Disabled people are the most socially vulnerable category of the population; the state pays them benefits, therefore the size of the disability pension for group 2, as well as for other groups, is important information for people who have lost their ability to work. In general, the amount of payment is determined by the type of social benefit, the presence and length of work experience, the number of pension points, regional coefficients and allowances.

You can calculate the amount of your pension yourself or by contacting a branch of the Pension Fund.

Disabled people of the second group are citizens with a level of disability of 79-80%. In other words, this category of people is considered disabled, but capable of caring for themselves (independently or with the help of technical devices) and not requiring constant care.

Such a citizen can work only after passing a special medical commission and only if certain conditions are met. It is difficult for a disabled person to apply for a job with good pay, so for people in need of social protection, the question of how the disability pension of group 2 is calculated is very important.

How is disability pension of group 2 calculated?

Benefits for citizens of this category of disability can be defined in several types:

- social;

- state;

- insurance

The first type of social benefit is paid to those persons who have no work experience. This category also includes people with disabilities from childhood and those under eighteen years of age.

State

The state pension is assigned in accordance with certain laws of the Russian Federation or decrees of the Government of the Russian Federation.

This payment is available to a limited category of citizens:

- veterans of the Great Patriotic War;

- residents of besieged Leningrad;

- astronauts;

- liquidators of radiation disasters;

- victims of the consequences of radiation disasters.

Insurance

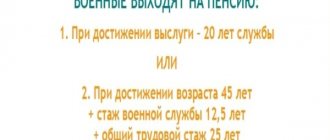

To apply for a disability insurance pension of group 2, the applicant must have at least 1 day of work experience.

The total payment amount depends on 3 conditions:

- pension capital;

- expected survival time;

- work experience.

At the same time, when the generally accepted retirement age arrives, a group 2 disabled person decides for himself which type of benefit is preferable for him - old age or disability.

FAQ

Question No. 1. On what grounds can a disability group be removed?

The reason is always the absence of the grounds that served to establish it. For example, a significant improvement in health, in which a citizen no longer needs social support.

Question No. 2. Can a group 2 disabled person continue to work in retirement?

Yes, the legislation does not provide for the work of pensioners, but benefits will not be indexed.

Registration of disabled status

Before applying for a disability pension of group 2, you should obtain a certificate of loss of ability to work. The status of a disabled citizen is determined on the basis of the conclusion of a medical and sanitary examination - ITU.

The attending physician refers the patient for an examination, where the commission examines the attached documents, examines the patient and makes a decision.

If a citizen is recognized as disabled, an act is drawn up and sent to the regional branch of the Pension Fund.

Further, the person recognized as incapacitated for work, upon personal application, provides to the Pension Fund:

- relevant statement;

- passport;

- SNILS.

Foundation staff are reviewing the application. Pension Fund specialists know how the disability pension of group 2 is calculated using current methods. The disabled person only needs to decide on the method of transferring benefits.

Important! In exceptional cases, the patient may be examined at his place of residence.

Disability of the second group is established for a period of 1 year. After this period, in order to extend payments, it is necessary to undergo re-certification once a year.

Grounds for suspension of payments

The transfer of benefits may be suspended in several cases:

- The disabled person did not pass the re-commission within the established time frame. If, after the expiration of the disability certificate, payments continue to be transferred, in the future the Pension Fund may demand the return of the overpaid money, so it is better to avoid such a situation.

- The pensioner does not collect the benefit for three months if it is issued through the mail. To avoid such situations, it is recommended to apply for a pension on a bank card; in addition, some financial institutions offer preferential terms of service and interest on the balance. This is cheaper than visiting the post office.

Also, payments stop in the event of the death of a pensioner or removal of the disability group.

Most common mistakes

Mistake #1. If a disabled person on pension dies, the heirs will not be able to receive the funded part of the pension.

No. According to the Civil Code of the Russian Federation, the inheritance mass may include money in bank accounts and funds transferred to the savings portion.

Mistake #2. An insurance pension is always more profitable than a social one.

