What is social pension

Material support provided by the state to disabled citizens who do not have sources of income, aimed at providing cash for their livelihood, is called a social pension.

The main and fundamental difference from an insurance pension is financing from the state budget, and not through contributions from employers.

Types of social pension

According to the law, there are several types of pension payments, which are divided depending on the category of citizens to whom benefits are assigned:

- due to old age,

- on disability,

- on the occasion of the loss of a breadwinner.

Next we will briefly look at each type.

Social old age pension (pensioners)

Those who have reached a certain age limit, but without the required amount of insurance experience, unemployed or able-bodied citizens are provided with monthly financial support from government funds.

Social disability pension

Due to limited life activity due to health reasons, citizens are provided with social assistance in the form of cash.

Social survivor pension

In the event that a dependent citizen loses his only breadwinner and is no longer able to provide for himself on his own, a social benefit is paid.

Who is eligible for disability benefits?

Budgetary assistance for disability in the Russian Federation is regulated by the law on state pension provision (Federal Law No. 166, December 15, 2001) according to which:

- Based on the results of a medical examination, an individual is assigned a disability status depending on the level of impairment of important life functions and associated limitations in his ability to work;

- the assigned status influences the amount and duration of social support assigned to the person;

- State support is provided for long-term disabled persons permanently residing in the country and does not apply to citizens who have left the Russian Federation.

Who is eligible to receive payments?

Recipients of social disability benefits include persons who have been unable to work since childhood, disabled children, and adults who have received a certain status group , namely:

- disabled people of group I who are completely dependent on other persons due to the impossibility of self-care or work;

- disabled people of group II who do not need continuous care from other persons and are capable of self-care, but do not have the opportunity to work fully;

- those who have received group III status, serve themselves independently and perform limited work in some professions, but are able to work only in easier conditions;

- disabled children whose category was assigned before reaching adulthood;

- disabled since childhood or citizens who were in this status in childhood and reached adulthood.

Important! Disability maintenance is paid from the federal budget for those who do not have the right to receive insurance coverage. But social assistance is not provided to persons living temporarily within the Russian Federation.

What is required to receive payments

The right to a pension for disabled people is granted to citizens recognized as belonging to one of the disability groups. The status is assigned based on the results of an examination during a medical and social examination, to which the applicant for social payment is sent by a medical worker.

A specific category is assigned:

- Based on relevant documents (referral from the attending physician, results of a medical examination).

- Depending on the patient’s illness associated with the disruption:

- respiratory organs;

- musculoskeletal system;

- digestive organs;

- organs of vision or mental disorders.

For different groups, confirmation of permanent disability status is made at different periods of time. This is due to the fact that as a result of rehabilitation, some of the disabled persons may improve their physical condition and restore some of the previously lost body functions.

Passing re-examination:

- citizens assigned to group I undergo medical re-examination once every 2 years;

- children with status - after 1, 2 years, or it is possible to establish up to 18 years of age;

- those assigned to other categories undergo the procedure annually.

Important!

It is important to undergo a repeat medical and social examination commission in advance, otherwise payments will be suspended due to untimely confirmation of status and resumed only after re-executing the package of documents. A citizen for whom a group of permanent disability has been recognized sends an application to the Pension Fund about the need to assign him social assistance in connection with obtaining the status.

Download for viewing and printing:

Sample application for a social disability pension

Registration of a social pension

For each of the previously listed types of social payments, there is a single assignment procedure.

Each citizen must complete the following steps:

- Consult the Pension Fund branch located nearby either your place of residence or your registration address.

- Collect all necessary documents.

- Go to the Pension Fund or the MFC with a collected set of documents to write an application. The application can also be submitted via the Internet (official websites of the Pension Fund and State Services).

The submitted application will be considered within the generally established period of 10 days . Based on the results of the review, a response will be sent to the address specified in the application, in case of a negative outcome - with explanations of the reasons and the deadline for re-sending.

The reason for refusal may be the unreliability of the information provided, or the presence of any sources of income related to work.

