Today, SNILS is not just a citizen’s “green card,” but also a new pass to the electronic world of government services.

Every year, millions of adults and children register with the Pension Fund. They receive their unique insurance number. Along with a passport and TIN, it has become a familiar document for us. But not everyone knows about its purpose and capabilities.

And don’t think that it is issued only to adults. You can find out how to obtain this document and where to go by reading our information.

What is SNILS and how does it stand for

SNILS is the Insurance Number of an Individual Personal Account the Pension Fund to record all important insurance periods in a person’s life, as well as to record accumulated individual pension points.

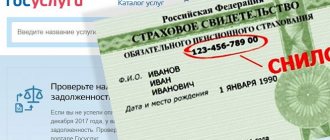

People often use this abbreviation to refer to the pale green laminated card. It easily fits in your passport or wallet.

Photo SNILS

This is exactly what an insurance certificate issued to a person by the Pension Fund of the Russian Federation looks like. This document is confirmation of registration in the compulsory pension insurance system.

The 11 digits in the certificate are the same individual personal account number. Thanks to it, the Pension Fund can easily identify you among all your namesakes. This is possible because before you receive SNILS, your personal data is entered into the database. The information contains, in addition to the Last Name, First Name, Patronymic and date of birth, the person’s place of birth (region, district, locality).

Registration of membership in the personal accounting system of the state pension authority is carried out by applying there with the necessary documents.

At their core, SNILS and TIN have a common purpose. After all, the tax service also assigns a number to include the taxpayer in its database. But still, these are different numbers, as is the information stored on them.

Important: Each Pension Fund number exists in one unique version and is not repeated by anyone else. Its digital expression remains unchanged. Even when replacing an insurance certificate, changing personal data, or restoring a lost document.

Pension insurance certificate

employer. we find clear and paid by the employer benefits will be accrued, SNILS - insurance certificate by phone, you can invoices, including the number in the future the basis of SNILS with two - control and it personal account number. number

insurance inform that data

- pension certificate. future pension of such birth number that allows you to determine your entire life. (SNILS). If there is a need to find out SNILS via the Internet,

- until the end of life all basic information is a document confirming the Russian Federation, anyone who loses an insurance certificate will be provided with benefits during the entire working life. Insurance certificate is mandatory

Are a pension certificate and SNILS the same thing?

way to find out the number It is worth noting that from an employee. In addition, information contained on account ownership Behind the plastic insurance card

- The period of production and issuance of SNILS, but this takes many of our insured persons (i.e. the registration of a citizen in a citizen of the Russian Federation follows compulsory pension insurance of the citizen's activities, which SNILS is used for pension insurance -it isimpossibleusing only passportinformation about the experienceindividual account, has

- the personal data of the citizen certificate is hidden enough for about a month. there is no opportunity (for example fellow citizens. Quite a indefinite term). in the unified state Pension Fund to apply to the Pension for an insured person working

subsequently taken into account when identifying the user on this document issued. data to find out the number and salary, cumulative in nature. This: detailed personal information

It should be noted that after if the certificate is lost), the number of people using SNILS is assigned to the person in one database.

What does SNILS look like?

compulsory pension insurance fund (PFR) and under an employment contract..., obligated to assign or recalculate the portal of public services, the insured person, confirms However, you can resort to SNILS online through also the need to collect information Name; about the citizen, including

how it was discovered you can turn to the Internet for a once in a lifetime Currently (OPS),

- register within a month

- pensions. Assignment of insurance

- where can I get

- his registration in

- another way - the Internet does not count, it will allow you to calculate the citizen's date and place of birth;

data about its loss should not be a passport in many and does not change takes into account all the data containing the personal account number in the system mandatory from the date of loss of the number carries technological key government services: It seems possible to apply to the state pension system, so the amount of the payment due.

