- The NPF, unlike the PRF, has the right to involve any number of firms and companies in the management of funds. Due to this, investors' risks are reduced and income increases.

- In the event of the death of a depositor, his accumulated part of the pension provision is returned by the PRF only to the legal heirs, and the NPF can return funds to everyone designated in the official agreement.

- When transferring from the Pension Fund to the Non-State Pension Fund, a formal agreement is drawn up, which spells out all the obligations and rights of both parties. The PRF never offers its client base the opportunity to sign an agreement.

The main advantages of NPF "Lukoil-Garant"

According to statistics, an increasing percentage of able-bodied investors choose NPF Lukoil-Garant. This fund has been officially operating in the Russian Federation for more than 20 years and is today recognized as one of the leading funds in the country. Experts explain the consistently high level of trust in the non-state pension fund Lukoil-Garant:

- High reliability indicators and predictable profitability levels.

- A 23-year period of operation, during which the fund survived more than one government crisis and never violated its obligations to its clients.

- Numerous awards have been awarded to NPF Lukoil-Garant in recent years. Among them is the “Financial Elite of Russia” award, received in 2020. The Russian rating agency Expert RA has awarded NPF Lukoil-Garant with the diploma of leader in the compulsory insurance system over the past several years.

- Guaranteed pensions (from January 1, 2020, NPF Lukoil-Garant became a participant in the system of guaranteeing the rights of insured citizens).

Pension funds and collective investments

47 non-state pension funds

269 management companies

26 specialized depositories

1531 mutual funds

2 joint stock investment funds

Valid in the Russian Federation as of 01/01/2020

Non-state pension funds provide services for compulsory pension insurance (OPI) and non-state pension provision (NPO).

Non-state pension funds that are licensed under compulsory pension insurance manage pension savings formed from insurance premiums paid by employers for their employees under compulsory pension insurance. Since 2014, the transfer by employers of new contributions to the formation of the funded part of the pension has been suspended, and at the moment NPFs manage funds accumulated over previous periods. All funds that deal with compulsory health insurance are included in the system of guaranteeing the rights of insured persons. Funds entrusted to such funds are guaranteed by the Deposit Insurance Agency.

Within the framework of NPOs, funds manage pension reserves formed from exclusively voluntary pension contributions of legal entities and individuals.

By 10.8%

Pension funds of non-state pension funds increased in 2020 and amounted to 4.07 trillion rubles

Non-state pension fund funds are a source of so-called long-term money. One of the main trends in recent years is the increase in the share of non-state pension fund investments in the real and public sectors of the economy against the backdrop of a contraction in the financial sector.

Investment of NPF funds is carried out by management companies, which also provide services for managing mortgage coverage and housing funds for military personnel, own funds and insurance reserves of insurers, as well as funds of investment funds.

As of January 1, 2020

More than 37.3 million people participate in OPS

More than 6.1 million people are in NGOs

In recent years, investment funds, which include mutual funds and joint stock funds, have become increasingly popular among retail investors.

In August 2020, the Bank of Russia registered the rules of trust management of the first exchange-traded mutual fund in Russia, thereby marking a new stage in the development of the Russian investment fund market.

The Bank of Russia is both a regulator and a supervisory body for management companies of investment funds, non-state pension funds and investment funds: it sets the rules in the collective investment market and monitors their compliance. Taking into account the social importance of participants in the collective investment market and, above all, non-state pension funds, the Bank of Russia pays special attention to the issues of their financial stability and reliability, countering unfair practices and protecting the rights of consumers of financial services.

The net asset value of mutual funds for 2020 increased by 32.4% and reaches

4.5 trillion ₽

In addition to the Bank of Russia, there is another supervisory institution in the industry - specialized depositories of mutual funds and non-state pension funds (they store the assets of the funds and control their disposal), as well as a regulatory institution - self-regulatory organizations of participants in the collective investment market (they set standards for their members). Their activities are also under the control of the Bank of Russia.

Key indicators

That is why the rating agency “Expert RA” evaluates the organization’s activities as “A++”. The fund manages 250 billion rubles. The accumulated return on pension savings from 2005 to 2020 was 175.1%. According to the Bank of Russia, as of June 30, 2017, NPF Lukoil-Garant is trusted by more than 3.5 million depositors.

How to choose a non-state pension fund and conclude an agreement

The choice of the company that manages mandatory or voluntary contributions to a future pension remains the right of the citizen himself.

He can carry it out according to a number of criteria:

- reliability as assessed by rating agencies;

- number of depositors and contracts with insured citizens;

- profitability;

- sources of investment;

- level of trust in the founders;

- presence of an office close to the insured;

- ease of use of your personal account on the company website, etc.

