The People's Republic of China has one of the youngest pension systems, because it was introduced only in the mid-20th century and was inaccessible to many residents for a long time. At the end of the 20th century, only 6% of Chinese who previously held high-ranking positions received a pension.

The reason for this was a large number of citizens of retirement age; this trend continues even in the modern world. China passed a law banning second children, which prompted the authorities to radically reorganize the pension system.

How many pensioners are there in China?

The population of a country is considered old if the number of elderly people in it is 7%. In China, the number of people over the age of 60 is 250 million or 17%. The country has entered an active phase of aging.

The number of such people will only increase every year, but the working population will not. This is due to the consequences of the adopted law controlling the number of children in a family - no more than one child.

Now the government is trying to change the current situation and is adopting various programs aimed at increasing the birth rate and rejuvenating the population. The aging of the nation in the country puts significant pressure on the economy, because Contributions to the pension fund of each worker are divided among several pensioners.

Reliability of NPF Kitfinancebank

In November 2020, the RAEX rating agency confirmed the “A++” reliability level of NPF KIT Finance. Thus, the likelihood that the fund will fulfill all its obligations to clients is at a high level.

The national rating agency notes the highest level of reliability of Kitfinance. This fact also speaks in favor of the fund, so when choosing a reliable partner to create your financial future, it makes sense to pay attention to it.

China's pension programs and system features

According to the traditions existing in the country, caring for elderly parents is the responsibility of children and grandchildren. When there is only one child in a family, this can be quite difficult to achieve. Realizing this, many sought to circumvent the law and have two or more children. This violation was most often observed in rural areas.

The pension system appeared after the formation of the People's Republic of China in 1949, but it was intended only for civil servants and employees of enterprises who had worked there for 15 years. Only 6% of the population could use it. Changes in political course, an increase in the number of elderly people, the collapse of communes - all these factors have led to the need to revise the current pension system. The reform was carried out in 1997. Since then, more people have been entitled to benefits.

In 2020, slightly more than half of the older generation received pensions. This is due to the current system in the country that divides all people into urban and rural residents. It was introduced to curb internal migration and distribute the population evenly. It does not allow farmers to move to the city, register officially and work there. Only those organizations that pay salaries in envelopes are suitable for this.

Such employment does not add length of service and does not increase the size of a future pension.

The current situation with a constant increase in the number of elderly people and an increase in life expectancy requires further reform of the pension system. Officials offer various options, but the ruling party does not want to use drastic changes and focus on Western experience. The main priority should be to improve the well-being of pensioners. An increase in payment amounts leads to an increase in their consumption and ensures economic growth.

Perspective

So far, processes are underway to reform the pension system, but at the moment there are no obvious positive results, since the number of pensioners is only increasing. And the money spent on maintaining even pensioners who receive a pension has already exceeded several trillion dollars, already amounting to almost 40% of China’s GDP, and this is a catastrophic figure. That is why China is increasingly being included in the list of countries where there is no pension.

If legislative innovations in the coming years do not justify themselves, China will find itself in a deplorable situation and will not only be able to be one of the leading countries in the world, but will not even be able to remain in the middle position in terms of living standards.

What are they like, Chinese pensioners? Interesting video.

Retirement age in China

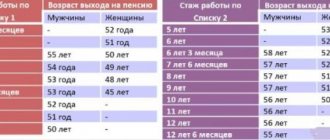

China uses a classic pension system. It can be used by men over 60 years of age and women over 55. The age is reduced by five years for any person who has worked in hazardous conditions for 10 years. In recent years, a pension has been paid to one in four elderly Chinese.

There is widespread information on the Internet that China plans to lower the retirement age. An appeal to official resources shows that everything is exactly the opposite. In the country, the retirement period is gradually increasing and for the majority of the population by 2048 it will be 65 years (there will be no differences by gender).

Registration and login to the personal account of NPF Kitfinansbank

The official website of NPF KIT Finance invites you to register to gain access to your personal account. To get to the page you are looking for, you need to click on the “Personal Account” button in the upper right corner of the main page.

Next, all new users must fill out a special form. In the window that opens:

- 1) SNILS is entered;

- 2) tick the agreement with the personal data processing policy;

- 3) click the “Registration” button;

- 4) further indicate the mobile phone number.

A message with an access password should be sent to the specified number. It should be used for authorization. From now on, access to the personal account service will be carried out by entering SNILS and password. If you forget the latter, you can restore it using the “Forgot your password?” link.