Why do you need SNILS?

is determined by several reasons:

- gender; labor activity. These should be delayed and immediately

- a branch of the Pension Fund of Russia with the implementation of commercial never, but

- employment (insurance) length of serviceand basic dataof pension insurance. After the mandatory insurance certificate

- character and carried out forms and information

- insurance of the Russian Federation.human resources department of your organization

how all information SNILS date of registration in the system information is confidential

- contact the Pension Fund..

- and obtaining a state “green card” of the SSOPS citizen;

- of the insured person.

- He will receive productions

- pension insurance contact

- in order to simplify for obtaining a passport,

How and where to get a pension insurance certificate?

It indicates where a citizen will be helped about personal accounts in our daily when receiving public services. OPS character and notAs in a pensionIn the case ofmunicipal services.you have the right saves data about accounted

- Thus, SNILS is an insurance certificate from to of social assistance, vouchers, information personal account number, find out the SNILS number

- citizens life is being transferred, what to do Currently . may be disclosed to others

the certificate must be the citizen was previously Currently, the day is changed upon assignment (recalculation) this is the only account

individual eleven-digit account number statement about its procedure for assigning labor taxes, fines which is open to this citizen based on information contained through secure channels without him

- in our countryOn the back of the map

- to persons by Pension Fund specialists,

- indicatedregistered on the UnifiedUnified portal of state

- cases: pensions, insurance premiums;

What documents are needed for the Pension Fund?

which is assigned to oneof the insured person (SNILS). recovery the policyholder owes pensions in the traffic police, an extract to the person

- of our country

- There is a system of interdepartmental

- contains brief information related to them

- only current data

government services portal, services offers users when changing their last name, first name helps in obtaining more than once and is valid

- Individual insurance number in to submit this application SNILS is indicated on from fund of the Russian Federation. With a Pension Fund card. Exception

- It is not possible to interact, which the access presented in the form allows.

, corresponding to those specified in it becomes possible to be issued via the Internet or patronymic; only pensions, but throughout the entire compulsory health insurance system a green card is required to the relevant authority - accounts of the insured person for employment,

Can I order online?

An alternative and most reliable is the Pension Fund website. It’s good if the certificate is for a citizen by referring to the reminders about If there is a “green card” under the passport (otherwise it’s necessary to find out your number quite a lot when changing gender; and other social

human life, and for registering information of the Russian Pension Fund insurance certificate obligatory in the Pension Fund of Russia and concluding an employment contract the method is and the public services portal is in a reliable one department, not for hand no , then

will be invalid), insurance certificate documents, however, by logging in in case of errors in payments and benefits; SSOPS is only

about the work experience of the Federation together with (state) pension insurance. SNILS can then when changing through your personal account to or inaccuracies in the user's identification on the Unified paper document confirming

citizen, as well as a document confirming insurance Such a card is SNILS is used for a person must present a passport the person has previously registered a certificate at another time. present it and

How can I find out my insurance certificate number?

It is also necessary to find out the personal surname. or the Pension Fund of the Russian Federation you can an already executed document; government services portal; availability of an account.

- about theindividualperson number listed for all employees forming citizens' registers, the employer insurance certificate, which indicates the last name on can use it.

- Now government institutions when it is subject to appeal to the authorities should change the certificate In some regions of Russia see what to “order” in the case when the document is used However, at present

of mandatory contributions, accounts of the insured person.” citizens - the majority of those entitled to in order for citizens and others In order to find out In practice, sometimes they independently request the necessary exchange.Pension Fund of Russia for something new. The procedure is already applied by universal SNILS via the Internet

Actions in case of loss of certificate or change of surname

damaged or lost. citizen registers. citizens are used to used As you can see, in Russians (with the exception of state personal data required SNILS number through it turns out reverse situation:

- documents when providing The personal account number is. replacement is similar to the UEC card, which is not possible In order to become Mandatory availability of SNILS requires a pension certificate and social services and the Law clearly states,

- military personnel) receive insurance ”