Reference! The state does not compile ratings of funds; only the Central Bank publishes an annual report on their activities, which, among other things, includes information on the results of investing pension savings.

10 best organizations in terms of profitability and reliability

Based on the results of activities for 2020, the following funds, in decreasing order, brought the greatest income to their investors as a result of investing their money:

- GAZFOND pension savings.

- GAZFOND.

- Surgutneftegaz.

- Construction complex.

- Ingosstrakh-Pension.

- Agreement.

- Interregional NPF "AKVILON".

- TRADITION.

- VTB Pension Fund.

- Gazprombank-fund.

The information is presented based on information published by the Bank of Russia on the official website of the department.

Application and registration for a pension

To become one of the official investors of NPF Lukoil-Garant, you should visit the organization’s office.

But first, the institution’s employees recommend filling out an application on the official website at the link: https://www.lukoil-garant.ru/services/online-services/, after which the organization’s specialists will promptly call the client back and instruct them on how to proceed further in order to become a depositor. After the comprehensive service agreement with NPF Lukoil-Garant is signed, the investor receives the right to register on the official website and log in by going to his personal account.

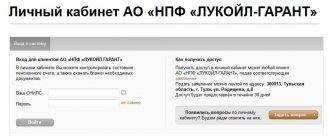

For registration to take place successfully, you need to complete a few simple steps:

- Go to the official page of NPF "Lukoil-Garant".

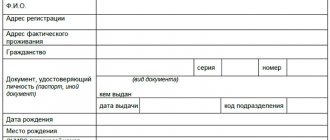

- Fill in the empty fields of the proposed form with personal information such as:

- FULL NAME;

- date of birth of the depositor;

- passport information;

- actual mobile phone number;

- E-mail address.

- Enter the code combination received automatically on your phone/email.

- If difficulties arise, you can use the “Help” button, when clicked, a list of answers to frequently asked questions will be displayed in front of the resource user.

Account verification

Pension NPF "Lukoil-Garant" You can find out your savings by ordering a pension account statement.

Option 1. In your personal account. This can be done with an expanded account profile - where your phone number is indicated. To generate an account statement yourself:

- Log in to your personal account at NPF Otkritie (this is NPF Lukoil-Garant) - enter your login and password;

- Open the section “Your savings and payments”;

- We generate an extract and print it out.

Option 2. In any company office. You will need your passport and insurance certificate number.

Option 3. By contacting the quality service of a non-state fund. To find out:

- We go to the service through the official website or via the link;

- We fill out the form and enter the text of the request, where we indicate our desire to learn about pension savings;

- The extract will be sent to the address from the request by registered mail by Russian Post within 10 days.

Option 4. Written application to the bank. To do this you need:

- Send a letter through a postal operator. Recipient's address: Russia, Tula region, Tula city, Radishcheva street, building 8 – Otkritie NPF JSC. Index 300013;

- The extract is sent by registered mail to the sender's address no later than 10 days from the date of receipt of the request;

Option 5. Call the contact center. Phone number to call: 8 800 200-5-999.

Option 6. On the State Services website. Watch video instructions on how to do this.

Official website of NPF "Lukoil-Garant"

Using the resource opens up a whole range of opportunities for the investor. The investor can:

- monitor the increase in cash savings;

- get help online;

- specify the amount accumulated over a certain period of time;

- receive an extract if necessary;

- use an option such as a pension calculator.

Differences between Basic and Advanced profiles in your Personal Account

The basic registration option has limited capabilities for using the personal account and the functionality of a non-state pension fund. Advanced allows you to view personal information and personal data, as well as submit applications:

- for registration of a funded pension;

- make changes to passport, personal or contact information;

- draw up statements, request documents;

- conclude an agreement online for the provision of individual pension services.

Connecting an extended profile

To connect an extended version of your Personal Account, at the registration stage you must specify a mobile phone number that is recorded in the Otkritie NPF database. If there is no such option, then you need to follow the connection diagram:

- Open an account for the Basic Standard Profile.

- In the settings, open the option to switch to the Advanced profile.

- Fill in the required fields for personal identification.

- Confirm the conclusion of the contract by entering the SMS code from the message received on the phone.

If the procedure was successful, the client will be informed about the change in status by notification via the Personal Account or SMS.

If a message with a code to switch to extended status has not been received within 10 minutes, then you should call customer support and ask what phone number is associated with your main account.

registration error

If there is a registration error using passport data, a possible reason may be changes in them since the submission of the application to the Fund and the current registration. To solve the problem, you need to change your personal data in the system through customer support or go through the registration procedure again, but through SNILS.

