Home / Labor Law / Payment and Benefits / Pension

Back

Published: 04/06/2020

Reading time: 3 min

0

267

— Now I’m 25, but I understand that you need to think about your future retirement as early as possible. I constantly come across offers from various non-state pension funds (NPFs). How are they fundamentally different from the Pension Fund and can you trust them with your money?

— In Russia there is only one state pension fund - the Pension Fund. Citizens can make a choice regarding the funded part of their pension, forming it not through the Pension Fund, but through a non-state pension fund. Let’s figure out how reliable it is and how to choose a non-state pension fund with minimal risks for yourself.

- Comparison of Pension Fund and Non-State Pension Fund

- Is it possible to be left without funds by investing money in a non-state pension fund?

Differences between Pension Fund and Non-State Pension Fund

The principles of operation of state and non-state pension funds are the same: the client transfers part of the funds from wages to a personal account to form future pension payments. But then the differences begin.

Let's look at the difference between funds using several specific examples.

1. The State Pension Fund pays the accrued pension regardless of the balance on the personal account. The private entity pays as long as there are funds in the account. If a pensioner is lucky enough to live to be 100 years old, it is not a fact that the NPF will make payments - the money in the personal account may run out. But such a situation occurs extremely rarely. Typically, funds assume that the pensioner will live another 30 years after retirement.

2. In the Pension Fund of the Russian Federation, the size of the pension is in no way linked to the profitability of the funds placed - the size of pension payments is calculated without taking this factor into account. Private foundations count every penny. The movement of funds in the account can be seen through your Personal Account.

3. Funds in the state fund are considered the property of the state - those who die before retirement cannot transfer the accumulated funds to their heirs: there is no normal legal framework. NPFs enter into agreements with their clients, where all issues are thoroughly discussed, including who will receive the rest of their pension savings.

4. The Pension Fund is constrained by instructions on the placement of its capital. Non-state pension funds have the right to invest clients’ money in any operations.

Let's summarize the first results: there is only one state pension fund in the country - the Pension Fund. It is included in the country's budget structure. Therefore, the size of pensions depends entirely on the adopted budget for the reporting year. All the talk about the profitability of funds in this fund is from the evil one - they do not in any way affect the size of the pension you receive. NPFs are non-profit social security organizations operating in the pension sector. Pensions are paid from accumulated funds. Their size has nothing to do with length of service and other government features. Linked only to the amount of accumulated funds.

How to choose a non-state pension fund with high yield?

The Bank of Russia clearly regulates what non-state pension funds can invest their clients’ funds in (high-risk instruments are excluded), and strictly monitors compliance with these requirements. However, any investment carries risk. And the higher the probable return, the higher the risk usually is.

Before concluding an additional pension agreement with a fund, it makes sense to study its investment declaration to understand what exactly it plans to invest the money you entrust to it. NPFs are not required to disclose it, but may do so.

Much depends on the professionalism of the experts who manage NPF money. If for several years the return on investment of a particular non-state pension fund is above the market average, then most likely it has a strong team of investment specialists.

You can compare the return on investments of different funds in summary tables on the Bank of Russia website. If the fund operates in both the compulsory pension insurance system and the non-state pension system, then the profitability indicators for these two areas are published separately, and they may differ. Therefore, first, choose what type of fund investment you are interested in and check the profitability over several years.

On the regulator’s website, funds show their total investment income before deducting their own commissions and other payments. The net profitability that NPFs accrue to client accounts can now only be viewed on the websites of the NPFs themselves.

It is also worth remembering that past performance is not a guarantee of the same profitability in the future. Moreover, first of all, when choosing a non-state pension fund, you should still think about its reliability, and only then about profitability.

Pros and cons of the state pension fund

Considering the positive and negative aspects of the Pension Fund's activities, experts get off with a couple of sentences, talking about the advantages of the fund, and one about the disadvantages.

