Recently, some users of the State Services portal began to receive a new system alert. It states that the court debt is assigned to SNILS. Many people are confused by this notification. In this article we will try to describe what this message means, where the debt came from and how you need to proceed.

Notification in State Services: Debt assigned to SNILS

General information about payments

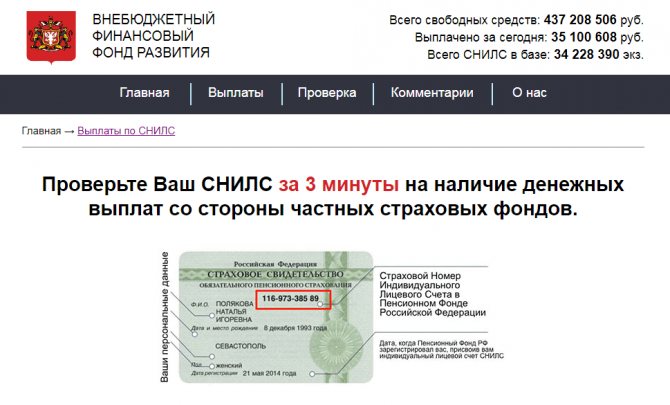

Since January 2020, information has appeared on the Internet revealing the possibility of receiving “insurance payments” from private funds to a SNILS account.

Any cardholder could use this method. To receive funds, a citizen had to pay a commission on the website. But the registration process did not end there: intermediary services were constantly becoming more expensive, but the money never arrived in the account.

Important! This scheme is recognized as fraud, therefore its implementation is punishable by law.

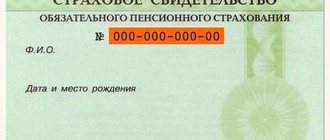

According to regulations, receiving compensation under SNILS is not provided. The purpose of the document is to register a citizen in the pension system. SNILS does not perform other functions related to finance.

In November 2020, the Pension Fund made an official statement in which it explained to citizens the new fraud scheme. Employees announced that there are no hidden payments, and ordinary people do not have access to SNILS data. To obtain information, the owner must personally contact the Pension Fund branch, or fill out an application on the State Services portal.

Real reasons for requesting SNILS by the bank

A bank employee can request SNILS data from a client for the following reasons:

- If it is necessary to confirm the identity of a citizen . For example, when replacing a passport or initials. You can’t replace SNILS, but you can easily replace your passport. If the SNILS number was previously entered into the database, then it can be used to determine all the personal data of the person applying to the bank.

- If you need to get a credit history.

- If you need to find out the client's official place of work , his level of earnings or other data.

So far banks have no other reasons to require clients to provide SNILS.

True or not

All advertisements promising “hidden payments” are lies.

This information is a trick of scammers. The first cases of violations were recorded in 2020, when the Pension Fund began to receive complaints from citizens about fraud related to SNILS. There are many fraudulent schemes associated with the identification number, and the most common among them are the following:

- men or women of pleasant appearance visited the homes of citizens, where they introduced themselves as employees of the Pension Fund of Russia. During the conversation, they asked to sign documents related to pension savings. In this way, the scammers not only learned the SNILS number, but also passport details;

- citizens in need of work were asked to sign an agreement to transfer their savings to a non-state pension fund. After receiving the signature, the person was denied the position;

- when applying for a consumer loan, the citizen also signed an agreement with the NPF, since often people do not read the documents to the end;

- Sociological surveys were conducted in public places to obtain an identification number.

There are widespread cases of fraud using Internet resources: citizens receive emails from UKSO guaranteeing payments according to SNILS. The abbreviation UKSO is the Social Security Control Office, but such an organization does not exist and does not have its own website.

When clicking on the link, citizens are taken to the scammers’ page, which contains information about the possibility of receiving monetary compensation for people who did not use social services.

Important! For greater reliability, scammers post hotline numbers, addresses, and even the UKSO emblem on the page, which resembles government agencies. Reviews confirming receipt of payments under SNILS are also listed on the website.

In order for compensation to be transferred, a citizen must register by indicating his SNILS or passport details. After authorization, a person is given access to his personal account, and information about checking his social balance is displayed. After some time, the citizen sees on the screen a tempting amount equal to 148,255 rubles.