Required documents

The most important and most time-consuming process is the process of collecting the necessary documentation. To assign benefits, you must submit the following documents:

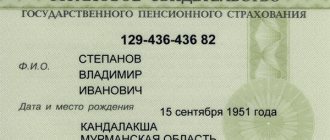

- application for a pension (depending on the type);

- citizen's passport;

- conclusion of a medical examination on assignment of disability (for disabled people);

- documents about the guardian (if necessary);

- SNILS;

- birth certificate from the registry office (for dependents who have lost their breadwinner);

- act on the death of the breadwinner (or a court decision declaring him dead);

- other documents confirming compliance with the conditions;

- certificate from the place of study at the university, in case of full-time study (in case of loss of a breadwinner);

- certificate of residence in Russia.

Where to contact

As soon as a citizen has the right to receive any type of pension, he must submit an application to the Pension Fund branch or to the MFC .

If you wish, you can implement such actions by registered post or electronically: through the websites of the Pension Fund or State Services.

To submit an application through the public services portal you need:

- Register an account and then log in.

- Follow the “services” link and select the one you need from the categories presented.

- Click on the pension link, where you need to select “establishment”.

- Select the type of service.

- Make a petition.

- Check the correctness of the entered information.

- Submit your application for consideration.

In the case of an electronic referral, you will need to confirm the sent information by contacting the Pension Fund or MFC branch with the original documents.

Procedure for processing payments for disability

The applicant can apply for the assignment of benefits independently or through a legal representative (authorized person) at his place of residence (residence, registration) to the Pension Fund of the Russian Federation:

- personally to the nearest PF body;

- through the employer;

- by sending registered mail to PF;

- through the PF website;

- through one of the social centers that have a cooperation agreement with the Pension Fund.

Required documents

Along with the application for a social disability pension, you must submit:

- applicant's passport or birth certificate;

- document on incapacity for work (ITU certificate);

- confirmation of place of registration and residence;

- documents for a representative, if the application for benefits is not carried out by the applicant himself personally.

Purpose of government payments

After 10 working days from the date of application, a decision is made on the assignment and amount of a disability pension, if the applicant provided a complete package of documents and there were no comments on them. Important!

Disability benefits are assigned to the recipient only after the latter has received the corresponding right to it, starting from the 1st day of the month in which the application for the appointment occurred. At the same time, the law does not limit the right of a citizen to seek help at any time from the moment this right arises. The person chooses the method of receiving monthly social benefits (at home, to a bank account) independently. He can receive the funds due in person, and if he has a notarized power of attorney, the amount can be received by a trusted person.

Conditions of appointment

The general requirement for the assignment of social benefits of any type is permanent residence in the country and a package of documents required to receive payments.

By old age

- presence of disability and unemployment;

- lack of other financial social benefits. help;

- reaching the required age limit.

By disability

- the presence of a “disabled person” status documented by a special commission.

On the occasion of the loss of a breadwinner

- death of the breadwinner with appropriate documentary evidence;

- a court decision to declare the breadwinner dead in the event of an unknown loss.

List of persons entitled to receive a social pension

Applicants for receiving social benefits in old age are citizens:

- not having the required amount of experience;

- who have reached the age limit required for retirement (60 and 65 years, for women and men, respectively).

People with disabilities of groups 1, 2, 3 can apply for a disability pension .

Disabled citizens who have lost their sole breadwinner receive a fixed cash payment

- children under 18 years of age who have lost a parent(s);

- children (age over 18 years) studying in institutions under the Federal State Educational Standard and who have lost their parent(s). The deadline for appointment is reaching the age of 23 or completing your studies.

- spouses and parents who have disabilities and have reached 55 years of age (women) and 60 years of age (men).

- immediate relatives (brothers/sisters/grandchildren) under the age of 18 who have lost their parents.

