Hello, dear readers.

In light of recent events around pension reform, the question of how to ensure a comfortable old age is urgent. His decision should not be shelved. One option to save for old age is to invest in a non-state pension fund.

The leading position in this segment is occupied by the non-state pension fund Transneft. To familiarize yourself with its proposals and regulatory documents, the easiest way is to go to the official website of NPF Transneft.

About the fund

By the end of 2020, over 24 thousand people received this type of pension payment. The formation of pension savings in the fund is available to everyone. Pension provision consists of compulsory pension insurance and non-profit pension provision.

When concluding an agreement on non-state pension provision with NPF Transneft JSC, the client is provided with certain opportunities:

- Determining the frequency of contributions, i.e. their frequency;

- Establishing or changing the amount of such contributions;

- Changes in the frequency of accrual of non-state payments (reduction or increase);

- Suspension or resumption of payments without terminating the contract.

Important! If money under an NPO agreement is contributed by the client for his own benefit, it is not subject to personal income tax.

The essence of the activity of the Transneft pension fund is the formation of a certain amount in the client’s personal account by the time of his retirement. This allows you to issue lifetime payments or an urgent regime for receiving a non-state pension.

Activity

The organization carries out its activities at the address: Moscow, st. Shchipok, 5/7, pp. 2,3.

Initially, the main task of the fund was to provide pension services to Transneft subsidiaries and other individuals. In July 2020, it was transformed into NPF Transneft. Payments to pensioners began in 2004, and by the end of 2014 the figure exceeded 18 thousand people. Now the organization is open to any citizen who has chosen Transneft JSC for pension savings.

In its work, the JSC uses a whole list of pension technologies:

- accumulates contributions;

- places pension reserves;

- maintains records of obligations;

- makes payments of non-state pensions.

To ensure activities, regulatory documents have been developed: pension and insurance rules. The first are the basis for organizing work on non-state pension provision. These rules were approved by the Foundation Council and regulate the procedure and conditions for fulfilling their obligations. Insurance rules are responsible for fulfilling obligations under concluded pension insurance contracts.

Official website

The official website of NPF Transneft https://npf-transneft.ru provides complete information about this organization: founders, structure, investment policy, management companies. Here you can find financial performance data, annual reporting and data on the questions that users most often ask.

The resource contains schemes and documentation on voluntary pension provision, as well as the features of compulsory pension insurance:

- Savings of citizens;

- Transferring money to the fund;

- Support options;

- Transfer of savings to another insurer;

- Payment of funds, including to legal successors.

Special schemes have been developed for legal entities that comply with the law. Through the fund’s corporate programs, the employer can provide employees with a decent level of pensions in the form of an increase in government payments.

Personal Area

For greater comfort when using the fund, at the office. The site has a personal account in which you can register and perform many functions and actions. To do this, you need to create a login, come up with a password and register an account. Information about profitability is strictly confidential and is presented exclusively in your personal account.

Possibilities

Opportunities - in your personal account you can track events and actions that occurred with funds and savings. It is also possible to check your fund balance and balance, and view profit growth statistics.

How to find out your savings?

How to find out your savings - to obtain information regarding the savings part, you need to go to your personal account by entering your login and password, click on the savings tab and get the necessary information.

Transneft corporate pension

The size of the Transneft corporate pension cannot be calculated in advance. The indicator depends on the time the employee joined the relevant program, the length of his work experience, the duration of the transfer of funds to the fund, as well as the choice of system. Employees are offered three options: savings, insurance, and accumulative.

The employee's income level also plays a role. The provision is about 40% of the salary level at the last place of work. From time to time, the level of provision is adjusted in accordance with the current cost of living. This process is called indexing.

The non-state pension fund Transneft offers a high level of security, including for old age. The minimum payment amount is 1,000 rubles. Qualified workers can count on more significant amounts.

To increase the amount of payments, the employee, on his own initiative, transfers funds to the Non-State Pension Fund in the selected amount.

Good to know! Pension contributions are made to the fund only in Russian rubles. The investor can enter into an agreement in his own favor or in favor of other persons.

Reviews

Customer reviews correspond to the company's rating and confirm its reliability. Former employee Mikhail writes that he worked for the company itself for 37 years and receives a good pension in monetary terms. Edward writes:

Serious fund. And this is natural, since it was founded by a company that has a good founder. And most importantly, it shows serious profitability and is more reliable than the Pension Fund.