To receive it, you can provide your e-wallet or bank card details. The procedure does not end there: the system displays an error and provides the opportunity to obtain operator advice.

The employee finds a reason why the amount cannot be transferred to the citizen’s card, so he offers to open a single account. But this procedure is paid, and amounts to 198 rubles.

After the payment is made, the money never arrives in the citizen’s account: the scammers try to extract as much money from the person as possible until he begins to suspect fraud.

Important! All actions of citizens carried out for the purpose of stealing other people's funds fall under the category of “fraud” and are punishable under Article 159 of the Criminal Code of the Russian Federation.

conclusions

If you receive a message to your email address or an SMS message to your mobile phone with a text similar to this - “Insurance charges in the amount of 32,578 rubles were found according to your SNILS,” then under no circumstances react or visit the resources that are provided to visit and clarify the information in the message. In total, scammers have several websites that are designed the same way. This means that they have a single interface, the same section descriptions and all the information they contain. There are several of them, the most basic and frequently visited are mysnils.ru, LtdRoyalinvest.ru, snils-rus.online, snils.top. If messages come to your number quite often, then it can be blacklisted.

What payments can you receive under SNILS?

The only type of payments that can be received using SNILS are pension accruals. All official information is posted on the State Services portal, or the Pension Fund. All other sites should not be trusted.

How to check payments according to SNILS

Citizens who want to know the status of their account can use the following methods:

- visit the Pension Fund in person, or leave a request via the hotline;

- use the “State Services” portal, where after confirming your identity (creating an account with entering personal data), gain access to your pension savings account;

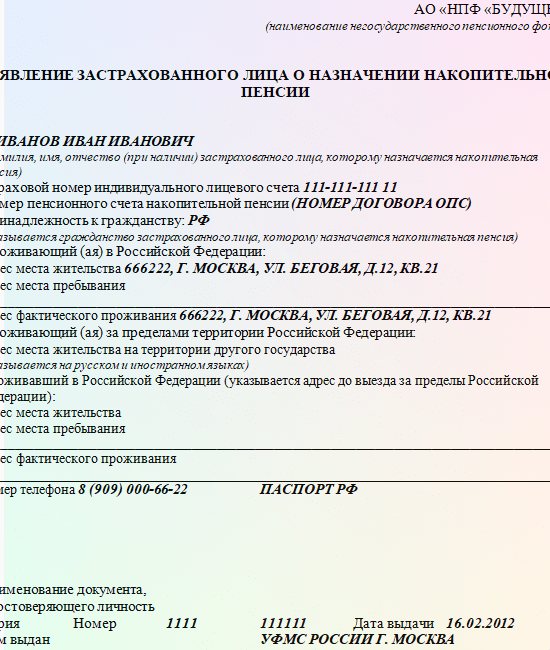

- contact the non-state Pension Fund. A visit to the institution is advisable if the citizen has drawn up an appropriate agreement under which his pension savings are transferred to a private structure.

A person receives insurance funds after he has retired: due to old age or disability. Money is transferred to the family if the breadwinner dies. There are no other ways to receive a pension.

How to check payments according to SNILS

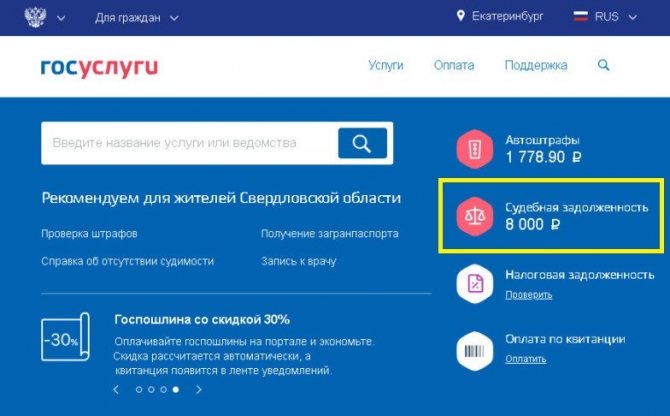

What does this notification mean in State Services?

