What does a pensioner's social card give?

This payment instrument is intended for making purchases and paying for services by bank transfer. The SPK has several limitations. Funds can be withdrawn from it exclusively in rubles. If the pensioner is still working, he will not be able to credit his salary to the SPK. There is no CVV2/CVC2 on the plastic, so you won’t be able to make purchases using the Internet. When applying for a card, a pensioner must understand that this is not just a payment instrument. It contains a lot of information about the plastic holder, including:

- Personal Information. These include the last name, first name, date and place of birth, gender, sample signature and social identification number of the owner of the plastic. More advanced models store an encoded image of the owner.

- Personal document identifiers. A citizen no longer needs to carry with him the originals of the compulsory medical insurance policy (CHI), SNILS (individual personal account insurance number), TIN (taxpayer identification number), etc. All of them are contained in the card's memory.

- Other data types. This includes information about current promotions and discounts in stores that the pensioner prefers to visit, card balance, payments made, and expiration dates of the plastic card.

Payment banking instrument

Using the card, you can make various transactions with money: receive a pension, pay for goods and services, apply for a loan in the form of an overdraft, receive bonuses (cashback) for purchases in the bank’s partner stores, etc. This banking plastic has few restrictions, and almost all of them are related to making money transactions via the Internet. It is better for a pensioner to immediately refuse unnecessary options when opening a SPC, for example, an automatic overdraft if the card account balance is zero.

Receiving social benefits

Card holders have access to free travel on public transport, discounts when purchasing medicines and products from partner companies of the issuing bank. Pensioners who have signed up for SPC receive 500 points from the state once a month to buy food. They are converted into rubles at the rate of 1:1. Such assistance is provided for disabled people and low-income pensioners. Money can be spent on vegetables, fruits, spices and other products. The exceptions are cigarettes, alcohol and industrial products.

What is the MIR payment system

The payment system is a system for non-cash payments and transfers. It can exist at the level of an enterprise, city, country, or world. Its uninterrupted operation is ensured by equipment, rules, programs, services and employees. The most famous international payment systems are Visa, Master Card.

MIR is a Russian system. Its development began in 2014.

The difficult situation around Crimea and economic sanctions have made the use of international systems vulnerable. The work of some of their participants began to fall under sanctions, paralyzing payments. To ensure Russian citizens independence from political decisions of other countries when making non-cash payments, the government decided to create its own payment system. Based on the results of a national competition, the name MIR was chosen.

The first MIR cards were released in 2020. From July 1, 2020, all points of sale that accept cashless payments are required to accept MIR. Outside the Russian Federation there are payment restrictions. It will be possible to pay without any hindrance only in Armenia.

The reception of the MIR in Turkey, Thailand, the UAE, and the EurAsEC countries is being agreed upon. Production has begun jointly with other countries. Such maps in Russia work as MIR, outside the Russian Federation as maps of systems of other states.

The goal has been achieved - we can pay non-cash within the country, regardless of political relations with other countries.

How to get a pension social card

First, a citizen must choose the bank to which he will contact to obtain an SPC. There are a lot of companies involved in issuing social cards. The pensioner needs to carefully study their proposals. Some companies issue cards with a built-in system for returning funds from purchases of goods from certain categories (meat, vegetables, medicines, etc.). After the citizen has decided on the issuing bank, the procedure will be as follows:

- An elderly person visits a branch of the organization that issues social cards for pensioners, along with the package of documents required to open an account.

- After a citizen receives the plastic card, he must contact the territorial department of the PFR (Pension Fund of the Russian Federation) and fill out an application there to transfer the pension to the card account. The document contains the following information:

- insurance number of an individual personal account;

- full name and number of the applicant’s identity document;

- full name of the credit institution through which the pension will be delivered;

- recipient's account number (it is indicated separately in the banking service agreement, not to be confused with the card number).

Documents for registration

Obtaining a social card involves collecting certain certificates. Documents for a social card:

- passport of a citizen of the Russian Federation;

- compulsory medical insurance policy;

- SNILS certificate;

- pensioner's certificate;

- other certificates.