- grandparents who have no other income;

Social old-age pension: conditions, terms, payment procedure, registration

Conditions of receipt

- The citizen has reached the age of incapacitation;

- It does not have a sufficient level of IPC (individual pension coefficient), the minimum value of which changes annually: in 2020 it is 18.6, and by 2023 it will be at around 30.

- The citizen has not even accumulated the minimum work experience. Now it is 11 years, by 2023 (the end date of the transition to the new pension program) it will be 15 years for women and men.

- The citizen does not officially work and does not receive benefits from the employment center. There are no contributions to the Pension Fund for it.

Residents of the Far North – representatives of indigenous peoples – are specified separately in the legislation. They have the right to earlier retirement, but only on the condition that they belong to small and indigenous peoples, live in the north permanently, preserve the customs and lead the lifestyle of their ancestors.

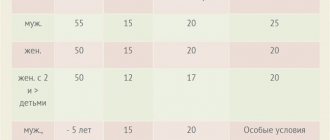

Appointment dates

- Citizens whose age is 5 years older than the age of onset of disability can count on a social pension. In 2020, this is 63 years for women and 67 years for men . By 2023, the values will be set at 65 and 70 years, respectively.

- Residents of the northern territories can apply for benefits in 2020 at the age of 52 for men and at the age of 47 for women (after completion of the reform - 55 and 50 years, respectively).

- Payments are made for life or until the social pensioner gets a job. Employment provides a chance to accumulate the missing length of service and IPC, after which the pensioner is assigned an insurance pension.

How to apply for an old age pension

A citizen who has reached retirement age applies to the regional branch of the Pension Fund of the Russian Federation, where he receives information about the status of his account. If the IPC and length of service do not reach the minimum values, he is given 5 years to accumulate the missing indicators. If this does not happen, you need to contact the Pension Fund again with documents and an application. In 10 days the social pension will be assigned.

Procedure for payment of social old-age pensions

Monthly in the amount established by the state in each region separately. For 2020, the amount of social pension is 5283 rubles 85 kopecks . Every year this amount is indexed and increases due to inflation. In each region, a pensioner who has received a social pension is entitled to additional payments from the regional budget: their amount is determined by the subjects independently.

Deadlines for assigning a social pension

When submitting an application with the necessary package of documents for the assignment of any type of social pension, employees of the Pension Fund will consider the application within 10 working days .

Upon expiration of the period, the results of the review are sent to the address of the citizen specified in the application. In case of refusal, the reasons will be explained in writing and the deadline for appeal will be indicated.

The date of assignment of social benefits is considered to be the first day of the next month from the moment of the citizen’s application (or stamp, in the case of sending by mail).

The exceptions are:

- situations where a citizen who has reached the required retirement age was previously accrued an insurance benefit due to disability until the age limit was reached.

- disabled since childhood (under 19 years of age) who previously received financial assistance from the state

- disabled children who stopped receiving payments due to reaching adulthood.

Transfers of survivor benefits are terminated:

- upon reaching 23 years of age (if training is still ongoing);

- upon reaching 18 years of age (without admission and training);

- during employment.

The period for assigning social disability benefits is the period during which the commission recognized the citizen as disabled.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

For disabled people of group 1, the established period for receiving payment is 2 years , for groups 2 and 3 – 1 year .

In the case of disabled children, the category is assigned for 1 or 2 years, or from 5 to 18 years.

Social pension for the loss of a survivor

Conditions of receipt

Children and students can apply for this type of financial assistance in accordance with Article 11 of Federal Law 166 , if the lost provider did not have work experience and did not work in government agencies. In other cases, an insurance payment or allowance is awarded from the funds of the Ministry of Defense (if the deceased was a military serviceman).

Appointment dates

- From the date of loss of the breadwinner: from the moment he died or was officially declared missing;

- Before reaching 18 years of age;

- For students - up to 23 years of age or completing full-time studies at a university.

Note: if a citizen, while a student, officially got a job, payments will continue.

