In the event of termination of employment relations with working pensioners, the Pension Fund branch must be notified about this. For this purpose, a package of documents is drawn up and submitted. Disputes often arise regarding how and by whom the Pension Fund of Russia should be notified of the dismissal of a working pensioner, by the company management or by a former employee. To understand this, you should know the provisions of the legislation on pension provision.

Indexation of pension after dismissal of a working pensioner: news for 2020

True, many of them have already forgotten that the authorities also considered the possibility of canceling their pensions altogether in 2020, but, fortunately, it did not come to that.

This means that the working pensioner will still continue to receive payments, but they will not increase by the amount of inflation until he is dismissed from work. In this situation, indexation will be calculated in the next month after visiting the Pension Fund.

It is also important to attach a blueprint of the employment record to this application - this will confirm the fact of dismissal from work. In some cases, Pension Fund employees may require a number of additional documents, but, as a rule, this does not happen.

Free legal consultation

Since April 2020, the obligation to notify Pension Fund employees has been removed from retired pensioners.

According to the requirements of Russian legislation, any organization is obliged not only to regularly submit reports to the Pension Fund of the Russian Federation, but also to provide the employee himself with a copy of his individual information (Article 11 No. 27-FZ).

If you are late, no compensation is provided to the employee. A pensioner can receive indexation if he quits for a while and then gets a job again (if the employer does not object to such actions and is ready to take him back).

In this case, you must independently contact the Pension Fund branch at your place of residence to confirm your status as an “unemployed pensioner.”

Documents to the Pension Fund upon Dismissal of a Pensioner in 2020

I have been a working pensioner since 1977. On June 28, 2020, I submitted an application of my own free will and received compensation for the past year. From September 1st I want to work again in the same organization. Will my pension be indexed from the moment the state stopped indexing pensions for working pensioners?

I have been a working pensioner for 2 years. For me, the organization transfers insurance contributions to the Pension Fund, which are almost equal to my pension. The state has not yet transferred to me a single ruble from the insurance premiums previously transferred for me. Why do we, working pensioners, not have the right to compensation and indexation as non-working pensioners? We not only work, but also benefit the state with our work.

Do I need to report to the Pension Fund if a pensioner quits his job?

A few years ago, it was mandatory to notify the Pension Fund.

However, at the moment, circumstances have changed in a certain way. This happened primarily due to the fact that the indexation of pension accruals was canceled for the working category from last year. Now the employer has been assigned to do this directly. The latter reports every month to the Pension Fund about all persons working for him. Consequently, the employees of this organization now already know what the status of each individual pensioner is.

Recalculation of pension after dismissal of a working pensioner

It is the employer’s responsibility to inform the Pension Fund about dismissed employees, so there is no need to contact the Pension Fund with an application. The employer will transmit information to the Pension Fund the next month after termination of the contract with the employee, within a month the Pension Fund will make a decision on indexation, and starting from the next month, pension payments will be recalculated. Provided the employer submits reports on time, the process takes just over three months.

This is interesting: What Documents Are Needed to Sell an Apartment from the Owner 2020

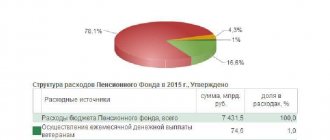

Federal Law No. 385-FZ of December 29, 2020 canceled the increase in pensions for working pensioners from 2020. The increase in payments that took place in August at the expense of insurance contributions paid by the employer, from 2020 is limited to three pension points, which is just over 200 rubles.

What documents does the employer submit for a dismissed pensioner to the Pension Fund?

The decision to pay a pension, taking into account indexation, in this case is made by the Pension Fund of Russia in the month following the month the employer submits reports, and payment of the pension, taking into account indexation, will be made from the month following the month in which the decision was made, i.e. 2 months after the employer provides information.

Starting from April 1, 2020, the procedure for paying insurance pensions, taking into account indexation, has changed. Now, if a pensioner is dismissed on April 1 or later, the indexation of the insurance pension will be carried out on the basis of data submitted by the employer to the Pension Fund of Russia. Information about work will be provided by the employer every month no later than the 10th day of the month following the reporting month.

Where to complain if you were fired illegally?

