The Russian Ministry of Finance proposes to extend it for 2016-2020. the period during which citizens will be able to choose their pension option under the conditions in force in 2014-2015. The main argument in favor of such an extension is a significant change in the rules of the game, making it difficult for a citizen to make an informed choice of his pension future: this is the “freezing” of the funded part of the pension, and a change in the rules of choice themselves, as well as a change in the system of control and supervision over the investment of pension savings and the activities of non-state pension funds.

According to the financial department, it takes at least five years to stabilize the work of new mechanisms and institutions, and therefore it is proposed to extend the period for choosing a pension option for citizens born in 1967 and younger.

However, if this initiative of the Russian Ministry of Finance is not supported, a little more than a month remains to make an appropriate decision. What should you be aware of when choosing your retirement strategy? What factors should influence the decision? Do you need to make any choice at all? We will try to understand these issues.

About the right to choose

The employer pays insurance premiums for compulsory pension insurance of employees at a rate of 22%, of which 16% is an individual rate; 6% is the joint part of the tariff.

The solidarity part of the tariff ensures the implementation of one of the most important principles of modern pension systems around the world - the principle of solidarity between generations. It is intended to generate nationwide funds necessary for a fixed payment. This is a guaranteed amount that the state sets for the insurance pension in a fixed amount.

Insurance premiums paid for the individual part of the tariff participate in the formation of the pension rights of a particular person. These amounts are accounted for in the individual personal account (IPA) of the insured person at a rate of 16% of the amounts paid by the employer. The ILS of each person is maintained by the Pension Fund. It is these 16% that form a person’s right to his future pension. Depending on the chosen option for forming pension rights: if a person decides to refuse to form pension savings, all 16% goes to the insurance pension. If a person decides to continue building pension savings, then 10% goes to the insurance pension, and the remaining 6% goes to the funded pension.

It is in relation to the 16% of the individual part of the tariff that the insured persons will have to make a decision. You can implement the option of choosing a pension provision option (insurance contribution tariff) as follows: either leave 6%, as it is today, or refuse further formation of a funded pension, thereby directing all the insurance contributions that the employer pays for you to form an insurance pension.

As financial advisors note, choosing a pension option is a multifactorial process that depends on many initial conditions:

— having a personal pension plan or at least pension goals;

— level of income and its expected sustainability;

— availability of sources of passive income;

— the desire to continue working after reaching retirement age and many others.

Therefore, the choice of pension option cannot be universal.

Workers who are not interested in their retirement future and who give up the right to make a choice constitute the so-called “silent” category. Starting next year, their savings will no longer be formed, and insurance premiums at a rate of 16% will be used to form an insurance pension.

Those who do not rely on the state and want to choose their own retirement future need to understand the full range of opportunities that pension legislation provides.

What reforms are planned in this area?

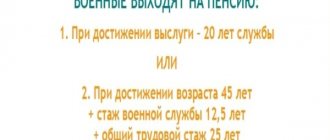

The reform of the Russian pension system in 2020 in Russia consists of several important areas at once:

- increasing access to a well-deserved old-age pension due to the emergence of an imbalance - for men up to 63-65 years old and for women - up to 58-60 years old;

- reducing the list of beneficiaries who enjoy the right to early retirement;

- working pensioners will lose the right to index payments in comparison with other categories of disabled citizens;

- from 2020, a system of individual pension savings will begin to operate in Russia, when any citizen will be able to independently form their own payments;

- the introduction of a point system, when every year any working citizen will be able to independently receive the required number of points, which will contribute to an increase in the size of the pension.

Important!

The regional pension system is now coming to the fore, since payments from the federal budget are often insufficient, and with the help of the country's constituent entities it will be possible to use other sources of income - personal, corporate or budgetary. It is necessary to more actively attract the personal savings of citizens to turn them into permanent investments.

Legislation

The right to choose a pension option is regulated by Federal Law No. 351-FZ dated December 4, 2013 “On amendments to certain legislative acts of the Russian Federation on issues of compulsory pension insurance in terms of the right of insured persons to choose a pension option.”