How to apply for a survivor's pension

When applying for this type of payment for a dependent, the legal representative of a child left without one or two parents must provide papers confirming guardianship. An able-bodied citizen studying full-time can submit an application independently. The package of documents includes papers confirming the identity and relationship with the deceased, as well as a document confirming the death or recognition of the guarantor as missing. Additionally, you may need a certificate from an educational institution and other documents on the basis of which the dependent does not have the right to an insurance pension.

Payment procedure

The pension is transferred once a month. Its size at the beginning of 2020 is 4982 rubles 90 kopecks , but annual indexation is expected on April 1, after which the size of the payment will increase slightly.

The size of the social pension in Russia in 2020

The average value of social benefits for old age, taking into account additional payments in Russia, is 9,276 rubles .

For persons with disabilities, the amount of social benefits is determined by the group and disability status.

| Group, disabled status | Amount of social pension (RUB/month) |

| First | RUB 10,567.73 |

| children | RUB 12,681.09 |

| since childhood | |

| Second | RUB 5,283.84 |

| since childhood | RUB 10,567.73 |

| Third | RUB 4,491.30 |

For the current year 2020, the amount of payment for minor citizens who were dependent on deceased parents and for citizens studying full-time in educational institutions (age category up to 23 years) amounted to 5,240 rubles . If both parents are lost – 10,481 rubles .

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

The amount of the pension is established by a regulatory act in accordance with the increase in the cost of living (clause 1, article 18 of Federal Law No. 166-FZ).

For citizens living in the Far North and areas with similar climatic conditions, an additional coefficient is established for the region, which increases the amount of the pension. The period of such additional payment ends in the event of a change of permanent place of residence and moving to another area that is not regulated by law.

If situations arise where the payment amount does not reach the subsistence level, you should contact the Pension Fund to arrange an additional payment.

List of persons entitled to receive a social disability pension

A disability pension is established for citizens who have been unable to work since childhood or who have received a certain status group during their lifetime. Recipients of this type of social assistance are the following categories of the population.

Citizens with the status of “disabled” 3 groups according to medical and social indicators

Such people are able to provide for themselves independently and engage in work activities, but with restrictions in certain professions.

That is, disabled people of the 3rd group must work in a light mode.

Citizens belonging to the 2nd disability group

Citizens belonging to the 2nd disability group who do not require constant care, however, full-time work is not possible.

Citizens who received 1st disability group

Citizens who have received the 1st group of disability and are unable to work due to the inability to self-care. Individuals with disabilities represented are dependent on others because certain health problems prevent them from caring for themselves.

Disabled children

Disabled children with serious health problems before their 18th birthday.

Citizens who were disabled in childhood and have reached the age of 18

Citizens who were disabled in childhood and have reached the age of 18.

Disabled people of 3 groups

For people with group 3 health problems, documented by a medical commission, they are offered work in their profession, but in easier working conditions.

According to calculations, the amount of social pension for group 3 disability per month for the current 2020 is 4,491.30 rubles. .

However, in each case, the amount of the benefit may change, so you must contact the Pension Fund for clarification.

In addition to cash payments, disabled people of group 3 are also provided with other benefits:

- pharmacological drugs with a 50% discount or free (with a prescription);

- free travel on public transport vehicles;

- vouchers to sanatoriums for treatment.

In 2020, the monthly cash payment (MCV) to pay for the social package is presented as 1121 rubles 42 kopecks , of which:

- 863 rubles 75 kopecks – for medicines;

- 133 rubles 62 kopecks – for resort packages;

- 124 rubles 5 kopecks – for travel.

Like the pension amount, the size of the EDV is determined individually by the Pension Fund based on certain indicators.

Disabled people 2nd group

Disability group 2 is assigned to citizens who are unable to work, but who have the ability to care for themselves. Accordingly, depending on the group and certain conditions (congenital or acquired pathology that limits work activity), a specific pension amount is paid.

For 2020, the amount of social benefits for disabled people of group 2 is 5,283.84 rubles. , from childhood – 10,567.73 rubles. .

