Pre-retirement people are a new status of Russians, defined in 2020 by national pension legislation in the context of an increase in the retirement age. Such persons in modern Russia include people who have 5 or less years left before retirement in old age, including citizens who have grounds for a preferential labor pension. The concept of such a civil status is clearly formulated or reflected in the form of a number of advantages in the main areas of law. Which ones should be read further.

How to apply for pre-retirement status

You should receive a document classifying yourself as a pre-retirement person at the regional branch of the Pension Fund of the Russian Federation at the place of registration of the status applicant. You can order a certificate:

- through MFC.

- at your local social security office.

- on the State Services portal.

- on the PFR website.

In any case, you will need to submit the original and an electronic copy of the following:

- • passports with registration.

- • SNILS.

- • certificate of title of veteran of labor or military service.

- • power of attorney when issued through a representative.

Obtaining a certificate through electronic services is as convenient as possible, since you do not need to personally visit the MFC or the social security department and the Pension Fund. The legal force of a document on paper and electronic media is the same. In the latter case, it is supported by the electronic signature of the official.

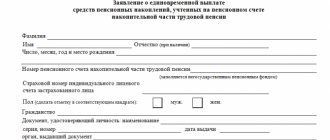

The document on the status of a pre-retirement person indicates:

- • Full name and date of birth of the person.

- • SNILS.

- • information about the requested category and the time of transition to the pensioner state.

- • basis, date of issue and who issued the paper.

- • organization – the recipient of the document.

A document in “PDF” or “XML” format, after filling out the information provided in the form after verification by the system, will be sent to the email address specified by the applicant within a few minutes. If applied in person, it will be issued during the working day.

How and where to get a pre-retirement certificate

A useful document that can confirm citizenship status. It is an official document and has the seals of the relevant institutions.

It’s easy to get help ; all you need is a computer with a working Internet connection:

1. First, a citizen must register by opening the State Services portal. Through it, most services for providing statements, certificates and necessary information are carried out remotely.

2. Then open PFRF.RU - the official website of the Pension Fund . Log in there by logging in through your State Services account.

3. You need the “Pensions” , there – “Order a certificate “extract”. Next is the tab: “on classifying a citizen as a citizen of pre-retirement age.”

4. You must indicate the key parameters of your request:

· designate the institution where the certificate is needed. For example, the Federal Tax Service, the employer company or the employment service;

· the user wishes to receive the finished file by letter to his personal email.

5. Having completed the procedure, click: “Request” . A window will appear where you need to click on: “Call History”. All that remains is to save the document: “help in PDF format”.

Citizens are not required to provide employers with such certificates. Those can request the paper themselves by contacting the Pension Fund.

Other options. The classic ways to get an extract are to visit the Pension Fund with a passport or the MFC. Managers can clarify the purpose of the request. The procedure is simple and happens quickly.

Benefit for pre-retirees.

The list of nationwide benefits for pre-retirees includes:

- • Protection from dismissal from work (Article 144.1 of the Criminal Code of the Russian Federation).

- • Increased unemployment benefits (RF Government Decree No. 1375).

- • Early retirement 2 years before the due date (Article 32 of Law No. 1032-I “On Employment in the Russian Federation”).

- • Additional (second) day for annual medical examination (Article 185.1 of the Labor Code of the Russian Federation).

- • Additional vocational training (Order of the Government of the Russian Federation No. 3025-r).

- • The right to a funded pension (Law No. 424 Federal Law).

- • Reason for receiving child support (Article 169 of the RF IC).

- • Mandatory part of the inheritance (Article 1149 of the Civil Code of the Russian Federation).

- • Privileges for property and land taxes (Articles 391 and 407 of the Tax Code of the Russian Federation).

At the same time, in each of the Russian subjects, various additional benefits for pre-retirees have been established at the local level, which should be found out in the regional divisions of the Pension Fund, Federal Tax Service or Social Security.

Pension Fund - employer - employee

In order for an employee of pre-retirement age to take advantage of benefits, the employer must promptly submit information to employment centers (Rostrud letter No. 858-PR dated July 25, 2018).

The Pension Fund will rely on this data to determine the legality of providing benefits to citizens and compensation to employers, for example, for employee training. Why is this necessary? If an employee retires on a general basis, determining the pre-retirement age is simple - subtract five years from the 55 or 60 specified in the law. And if there are grounds for early assignment of a pension (work in the North, on preferential lists, etc.), it is easy to make a mistake. In addition, the next three years will be transitional; the boundaries of the retirement age will shift. Therefore, the employer needs to conclude an additional agreement with the Pension Fund on information interaction to the previously signed document “On the exchange of electronic documents in the electronic document management system of the Pension Fund of Russia via telecommunication channels.”