We quote them verbatim:

- The advantage of a state fund is its reliability - there is absolutely no risk of losing savings;

- regular indexation linked to inflation.

The disadvantages include the low profitability of funds stored in the Pension Fund.

If we talk about the advantages, they are stated precisely and even with a strong desire you will not find more. But you need to deal with the disadvantages.

1. When talking about low income, social service workers are either disingenuous or do not understand what they are talking about. After all, the level of profitability of funds set aside in the Pension Fund does not in any way affect the pension of the country’s residents. There is not a single word in the regulatory documents that links the size of pension payments to the profits of the Pension Fund, which circulates the population’s money through VEB.RF.

Profitability affects only the number of fund employees, their salaries and palace buildings. Judging by what is observed on the ground, everything is fine with making a profit: a huge staff, large salaries, buildings better than Gazprom’s.

2. In all developed countries, pension savings belong to the investor. He has the right to bequeath them or withdraw them completely at any time. The amounts there are considerable. For example, in the USA, a worker, not a white collar worker, but a hard worker, upon retirement has about 750.0-1500.0 thousand US dollars in his pension fund account, which allows him to travel around the world without worries or provide financially for his family after of death.

The difference in pension provision is clearly demonstrated by a curious case from US legal practice. The widow of a Navy colonel received a large pension for her husband, even by American standards. At the age of 80, she wanted to marry a 40-year-old illegal Ukrainian immigrant. The marriage was registered. After 5 years the woman dies. After legal proceedings, the United States government was forced to pay a pension for the deceased colonel to the widower.

Is this possible in Russia? Here, even direct heirs cannot receive the rest of the pension savings from the state fund. That's all the difference. This is a minus and a fat one at that.

3. Information about the activities of the fund is completely closed. Under no circumstances will it be possible to find out where and under what conditions the fund’s money is invested.

4. It is also impossible to obtain information about the state of a pensioner’s personal account. Information is provided only when funds are transferred to a non-state fund. There’s no need to even explain anything here. After all, knowing the amounts confirmed by an extract from the fund, the heirs can try to get the unpaid part of the pension savings through the court. And so - no paper, no business.

5. The fund’s huge staff does not correspond to the quality of service. It even seems that the more employees there are, the more difficult it is to achieve your goal.

6. The absence of a formal agreement between the fund and the client puts the latter in a powerless position.

The results of the analysis are impressive: the Pension Fund of Russia has practically no disadvantages.

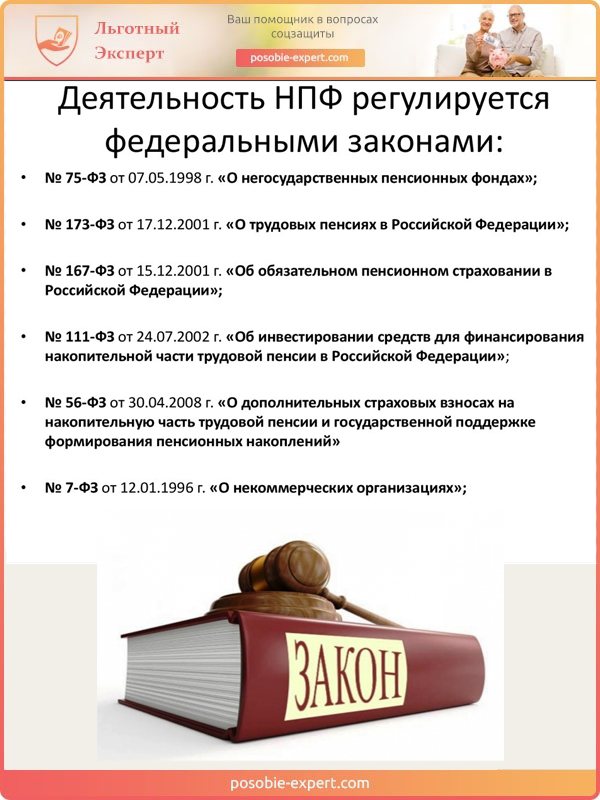

Licensing Features

To obtain a license for a non-state fund, you must contact the structures of the Central Bank of Russia

