Today, the Russian market offers a huge number of non-state pension funds that provide both compulsory and voluntary insurance. But their function also includes a system of deposits and investments, presented exclusively for pensioners. This was done to provide them with the opportunity to invest their own funds to increase them.

One of the earliest pension funds of this type is the Rosgosstrakh fund, which was founded in 1921. Over almost a century of existence, it has managed to help millions of investors and pensioners who trusted this fund. For this reason, you should not be skeptical about these organizations, since they operate officially and all services are provided in accordance with the law. Entrust your funds to a reliable fund, namely the Rosgosstrakh fund.

Open mutual funds

A mutual investment fund (UIF) is a convenient tool for preserving and increasing capital.

In order to work with mutual funds, you do not need to be a financial expert, have an impressive starting capital and constantly monitor investments. All you need is to entrust the management of your funds to a team of professionals. Information on the estimated value of an investment unit, the value of net assets and their changes is available until the publication of new data or the publication of a message about the termination of a mutual investment fund.

Offer for pensioners

For any person who depends on government payments, savings and financial benefits are important. Therefore, the bank offers its clients favorable conditions:

- free receipt of a debit plastic card;

- Interest is accrued on the account balance;

- the company provides virtual points for payments in supermarkets and service establishments;

- virtual points give discounts and nice gifts.

Conditions

There are no separate requirements. To open such a card, you just need to provide information about the assigned payments from the state:

- old age pension;

- by length of service;

- on disability;

- caring for a disabled family member, etc.

There are two types of plastic from RSHB.

- Unnamed. It is given to the client directly on the day of application.

- Named. It will have to wait a few days.

Regardless of which one you want to apply for, you won’t have to pay.

Tariff "Pension"

This tariff is available on six cards from Rosselkhozbank. Three of them have the MIR payment system, another three have MasterCard. The peculiarity is that MIR can be reissued or replaced. MasterCard was issued only until 2020, and if you lose it, it can only be replaced with MIR. MasterCard is no longer issued.

Features of the tariff plan:

- Only adult individuals have the right to receive;

- requirement: Russian citizenship;

- issued on the basis of the purpose of government payments.

In order to become a client of this package of services, it is important to collect and provide the following documents to the financial institution:

- statement;

- passport + photocopies of all its pages;

- pensioner's certificate, or other certificate that gives the right to receive subsidies from the state.

Advantages of open mutual funds

- Diversification

- Reliability and state control

- Liquidity

- Tax minimization

Date of relevance of changes: per day – 08/03/2018 , for other periods – 08/03/2018 Published: 08/06/2018 at 15:22

Get a complete data analysis of your investments

© RSHB Asset Management LLC, 2012-2018 All rights reserved. Legal license information.

Limited Liability Company "RSHB Asset Management". License to carry out activities for managing investment funds, mutual investment funds and non-state pension funds No. 21-000-1-00943 dated November 22, 2012, issued by the Federal Financial Markets Service of Russia, without limitation of validity. License of a professional participant in the securities market to carry out securities management activities No. 045-13714-001000 dated November 22, 2012, issued by the Federal Financial Markets Service of Russia, without limitation of validity.

The value of investment shares may increase and decrease, past investment results do not determine future income, and the state does not guarantee the return on investments in mutual funds. The rules of trust management of mutual investment funds provide for discounts to the estimated value of shares upon their redemption; the collection of these discounts reduces the profitability of investments in investment shares of mutual funds. Before purchasing an investment share, you should carefully read the rules of trust management of a mutual investment fund.

You can obtain information about the funds and familiarize yourself with the Rules for trust management of funds, as well as information about places for accepting applications for the acquisition, redemption or exchange of investment shares and other documents provided for by the Federal Law “On Investment Funds” No. 156-FZ and regulations of the Bank of Russia at the address of the Limited Liability Company "RSHB Asset Management": 125009, Moscow, Bolshoi Kislovsky Lane, building 9, tel.; Internet page address: www.rshb-am.ru, agents for the issuance, redemption and exchange of investment units of the fund (the list of agents can be found on the Internet website at: https://www.rshb-am.ru /offices/).

