When calculating the conditional amount of the insurance pension, the following indicators relevant for 2020 are used:

- Fixed payment - 5,686.25 rubles.

; - The cost of 1 pension coefficient is 93,00

; - The maximum salary before personal income tax, subject to insurance contributions, is 95,833 rubles per month.

In 2020, about 1.5-2 million citizens will retire. However, younger people should not delay and become interested in future old-age benefits now. The pension calculator calculates how much a person will receive if he retires this year, given his current salary and other parameters. It shows the approximate result.

The exact amount will be known after submitting your application for retirement and calculating all rights and benefits; you can always view it in your personal account of the Pension Fund. An analysis done in advance helps determine future financial support in old age and creates motivation for honest, regular contributions to a retirement account.

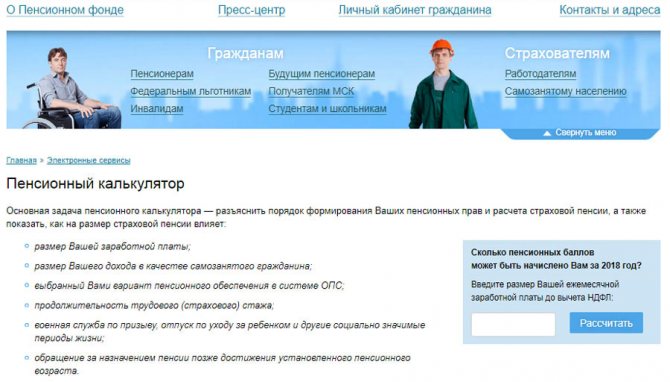

Pension calculator on the website www.pfrf.ru

Calculation of pensions using the new formula calculator online

Influencing factors

After the reform, the IPC - Individual Pension Coefficient - was added to the influencing factors for calculating pensions. It is quite simple to calculate it by entering your salary before deduction of personal income tax into the form on the website. In another way, IPCs are called pension points. They affect old-age insurance benefits, which are calculated by multiplying points by the price of one point in a given year and summing these values.

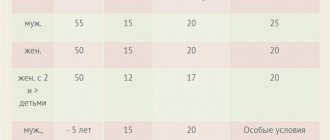

Conditions for receiving old age benefits:

- Availability of retirement age: from 55 years old for women and from 60 years old for men.

- A certain number of years of experience in paying insurance premiums. From 2024 this figure will reach 15 years.

- Minimum number of pension points: 30.

Important : the number of points per year is limited. In 2020 it is 9.13, and in 2021 it is 10 for citizens who do not have pension savings. Otherwise, other figures appear: up to 6.25% in 2021.

It is worth remembering : the state regularly indexes the insurance pension, while the funded one is in the NPF or Criminal Code, depending on the desire of the citizen, and is not subject to indexation. Verified funds invest these funds in financially profitable projects, increasing the client’s income. If the programs turn out to be failures, then the client can only hope for the amount that he had already contributed earlier.

Accrual of pension points for individual entrepreneurs

An individual entrepreneur pays insurance to the Pension Fund, so he can also receive a labor pension. To obtain it you must meet the following requirements:

- Reach retirement age. As of 2019, the retirement age for men is 60.5 years, and for women 55.5. But every year it increases, in 2028 it will be fixed at 60 years for women and 65 years for men.

- Insurance experience . This value refers to the period of insurance payments to the Pension Fund. Individual entrepreneurs pay it themselves, while their employer pays for ordinary workers. In 2020, the insurance period must be at least 10. But it increases every year, and in 2024 it will be 15 years.

- Minimum number of points. In 2020, this figure is 16.2 points. In 2025 it will increase to 30 points.

What else is the IPC charged for: individual cases

IPC can be accrued not only based on length of service, but also in some situations described in the law.

1.8 points are awarded for one year of care for the following category of citizens:

- disabled person of group I;

- disabled child;

- old people over 80 years old;

- child under 1.5 years old (both parents).

1.8 is also accrued for one year of conscription service in the army. If a parent takes a year off to care for a second child, he will be awarded 3.6 points, and for the third and fourth - already 5.4.

The Pension Fund encourages people to retire as late as possible by offering an increase in fixed payments and insurance cash benefits by 36% and 45% points, respectively, if a citizen applies 5 years after receiving the right to security in old age. After 10 years, the fixed payment will increase by 2.11, and the insurance payment will increase by 2.32.

Military pension

Military pension also has its own calculation formula:

- 50%. .