In the context of legislation, the pension option means the choice by the insured person in the compulsory insurance system of a percentage (0% or 6%) for a funded pension.

The right to choose a pension option is granted to persons born in 1967 and younger, registered in the compulsory pension insurance system. They must choose one of the following options:

— continue to form pension savings, directing 6% of the individual part of the insurance premium tariff to finance the funded pension;

— abandon the formation of pension savings and direct the full individual part of the insurance premium tariff (16%) to finance the insurance pension.

In other words, insured persons born in 1967 and younger will be able to choose: to receive only one pension - insurance, or two - insurance and funded.

Pension system of Russia 2001 - 2014

In December 2001, laws were adopted: from December 15, 2001 “On state pension provision in the Russian Federation” and from December 17, 2001 “On labor pensions in the Russian Federation”.

The approved laws envisaged a radically new pension system, including compulsory pension insurance, state pension provision and additional non-state pension insurance.

The main idea of these laws was to establish guarantees and further confidence for working Russian citizens that employer contributions or individual citizen contributions to the pension system will be returned to citizens in the form of pensions upon reaching retirement age.

Perhaps it is safe to say that people believed in this version of the pension system. This is evidenced by the active development of non-state pension funds, independent contributions to the savings system, as well as numerous investments of funds in co-financing the state pension.

This format of the pension system lasted for more than ten years. In December 2012, the government summed up the results of the current system, as a result of which possible problems in further pension provision were identified.

In particular:

- the current pension system does not ensure the long-term functioning and balance of the budget of the country's Pension Fund;

- does not make it possible to maintain pensions at an acceptable level for today's pensioners (simply, there is not enough money for indexation);

- the established maximum limit for the payment of pensions significantly limits the rights of the middle class, that is, people receiving income at a level significantly above the average (that is, even if you receive a large official salary, from which you pay all taxes and pension contributions, only a limited amount is included in the pension calculation amount, everything else goes into the “common pot”);

- problems with financial stability and bankruptcy of non-state pension funds (that is, if you chose a non-state pension fund, which subsequently went bankrupt, you lose all your savings);

- lack of a source of safety for pension savings at the state level, etc.

As a result of growing problems, against the backdrop of another financial crisis, all contributions to the funded part of the state pension were “nationalized” by the state. By the decision of the Government of the country, all contributions for 2014, 2020, 2020 were directed to the formation of the insurance part of the pension, that is, to pay pensions to today's pensioners.

The need for a significant modernization of the existing pension system, including ensuring the financial stability of non-state pension funds, creating a system of control over the investment of pension savings, led to the need for another pension reform.

Insurance and funded pensions: what is the difference?

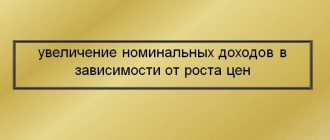

The insurance pension is protected by the state from market risks, since it is subject to annual indexation. Indexation is carried out according to the level of income of the Pension Fund, but not below inflation.

Indexation coefficients are established by regulations of the Government of the Russian Federation. Thus, in accordance with Decree of the Government of the Russian Federation dated January 23, 2014 No. 46, the indexation coefficient is set at 1.065.

It is important to understand that insurance premiums for an insurance pension are the “virtual money” of the insured person. In accordance with the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” (hereinafter referred to as Law No. 400-FZ), they are annually recalculated into pension points, on the basis of which the future pension is calculated.

In addition, the law does not provide for inheritance of insurance pension funds if the person has not reached retirement age.

The fundamental difference between insurance contributions for a funded pension is that they are subject to investment. That is, this is real money set aside for the future and designed to bring additional income to the future retiree.

The state not only ensured the formation of the funded pension itself, but also gave citizens the right to dispose of the funded part during its investment. That is, a person can influence the size of his future pension. At the same time, investment income may be much higher than the inflation rate, but there may not be such income - it all depends on how the non-state pension fund (NPF) or the management company performed.