What documents do you need to collect to receive a discounted travel pass?

| Document type | Where to get it |

| Application for a discounted travel pass | Provided when submitting documents for social protection |

| Passport and its copy | |

| Certificate of permanent registration at the place of residence | Passport office, EIRC |

| Medical pole | At an insurance company |

| Pensioner's ID | Pension Fund |

| If the citizen is disabled, then the conclusion of the medical expert commission on the assignment of disability | ITU Bureau |

| War participant certificates | USZN |

| Honorary Donor Certificate | Health Committee |

| Large family certificate | USZN |

Where to apply

Many banks in the Russian Federation are issuing social cards for pensioners. Citizens often turn to Sberbank because... branches and ATMs of this organization are present in all localities of the country. The company has provided for elderly people the opportunity to pay utility bills online and issue a second card for a close relative of the client. In addition to Sberbank, the following banks issue social cards on favorable terms:

- VTB Bank of Moscow;

- Uralsib;

- All-Russian Regional Development Bank;

- Sovcombank;

- Binbank;

- Opening;

- Transcapitalbank;

- Rosselkhozbank.

- 12 reasons why you shouldn't drink cow's milk

- Documents for a mortgage - which are necessary for the purchase of a new building, house, secondary housing or programs

- Curtains for the balcony

Rules for using a pensioner card

Immediately after receiving the SPC, a citizen must copy down its number and place the sheet with it in a safe place . This is necessary in case the plastic is lost. The owner of the plastic card must remember the PIN code. It is needed to protect money from fraudsters and conduct transactions. It is issued along with a card, the owner of which can withdraw money from the account, pay with it for purchases in stores, travel on public or private transport.

In some Russian cities there is a special transport card for pensioners. It replaces a travel document, i.e. a citizen can use it to pay for public transport services. It cannot be used when purchasing products. The social card is more universal. You can not only withdraw money from it, but also deposit money into it. The rules for using a pensioner card are as follows:

- When withdrawing money from the account. An individual can withdraw money independently through an ATM or at a bank branch. In the first case, you need to insert the plastic card into the terminal, enter the PIN code, indicate the amount and click on the “Withdraw funds” button. Be sure to take the receipt with you. In the second case, the individual simply gives the plastic and his documents to the bank employee, and he already performs all the necessary actions.

- When paying for products and services. The card must be inserted into the payment terminal for cards and the PIN code must be entered.

- When paying for travel. The social card is applied to the yellow circle on the turnstile. The appearance of a green signal means that the payment has been made.

How to top up

The pension is transferred to the SPK automatically from the state budget once a month. A citizen can transfer additional funds to a card account. To do this, you will need to visit a bank branch or use a special terminal (not all financial companies have it). Other people can also top up their card account balance by completing a transfer. Depending on the chosen method, the money transfer algorithm will change:

- Bank. An individual comes with an identification document and social card number. If the owner of the plastic card is replenishing the account, the commission will be zero. Otherwise, 2% will be withheld from the amount.

- Terminal. You must enter the card number or place it in the card reader, and then insert the bills into the currency acceptor. The standard commission size is 1.5%.

- Bank transfer. The citizen must provide an account number or social security number and identification documents. The commission size is from 1 to 3%.

Transfer of funds

Some financial institutions offer clients an additional service: connecting to a virtual or mobile service. With its help, you can access your personal account and transfer money from one card to another. Funds can be sent not only to the issuer’s account, but also to the accounts of other companies . The commission will be only 1%, but this method is often inconvenient for older people. You can transfer money from a social card to another card of the same bank in the following ways:

- Through an ATM. You need to place plastic in the card reader, enter the PIN code, and then in the menu select the option to transfer money to another card.

- Contact the nearest branch of the company to make a transfer. In this case, the individual must present his card and the recipient’s plastic number. The commission will be 1.5%.

- Using virtual or mobile banking. You need to log in to your personal account and then transfer the required amount to your social account number. The commission will be 1%.

- From an account of another financial institution. When transferring, you must indicate the account number linked to the social card. The commission will be 2%.