No, in some cases, with a minimum length of service, the amount of the insurance benefit is lower than the social benefit, and then it is more profitable to apply for the latter.

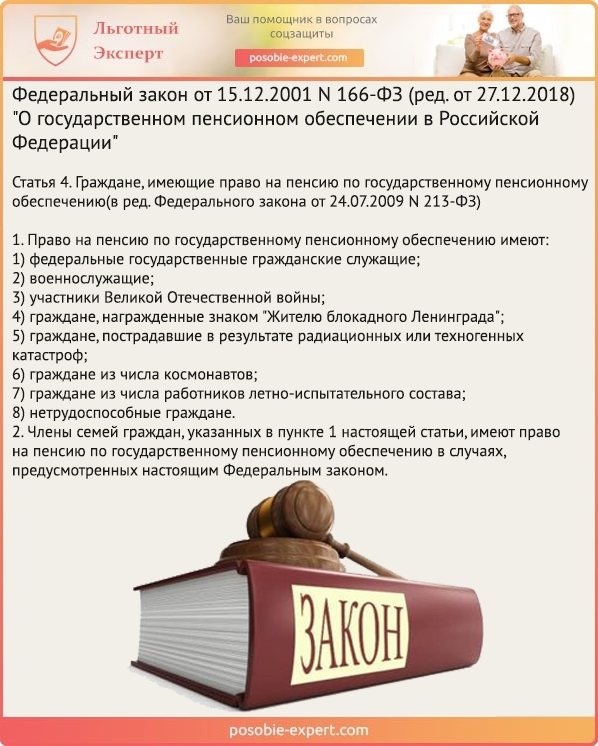

State compensation

This type of payment is regulated by Federal Law No. 166-FZ dated December 15, 2001. Citizens of the Russian Federation and foreigners living here on a permanent basis can receive it:

- military servants;

- civil servants upon reaching 15 years at the place of work;

- WWII participants;

- injured during a radiation or man-made accident;

- those who lived in Leningrad during the siege;

- persons unable to carry out labor activities;

- cosmonauts and pilots of the test team with 20 years of experience. (women) and 25 l. (men).

Thus, there are 5 types of government compensation:

- Due to disability.

- For long service.

- Upon reaching retirement age.

- Due to the loss of the only provider.

- Social.

State payments are regulated by Federal Law dated December 15, 2001 No. 166-FZ

Cases of paying 2 pensions at the same time

Almost everyone who fits the categories can only qualify for one type of payment. But there are exceptions. These persons can be paid 2 types of pensions:

- parents or widows of military personnel killed during service (benefits due to the death of the breadwinner + due payment in case of old age or + social compensation or + for long service);

- disabled military personnel and WWII veterans (insurance payment due to reaching the required retirement age + compensation as a disabled person);

- relatives of deceased cosmonauts (payment as a dependent due to the loss of the sole breadwinner + any other pension);

- relatives of persons with radiation sickness who are unable to work, as well as victims of the Chernobyl nuclear power plant (payment due to the loss of their breadwinner + labor pension due to the onset of the required old age (as well as due to disability) or + social compensation).

There are certain categories of persons who are paid 2 types of pensions

Insurance payment

These monetary compensations are regulated by Federal Law No. 400-FZ dated December 28, 2013. Both insured persons with Russian citizenship and foreigners can apply for payment. As already mentioned, this includes elderly people who have the right to receive this benefit, dependents left without support, and disabled people of groups 1, 2, 3. To be able to apply for a subsidy, the last of the above-mentioned citizens must first of all confirm their disability. According to Decree of the Government of the Russian Federation dated February 20, 2006 No. 95, the following reasons together are required:

- permanent inability to perform daily functions due to illness;

- limited activity related to vital functions: inability to move, take care of oneself, etc.;

- rehabilitation need.

Decree of the Russian Federation N 95 “On the procedure and conditions for recognizing a person as disabled”

Conditions of appointment

In order for a pension to be granted, three main conditions :

- The person was recognized as disabled.

- ITU has established a disability group.