In addition, the funds of the funded pension in the event of the death of the insured person are transferred to the heirs or other persons based on the citizen’s application (Part 6, Article 7 of the Federal Law of December 28, 2013 No. 424-FZ “On the Funded Pension”).

Note!

Currently, for employees born in 1966 and older, the employer makes contributions only to the insurance pension, while for employees born in 1967 and younger, both an insurance pension and a funded pension must be formed.

In addition, men born in 1953–1966 and women born in 1957–1966 also have pension savings, in whose favor insurance contributions were paid for the funded part of their labor pension in the period from 2002 to 2004 inclusive. Since 2005, these deductions have been discontinued due to changes in legislation.

In 2020 (as in 2014), all insurance contributions of citizens are directed towards the formation of an insurance pension (the rate of insurance contributions for a funded pension is 0%). This decision was made during the period of reorganization of non-state pension funds and the creation of a mechanism to guarantee the safety of pension savings. It is important to note that all previously generated pension savings are still invested by the management company or NPF and will be paid in full, taking into account investment income, when the insured person becomes eligible to retire and applies for it.

Thus, the employee needs to decide whether he will continue to increase the funded part of his labor pension. If legislators do not extend the deadline for making such a decision during the fall session, they must decide on the choice before January 1, 2020.

There are two possible solutions.

Option 1.

An employee may refuse further formation of pension savings, while 6% of contributions will go to the insurance pension (that is, the rate of contributions to the insurance pension increases from 10 to 16%).

Option 2.

The employee can continue to build up pension savings. In this case, insurance premiums on the personal account of the insured person will be distributed according to the previous scheme: for the insurance pension - 10%, for the funded pension - 6%).

Specific actions that an employee needs to take in a particular case are presented in the table.

Table. Employee actions when choosing different pension options

| Status (attitude to the formation of pension savings) | Refuses from further formation of pension savings | Continues to build pension savings |

| "Silent" | By default, no action needs to be taken | It is necessary to submit an application to select any investment portfolio to the State Management Company or Management Company, or to transfer pension savings to a non-state pension fund* |

| First filed in 2014-2015. application for selection of a management company or transfer to a non-state pension fund | It is necessary to submit an application for refusal to finance a funded pension in favor of an insurance pension | It is enough to submit an application to select any investment portfolio to the State Management Company or Management Company, or to transfer pension savings to a non-state pension fund* |

| In 2013, he submitted an application to select the investment portfolio of the State Management Company with a mark of 2% or for a transfer from a non-state pension fund to the Pension Fund of the Russian Federation with a mark of 2% | No action required | It is necessary to submit an application to select any investment portfolio to the State Management Company or Management Company, or to transfer pension savings to a non-state pension fund* |

| Not a “silent one”, in 2013 he submitted an application to select the investment portfolio of the State Guarantee Company with a mark of 6%, the insurer is the Pension Fund of the Russian Federation, does not want to change the insurer | It is necessary to submit an application for refusal to finance a funded pension in favor of an insurance pension | No action required |

| Not a “silent one”, in 2013 he submitted an application to select the investment portfolio of the GUK with a mark of 6%, the insurer of the Pension Fund of Russia, wants to change the investment portfolio of VEB or the management company | Simultaneously with submitting an application for choosing an investment portfolio or later, you must submit an application for refusal to finance a funded pension in favor of an insurance pension | It is necessary to submit an application for choosing an investment portfolio or management company |

| Not a “silent” NPF insurer, does not want to change insurer | It is necessary to submit an application for refusal to finance a funded pension in favor of an insurance pension | No action required |

| Not a “silent”, the insurer of the Pension Fund of Russia or the Non-State Pension Fund, wants to change the insurer | It is necessary to submit an application for transfer from the NPF to the Pension Fund or vice versa, and at the same time or later it is necessary to submit an application for refusal to finance a funded pension in favor of an insurance pension | It is necessary to submit an application for transfer from NPF to Pension Fund or vice versa, or from one NPF to another NPF* |

| Not a “silent man” whose pension savings are in any investment portfolio of the State Management Company or Management Company, the insurer PFR, or in a non-state pension fund In 2014, he submitted an application to refuse to finance a funded pension in favor of an insurance pension | No action required | It is necessary to withdraw the submitted application for refusal or in 2020 to submit an application to select any investment portfolio in the State Management Company or Management Company, or to transfer pension savings to a non-state pension fund* |

*In order for an application for transfer to a non-state pension fund to be granted, it is necessary to conclude an agreement with the selected non-state pension fund.