Interest on balance

The bank charges 3.5% per annum on your money in the account. This means that the amount is charged 3.5% if it remains on the account for 1 year. But the amount in the account may change every day.

When calculating interest for less than a year, the interest rate is divided by 365 days and multiplied by the number of days the money is in the account. For independent calculations, we remember school mathematics: when calculating, we take fractions, not percentages. 3.5% = 3.5 / 100 shares = 0.035 shares.

The bank records funds from the next day after the account balance changes. Interest is paid every 3 months for the actual number of days.

Let's look at an example:

On May 4, 10 thousand rubles were credited to your pension card.

On the same day you withdrew 2 thousand.

From May 5, the remaining 8 thousand will be taken into account when calculating interest. For each day you will be charged: 8000 x 0.035 / 365 = 77 kopecks.

On May 18, you cashed out another 6 thousand.

From May 19, the remaining 2 thousand will be taken into account when calculating interest. Daily: 2000 x 0.035 / 365 = 19 kopecks.

On June 4th the next payment of 10 thousand will be made.

From June 5, 12 thousand are accepted for interest calculation. For each day: 12,000 x 0.035 / 365 = 1.15 rubles.

On June 7 you withdrew 5 thousand.

From June 8, the balance of 7 thousand is taken into account. Daily: 7000 x 0.035 / 365 = 0.67 kopecks.

July 1 interest accrual:

| Days | Accruals |

| From 5.05 to 18.03 = 14 days | 14 x 0.77 = 10.78 |

| From 19.05 to 4.06 = 17 days | 17 x 0.19 = 3.23 |

| From 5.06 to 7.06 = 3 days | 3 x 1.15 = 3.45 |

| From 8.06 to 1.07 = 24 days | 24 x 0.67 = 16.08 |

| Total | 10,78 + 3,23 + 3,45 + 16,08 = 33,54 |

For the period from May 4 to July 1, Sberbank will credit the MIR pension card with 33 rubles 54 kopecks for the account balance.

The card holder has the right to top up the account, 3.5% per annum will be charged on the entire balance. The rate is lower than that of deposits. However, registering a deposit takes time, and deposits with higher interest rates impose obligations. The higher the percentage, the more restrictions there are on using the money before the deposit expires: it is not always possible to withdraw or report.

On a pension card, money is always available, interest is accrued on the balance, regardless of its amount and the period the money is in the account.

Validity period and reissue procedure

Bank payment instruments work for a certain time. The numbers indicated on the card to the right of the individual’s photograph across the line indicate the date when the SPC expires. A month before the expiration date of the plastic card, an individual must come to the nearest bank branch and submit a request for reissue. You will not be able to receive a new social card on the same day of application. It will take 2 weeks to prepare the plastic.

When reissued, the SPC account remains the same, but the number and PIN code will be new. The balance of funds from the old social card will be transferred to the re-issued one. In some financial institutions, the cost of re-issuing plastic is 200-300 rubles, but often this service is provided to elderly people free of charge. It is not possible to extend the validity period of a social card. It is issued for 3-5 years. Many companies have a system for automatically sending SMS notifications about the re-issue of SPC.

Social card for pensioners of Moscow and the Moscow region

The capital has its own program to support the population. Elderly people using a Moscow social card will be able to pay for food, travel by car, receive some medications with a 50% discount, etc. It is issued by the Bank of Moscow. Electronic coupons are automatically added to the card. You can exchange them for food until the end of the month in the Perekrestok and Karusel stores. A pensioner's social card in the Moscow region and Moscow is valid for 5 years.

- 13 Signs Your Kidneys Need Help

- How testosterone production changes in women after 50 years

- 6 ways to look 10 years younger

Conditions of receipt

Citizens who have permanent registration in Moscow or the region can apply for a social card. Residents of the capital with temporary registration are deprived of this privilege. An individual must confirm his right to receive plastic with the help of certificates or special IDs . If a citizen cannot do this, his documents will not be accepted. The conditions for receiving a social card are as follows:

- Permanent place of residence is Moscow or the Moscow region.