- There is an insurance period, that is, the period of payment of insurance contributions to the Pension Fund.

Availability of an official document confirming the status of a disabled person

As a rule, an extract from the medical and social examination report is sent by the organization to the relevant pension authority within 3 days from the moment the citizen is recognized as disabled.

Experience of any length

In the absence of a period of labor activity, the citizen is paid a social benefit.

Who is assigned the status of group 2 disabled person?

A person with moderate impairments is assigned the status of group 2 disabled person. The Ministry of Health and Social Development of the Russian Federation has approved a list of consequences resulting from chronic diseases, injuries, congenital deformities, under the influence of an iatrogenic factor (medical error), which are sufficient grounds for recognizing the limited capabilities of a citizen:

- The ability for self-service is not fully expressed.

- There is not enough physical ability to establish full contact with other people (for example, with serious hearing, vision, or speech impairments).

- Mobility abilities are limited.

- Adequate perception of the environment is difficult.

- Characterized by serious violations of self-control.

- The level of development does not correspond to the indicators of peers.

- Ability to work depends on compliance with a number of conditions - the availability of devices, a specially equipped workplace, and support from third parties.

- How to protect yourself from coronavirus infection on the subway

- Indexation of pensions for non-working pensioners in 2020 - stage schedule

- How to choose a pedometer for pensioners

Social payment

Who is entitled to

People who have no work experience or have reached old age can count on social compensation. According to Federal Law No. 166-FZ dated December 15, 2001, this includes:

- children under 18 years old or up to 23 l. before the end of full-time education, who lost 1 or 2 breadwinners;

- citizens who have reached 70 years of age. (men) and 65 l. (women), including foreigners of this age who have lived in Russia for 15 years. and more;

- small inhabitants of the North 55 y. (men) and 50 l. (women);

- people of any degree of disability, as well as people with disabilities since childhood;

- disabled children.

Federal Law “On State Pension Provision in the Russian Federation” N 166-F3. Article 4

Find out how to apply for a survivor's pension, as well as the size and indexation, from our new article.

Documents for registration

This type of pension is paid by the state. To apply for social security, a disabled person must provide:

- passport, as well as information about the representative of his rights;

- document proving place of residence;

- application (you can find the form here, and an example of how to fill it out here);

- a certificate confirming his ability to receive this benefit.

You can submit documents:

- at a personal meeting with a person representing the Pension Fund;

- in the MFC;

- by post;

- via the Internet on government services: https://www.gosuslugi.ru.

You can apply for social benefits for disability via the Internet on the government services website

Cash support is assigned starting from the next month after the application is submitted. There is no limit to the period during which you can apply.

Amount of social benefit

The payment amount was indexed in 2020 and, due to the pension reform, increased by 7.05%. So now it is:

| Disability | 2019 | 2018 |

| People with disabilities 1 gr. from childhood, as well as disabled children | RUB 12,730.82 | RUB 12,082.06 |

| 1 gr. and persons with disabilities since childhood 2 gr. | RUB 10,609.17 | RUB 10,068.53 |

| 2 gr. | 5304.57 rub. | 5034.25 rub. |

| 3 gr. | 4508.91 rub. | 4279.14 rub. |

The pension reform, of course, affected not only disabled people. It applies to all persons who have reached a certain old age: now it is 60 l. (women) and 65 l. (men). Previously it was 55 l. and 60 l. respectively.

Note! Social compensation is issued for the period of disability of a person, maybe for an indefinite period, if due to persistent inability to carry out life activities, a period is also not established.

The above amount will be received every month:

- to an account in one of the banks;

- through a company that has entered into an agreement with the Pension Fund;

- to the post office or home delivery.

If a citizen is unable to receive a pension himself, this can be entrusted to a representative by drawing up a document for him under a power of attorney. You can confirm the authority of the representative at any treating medical institution.

A disabled citizen can draw up a document under a power of attorney for a representative to receive a pension

Find out what insurance and social pensions are and what the difference is from our new article.

