Calculation of pensions in the DPR

Free consultation by phone Contents Average salary in the DPR 2020 for calculating a pension This takes into account the average monthly labor income of a certain citizen and its ratio with the same indicator for the same period of time, averaged throughout the country and presented in one of the summary tables. Table 1. Average monthly salaries from 1960 to 1990 (rubles) Table 2.

From 1991 to 2001 (up to 1993 rubles, from 1993 thousand rubles, from 1998 rubles) Table 3. From 2002 to 2020 (rubles) It is the table of the average salary in the Russian Federation for calculating the size of the pension that is one of the main documents. Based on the specified data, the value of the point and, consequently, the actual amount of payments is determined.

How is the average monthly income of working citizens in Russia calculated? The average monthly income of working citizens (wages) is calculated based on the total amount of funds paid to the employed segments of the population throughout the Russian Federation.

- If the insured person continued to work after the pension was assigned, the pension is recalculated taking into account at least 24 months of insurance experience after the pension was assigned, regardless of breaks in work. Recalculation of the pension is carried out based on the salary (income) from which the pension was calculated.

- Attention: Is pension recalculation carried out for working pensioners on the territory of the Donetsk People's Republic?

At the request of the pensioner, the pension is recalculated from wages for the periods of insurance coverage using the average wage indicator, which was taken into account when assigning the (previous recalculation) pension.

If the insured person, after the appointment of a pension, has an insurance period of less than 24 months, the pension is recalculated no earlier than two years after the appointment, taking into account the insurance period and the salary from which the pension was assigned. This value is divided by the number of officially employed employees – and the average indicator is displayed.

At the beginning of this year (2017) it was equal to 35,900 rubles. It has not yet been calculated at the end of the calendar year.

The pension calculator on the Pension Fund website will help you calculate your future pension

Subscribe to news

A letter to confirm your subscription has been sent to the e-mail you specified.

17 September 2020 14:47

Electronic services and services of the Pension Fund of the Russian Federation are becoming more and more in demand among the population. And this is not surprising. They are simple and easy to use. One of the popular services is the pension calculator on the Pension Fund website. With its help you can calculate the size of your future pension.

The calculator is available without registration on the official website of the Pension Fund of Russia in the citizen’s Personal Account. Its main task is to explain the procedure for forming pension rights and calculating the insurance pension, and also to show how the size of the insurance pension is affected by the amount of wages, the amount of income as a self-employed citizen, the chosen pension option in the compulsory pension insurance system, the length of the insurance period, and military service. conscription, maternity leave and other socially significant periods of life.

Please note that the results of calculating the insurance pension using the Pension Calculator are conditional and should not be taken as the actual amount of the future pension. To make the results easier to understand, all calculations are made taking into account the current year’s figures. For the calculation, it is assumed that the entire period of formation of future pension rights took place in 2020 and the citizen was “assigned” an insurance pension in 2020, taking into account the life plans indicated by the citizen personally, and also on the condition that the citizen will receive the amount of salary specified by him for all years of his working life fees. The calculation also takes into account the cost of the 2020 pension point - 87.24 rubles, as well as the size of the fixed payment - 5334.19 rubles.

In the PFR mobile application, the calculator is personalized, that is, it automatically takes into account already formed pension rights in pension points and length of service.

The pension calculator consists of two blocks. The first is the number of pension points already accrued to the citizen and the length of work experience. In the data of the first block, a citizen can add periods of conscription service in the army, leave to care for a child or a disabled person. If there were such periods in his life, then the number of pension points and length of service will increase.

The second block is modeling your future. The user must indicate how many years he plans to work, serve in the army or be on parental leave, indicate the expected salary before deduction of personal income tax and click on the “calculate” button. The calculator will calculate the amount of the insurance pension based on already formed pension rights and the future circumstances expected by the citizen, provided that the number of pension points and length of service are sufficient to obtain the right to an insurance pension.

The actual amount of the insurance pension is calculated by the Pension Fund of the Russian Federation when applying for its appointment.

advokatymurmanska.ru

Until 2008, everything in this formula was extremely simple: the value of the estimated cost of a year of insurance experience was equal to one.

That is, “All” could simply be removed from the formula. The experience coefficient was determined very simply: the total number of months of experience was divided by 1200. In practice, it turned out that 20 years of experience is 20% of the salary, 30 years is 30% of the salary, etc.

After 2008, the value of the cost of one year of experience was 1.35.

Roughly speaking, the length of service coefficient for all pensioners was increased by 35%. If a person has, for example, 40 years of experience, then his pension is now considered as if he had 54 years of experience, that is, 54% of his salary. From January 1, 2020, it is planned to reduce the cost of one year of insurance experience to one again, that is, return to the simpler option that existed before 2008.

But this option is, of course, less profitable. Attention The salary for calculating the pension is determined by the formula: Zp = Zs * (Sk / K), where: Zp – salary for calculating the pension in hryvnias; Zs – the average salary per one insured person in Ukraine as a whole, for the 3 calendar years preceding the year of applying for a pension.