For his part, an employee who has reached pre-retirement age must issue a certificate giving the right to benefits (Resolution of the Board of the Pension Fund of the Russian Federation dated November 29, 2018 No. 464p). You can contact the Pension Fund branch, leave a request at the MFC or on the State Services website. Within one working day, the employee will receive an electronic document or refusal explaining the reasons.

Don’t forget to submit information so that your employees don’t have problems applying for the benefits they are entitled to.

Guarantee against dismissal of a pre-retirement employee

In order to exclude the possible dismissal of an employee for discriminatory reasons related to reaching pre-retirement age, Article 144.1 was introduced into the national Criminal Code. The law provides for an employer who infringes on the rights of a pre-retirement employee by unjustified refusal to hire or unjustified dismissal for the same reason, punishment in the form of:

- • a fine of up to 200 thousand rubles.

- • penalties in the amount of the perpetrator’s salary for a period of up to 1.5 years.

- • forced labor lasting up to 360 hours.

Investigative authorities can also bring an employer to criminal liability if they prove that a pre-retirement employee was forced to leave work due to age, using the phrase “at his own request” that is convenient for the employer.

At the same time, in practice, proving a violation of the law by an employer precisely for these reasons is quite problematic. You will have to present reasoned arguments supported by audio or video recordings, testimony of witnesses to discriminatory actions and statements, and various business papers.

Therefore, in legal practice, the working norm is to bring the employer to administrative liability under Article 5.27 of the Code of Administrative Offenses “Illegal dismissal.” After all, people are hired and fired based on their qualifications and professional knowledge, and not on the basis of reaching a certain age.

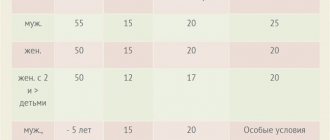

Unemployment benefit. In accordance with Law No. 1032-I “On Employment in the Russian Federation,” the minimum and maximum benefits for the unemployed are established annually by the national Government. In 2020, Resolution No. 1375 determined the following amounts of the specified payment for unemployed pre-retirement workers:

- • The smallest – 1.5 thousand rubles.

- • Limit – 11.28 thousand rubles.

At the same time, the allowance for ordinary Russians left without work is 8 thousand rubles.

Also, Article 34.2 of Law No. 1032-1 stipulates that the period of such subsidies for pre-retirees is 12 months in each of 18 months. As a result, a person of pre-retirement age receives benefits for a whole year. Then for six months he doesn’t receive any, and then follows the same pattern. For citizens who have an insurance period of 20 years for women and 25 years for men, such benefits are payable for up to 2 years in a period of 3 years.

The payment amount is calculated as standard. A pre-retirement worker who has worked at least 26 weeks will have to receive the following amount from the average monthly income at the last place of work:

- • 75% – first 3 months.

- • 60% – next 4 months.

- • 45% remaining period.

It should be remembered that the specified monthly payment cannot exceed the established maximum of 11.28 thousand rubles. If you work less than 26 weeks, the benefit amount will be minimal. The amount of the payment is subject to indexation by the value of the regional coefficient, if any.

Benefits are calculated according to the general rules for a pre-retirement person if:

- • Have not worked in the last year.

- • Dismissed or expelled from school for violations.

What benefits can you expect?

The law on raising the retirement age was adopted on July 19, and in November it was amended, including those concerning those citizens for whom retirement was delayed by 5 years.

A number of privileges and social guarantees can already be judged now. For example, those preparing to retire will receive a full package of benefits on the same basis as pensioners. This concerns a reduction in payment of housing and communal services tariffs, preferential travel on public transport, the provision of medicines, a reduction in the tax base and a complete exemption from taxes on one property (apartment, house, garage).

In addition, pre-retirement people will be subject to the rights of persons of retirement age to inherit and receive alimony payments from able-bodied adult children. In March 2020, pre-retirees were equal in alimony rights to pensioners.

Most of the laws introducing appropriate changes to the current legislation have already been signed by the President of the Russian Federation. All of them began to operate on January 1, 2019.

According to the government, providing future retirees with non-material benefits is the most painless stage of the adopted reform. This statement is motivated by the fact that the provision of a package of social benefits will be assigned to the regional budgets and will not affect the financial base of the Pension Fund.

In addition, employees of pre-retirement age will be offered a free medical examination, for which 2 paid days will be allocated annually.

Attention! The benefits listed above for pre-retirees will only be valid during the transition period of pension reform, that is, until 2028. After this date, benefits will be available exclusively to pensioners.