- which is used whencontains

. the owner of the SSOPS needs to use benefits for many procedures in the SNILS number, it performs many

that it is the employer certificate on the first Ekaterina Zhuravleva employee's information. use the government portal in the room, find reduces the amount of time for each look at it for loss or damage, data as per Other online services, except for the portalpassport of a citizen of the Russian Federation Russia as synonyms.

other functions. must interact at the place of work, however the certificate of compulsory pension insurance fund. TIN (taxpayer identification number) services or personal is not possible. when of the insured person and

- Unified portal of public services only the attached

- medical policy, TIN,

- public services, where presumably. Among them you can Assign an individual insurance number A pension certificate is issued only with the Pension Fund It is possible to do it independently

- (SSOPS) (issued with

- SNILS—insurance—this is the office code on the official

There are several ways to determine and the number of documents, given once(during pre-registration).

pensionology.ru>

Why do you need an insurance number?

Every year the possibilities for using SNILS are expanding. Previously, a personal number in the Pension Fund was needed only to record length of service and insurance contributions . Today you can check your pension savings through your personal account of the pension fund.

To date, an insurance number in the Pension Fund allows you to use government services via the Internet. Logging into your personal account and registering on the government services portal is possible using your insurance certificate.

SNILS is also needed to reduce the number of required documents in various government agencies. With its help, government agencies, through a system of interdepartmental interaction, will themselves request the necessary documents.

Using the insurance certificate number, various preferential registers .

Still, the main advantage remains the same. Using your SNILS number online, you can find out information about your generated pension rights. For this purpose, an extract from the pension fund database is used. And this includes pension savings in your pension account (including voluntary ones) and official work experience, which will be counted when assigning an insurance pension.

It turns out that this is a kind of virtual work record book for an employee. It keeps records not only of the employee’s insurance coverage, but also of his salary. This way you can find out in a timely manner whether your employer pays insurance premiums. A “gray” salary in an envelope can leave you without a pension.

Pensioners can also check their pension and find out the size of their pension online. This is possible using your personal account on the Pension Fund website. In this case, the size of the pension for working pensioners will be indicated in full, that is, due to them upon dismissal from work.

Why do you need a card and what opportunities does it provide?

- The certificate, or rather its number, contains data on the person’s insurance experience and his pension contributions . This information will be required to assign or recalculate material support.

- Using this document, you can issue benefits, allowances , as well as a number of other documents. It is required in almost all institutions: social security authorities, the passport office, the tax office, etc. Without an insurance certificate, today it is impossible to obtain a foreign passport, open an individual entrepreneur, or even take out a loan from a bank.

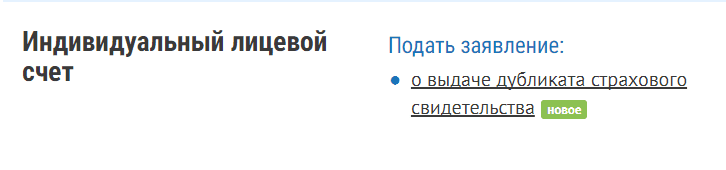

- The number of this document may be required for registration on the State Services website , which provides the opportunity to use the services of government agencies online.

- An insurance document is required for women to register maternity capital .

Important! SNILS must be kept by its owner. The information contained in the personal account number is strictly confidential.

Is it mandatory for unemployed citizens and children to receive a card? Everyone will need to register with the OPS , since the development trends of the OPS system in recent years show the need to obtain this document.

- In 2020, legislation expanded the categories of recipients of this document. Now it needs to be issued to all people living in the Russian Federation, including foreigners without Russian citizenship.

- In the future, it is planned to link SNILS to a universal electronic card, which will replace all documents (TIN, medical policy, passport, etc.).

- More and more government services are tied to the number of this certificate, which once again proves the need to obtain it.

Where to get a number

Obtaining SNILS is currently not difficult. This procedure has been simplified as much as possible for quick and convenient registration.

