All about checking your pension savings for 2020

The reform carried out in 2020 makes it possible to independently form your own pension with certain savings. The insurance pension, in turn, is divided into the following groups:

- in case of loss of a breadwinner;

- establishing the fact of disability (disability group);

- reaching the age limit for old age pension.

Also, pension savings are divided into 3 categories:

- target;

- urgent;

- one-time

This right is granted as a result of the formation of the required number of points or IC (individual coefficient).

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Points are awarded annually during your career. In the case of the formation of an exclusively insurance benefit, a person adds 10 points .

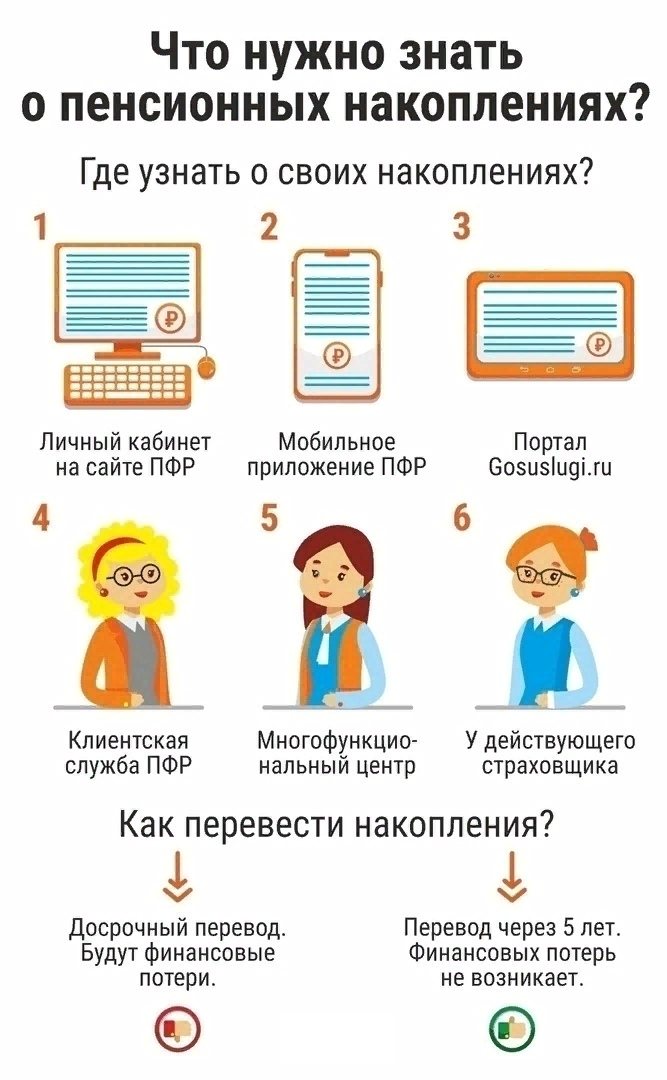

Checking savings through government services

If you are not registered on the State Services Portal, you need to register and confirm your Pension Fund account or use Russian Post. For those who have already used this site, you need to visit your Personal Account.

- Select from the catalog and follow this link.

- After that, click on “Notification and personal account status.”

- These actions will be followed by a statement in which all deductions to your individual account will be indicated.

Check where your pension savings are?

06 July 2020 09:59

A citizen can form a funded pension:

- in the Pension Fund of the Russian Federation (PFR),

- in the State Management Company (GUK)

- in a private management company (PMC),

- in a non-state pension fund (NPF).

PFR and NPF are insurers. You can exercise the right to change insurers annually.

If you decide to transfer your pension savings to a non-state pension fund, take the choice of fund as responsibly as possible.

If your rights were violated and you learned that your pension savings were “transferred” to another fund, without your consent (you received the information from the Pension Fund notification, from the corresponding letter from the NPF, or saw it yourself on the State Services portal), then you can:

- File a complaint with the NPF and request a copy of the Compulsory Pension Insurance Agreement allegedly concluded with you (hereinafter referred to as the Agreement). The text of the claim is drawn up in free form. The NPF is obliged to inform you on the basis of which your pension savings were transferred to this NPF. The NPF must have the original of the Agreement with the citizen on the transfer of pension savings;

- Call the NPF (can be found on the NPF website);

- Contact law enforcement agencies regarding the fact of transferring funds to a non-state pension fund without your consent, to initiate a criminal case regarding the facts of forgery of your signature on documents, in accordance with which the Pension Fund of the Russian Federation made a decision to transfer funds to a non-state pension fund;

- You can go to court. Please note that in accordance with the provisions of the Federal Law of 05/07/1998 No. 75-FZ “On Non-State Pension Funds”, which entered into force on 01/01/2010, the Agreement may be recognized as concluded by improper parties. At the same time, in accordance with paragraph 5.3 of Article 36.6 of the Federal Law of May 7, 1998 No. 75-FZ, pension savings must be returned to the previous insurer no later than 30 days from the date the NPF receives the corresponding court decision;

- If you do not want to leave your funded pension in the NPF and do not want to go to court, we recommend that you submit an Application for transfer from the NPF to the Pension Fund by contacting the territorial body of the Pension Fund before December 1 of the current year. It should be taken into account that an early transfer from a Pension Fund to a Non-State Pension Fund, from a Non-State Pension Fund to a Pension Fund, or from a Non-State Pension Fund to a Non-State Pension Fund may result in a loss of investment income.

