NFP Sberbank is the main leader in the specialized pension insurance market. Started its work in 1995, it has attracted more than 3 million clients. The non-state pension fund Sberbank offers services for citizens who want to increase the funded part of their pension, calculated from employer insurance contributions. For the convenience of its clients, the Foundation has developed an individual portal where you can register in your personal account. The service greatly simplifies the process of working with the institution.

Profitability of Sberbank NPF

An indicator such as the fund's profitability tells how much the organization earned on investments, which means how much profit clients received. Yield by year is reflected on the official portal of Sberban NPF in the form of convenient charts. According to the data, the interest rate is rising.

A constant analysis of the fund's profitability over 8 years shows that in 2014-2017 there was an increase in the number of people insured under compulsory pension insurance programs with non-state financing. It was then that the accumulated profitability began to grow from 62 to 115%.

| Year | Accumulated profitability, % |

| 2014 | 66.2 |

| 2015 | 82 |

| 2016 | 99.2 |

| 2017 | 115.7 |

How to register in your personal account of Sberbank NPF

All clients of the Sberbank non-state pension fund can log into their personal account. However, it is worth noting that all the features of the online account can be used by those who:

- entered into an agreement;

- opened a pension savings account;

- consented to the processing of personal information.

Registration of a remote account is available on the official page of the fund.

Registration

How to submit an application

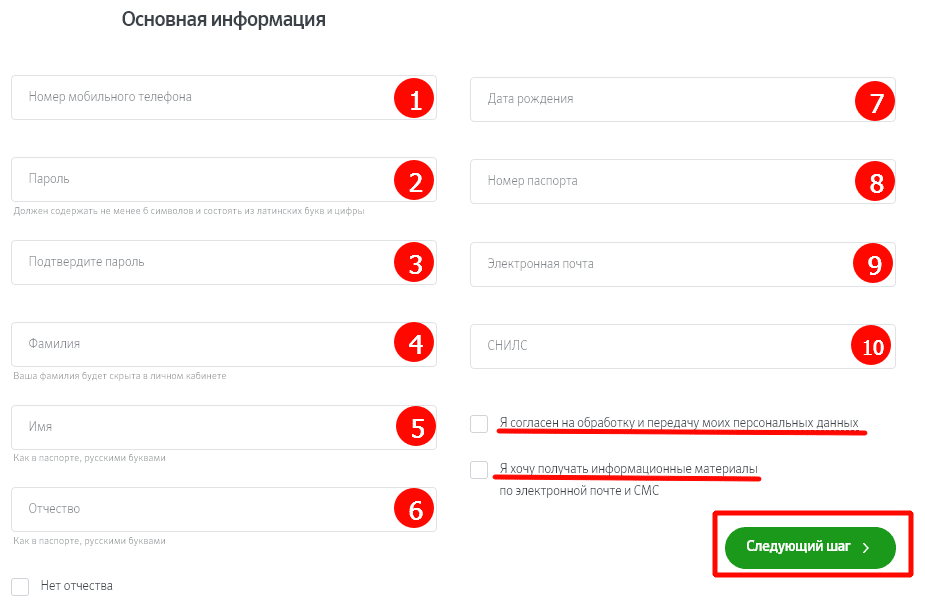

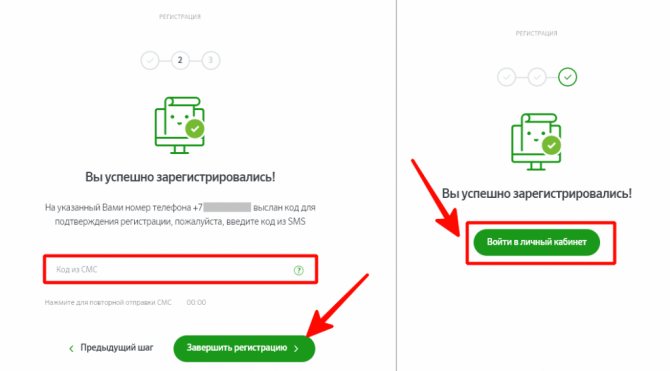

To register a personal account, you must fill out an online application using the form provided on the page.

- Phone number to which the system can send messages with an authorization code in the personal account.

- Create a password to access your account and repeat it. If the passwords do not match, the user will see a warning. Check the combinations are correct.

Important! The security system requires you to create a password consisting of 6 or more characters, including Latin characters and numbers.