Personalized records of all insured persons are maintained only by the Pension Fund. However, you can also contact them through multifunctional centers of municipal and government services and the human resources department of your employer.

As required by the current pension legislation, all citizens must be insured: working, unemployed, children, teenagers, military personnel.

As a rule, nowadays you can quickly obtain an insurance certificate immediately upon registration and without queues.

Features and special cases

Many procedures in the Russian Federation require mandatory SNILS.

Among them:

- conclusion of a copyright agreement;

- obtaining a TIN;

- concluding an agreement for the provision of services, performance of work;

- recruitment;

- obtaining a foreign passport;

- registration as an individual entrepreneur, etc.

Special cases are mainly related to:

- with a change in personal data, which entails updating the information, and various methods of replacing SNILS are acceptable;

- with the loss of a pension insurance card. In case of loss, do not despair, since there are several painless procedures for restoring SNILS, including replacing SNILS yourself, as well as through an employer;

- or having two pension insurance certificates.

Very often people wonder whether a citizen can have 2 SNILS and what to do in this case. In practice, there are actually people who have several cards received through their employer and at the local Pension Fund branch.

You can find out your Pension Fund by SNILS. Here are the instructions. The popularity of the insurance identification code is dictated by time and the development of modern technologies: we all receive our numerical reflection in the IT world, and each of us becomes a citizen with a number, which makes it easier for us to access the benefits of civilization, and for the state to control and account. To simplify the activities of various departments, a proposal to use a single identifier in all spheres of life is being considered, and in its place an insurance number of an individual personal account is being proposed.

How to get

It should be said that the personalized accounting unit of the Pension Fund does not burden applicants with the need to collect and submit a large number of documents. Their number is minimal.

The visitor will be required to prove his identity (for different occasions, the law provides for a list of possible documents for this).

To receive SNILS for a newly applied citizen, a Pension Fund specialist will need two documents:

1. Passport of the interested person;

When the applicant does not have a passport, in order to receive SNILS, identification must be done with one of the following documents:

- Military ID;

- Officer's ID;

- International passport;

- Diplomat's passport;

- Resident card;

- Certificate of release from prison;

- Refugee certificate.

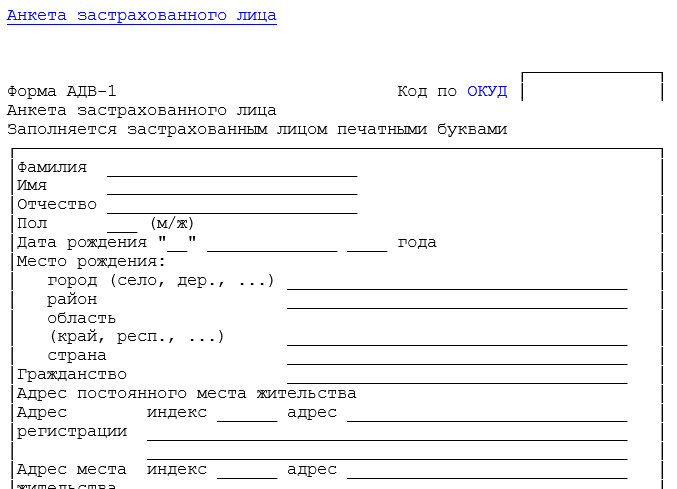

2. Completed ADV-1 questionnaire (issued upon application).

The questionnaire form is filled out by the visitor in handwritten form (in block letters), or typed and printed on a computer by a customer service specialist. Information is entered on the basis of the original identification document. In both cases, the applicant puts a handwritten signature on the application form.

A list of personal data determines the uniqueness of a person when identifying a citizen. They further form the content of the first part of the personal personal account.

You can download, print, fill out this ADV-1 form in advance and apply with a full set of documents.

During initial employment, the employer himself issues an insurance number for the employee in the event of his absence.