Sk – the sum of wage coefficients for each month (K1+K2+...); K – the number of months of insurance experience for which the coefficients are calculated. The wage coefficient, in turn, is calculated by the formula: Кз = Зв/Зс, where: Кз – wage coefficient of the insured person; Zv – the amount of the insured person’s salary, from which insurance premiums are paid and which is taken into account to calculate the pension for the month for which the coefficient is calculated; Zs – average salary per insured person in Ukraine as a whole for the month for which the coefficient is calculated. Law No. 1058). Since the bodies of the DPR Pension Fund do not have access to a unified database of insured persons in Ukraine, which does not make it possible to take into account all the available individual information of citizens of the Republic on length of service and wages necessary for calculating pensions, the Council of Ministers of the DPR adopted a resolution

“On some issues of assignment (recalculation) of pensions in the Donetsk People’s Republic during the transition period”

dated January 10, 2015 No. 1-12, which determines that if it is impossible to obtain data from the personalized accounting system, the document confirming the person’s insurance experience is the work book, and the document confirming the amount of accrued wages and payment of insurance premiums by the enterprise is the earnings certificate, issued by the owner or an authorized body (archival institution).

Now it is 1.35, that is, for each year worked, the pensioner receives 1.35% of his earnings.

Free legal assistance

/ / How is a pension calculated in the DPR? If the applicant applied for an old-age pension after three months from the date of reaching retirement age, the pension will be assigned from the date of submission of the application to the territorial body of the Pension Fund of the Republic. How is the pension amount calculated and what is taken into account? Does military service and parental leave count towards length of service?

The procedure for calculating the insurance period is regulated by Article 24 of the Law

“On compulsory state pension insurance”

. The period of military service and the period of receiving child care benefits under the age of three years are subject to inclusion in the insurance period.

The procedure for determining wages for calculating pensions is regulated by Article 40 of the law.

To calculate the pension, wages for the entire period of insurance coverage, starting from July 1, 2000, are taken into account.

The Pension Fund will help: - send a request to former employers, - make a request to archival organizations, - check the correctness of the documents, - evaluate the completeness and accuracy of the documents, - suggest which type of pension is more profitable to receive. In this regard, the DPR obligations are more modest, in contrast from Ukraine, which pays pensions to all pensioners of the DPR and LPR, since it considers them its citizens.

Another thing is that getting it is problematic and for this you need to collect a bunch of documents. However, in the DPR there are no such obligations towards those who live in the territory occupied by Ukraine.

Since the size of pensions is very small, many pensioners receive two pensions - in the DPR and in Ukraine. The head of the DPR, Alexander Zakharchenko himself, called for this, that if you can take something from Ukraine, then take it.

A pension fund is not needed. Option 2. If the salary in 2000-2002 was small or the citizen did not work at all, he has the right to submit a salary certificate for any 5 years (60 months) in a row in the period until January 1, 2002.

In different situations, the Pension Fund requires additional documents. For example, if a citizen has dependents, this will need to be confirmed. Additional: * certificate of average monthly earnings for any 60 consecutive months before 2002 (issued by a former employer, successor organization, archival organization), * documents confirming length of service (employment contracts, certificates from employers, extracts from orders, etc.), * documents on education, * documents on disability, * documents on changes in full name, * documents on disabled family members, * documents confirming residence in the Far North, * certificates specifying a special character work and working conditions.

Free consultation on labor law and pensions

Experts say that in 2020, the deficit of the Russian Pension Fund should be reduced by about 20%, but will this be enough? It’s no secret that increasing life expectancy is a significant problem for the pension fund, although for everyone else it is a huge leap forward development.

This is explained by the fact that at the time the retirement age was established, the life expectancy of the population was much shorter, and therefore there were more people who had the opportunity to work. For this reason, there was no shortage of funds to pay pensions. Nowadays, everything is not as good as we would like.

Too large a percentage of the population receives a pension, which affects the budget of the Pension Fund, which does not have time to replenish it with taxes, and therefore does not have the opportunity to pay the pension in full. It is also worth noting one feature.

Not every citizen of our country receives a white salary. Many consider it necessary to remain silent about their real income, as a result of which payments to the Pension Fund are received in small quantities. Experts talk about the possibility of further increasing life expectancy, which in the future could become a big problem for the economic situation in the country.

The percentage of people receiving a pension increases every year, which means that the burden on the Pension Fund, which is not coping with it very well, is also growing. The state is extremely concerned about this problem, so this issue is being discussed at the highest level. The CSR is convinced that raising the retirement age is necessary, arguing that there is no other choice. This measure, according to the top representatives, will avoid a decline in the economy, and will also give it an impetus for further development. Officials believe that this reform will help maintain the budget.

They are convinced that results will not take long to arrive. They believe that the age increase should reach 63 years, only then the economic situation will be able to level out. The government is confident that economic growth occurs even without this measure.

We recommend reading: Agreement for the storage of petroleum products, acceptance under the TTN 2020

Raising the retirement age of police officers

› The Russian government plans to increase the retirement age in the Ministry of Internal Affairs.

This reform will take place as part of a general fundamental change in the pension system and will most likely begin in 2020. How will the retirement procedure for police officers change, will their situation worsen significantly, and why does the government want to make such unpopular changes? Contents: Discussions that the government plans to increase the retirement age for police and military personnel have been going on for at least 5 years.