If the dismissal of an employee is carried out against his will, he has the right to file a complaint against the employer with the authorized bodies, including:

- Prosecutor's office.

- Court.

- Labour Inspectorate.

- Antimonopoly Service.

But before contacting higher authorities, it is recommended to try to resolve the conflict through negotiations with the manager or his superior. It is also permissible to file a complaint addressed to the founder of the enterprise or the board of directors.

Reasons for dismissal of working pensioners:

Recalculation of pension after dismissal of a working pensioner

Pension benefits are indexed twice during a calendar year. The first is provided for the recalculation of insurance payments and was previously carried out in February. But back in 2020, as in 2020, the President of the Russian Federation decided to postpone the indexation of old-age insurance accruals to January.

IMPORTANT! In August last year, representatives of the Pension Fund of the Russian Federation carried out an undeclared adjustment of payments to retired elderly people. The reform standard is determined by clause 3, part 2, part 4 of art. 18 of Law No. 400-FZ; clause 56 of the Rules, approved. By Order of the Ministry of Labor of Russia dated November 17, 2014 No. 884n. This means that a similar recalculation of pensions will be carried out in August 2020. Moreover, there is no need to submit any applications for increased payments to the Pension Fund.

Complete list of documents when dismissing an employee in 2020

Dismissal of an employee at his own request is the most common way to terminate an employment relationship. The employee needs to write an application addressed to the manager no later than two weeks before the date of the proposed dismissal (Article 80 of the Labor Code of the Russian Federation). However, if the manager resigns, the period is a month. But an employee who is on a probationary period can submit an application for his dismissal three days in advance (Article 71 of the Labor Code of the Russian Federation). Also, persons with whom an employment contract was concluded for a period of less than two months (Article 292 of the Labor Code of the Russian Federation), as well as those who are employed in seasonal work (Article 296 of the Labor Code of the Russian Federation), can complete an application within three days.

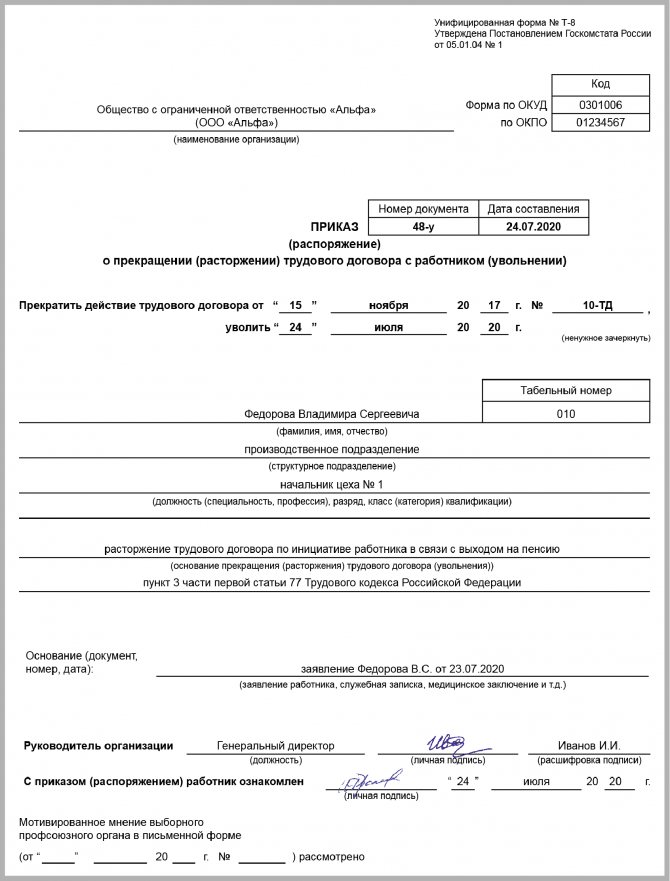

Based on the employee’s application, which is signed by the head of the organization, an employee of the human resources department or an accountant, if he is entrusted with personnel records, issues a dismissal order in Form No. T-8. The form was approved by Decree of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

This is interesting: What payments are there for the birth of the first child in 2020 if the mother does not work?