Open-end mutual investment fund of market financial instruments “RSHB - Balanced Fund” (Fund Rules registered by the Federal Financial Markets Service No. 2566 dated March 26, 2013); Open-end mutual investment fund of market financial instruments “RSHB – Bond Fund” (Fund Rules registered by the Federal Financial Markets Service No. 2567 dated March 26, 2013); Open-end mutual investment fund of market financial instruments “RSHB - Share Fund” (Fund Rules registered by the Federal Financial Markets Service No. 2568 dated March 26, 2013); Open-end mutual investment fund of market financial instruments “RSHB - Treasury” (Fund Rules registered by the Bank of Russia No. 2797 dated May 22, 2014); Open-end mutual investment fund of market financial instruments “RSHB - Currency Bonds” (Fund Rules registered by the Bank of Russia No. 2795 dated May 22, 2014); Open-end mutual investment fund of market financial instruments “RSHB - Gold, Silver, Platinum” (Fund Rules registered by the Bank of Russia No. 2796 dated May 22, 2014); Open-end mutual investment fund of market financial instruments “RSHB - Best Sectors” (Fund Rules registered by the Bank of Russia No. 2800 dated May 28, 2014).

RSHB Asset Management LLC notifies clients and other interested parties of the existence of a risk of a conflict of interest when carrying out securities management activities. In this case, a “conflict of interest” is understood as a contradiction between the property and other interests of RSHB Asset Management LLC and/or its employees and clients, or between the interests of several clients, as a result of which the actions (inactions) of RSHB Asset Management LLC and/or its employees cause losses to the client and/or entail other adverse consequences for the client. The rules for identifying and monitoring conflicts of interest and preventing its consequences when carrying out professional activities on the securities market of the Limited Liability Company “RSHB Asset Management” are posted in the “Information Disclosure” section of this website.

Source:

https://www.rshb-am.ru/trust/

Personal Area

The site also provides a service for using a personal account. This service is quite convenient to use, as it provides many opportunities regarding managing funds, conducting operations, and tracking the savings portion. To start using your personal account, you need to create an account on the site, then come up with a login and password, and register.

Possibilities

your personal account contains functions that manage funds remotely, while sitting at home. Now it is possible to check your balance, make deposits online, and track profit statistics.

How to find out your savings?

To check your savings balance, log into your personal account by entering your username and password. After which information regarding payments and savings will be provided.

Rosselkhozbank decided to create its own pension fund

Rosselkhozbank plans to create a non-state pension fund, follows from the bank’s development strategy until 2020, Kommersant reported on Wednesday. The NPF will specialize in serving the population of rural areas, small and medium-sized cities. “The creation of a non-state pension fund bank will contribute to the growth of social and financial security of residents” of these settlements, the strategy says.

Many large state and private banks have their own NPFs, such as Uralsib, Raiffeisenbank, Sberbank, Gazprombank, VTB, Russian Standard. A bank that has its own non-state pension fund has the opportunity to attract pension funds for deposits. “However, the fund itself will require quite serious investments from the bank,” says Galina Morozova, president of Sberbank Non-State Pension Fund.

However, pension market participants believe that the logical step for RSHB would be to acquire an existing non-state pension fund. If a fund wants to carry out activities in compulsory pension insurance (OPI), then by law it must first work for at least two years in the field of non-state pension provision, and by purchasing a fund “with a history”, the Russian Agricultural Bank could begin developing compulsory pension insurance on its basis immediately, explains Executive Director of NPF "National" Svetlana Kasina. According to the Federal Financial Markets Service, from January to September 2012, the volume of pension savings of non-state pension funds (raised within the framework of mandatory pension insurance) increased by 53%, while the volume of pension reserves (formed within the framework of voluntary programs) increased by only 6%. Over the past three years, only one new license has been issued in the pension market.