- Availability of documents confirming the right to receive a social card and additional benefits on it. These include a pension certificate, a disabled person certificate, etc.

What benefits and discounts are provided for Muscovites

Residents of the capital can take advantage of additional privileges provided for SEC owners. They help older people reduce costs for food products, medicines, moving around the city, traveling to their summer cottages and back. When using the card, the following benefits are provided for pensioners in the Moscow region:

- discounts in stores that are partners of the bank;

- discounts up to 5% on any medicines in pharmacies;

- low-income elderly people will be able to receive free food in state canteens;

- free travel on public transport within the region and on suburban railway transport;

- the opportunity to receive money for 8-9 days under the overdraft lending program;

- free tickets once a month to a museum, theater, art gallery;

- payment of housing and communal services without commission.

Why is this benefit needed?

The picture shows a sample of a plastic social card:

A plastic card that helps you receive social assistance is called social. It is a multifunctional device that makes it possible to use it to conduct financial procedures. In addition, this plastic is considered a document of title that allows you to prove the right to receive government assistance.

More than 60% of the population does not have such a card. According to statistics, residents of the Moscow region use the card more actively.

Watch everything about the social map of Moscow in the video:

If you have this card, you can forget about other legal documents that allow you to use government benefits depending on the person’s place of residence:

- Receiving discount bonuses in various areas of social security (utility payments, travel, receiving services in a medical institution).

- Carrying out consumer payments (if a product is purchased or services are ordered).

- Identification of the holder (the card has information about its recipient).

This document is received not only by pensioners, but also by other categories of citizens. Who is entitled to:

- Student social card. Received by students of universities and secondary technical institutions in order to use benefits and concessions from the municipality.

- For pensioners and labor veterans. Only citizens who have reached pension age can apply. In addition to the due monthly pension, you can get relief in the field of social security.

- For students. Received by minor citizens who study in schools and lyceums. Valid in transport during the study period.

- Children's card. Issued by the mother or guardian of a child under three years of age. Mainly given to disabled people.

These plastic documents vary regionally. For example, in the Moscow region there is a Muscovite card. The person who received this document has the right to the following benefits:

- Receiving a discount when purchasing goods and products.

- Registration of medical care in the form of services and free medicines.

- Medicines in social pharmacies are sold at a 50% discount.

- Pensioners who have benefits below the subsistence level can receive food using this document.

- Free travel on many types of public transport.

- Receiving one-time, regular targeted social assistance, depending on the privileges provided to the beneficiary.

Who is entitled to a Muscovite social card, see the picture:

Where to get and how to apply

It is a little easier for the population of Moscow to receive SPK. Pensioners can contact the Multifunctional Center (MFC) or visit. You do not have to bring your own photos to receive the plastic. MFC employees will photograph the future owner of the SEC for free, but if desired, the citizen can bring a ready-made 30X40 mm photograph on a flash drive. The social plastic registration algorithm consists of the following steps:

- A citizen brings documents to the MFC to obtain a social card (passport, compulsory medical insurance policy, SNILS, pension certificate), and then fills out an application. If a photo is not available, the pensioner will be photographed for free.

- The citizen is given a discounted travel ticket for all types of transport and a tear-off coupon for the application for the issuance of plastic.

- After 30 days, the pensioner comes to the branch of the MFC, where he submitted the documents, to get the finished card. Be sure to take your coupon, passport or pension card with you.

Instructions for registering SCM

The first step is submitting an application at one of the “My Documents” MFCs.

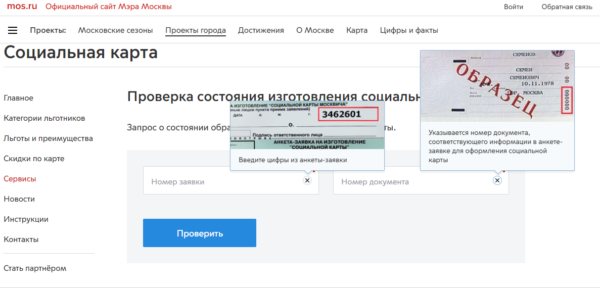

You must have with you a passport, papers confirming the applicant’s right to receive benefits, SNILS and a photo in 3x4 format (optional, you can take a photo on the spot). After submitting your application, you should be issued a preferential travel ticket for all types of public transport in the capital for a period of up to 30 days (the social card will be ready during this time). You can check the readiness of the card on the website https://www.mos.ru/socialnaya-karta/services-proverka-sostojanija-izgotovlenija-socialnoj-karty/, for which you need to enter the document and application number in the special fields, as shown in the example.