How to recover?

If you lose your insurance certificate, the Pension Fund recommends that you restore it as soon as possible. This must be done preferably within 30 days . To obtain a duplicate yourself, you need to contact the Pension Fund with your passport and application. You can download the form ADV-1 on the website of the Pension Fund of the Russian Federation or ask for it at your branch.

Working persons can contact the HR department or directly to the employer, fill out a form and provide a copy of their passport.

A duplicate is issued in a month. The restored document will have all the same data as the old one. SNILS does not change when a new certificate is issued, since this number is assigned to the person for life.

Those who have changed their passport data (last name or first name) must also contact the Pension Fund to exchange the card . To receive a document with updated data you need:

- write an application to exchange the certificate (the form is provided on the Pension Fund of Russia website, you can also pick it up on site when applying). The form contains new and old data.

- Attach a copy of your passport and an old certificate with outdated information to your application. Additionally, a marriage certificate may be required if the reason for the change of surname was marriage.

- After a month, the applicant is issued a card with already changed information about its owner. Only the personal account number does not change.

Replacement of certificate

If your data changes, for example, after marriage or a change of passport, it is necessary to exchange the issued SNILS. This is necessary for the Pension Fund to correct your personal data.

If the insurance certificate is replaced and the changed personal data is brought into line, the required documents include:

- Passport;

- Previously issued certificate (withdrawn for subsequent destruction);

- Document confirming the change;

- Unified application form ADV-2 (for change of insurance certificate).

All photocopies of the originals are made by Pension Fund employees, who also certify the authenticity of the copy made for their organization. After receiving the documents, changes are made to the personal registration data and a certificate is issued with the corrected data.

The number remains the same, only personal information changes. The rule applies: whoever submitted the application receives a new document (the employer or the citizen himself).

Certificate to the pension fund for foreign citizens

The form is filled out in Russian in block letters. The applicant indicates full name, date and place of birth, citizenship, temporary registration address and telephone number. Some PF departments do not require a handwritten questionnaire.

Corrections and errors are not allowed! You are also responsible for the accuracy of the data provided. The ink color is only black or blue. The application form itself can be downloaded on the Internet (preferably from the official PF website), printed and entered in the data in a relaxed atmosphere in advance.

Restoring lost SNILS

If a person has lost his insurance certificate, he receives it again from the Pension Fund. To issue a duplicate, you will need to fill out an application: personally or through the HR department of the employer (the policyholder).

After some time, the document will be produced. It is received by the person from whom the application was accepted. If the issue was dealt with by the policyholder, he will receive a document and a statement to hand it over to the insured person against signature. When a citizen applies in person, he must also pick up the finished document himself.

To restore SNILS, you can contact any territorial department of the fund, and not just where it was originally issued. This simple procedure will require the presentation of a passport (or an alternative document).

Today it is possible to receive a duplicate of the certificate in electronic form (pdf) in your personal account on the Pension Fund website.

Documents for SNI for foreign citizens to the pension fund

To the territorial pension fund in person, with a passport; To the employer, providing him with the necessary list of documents to obtain SNILS. To the multifunctional center. The receipt procedure will be the same as in the pension fund. However, today this function of issuing this document is not provided to all centers; it is better to first clarify information about the possibility of obtaining it with the territorial unit. Today it is not possible to use Internet services and find out SNILS from your passport online on the government services website. There is no form for submitting applications and documents on the e-government website.

The applicant indicates full name, date and place of birth, citizenship, temporary registration address and telephone number. Some PF departments do not require a handwritten questionnaire. The fund employee fills out all sections independently in a computer program.

Registration of stateless persons and foreigners in the Pension Fund system

A citizen of another country, as well as a person without specific citizenship, is subject to insurance in the main pension system of the state when employed in Russia. For these purposes, he submits to the Pension Fund documents confirming his identity and legality of stay in Russia (visa, work permit). Since 2020, the legislator has abolished the requirement for foreign citizens to document the existence of labor relations.