The debt is assigned to SNILS - this is a system alert in the State Services, which indicates that a citizen has an active debt. The system determines the citizen’s identity based on information pulled from his SNILS data. This document is a universal identifier and it is by its parameters that you can quickly find the desired debtor.

First, let's figure out what the system is that finds and assigns such debts to citizens of the Russian Federation. This system is called “GIS-GMP”. This service was developed for automatic data exchange between government departments and allows you to track the status of allocated budget revenues. The State Services portal is also actively included in the work of GIS-GMP, which has formed a large user base and allows you to instantly notify them of any assigned debts.

Amount of legal debt in State Services

Such debts are established by court decisions, justices of the peace, FSSP bodies, municipalities and other authorized persons. Generally speaking, a citizen can be assigned a debt according to SNILS in the following situations:

- The purpose of taxes determined by the Federal Tax Service of Russia can be transport or property taxation;

- Required payment of assigned state fees;

- Instructions for the repayment of fines imposed by the traffic police;

- An administrative fine issued by the municipal commission;

We recommend our material about the arrival of registered letters marked “Judicial” and “Administrative”, which Russian citizens have begun to receive very often. You will understand who is sending these envelopes and what notifications are included in them.

What can scammers do if they know SNILS?

The obligation to make contributions to the Pension Fund or Social Insurance Fund rests with the employer. The received amount is divided into a savings and insurance part. By default, all financial transactions are carried out by Pension Fund employees until the citizen decides to transfer his savings to a non-state fund.

If fraudsters find out the SNILS number, then they are unable to withdraw funds from the account, but can transfer them from the Pension Fund to the Non-State Pension Fund. Since citizens prefer to trust the Pension Fund, unscrupulous persons find a way to illegally transfer money to another structure.

If citizens are extorted for their SNILS number, then the scammers’ goal is to receive a monetary reward. Depending on the non-state pension fund, they are paid 3-6 thousand rubles for each transfer.

It is impossible to get a loan from large banks using someone else's SNILS. This operation is feasible in microfinance structures, but in this case the fraudster will need to provide passport information.

Important! You should not provide information from your passport to anyone without first making sure that it is really necessary.

The big danger is that citizens who unknowingly transferred their pension to a non-state pension fund may lose it partially if the organization makes an ill-considered investment.

How to protect yourself from fraud

To avoid getting into bad situations and not transferring your funds to strangers, you need to follow a few simple rules. The most important thing is that if you become a victim of scammers, you should not panic.

You can protect yourself from data theft in the following ways:

- do not disclose your SNILS number to other people and do not write it on the Internet;

- ensure that the original document and its copies do not fall into the hands of strangers;

- Always contact only trusted banks and financial and credit organizations with a license;

- do not talk to people who are provided by government employees on the street or in the entrance of a house;

- check all the information and text of the contract before signing it; a column on non-disclosure of data must be indicated there.

If you follow all these rules, you can keep your data safe and also save your funds from the hands of scammers. Attentiveness and caution will protect against rash actions to obtain imaginary benefits.

Why can’t you enter your SNILS data on the Internet?

- First, you will lose money.

- Secondly, show your bank card - you will pay for access to the so-called database of insurance companies from it. And this is the risk of losing money again, only not 200 rubles, but everything that is stored in the account. Having the confidential information of your card, fraudsters will be able, for example, to pay with it in online stores.

- And finally, a few years ago, the following fraud was widespread: people walking around apartments (or even the streets), introducing themselves as employees of the Pension Fund and asking citizens to give their SNILS number. Under a variety of pretexts - from a basic check of the insurance number of an individual personal account (“What if your number is registered to another person, and you make all contributions to the Pension Fund in his name?!”) to the need to draw up documents required to receive a pension (“Without You won’t see this pension”). In fact, these people collected the SNILS of their compatriots to transfer their funded pensions to non-state funds (NPF). The fact is that in order to attract clients (and, accordingly, their pension contributions), NPFs paid remuneration to persons bringing new clients - several thousand rubles for each person. As a result, it turned out that citizens who agreed to name their SNILS and sign some papers, without knowing it, transferred their funded pensions to dubious funds or funds with negative returns.