- Indicate personal information in the appropriate lines: information from your passport, as well as the insurance number of your individual personal account.

- Enter your email - it will be needed to confirm registration actions on the site.

- Consent with the processing of personal data is expressed by checking the appropriate box.

- Additionally, you can express your desire to receive informational messages.

Confirmation of registration is carried out by entering a combination of characters, which is automatically generated and sent to the phone number specified in the application form.

Calculation of the funded part of the pension on the website

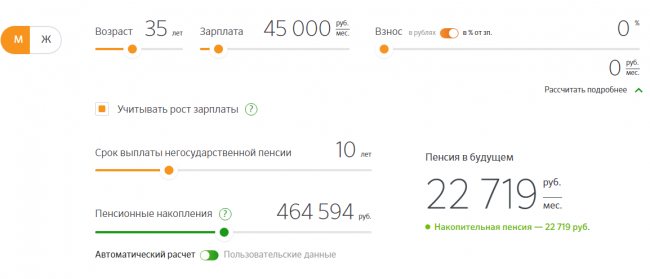

On the main page of the official website of the organization there is a pension calculator , which allows you to calculate the size of future funded and non-state pensions. The calculator assumes that the funded pension will not cease to exist, and contributions to it in the amount of 6% of the employee’s salary will resume in 2022 after the end of the moratorium.

In order to roughly calculate your future income as a pensioner, the service suggests providing the following information:

- floor;

- current age;

- average monthly salary;

- the desired contribution amount when forming a non-state pension under an individual plan;

- the need to take into account future wage growth;

- the desired period for receiving a non-state pension;

- the amount of savings already made within the framework of compulsory insurance.

The last three points need to be specified only in the extended, more detailed version of the calculator.

Attention! The calculator's indicators are very approximate and are presented rather for informational purposes. For example, by default the calculator calculates a citizen’s work experience from the age of 18, which in practice is extremely rarely true.

Login to your personal account of Sberbank NPF on lk.npfsb.ru

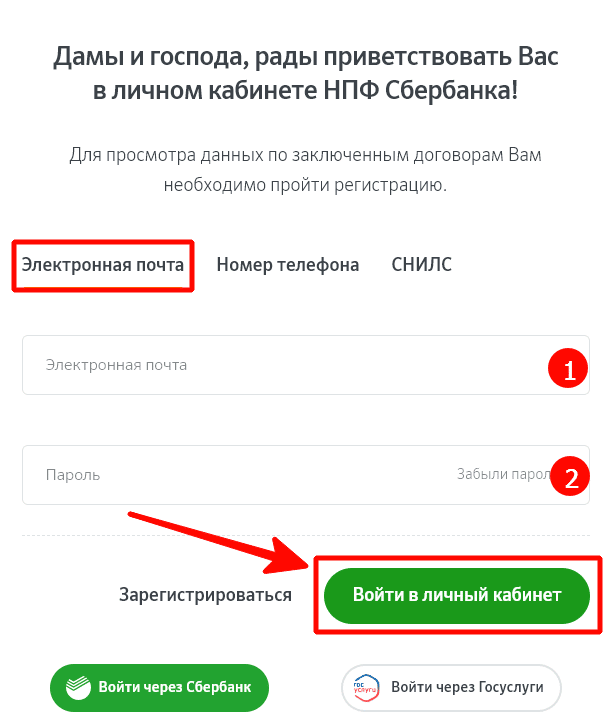

Authorization in the online account of Sberbank NPF can be done on the page. It is possible to authorize in different ways, which we will discuss below. Select the appropriate method, provide authorization information and log into your personal account.