We recommend reading: Chained inheritance of the exam task

But only now they have every chance to move from the category of discussions to the category of innovations.

The project to increase the retirement age in the Ministry of Internal Affairs of the Russian Federation provides for the postponement of the retirement period for all police officers by 5 years. However, the promise of indexation of all payments in 2020 may be good news for police officers (ordinary citizens have not seen indexation for many years). Recent news also reports that another innovation may be the merger of two departments - the Ministry of Internal Affairs and the Federal Penitentiary Service.

Retirement age in the DPR for women and men in 2020

The Donetsk People's Republic (DPR), while remaining de jure in the legal field of Ukraine, de facto creates its own legislative framework.

In this regard, the retirement age in the DPR for men and women remained unchanged, unlike in Ukraine, where for a certain category of citizens it will increase to 2 years. You can find out about all the latest changes related to the retirement age in Ukraine for men and women. The DPR Pension Fund was organized in the fall of 2014 in accordance with the DPR Pension Fund. The work of the DPR Pension Fund during the transition period is regulated by the legislative acts of Ukraine on pensions to the extent that does not contradict the provisions of the Constitution of the Republic.

The assignment, recalculation and payment of pensions in the DPR is carried out on the basis of the Law of Ukraine No. 1058 of 07/09/2003.

“On compulsory state pension insurance”

(as amended in October 2011)

regarding changes in the timing of women’s retirement). All citizens registered on the territory of the republic have the right to receive a pension in the DPR.

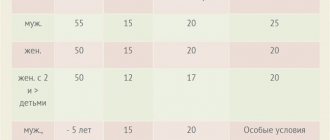

The DPR has the following retirement ages:

- women – 55 years old;

- men – 60 years old.

The mandatory total insurance period for all categories of citizens must be at least 15 years. When calculating the pension, all insurance contributions made from 07/01/2000 until the payment is calculated are taken into account.

If the insurance period for the last 15 years is insufficient (or at the request of the citizen), data on wages and insurance contributions for any 60 months before July 2000 are taken into account. Retirement before the established age (if there is appropriate length of service) is provided for the following categories of citizens:

- Citizens who have become disabled.

- Workers engaged in underground and above-ground mining and metallurgy.

- Workers in medical professions associated with hazardous working conditions.

- Women with 5 or more children.

Working pensioners receive payments in full.

After termination of employment, the pension is recalculated in accordance with the length of service and the amount of insurance payments. The pension amount is calculated in hryvnias, payments are made in rubles in a ratio of 1:2.

Indexation 2020

One of the components of pension contributions is annual indexation, which allows you to increase the size of the pension in accordance with the inflation rate.

In 2020, the DPR authorities plan to index pension payments by 5-10%. In monetary terms, the increase will average 400 rubles. However, the exact date of the planned pension increase has not yet been established.

How much the military pension was indexed in Russia in 2017.

The last pension recalculation took place in October 2020. Then the pension was raised by 10%.

It is worth highlighting the features of indexing:

- citizens who simultaneously receive minimum payments, state and targeted assistance do not have the right to recalculate their pension;

- pension payments related to the death of a relative must be indexed regardless of the amount of payments;

- when miners receive pension payments in the amount of three subsistence minimums, then indexation is not required.

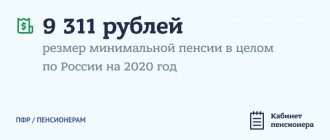

Minimum pension in the DPR

Contents The editors of our newspaper receive many questions regarding the registration of pensions.

For clarification, we turned to the head of the Pension Fund (PF) of the DPR in the Voroshilovsky district of Donetsk, Natalya Petrova. Natalya Evgenievna, when do residents of the DPR have the right to apply for an old-age pension? Resolution of the Council of Ministers of the DPR dated January 10, 2015 No. 1-12

“On some issues of assignment (recalculation) of pensions in the Donetsk People’s Republic during the transition period”

it is stipulated that for the transition period the Law of Ukraine “On Compulsory State Pension Insurance” dated 07/09/2003 No. 1058 (as amended until October 2011 in terms of determining the retirement age for women) is in force, namely: women have the right to an old-age pension after reaching 55 years old and with at least 15 years of insurance experience.

The retirement age for men is 60 years. If a person who has issued a pension continues to work, can he count on receiving the pension and salary in full or will some kind of deduction be made from the pension? Pensions are paid to persons who continue to work in full, regardless of income.

At the same time, I would like to appeal to citizens who get a job after receiving a pension, with a request for timely provision of employment information to the territorial bodies of the Pension Fund, since the pension payment includes bonuses and increases, the right to receive and the method of calculation of which are determined depending on from the fact of work. How long does the process of applying for a pension take and when should a person submit documents to the Pension Fund: after reaching retirement age or, for example, a month before this date? The decision to grant a pension, if all the necessary documents are available, is made no later than ten days after submitting the application to the territorial body of the Pension Fund of the DPR.