There are three types of military pension:

- by length of service;

- on disability;

- for the loss of a breadwinner - relatives receive if he goes missing or dies.

Important : if 20 years of service are not reached, the pension is calculated based on mixed length of service.

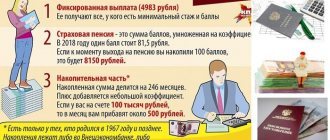

Fixed payment, its size in 2020

The fixed payment amount in 2020 is RUB 5,686.25. for persons who have reached retirement age. Depending on the category of pensioners, it may vary:

- 7,474.35 rubles for persons with more than 15 years of work experience in the Far North, with 25 years of experience for men and 20 for women.

- 9965.80 - for disabled people of group I.

- 4982.90 - for disabled people of group II.

- 2491.45 - for disabled people of group III.

- and some other categories, in accordance with the law of December 28, 2013 N 400-FZ.

Indexation of the fixed part occurs every year on February 1, taking into account the growth of inflation. From April 1 every year, the Government may consider increasing it based on the income of the Pension Fund.

How is the insurance pension calculated in 2020?

The insurance pension includes four periods of earned funds:

- until 2002;

- 2002-2014;

- after 2015;

- others non-insurance.

In 2020, the cost of one point is 93.00 . It grows from year to year, taking into account indexation and inflation. The formula for calculating a pension is: multiply the number of points by the cost of one and add a fixed payment. Let’s say you have 70 points in your account, then the insurance benefit will be 70 x 93.00 +4982 = your pension.

The number of points depends on the citizen’s work experience and his contributions, while the other two indicators are established by the state annually and indexed.

Cost of points

To convert PB into rubles, you need to multiply only 2 numbers: the number of PB by the price of one PB. Below you can see an example of this procedure.

A college teacher received 20 thousand monthly. During the period of work, he accumulated 100 PB. In 2020, the price of one PB is 87.24 rubles. Consequently, a citizen’s pension insurance will be equal to the product of 100 and 87.24, that is, 8724 rubles. Of course, the fixed payment equal to 4983 rubles is not taken into account here. It must be added to the citizen’s insurance pension; it is also paid every month.

Funded pension: size, sources and conditions of receipt

From 2020, the funded pension (CP) ceases to be part of the labor pension and becomes an independent type of old-age benefit. Its size depends on the length of the payment period.

Formula for calculation: the amount of pension savings is divided by the number of months of the expected payment period.

NP is formed in several ways:

- The funds are contributed by the employer during the entire working period of the employee: 22% of the salary - 16% to the insurance part and 6% to the funded part.

- Maternity capital can be invested partially or in full.

- Participation in the Co-financing Program.

An insured person of retirement age has the right to receive NP if his savings in the pension account are at least 5% in relation to the amount of the old-age insurance benefit. The fixed payment and the amount of the funded pension, which is calculated as of the day of its appointment, are also taken into account. Otherwise, when the ratio is less than 5%, the citizen has the right to request a lump sum payment, when the accumulated amount is paid at a time without monthly division.

In addition, a citizen receives NP regardless of receiving other cash benefits.

How to check the amount of pension savings?

Previously, information about pension savings was reported by the Pension Fund, but now a citizen himself can familiarize himself with them at any time:

- online on the websites gosuslugi.ru and pfrf.ru, you only need your SNILS number;

- in the branches of the Fund;

- from employees in bank branches or ATMs: VTB, Sberbank, etc.

Important: to create an account on the State Services portal, you will need your passport number and series, as well as SNILS. After gaining access to sections of the site, open the “Russian Pension Fund” tab for further information. If difficulties arise, the Hotline will provide options for solving the problem. Number: 8 800 100-70-10.

How to calculate your pension using the new pension calculator?

The PFR pension calculator allows you to calculate your future pension online and form your opinion on how to ensure your old age with dignity. It is not suitable for military personnel and law enforcement officers who do not have employment experience in civilian areas.

All calculations are approximate, the exact figure will be obtained after applying for cash benefits, when all pension rights and benefits will be calculated in each case. To simplify the calculations, some factors are assumed to be constant, taking into account that the person retiring will receive it in the current year.

Persons who worked in the Far North, caring for certain categories of citizens, have the right to increased coefficients for calculating benefits.

Self-employed citizens must annually transfer 1% of the amount of at least 300,000 rubles to compulsory pension insurance.

A small questionnaire is presented on the official website of the Pension Fund. You must specify:

- floor;

- year of birth;

- number of years of conscription service;

- number of planned children;

- duration of care for certain categories of citizens;

- the period after reaching retirement age during which a person refuses to pay cash benefits;

- official salary;

- type of work: self-employed or hired worker;

- seniority.