Recalculation of pension after dismissal

Recalculation of a pension upon dismissal of a working pensioner is a procedure regulated by law. The monetary support of a citizen who continues to work after retirement and then quits his job is subject to mandatory indexation. In this case, when recalculating, the amount of payments increases significantly. The final pension amount is influenced by a number of certain factors, which, as well as the procedure, should be known to every working pensioner.

If the pensioner was engaged in private practice, information about him will be provided by the tax service, or you will still need to visit the MFC or a branch of the Pension Fund and fill out an application form. However, here the procedure is no different in complexity. Additionally, documents may be required, the list of which depends on the applicant’s area of activity.

If a pensioner quits his job, where should he bring documents and what documents?

They, like the employment services, motivate this decision by the social security of an elderly employee who is already receiving a pension. Under such circumstances, a dismissed pensioner should also contact a lawyer to find out what payments he is entitled to after retirement, and then go to court to resolve the conflict and receive compensation. According to the authors of the law, working pensioners have other sources of income and are less exposed to inflation risks than their unemployed colleagues.

However, the state indicates that as soon as a citizen finally stops working, all required indexations for the period of his work in retirement are transferred to him. In addition, already 2 months after the date of retirement, social payments increase to standard values. This period of time is required for employees of the Pension Fund in order to, upon receiving a message confirming the dismissal, process the data and recalculate.

Pension for working pensioners from January 1, 2020

The issue of canceling pensions for working pensioners has already been raised several times , and in connection with the start of the pension reform proposed by the Government in 2020, it began to be discussed even more actively. However, at a meeting of the Council under the President of the Russian Federation for the Development of Civil Society and Human Rights, which took place on July 11, 2020, Deputy Minister of Labor and Social Protection Andrei Pudov said that they do not intend to cancel . “No, such a plot is not being considered,” said A. Pudov.

For working pensioners, the value of the pension point and the amount of the fixed payment are “frozen” at the level that was established on the date of retirement or before January 1, 2020. This means that the annual indexation of these values carried out by the Government does not in any way affect the pension provision of working citizens - while they are working, their pensions remain at the same level .

Certificate for the Pension Fund regarding the dismissal of a pensioner

And when pensioners resign, pension indexation begins. However, I know of many cases when a retired pensioner goes on his own initiative to the pension fund for “greater reliability” in order to report that he is no longer working). The Pension Fund is interested in information about whether a pensioner is working, because during the period while he is employed, pension indexation is frozen.

Now you can easily answer the question if a pensioner quits his job: does he need to report this personally to the Russian Pension Fund. Today there is no need for this, since this responsibility lies with the employer who employed the pensioner.

This is interesting: Apartment Rental Agreement between Individuals 2020 Must be Notarized

How to write an application correctly?

To inform the Pension Fund of the Russian Federation about the termination of employment, the pensioner needs to prepare a notification application. There are no strict requirements for its preparation. But there is a standard form that can be used when drawing up an application. It is enshrined in the second appendix to the Administrative Regulations for the provision of public services by the Pension Fund for the establishment of insurance pensions, approved by Resolution of the Board of the Pension Fund No. 16p dated January 23, 2020.

The form is filled out in this order:

- the top line indicates the name of the territorial body of the Pension Fund at the place of registration;

- the first part provides personal information about the pensioner: his last name, first name and patronymic, citizenship, gender, insurance account number, contact telephone number, passport details. The name of the Pension Fund branch that calculates pension payments is also noted;

- the second section is completed if the application is submitted by the citizen’s legal representative. Information about the authorized person is entered here. The details of the power of attorney are specified separately;

- the third part provides the grounds for recalculating the pension and indicates the type of payments;

- in the fourth paragraph of the application, a note is made that the citizen does not work. The presence of disabled family members is also indicated;

- the fifth section provides information about when and what changes the pensioner is obliged to notify the Pension Fund of the Russian Federation;

- The sixth paragraph shows a table with two columns. It lists the documents attached to the notification-application. The first column contains the serial number, and the second – the name of the paper;

- the seventh part indicates the email address for sending notification to the Pension Fund of the decision. This item is not required to be filled out;

- in the eighth section, the citizen needs to confirm the accuracy of the information provided, put the date of the application and a personal signature with a transcript.