Article 44 of the Law of Ukraine

“On compulsory state pension insurance”

(used for the transition period) the right of citizens to apply for an old-age pension is determined no earlier than a month before reaching retirement age.

Retirement for women with a table by age and length of service

The minimum amount in the DPR is currently 3194.00 rubles . The last increase was 10% from June 13, 2018 ; there is no procedure for indexing benefits. The maximum size does not exceed RUB 24,186.

The average is 4945 rubles , since the bulk of the population are miners. For disabled people and disabled children from 2600 to 5300 rubles. Payments for the loss of a breadwinner up to 5,400 rubles . Additional payments to deductions are provided.

Citizens are entitled to such additional payments:

- with children under 18 years of age ;

- caring for disabled people of groups 1-2 ;

- having an “honorary donor” certificate;

- pension payments that are lower than the subsistence level;

- disabled people of any category.

There are many military personnel in the republic who receive money based on length of service; such persons are assigned by decision of the head of the Republic; the increase does not apply to such citizens.

Citizens of the Donetsk People's Republic who have reached the age of 55 years have the right to apply for benefits - women are 55 years old, men are five years older.

It is important to know! If citizens of the DPR have disabled people (incapacitated) under their guardianship, the retirement age is reduced, and women have the right to retire at 50, and men at 55.

A minimum of 15 years is a prerequisite for registration.

To apply for a pension, you need to collect a package of documentation:

- passport + copy;

- identification code + copy;

- work book or other documents that can confirm the presence of work experience. Copies of completed pages;

- salary certificate for 5 years of insurance experience;

- education documents + copy;

- marriage certificate + copy;

- children's birth certificates;

- military ID + copy;

- salary certificate for five years;

- statement;

- documents confirming the availability of benefits;

- certificate of an individual entrepreneur (if any) + certificate of payment of insurance premiums.

It is important to know! The list is not final and may be supplemented depending on the reasons for withdrawal.

Documents are submitted upon reaching retirement age or a month before it. The period for reviewing documents is no more than 10 days . If a person is undergoing treatment, military service or in a pre-trial detention center, documentation for obtaining benefits can be submitted by a trusted person.

There is a formula for calculation :

Pension=sot*cat*kts , where:

- hundred - average wage. Selected from a total of 60 months of experience with the highest salary;

- cat - wage coefficient. It is calculated very simply - the amount chosen for the hundred is divided by the amount of the average salary in the country for that period of time. For example, the amount chosen was 9,000 rubles, and the average wage was 3,000 rubles. cat = 9000/3000=3;

- kts - length of service coefficient. This figure depends on the total number of years of work experience. This period is multiplied by 1.35% (the percentage due to each working citizen).

For example, a citizen has 20 years of work experience . Kts = 20*1.35%=27%

Example of pension calculation:

- We have a citizen with 20 years of work experience , with an average salary for the selected period of 9,000 rubles. and the previously calculated work experience coefficient = 3;

- pension = 9000*3*27%=7290 rub.

If a person is still working, the pension is calculated according to the specified formula, regardless of the citizen’s current income. Every 24 months, payments for working citizens are re-indexed, regardless of breaks in work. Recalculation occurs from the wages from which payments were calculated.

Pension in the DPR

» Due to the martial law in the DPR, most funds from the federal budget go to military needs. As a result, there is no money in the budget for pension payments.

Therefore, many older people are interested in answers to the following questions: Who generates payments? What documentation is needed? What will be the amount of pension contributions? We will answer these and other questions in our material.

Since May 2014, the Donetsk People's Republic (hereinafter DPR) has been a sovereign state. From this moment on, the Ukrainian authorities refuse to pay pensions to residents of the Donetsk and Lugansk republics. The public appealed to the Ukrainian authorities to resume payments, but everything turned out to be unsuccessful.

Thus, in 2020, Decree No. 158 was signed, on the basis of which pension payments are made by the Central Republican Bank and the State Enterprise “Donbass Post” from the 4th to the 25th.

In this case, pension contributions must be paid in rubles (Decree No. 119 of March 25, 2015). To receive the appropriate payments, you need to submit an application and a list of documents to the Pension Fund.

At the same time, citizens of retirement age do not have the right to receive pension payments from Ukraine. To obtain advice, DPR citizens can contact the Ministry of Information, the Ministry of Labor and Social Policy, or the DPR Pension Fund (hereinafter referred to as the DPR Pension Fund).

Currently, the DPR pension reform is subject to changes. In order to keep abreast of the latest news, you should visit the official website of the DPR, namely:.

In addition, you can call the hotline number, namely:

- Pension Fund - (062)-300-25-76, 066-607-72-99.

- Ministry of Labor – 8-800-500-39-20.

A complete list of contact telephone numbers of territorial departments of the DPR Pension Fund can be found at the following link: .

Citizens living in the DPR have the right to receive pension payments at the ages of 55 and 60 years - women and men, respectively. To assign pension payments, it is worth preparing a list of documentation for the DPR Pension Fund, namely:

- passport

Average amount of pension contributions

According to official data, the average pension payment in the DPR is 5,000 rubles. According to preliminary calculations, the DPR authorities spend 28 billion a year on pension payments.