Alexander advises to trust the fund unconditionally, since it has many awards, the number of which is inferior to other NPFs. He himself already receives a pension here without delays, but estimates the level of profitability as 0.9%.

I’m not very happy with the cooperation with JSC Sergey, but these are the rules of document flow:

The staff gave us a list with the necessary papers. Documents must be certified by a notary, which is an additional expense. You will spend part of the already small amount just on them.

Ulyana was surprised by the fund’s low return in 2011, but this was due to a sharp drop in prices for shares and JSC securities.

If you are choosing a pension fund, be sure to watch the video below and decide whether Transneft fits the criteria.

Reliability rating and profitability of Transneft

RA "Expert" confirmed the fund's reliability rating at the level of "A++" with a stable forecast. This is the maximum indicator indicating high reliability.

However, in 2020 this rating was withdrawn due to the expiration of the validity period. NPF refused to update the data.

The profitability of Transneft by the end of March this year was equal to 1.79% according to OPS, such data were provided by the Central Bank. Pension payments amounted to 5,861.20 rubles. For non-state collateral, by the same date the yield level reached 3.35%. Pension payments amounted to 698252.30599 rubles.

High ratings and profitability are largely due to the decent professional level of managers.

In addition, Transneft is a group of companies that own approximately 50 enterprises in different economic sectors.

Accordingly, the fund has the opportunity to diversify investments by investing in heterogeneous groups. This allows us to minimize the risk of losing the savings of NPF clients.

Information disclosure

The main criterion when choosing an insurer for accumulating a pension is its reliability and stability, they are influenced by such indicators as profitability (how competently the collected funds are placed), the number of people using the services and the volume of stored savings. The higher the specified data, the greater the likelihood of successful cooperation with the company.

Fig.1. Society advertising banner

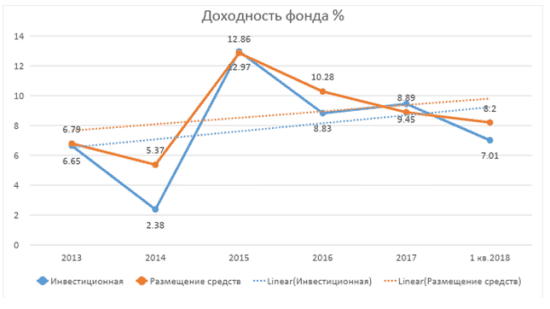

Profitability of NPF Transneft JSC

The company uses 2 schemes for earning money from placed funds: investments or placing funds in other financial institutions.

Table 2. Growth dynamics of all types of company profitability from 2013 to 2020. Source: official website

| Period | Profitability % | |

| From investing | From placement | |

| 2013 | 6,65 | 6,79 |

| 2014 | 2,38 | 5,37 |

| 2015 | 12,97 | 12,86 |

| 2016 | 8,83 | 10,28 |

| 2017 | 9,45 | 8,89 |

| 1 sq. 2018 | 7,01 | 8,2 |

Chart 1. Profitability over time. Source: official website

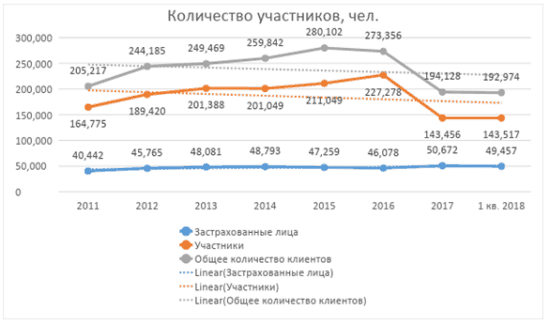

Number of clients

The fund includes the insured persons and other fund participants.

Table 3. Number of participants 2011-2018

| Years | Insured persons | Participants | Total number of clients |

| 2011 | 40 442 | 164 775 | 205 217 |

| 2012 | 45 765 | 189 420 | 244 185 |

| 2013 | 48 081 | 201 388 | 249 469 |

| 2014 | 48 793 | 201 049 | 259 842 |

| 2015 | 47 259 | 211 049 | 280 102 |

| 2016 | 46 078 | 227 278 | 273 356 |

| 2017 | 50 672 | 143 456 | 194 128 |

| 1 sq. 2018 | 49 457 | 143 517 | 192 974 |

Chart 2. Dynamics of the number of fund clients for the period 2011-2018. (1 quarter). Source: official website

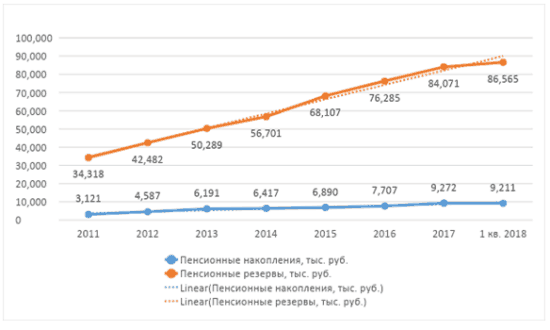

Volume of reserves and savings

An indicator that tells you how much money was placed in the fund from clients for the entire period. Transneft uses 2 types of attracted amounts: pension savings (formed from compulsory insurance) and reserves (from non-state pension provision).