Important!

Those who are already working can exercise the right to choose a pension option only once - within the period established by law. It is impossible to make a decision on the further formation of pension savings after this period. But it will be possible to refuse further formation of pension savings if the employee has now decided to save them.

Pension savings funds, in addition to insurance contributions paid by the employer for an insurance pension (at a rate of 10% or 16%), include:

— additional insurance contributions for a funded pension under the co-financing program paid by the insured person;

— employer contributions to the funded pension, paid at the expense of the employer under the co-financing program, for employees who entered the co-financing program on the basis of Federal Law No. 56-FZ of April 30, 2008 “On additional insurance contributions to the funded pension and state support for the formation of pension savings” (as amended on November 4, 2014);

— co-financing transferred by the state under the program of state co-financing of funded pensions on the basis of Federal Law No. 56-FZ of April 30, 2008;

— maternal family capital funds allocated for the mother’s funded pension.

How to choose a pension option: with or without a funded pension

In 2014 and 2020, every citizen born in 1967 and younger had the opportunity to choose a pension option for themselves: to direct the entire amount of the employer’s insurance contributions to finance only the insurance pension or to distribute this amount to finance funded and insurance pensions.

Citizens born in 1967 and younger who, before December 31, 2015, chose to form an insurance and funded pension in the compulsory pension system can at any time refuse to form a funded pension and direct 6% of insurance contributions to form only an insurance pension.

The right to make a choice in favor of further formation of pension savings is retained by citizens born in 1967 and younger, for whom insurance contributions for compulsory pension insurance first began to be calculated on January 1, 2014. They retain this right until December 31 of the year in which the five-year period expires from the date of the first accrual of insurance premiums. If these persons, after the expiration of a five-year period from the date of the first assessment of contributions, have not reached 23 years of age, the specified period is extended until December 31 of the year in which they turn 23 years of age (inclusive).

When choosing a pension option, you should take into account that the insurance pension is guaranteed to be increased by the state through annual indexation. The funded pension funds are invested in the financial market by the citizen’s chosen NPF or management company. The profitability of pension savings depends on the results of their investment, that is, there may be a loss from their investment. In this case, only the amount of insurance premiums paid is guaranteed for payment. Pension savings are not indexed.

The pension option in the compulsory pension insurance system affects the calculation of annual pension coefficients. When forming only an insurance pension, the maximum number of annual pension coefficients is 10, since all insurance contributions are directed towards the formation of an insurance pension. When choosing to form both an insurance and funded pension, the maximum number of annual pension coefficients is 6.25, since 27.5% of insurance contributions are directed to the formation of pension savings.

It is important to note that even in the event of refusal to form a funded pension, all previously formed pension savings of citizens are preserved: they continue to be invested and will be paid in full when citizens receive the right to retire and apply for one. In addition, insured persons still have the right to manage their pension savings and choose who to entrust their management to.

How to refuse further formation of a funded pension

If the formation of a funded pension is refused, the rate of insurance contributions, which the employer pays from the employee’s wage fund, is distributed as follows:

| The employer's insurance contribution rate for your future pension | 22% | 16% on insurance pension (individual tariff) 6% for financing a fixed payment (joint tariff) |

In order to refuse the formation of a funded pension, you must submit a corresponding application to the Pension Fund. Before the expiration of the year in which the application for refusal was submitted, the insured person has the right to withdraw it by also filing a corresponding application.