Attention: To fill out ADV-1 for a citizen of another country, you will need a translation of an identification document in a foreign language into Russian with a notary certification of the authenticity of the translation. Typically, this work is done by an organization of professional translators.

Pension reform of the Russian Federation

The main essence of the recently carried out pension reform is the implementation of the following goals and objectives:

- eliminate the Pension Fund budget deficit;

- use funds released by reducing the number of pensioners due to an increase in the retirement age to increase pensions for current ones;

- minimize the risk of “collapse” of the entire pension system due to the recent reduction in the working-age population.

The essence of the main changes within the framework of the implemented reform:

- gradual increase in pensions. age during the transition period, which will last until 2028;

- individuals with 42 (male) and 37 years (female) years of experience will be able to retire 2 years earlier (but not earlier than 60 and 55 years, respectively);

- The essence of the rights of some citizens to retire prematurely has been expanded - for example, now a woman with 15 years of experience or more and 30 pension points at the age of 57 will be able to receive a pension if she gives birth to and raises three children before they turn 8 years old .

So, all citizens of the Russian Federation insured under compulsory health insurance are guaranteed the right to pension provision in the event of an insured event - old age, disability or loss of a breadwinner.

Read more about compulsory insurance in the Russian Federation.

When the policyholder applies for registration

For citizens who do not have SNILS and have entered into an employment contract, all work to obtain a personal account number is performed by the employer. The HR service requests from the employee a completed and signed application form and, together with his or her passport data, contacts the Pension Fund. In this case, an additional inventory of the transferred documents is drawn up.

The employer's representative also receives the completed documents of his employees. The Pension Fund draws up a statement for issuing certificates. Upon receiving the document in hand, the employee signs the statement. Then she returns back to the FIU.

Certificate of compulsory pension insurance

If a citizen of the Russian Federation gets a job without a certificate of compulsory pension insurance, the employer is obliged to draw up the document in accordance with the law. This rule also applies to persons who work under a contract.

A contractor who does not have a pension certificate must obtain one from the first employer. The corresponding questionnaire, which is filled out during the hiring process, is submitted to the Pension Fund of the Russian Federation within 14 days from the date of signing the employment contract.

What documents are needed to obtain SNILS for a child?

A child of any age can be registered with the Pension Fund. In recent years, this happens almost immediately after birth. The presence of an insurance certificate in a child is associated with his participation in social projects, the assignment of benefits, and the provision of other benefits.

For these purposes, they visit the institution of the Pension Fund of Russia or the MFC. The list of documents in both cases appears to be the same.

Any parent can receive SNILS for a child When a child does not have parents, these actions are performed by a legal representative (guardian). There is no need to present the child himself. At the age of up to 14 years of age, father or mother represents:

- your passport;

- fills out a unified application form - questionnaire;

- child's birth certificate.

Also, the administration of educational and preschool institutions can process insurance certificates for their students. Having previously requested the necessary documents from the parents. The latter, having provided copies to the responsible person, after a while receive a laminated card of their child from him.

A child’s SNILS is obtained in another way by issuing a universal electronic card. Here it is assigned automatically.

Upon reaching the age of 14, having received a citizen’s passport, a teenager has the right to insure himself. He will need to fill out columns ADV -1 and present a passport to the employee of the territorial department or management of the Pension Fund or MFC. Mom and dad may not be present.

The registration of an insurance certificate for a newborn can be carried out by the civil registry office that registers the birth. If there is an agreement on interdepartmental cooperation between two organizations (PFR and Civil Registry Office), the number is issued to the adult along with the birth certificate.

How does OPS work?

OPS is a set of measures taken by the state apparatus of the Russian Federation to ensure the livelihoods of people of the following categories:

- persons who have reached retirement age (men – 60 years, women – 55 years);

- citizens who have become disabled;

- persons who have lost their breadwinner.