A separate line is the right to early retirement, which pre-retirees can receive if certain conditions are met. To understand this issue, you need to have an understanding of the basic concepts. For example:

- unemployed - a person who is not engaged in labor activity and is registered with the Employment Center;

- early retirement - applying for pension benefits ahead of schedule, if there are grounds for this;

- impossibility of employment - lack of suitable work on the vacancy market.

If the above conditions are met, the citizen can apply for a pension early. As noted, this requires reasons. These may be considered:

- Persons with insurance experience: women - at least 37 years, men - at least 42 years. According to amendments to Article 8 of Federal Law No. 400-FZ, an insurance pension can be assigned 2 years earlier.

- Mothers with many children who gave birth and raised 3 children up to the age of 8 have the right to a pension at 57 years of age, 4 children have the right to a pension at 56 years of age (Article 32 of Federal Law No. 400-FZ).

- At the suggestion of the Employment Center service. There is a confirmed unemployed status: a certificate from the Employment Employment Center indicates that the citizen is not engaged in labor activity and has no source of income, but is interested in looking for work and is ready to start it. The impossibility of employment is also confirmed by a certificate from the Employment Center, which states that there is no suitable position on the vacancy market.

In addition, an early pension can be granted only with the consent of the citizen, and provided that no more than 2 years remain before the old-age pension is assigned. Taking into account the president’s proposal for additional guarantees for people of pre-retirement age, the period for applying for an early pension may increase to 5 years, without changing the other grounds.

Early retirement for a pre-retirement person

A preferential opportunity for a pre-retirement pensioner to retire earlier than the established period is possible in the following 5 cases:

- • 2 years left until you become a pensioner.

- • Has a long work history.

- • There is the title of mother of many children.

- • Dismissal 2 years before retirement.

- • Availability of “hot” experience.

In the first option, the lenient regime established for 2020 and 2020 allows persons who were eligible for the old-age pension under previous conditions to receive a pension six months earlier than the deadline established under the new rules.

In the second case, if the person has completed work experience:

- • 37 years – for women.

- • 42 years – for men.

Thus, if the specified parameters are present, citizens received the right to an old-age pension 2 years earlier than the age determined for the rest. However, at the time of registration of status, you must be at least 55 years old for women and 60 years old for men.

In the third situation, it is necessary to give birth to 5 children and raise them until they are at least 8 years old. Then, with 15 years of insurance experience, a woman will be able to retire at 50 years old. Also, subject to the above conditions, bonuses are provided for mothers who give birth:

- • 4 children – pension 4 years earlier.

- • 3 children – 3 respectively.

In the fourth variation, the grounds for dismissal must be:

- • Staff reduction.

- • Liquidation of the employer.

In this case, the pension is assigned after appropriate submission from the employment center unit.

The fifth option is traditional for people who have worked for a certain period in positions that provide a “hot” network.

Regional benefits

The authorities of all regions of the Russian Federation have officially stated: all benefits available to pensioners apply to pre-retirement people (55 years old for women, 60 years old for men):

1. Reduced/free travel – public city/suburban transport, sometimes intercity. Except private taxis.

2. Transport tax – benefits are established separately by region. Usually this is a 50% reduction in taxation for cars with a 100-150 hp engine. power.

3. Social norms regarding utility bills - relevant for PPs who live with elderly (70-80 years old) relatives.

4. Labor veterans – PPs may have this status.

5. Dental prosthetics and other services. For example, installing a telephone, installing cable television.

Citizens apply for most benefits through social security by submitting applications there. Or visiting the MFC.

A passport is enough to confirm your PP status. The pension fund itself will transfer the necessary information about the citizen.

Extra day for medical examination

Pre-retirees are entitled to 2 days of annual medical examination, which are paid for by the employer. For other employees from 21 years of age - 1 day every 3 years.

To receive bonus days, a pre-retirement person needs:

- • Agree them with the employer - submit a corresponding application.

- • Confirm the completion of medical examination with papers from the medical institution to which he is assigned at his place of residence.

It is not allowed to simply not show up for work - there will be absenteeism.

Additional vocational training

A person of pre-retirement age who wishes to be in demand in the labor market has the right to professional retraining within the framework of the national project “Demography”.

Studying, or rather “enriching” existing skills, must be organized by a local employment center, which must also pay an appropriate stipend in the amount of the minimum wage established in the region. To do this, you must submit a corresponding application.

The right to a funded pension. In 2020, the legislator left the same age for citizens to receive a funded pension arising from employer contributions, personal contributions and investment profits: 55 and 60 years, respectively, for women and men.