Pension savings formed within the framework of the State Co-financing of Pensions Program and maternity capital funds aimed at forming a funded pension are included in the total amount of a citizen’s pension savings in the compulsory pension insurance system. Participants in the Program may refuse to form a funded pension under compulsory pension insurance, but will be able to continue to participate in the Program: pay voluntary contributions, receive co-financing from the state and investment income. Owners of a certificate for maternity (family) capital can also choose the option of pension provision without forming a funded pension, but they still have the right to use MSC funds or part of them to form pension savings.

You can learn more about exercising the right to choose a pension option on the website of the Pension Fund of Russia or by calling: 8 800 302 2 302 (toll-free throughout Russia).

Application form for refusal to finance a funded pension and direction to finance an insurance pension of 6.0 percent of the individual part of the insurance premium tariff

Application form for withdrawal of an application for refusal to finance a funded pension and the direction to finance an insurance pension of 6.0 percent of the individual part of the insurance premium tariff

How to continue further formation of insurance and funded pensions

When forming insurance and funded pensions, the rate of insurance contributions, which the employer pays from the employee’s wage fund, is distributed as follows:

| The employer's insurance contribution rate for your future pension | 22% | 10% on insurance pension and 6% on funded pension (individual tariff) 6% for financing a fixed payment (joint tariff) |

Currently, the right to choose a pension option in relation to future pension savings is retained by persons born in 1967 and younger, in respect of whom insurance contributions for compulsory pension insurance are charged for the first time from January 1, 2014. They still have the opportunity to decide:

- generate only an insurance pension;

- form an insurance and funded pension at the same time.

- conclude an agreement on compulsory pension insurance and apply for transfer (early transfer) to a non-state pension fund;

- or apply for the choice of an investment portfolio of a management company, an expanded investment portfolio of a state management company or an investment portfolio of government securities of a state management company.

When changes are made to the unified register of insured persons for compulsory pension insurance or when the Pension Fund of the Russian Federation satisfies an application for choosing an investment portfolio with the establishment of a pension provision option that provides for the allocation of 6.0 percent of the individual part of the insurance premium tariff to finance a funded pension.

for these insured persons, a pension provision option is established, which provides for the allocation of insurance contributions to a funded pension. Before the exercise of this right of choice, as well as for persons who have not exercised this right, a pension provision option is established, which provides for the allocation of the insurance premium in full to finance the insurance pension.

If, after the expiration of a five-year period from the date of the first accrual of insurance contributions for compulsory pension insurance, these insured persons have not reached the age of 23 years, this period is extended until December 31 of the year in which the person reaches the age of 23 years (inclusive).

You can learn more about exercising the right to choose a pension option on the website of the Pension Fund of Russia or by calling: 8-800-775-5445 (toll-free throughout Russia).

Application form for transfer from the Pension Fund to the Non-State Pension Fund

Application form for early transfer from the Pension Fund to the Non-State Pension Fund

Application form for transfer from NPF to Pension Fund

Application form for early transfer from NPF to Pension Fund

Application form for transfer from one NPF to another NPF

Application form for early transfer from one NPF to another NPF

Application form for choosing an investment portfolio (management company)

Form notification of replacement of the selected insurer (investment portfolio (management company) specified in the application for transfer

Application form for refusal to finance a funded pension and direction to finance an insurance pension of 6.0 percent of the individual part of the insurance premium tariff

Application form for withdrawal of an application for refusal to finance the funded part of the labor pension and the direction to finance the insurance part of the labor pension 6.0 percent of the individual part of the insurance premium tariff

List of documents when choosing a management company or non-state pension fund

Where to go

- If you refuse to finance a funded pension

An application for refusal to finance a funded pension is submitted in the following ways:

- personally (through a representative) to the Pension Fund of Russia - to any client service of the territorial body of the Pension Fund of Russia. In this case, identification and verification of the authenticity of a citizen’s signature is carried out by an employee of the territorial body of the Pension Fund of Russia;

- by mail. In this case, identification and verification of the authenticity of a citizen’s signature is carried out by a notary or in the manner established by paragraph 2 of Article 185.1 of the Civil Code of the Russian Federation, or by an official of the consular institutions of the Russian Federation, if the citizen is located outside the Russian Federation;