Table 4. Amounts of funds placed in the Fund. Source: official website

| Period | Savings, thousand rubles | Reserves, thousand rubles |

| 2011 | 3 121 | 34 318 |

| 2012 | 4 587 | 42 482 |

| 2013 | 6 191 | 50 289 |

| 2014 | 6 417 | 56 701 |

| 2015 | 6 890 | 68 107 |

| 2016 | 7 707 | 76 285 |

| 2017 | 9 272 | 84 071 |

| 1 sq. 2018 | 9 211 | 86 565 |

Chart 3. Dynamics of savings 2011-2018. Source: official website

How to conclude an agreement with a company under OPS

To transfer insurance premiums to the company, the insured person will need to conclude an appropriate agreement using one of the following methods:

- visit the Foundation in person with the originals of your documents;

- by transferring the signed Agreement (it is necessary to check the box in clause 43 about familiarization with the Rules), consent to the transfer and processing of data, an individual’s questionnaire in the established form.

Documents required for concluding an agreement:

- passport;

- insurance certificate for compulsory insurance;

- tax registration certificate (TIN) – if available.

Attention! When submitting documents to a non-state pension fund by mail, the client’s documents must be certified in the prescribed manner either by a notary or personally by the owner with a handwritten signature.

Fig.3. Contract signing process

After concluding the agreement, the participant must, by December 31 of the current year, submit a statement of intent to switch to services to NPF Transneft JSC before the end of the current calendar year.

The effective date of the agreement is the day when the previously accumulated pension under the compulsory pension insurance of the insured person will be transferred from the former insurer or Pension Fund to the person’s account at Transneft.

Important! The insured has the right to apply to change the insurer no more than once a year, provided that documents have not yet been submitted to establish payments.

Joint Stock Company "Non-State Pension Fund "Transneft"

The amount of the corporate non-state pension is calculated by the Fund using actuarial calculations, based on the payment period, the amount of accrued pension payments indicated by the Investor in the letter of order, and the availability of funds in the joint or personal pension account.

After receiving all the documents necessary to resolve the issue of assigning a pension and if the necessary pension grounds are available, the Fund makes a decision on assigning a corporate non-state pension to the Participant from the date specified by the Investor in the order letter on assigning a corporate non-state pension to the Participant.

Legal assistance

Former employees also receive financial assistance in the event of loss of property from theft or other disaster, annual assistance for health improvement, payments for anniversaries and holidays, annual compensation for vacation expenses, and assistance for medical needs. Lukoil, Rosneft, Rosseti, which took 3rd, 4th and 5th places, respectively, have an approximately equal set of privileges. Companies pay a lump sum benefit to a retiring employee; provides regular financial assistance to non-working pensioners who do not receive non-state pensions from organizations; retain the right to health insurance. Lukoil employees who have become disabled due to an industrial accident can count on material and organizational support for prosthetics abroad if this is not possible in Russia.

Typically, corporations set 10 to 15 years of service as the minimum limit for departmental pay assignments. The size of the corporate pension It is necessary to understand that the amount of maintenance, first of all, depends on the amount of income at the place of work. After all, the greater the payment to the employee, the more funds the employer transfers to the non-state pension fund.

Pension savings: Corporate pension programs based on non-state pension funds

The number of participants in corporate pension programs, unfortunately, has practically not grown since that time, and the number of those insured under compulsory pension insurance is growing rapidly and is already almost twice as large as the number of participants in corporate pension programs.

“I worked at the Ministry of Railways for more than 15 years, and then moved to another company, also related to railway transportation, and worked there as a diesel locomotive driver. Currently, employees of Russian Railways have increased pensions. Can I receive it too? If I can, how can I do it?”

