Today, many citizens of our country have northern experience. Many of them dream of moving from the Far North to some cozy place, but do not know whether their pension provision will change or not.

What can affect the size of the northern pension? What additional benefits are there if you have a northern pension? For this reason, we will consider this issue in more detail.

Features of calculating the northern pension

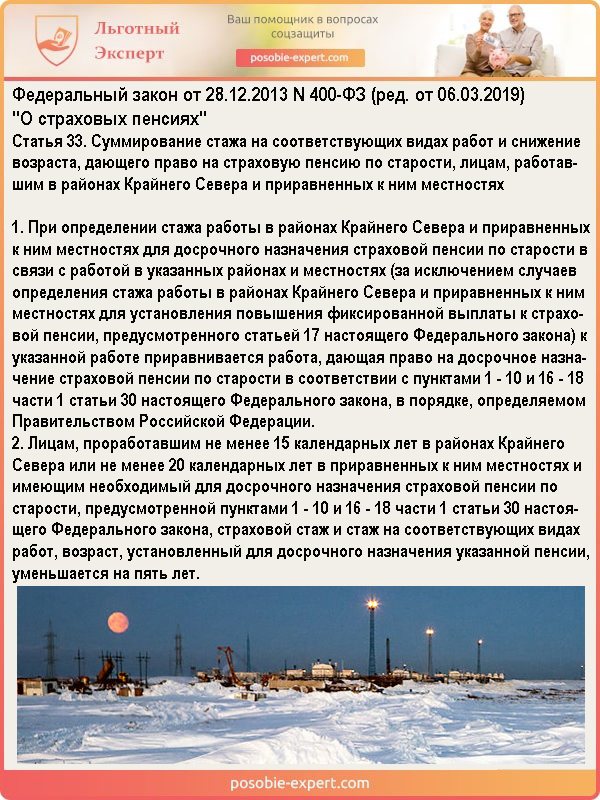

Residents of the Far North can receive two types of benefits at once. Law 33-FZ establishes the possibility of early retirement in old age. Article 17 No. 400-FZ approves an increase in the insurance share of the pension.

Important! Having northern experience allows you to receive the title “Veteran of Labor” ahead of schedule, taking into account additional multipliers and coefficients.

Features of calculating the northern pension

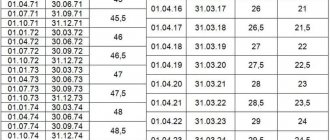

“Northerners” have the right to retire at age 55 for men and age 50 for women. In order to start receiving payments, a man must have at least 15 years of experience in the Far North or 20 years in equivalent areas.

For women, the list of opportunities to retire early is somewhat broader:

- the birth of two or more children;

- exceeding 20 years of total insurance experience;

- having at least 12 years of northern experience or 17 years in equivalent conditions.

For fishermen, hunters and reindeer herders, the age limit is shifted another 5 years lower (50 men, 45 women), while the length of service must be at least 25 (20) years.

In addition, for residents of the North, the insurance portion of their pension is increased by a special coefficient. The amount of the supplement is set by the federal government, and to receive it you must live in the region.

Federal Law N 400-FZ. Article 33

Northern experience

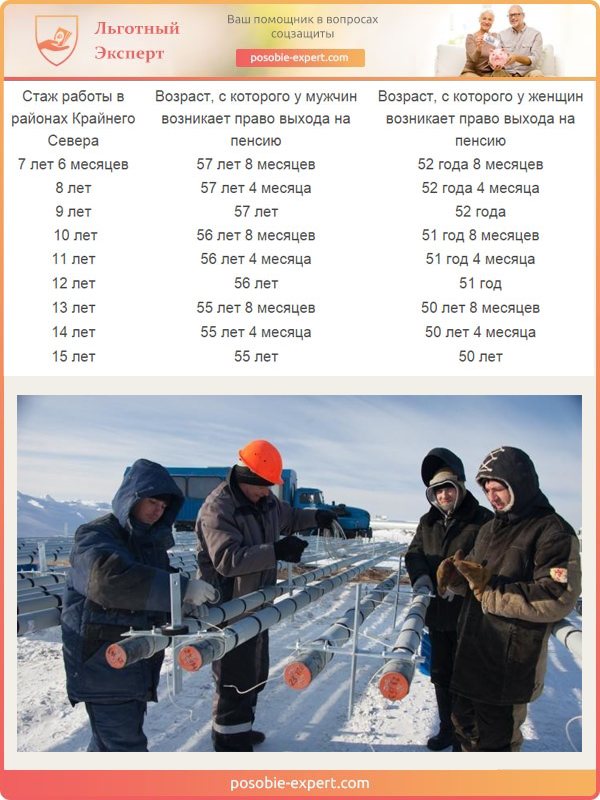

The basis for increased payments to northern pensioners is the northern length of service. This type of length of service is accrued according to a special scheme, and in case of sufficient accumulation, it gives the pensioner various benefits and advantages.