As for the size of the pension by category, we can highlight the following indicators:

- disabled people – 2,600 to 5,300 rubles;

- loss of a breadwinner – up to 5300;

- disabled children – 3500.

Pension payments are realized no later than the 25th of each month, but not earlier than the 4th.

Social pension in the DPR

» According to the statement of the acting Minister of Labor and Social Policy of the DPR Larisa Tolstykina, the DPR authorities decided to double pension payments at the end of 2020.

The first stage of the increase will take place in January 2020; from this month, pensions will increase by 174 rubles.

The second and fourth quarters will see the largest increases in pensions, at 40 and 50 percent respectively. At the moment, the issue of increasing pensions depends on Russia, which is the main donor to the budgets of the DPR and LPR. Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please contact the online consultant form on the right or call:

- +7 ext. 987 (Moscow and region)

- +8 ext. 652 (Regions)

- +7 ext. 133 (St. Petersburg and region)

It's fast and free! For these purposes, it is planned to allocate an additional 45 billion rubles from a special fund, which will be used to pay Donetsk pensioners.

At the same time, it is worth recalling that pensioners of the DPR and LPR have the right to receive pensions in Ukraine, where they earned their money. The authorities of the DPR and LPR call on Ukraine to resume payments and not discriminate on a territorial basis. Social benefits experts believe that the issue of pensions is the most problematic.

Therefore, when a crisis begins and the economic situation weakens, more problems arise. In this case, the pension is considered an insurance pension.

But there are exceptions when a citizen, due to incapacity for work, is deprived of the right to receive such a payment. In order for a person to live somehow, the state assigns a social pension payment. The amount of money is determined by the cost of living. This was reported by the acting Minister of Labor and Social Policy of the DPR Larisa Tolstykina.

This normative act also applies to citizens who previously entered into an employment relationship before the established time.

Penalty for double pension payments

Due to the low amount of pension payments, most residents of the DPR and LPR receive a double pension - one from the Donetsk Republic, the other from Ukraine. At the same time, employees of the DPR Pension Fund do not have the right to ask about the availability of a second pension.

But if this fact is discovered, the pensioner will have to not only refuse the Ukrainian pension, but also pay a fine. Therefore, the DPR authorities recommend abandoning the double pension in favor of a single Donetsk pension. But the amount of the fine has not yet been documented.

How to calculate your pension in the DPR yourself

- Insurance experience coefficient: 0.3 x 1.35 = 0.405

- Basic pension amount: 1197.91 UAH. x 0.405 = 485.15 UAH.

The total pension amount from May 1, 2020 is UAH 1,360.52, including:

- 485.15 UAH. – basic pension amount;

- 48.52 UAH.

– additional payment for 10 years of excess experience (485.15 UAH x 10%). - 826.85 UAH. – additional payment up to the minimum pension (up to 1312 UAH);

Calculation of pensions taking into account the new salary in the country If the “updating” of pensions taking into account the new average salary (currently 3764.40 UAH) were carried out tomorrow and the length of service coefficient was not touched, then with similar indicators a different picture would emerge. Amount of earnings for pension calculation: 3764.40 UAH.

x 1 = 3764.40 UAH. Insurance experience coefficient: 0.3 x 1.35 = 0.405 Basic pension amount: 3764.40 UAH. x 0.405 = 1524.58 UAH.

- 196.80 UAH. – additional payment for 15 years of excess experience (1312 UAH x 15%).

In this case, an increase in pension is possible by UAH 1,788.41. Calculating a pension using the “new formula” As in the first example, let’s imagine that a man with the same length of service and salary will be granted a pension this year and at the same time the cost of one year of insurance experience will be reduced from 1.35 to 1.

Amount of earnings for pension calculation: 3764.40 UAH. x 1.5 = 5646.60 UAH. Insurance length coefficient: 0.4 x 1 = 0.4 Basic pension amount: 5646.60 UAH.

x 0.4 = 2258.64 UAH. In this case, the pension amount would be 2324.24 UAH, including:

- 2258.64 UAH. – basic pension amount;

- 65.60 UAH. – additional payment for 5 years of excess experience (1312 UAH.

How to calculate “DNRovskaya9quot; pension?

During the transition period, the pension legislation of Ukraine is applied. In accordance with the resolution of the “Council of Ministers of the DPR” for the transition period, “the pension legislation of Ukraine is applied to the extent that does not contradict the Declaration of Sovereignty and the Constitution of the Donetsk People’s Republic.” According to Part 1 of Article 40 of the Law of Ukraine

“On compulsory state pension insurance”

, to calculate the amount of the pension, wages are taken into account for the entire period of insurance service, from 07/01/2000, and in the period until 01/01/2016, at the request of the pensioner, and subject to confirmation of the salary certificate with primary documents, to calculate the amount of the pension, wages are taken into account payment (income) for any 60 calendar months of insurance service in a row until 07/01/2000, regardless of breaks.

How to calculate your pension in the DPR yourself

If there is insufficient insurance experience for the last 15 years (or at the request of the citizen), data on wages and insurance contributions for any 60 months before July 2000 are taken into account. As we can see, the legislative framework of the DPR for pensioners remains the same as in Ukraine, so we are waiting new achievements.