You can receive the SCM at the same center where it was issued. To do this, you need to take your passport and a tear-off coupon for issuing a card with you.

In case you lose the SCM, it is recommended to write down the 16-digit code (it is indicated on the front side), as well as the number located above the photo on the back side.

What to do if you have lost your Muscovite social card

As soon as the pensioner discovers the loss, he must immediately call the bank and block the account . This is necessary in order to save existing money. The restoration and re-registration process will take 20-30 days. Some financial institutions, for an additional fee, can reduce the time for re-issuing plastic to 5-7 days. The algorithm of actions of the card owner in case of its loss will be as follows:

- Call the bank that issued the plastic and insist on blocking the account.

- Visit the nearest bank branch with the agreement and identification documents. Submit an application for reissue of the card.

- Pick up the finished SPK in 20-30 days.

The replacement of the Moscow Region social card for pensioners follows the same algorithm as re-issuance after its expiration date. Only when filling out the application must the citizen indicate that he is changing the payment medium due to loss. Re-production of the SPK takes from 1 week to a month. After the plastic is ready, a bank employee will contact the pensioner. After loss or reissue, the social card number changes.

How to find out about pension savings on the Pension Fund website using SNILS

For a citizen who prefers to receive information from the primary source, the best option is to use the official portal of the pension authority. Since the beginning of 2020, a section related to using the capabilities of your personal account began working on this resource. This resource makes it possible to find out how many coefficients a citizen has earned over a certain period of time.

In addition, information about the length of service of a particular citizen must be reflected.

Also, using the site allows you to:

- use an advanced calculator for calculations;

- the ability to print a notice about the status of the pension account;

- information about the time period while the citizen was working and the amount of contributions he made to the employee’s account.

To obtain information from SNILS about the amount of a funded pension on the pension fund website, you need to use the following algorithm of actions:

- Log in to the official website and select the section related to using your personal account.

- Open a section that provides information about the formation of a pension and obtaining information about the rights of a citizen related to the pension;

- Go through the authorization process on the State Services portal. When a person previously registered, they simply need to enter their login information. Otherwise, initially register on the site by entering your last name and cell phone number.

- After opening a personal account, a person gains access to information about insurance production, and the information is provided by the Pension Fund of Russia. In addition, it is possible to make a request to obtain information about earnings contained in the personal account.

In this way, it will be possible to obtain information transmitted by the management of the organization where the person works. Based on the specified information, the person receives information about what period is used to calculate the pension and the place of employment. This data is used to make funded pension calculations.

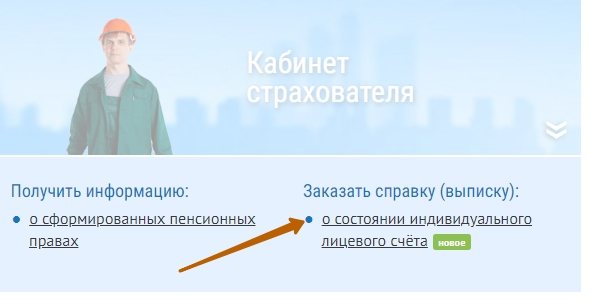

To receive a statement in printed form, you need to click on the section on obtaining information about your account status . The system automatically generates a document, a person can print it at any time.

It is also possible to use the link to calculate the amount of future payment. If you click on it, the screen displays information about what data to enter to receive the amount.