Login to your personal account

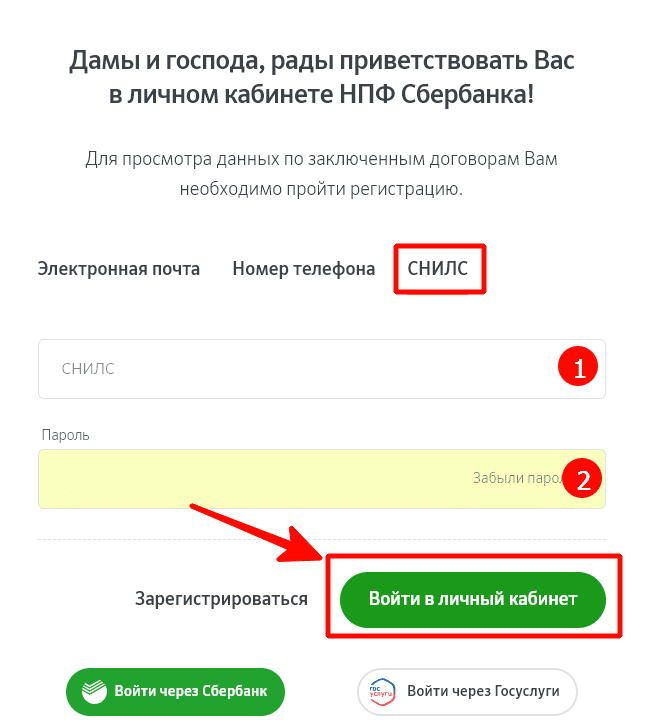

Please note that any method of logging into your personal account requires entering the password set at the time of registration.

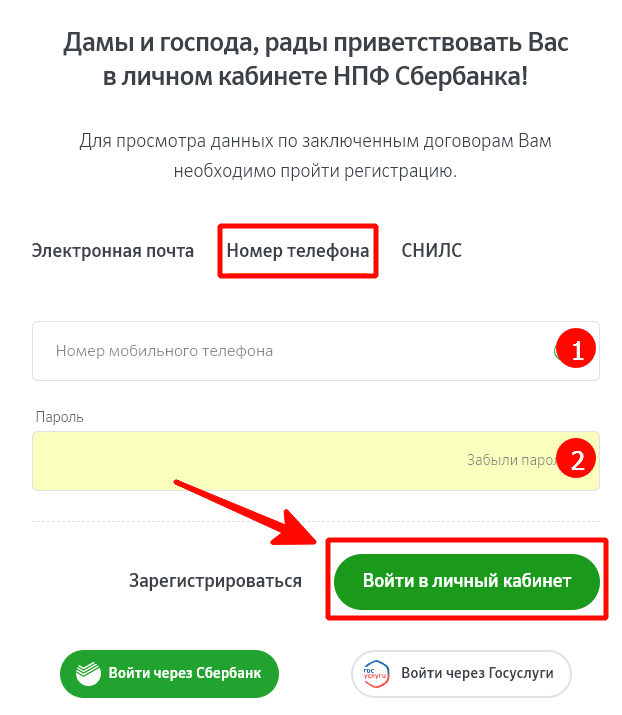

Login for individuals by phone number

- Enter the phone number you provided in the registration form.

- Enter your password.

You can also choose the option of authorization using your email address.

Login using SNILS

The insurance certificate number is entered in the first line, and the password is entered in the next line.

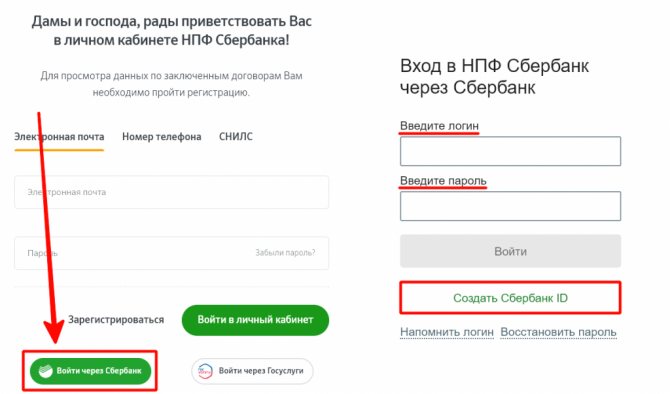

How to log in through Sberbank Online

The founder of Sberbank NPF is the bank of the same name, therefore, for the convenience of clients, authorization has been implemented through Sberbank’s remote banking service system. Login to the personal account of Sberbank NPF through Sberbank Online is carried out after specifying authorization data.

Login through Sberbank Online

If the policyholder does not have a Sberbank personal account connected, then you can create a Sberbank ID:

- indicate the numbers from the Sberbank card to which the Mobile Bank service is connected;

- confirm ID registration;

- the system will send personal login information.

Now you can log into your personal account of Sberbank NPF.