True, in Ukraine they recently increased the retirement threshold for men and women: 55-57, 60-62-65.

But that's not the point. Let's delve into the intricacies of calculating future pensions in the DPR.

As you can see, we will count as before, but before we thought like this: The size of the future pension depended on the accrued average salary: for the country, now the republic; your salary; total work experience.

To calculate a pension, there is only one killer formula: P = ZS x KZ x KS. It's finally done. The government submitted the Pension Reform project to parliament. A detailed analysis remains to be done.

And in recent issues of the newspaper “On Pension” (No. 21 of May 23 and No. 24 of June 13, 2020) we already wrote about what they plan to change. Today we are talking about a new formula for calculating pensions. Will pensioners win or lose in this case?

Will the calculation mechanism change?

In fact, the “new formula” for calculating pensions is not new at all. Currently, the calculation of pensions for most citizens is carried out on the basis of the Law of Ukraine

“On compulsory state pension insurance”

, which came into force on January 1, 2004.

The formula for the basic pension amount is approved by Article 27 of this Law, and it will remain the same, but some nuances will change. To understand these nuances, you need to remember how pensions are calculated now.

Info Ks = (Sm * Sun) / (100% * 12), where: Ks – insurance period coefficient; cm – the sum of months of insurance experience; Sun – the value of the assessment of 1 year of insurance experience, which for the period of participation in the solidarity system (before 2008 is equal to 1%, since 2008 is equal to 1.35%). Then you need to calculate the amount of wages, which is taken into account when calculating the pension. Let us recall that for

INFORMATION PORTAL OF THE DONETSK PEOPLE'S REPUBLIC Gorlovka News: promptly, objectively

On July 1, 2020, the decree of the Head of the DPR on increasing the amount of pension payments came into force.

To whom and by how much have pension payments increased in the DPR? From July 1, the amount of the minimum pension payment and survivor's pension will be 4,000 rubles. rubles It should also be noted that pensions will be additionally recalculated taking into account the insurance experience of each citizen. “The main principle of the increase is to establish a direct relationship between the size of the increase and the insurance length of each citizen.

For each full year of service worked in excess of the established one (depending on the date of appointment or recalculation), the pension payment will be increased by 1% of the established minimum pension payment (RUB 4,000.00), that is, by 40 rubles. The price of one year of excess experience is 40 rubles.

Let me give you an example: a woman retired in 1993. Her insurance experience is 35 years. For those pensioners who retired before October 2011, excess length of service was considered to be 20 years for women and 25 years for men.

This means - 35 minus 20 - 15 years of excess experience. Until July, she received the minimum pension payment - 3 thousand 194 rubles 40 kopecks.

The difference between 4 thousand is 805 rubles 60 kopecks and the additional payment for excess length of service is 15 years multiplied by 40 = 600 rubles.

At the moment, her pension payment is 4 thousand 600 rubles. For pensioners who retired after October 2011, the calculation of excess length of service is for women - from 30 years, for men - from 35 years,” explained Chairman of the DPR Pension Fund Galina Sagaidakova.

As a result of the recalculation, more than 550 thousand citizens received an increase for length of service worked beyond that specified by law.

In addition, from July 1, the size of pension payments has been increased by 25% for 13.1 thousand citizens whose pensions were assigned in accordance with the Law of Ukraine

“On pension provision for persons discharged from military service and certain other persons”

.

After recalculation, the average pension size of this category of recipients will increase by 1,367.79 rubles.

Donetsk pensions: imagined and real

From January 1, 2020, in the unrecognized republic the pension “minimum wage” is 4,800 rubles, while in Ukraine it is 4,275 (converted from hryvnia to rubles, of course).

And this is not the limit. The leaders of the two Donbass republics, Denis Pushilin and Leonid Pasechnik , simultaneously announced their firm intention to bring salaries and pension payments in their states to the level of those existing in the neighboring Rostov region in 2022. That is, if some force majeure does not interfere with reality, the smallest pension in Donetsk and Lugansk will be 8846 rubles, one must assume.

From “retirement tourism” to normal life

Considering that in the Donbass for the last thirty to forty years, pensioners have made up at least a third of the population, this is encouraging news. But besides the moral side of the matter, this message, of course, contains several not entirely noticeable, but very important things that must be said clearly and unambiguously so that there is no speculation.

We are talking about the so-called retirement tourism, which the elderly people of Donbass were forced to engage in by the regime of Petro Poroshenko, first in the fall of 2014, who organized a transport blockade of the rebellious region, and then adopted a number of by-laws that made life as difficult as possible for the already disadvantaged old people by the war.

For us, for you, and for Donbass! The rebel republic is preparing to burst into the New Year

©

goodfon.ru

Hundreds of thousands of people are forced to travel a long way from their cities and villages on the “Ukrainian” side in order to register as “temporarily displaced persons” (for money, if you have no relatives or friends in a particular city), to check in almost every two months, bribe officials in order to leave back after dark and not pay for a forced overnight stay.