In order to obtain a license, the fund must contact the structures of the Central Bank of Russia. To protect citizens, the law establishes the following requirements for commercial organizations:

- NPFs are required to issue only common shares, without preferred shares. Before registration begins, all shares must be supported by money;

- the fund has the right only to ensure savings and investments; additional services, such as issuing loans, are prohibited;

- the staff consists of specialists with sufficient qualifications and no reputation problems;

- documentation and actual activities of the fund do not intersect with current legislation;

- authorized capital and funds should not fall below 120 and 150 million rubles, respectively. In 2020, the figures will be changed to 150 and 200 million;

- the name contains the phrase “non-state pension fund”.

License of a non-state pension fund

Important! The license is issued without any time limit. Revocation of a document is possible only in case of non-compliance with the requirements of the Bank of Russia.

The algorithm for submitting and considering an application for a license is described in No. 75-FZ. In order to obtain permission to operate, the NPF will have to provide originals and copies of a number of documents:

- constituent documents;

- orders to create control and management structures, such as a board of trustees or the position of director;

- financial reports on the state of the fund, confirmed by external audit;

- assessment of the value of the fund's property;

- information on the staff of NPF employees with confirmation of their qualifications in a standard form;

- established pension and insurance rules, as well as standard forms of contracts;

- regulations for internal control of fund funds, together with mechanisms to protect against money laundering;

- receipts for payment of necessary state duties and fees.

After submitting documents, the Bank additionally requests information through internal channels. The Federal Tax Service confirms the existence of the organization in the Unified State Register of Legal Entities and registration with the tax office, and also checks the employees. The Ministry of Internal Affairs provides a summary of the presence/absence of a criminal record, and the Treasury confirms payment of taxes and fees. To simplify the work, the applicant has the right to personally provide this information to the inspection authorities.

The activities of NPFs are regulated by federal laws

Next, the documents are reviewed within 10 days to ensure they are correctly completed and completed. If the application has not been returned for revision within this period, it will be considered within two months.

Why is a licensing procedure necessary?

Quite complex requirements, high authorized capital and personnel requirements make the creation of a non-state pension fund for medium-sized businesses almost impossible. At first, the organization will not bring anything at all except losses on the authorized capital, salaries of qualified employees, and preparation of initial documents.

This means that the fund is overwhelmingly backed by a large financial or industrial company. Often this is either a bank that has decided to expand its scope of activity, or a large concern that needs free funds to finance projects.

Any pension activity without a license is prohibited and is illegal. Punishment depends on the scale of the violations - from large administrative fines to criminal liability for people who authorized illegal actions.

Pros and cons of a non-state fund

The population's attitude towards non-state pension funds is more negative than positive, which contradicts common logic. The reason seems to be one thing: poor knowledge of the legislative framework and lack of explanatory work through the media.

But here everything is clear: they cannot spend their own savings on advertising NPFs - it’s expensive, and the state is not ready to cut the branch on which it sits, i.e. is not interested in explaining to the population the pros and cons of non-state structures in the field of pension provision.

Let's try to explain how a non-state pension fund differs from a state one based on the advantages of the first:

- total control by government services. This is, firstly, the fight against a competitor, and secondly, the protection of the interests of the country’s citizens;

- high-quality service - no one will go to employees of a non-state fund who scream or do not notice the client;

- the possibility of transferring unspent amounts to pay pensions to heirs;

- the existence of an agreement between the fund and the client, which transfers all relationships to the legal plane;

- the accumulated amount can be received in full upon retirement;

- high yield, significantly increasing the amount of savings;

- the ability to change the fund once every 5 years;

- protection of deposits in several ways at once;

- transparency of the entire work of the fund - through your personal account you can get all the necessary information: placement of savings, movement of amounts on your personal account, etc.