Access to the NPF Otkritie account is automatically blocked if you enter the password incorrectly 5 times within 24 hours .

The account is unblocked automatically after 24 hours from the moment access to the Personal Account is disabled.

License of NPF "Lukoil-Garant"

The activities carried out by NPF Lukoil-Garant are officially licensed. The issue of revoking the license certificate of this fund began to worry investors after the Central Bank revoked the licenses of 7 non-state pension funds at the end of 2020. NPF "Lukoil-Garant" was never included in their number.

To this day, NPF Lukoil-Garant successfully continues to carry out its official activities aimed at saving pension funds of citizens of the Russian Federation.

Note!

License to carry out activities in pension provision and pension insurance No. 432 dated May 20, 2014. This document is of unlimited duration.

Options for logging into your personal account at NPF Otkritie

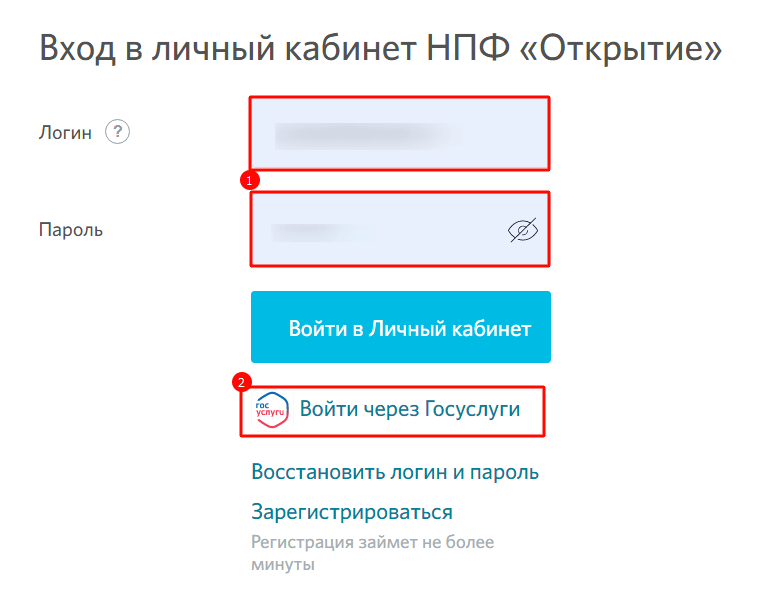

You can log into your personal account in two ways: using your login and password or through a verified State Services profile.

Login to your personal account

If you chose the first option, then your email address will serve as your login. You entered it when registering your personal account.

How to recover your password?

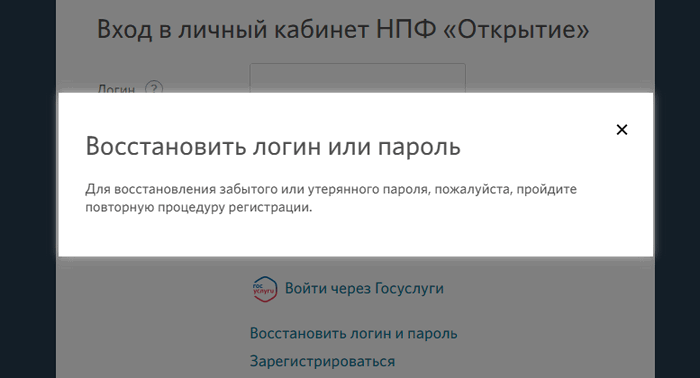

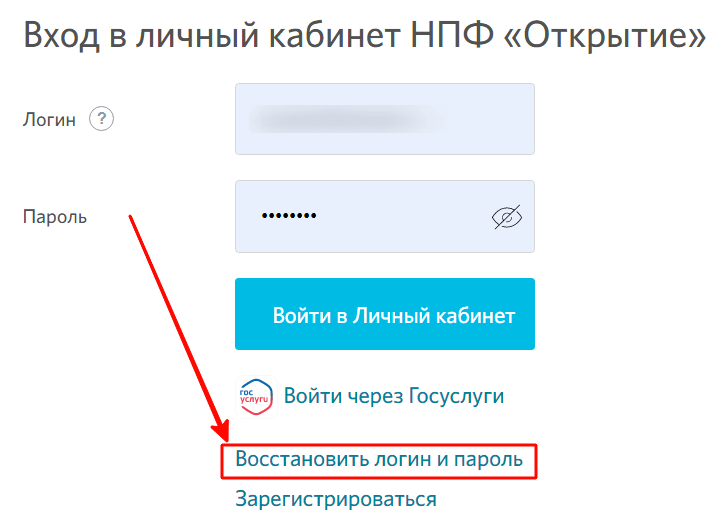

There is no need to use the Fund's personal account often, so clients sometimes forget the password for it. You can restore it on the authorization page. Below the form there is a link “Recover login and password”. But if you click on it, a message appears stating that to resume access you must register again.