It is also not prohibited to draw up a document in any form. In this case, you must adhere to the standard structure and rules for writing an application. It is necessary to indicate personal data, reasons for revising the pension, and a list of additional attached papers. The date of termination of employment must be set. All documents attached to the notification application are also listed.

Everything you need to know when submitting a package of documents to the Pension Fund is given in Resolution of the Plenum of the Armed Forces of the Russian Federation No. 30 dated December 11, 2012. Information regarding pension provision, calculation of length of service, accounting for benefits, etc. is presented here in a concise and accessible manner. Links to legal norms are also provided.

Indexation of pensions for working pensioners after dismissal in 2020

The new payment amount is determined taking into account the cost of consumer goods during the previous period. That is, when calculating the increase for pensioners in 2020, prices in 2020 should be taken into account. And the size of a person’s pension itself depends on the amount of insurance premiums paid by the organizations where he worked. And, although in 2020, instead of indexation, pensioners were paid an amount of 5,000 rubles, now the recalculation will be carried out according to all the rules.

As an example of how indexation occurs, we can consider the situation with information about dismissal incorrectly submitted by the employer within 2 months. In the fourth month, he continues to be paid the same pension as before. After a person applies to the Pension Fund or receives the correct information from the employer, a recalculation is carried out, and already from the fifth month the amount of pension payments is brought into line with the indexation coefficient. Although there will be no additional payment for the fourth month, the law does not provide for such compensation.

Dismissal of pensioners in 2020 at their own request or due to staff reduction

- at one's own request - Art. 80 Labor Code of the Russian Federation;

- by mutual agreement of the parties - Art. 78 Labor Code of the Russian Federation;

- in connection with the liquidation of the enterprise - Art. 180 Labor Code of the Russian Federation;

- according to Art. 81 of the Labor Code of the Russian Federation under the following circumstances:

- violation of official duties;

- low qualifications;

- staff reduction;

- absenteeism;

- serious complaints from the company management: embezzlement, theft, being under the influence of alcohol/drugs at work, negligent/criminal actions.

The procedure for dismissing an employee due to retirement differs from the procedure for terminating an employment contract at will only in documentary language. The first important nuance is the entry in the resignation letter, precisely indicating the reason. It gives the right to dismiss a pensioner without working off. Application example:

Procedure for terminating a contract with an employee of retirement age

Termination of employment relations with a retired specialist is carried out in the sequence established by law, similar to the dismissal of other categories of employees:

- On the employee's own initiative.

- At the initiative of the employer.

- By agreement of the parties.

The main difference is the right of a retired employee to resign without working.

Dismissal due to retirement

An employee has the right to terminate an employment contract when he reaches retirement age.

Reference. In accordance with the reform, men in Russia retire at 65 years old, and women at 60 years old. Some circumstances allow early registration of pensioner status.

For this reason, a resignation letter may be submitted at least one day before the planned date of leaving the position. Particular attention is paid to recording the grounds for termination of the contract - “retirement”, supported by the date of leaving work.

Sample letter of resignation due to retirement:

How many times can an employee resign due to retirement?

Termination of labor relations between an employer and an employee due to the latter’s retirement is allowed once in a lifetime.

How does a pensioner retire on his own initiative?

Based on a written application from a retired employee, the employer takes several actions:

- Generates an order.

- Makes an appropriate entry in the employee’s work book.

- Conducts required accounting reports.

- Issues documents to the pensioner within the period specified upon application.

If the employee indicates his own desire as the reason for dismissal, the contractual relationship is terminated after two weeks.

Sample order for dismissal of an employee due to retirement:

Dismissal of pensioners at their own request without service

In accordance with Art. 80 of the Labor Code of the Russian Federation, an employee has the right to leave a position on the staff of an organization without the two-week period of work established by law if there are reasons that prevent him from continuing his work activity. Retirement is one of these reasons.

If an employee expresses a desire to resign due to retirement, the employer is obliged to formalize the termination of the employment contract with the employee within the period specified by him.

Attention! Some employers require a copy of the pension certificate to be attached to the written application. However, the request is not legally binding. A working pensioner, in his resignation letter on his own initiative, indicates a number of mandatory points:

- own full name and position held;

- Full name and position of the employer's authorized representative;

- resignation letter;

- date of dismissal;

- own signature;

- date of application.