For some reason, the disadvantages include:

- the possibility of bankruptcy with loss of income received;

- high probability of license revocation.

Let's see how these disadvantages really are the weak side of non-state structures in providing pensions to citizens.

1. There really are risks of going bankrupt or losing your license. But no one says how they affect specific Ivanov, Petrov, Sidorov.

Let's start with the fact that pension savings are protected:

- reserves for compulsory pension insurance (OPI);

- a national guarantee fund, which, by the way, includes the Pension Fund.

This means that in any case, the pensioner will receive the amount transferred to the non-state fund during his work. Only accrued income will be lost.

2. The profitability of the Pension Fund does not in any way affect the final size of the pensions of Ivanov, Petrov, Sidorov. This means that the transfer of pension savings to the Pension Fund in the event of bankruptcy of a non-state pension fund or revocation of a license will not be able to reduce the accrued pension of clients of a non-state structure, i.e. they would receive the same pension if the funds were transferred immediately to the state fund. So what risks are we talking about? About those who could, but did not receive higher pension payments?

Let's summarize: regardless of where pension savings are accumulated, the future pensioner is guaranteed to receive a pension in the amount calculated by the state. But when working with a non-state entity, payments can be significantly higher.

The editors of the site hope that the information provided is enough to understand how the NPF differs from the Pension Fund.

Which NPF is the most reliable?

When choosing a private pension company, an important role is played by the reliability of the NPF, determined through the company’s voluntary participation in the rankings of independent agencies.

Expert RA and National RA are recognized as the most influential analytical agencies in the field of pension provision.

List of non-state pension funds that have been assigned an exceptionally high (A++) level of reliability from Expert RA:

- "Diamond Autumn"

- "Atomgarant".

- "Welfare".

- "THE WELFARE OF EMANCY."

- "Big".

- "Vladimir."

- "VTB PF".

- "Gazfond".

- "European PF".

- Keith Finance.

- "National".

- "Neftegarant"

- "Gazfond Pension Savings"

- "Promagrofond".

- "SAFMAR".

- "RGS".

- "Sberbank".

- JSC "Surgutneftegas".

The National rating agency has published its list of non-state pension funds that are financially strengthened (AAA) and are responsible for their obligations to depositors.

It included 9 companies, 6 of which were recognized by two agencies as the most reliable:

- "Welfare".

- "European PF".

- Keith Finance.

- "Neftegarant"

- "RGS".

- "Sberbank".

In addition to those listed in the rating from Expert Ra, OJSC Telecom-Soyuz, the non-state fund Electric Power Industry and OJSC Lukoil-Garant are also among the 9 most stable organizations that invest pension savings.

What and in what case should you choose?

As can be seen from the general thrust of the material, the author is completely in favor of non-state structures. At the same time, there is no discrediting of government agencies. How can they be discredited if “the state is me, you, all of us together, from Kaliningrad to Kamchatka.” But let’s be objective and consider what to choose, the Pension Fund or the Non-State Pension Fund for the formation of a future pension based on purely mercantile interests.

Let us immediately note that the choice of fund is a personal matter for a citizen of the Russian Federation. Neither the employer nor the banks have the right to require him to work with the Pension Fund or NPF when drawing up lending agreements (VTB and Sberbank have their own NPFs).

From the financial side, in 2020 it is definitely more profitable to deal with a non-state fund. But when choosing a pension savings holder, you need to consider:

- fund rating (updated 2 times a year, you can see it, for example, here). It is advisable to choose the one with the ruAAA index, the highest, indicating the stability and reliability of the NPF. You can also choose one with a lower rating - their position is still stable. Only low scores with one or more B's in the index signal potential instability;

- financial indicators for the reporting period, including the amount of client income, indicate the effectiveness of money supply management;

- the amount of equity - the more capital, the better;

- number of clients – indicates the population’s confidence in the structure, but does not protect against possible risks of losing the accumulated part of pension savings;

- transparency of work;

- level of service;

- reviews from experts and clients.