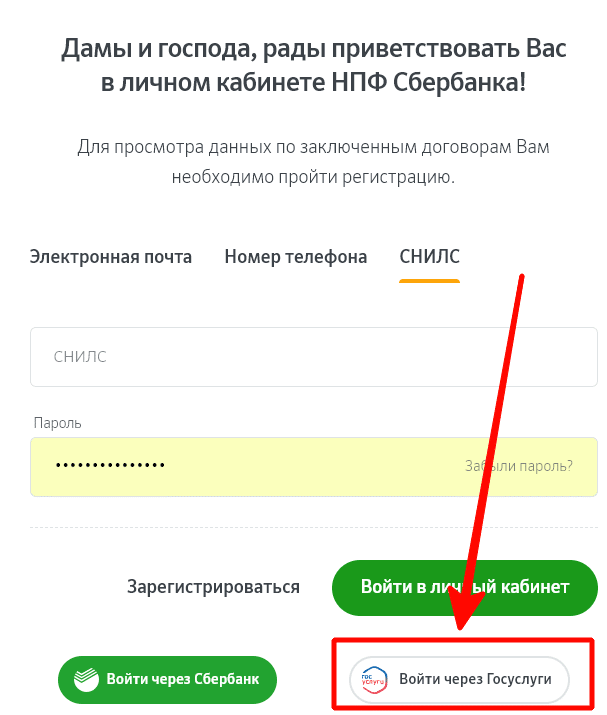

Login through State Services

The State Services portal interacts with an increasing number of companies every year and allows you to log in with a single login and password in different systems. Select the authorization method through State Services and use the password of this portal.

Login through State Services

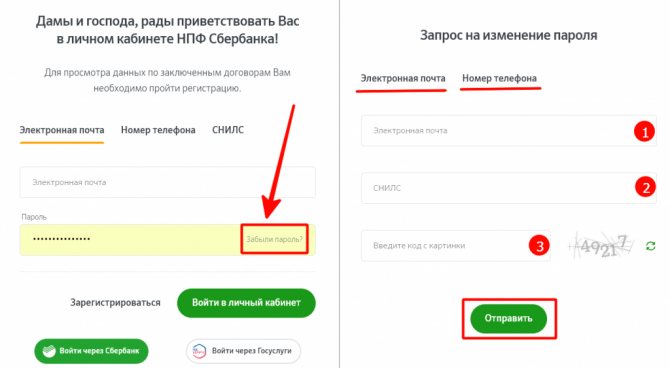

Recovering lost login and password

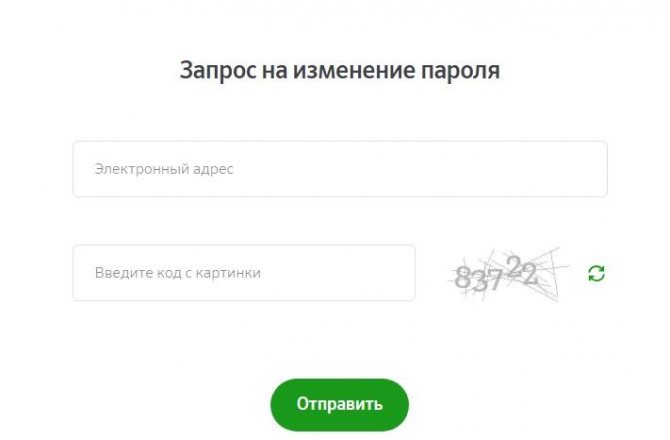

Lost authorization data can be restored without visiting offices. Click the “Forgot password” button and enter any data of your choice to identify the user: email, phone number, SNILS. Confirmation of the operation consists of the verification code from the picture.

Password recovery

Password recovery

A lost, forgotten or hacked system password can be reset (it cannot be found out!) using the access recovery form, which can be found by clicking the “Forgot your password?” link. personal account login menu. The window that opens requires you to enter your email and captcha code.

Further, the received email will contain further instructions.

The activities of the Sberbank division are monitored annually by the Federal Tax Service, the Bank of Russia, an Independent Auditor, an independent actuary, the Accounts Chamber, and the Pension Fund of the Russian Federation.

Autopay settings

Persons insured by Sberbank NPF have the opportunity not to miss contributions to their pension account using the automatic payment service. It is available for connection after the contract is loaded into the database. The user independently sets the transfer amount and frequency. The operation is not subject to commission if carried out from a Sberbank account or card. When auto-replenishing an NPF account from a card of another bank, you should clarify the amount of the commission.

Important! Autopay is available to those who have already made the initial funds transfer.