To avoid possible conflicts, it is recommended to make a copy of the application and put the date and number of the incoming document on the second copy.

By agreement of the parties to the employment contract

If the parties to labor relations mutually decide to terminate cooperation, the contract is terminated by agreement of the parties. The peculiarity of this type of dismissal is the holding of preliminary negotiations between the parties to the transaction and the opportunity for the employee to express his own vision of the termination of the agreement with the possible payment of compensation.

Attention! Termination of contractual relations in this case takes place on a voluntary basis. The use of various kinds of manipulation and psychological pressure on an employee is unacceptable.

Dismissal of a pensioner due to staff reduction

In practice, the reduction primarily affects working pensioners. The dismissal procedure in this case is carried out on a general basis and looks like this:

- The employee is notified 2 months before the layoff in the form of a written notice, in which he must sign receipt.

- An order is generated for the organization with changes to the staffing table.

- The pensioner is offered in writing other positions that are not subject to reduction.

- Refusal of offered positions must be made in writing.

- All benefits and compensations provided for by the Labor Code of the Russian Federation in case of staff reduction are paid.

Reference. If the employee agrees to the new position, his transfer is formalized.

How much severance pay is an employer required to pay when laying off a retired employee?

In accordance with Art. 178 of the Labor Code of the Russian Federation, when laying off an employee of retirement age, the employer is obliged to pay him a salary for the time actually worked and compensation for unused vacation days. Additionally, severance pay and the amount of average earnings for the period of searching for a new job are paid.

Reference. Severance pay in case of staff reduction is the amount of average monthly earnings.

If in the next two months after the termination of the employment relationship the pensioner does not find a job, he is paid another average monthly salary. To receive it, an application is submitted to the employer, providing him with his own work book.

Dismissal for medical reasons

Termination of labor relations between an employer and a retired employee is allowed in two cases:

- The specialist, according to a medical report, was declared unfit for work - clause 5, part 1, art. 83 Labor Code of the Russian Federation.

- Based on the medical examination received, the employee has contraindications for the work performed, and refused to be transferred to another - clause 8, part 1, art. 77 Labor Code of the Russian Federation.

The procedure for dismissal of financially responsible pensioners

Leaving the position of a pensioner on his own initiative is sometimes associated with certain problematic issues for the management of the organization. One such case is the fact of the employee’s financial liability.

The legislation, even in the presence of material circumstances, does not make exceptions to the rules for dismissing a pensioner. Violation of the procedure implies holding the employer liable in accordance with Art. 5.27 of the Code of the Russian Federation on Administrative Offences.

However, it is important to consider two points:

- dismissal after causing material damage does not relieve the former employee from liability - Art. 232 Labor Code of the Russian Federation;

- the right to recover damages from a person dismissed due to retirement is confirmed by judicial practice - the appeal ruling of the Saratov Regional Court dated March 29, 2018 in case No. 33-2059/2018.

Expiration of the contract

The employment contract terminates when it expires, regardless of whether the employee has reached retirement age or not.

Reference. Some employers, when an employee reaches retirement age, persistently persuade him to switch to a fixed-term contract. The translation is not supported by the legislation of the Russian Federation and is an unlawful act.

Without consent (and other methods)

If a working pensioner does not express a desire to leave his position in the organization on his own initiative, but at the same time makes mistakes while performing assigned tasks or his health condition does not allow him to continue cooperation, the employer has the right to terminate the employment contract.

The dismissal of a specialist of retirement age presupposes the presence of a compelling reason, supported by documents.

Attention! Conclusions and decisions of medical commissions are presented in their original form. Otherwise, the dismissal may be challenged.

Documents upon dismissal from an employer in 2020

There are more documents when leaving an employer. For example, a new form SZV-STAZH has been added. In addition, legislators updated the form of the earnings certificate and replaced the RSV-1 report with a calculation of contributions. We will help you not to get confused in these documents and tell you what documents an employee receives from an employer in 2020 upon dismissal.

Laws require that employees be given various certificates and extracts from reports and other documents upon dismissal. The employer is required to issue some documents by law, and some at the request of the employee. Detailed information about what must be given to an employee upon dismissal is in the article “SZV-STAZH and six other mandatory documents for dismissed employees.”