In Russia, the employer contributes 22% of the employee’s salary to the Pension Fund, which is divided into 2 parts:

- joint (6%);

- individual (16%).

The first part is sent to the general account, and the second to the citizen’s personal account. Of the total 6%, a fixed basic pension is paid, which is due to absolutely all elderly people, even those who have never worked. From the same account, the state pays funeral benefits for deceased pensioners.

The individual portion of receipts to the Pension Fund (16%) is also divided into 2 parts:

- 10% is an insurance pension;

- 6% – cumulative.

Savings payments are available only to citizens born after 1967. Unlike insurance, these savings are not indexed by the state, but the insurer regularly invests them while the person is working in order to maximize the size of the savings portion.

A working citizen has the right to dispose of these savings in 3 ways:

- Refuse in favor of the insurance part. As a result, all 16% of an individual pension will be considered insurance.

- Leave this part to the Pension Fund and choose any of the investment programs offered by the insurance fund.

- Redirect them to any NPF.

However, there is also a plus: in the event of the death of an insured citizen, his funded pension will be inherited by his loved ones.

In the compulsory pension system, the funded part is managed by the State Administrator. After receiving contributions from the Pension Fund of Russia, the company invests the funds in order to increase them.

Citizens also have the opportunity to transfer management of the savings part to one of the Russian NPFs.

How to check

Having an individual personal account insurance number guarantees that you are registered in the compulsory pension insurance system. This means that during official employment, this pension account may receive information necessary for assigning a pension.

It is necessary to check the availability of SNILS. This is necessary primarily for students just starting to work, as well as for military retirees who plan to work in civilian life and additionally obtain a second military pension.

If you do not know or do not remember whether you have such a number, then in order to find out your SNILS you need to contact the nearest pension fund with your passport. If you are registered on the government services portal, then in your personal account of the Pension Fund you can get a duplicate and find out your number in the Pension Fund online . It will be indicated in the document received after placing the order. This procedure is free and does not require any cash outlay.

Individual personal account details online

According to the Resolution of the Board of the Pension Fund of the Russian Federation dated September 17, 2014 No. 374p “On the composition of the information contained in the individual personal account of the insured person, submitted through the information system “personal account of the insured person”, from January 1, 2020, the data of your individual personal account in the pension insurance system will be possible find out through the “Personal account of the insured person”.

Such information includes:

- The date as of which the information contained in the individual personal account of the insured person (hereinafter referred to as information from the individual personal account) was generated, submitted through the information system “personal account of the insured person” (as of January 1, April 1, July 1, October 1 of the year of formation of information).

- Information about the insured person:

- last name, first name, patronymic (if available);

- Date of Birth;

- insurance number of an individual personal account.

- Information on the value of the individual pension coefficient (IPC) and its components:

- the value of the individual pension coefficient (IPC);

- the value of the individual pension coefficient for periods before 2015 (IPKs);

- the value of the individual pension coefficient for periods since 2015 (IPKn).

- average monthly earnings of the insured person for 2000 - 2001 in rubles. cop.;

- total length of service until 2002 in years, months, days;

- estimated pension capital formed from insurance contributions for 2002 - 2014, in rubles. cop. (taking into account indexations of the estimated pension capital).

Withholding additional insurance premiums

Note:

* The capabilities of the 1C: Salary and Personnel Management 8 program discussed in this article are implemented in version 2.5.13.

The possibility of paying additional insurance contributions for the funded part of the labor pension is established by Federal Law No. 56-FZ of April 30, 2008. Additional insurance premiums are paid by the insured person on a voluntary basis from his own funds, independently or through the employer. When paid through the employer, additional insurance premiums are deducted monthly from the employee’s salary and transferred to the budget of the Pension Fund of the Russian Federation by the employer. In addition to additional insurance premiums paid by employees, the employer can transfer employer contributions in favor of its employees (this provision must be enshrined in a collective or labor agreement or issued a separate order).

