There come times in the life of every person when, with the advent of old age or the onset of disability, he cannot work, and, therefore, receive wages to support himself and the disabled members of his family. Here social cash payments from state and non-state pension funds (PFR and NPF, respectively) come to the rescue. But such payments are the income of an individual. In accordance with Art. 207 of the Tax Code of the Russian Federation, all residents and non-residents who received income in Russia are required to pay personal income tax. Therefore, a logical question arises among older people: do pensioners pay tax on their pensions?

Brief answer to the question

To answer the question briefly, many experts narrow the topic and consider only income taxes. But there are other types of taxes: transport, property, land. Do pensioners pay them? After all, funds for these types of taxes do not fall from heaven in the form of “manna from heaven.” They have to be taken from the same pension.

We answer:

- income tax is not paid. Personal income tax is withheld only in rare cases, which we will discuss below;

- transport tax - paid by vehicle owners, regardless of age. It refers to regional types of taxation, so in some places there are benefits for pensioners, but in others there are not;

- property – paid, but there are benefits that people of retirement age can take advantage of;

- land - taken from all owners of land plots, regardless of what type they are classified as. There are benefits for individuals living on pensions.

Pensioners and transport tax

Transport tax is under the jurisdiction of local administrative authorities, and therefore the provision of any benefits in this area is distributed locally.

In many regions of the Russian Federation, pensioners are fully or partially exempt from paying transport tax. In other regions they are given good discounts on fees. In particular, vehicles may not be subject to taxes locally

- with low power;

- one of the vehicles owned by the pensioner;

- vehicles falling under a certain category;

- means of domestic production.

Regions whose budgets are noticeably lower than their larger neighbors cannot afford exemptions from the tax burden for ordinary pensioners, let alone those who continue to work, and therefore privileges do not apply to this category of residents.

Is income tax paid on pensions?

In accordance with Art. 217 of the Tax Code of the Russian Federation, income tax for pensioners is not taken from a pension if it is paid:

- employees of the state and municipal government apparatus;

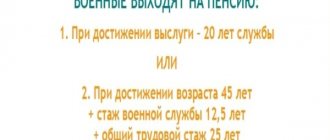

- military, which includes personnel from the Ministry of Defense and astronauts;

- persons who participated in the liquidation of the Chernobyl accident;

- persons who have reached the established age (old age);

- people who have become disabled (due to disability);

- families who have lost their breadwinner.

Personal income tax is not charged from the insurance pension on:

- the estimated part of the labor pension;

- fixed payments added to insurance coverage;

- disability payments;

- survivor benefits.

From the above list it is clear that all main types of payments from the Pension Fund and the state or regional budget are not subject to income tax.

Things are different with non-state pension funds. According to paragraph 2 of Art. 213.1 of the Tax Code of the Russian Federation, payments of pension amounts from funds that are not state-owned are subject to taxation at a rate of 13%. However, not everything is so simple here either. There is no personal income tax when receiving a pension from a non-state pension fund if:

- accruals are made from the accumulative part;

- a non-state fund received a license;

- The agreement with the NPF was concluded by the employer, not the individual. Here the main requirement is not the presence of a license, but the registration of the fund in Rosreestr;

- The agreement with the fund was concluded by a close relative of the pensioner. In this case, the pensioner is considered a third party to the agreement and his pension payments are not subject to the requirement of the law to accrue 13% personal income tax.

Pension taxes and contributions - types

Any employer, both a budgetary organization and an individual entrepreneur, is required to pay four types of insurance contributions:

- pension tax or contribution to the Russian Pension Fund;

- medical contribution, which is paid to the Compulsory Medical Insurance Fund;

- compulsory insurance contribution for employees to the Mandatory Social Insurance Fund in case of sick leave and payments related to pregnancy and childbirth;

- mandatory contributions to the Social Insurance Fund for payments related to accidents and occupational diseases.

Pension fund tax includes two types of payments. Some form the insurance part of the pension, while others form the funded part.

Do I need to pay taxes on pension supplements?

In addition to the main body of pension accruals, pensioners are paid various additional payments and allowances. Like the main types of pensions, all additional payments and allowances from the Pension Fund and the budgets of the country and regions are excluded from the tax base. This means that the following are not subject to personal income tax:

- additional payments up to the cost of living, paid from the federal and regional budgets. This rule of law also applies when the amount of additional payment is greater than the amount of the pension;

- supplements to pensions from the regional budget for WWII veterans, persons who survived the siege of Leningrad, and labor veterans;

- increased fixed payments for dependents;

- fixed premium (twice) for persons over 80 years of age;

- northern allowances;

- additional payments to pensions based on various coefficients: motivating, regional and for small peoples of the North.

Thus, indexation of pension provision, as well as bringing the pension amount to the level of the minimum wage, do not relate to additional income. Therefore, according to Russian laws, no income tax is withheld from them.

From the above, it logically follows that all additional payments from other sources, from the point of view of the Tax Code of the Russian Federation, relate to additional income. The Ministry of Finance has the same vision of the problem, which, in its letter No. 03-04-05/48965 dated July 13, 2018, classifies corporate pension supplements (paid by a former employer) as additional income, which is taxed at 13 percent. It makes no difference whether a pensioner is working or not.

The same attitude applies to additional payments to employees of municipal government bodies, if additional accruals are carried out on the basis of a decision of the Legislative Assembly.