Advantages of the Non-State Pension Fund

Among the many non-state structures that operate on the territory of the Russian Federation, there are quite a few unregulated organizations and institutions. However, the Non-State Fund from Sberbank is a transparent financial organization with which you can track any information on savings. The benefits include:

- Availability of online access 24/7;

- Saving time for performing simple tasks, signing contracts;

- Guarantees of safety and security of information;

- Security of income and transparent flow of funds;

- Free consultations.

NPF Sberbank is an opportunity to comfortably, without leaving home and at a convenient time, access your pension savings without unnecessary trips to government agencies and spending time on registering your savings. The National Fund provides ample opportunities for action, regardless of how long the activity has been carried out, or what the general indicator of length of work experience is.

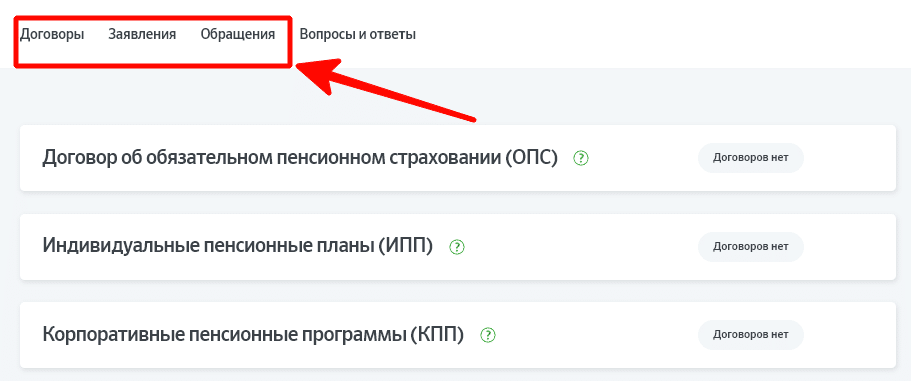

Section of contracts and statements

In the corresponding section of the online account of NPF Sberbank, you can view all the documentation. If the client does not see the documents in the personal account, this is most likely due to the fact that the contract was not concluded or the client’s personal data has been changed since its conclusion. Sometimes the absence of a contract is due to the fact that personal information was entered incorrectly during registration. If there are no reasons for the absence of documents, then they are available online - they can be viewed and printed.

Profitable deposits without benefits for pensioners

Sberbank’s line today includes deposits that do not have special conditions for older people and pensioners. But this does not mean that they should be avoided. On the contrary, their design may be a good solution.

Survey

3.1. Sberbank deposits “Manage” and “Manage Online”

The “Manage” deposit does not have benefits for pensioners, but it can also be interesting, since it allows you to replenish your account and partially withdraw some funds without losing interest.

The “Manage” deposit is opened at a bank branch, and the “Manage Online” deposit with an increased rate in rubles is opened remotely.

Conditions

- Duration: from 3 months to 3 years.

- Amount: from 30,000 rubles

- Replenishment: allowed. • cash - from 1,000 rubles, • non-cash - unlimited.

- Partial withdrawal without loss of accrued interest: allowed up to the minimum minimum balance.

Interest rate

| in the office | online |

| up to 2.41% | up to 2.56% |

Pros and cons of the “Manage” deposit

It is possible to replenish your account and partially withdraw money without losing interest.

Low percentage.

See the conditions and rates of deposits for individuals at Promsvyazbank. Read more →

How to terminate an agreement with NPF Sberbank

The law establishes a restriction that allows you to terminate cooperation with a non-state pension fund only once a year. It is worth noting that you cannot refuse service within the framework of state pension insurance, but the funded part can be transferred to another fund. Termination of the contract is stated in the document itself and consists of a written notification of such a desire.

Attention! Do not forget to indicate in the application for termination of the agreement with Sberbank NPF the details by which funds should be transferred from the account.

What to do if errors appear when calculating savings?

Modern banks have automated many processes related to customer service. But even the most innovative programs are not immune to errors. And banking developments sometimes fail. It often happens that other people's money, or simply excess amounts, end up in savings accounts.

Attention! Such transfers will be debited from client accounts in the future.

Sberbank employees should report any such errors. They fill out a special application and come to one of the offices with SNILS and a passport. The same procedure is relevant for those who are faced with insufficient funds. The money transfer should be completed a maximum of 5-10 days after the request.