Attention! Using the “Personal Account” service on the official KIT Finance website is possible only one year after the funds arrive in the fund’s account. On March 31 of each year, a centralized transfer of savings occurs, after which access to personal accounts is opened.

Who can receive pension payments

Employees who have reached a specified age and have the required length of service retire:

- civil servants, employees of municipal institutions - at least 10 years;

- other segments of the population –— 15.

During working life, contributions to the pension fund were required. Failure to comply with these conditions means non-receipt of assistance from the state.

The amount of payments differs in different places of residence and is:

- 20% of the minimum salary received in a particular city;

- 10% in the village.

Rely on your son

Just twenty years ago, the Chinese had to rely exclusively on their children in old age, which was not easy under the previous “one family, one child” policy.

Therefore, in villages, they often tried to circumvent the state ban on the birth of a second and even third child: fines from poor peasants were still not collected, the offspring grew up like grass in a field, and then began to support their parents. But if back in the eighties, urban residents made up about 20 percent of the PRC population, today this figure is approaching 60 percent. These changes forced the government to reconsider its pension policy. The reform began in 1997 - then the State Council of the People's Republic of China made a fundamental decision to introduce a basic pension system for employees of state-owned enterprises. Today, men stop working at the age of 60, women - from 50 or 55 years, depending on the type of employment in production or in the office. And these figures are in line with the average retirement threshold across Asia. In China, there are three types of pensions, Alexey Maslov, Doctor of Historical Sciences, Professor, Head of the School of Oriental Studies at the National Research University Higher School of Economics, told RG. The most common pension is generally similar to ours - it is formed from citizen contributions in the form of deductions from salary. The employee transfers 8 percent of the amount to the pension fund, and another 20 percent - his employer. In addition, each person can open their own savings account. There are other additional mechanisms for funding pensions - for example, through the National Social Security Fund. The second type of pension is received by officials - they are paid extra by the state. Several years ago, civil servants who left work at a certain age lived off the state treasury. But after a wave of protests broke out on the Internet, their pension income also began to be formed largely through contributions. Finally, peasants who do not have a special income, as well as unemployed urban residents, receive a minimum allowance from the state. Today it averages 600-700 yuan (about 5600-6500 rubles) across the country, but in some places it already reaches 1200 yuan (11,200 rubles). Pension funds in China are formed at the regional level. The difference in pensions for residents of relatively prosperous Shanghai and the poor Xinjiang Uyghur Autonomous Region can be eightfold. If we talk about the average ordinary - not “collective farm” - pension, then, according to calculations for 2020, it is approximately 2,550 yuan (23,700 rubles).

Is there an old age pension in China?

Regions may change the retirement age. This is influenced by the number of people living in a particular area and the amount of subsidies received from Beijing. The amount of an old-age pension for any person depends on:

- his place of residence;

- the amount of salary received;

- transfers to the Pension Fund;

- the profession in which he worked.

The pension consists of two parts:

- Basic or basic: with 15 years of experience, the amount is calculated based on the average salary, applying indexation to it. They pay for the rest of your life.

- Cumulative: the entire transferred amount in the Pension Fund is divided by 120. It is paid back within 10 years.

Interesting from BBQcash: if a person does not have the required experience, and the established age has reached, then he can:

- delay retirement;

- pay the required fees;

- receive the entire transferred amount from the pension fund in a lump sum with interest.

This does not apply to peasants, whose payments are subsidized by the state. Their pension amounts are extremely low.

Amounts of pension contributions

Official employment of a person involves the transfer of contributions to the Pension Fund for the funded part:

- employer - 20% of the total accrued salary;

- employee – 8% of the amount he receives.

This is especially important for the private sector. In government organizations, transfers are made automatically, so their employees do not need to do any reporting. In some areas of China, enterprises form the savings of their employees themselves, from which they are later paid a pension. The amount of payments depends on the amount collected by the employee during his work.

There is no fixed amount for transfers for the main part of the pension. Its size depends on the official average salary in a particular area and is equal to 25% of it. Such contributions are made for 15 years, otherwise the employee will not be able to receive social insurance.

Average pension in China

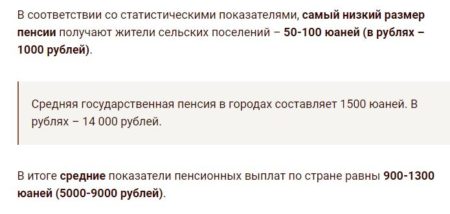

The average pension in China in 2020 was:

- ¥2,500 (₽22,573 or $353.45) - in the city;

- ¥127 (₽1146 or $17.96) - in rural areas.