Appeal ruling of the Investigative Committee for civil cases of the Tyumen Regional Court dated January 20, 2020

The court made the above decision, with which the plaintiff Petrikeev V.Ya. does not agree, in the appeal he asks the court to cancel the decision and make a new decision in the case to satisfy the claims, considering that the court incorrectly applied the norms of substantive and procedural law. As in the first instance, he refers to the need to apply in the case the provisions of Federal Law No. 76-FZ of May 27, 1998 “On the status of military personnel.” Expresses disagreement with the court's conclusion that it is impossible to apply labor legislation in the case, since the grounds for calculating a pension arose while the parties were in an employment relationship. Finds the requirements of the defendant’s local regulations regarding the required length of work experience in the regions of the Far North for the application of the regional coefficient when assigning a corporate pension to be contrary to the norms of federal legislation, which provide as a condition for the application of the regional coefficient when calculating the labor pension only the fact of residence of the pensioner in the relevant area. Notes that his receipt of a long-service pension cannot serve as an obstacle to the application of the norms of the Federal Law of May 27, 1998 N 76-FZ “On the status of military personnel” when assigning a corporate pension. Contrary to the conclusions of the court, he considers himself to have the right to demand compensation from the defendant for sanatorium treatment, who throughout the entire period of his employment relationship avoided providing him with such a guarantee.

Types of pension products

Joint Stock Company NPF Transneft offers its clients voluntary, compulsory and corporate pension insurance programs, each of which has its own schemes.

Fig.2. Saving for a pension is important

Table 6. Pension insurance products

| Program categories | Product diagrams | Detailed description |

| Mandatory pension insurance | Only insurance pension. | The opportunity to choose is provided to persons born in 1967 and younger until the expiration of five years from the date of first accrual of contributions to the compulsory pension insurance. |

| Combined insurance and funded pension. | ||

| Voluntary provision | Fixed contribution amount. Payments for a limited period of years. | |

| Contributions are a set amount. Maintenance - for life. | ||

| Established amounts of pension payments. | ||

| Corporate programs | With a certain amount of pension contributions and a limited payment period. | |

| Fixed contribution and lifetime benefits. | ||

| Joint and several with a fixed amount of payments. | ||

| Established amounts of pension payments. | ||

| Contributions are fixed. The corporate pension is paid until the funds in the pension account are exhausted, but not less than 5 years or on a lifetime basis. | ||

| The amount of contributions is set. Payments before the termination of pension grounds. | ||

| With equity participation and payments until the funds in the personal account are exhausted, from 5 years or for life. | ||

| With lifetime payment of a corporate pension. | ||

| Payment of a corporate old-age pension on a share basis, until the funds in the personal account run out for at least 5 years or for life. | ||

| The pension is paid for life upon expiration of the funding period established by the contract. |

For reference! Having decided on the choice of NPF and pension program, the insured person needs to enter into an agreement with the company and submit an application to the Pension Fund.

Profitability statistics

| NPF | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 |

| Telecom-Soyuz JSC NPF | 15,48 | -16,81 | 0,12 | 9,05 | 8,42 | 2,29 | 5,60 | 8,45 | 2,25 | 14,91 | 38,05 | -33,20 |

| Hephaestus JSC NPF | 12,16 | 3,94 | 9,97 | 11,95 | 16,65 | 0,62 | 7,37 | 6,62 | -1,99 | 16,43 | 24,59 | -71,26 |

| Surgutneftegaz JSC NPF | 12,12 | 5,32 | 8,74 | 11,61 | 12,94 | 0,25 | — | — | — | — | — | — |

| Khanty-Mansiysk JSC NPF | 10,94 | 4,15 | 8,16 | 9,63 | 15,84 | 0,44 | 6,61 | 7,91 | 2,39 | 14,85 | 23,29 | -15,72 |

| Volga-Capital JSC NPF | 10,81 | 4,10 | 9,66 | 11,31 | 13,69 | 7,59 | 8,96 | 7,35 | 0,13 | 13,92 | 19,00 | -44,00 |

| Akvilon OJSC MNPF | 10,75 | 6,83 | 9,71 | 11,51 | 8,40 | 6,69 | 5,27 | 3,98 | -4,20 | 11,40 | 55,72 | -35,99 |

| First Industrial Alliance JSC NPF | 10,72 | 5,04 | 8,14 | 12,22 | 13,34 | 2,73 | 8,68 | 8,35 | 2,77 | 14,75 | 24,25 | -24,25 |

| Rostec JSC NPF (AvtoVAZ) | 10,60 | 3,30 | 8,18 | 7,88 | 14,00 | 4,66 | 6,45 | — | — | — | — | — |