- in the form of an electronic document through the portal www.gosuslugi.ru, in the Personal Account of the insured person on the Pension Fund website

- When choosing the further formation of insurance and funded pensions

The choice of forming an insurance and funded pension is available only to citizens born in 1967 and younger, in whose favor insurance contributions for compulsory pension insurance will begin to be accrued by the employer for the first time after January 1, 2020. In order to subsequently form insurance and funded pensions, they should, within five years from the date of the first accrual of insurance premiums, submit an application to select a management company or a non-state pension fund with the direction of 6% of the insurance premium rate to finance the funded pension. If a citizen has not reached the age of 23, the specified period is extended until the end of the year in which he turns 23.

How to manage your pension savings

How pension savings can be managed is defined in Federal Law No. 111-FZ dated July 24, 2002 “On investing funds to finance funded pensions in the Russian Federation” (as amended on June 29, 2015; hereinafter referred to as Law No. 111-FZ). Every citizen has the right to choose one or another mechanism for investing a funded pension: either transfer it to the management of a market investment company, or transfer it to a non-state pension fund, or leave it in the Pension Fund under the management of the state management company - Vneshkonombank (hereinafter - GUK).

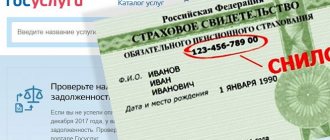

Citizens who are covered by compulsory pension insurance (having a certificate of compulsory pension insurance) can independently choose who to entrust the management of pension savings to.

Article 31 of Law No. 111-FZ determines that when forming a funded pension, insured persons, before applying for the establishment of a funded pension, have the right to:

— choose the investment portfolio of a management company selected by competition (hereinafter referred to as the Management Company), or the expanded investment portfolio of the State Management Company or the investment portfolio of government securities of the State Management Company;

— refuse to form a funded pension through the Pension Fund and choose a non-state pension fund in accordance with the legislation of the Russian Federation on compulsory pension insurance;

— refuse to form a funded pension through a non-state pension fund and carry out the formation of a funded pension through the Pension Fund, choosing the investment portfolio of a management company selected by competition, or an expanded investment portfolio of a state management company or an investment portfolio of government securities of a state management company.

We manage pension savings with the help of the Pension Fund

If pension savings are in trust management of a management company or state management company, the assignment and payment of the funded part of the labor pension, accounting of pension savings and the results of their investment by management companies is carried out by the Pension Fund.

To manage their pension savings directly through the Pension Fund, a citizen has the right to choose a management company or a state management company.

It is worth noting that the management company has a wider list of assets into which pension savings can be placed than the state management company. The list of management companies with which the Pension Fund of Russia has entered into agreements on trust management of pension savings funds is given on the Pension Fund of Russia website (www.pfrf.ru).

The State Management Company invests pension savings only in government securities, which is a less profitable but also less risky type of pension savings management.

We manage pension savings through non-state pension funds

If pension savings are in a non-state pension fund, the investment and accounting of pension savings funds, as well as the assignment and payment of the funded part of the labor pension are carried out by the non-state pension fund chosen by the insured person. At the same time, the NPF independently decides on the number of management companies with which it is necessary to conclude trust management agreements for the pension savings of the insured person. The list of NPFs operating compulsory pension insurance is available on the Pension Fund website.

NPFs can invest pension savings not only in government securities, but also in shares, bonds of Russian organizations, as well as other financial instruments permitted by law.

How to transfer pension savings to a management company or non-state pension fund

In order to maintain the amount of deductions of insurance contributions for the funded part of the labor pension at the level of 6%, it is necessary to submit an application by December 31, 2020 (if this period is not extended by law) to transfer the funded part of the labor pension to a non-state pension fund or to choose a management company.

Pension system under socialism

The established Soviet government also understood the need to provide pensions for the country's citizens. Actually, one of the factors of loyalty to the new government was the introduction of a new pension system. As a result, after the revolution of 1917, the establishment of Soviet power in the country, the following resolutions were approved:

- in 1917, the Resolution “On the issuance of percentage bonuses to the pensions of military disabled people” was approved;

- in 1918 - Resolution “On approval of the Regulations on Social Security of Workers”;

- in 1924 - long-service pensions were approved for scientists and teachers of workers' faculties;

- in 1925, long-service pensions were established for teachers in urban and rural schools.