If a citizen has work experience, he or she is given the opportunity to receive an insurance pension, the amount of which is correspondingly higher.

For these categories of people, 1,580 rubles to pay for prescription drugs, vouchers, and travel.

Citizens are given the right to exchange a full package of social services for cash benefits. In this case, it is necessary to submit an application to the Pension Fund, after which, after consideration, a payment will be assigned from the beginning of the next year.

Disabled people of 1st group

Persons with disabilities of group 1 need support from other people due to health problems, and therefore the state allocates funds to an unprotected category of people.

On average, the size of the social pension for people with disability group 1 is 10,567.73 rubles. , for disabled people since childhood – 12,681.09 rubles. .

The amount of the benefit depends on both the characteristics of the disability and the region of residence.

Receiving an insurance pension is possible if you have at least one day of work experience.

The set of social services (NSS) is expressed in monetary terms as 1121 rubles 42 kopecks :

- for prescription drugs – 863 rubles 75 kopecks ;

- for a recreational holiday – 133 rubles 62 kopecks ;

- for travel – 124 rubles 5 kopecks.

As for other groups of citizens, it is possible to convert NSO into cash payments by submitting an application with a corresponding request.

Methods of delivery of social pension

Regardless of the type of payment, each citizen who meets the previously presented conditions is given a choice of how to receive state financial assistance.

Using Russian Post

Each citizen is invited to receive funds directly in person at the post office closest to their place of residence or registration on an individually designated date, or at home, using the services of a postman. If there is a delay in payment that does not exceed the delivery time, do not worry.

If a citizen has not received social benefits for a long time (6 months), then the pension will be suspended. Renewal can be carried out by submitting a corresponding petition to the Pension Fund or MFC.

By transfer to a bank account

The most convenient way for the majority of the Russian population is to transfer financial assistance to a bank card without charging a commission. There is another option for receiving funds - through the cash desk of a bank branch.

Using companies specialized in delivering benefits

Payment of funds is carried out according to the same principles as mail (issuance both in the organization and at the pensioner’s home)

When choosing delivery or if you want to change the type, you must notify in an accessible and convenient way:

- appeal to the Pension Fund;

- sending an application electronically through the website of the Pension Fund or State Services.

Popular questions

It is worth considering frequently asked questions.

What is the amount of the minimum social pension?

For better clarity, information about the minimum benefit values is presented in the table.

| № | Category | Amount (RUB/month) |

| 1. | Persons with disabilities 3 groups | RUB 4,491.30 |

| 2. | Pensioners | RUB 5,283.84 |

| 3. | Persons with disabilities 2nd group | |

| 4. | Children left without a breadwinner | |

| 5. | Children who have lost both parents | RUB 10,567.73 |

| 6. | Persons with disabilities of group 1 | |

| 7. | Persons with disabilities 2nd group since childhood | |

| 8. | Disabled children or persons with disabilities of group 1 since childhood | RUB 12,681.09 |

When will the social pension be increased?

The benefit amount is expected to increase in the coming 2020 by 7%.

Calculation of the amount of disability accruals in 2020

The amount of payments from the budget is set by the state in a fixed amount depending on the cost of living. Every year, the amounts are indexed by the state taking into account the cost of living in the country in the past year.

From April 1, 2020 to April 1, 2020, the amount of the budget payment for disability was:

| Recipient status, group | Amount of monthly assistance, rub. | |

| 1 | Disability group I and group II since childhood | 10360,52 |

| 2 | II disability group | 5180,24 |

| 3 | III disability group | 4403,24 |

| 4 | Group I from childhood and disabled children | 12432,44 |

What determines the amount of charges?

For those living in the Far North, supplements to the disability pension are applied through the use of an increasing regional coefficient established for the period of residence of recipients within the specified areas.

The material support of persons in these categories cannot be below the subsistence level. Based on what pension the disabled person has, an additional payment is established to adjust the amount of assistance to the recipient, paid by the Pension Fund of the Russian Federation (at the federal level) or the territorial social protection authority (at the regional level).