Source:

https://www.banki.ru/news/lenta/?id=4559709

Official website of NPF "RGS"

This foundation is one of the oldest among existing organizations. He was one of the first to appear on the market and continues to successfully operate to this day. The company also has an official website, which presents its entire detailed history, as well as a lot of useful and necessary information regarding deposits, investments, savings and the entire operation of the system.

The site also serves as your personal assistant, because here you can find all the necessary information on the fund, answers to the most frequently asked questions and much more.

When determining, you should know the data regarding its profitability and reliability rating. These two factors are indicators of the level of profit and the risk of loss of funds. Accordingly, the higher the company’s performance, the greater your profit will be and the lower the risk of losing money and pension.

Now let’s take a closer look at the indicators of this fund and explain what they mean.

Profitability

This indicator is one of the most important among the others, since it is it that guarantees investors a high rate of return on their deposits. A figure of at least 8 is considered the norm. If the indicators are less than the specified number, then your income will not be very large. Accordingly, the higher the number, the greater your profit will be. This fund has a yield of 9.48, which is quite good for a fund.

Reliability rating

As for this point, it also plays an important role in the operation of the system. It guarantees investors that all invested funds will be intact and safe, regardless of external factors that have a negative impact on its work. Rosgosstrakh has a rating of A++, which means a high level of public trust.

Good to know. When choosing a particular fund, it is very important to pay attention first of all to these two points, since they play a key role in the operation of the system.

Investment activities

Find out about the investment strategy of Sberbank NPF and investment performance indicators

It is not an offer and does not guarantee future profitability. An actuarial yield of 7.5% is used in the calculations. The calculations take into account the growth of wages at the average inflation rate according to the Forecast of long-term socio-economic development of the Russian Federation for the period until 2030 of the Ministry of Economic Development of the Russian Federation (3.7%). The calculator shows the calculation of a non-state pension, taking into account an initial contribution of 1,500 rubles, with payment over 10 years, based on the “Universal” individual pension plan. The length of service for calculating the funded pension is calculated from 2002. The age for starting work is 18 years. In the calculations of the funded pension, a moratorium on deductions of 6% of employer contributions for 2014–2019 is taken into account.

Source:

https://npfsberbanka.ru/

Interest accrual in 2020

According to information on the official website of Rosselkhozbank, interest on the balance is calculated using the following formula: balance amount in rubles X 4%/365 days).

Conditions

To calculate interest, the bank calculates the current account balance. In those months when the account has 50 thousand rubles or more, the interest begins to “drip”.

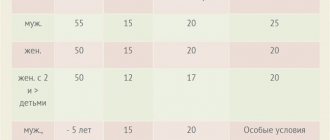

| Balance, rub. | Surcharge to the rate |

| 0-50000 | 0% |

| 50000-100000 | 0,5% |

| 100000-500000 | 1% |

| More than 500,000 | 2% |

How are they calculated?

Basic 4% is calculated every day. If the remainder changes, they do not burn. The final amount is credited on the last day.

Restrictions

Interest accrual on deposits is sometimes late. Since the bank does not process such transactions instantly, the money may be late by 2-4 days.

Additional income from pension

Transferring your savings to a deposit is a reliable income for retirees. Rosselkhozbank offers favorable conditions and several tariff plans. It is also possible to open a deposit.

Advantages and disadvantages

Advantages of Rosselkhozbank and the Pension card:

- free issue;

- cheap service;

- high interest on deposits - up to 6% per annum;

- Unionpay availability.

Among the disadvantages are:

- When registering using any method, you will still have to go to the office to pick up the finished plastic.

Each bank client analyzes the conditions and decides for himself whether they are convenient or not. Before opening a retirement account, research the offerings of different financial institutions to make an informed decision.