In what cases is proof of income required?

Initially, income documents are required when applying for a residence permit. When switching to an indefinite option or extending the status, the certificate is no longer included in the package of mandatory official papers.

The monthly income must not be lower than the minimum subsistence level established for the specific area in which the foreigner is applying for permanent residence.

The minimum is established by the Order of the Ministry of Labor and regional regulations. For most able-bodied people it is at the level of 10–12.3 thousand rubles. For Moscow, the bar is higher - 19.9 thousand rubles per month (according to data for the 2nd quarter of 2021).

In the absence of legal income, a foreigner has the right to obtain a residence permit based on incapacity for work, the proof of which is a medical certificate of disability.

While living in the country, foreigners annually report their income to the Russian Ministry of Internal Affairs. The types of supporting documents are similar to those for obtaining the residence permit itself. Ignoring the procedure for more than two years will result in the cancellation of the residence permit.

The essence of the event is to monitor the ability of foreign guests to survive in Russia by migration services. The state is not interested in accepting citizens of other states who are not able to provide for themselves.

Lack of earnings for six months is punishable by termination of the residence permit.

Migration Forum of St. Petersburg

It's simple. The total amount of income received for the year, when divided by 12 months, must confirm the average monthly income at a level not lower than the subsistence level established in the region of residence of the migrant. In St. Petersburg and the Leningrad region, the living wage is established annually. As of the date of writing this article, the cost of living in St. Petersburg was established by Decree of the Government of St. Petersburg dated 06/07/2021 N 417 “On establishing the cost of living per capita and for the main socio-demographic groups of the population in St. Petersburg for the first quarter of 2021 ", for the Leningrad Region - by Decree of the Government of the Leningrad Region dated February 13, 2021 N 20 "On establishing the cost of living per capita and for the main socio-demographic groups of the population in the Leningrad Region for the fourth quarter of 2021."

We recommend reading: What are the amounts of monthly benefits for children under 18 years of age in 2021

If a citizen does not have sufficient funds, his temporary residence permit and residence permit may be revoked (an exhaustive list of grounds for cancellation of temporary residence permits and temporary residence permits is specified in Article 7 and Article 9 of the Federal Law “On the Legal Status of Foreign Citizens in RF")

How to confirm income when applying for a residence permit?

Income is confirmed by a 2-NDFL certificate (a sample can be viewed here). This is the main document required when applying for a residence permit.

We advise: How will a bank deposit help when confirming income for a residence permit?

In addition to 2-NDFL, it is allowed to provide:

- a regular certificate from work indicating salary;

- 3-NDFL (tax return);

- pensioner's ID;

- certificate of availability of a deposit indicating the account number and deposit amount (not lower than the subsistence level in the region).

If one salary does not reach the required level, then it is allowed to additionally attach documents about other sources of financing. You can choose from the above list.

It should not be overlooked that for able-bodied persons, children and pensioners, the minimum size differs, including by region. The level for pensioners, broken down by region, is available for reading on the website of the Pension Fund, for other persons - on the websites of local authorities.

[vote2x id=”1398" align=”center”]

The types of official income papers that are suitable vary. Commonly used forms are described below:

- Certificate of income. A salary certificate in form 2-NDFL includes information about the place of work, position held, income for the entire period of work from the date of receipt of a temporary residence permit (TRP), and employer contacts. The usual validity period for a certificate is 1 month.

- Tax return. 3-NDFL also reflects information about income. It is suitable if there is no official work, but there is an inheritance, money for sold housing, etc. 3-NDFL can be found here. When declaring income, you will need to pay an income tax of 13%.

- Statement from the bank. The deposit certificate works as an auxiliary document in the presence of 2-NDFL. The account must have 4 subsistence minimums for the region (exactly for 4 months of consideration of the application). If there is no other proof of income, it is advisable to increase the amount as much as possible (at least to 12 subsistence levels). The bank certificate is valid for several weeks. Available at any branch upon request.

The deposit can be made not only in rubles, but also in foreign currency. In this case, you need to indicate the equivalent amount in rubles at the exchange rate of the Central Bank of Russia on the date of filing, and obtain a certificate from the bank about the exchange rate.

How much money do you need to have in your account to get a residence permit in the Russian Federation?