The size of the pension at that time depended on the average monthly earnings of the pension recipient, working conditions and family composition.

During the same period, in the 1920s, the existing pension system was replaced by a social insurance system. The formation of the social fund was carried out through the payment of taxes by all enterprises and organizations of the country to the general budget of the country, from which money was also allocated for the payment of pensions to citizens.

Closer to 1931, new concepts appeared in the pension system: old-age pension, retirement age. The amount of wages was also established, on the basis of which the pension was calculated - 300 rubles.

Also in the 30s of the 19th century, a retirement age was established, upon reaching which a citizen received the right to receive a pension: 55 years for women and 60 years for men. This age was based on numerous medical examinations of workers, which showed that the state of health of workers upon reaching this age does not allow them to work fully in the future, and the majority of women and men cannot continue to work.

The final formation of the pension system of the Soviet Union dates back to 1950 - 1960, and included pension provision for workers and employees of state enterprises and pension provision for collective farmers.

By this time, types of pension provision had also been formed: old-age pension, disability pension and survivor's pension. There were also additional (increasing) pensions for length of service, personal pensions, and for special services to the state.

It was also possible to retire 10 to 15 years earlier: various benefits were available, such as working in harsh climatic conditions or in hazardous work environments.

There were also significant distortions in the pension system of the socialist period. Thus, the legislation of that time did not provide for indexation of pensions. And it turned out that against the backdrop of a gradual increase in the average wages of workers, people who retired several years, or even decades earlier, received a obviously smaller pension than pensioners who retired later. The pension provision did not take into account changes in living standards, including the rise in prices of basic food products...

As a result of this imbalance, it turned out that by the 1980s, pensioners 70 years of age and older were the poorest segment of the population, especially the older age.

In order to eliminate such a imbalance, on May 15, 1990, the USSR Law “On Pension Provision of Citizens in the USSR” was approved, which provided for the introduction of additional payments and allowances, the so-called indexation, for the country’s pensioners.

But, in the same year of 1990, the state structure of the country changed radically, which entailed a significant change in the pension system.

What needs to be done to maintain a funded pension

If legislators do not extend the time to make an appropriate decision, by December 31, 2020, citizens insured in the compulsory pension insurance system who have decided to allocate 6% of the insurance premium rate to finance a funded pension must submit an application to choose a management company or a non-state pension fund. Such an application is submitted to the Pension Fund. As before, when transferring pension savings to a non-state pension fund, a citizen must conclude an appropriate agreement on compulsory pension insurance with the selected non-state pension fund.

The new insurance premium rate will be applied starting from January 1 of the year following the year in which the application for choice was submitted to the Pension Fund (Clause 3, Article 33.3 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation”, hereinafter - Law No. 167-FZ).

However, for citizens who in previous years applied at least once to choose a management company or a non-state pension fund, and it was granted, 6% of the tariff will continue to be transferred to the funded part of the pension. In this case, there is no need to send an additional application to the Pension Fund. This category of citizens needs to apply only if a decision is made to refuse further formation of the funded part of the pension.

It should be noted that for citizens who during 2013 submitted applications to choose the State Institution “Vnesheconombank” with a tariff of 2%, from the beginning of 2014 the funded part was not formed by default and all insurance contributions were directed to the insurance part of the pension (to the insurance pension - from 2020). Thus, this category of citizens must, in general, decide to form a funded part in the amount of 6% by submitting an appropriate application to the pension fund, or to refuse it.

Even if a citizen refuses further formation of the funded part of the pension, all pension savings previously formed by him will continue to be invested and will be paid in full, taking into account investment income, when he receives the right to retire and applies for its appointment.

Before the insured person makes any decision (until December 31, 2020), the insurance premium rate will be used in full to finance the insurance pension (paragraph 2, clause 1, article 33.3 of Law No. 167-FZ). The tariff will be distributed in a similar way in cases where the choice is not made within the prescribed period.