After entering all the data, you need to click the “Calculate” button.

On the page with the calculator there is also a column where you can calculate the number of pension points that can be received in 2020, taking into account wages before deduction of personal income tax (NDFL).

Necessary data for calculating the northern pension on a calculator

In order for the calculation of the northern pension made on the calculator in 2017 to be correct, you must enter only reliable information.

To carry out calculations you will need to enter the following data:

- the age when a citizen plans to retire (please note that when working in the northern regions of the country and in areas equivalent to them, you can retire earlier than throughout Russia);

- monthly salary;

- in a letter from the Russian Pension Fund you will need to find the amount of existing savings for a future pension.

Let's sum it up

The main task of the online calculator from the Pension Fund for calculating pensions is to inform the population about the criteria that influence the provision of old age, and to motivate them to increase their readings by increasing social and labor activity. The flat salary, regular contributions, insurance period and retirement age determine its size.

It is quite difficult to manually calculate all the benefits and entitlements over a lifetime. Special algorithms will do this on their own, taking into account various criteria, but their numbers are not accurate due to some constant coefficients. It will be possible to find out the specific amounts after submitting an application for retirement, where Pension Fund specialists will calculate all the nuances in accordance with the law.

The expert explained whether it is possible to accurately calculate your future pension yourself

It is almost impossible to calculate the exact amount of your future pension yourself, says Alexander Safonov, vice-rector of the Financial University under the Government of the Russian Federation.

- Why is this impossible? If a person worked during the Soviet years, then he has non-insurance periods. This applies to everyone who worked before 2001. How they are included in the total length of service and how much they cost is known only to the Pension Fund. On the PFR website there is a so-called pension calculator, which takes into account length of service, earnings, periods when insurance premiums were not paid for the employee (for example, when a woman was on maternity leave or a person was caring for a group I disabled person), retirement age, but still the calculations will be very approximate,” explains the expert.

This is recognized by the Pension Fund itself. Earlier, the Pension Fund of the Russian Federation clarified to Rossiyskaya Gazeta that the results of calculating the insurance pension obtained using the pension calculator are purely conditional and should not be taken as the real amount of the future pension. “The actual amount of the insurance pension is calculated by the Pension Fund when applying for its appointment, taking into account all the generated pension rights and benefits provided for by the pension legislation on the date of assignment of the pension,” the Pension Fund added.

Let us remind you that the day before the Accounts Chamber published the results of a random audit of the Pension Fund’s activities in organizing individual (personalized) registration of citizens. The audit was carried out in branches in Moscow, the Moscow and Saratov regions, as well as in the Interregional Information Center of the Pension Fund.

Several serious system errors have been identified. “The old story is when relatives continue to receive the pension of a deceased family member. The law does not oblige us to run to the Pension Fund and report the death of someone close to us. Civil registry offices must themselves transmit such information to the Pension Fund. There are glitches and hiccups, the pension continues to arrive, and relatives, especially if the bank card of the deceased remains, continue to calmly use the money. Sooner or later, the Pension Fund will discover the overpayment and try to recover the money. But why should one recover it if it turns out that the person who received funds that were not due to him does not officially work anywhere,” notes Alexander Safonov.

Another old problem is when experience and income are “assigned” to someone other than the person who actually earned them. Due to confusion in the data of the Ministry of Internal Affairs and the tax service, one SNILS (individual personal account) is assigned to several people at once. And someone ends up with an undeserved gain, and someone turns out to be undeservedly deprived. It happens that when assigning or recalculating pensions, special experience is not taken into account. “A person lived and worked in a radiation zone, but there are no records. Or he cared for a disabled person, but this is not reflected anywhere,” says Safonov.

In order not to be disappointed when receiving your first pension, the expert advises checking the status of the insured person’s personal account more often. This can be done through the website of the Russian Pension Fund or the government services portal. It contains up-to-date information about a person’s insurance experience and the insurance coefficients (points) accrued to him, which depend on salary and employer contributions. If the accuracy of points can be checked by remembering your salary or requesting a 2-NDFL certificate from your employer for all years of work, then everyone knows their official length of service well.

“If retirement age has already approached and a pension is about to be assigned, then the surest way to protect it from mistakes is to take your work record and go to the local Pension Fund. Let them compare the data from the book with the data of the personalized accounting system. Trust, but verify,” the expert advises.