However, some lawyers who practice assistance in obtaining a residence permit say that most often a certificate of availability of a bank deposit may reflect the amount of monthly subsistence minimum (depending on the subject of the Russian Federation) for only six months, and not for twelve. This is exactly how many months it takes for the migration service to consider an application for a residence permit.

First, let’s look at how the law defines the concept of income for migrants who come to work. Decree of the Government of the Russian Federation dated February 9, 2007 No. 91, paragraph 5, states: In this case, income can consist of the following types of cash receipts: Income is taken into account before taxes.

We recommend reading: Reviews About Pay for Housing for Military Personnel in 2021

The minimum requirement when applying for a residence permit: the amount in the personal account must be more than twelve subsistence minimums of the region in which you live - the annual subsistence level (ML). As of May 1, 2021, the monthly minimum for Moscow, for example, is 18,742 rubles and 13,750 rubles for the Moscow region. Thus, if we are talking about the capital, the account should have at least 224,907 rubles, for the Moscow region - 165,000 rubles.

This type of tax reporting is an official statement by a migrant about exactly what income he received over a certain period of time. Such a declaration is submitted to the tax office in a strictly regulated form, which allows the authorized service to control the amount of duty that must be paid.

The document is one of the most required. It may be needed by both a civil servant and an ordinary employee of a private organization. It shows how solvent a given person is. It is often required for bank loans, when applying for visas, for various social services and, of course, for the tax authorities.

- The behavior of a migrant must comply with the law and constitution of Russia.

- A foreign citizen must be able to provide for himself and his family, that is, the average income must not be lower than the subsistence level.

- Foreign citizens with a residence permit are allowed to travel abroad of the Russian Federation for no more than 6 months.

- Once a year, a foreigner is required to submit a notification confirming residence under a residence permit in Russia. We will tell you more about how to do this below.

Only one-time payments are not taken into account when determining monthly income. For example, bonuses at the place of work based on the results of the year. To confirm pension contributions, it is necessary to provide a certificate from the Pension Fund of the Russian Federation at the citizen’s place of residence about receiving funds from Russian sources. Funds received from foreign authorities are not taken into account. Equally, property that is rented out for the purpose of generating monthly income in order to confirm means of subsistence must be located and registered in Russia, and not in a foreign country.

Issues of obtaining a residence permit are regulated by Federal Law No. 115 of July 25, 2002, and specifically Article 8. In accordance with this rule, it is necessary to submit an application in the form established by Order of the Ministry of Internal Affairs 846 of November 9, 2017. The application (clause 12 of information about the applicant) is required to indicate the type and amount of average income per month received by a person wishing to reside in the country on a permanent basis.

The application for registration of a residence permit 2021 must be filled out in duplicate and brought to the department of the Ministry of Internal Affairs of the district where the foreigner is registered. Until now, this could only be done in person at the department. The design function for this did not work due to technical reasons. An application for a residence permit 2021 can also be submitted through the electronic service. However, this service is not available everywhere.

You can contact the department remotely regarding a residence permit only when you first receive it or replace it in case of loss or change of personal data. But even in such a situation, we are only talking about signing up for an electronic queue, but not about submitting documents.

Dependency confirmation

Lack of work, sources of income from deposits, business, or rental housing in some cases does not become an obstacle to proving means of living. If a foreign person in the Russian Federation is dependent on a Russian relative or other person, you can provide a certificate of the sponsor’s income.

We advise: How to confirm your residence under a residence permit and does everyone need it?

The average monthly income, in this case, is divided into at least two people (a dependent and an able-bodied person). Accordingly, if a sponsor earns 20 thousand rubles, and the cost of living in the region is 15 thousand rubles, then the income will be considered insufficient and a refusal to issue a residence permit will follow.

How to submit a notification?

A foreign guest can submit an application for residence and income at any branch of the Russian Post (a sample can be downloaded here). There is no electronic submission option. It is possible to visit the migration service at your place of residence.

For annual reports, the submission methods are similar. A caveat: once every five years you will have to report to the Ministry of Internal Affairs in person. You must report two months before the end of the year from the date of receipt of the residence permit.