You can leave everything as it is if you are completely satisfied with the new NPF.

Through your personal account in the pension fund

While on the Pension Fund website, you are also required to register, indicating a valid (working) email for confirmation.

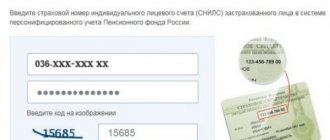

- After the above steps, you need to fill out a form in which you should indicate your passport details and SNILS number.

- Next, to get information about savings, you need to go to the “Pension Fund” section and select the appropriate link there.

If any problems arise, you can contact the Pension Fund staff at the phone number indicated at the top of the page. The hotline operates 24 hours a day and calls are free.

Check contributions to the Pension Fund via the Internet on the Pension Fund website

In addition to the government services portal, insured persons can obtain information about their formed pension rights for insurance pensions and pension savings, the insurer of which is the Pension Fund of the Russian Federation, on ]]>the official website of the extra-budgetary fund]]>. To do this, you will need to register in the electronic service “Citizen’s Personal Account” through the Unified Identification and Authentication System (USIA). Then in the “formation of pension rights” section you can obtain information about your individual pension account.

If one of the two above methods is used, the citizen receives information about the payers of insurance premiums, the amount of contributions received for the entire period, the amount of contributions for the reporting period and the final indicator of pension rights. And also, the percentage of profitability from investing pension savings, if the Pension Fund is the insurer for them.

Pension contributions in Sberbank

All pension contributions occur through various credit organizations, but only through those with which the Pension Fund has an agreement. Among them is Sberbank, to which you can submit an application to receive a statement of savings. As when visiting the Pension Fund, a citizen must have SNILS and passport data with him, which will be used to draw up an application for the provision of services.

Find information on SNILS if you are a member of a non-state pension fund

If we talk about the option of turning to non-governmental organizations, it is worth pointing out that this option can only be used if the citizen’s funds are accumulated in this company. information can be obtained by accessing the official portal.

There are also other ways:

- personal visit to the company office;

- telephone call.

To enter your personal account, a citizen will need to keep his SNILS number and the details of the act by which his identity is verified. Email address information and password are also provided.

Sometimes non-state companies provide access subject to registration of an entry on the State Services portal. However, in this situation you need to use SNILS. Examples of such companies are Sberbank and Future.

It is possible to order a ready-made extract via email. It indicates the amount of accumulated funds. You can also request delivery using registered mail or hand delivery during a personal visit to the NPF.

Also, a personal account allows a citizen to dispose of accumulated funds. However, this can be done subject to the existence of such a right. It will be possible to generate and send an application to receive a lump sum payment.

Thus, there are several methods for obtaining information about savings. The citizen himself decides which method to use.

How to check the correctness of pension calculations through State Services?

According to the law, contributions must be made to the Pension Fund from the employer in the form of a 22% tax. There are also organizations in which points for employees are awarded not 22 percent, but 20%. But in companies where employees are engaged in work activities with hazardous and harmful substances, or are in difficult working conditions, the employer charges an additional 4% in excess of the established 22%.

Sometimes employees may feel that it is unfair for the employer to contribute to the account. In this case, it is possible to find out through the accounting department of the organization in which they work. However, not everyone wants to clarify this issue in this way, so you can easily use the same website of State Services, the Pension Fund, banks and the Multifunctional Center.

Requesting pension data through the bank

If it was not possible to use the above methods, you can request information by contacting financial organizations that cooperate with state and non-state pension funds of the Russian Federation. Not all banks conduct similar activities. These are usually large financial institutions with which most citizens and commercial enterprises cooperate. The organization takes on an intermediary role, helping to make contributions to the pension fund. Data on which of them a citizen is a member of is also available in such banking institutions.

The list of such companies includes:

- VTB 24;

- Gazprombank;

- "Bank of Moscow";

- Sberbank;

- "Uralsib".

If a person wants to request information about which NPF it belongs to, it is necessary to contact a representative of one of the above companies. To send a request you will need a passport and SNILS. The client will have to write a statement. After this, the data of interest is provided.

Extract from the Pension Fund through State Services

You can find out your pension savings from the Pension Fund, as mentioned above, by using the State Services Portal.

- First of all, you need to go to your Personal Account by selecting and clicking the link “Receive an extract from the Pension Fund of Russia”.

- After clicking on this section, the system will begin checking your savings online, so this operation will take some time.

- After a couple of minutes, the page will display the result, which can be sent to an email address or downloaded to your PC.

- When saving a document, the system will notify you that this paper can be used for informational purposes only. Then you need to click on the “save” button, selecting the path on your computer. With the support of the browser used at this moment, the online PDF viewing function, the saved file can be displayed in a new window.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer can advise you free of charge - write your question in the form below:

Using the portal "State Services"

To find out which pension fund you are a member of, you can use the public services service. The system is available only after registration. If you already have an account, you will need to log into your personal account. Login buttons are located in the upper right corner of the site. The registration process and request for pension data through Gosuslugi is not complicated. You just need to follow the system prompts.

To find out whether a citizen is a member of the Pension Fund or Non-State Pension Fund, you will need to provide the login and password for your personal account and log into it. Next you will find the “Check pension savings” section. There is data on this issue here. A person will also be able to find out information about the fund to which he is a member. The system allows you to obtain almost any information. The method is simple and convenient. However, the method is not available without registration. In this case, the process may take 5-10 days.