Important! According to 400-FZ, persons who have worked for 15 years in the Far North and have 25 years of insurance experience (20 years for women) are entitled to an increase in the fixed part of payments by 50 percent. For regions equated to the KS, at least 20 years of work will be required, and the increase in payments will be 30 percent.

The basis for increased payments to northern pensioners is the northern length of service

The minimum unit of calculation is the calendar month. In the northern work experience, unlike the usual one, periods of unemployment with registration at the employment center, child care for up to one and a half years, and part-time work are not taken into account.

Also, the following periods will be deducted from the term, which would be counted for regular length of service:

- refresher courses;

- study leave;

- leave to care for a disabled person;

- other types of vacation at your own expense.

For men, military service time is taken into account. This will not provide any particular advantage for conscripts, but professional military personnel will be able to receive a significant increase in their pension.

Conditions of retirement

To confirm the period of work in the Far North before registering a SNILS identifier, a citizen can provide a work book, a concluded contract, certificates, salary slips and other archival documents. In this case, the decision to confirm the length of service or refuse the request is made by the Pension Fund. After receiving SNILS, it is enough to provide the card number - all information on work is entered into the database automatically.

The procedure for applying for a preferential pension and social supplement

The issues of assigning the “northern” pension, as well as other subsidies, are dealt with by the Pension Fund of Russia. It is there that the citizen must apply with the appropriate application, attaching the necessary documents to it. Their list includes:

- passport;

- pension certificate or certificate from the Pension Fund of Russia;

- certificate confirming place of residence;

- work book or other documents indicating the presence of “northern” work experience.

If the pensioner is disabled or supports dependents, he should attach the relevant documents.

Review period

The appeal is reviewed within 10 working days. During this time, Pension Fund employees establish the accuracy of the information received and make a decision. If it is positive, then the bonus will be paid from the 1st day of the next month. Moreover, the accrual will also occur for the month in which the applicant submitted documents. Subsidies are added to the basic pension and are paid for life.

In case of refusal, the Pension Fund is obliged to provide a written reasoned response. Within 10 days from the date of receipt, the pensioner has the right to appeal it in court.

Pension size for northerners in 2019

The formula for calculating payments in general looks like this:

base size + (Regional coefficient * Pension point price * Total number of points).

The basic amount is set annually for various categories of pensioners.

- for each dependent, the increase in the basic amount will be 30% (no more than three in total);

- for citizens working in the Far North for more than 15 years with a total experience of 25 (20) years, the amount will be equal to 8,002 rubles;

- when working in areas equivalent to KS, the base will be 6935 rubles;

- for group I disabled people, orphans and elderly people over 80 years of age, the fixed payment amount is equal to 10,669 rubles.

The decision to confirm the pension experience or refuse the request is made by the Pension Fund

What does this look like in practice? Let’s say the northerner Fedorov worked at the CS for 25 years. The fixed pension in 2020 for residents of the North is 8,002 rubles, the price of one point is 87.25 rubles. The regional coefficient in the city of Mirny, where Fedorov lives, is 1.8, and the number of pension points earned is equal to 60. Let’s substitute the values into the formula.

8002 + (1.8 * 87.25 * 60) = 17425 rubles.

You can view the coefficients for different regions of the Far North in the table:

| Region | Coefficient |

| Islands of the Arctic Ocean, diamond mining enterprises of Yakutia, Kuril regions, Aleutian region of Kamchatka, Chukotka | 2.0 |

| Norilsk, Murmansk-140 | 1.8 |

| Magadan, a number of northern regions of the Sakha Republic, the village of Tumanny, Murmansk region | 1.7 |

| A significant part of the regions of the Sakha Republic, the city of Vorkuta, Taimyr Autonomous Okrug, the north of Evenki Autonomous Okrug, Kamchatka (except for the Aleutian region), Koryak Autonomous Okrug, a number of territories of the Krasnoyarsk Territory and the Sakhalin Region | 1.6 |

| Inta city, Kangalassy village, Nenets and Yamalo-Nenets Autonomous Okrug, Uvat district of the Tyumen region, large areas of the Tomsk region, north of the Republic of Tyva | 1.5 |

| A number of regions of the republics of Altai, Karelia, Sakha, Primorsky Krai, Arkhangelsk region. All remaining territories of the Murmansk and Sakhalin regions | 1.4 |

| Areas belonging to Buryatia, Karelia, Komi, Evenki Autonomous Okrug, Krasnoyarsk Territory and Amur Region, the southern part of Khanty-Mansiysk Autonomous Okrug | 1.3 |

| Developed areas of Buryatia, Komi, Primorsky and Khabarovsk territories, almost the entire Arkhangelsk region and Komi-Permyak Autonomous Okrug | 1.2 |

Travel discount for “northerners”

The government has provided two types of travel benefits for residents of the Far North:

- reimbursement of expenses associated with moving for permanent residence to another subject of the federation;

- compensation for the cost of purchasing tickets to travel to and from the holiday destination.

