained, they will increase by a certain amount of interest that the fund gives.

It is important to remember that if a person decides to change the fund within five years, then all the interest that he has accumulated during his stay in the fund is lost - only the amount that was initially transferred to the insurer is transferred. If a person decides to transfer to another fund or Pension Fund after five years, the interest will remain.

Consideration of the application

The application will be considered within a time period depending on the type of application. There are urgent and early varieties.

- Urgent. The final transfer of funds will be made by March 31 of the year following the year in which the five-year period expires from the date of application. That is, if it was submitted before March 1, 2019, the money will only be transferred by March 31, 2024. Both the payer's deductions and his investment income are preserved.

- Early. The savings will be credited to the recipient’s account at the Pension Fund by March 31 of the year following the submission of the application. That is, if the application was submitted before March 1, 2020, the transfer will be completed by March 31, 2020. This type of transfer does not provide for the payment of investment income. The payer is guaranteed to receive only his own savings contributions.

How to choose

Today, this issue is the most painful for every person, since during the year he receives a huge number of offers from various funds.

The agent network of each NPF works just fine - every person over the age of 20 has been able to contact representatives of non-state funds more than once, and now almost every Russian is well aware of what pension reforms have taken place in the country.

You can certainly trust agents that their fund is the best, but you need to check this information yourself. Today there are a large number of sites on the Internet where you can get the necessary information on this issue.

There is also a rating of funds according to various criteria, as well as a general rating, which is official. If you check this source of information, you will be able to get an idea of which fund can really be called the best.

In general, the approximate fund rating for 2020 looks like this:

- VTB 24.

- "Confidence".

- Sberbank.

- "Agreement".

- "Gazfond".

The selected five funds today are leaders in various features - the number of clients, the volume of invested assets, reliability, etc.

If a person chooses one of the five proposed, then he subsequently should no longer deal with the issue of determining his funded part, because in this case he will lose all his interest after each transfer.

If the transfer is made

If your ordeal with the transfer is over and the funds are transferred by March 31, then Law No. 75-FZ determines their future fate within the Pension Fund - within a month they must be invested in the investment company chosen by the pensioner.

In the future, annually, the Pension Fund is obliged to inform the citizen about the results of the “work” of money, including the amount of income received. Here, I note, according to the law, the Pension Fund must send out these notifications on its own initiative.

But I advise you not to wait for the weather by the sea, to show initiative and your civic position and personally contact the Pension Fund to provide such information, which should be at your disposal within 10 days. The form of such notification was approved by order of the Ministry of Labor of Russia No. 505n dated October 31, 2012.

How to transfer from a non-state pension fund back to the state pension fund

A large number of people, after signing an agreement with a non-state fund, then begin to think about the question of how to transfer from a non-state pension fund back to the state pension fund. In fact, you should first think about whether this is really necessary.

If a person has collected the necessary information about the progress of pension reforms in Russia and has decided to return to the State Pension Fund, then he will need to adhere to the following algorithm of actions:

- Come to the Pension Fund.

- Fill out an application to transfer your private entrepreneur back to the Pension Fund.

- Expect a letter at the end of March - beginning of April stating that the funds have been transferred to the State Pension Fund.

There is also the possibility of another development - come to the representative office of the NPF to which the funds were initially transferred and write a written refusal to join the fund.

The main thing is to do this no later than March of the year following the year of signing the agreement on the transfer of the NPE.

See what are the conditions for granting a pension for long service. Conditions for retirement in areas equivalent to the Far North. Find it at the link.

Written appeal

You can fill out an application for transfer of contributions by visiting a specialist at the territorial office of the Pension Fund in person, which is located in the area of residence of the interested person.

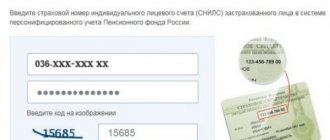

A citizen who plans to transfer his savings must draw up a special application and indicate:

- your initials and surname;

- individual insurance account number;

- TIN number;

- details of the non-governmental organization to which the savings should be transferred.

How to transfer your savings to the State Pension Fund

Transferring savings can be done in several ways:

- By personally contacting the Pension Fund and writing an application for the transfer of the private entrepreneur.

- Through a single portal “State Services”.

- By writing a refusal to join a non-state pension fund chosen by a person earlier.

Of course, the most reliable scenario will be the first. Still, the Pension Fund is interested in the fact that the person kept the money there, so they will do everything necessary to ensure that the transfer back occurs.

To do this, a person will need a minimum of effort and documents - he will need to take with him a passport, SNILS and, if possible, an agreement that was previously signed with the NPF. After this, the person writes a corresponding application for the transfer of the NP to the Pension Fund.

Deadlines and methods for submitting an application for transfer

It is important for every person to remember that the financial year in Russia ends in March. At this time, all reports are prepared; accordingly, at the same time, the actual transfer of pension savings from the NPF to the Pension Fund and vice versa is made.

Accordingly, the application can be submitted no later than this period. A person has time strictly until March 1 of the year following the year of filing an application for transfer to a non-state pension fund in order to return everything to normal without any consequences.