Amount of insurance payment

Cash support is carried out according to the formula:

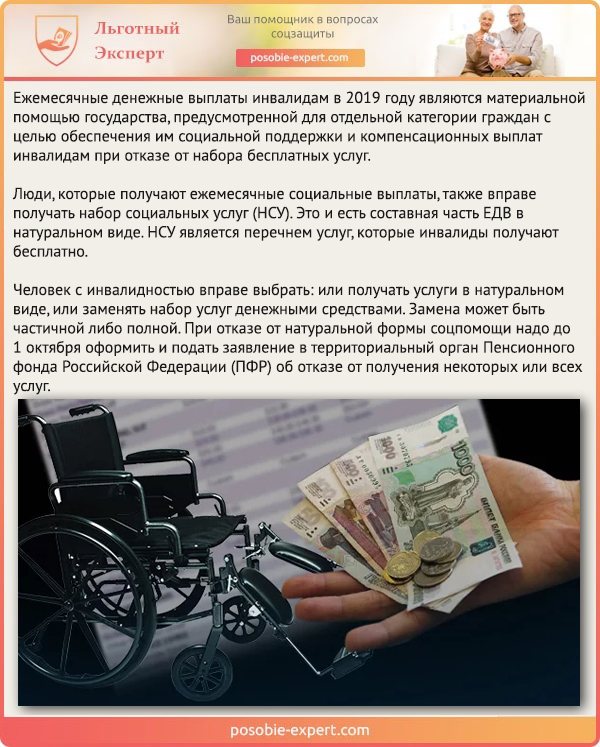

SP = PB * S + P, where SP is the payment itself, PB is points accumulated before receiving a pension, C is the cost of 1 point in a certain year, P is a permanent benefit paid to disabled people every month - EDV. In 2020, the size of the single cash payment is:

| Disability | 2019 | 2018 |

| 1 gr. | RUB 3,750.30 | RUB 3,626.98 |

| 2 gr. | 2678.31 rub. | 2590.24 rub. |

| 3 gr. | 2144 rub. | 2073.51 rub. |

| Disabled children | 2678.31 rub. | 2590.24 rub. |

| Limited in opportunities due to war | RUB 5,356.59 | 5180.46 rub. |

| Disabled Chernobyl survivors | 2678.31 rub. | 2590.24 rub. |

This also includes the NSO (set of social services). If a citizen does not want to take advantage of this type of assistance, it is replaced with a cash payment. In 2020 it is 1111.75 rubles, while 856.30 rubles. paid for the purchase of tablets, 132.45 rubles. – for treatment in a sanatorium, 122.90 rubles. – for travel to the institution where treatment will take place. This type of benefit is provided every month.

Monthly cash payments to disabled people in 2020 are financial assistance from the state

Example: Terentyeva A.R. In 2020, she received group 2 disability and wants to apply for an insurance pension. Her work experience is 3 years. For 2020, Terentyeva earned 440,000 rubles, for 2020 - 470,000 rubles, for 2020 - 510,000 rubles. In 2019, the cost of 1 pension point is 87.24 rubles. (in 2020 – 81.49 rubles, in 2020 – 78.58 rubles) First, let’s calculate pension points. To do this, you need to determine the ratio of contributions paid by the employer at the insurance rate (16%) to contributions from the maximum annual salary. In 2020 it was equal to 796,000 rubles, in 2020 – 876,000 rubles, in 2020 – 1,021,000 rubles. After this you need to multiply by 10.

2016: 440,000 rub. / 796,000 rub. * 10 = 5.53 b.

2017: 470,000 rub. / 876,000 rub. * 10 = 5.37 b.

2018: RUB 510,000 / 1,021,000 rub. * 10 = 5 b.

Thus, Terentyeva has 15.9 points.

Let's find out the amount of the labor pension:

15.9 b. * 87.24 rub. + 5334.19 rub. = 6721.31 rub.

Insurance compensation is assigned within 10 days. from the date of filing the application, but if the request was made no more than one year from the date the person was recognized as disabled.

Insurance compensation for disabled people is assigned within 10 days. from the date of application