Both types of travel compensation are provided in two options:

- travel benefits for pensioners (unemployed) of the Far North in 2020;

- Reimbursement of the cost of tickets already purchased.

It is important to know that the reimbursement is of a declarative nature. That is, it is provided only upon application of the interested party. If the pensioner does not submit an application within 24 months from the date of purchase of the ticket, then compensation for the expired period is not paid. The same can be said about the benefits for pensioners “northerners” when moving.

Pension calculation calculator taking into account the regional coefficient

Go to calculations

Video - Will the northern pension change if you move to another region?

The main advantage of the “northern” pension is the rapid acquisition of the required length of service and a noticeably higher salary in the region, which makes it easier to collect pension points and retire with a significant insurance pension in your account.

The coefficient further increases the total amount of payments, but it will not remain in the event of a move. To clarify the list of regions and the coefficient in a particular area, you should contact the Pension Fund specialists at your place of residence.

What is the regional coefficient in Russian legislation

The regional coefficient (RC) is a special indicator that is used to calculate pensions, scholarships, compensation, as well as wages for persons living in the RKS (regions of the Far North) and MKS (areas equated to the Far North). With the help of the Republic of Kazakhstan, the incomes of citizens in various regions of our country are equalized.

First of all, at the legislative level, the concept of the Republic of Kazakhstan is enshrined in the Labor Code of the Russian Federation. According to the provisions of stat. 316 the size and procedure for applying this coefficient are approved by the Government of the Russian Federation. Additionally, authorities at the regional and local levels have the right to establish higher sizes of the Republic of Kazakhstan.

Procedure when changing place of residence

When changing place of residence, the citizen retains northern experience, which gives privileges upon retirement

When changing place of residence, a citizen retains northern experience, which gives privileges upon retirement and higher pension points. The payout ratio will vary depending on the specific region.

When moving to a new region, a pensioner must apply to the Pension Fund office for payments in the new place. By law, the Pension Fund must be notified of any change of residence. Based on the application, the fund’s specialists will request the citizen’s personal file from the previous place of residence. After transferring the case, the local pension fund registers the pensioner again and recalculates payments depending on the new conditions.

Using the example given above. So, Fedorov decided to move from Mirny to Krasnodar to live with relatives. At his new place of residence, he loses the northern coefficient, ultimately receiving 8002 + (87.25 * 60) = 13237 rubles.

Important! Most additional benefits and payments are made on an application basis. This means that in order to recalculate the number of dependents or the amount of payments after the age of 80, a pensioner must visit the Pension Fund office and submit an application.

How to make an appointment at the Pension Fund of Russia

When leaving for a long time to another country, a citizen loses the right to the regional coefficient. Northern experience, benefits received and all payments are retained. In general, changing your country of residence is no different from moving to a region with missing modifiers. The northern pension is also preserved when moving to another region of Russia.

| Type of document for transferring pension payments abroad | completed form | |

| Application for changing personal data | ||

| Application to request a payment case | ||

| Certificate confirming permanent residence outside the Russian Federation | ||

| Certificate of performance (non-performance) by a citizen of paid work outside the Russian Federation | ||

| An act of personal appearance of a citizen (his legal representative) in order to continue payment of a pension during the relevant period |

Payment of pensions when moving to another region

Pension recipients often change their place of residence in Russia. In this case, the citizen needs to notify the Pension Fund to redirect the payment case to a new address. This rule does not apply to Russians who have moved abroad (both to the CIS countries and to other states). A different procedure for pension payments has been established for them.

What payments are indexed to the regional coefficient?

Legislative indexation in the Republic of Kazakhstan is carried out for the following types of payments:

- Employee's salary, including salary and tariff rate.

- Additional payments and salary allowances, including “for harmfulness”, for qualifications, for maintaining commercial or military secrets, etc.

- Awards.

- Hospital benefits and scholarships.

- Minimum wage, as well as payments tied to the minimum wage.

- Compensation for work at night, in harmful or dangerous conditions.

- Pensions – the RK can be used when calculating the amount of pension provision only if the citizen lives in the relevant territory.

- Other types of payments provided by the employer.

The Republic of Kazakhstan does not apply when calculating vacation pay, one-time bonuses, amounts of financial assistance, percentage bonuses for employment in the RKS/ISS, business trips (except for trips to territories that also belong to the north). The values of the regional coefficient depend on the place of residence.

Read: Early pension for the unemployed in 2020