Advantages and disadvantages

A pensioner’s social card greatly simplifies the process of purchasing things, services and receiving various payments. Citizens no longer need to carry cash with them, because... it has plastic. The pensioner does not need to remember the full plastic number, because To pay for purchases in a store, you just need to enter a PIN code, but in case of theft, it is better to save the full SPC details. There are other benefits of a social card:

- Free pass. In some regions, pensioners, labor and WWII (Great Patriotic War) veterans, if they have plastic, are exempt from paying for public transport services.

- Discounts at partner stores. The recipient of pensions and benefits will be able to save up to 35% on their purchases.

- Ease of obtaining medical services. Upon presentation of a social card, state health institutions may provide some services without the original policy.

SPK has some disadvantages. Pension funds credited to a card account can be withdrawn only in Russia. When you receive money from an ATM, a commission will be automatically charged. In small towns there are often no terminals with which you can pay for purchases. The pensioner will still have to look for an ATM to get cash. Not all government agencies have terminals for social cards, and often staff do not understand how to work with the electronic SPC system (view information about a citizen, etc.).

Card conditions

Sberbank issues pension cards free of charge. It does not provide the opportunity to order additional plastic for loved ones. After 5 years have passed from the date of registration of the plastic, its reissue is carried out without charging a fee.

Tariffs and cost of additional services

Pension card servicing is free of charge. But for reissue if the plastic is lost/stolen or the holder’s data is changed, a fee of 30 rubles will be charged. SMS notifications about all transactions are available for 30 rubles/month. But the client can activate a free package without SMS about purchases. It provides codes for online banking and online shopping, as well as access to payments and transfers via SMS.

Cash withdrawal through ATMs and Sberbank cash desks within limits from a pension card is free of charge. Commission for exceeding the daily limit through the Sber cash desk is 0.5%. When withdrawing cash from third-party ATMs, the service fee will be 1% (min. 100 rubles), and when receiving money through the cash desk of another financial institution - 1% (min. 150 rubles)

Access to Sberbank Online, mobile banking is provided to the owner of a pension card free of charge. These services are available to all bank account owners.

Comment. Payments for services, transfers within Russia and other services may be charged in accordance with the tariffs.

THANK YOU bonuses and interest on balance

The owner of the pension card can register in the Thank you program. It accrues cashback points of 0.5% from the bank and up to 30% from partners. Accumulated bonuses can be spent with partners or on special websites created by Sberbank.

Interest is charged on the account balance at a rate of 3.5% per annum. Income is accrued every 3 months. The interest income on the balance will be small. If you want to place your savings more profitably, it is recommended to use deposits.

Comment. Sberbank’s assortment includes many cards with different conditions - interest on the balance, up to 10% cashback; more details about the bank’s debit and credit cards can be found in the article “All Sberbank cards”.

Limits and restrictions

The pension card is issued exclusively for ruble accounts. It has no restrictions on the amount of credits or limits on purchases. The owner can independently set limits on purchases through an online bank or office.

The bank sets a limit on the card only for cash withdrawals. It is 50 thousand rubles. per day and 500 thousand rubles. per month. When receiving cash at the Sberbank cash desk, the daily limit is allowed to be exceeded, but subject to additional payment. commission of 0.5%.

Important! A client cannot have more than 1 Sberbank pension card.

Why may they refuse extradition?

Citizens often cannot obtain a social card because they provided incomplete or inaccurate information. It will not be possible to issue an SPC if your passport or any other document required to open an account is about to expire. Some pensioners, if their card is lost or damaged, try to get a new one instead of restoring it. This cannot be done either, because... The banking system will generate an error when trying to register. Reasoned refusal can come when:

- lack of a compulsory health insurance policy;

- absence of SNILS;

- providing false information about registration.

Information contained in the card

The pension social card contains the following information:

- Personal information. The personal data of the card recipient is the last name, first name, patronymic, as well as TIN, date of birth, gender and valid signature. New Moscow cards contain a photo of a pensioner.

- Identification data. Data of different types is provided, depending on the status of the person and the city of his residence. Such information includes SNILS, registration number plate in the social security authorities at the address of residence, compulsory health insurance policy.

- Additional personal and typical information. In this case, the category of social assistance recipient is indicated with a note about information about the benefits purchased. Each government relief has an expiration date.