| Federation of JSC NPF (Captain JSC) | 10,50 | 3,41 | 6,70 | 9,54 | -2,09 | — | — | — | — | — | — | — |

| Consent of JSC NPF (Defense-Industrial Complex OPK) | 10,42 | 4,38 | 8,31 | 10,57 | 12,87 | 1,91 | 6,99 | 6,81 | -0,77 | 12,57 | 56,20 | -43,07 |

| Evolution of JSC NPF (Neftegarant) | 10,36 | 5,12 | 8,13 | 10,80 | 10,57 | 7,26 | — | — | — | — | — | — |

| Opening of JSC NPF (Lukoil-Garant) | 10,33 | -10,80 | -5,26 | 8,23 | 8,96 | 8,95 | — | — | — | — | — | — |

| UMMC-Perspective JSC NPF | 9,88 | 4,78 | 9,19 | 10,36 | 12,75 | 2,19 | 6,07 | 6,80 | 0,34 | 11,27 | 46,17 | -36,46 |

| Stroykompleks JSC NPF | 9,86 | 5,82 | 7,96 | 6,42 | 12,51 | 5,01 | 7,67 | 7,28 | 4,08 | 9,08 | 13,20 | -11,77 |

| Alliance JSC NPF | 9,68 | 4,20 | 8,83 | 9,76 | 12,15 | -0,13 | 9,84 | 6,37 | -4,28 | — | — | — |

| Big JSC MNPF | 9,62 | 2,21 | 7,16 | 9,60 | 11,33 | 6,15 | 7,25 | 7,13 | 1,53 | 10,40 | 22,80 | -35,23 |

| National JSC Non-State Pension Fund | 9,49 | 4,08 | 9,81 | 11,48 | 11,90 | 1,65 | 4,94 | 5,21 | 1,65 | 12,29 | 30,38 | -0,03 |

| Defense-Industrial Fund named after. V.V. Livanova JSC NPF | 9,33 | 6,31 | 8,62 | 12,31 | 13,06 | 6,48 | 7,51 | 6,13 | -5,56 | 13,72 | 33,37 | 50,29 |

| Magnit JSC NPF | 9,09 | 1,95 | 3,18 | 10,88 | 7,74 | 0,86 | 13,30 | 8,84 | -2,96 | 8,92 | 20,32 | -22,43 |

| Formation of JSC NPF | 9,05 | -19,45 | 3,27 | 7,04 | 9,43 | 5,91 | 8,39 | 9,58 | 0,95 | 9,62 | 26,85 | -29,52 |

| Transneft JSC NPF | 8,78 | 3,72 | 8,39 | 8,83 | 12,97 | 2,38 | 6,65 | 7,16 | 1,74 | 13,42 | 20,33 | -19,47 |

| Diamond Autumn JSC NPF | 8,78 | 6,78 | 11,16 | 12,62 | 13,59 | 2,02 | 5,03 | 7,05 | 1,74 | 10,99 | 24,17 | -25,20 |

| Socium JSC NPF | 8,71 | 5,61 | 8,93 | 10,62 | 12,43 | 7,10 | 8,53 | 10,24 | 1,87 | 11,88 | 14,41 | -15,47 |

| Rostvertol JSC NPF | 8,63 | 3,62 | 8,31 | 8,83 | 9,71 | 6,95 | 8,27 | 6,90 | 2,93 | 13,24 | 7,10 | -25,10 |

| VTB Pension Fund JSC NPF | 8,58 | 5,53 | 9,02 | 10,30 | 10,76 | 4,72 | 6,59 | 10,99 | 0,73 | 11,54 | 17,42 | -11,15 |

| Social development of JSC NPF | 8,30 | -16,49 | 3,24 | 8,55 | 14,49 | 0,88 | 6,90 | 6,88 | 0,55 | 11,08 | 25,36 | -19,80 |

| Sberbank JSC NPF | 8,17 | 4,64 | 8,70 | 9,60 | 10,70 | 2,67 | 6,95 | 7,84 | -0,09 | 11,31 | 32,22 | -27,34 |

| Professional JSC NPF | 7,31 | 3,86 | 8,59 | 8,25 | 8,11 | 3,27 | 7,40 | 7,07 | 3,90 | 6,68 | 13,46 | 0,13 |

| Trust JSC ONPF | 7,28 | 4,30 | 8,49 | 10,10 | 9,60 | 5,43 | 8,35 | 6,07 | -3,29 | 11,60 | 35,70 | 1,20 |