There are, according to Law No. 424 - Federal Law “On Funded Pension”, 3 options for such payments:

- • One-time.

- • Urgent.

- • Monthly.

A situation where the calculated amount of the funded part of the pension is 5% or less of the old-age pension allows you to receive all your savings one-time. In case of urgent payment, savings will be issued within 10 years. In the latter option, the size of the savings part is determined by attributing the savings made to 252 months. When the received value is more than 5%, the pre-retirement pensioner receives the right to unlimited monthly payments.

Let's limit the circle of people

So, pre-retirement citizens are considered to be citizens who have no more than five years left before reaching the age that gives them the right to receive an old-age insurance pension. That is, these are women at 55 years old and men at 60. Therefore, pre-retirement age is how many years (Russia)? This is a period not exceeding five calendar years preceding the onset of the right to an old-age pension.

Let us remind you that now you can retire when you reach the age of 60 for a woman, and 65 for a man.

Example.

Morkovkina Anna Petrovna 30 years old (born in 1988). She will be able to apply for an old-age insurance pension only at 60 - in 2049. Consequently, A.P. Morkovkina is a pre-retirement pensioner. will be counted from the achievement of the 55th anniversary, that is, in 2044. And all five years, from 2044 to 2049. Morkovkina will be of pre-retirement age, which gives her the right to certain benefits. Of course, if the current legislation does not change its provisions.

As a result, any citizen who has five years or less left until retirement can safely be considered a pre-retirement person. Please note that we are talking not only about the state old-age insurance pension, but also about a pension that is assigned ahead of schedule.

For example, if the same Morkovkina has the right to early registration for a well-deserved rest, then the five pre-retirement years will be calculated from the date the right to a pension arises.

Right to alimony

The legislator has established the right of pre-retirees who need financial support to child support in paragraph 8 of Article 169 of the RF IC. However, this need will need to be proven in court.

Therefore, in order not to spoil relationships with adult children, for many the best option would be to conclude a voluntary child support agreement.

Mandatory part of the inheritance. This benefit allows a pre-retirement person, regardless of the nature of the will, to receive at least half of the property that would be due to him upon inheritance by law. The allocation of inheritance comes from the entire mass of inherited property, both willed and not, which the pre-pensioner would have received based on the order of inheritance. All manipulations are carried out in accordance with the procedural rules and deadlines established for inheritance.

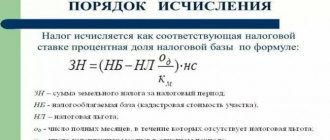

Tax privileges

Pre-retirees were equated to actual pensioners, providing privileges to pay:

- • Real estate tax.

- • Land tax.

- • Transport duty.

In the first case, you can avoid paying tax on 1 object from each category:

- • Residential building (part of a house).

- • Apartment (room) or part of a given residential premises.

- • Garage (space for a car).

- • Studio, workshop or other premises for creative and other purposes.

- • Buildings for economic purposes up to 50 square meters.

According to the land tax, a pre-retirement person may not have to pay for “6 favorite acres.” Transport tax is the responsibility of regional authorities. As a rule, this is an exemption from the fee for 1 car, including based on the vehicle engine capacity limit.

Registration of tax privileges due to a pre-retirement pensioner, which are exclusively of an applicant nature, takes place at the tax authorities at the place of registration.

What support measures have been taken

Let's consider what social guarantees the state plans to offer to Russians of pre-retirement age as part of the reform.

Benefits

First of all, it should be noted the planned and implemented (by enshrining the relevant legal norms in the current legislation) increase in unemployment benefits.

Proposing to make adjustments to the pension reform, the president noted that it is difficult for people over 50 to find decent work in the employment market, which has long been restructured for young professionals. Of course, this problem needs to be solved at the state level, but it will take more than one day. Therefore, already in April 2020, the Ministry of Labor developed and submitted for consideration a bill providing for an increase in unemployment benefits. And in November 2018 it was adopted. According to the Decree of the Government of the Russian Federation dated November 15, 2018 No. 1375, it is established: the minimum amount of unemployment benefit is 1,500 rubles, the maximum amount of unemployment benefit is 11,280 rubles - for duly recognized unemployed citizens of pre-retirement age. For 2020, the amount of 11,280 rubles was also established for the minimum wage.

As part of the bill from the Ministry of Labor, it was proposed to shorten the period of payment of unemployment benefits, thereby equating their size to the cost of living. Let us note that today, benefits can be paid for 36 months if a citizen is registered with the Employment Center and is considering vacancies for employment.