The right to choose pension options

According to Article 33.3 of the Federal Law of the Russian Federation of December 15, 2001 No. 167-FZ, until 2020, any citizen born in 1967 or younger could decide whether he needed a funded pension or not. After this date, the right to choose the funded part remains only for those citizens who first started working in 2020. are given 5 years to determine or until they reach 23 years of age. At the same time, if the insured person (IP) has a funded pension option and changes his mind, then there is an opportunity to refuse the formation of a funded pension and switch to an insurance pension in full from next year at any time by submitting an application about the desire to form only an insurance part of the pension to the Pension Fund of Russia.

At the same time, previously accumulated contributions are preserved, can still be invested and will be paid after the right to receive it arises upon the application of the AP.

Example

The insured person chose the option of forming an insurance and funded pension in 2014. Transferred pension savings to a non-state pension fund. However, at the end of 2020, the increase was insignificant, lower than the indexation of insurance premiums. Is it possible to switch to the option of forming only an insurance pension?

In this case, a citizen can choose the option of forming only insurance premiums by submitting an application to the Pension Fund of Russia, which will be valid from next year. Those contributions to the funded pension that have already been formed remain and can be invested in another NPF or management company.

Right to funded pension for new employees

Employees who began working in January 2014 and later can decide to choose a model for forming a future pension within five years from the date of the first accrual of insurance premiums in their respect. And if a young person began working before the age of 18, the corresponding decision can be made before December 31 of the year in which he turns 23.

At the time of submitting an application to the Pension Fund for choosing an insurer, a citizen must be 14 years old. Until the employee makes a choice, 6% will be used to finance the insurance pension (Clause 2, Article 33.3 of Law No. 167-FZ).

Russian pension system: to be continued...

You may ask, why do you need to know the history of the pension system?!

There is only one answer: in order to understand that for a decent living in retirement, payments from the state are not enough, and it is necessary to form your own financial reserves. I hope our website Sizhu-doma.ru will help you in matters of saving money and forming a balanced family budget.

And while our “monetary” authorities are coming up with new ways to provide funding for current and future retirees, we should take care of our future: learn to save, set aside money for a future retirement, or otherwise ensure that we can live in old age.

You need to think about your future pension not five years before retirement, but much earlier, at least at 40-45 years old.

15 - 20 years before retirement age, you can create a good pension capital for yourself, if, of course, you treat your money wisely and distribute your income rationally.

The fate of existing pension savings

The pension savings that the insured persons already have will, as before, be invested in accordance with the choice made by the insured persons. The exception is the already accumulated funds of the “silent people”. Their savings will be placed by the State Management Company “Vnesheconombank”. And in the future, insured persons will be able to change the selected management companies, including Vnesheconombank, or NPF; as for the “silent ones”, they will be able to transfer their pension savings to the management company or NPF. To do this, insured persons, as before, must submit a written application to the Pension Fund (but they can do this no more than once a year).

Upon reaching retirement age, you can receive a funded pension from these amounts.

If an employee refuses to form pension savings

You can refuse the further formation of a funded pension at any time and after December 31, 2020. If a citizen refuses a funded pension, then from the year following the year of filing the application for refusal, his existing pension savings will not increase due to new contributions to the funded pension. pension.

It will be impossible to change this decision later.

Also, the pension savings of “silent people” formed before January 1, 2014 will not increase due to new contributions.

Information about the status of your personal account

You can find out which insurer is currently generating pension savings for a particular insured person by receiving an extract from an individual personal account. To do this, you need to contact the Pension Fund client service or through the website https://www.gosuslugi.ru.

Note!

Based on the results of the transition campaign of 2013-2014. 399.2 billion rubles were transferred from the Pension Fund to 24 non-state pension funds that were included in the guarantee system. 28.3 million citizens entrusted their savings to non-state pension funds, 482,500 people - to private management companies, and 51.9 million people - State Management Company "Vnesheconombank".