NPF's license was taken away: what should clients do?

In case of cancellation of the fund's license, the client is given the opportunity to transfer his savings to another private company. If you refuse to choose another NPF, pension savings will by default be transferred to the Pension Fund of Russia, retaining 6% of the NPF.

Within the framework of Law No. 422-FZ, which regulates the rights of insured persons when concluding compulsory insurance in the Russian Federation, at the end of 2020, 32 non-state pension funds entered the non-public private enterprise guarantee system. This means that pension savings of citizens, indexed by the Pension Fund or Non-State Pension Fund (protected by the Deposit Insurance Agency), are guaranteed by the state.

How to transfer to a non-state pension fund or return to the Pension Fund of Russia

You can switch from one fund to another at any time. However, you need to remember the 5-year rule, according to which a transfer while maintaining the funded part of the pension is possible only once within five years. If the condition is violated, only the part of the money transferred from the salary will be transferred, without income. This is the same as withdrawing your deposit early.

True, it is not clear how the provisions of the law are implemented during the transition from the Pension Fund to the Non-State Pension Fund. In reality, no one there charges interest on amounts stored in a personal account - there is no point. All the same, the pension will be calculated according to different rules.

To transfer, you need to submit a corresponding application to the fund directly or to the MFC. The law allows you to submit documents in person, online or by mail. In the latter case, the application must be notarized. The role of a notary can be performed by law and other representatives of government bodies.

Documents on exit (transition) are accepted from January 1 to December 1. A month is given for the final decision. It's like a divorce - a probationary period. What if he changes his mind?

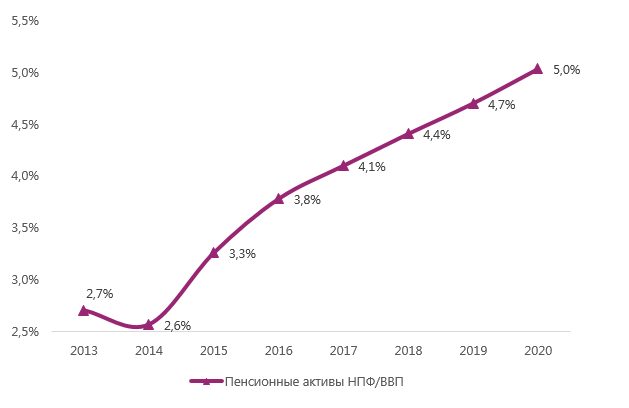

List of fixed assets

Forecast of changes in the indicator of pension assets of NPFs

The entire list of organizations involved in pension provision will not be given here - there are too many funds to describe each in detail within one short article. Here you can see the seven best commercial pension funds, chosen by popularity, reliability, income and member reviews.

The funds themselves are assessed according to the following criteria:

- reliability rating. A key metric, revenue or market penetration means nothing if the company no longer exists in a few years. It is assessed through an external audit of expert agencies, in our case the “Expert RA” rating is used;

- interest rate. The higher the fund's annual return, the weaker the impact of inflation on investors' money and the greater the payout. Based on information for 2020;

- total amount of savings. It is a general metric for both the number of people participating in the fund and the duration of its work. A large number can indicate both a large number of investors and years of impeccable work;

- market share. Percentage of depositors who applied to this MFO. Together with the volume of savings, it makes it possible to understand who the fund’s clientele is.

So, let's start with the three largest funds in Russia.

JSC NPF "Sberbank"

Non-state pension fund "SBERBANK"

Reliability : AAA.

Profitability: 8,9%.

Savings : more than 570 billion rubles.

Market share: 21,5%.

The most popular bank in Russia has not remained aloof from the pension reform. The highest interest rate out of the top three, a well-known brand and the trust of citizens - all this makes Sberbank the best “default” choice when no special conditions are required.