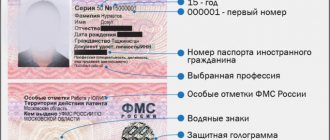

The notification is filled out in one copy and submitted for verification along with the passport and residence permit. The procedure is mandatory for all migrants over 18 years of age. The application indicates the place, date of birth of the foreigner, details of the foreign passport, and information about work.

Common mistakes when verifying income

When submitting documents, many people treat the issue of income confirmation formally. Some people simply buy certificates or forge them.

Lies are easily detected. Migration services check the reality of the employer, the validity of work activity in the organization.

Another mistake: submitting documents without any proof of means of subsistence due to the lack of a job. For able-bodied individuals, this is a guaranteed refusal.

Confirmation of income for obtaining a residence permit is the most important thing in the procedure for registering the legal presence of a foreign citizen on the territory of the Russian state. Migration authorities will assess whether the foreign visitor is able to pay ongoing expenses after emigration. Low income is a sure sign of refusal to issue a residence permit.

Confirmation of income for residence permit in 2020

The migration policy pursued by the Government of the country and a number of adopted Russian laws in this area (see about the amnesty of Moldovans and Kyrgyz) are changing the process of legalization, from entry into the Russian Federation to registration for migration under Federal Law 163, to a new one, mutually beneficial for our state and foreigners. The emphasis on simplifying the acquisition of Russian citizenship is at the same time a reason for a migrant to decide whether he plans to live in the country, since for his further stay he will have to issue a temporary residence permit, and then a residence permit.

The stage of confirming financial stability is mandatory in the future, when a foreign citizen sends an annual notification of residence in the Russian Federation to the migration service. Based on financial documents proving the availability of income, the official will extend the residence permit, or decide on cancellation if financial resources are insufficient.

For a foreign citizen, being in a foreign country is associated with difficulties of integration into society, among which employment and the need to financially provide for the life of oneself and one’s family are the most in demand. The presence of income at a sufficient level is designated in migration legislation as a part that is important when considering application documents from a foreign citizen for obtaining the right of permanent residence in the Russian Federation under a residence permit.

The source of income for a foreign citizen can be a bank deposit, personal savings, income from employment and business activities, from renting out property, receiving scholarships, social benefits and pensions, and even money received from the sale of valuables or as a gift.

- individual entrepreneur;

- a person who received remuneration in 2021 under a civil contract for the provision of services to individuals or legal entities;

- persons engaged in private practice (the list of professions is limited);

- citizens who received income from the sale of valuable expensive items;

- who received financial benefits from the sale of property of citizens of foreign countries;

- foreign citizens receiving income from sources located outside Russia;

- lottery winners;

- recipients of inheritance or other property on the basis of a deed of gift.

If a foreigner leaves the Russian Federation for more than six months, he will be denied confirmation of a residence permit, and the document itself will be lost. A residence permit presupposes permanent residence in the country, which means that its holder has no right to leave Russia for 6 months.

When choosing a general or simplified taxation system, the owner of an individual entrepreneur must submit a declaration before April 30 of each year. This date may also coincide with a weekend, in which case you will need to appear at the Federal Tax Service on the next weekday. As a result, the deadline for submitting 3-NDFL is May 2. If you are late you will have to pay a fine. So a migrant who needs to submit a notification for a residence permit in October must still complete the procedures with the tax service before the beginning of May. This means that there is no point in creating an individual entrepreneur at the last moment.

The corresponding application is submitted in printed form to the Federal Migration Service. It is provided by a foreigner who has reached the age of 18. For children and incapacitated adults, residence permits are extended by their parents, guardians and other legal representatives. Modern technologies make it possible to send an appeal online, on the official website of the State Services in electronic form. The method of filling out the application form remains the same (in accordance with Appendix 6 to the Administrative Regulations).

We recommend reading: Timing for Privatization of Dacha Plots Until Which Year

Until recently, the Russian Federation did not require confirmation of residence in the status of a residence permit in the same way as today. But cases have become more frequent when foreigners applied for a residence permit, and then simply left Russia and stayed abroad for a long time. Therefore, the FMS introduced a new rule on informing government bodies.

The point of the procedure is to notify the FMS where the migrant is located and lives and whether he plans further activities in the Russian Federation. Next, we will tell you in detail about how to confirm a residence permit in Russia in 2021, how to correctly fill out the annual notification, and find a sample and form of the document.