The application can be delivered to the Pension Fund in different ways:

- Through a personal visit.

- Through the portal "State Services".

- Through an NPF agent who had previously drawn up an application to transfer a citizen to his fund.

Naturally, the first method is the most reliable, therefore, it is recommended to use it in such situations.

Other documents

A person does not need any additional documents in order to carry out a reverse transfer. The most important thing is a passport, SNILS and a completed application form. This form can be obtained from the Pension Fund of the Russian Federation, or you can fill it out in this institution automatically with the help of a fund employee.

Of course, to facilitate the transfer procedure, a person can also bring with him his own copy of the agreement with the non-state pension fund, so that the State Pension Fund employees have an idea of which fund the person was transferred to and where the accumulated funds should be transferred from if something happens.

It is also worth remembering that procedures for transferring funds begin strictly in the month of March of each year, therefore, people always have time to write a corresponding application.

At the same time, we should not forget that at this moment in time there are no written notifications from the Pension Fund about joining the fund - this must be controlled independently, through the Gosuslugi portal.

Registration and electronic signature

In order to use the services on the portal, the user must first register on it.

There are three "difficulty levels" of an account:

- Simplified - it is enough to indicate your full name, mobile phone number and email.

- Standard – you must fill in information about your passport data and SNILS number.

- Confirmed – when the user has confirmed the specified data in one way or another:

- in person, by contacting one of the Service Centers (as a rule, they are located in the regional branches of the Pension Fund of Russia);

- via Russian Post;

- using remote banking services of Sberbank, Tinkoff or Post-Bank; This is the easiest and fastest confirmation method, but it is only available to clients of specified banks.

To change your pension fund through the portal, you need a verified account.

In addition, the application will need to be certified with an enhanced qualified electronic signature. It differs from the usual one in that it uses special encryption tools. To obtain such a signature, you must contact the Service Center.

As a result, it turns out that in order to change a pension fund, the registration stage cannot be completed completely “online”, and you will still have to go to the Service Center once. In addition, obtaining a signature is paid and costs an average of 700-1000 rubles for individuals. But in the future, a citizen can not only freely manage the placement of his pension savings, but also fully use all other features of the portal.

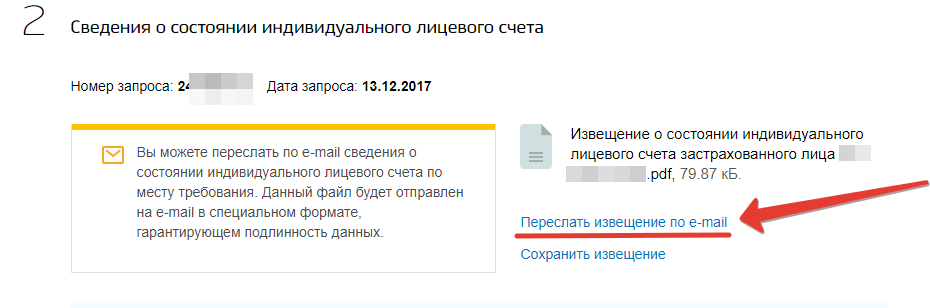

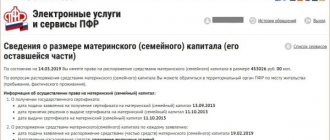

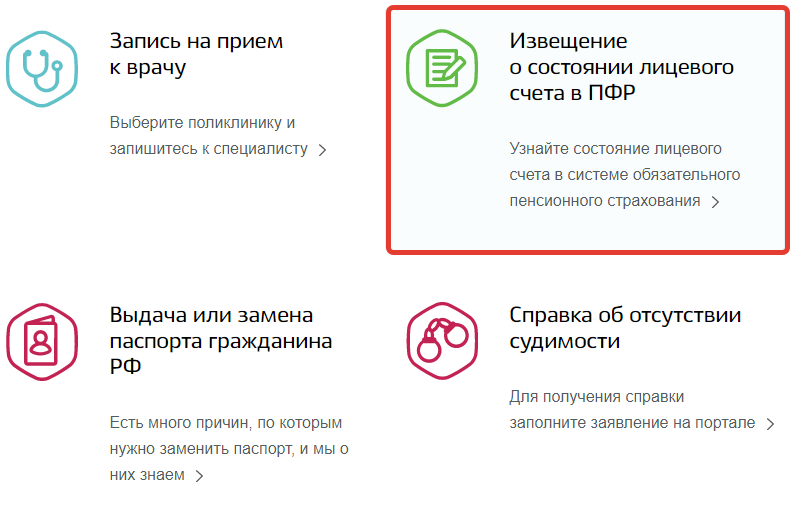

How to find out your NPF through State Services

How can you find out your non-state pension fund through State Services? This is done extremely simply, all you need to do is:

- Go to your Personal Account on the portal;

- Choose ;

- Then click on the “Get service” button;

- And in a few seconds you will receive an extract. Here you can either simply view or download the notice to your computer, or send the notice to the desired mailbox.