OJSC NPF "Gazfond: Pension savings"

Non-state pension fund "Gazfond"

Reliability : AAA.

Profitability: 8,5%.

Savings : more than 500 billion rubles.

Market share: 18,9%.

Not far from Sberbank there is a Gazprom fund secured by the assets of the state corporation. All the same highest reliability with slightly lower incomes provided the gas giant with second place in the market with comparable assets. The choice between one of the two leaders depends on personal preferences - a little more confidence from Gazprom, whose liquidity is provided by natural resources, or a higher rate from Sberbank, together with the convenience of a professional financial institution.

OJSC NPF "VTB"

Non-state pension fund NPF "VTB"

Reliability : AAA.

Profitability: 7,8%.

Savings : more than 190 billion rubles.

Market share: 7,2%.

The country's largest commercial bank for those who do not trust the state. Vneshtorgbank’s colossal reserve of unsinkability, huge assets and ease of working with clients brought the organization to third place in our ranking.

In total, the big three funds manage almost 50% of the total amount of non-state savings.

OJSC NPF "Future"

Non-state pension fund "FUTURE"

Reliability : BB-.

Profitability : unknown.

Savings : more than 280 billion rubles.

Market share: 11%.

A conglomerate of several large funds merged into one. Previously known as Blagosostoyanie, after the merger in 2020 with the Stalfond, Uralsib and Our Future funds, it changed its name.

It is the largest pension fund that is not backed by a state corporation or bank. Reliability is confirmed by mandatory deposit insurance in the Rosgosstrakh system; experts note a high negative sensitivity to external factors.

JSC NPF "Otkritie"

Non-state pension fund "Otkritie"

Reliability : not rated.

Profitability: 8,75%.

Savings : more than 240 billion rubles.

Market share: 9,2%.

Another merger of several funds based on the oil giant LUKOIL. It claims to serve more than 7 million people. It stands out for its convenient system of working with clients and its statements about “more than 20% of the Russian pension savings market.” The fund does not provide special conditions; the main interest in it is caused by the safety of deposits due to insurance and protection of the assets of one of the largest oil companies in the country.

ZAO MNPF "Bolshoi"

Non-state pension fund "BOLSH"

Reliability : AA-.

Profitability: 9,95%.

Savings : more than 38 billion rubles.

Market share: 1,4%.

One of the oldest funds in Russia, operating for more than 20 years. It is in the top five in terms of profitability in the market, while being a relatively large and respectable organization. An excellent choice for those who prefer a small risk with noticeable bonuses - in a few decades the difference between 8% and 10% of annual income will become noticeable to the naked eye.

JSC NPF “Defense-Industrial Fund named after V.V. Livanov"

Non-state pension fund “Defense-Industrial Fund named after V.V. Livanov"

Reliability : A+.

Profitability: 12,14%.

Savings : about 5 billion rubles.

Market share: 0,18%.

The highest returns with acceptable risk. The fund has been in existence for more than 12 years, with significant fluctuations in investment returns. At the beginning of 2020, the estimated yield was 7.7%, so it’s not worth running and transferring all your savings just yet. However, last year's leader is still worth paying attention to.

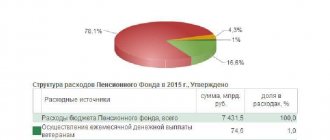

Pension structure

According to the letter of the law, the pension consists of two parts: insurance and funded, respectively, 16% and 6% of the total amount. The insurance component is stored only in Vnesheconombank (PFR) and is used to pay pensions to those who have reached a certain age. It is assumed that the second, accumulative part, will become an object of investment and will bring profit to the investor in the future. In addition, any citizen can form a future funded portion on their own by making voluntary contributions to the chosen organization.

What is the difference between insurance and funded pensions, look at the picture:

Important! In 2014, the State Duma adopted a draft on a moratorium, or freezing of funded pensions. Today, employers' pension contributions go entirely to forming the insurance part of the pension.