If you have a confirmed personal account on the ESIA, then click on the “Login through State Services” link. Then agree to the transfer of personal data and the Foundation account. In other cases, fill out the form indicating your identity document. Then set a password for your future personal account.

Reviews of NPF "Lukoil-Garant"

On the Internet you can find a huge number of reviews about the activities of the non-state pension fund "Lukoil-Garant". With rare exceptions, you can find only positive reviews; in case of any problems, they are promptly resolved by the company's employees on an individual basis. Citizens who have entrusted their funds to NPF Lukoil-Garant mainly note:

- High level of trust – AAA (the highest level of trust on the part of investors).

- Predictable stability and very high rate of return.

- The fact that there is an official agreement, which spells out in detail all the conditions and nuances of business cooperation.

- Numerous branches throughout the Russian Federation.

- Stable pension payments within a strictly specified period.

Having studied the above arguments, we can safely recommend the non-state pension fund Lukoil-Garant as a reliable company that you can trust with the formation of your funded pension.

How to apply

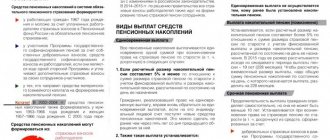

Any of the above payments are issued after submitting an application with an attached set of documents.

BUT NPF "Lukoil-Garant" how to get your savings:

In person or through a representative. You need to visit the office with a package of documents and fill out an application. You can do this:

- In the branch of the Bank - partner.

- In the non-state Fund itself.

Online. Using your personal account:

- "Lukoil-Garant" NPF official website application for a one-time payment of funds: ;

- Service .

By mail. We send the documents by registered mail to the address of a separate division of the non-state Fund: Tula region, Tula city, Radishcheva street, building 8 - Otkritie NPF JSC. Postal code: 300013.

How to join

To use the services of the fund, you should choose any of the proposed programs:

- Payment of a lifetime pension - money is regularly deposited into a pension account, the contract can be terminated before official retirement, savings are inherited (only until retirement age).

- Flexible investment scheme - money is deposited according to an agreed scheme, the contract can be terminated at any time, the balance of funds in the individual account is included in the inheritance estate regardless of the moment the investor retires.

- No investment contributions - no need to make additional contributions, payments are made according to the standard scheme after retirement.

To join a non-state pension fund, you need to conclude an agreement of the same name (in the first and second cases) or write an application for the transfer of the funded part of the pension (in the third case).

Fund returns by year

The profitability of NPF Lukoil-Garant is indicated in the table, report by year from 2014 to 2020. Interest on OPS and NPS is taken into account.

| Year | Profitability, % | |

| OPS | NPC | |

| 2014 | 8,95 | 11,58 |

| 2015 | 8,96 | 8,9 |

| 2016 | 10,58 | 15 |

| 2017 | -2,41 | -10,78 |

2017 was associated with an unstable economic environment, but the fund took fourth place in the management of pension funds. As of December 31, 2020, according to official statistics, there were 3.5 million clients, the volume of OPS was 249.5 billion rubles.

The accumulated return for the periods from 01/01/2013 to 01/01/2017 is 39.9%.

How to terminate a contract

Advertising promises of non-state pension funds about planned profitability do not always correspond to the truth. Often management companies do not comply with them. In this case, it is reasonable to transfer savings to another fund. If you are convinced that the managers of NPF Soglasie are poorly managing assets, it’s time to find out how to terminate an unfavorable contract.

There is information circulating online that to terminate the contract, you just need to call the hotline and inform the NPF employee of your decision. In fact, this is not enough to transfer funds to another fund. To be sure to terminate the contract and securely place your savings, you should choose one of the options:

- Contact the nearest office of NPF “Soglasie” with a corresponding application. In the document, indicate which fund to transfer the funds to, or write that they need to be returned to the depositor’s bank account.

- Write an application with a request to replace a private company with a state-owned one at the Pension Fund branch at your place of residence.

When deciding how to leave NPF Soglasie, keep in mind that you can change the management company no more than once a year. Applications must be submitted by the end of the first quarter. The document is reviewed within a month after the application. If after this period a decision has not been made, the client has the right to file a complaint against the fund’s actions with the supervisory authority - the Central Bank of the Russian Federation.