When paying severance pay to pensioners, income tax is not charged on the amount of 3 average monthly salaries for the main part of Russia, and 6 monthly salaries for the northern and equivalent regions of the country. Everything above is taxable (letter of the Federal Tax Service No. AS-4-3/15293 dated September 13, 2012).

The Russian Ministry of Finance is considering options

In this case we are talking about pension savings. The Ministry of Finance and the Central Bank have developed an updated funded pension system, which they called a guaranteed pension product (GPP). It is planned that this will be a voluntary system, and the owner of the accumulated funds will be the person himself. Any owner of pension savings who is a participant in the GPP program will be able to leave them to his heirs and even receive them in a lump sum.

Just in the case of a lump sum payment, according to the Ministry of Finance, the pensioner will need to pay personal income tax.

True, officials of the Ministry of Finance have not yet decided whether they will levy income tax on the entire amount generated in the GPP system, or perhaps personal income tax will be imposed only on investment income received from the placement of accumulated pension funds.

In this way, officials want to protect participants in the GPP system from the temptation to withdraw all the money at once and spend it.

The Ministry of Finance of the Russian Federation published a letter dated May 8, 2020 No. 03-04-05/30927 “On personal income tax taxation of pensions paid by a non-state pension fund to individuals”, this letter explains when a non-state pension fund becomes a tax agent and it has an obligation to withhold income tax from pension amounts paid under non-state pension agreements.

Nuances of taxation of working pensioners

Employed persons of retirement age belong to a special group of Russian citizens. After all, in order to survive, they receive payments from two different sources:

- from the employer, for the work done;

- from the Pension Fund and the budget in the form of social payments (pensions and benefits).

Income tax is not calculated on the pension of working pensioners. But deductions are made from wages in the amount of 13%. After all, from the point of view of the law, as an employee, a pensioner is no different from the rest of the working population.

Attention: from any additional income that does not fall into the category of pension or social benefits, including income from deposits, investment activities, dividends from various shares, etc. personal income tax is withheld.

Benefits for pensioners under labor law:

This type of benefit is established by the Labor Code of the Russian Federation and applies to all working pensioners.

Additional day off

A provision for this may be provided at the level of the enterprise itself. But then this norm should be fixed in internal local acts. Most often, when they talk about an additional day off, they mean the opportunity to request additional leave from the employer at their own expense.

Additional unpaid leave

The Labor Code establishes that a pensioner who works at an enterprise may be given an additional rest period of 14 calendar days. This happens once a year. However, such vacation is not subject to payment.

A pensioner can take these days separately, split them into small intervals, or add this rest to the main vacation.

Important! If the pensioner did not use the period established by law during the year, or did not use it fully, then the remaining days expire and cannot be transferred to the next period.

Special assessment of working conditions

The result of a special assessment of working conditions at an enterprise is the identification of harmful and dangerous factors in the workplace.

Features of paying other taxes from pensions

Several other mandatory taxes are paid from pension payments: transport, property, land. Considering the small size of pensions for the bulk of the population, legislators have provided benefits and discounts for people of retirement age.

Transport. The tax refers to regional types of taxation. Therefore, the Legislative Assembly of each subject of the federation independently decides the amount of tax and benefits for pensioners. As a result, there are regions with benefits, and others where pensioners pay on an equal basis with the working population. This topic is covered in detail in the work “Transport Tax for Pensioners.”

Property. Based on Art. 407 of the Tax Code of the Russian Federation, pensioners do not pay tax for one object of each category of real estate:

- apartment;

- country house;

- garage;

- private house, etc.

There are two conditions for exemption from payment:

- the property must be owned by the pensioner;

- did not generate income (was not rented out or hired and was not used for business activities).

Land. Also applies to regional taxation. Can be reduced by 10.0 thousand rubles. for some pensioners, which include disabled people, WWII veterans, Chernobyl survivors, etc.

We especially note that the benefits are of a declarative nature. This means that if there is a benefit, but the pensioner did not submit a corresponding application to the tax and duties inspectorate in a timely manner, he will have to pay the tax in full.

To receive benefits, you must submit to the Federal Tax Service:

- passport;

- pensioner's ID;

- documents confirming ownership;

- application for preferential tax treatment.

To pay or not to pay?

Do working pensioners pay taxes? Of course they pay. In our country, taxes are levied as long as there is something to collect them from. In order not to pay taxes, you must either lose the object of taxation (land, property, salary) or acquire the status of a benefit recipient.

Pensioner status gives working citizens the following rights:

- not pay property taxes on one piece of non-profit property of your choice;

- receive tax deductions from the personal income tax base;

- take advantage of regional and local tax benefits established for pensioners.

Working pensioners pay everything that goes beyond the scope of the above in the same manner as other citizens.

Separately, it is necessary to say about pensioners - “federal beneficiaries”. Unlike ordinary pensioners, these categories have their own different system of benefits. Who are they? These are WWII and military veterans, disabled people, former military personnel, and citizens affected by radiation.

Tax benefits for federal beneficiaries are provided in almost all regions. They overwhelmingly and with few restrictions do not pay property, transport or land taxes. If you belong to one of these categories, we recommend that you contact the tax office in your region, where they will tell you in detail how and when you can receive the benefit you are entitled to.

Further in this article we will no longer touch upon pensioners - “federal beneficiaries” and will focus on ordinary citizens.