Often, after such a trip, pennies are left on hand. But a pensioner cannot refuse them either. It is difficult to imagine what would have happened to these people if the republics (with direct assistance from Russia, of course) had not paid assistance to the elderly - each in the amount of their former Ukrainian pension. It is noteworthy that in the first years, Donetsk, Lugansk, Gorlovka, Rovenkovsk, Enakievo, Makeyevka, Alchevsk pensioners “from the other side” brought food and things, it was at least a little, but profitable. Now that prices have leveled off, pensioners of the “Ukrainian” Donbass are looking at the “republicans” with a certain jealousy.

“They are jealous, what can I say, although there seems to be nothing to envy,” says 77-year-old Leonty Maksimovich, who is going to his native Krasnoarmeysk to collect his Ukrainian pension. “We have leveled off in many ways, but our utilities, they know, are several times less, and they raise them all the time, even though there was Poroshenko, even now Zelensky. Now they are muttering that you will get all Russian passports there, you will start to fatten, and receive three pensions.”

The Tale of the Troika

The topic of the “third pension” is actively discussed in both parts of Donbass. They also talk about it in the Rostov region, where, after Donbass residents began to receive Russian citizenship en masse, their neighbors’ problems became much better known. There, understandably, they were wary - would the process affect the size of pensions?

By the way, in the Rostov region it is one of the highest on average in the country. Local authorities, starting with Governor Vasily Golubev , have long been reassuring that Donetsk and Lugansk pensioners who have received registration in the region are still negligible. Without registration, the “new Russians,” as the Donetsk residents who received the coveted Russian passports called themselves, cannot count on a Russian pension.

Ukrainian pensions 2020: to whom and how much they will give

©

RIA Novosti, Pavel Palamarchuk |

Go to photobank The Russian Pension Fund made a special clarification on this matter almost immediately after last year’s Decree of the President of the Russian Federation on a simplified procedure for obtaining Russian citizenship for residents of the DPR and LPR was published.

Pensions will be calculated for residents of Donbass who decide to move to Russia in accordance with the general procedure and in accordance with current legislation. The Pension Fund emphasized that they will help confirm the length of service and earnings of citizens, including by sending requests to colleagues from Ukraine, the DPR and LPR. Simply put, for a pensioner from Donetsk, nothing has changed in terms of receiving a pension. If he does not leave for the Russian Federation for permanent residence, he received his pension in the DPR and will continue to receive it. If you went for a Ukrainian one “for the ribbon”, then that’s how you’ll go.

Here it is necessary to refute the “horror story” that Ukrainian propagandists posted on social networks and which some unscrupulous Russian journalists are spreading today in their public pages. They say that a pensioner who received a Russian passport under a simplified scheme is automatically deprived of the right to a Donbass pension. It must be said that people in Donbass are accustomed to such fake news and no one falls for the bait of rumors. At one time, in the same way, there was a rumor about a DPR passport, without which, they say, it is impossible to receive help from the state in old age.

The fake story about unfortunate pensioners who decided to get a Russian passport caused indignation in the DPR. Experts reassure the local population and explain everything literally:

“Having issued a Russian passport, the pensioner must register on the territory of the Russian Federation, issue SNILS and all the required documents, then register with the Pension Fund of the Russian Federation. To do this, he either receives his personal pension file in person (upon application), or the Russian Pension Fund receives it from the DPR Pension Fund through an official request. From the moment a pension is assigned to the Russian Federation, the pensioner is considered a resident (and not just a citizen) of Russia with all the ensuing consequences.”

In the DPR, such a pensioner does not have a pension file - it is in the Russian Federation, and he receives his pension in Russia. However, as long as this citizen’s case (whether it is the Russian Federation or Ukraine, it doesn’t matter) is in the DPR Pension Fund, he will definitely receive a DPR pension.

In essence, this is the answer to the question of whether it is possible for a pensioner from Donetsk to receive three pensions at once, being a citizen of the Russian Federation. No - as before, in recent years, there will be two or one pensions.

True, in contrast to the official interpretation of the right to a pension, life makes its own adjustments. A military pensioner from the Russian Federation, a native of Donetsk, Andrei Nikolaev left his service in the Russian Armed Forces many years ago and lives in Donetsk. At the same time, he is registered in the Rostov region, and goes there to collect his pension. He says there are no problems. Yes, this is a violation of Russian law, if you follow the letter of the law, but usually they turn a blind eye to it. Moreover, there are still very few pensioners of this kind in Donbass; they are mostly “left behinds”. And yes, they live only on Russian pensions.

"Oil" and "shaking of the ether"

But there is a category of elderly people in Donbass for whom the establishment of republican pensions at the Rostov level means a lot. More than for other pensioners. These are people who, for one reason or another, cannot (or do not want, for example, for ideological reasons) to travel for a Ukrainian “supplement” to their modest income. For many, the journey is simply beyond their means - illness and a more than modest wallet do not give them the opportunity to replenish their budget in this way. Both Ukraine and Donetsk and Lugansk can hardly say exactly how many such people there are. But according to some estimates, this is approximately a third of the total number of pensioners in the republics. Other experts say 25 percent. But in any case, there are quite a lot of such people. And for them, the news about 2022 is oil for their wounds.