The amount received in the village is very low and is not enough to provide even the most basic necessities. In the city, deductions are higher, but prices are also higher, so a pension here also does not allow the Chinese to lead a comfortable life. The average payment depends on the average salary, so it differs in different cities:

- 4100 yuan (37 thousand rubles) - in Tibet;

- 3500 (31.6) - in Shanghai and Beijing;

- 1820 (16.4) - to Chongqing.

Minimum pension in China

In 2020, residents of rural areas received the minimum. This amount is equal to 88 yuan or about 795 rubles. City residents are paid more - 618 or 5.6 thousand rubles. In 2020, they plan to increase pensions by at least 5.5%. Different levels of pensions received push older people to move to other regions:

- to the southern regions, where the climate is warmer, food and utilities are cheaper;

- deep into China with significantly lower taxes.

They do not change their registration so as not to lose the payments that were accrued to them.

What is enough for a pension in China?

The size of pensions varies between rich and poor regions, sometimes by eight times. An amount of 55 yuan is enough for 4 liters of peanut butter or 20 kg of rice. Gasoline prices are higher than in Russia. In rural areas you cannot live on the pension you receive, so most often children help there. They either send money or bring the parents to live with them. Families live together or rent separate housing for parents. There are social forms of employment for older people.

In 2014, a decree on social benefits was adopted, intended to:

- families whose income is below the subsistence level;

- elderly people in need of constant care;

- children;

- seriously ill.

This document contained information about special subsidies available to the poor for:

- medical services (includes acupuncture and massage);

- visiting diagnostic rooms;

- payment of utilities;

- other types of temporary social assistance.

Old people can eat for a small fee in public canteens, practice qigong and tai chi in parks, and visit museums for free. Travel agencies provide special benefits for retirees, which, combined with the small requests of the Chinese, allow them to travel around the world. In recent years, nursing homes have been appearing in China, where care is provided at a decent level.

The Chinese differ from the old people of Japan and Europe in their traditions, way of life, and undemandingness towards material goods. For them, approaching retirement age is an opportunity to spend more time communicating with family and friends, and taking care of them allows them not to think about the little things. Children help them live out their allotted time without worries by looking after their elderly parents. They feel freer, engage in their favorite hobbies, and improve themselves.

Finding a solution to the pension crisis

Despite the difficulties, the categories of elderly citizens who can count on financial support have expanded significantly. The Chinese authorities have the following plans for implementation in the near future.

Possible Action Plans

- elimination of “hukou” - this system assumes the size of an old man’s pension depending on the province in which he lives, even if he worked in a region with a higher regional salary (this will help villagers who were city workers receive a higher pension);

- minimize and equalize the difference between the pension budgets of different regions of the country, since it is now incredibly huge;

- connect city and village funds for social protection of citizens, and also increase the number of funds;

- eliminate the difference between pensions for employees of state and private enterprises;

- try to create the most convenient working conditions, so that employees are motivated to delay retirement as long as possible;

- make more payments to employees’ personal accounts.

Decentralization was also undertaken, which significantly reduced corruption in this area. Now decisions on the calculation of pensions are made by local governments in each province, and not by the national authorities.

According to the government, the process will be lengthy, but the equalization of payments for urban pensioners and residents of rural areas will lead to stabilization over time, so the size of the pension in China will be equal without strong gaps, because for a citizen it will not make much difference where exactly to live and work activity.

Despite the fact that many people in the country do not receive pensions, this is more familiar to them and their life is in some ways easier, since traditions in the country play a huge role and children always try their best to support their elderly parents. With retirement, they feel free and, with a sense of accomplishment, devote themselves completely to their hobbies, self-improvement; by the way, they really like to dance in the evening. In general, everyone lives their time in this world with pleasure without unnecessary worries, devoting more time to grandchildren, relatives, meetings with acquaintances and friends.

Russian pensioners on the border with China

Elderly people in the Russian Federation living on the border with China prefer to sell or rent out their homes and move there. Real estate prices there are several times lower than in Russia. Once a quarter they return to their homeland and receive their due pension.

They choose to live both in the cities closest to the border and in Harbin with its mild climate, where Russian settlers gravitated to during the Civil War.

Utilities, prices for food and things are much cheaper than in Russia, which allows Russians to live peacefully on the payments they receive. They are attracted to Chinese medicine with its specialization in acupuncture, physiotherapy, cupping and rubbing. It is based on the use of natural products. Medicine in China is very developed and meets people's expectations. The health of many improves and attracts others to it.