Algorithm of actions in case of money transfer

Sometimes citizens go through the entire scam scheme and send funds for a non-existent state fee. After this, the criminal has SNILS and bank card numbers. The first thing to do without panic is to prevent transfers of funds from your retirement savings account.

The following must be done:

- contact the Pension Fund at your place of registration and write a statement indicating all the actions that led to the debiting of funds;

- draw up a complaint, which the Pension Fund must send to non-state structures;

- a non-state fund is considering a claim for a forced transfer of funds, which is confirmed by an agreement and statement;

- After the application is accepted, the money will be transferred to an account in the non-state pension fund.

Sample application for transfer of funds

Money can be returned back after a year, so it’s better to play it safe and do this operation. If SNILS is lost, then it is advisable to also perform such an algorithm so that no one can transfer funds to another fund.

Next, you need to deal with the money that was sent to the criminals. It is necessary to write a statement to the police , which sets out in detail all the facts of the crime.

What fraudsters are entitled to by law is regulated by the Criminal Code of the Russian Federation. Namely Art. 159 of the Criminal Code of the Russian Federation. Depending on the severity and amount of funds obtained fraudulently, the offender is sentenced from a large fine to many years of imprisonment.

Thus, there are no payments by SNILS number. This is a trick of scammers for those who do not know the laws well. Therefore, it is always necessary to carefully visit websites, look at the names of organizations and not be fooled by similar symbols to government agencies. When sending funds, fraudsters need to transfer their pension insurance savings to a non-state fund and file a police report

Summary

This information applies to residents of all regions of Russia: Adygea, Altai, Bashkiria, Buryatia, Dagestan, Ingushetia, KBR, Kalmykia, Karachay-Cherkessia, Karelia, KOMI, Crimea, Mari El, Mordovia, Sakha (Yakutia), North Ossetia (Alania), Tatarstan, TUVA, Udmurtia, Khakassia, Chechnya, Chuvashia, Altai Territory, Transbaikal Territory, Kamchatka Territory, Krasnodar Territory, Krasnoyarsk Territory, Perm Territory, Primorsky Territory, Stavropol Territory, Khabarovsk Territory, Amur Region, Astrakhan Region, Arkhangelsk Region, Belgorod Region, Bryansk region, Vladimir region, Volgograd region, Vologda region, Voronezh region, Ivanovo region, Irkutsk region, Kaliningrad region, Kaluga region, Kemerovo region, Kirov region, Kostroma region, Kurgan region, Kursk region, Leningrad region, Lipetsk region, Magadan region, Moscow region, Murmansk region, Nizhny Novgorod region, Novgorod region, Novosibirsk region, Omsk region, Orenburg region, Oryol region, Penza region, Pskov region, Rostov region, Ryazan region, Samara region, Saratov region, Sakhalin region, Sverdlovsk region, Smolensk region , Tambov region, Tver region, Tomsk region, Tula region, Tyumen region, Ulyanovsk region, Chelyabinsk region, Yaroslavl region, federal cities - Moscow, St. Petersburg, Sevastopol, Jewish Autonomous Okrug, Khanty-Mansi Autonomous Okrug, Yamalo-Nenets Autonomous Okrug, Nenets and Chukotka Autonomous Okrug.

Payment of the savings portion

The usual option for many people to receive a low-income pension is this method. Here the LF is transferred to pensioners along with the monthly pension. This method is considered the most common.

Savings from a non-state pension fund or a private management company are transferred to the pensioner in accordance with the terms of the executed agreement.

So, let's summarize the above. Firstly, in order for your future pension to please you, you need to choose a non-state pension fund or a private management company, enter into an agreement and increase the funds every year. Secondly, it will be possible to withdraw the funded part of the pension only at retirement age. Therefore, you should take control of your future pension into your own hands.

The content of the article:

In the regions of the country, cases of fraudulent activities have become more frequent. The criminals introduce themselves as employees of the Pension Fund of the Russian Federation, gain confidence and find out the insurance number of the personal account in the compulsory insurance system for citizens. What fraudsters can do if they know the SNILS number, and how not to fall for a criminal scheme , we will consider in the article.