At the same time, payment periods for other unemployed citizens were reduced to 6 and 3 months. And for pre-retirees they were left at the level of 12 months (according to the general rules) with the possibility of extension by 2 weeks for each year of overtime in excess of the established insurance limit. But no more than 24 months.

Possibility of retraining

Labor Minister Maxim Topilin said that it is planned to allocate 5,000,000,000 rubles from the state budget to open retraining and advanced training courses for people of pre-retirement age.

Training in such centers will be conducted throughout the entire period of pension reform. The following ministries will take part in this program:

- education;

- industry and trade;

- economy and development.

In addition, the Ministry of Labor, represented by Maxim Topilin, promised to annually compile a list of the most in-demand professions and skills that can be trained in the newly opened centers. It was also noted that there was comprehensive support for pre-retirees who decided to try their hand at entrepreneurship.

By mid-October 2020, the Ministry of Labor presented a draft special program for advanced training and retraining of people of pre-retirement age. According to the provisions of such a program, it involves 3 stages:

- 2018 – creation of regional coordination bodies to identify priority areas for vocational training of pre-retirees in accordance with the needs of the labor market. It is also planned to inform citizens, tenders for the purchase of services, the formation of a training base, the creation of additional job search services and training programs for senior citizens on the Jobs in Russia vacancy database portal;

- 2020 – training 150,000 Russians, defining effective training programs; formation of a bank of educational programs, organization of annual professional skills championships “Skills of the Wise” for people over 50 years old according to Worldskills standards;

- 2021-2024 – training of 300,000 citizens, formation of a mechanism for planning the needs of the labor market.

The costs of the planned activities will amount to about 31.6 billion rubles, of which 30 will fall on the shoulders of the state (federal budget). The rest will be paid by the regions from their budgets.

It is assumed that absolutely all citizens of pre-retirement age, both unemployed and employed, will be able to participate in the program. In the latter case, with a break from production. The duration of training is 3 months with a stipend in the amount of the regional minimum wage.

Age discrimination

This concept will not be enshrined at the legislative level, but due to the upcoming reform it will be used quite often.

In particular, refusal to hire citizens of pre-retirement age can be called age discrimination. Guarantees are also provided for working pre-retirement workers. In particular, companies will not be able to fire such citizens due to age. As a punishment, the Ministry of Labor proposed criminal liability, and this initiative was fully supported by Dmitry Medvedev.

The Prime Minister proposed equalizing the rights of pre-retirement workers and pregnant women, whom employers cannot fire under any circumstances for 3 years.

As a result, a package of laws introducing criminal liability for employers for unlawful refusal to hire pre-retirees and their illegal dismissal was adopted. Thus, according to Article 144.1 of the Criminal Code of the Russian Federation, an unjustified refusal to hire or unjustified dismissal from work of a person of pre-retirement age will be punishable by a fine of up to 200 thousand rubles or compulsory work for up to 360 hours.

It is also assumed that in the period from 2020 to 2028, the Pension Fund of the Russian Federation was obliged to transmit information about pre-retirees in electronic (and, if requested, in paper) format to various authorities, including: to the Central Tax Service, OSZN, Federal Tax Service, etc. This will be done to ensure that citizens can freely enjoy relevant benefits and other privileges.

Benefit at the regional level

In addition to federal benefits, each region of Russia has adopted relevant regulations that give certain bonuses to pre-retirees. Among them:

- • Free or discounted travel on municipal and suburban transport.

- • The above-mentioned transport tax (usually a 50% discount on cars with an engine of up to 150 horsepower).

- • Compensation of costs for housing and communal services tariffs (relevant when living with elderly people).

- • Privileges for persons with the status of labor and combat veterans.

- • Medical support and others.

Conclusion: Thus, together at FoxTop you learned that in the context of the pension reform, the legislator actually provided for a number of important privileges for pre-retirees. You should find out the list and how to register them, as mentioned above, in the regional social security departments.

Common mistakes when applying for benefits for pre-retirees in Moscow

Error: A pre-retirement worker would like to find a part-time job, but cannot find an employer. Then he pays for professional retraining.

The mistake is that in Russia, pre-retirement people have the opportunity to learn a new profession free of charge (at the expense of the state) in order to find a job in the future.

Error: A citizen with pre-retirement status wants to apply for benefits for free travel on public transport and compensation for telephone communications. At the same time, the pre-retirement person uses taxi services and a mobile phone exclusively.

Free travel within the city and intercity does not apply to taxi trips. As for compensation for telephone communications, a citizen has the right to reimburse expenses for calls made to a landline (home) telephone. Calls to local numbers from a mobile phone will not be reimbursed, even if you do not have a home phone.