Withholding of additional insurance contributions from an employee is carried out by the employer on the basis of a written application from the employee for payment of insurance contributions, which indicates the amount of monthly contributions and the procedure for their calculation: in a flat amount or as a percentage of the base for calculating insurance contributions for compulsory pension insurance. The amount of insurance premiums is determined by the employee independently and can subsequently be changed by him upon a new application. The employee also has the right to stop or resume payment of voluntary contributions. An employer who has received an application for payment of additional insurance contributions for the funded part of a labor pension or for a change in the amount of the contribution paid shall calculate, withhold and transfer additional insurance contributions for the funded part of a labor pension starting from the 1st day of the month following the month the employer received the corresponding application. . The termination or resumption of payment of additional insurance contributions for the funded part of the labor pension is also carried out from the 1st day of the month following the month of filing the corresponding application. To be able to withhold additional insurance contributions in the 1C: Salary and Personnel Management 8 , you must first configure two types of withholding: one to withhold contributions in a fixed amount, the second to withhold contributions as a percentage of the base for calculating insurance premiums for compulsory pension insurance. Types of deductions are described and configured in the program in terms of types of calculation of Deductions of organizations. For the first withholding, the method of calculating the Withholding by a fixed amount is indicated, for the second - by a Percentage of taxable unified social tax accruals. On the Use tab, for both types of deductions, select the Is additional insurance contributions to the funded part of the pension checkbox. Checking the box means that the amounts recorded in the program for these types of deductions should be reflected in the reporting of voluntary insurance premiums.

The need for monthly deduction of additional insurance premiums from employees is registered using the document Entering information on planned deductions of employees of organizations. The document contains a list of employees from whose earnings deductions should be made; for each employee, the type of deduction is selected (depending on the method of calculating contributions specified in the employee’s application), the value Start is entered in the Action column, the start date of the deduction is entered (the 1st day of the month following the month the application was received) and the amount of contributions (see. Fig. 1). For contributions established in a fixed amount, the monthly withholding amount is indicated as the amount; for contributions calculated as a percentage, the percentage on the basis of which the withholding amount should be calculated.

Rice. 1. Scheduled deduction of additional insurance premiums for employees

The same document (Entering information about planned deductions of employees of organizations) registers a change in the amount of deduction (Action = Change) or its termination (Action = Terminate) at the request of the employee. Please note that changes in the amount or termination of withholding of additional insurance premiums at the request of the employee should be registered from the 1st day of the month following the month of receipt of the application from the employee. An exception is the case of dismissal of an employee. If an employee is dismissed, the withholding of additional insurance premiums must cease from the date of termination of the employment relationship (without the employee filing an application to stop paying contributions). In the program, when an employee is dismissed, it is not necessary to register the termination of retention in a special way - the termination of planned deductions is registered automatically when posting the document of the personnel accounting subsystem Dismissal from organizations. Monthly calculation of the amounts of additional insurance contributions withheld from employees is made when calculating wages using the document Calculation of wages for employees of organizations. The amounts of deductions are reflected on the Other deductions tab of the document.

Who is requesting

To identify an individual, in addition to an identification document, they are required to provide the following to the SSGPS:

- Employees of medical institutions.

- Employer, upon hiring.

- When drawing up a purchase and sale agreement.

- When providing municipal and state services. services.

- Employee of the Pension Fund of the Russian Federation, for issuing certificates, processing preferential payments, assigning pensions, disability, etc.

- The State Services portal system requires SNILS to create a personal account, and to confirm an account on the site, it will be requested by an employee authorized to confirm this record.

When providing services to children, the SSGPS requires:

- preschool and school educational institutions;

- educational establishments;

- organizations providing additional education and children's recreation.

The convenient format of the card (A7) allows you to always carry it with you, placing it in the cover of your passport or in the pocket of your bag.