But, of course, there is another side to this story - the Ukrainian one. Of course, trying to understand her actions towards Donbass pensioners often leads to cognitive dissonance. Vladimir Zelensky came to power in this country, his team tried, in its characteristic manner of thoughtless pursuit of PR, to talk to former fellow citizens from the republics in the language of promises. It all ended in a bad way.

Sergei Sivokho: sold laughter

©

Ruslan Marmazov

And to say that, almost the only one who spoke about this was the once popular showman in Donetsk Sergei Sivokho , who is responsible for Zelensky, to put it mildly, for connections with compatriots.

He even called the way Poroshenko’s supporters treated the elderly people of Donbass “outrageous.” In November, a bill appeared in the depths of the Ukrainian parliament to return Ukraine’s pension debts to Donbass. But he was immediately buried by the Cabinet of Ministers as soon as the debt figure of 70-odd billion hryvnia was announced. A poor state living on handouts from the IMF does not have that kind of money. That was the end of it. It would be appropriate to end these notes with yesterday’s words from Deputy of the People’s Council of the DPR Marina Zheinova. Speaking about the intention of the republic’s leadership to raise salaries and pensions in two years to the level of Rostov, she emphasized: “Such a decision by the republic’s leadership proves that integration with the Russian Federation is happening not in words, but in deeds.”

How much experience is needed for a pension in the DPR

Contents Until 2008, everything in this formula was extremely simple: the value of the estimated cost of a year of insurance experience was equal to one. That is, “All” could simply be removed from the formula.

The experience coefficient was determined very simply: the total number of months of experience was divided by 1200. In practice, it turned out that 20 years of experience is 20% of the salary, 30 years is 30% of the salary, etc. After 2008, the value of the cost of one year of experience was 1.35.

Roughly speaking, the length of service coefficient for all pensioners was increased by 35%. If a person has, for example, 40 years of experience, then his pension is now considered as if he had 54 years of experience, that is, 54% of his salary.

From January 1, 2020, it is planned to reduce the cost of one year of insurance experience to one again, that is, return to the simpler option that existed before 2008.

But this option is, of course, less profitable. Law No. 1058). Since the bodies of the DPR Pension Fund do not have access to a unified database of insured persons in Ukraine, which does not make it possible to take into account all the available individual information of citizens of the Republic on length of service and wages necessary for calculating pensions, the Council of Ministers of the DPR adopted a resolution

“On some issues of assignment (recalculation) of pensions in the Donetsk People’s Republic during the transition period”

dated January 10, 2015 No. 1-12, which determines that if it is impossible to obtain data from the personalized accounting system, the document confirming the person’s insurance experience is the work book, and the document confirming the amount of accrued wages and payment of insurance premiums by the enterprise is the earnings certificate, issued by the owner or an authorized body (archival institution).

Now it is 1.35, that is, for each year worked, the pensioner receives 1.35% of his earnings.

That is, if a person has worked for 10 years, he is entitled to 13.5% of his earnings.

If the work experience is 20 years, then the pension will be 27% of earnings and so on. At the same time, regardless of the size of the salary, the maximum

Pension reform for the Ministry of Internal Affairs

The ruling capitalist class in Russia is intensively sawing the branch on which it sits, shaking its main support - the bourgeois state and thereby preparing all the conditions for its overthrow. What has the Russian government done this time?

In pursuit of maximum profits for the oligarchy, it decided to extend the notorious pension reform to its own personnel - civil servants, in particular police officers. They will also retire later, like all other Russian citizens.

Developed by experts from the Ministry of Internal Affairs in conjunction with the Ministry of Finance, the project provides for increasing the service age limit by five years. For example, majors and lieutenant colonels will be able to serve up to 55 years, colonels - up to 60 years, and generals - up to 65. If police officers want, they can extend their service for another five years, passing a medical examination every year.

Thus, according to the project, the age limit for serving in the police can reach up to 70 years (!).

The reform also provides a “sweet pill” for Russian police officers. Their pensions are increased. If now long-service pensions are calculated on the basis of 50% of wages, then when length of service increases from 20 to 25 years, the pension amount will be 65% of wages. The lower ranks of the police were not at all happy about this future.

They are justifiably afraid that the pension may be completely cancelled. Therefore, mass layoffs began in the police.

Many police officers who already have 20 years of service are trying to retire now, before the law is adopted, so as not to work out the 5 years still required for retirement. The police authorities are trying with all their might to prevent dismissals, realizing that without ordinary police officers there will be simply no one to work in the authorities: “Now the cadres have been given the command that if a person resigns, then he is taken almost to an appointment with the general in this region.

They ask about the reasons why they quit. And they come up with all sorts of obstacles—additional detentions, sending them to authorities with a work permit, and so on. And dismissal is also a whole problem in many regions,” say ordinary police officers.

But this only exacerbates the contradictions in the power structures of the Russian bourgeois state, where there is already considerable dissatisfaction between the “lower classes” and the “higher ones,” bringing its collapse closer.

For information: the average salary of an ordinary police officer in Russia is 20-22 thousand rubles, a junior lieutenant - 27-30 thousand rubles.