Customer reviews about the personal account of Sberbank NPF

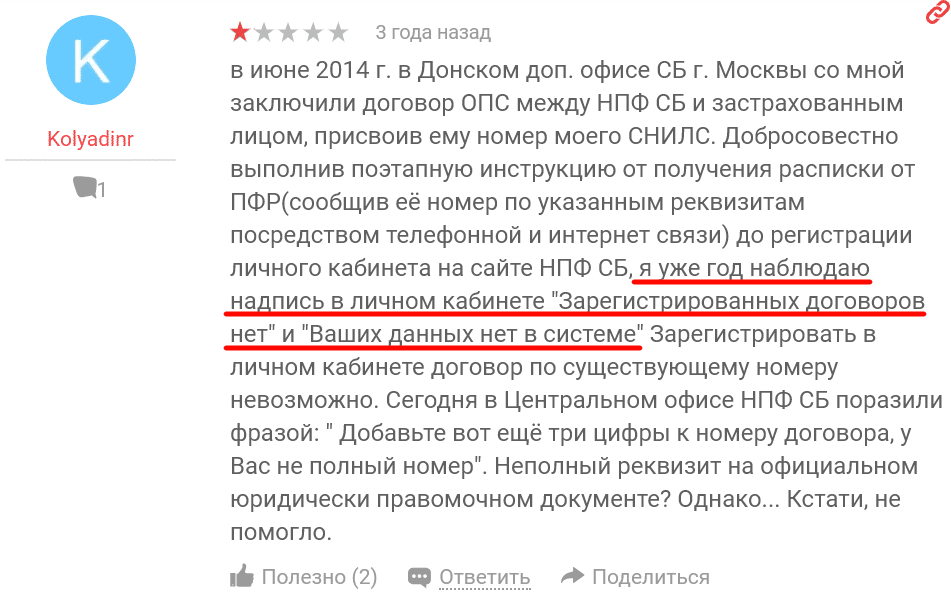

Clients of Sberbank NPF on various forums and websites note that their personal account does not always provide data on contracts. Very often you can see a message indicating that there is no concluded contract and no data in the system. Users of the review service under the nicknames Larisa Gavrikova and Koliyadinr and many others encountered this problem.

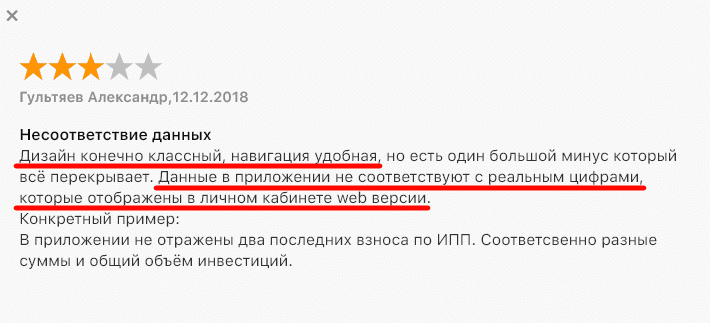

Those clients who have installed the mobile application, for example, Alexander Gultyaev, note the attractive design, easy navigation, but pay attention to the fact that the account balance in the personal account on the mobile device does not always coincide with the balance displayed on the site.

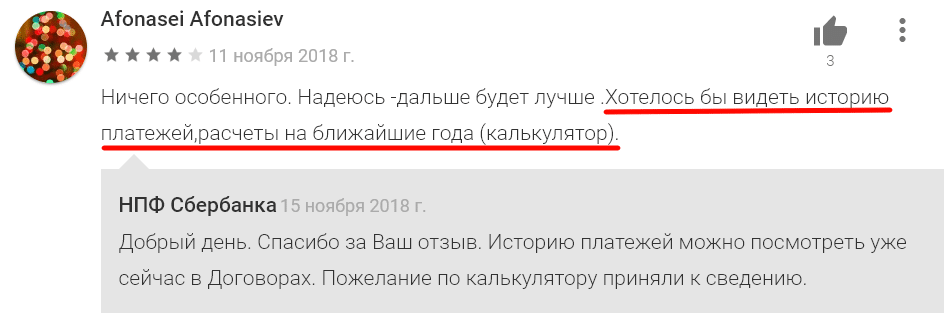

A user with the nickname Afonasei Afonasiev proposes to introduce a display of payment history and a functional calculator for calculating savings into the Sberbank NPF mobile application.

Are you a client of Sberbank NPF? Do you like your personal account and its functionality? Share your experience of interacting with a non-state pension fund with our readers.

Personal account of Sberbank NPF: login on the official website

3.4 (68%) 10 votes