Foreign investment

In general, there are quite a lot of concepts of foreign investment, probably several dozen. I will try to give the most general and understandable of them. Foreign investment is understood as the amount of investments (property, financial and intellectual) that foreign investors, as well as foreign branches of Russian companies, invest in domestic companies to generate income in the future.

The number of such investments determines the country’s investment climate, that is, how attractive the country is for such investments by foreign entities. Private individuals can also act as foreign investors, however, most often their role is played by funds, companies, transnational corporations or even other states themselves.

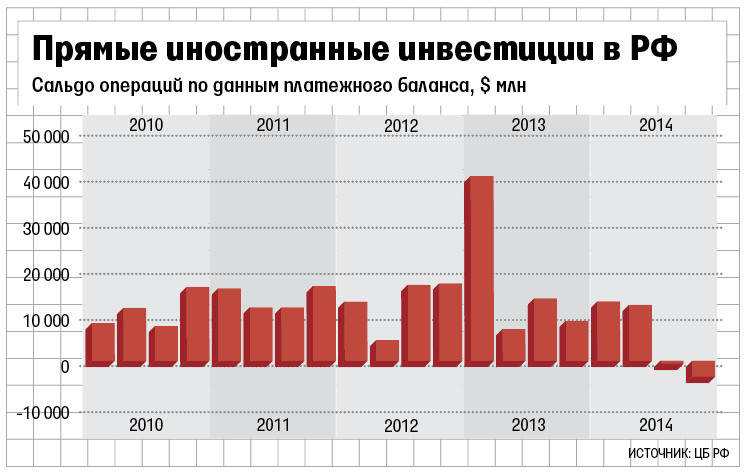

All foreign investments are divided into direct and portfolio, short-term, medium-term and long-term. Direct investments from abroad are aimed at purchasing controlling stakes in domestic enterprises in order to participate in their management. As a rule, such investments are the most desirable for the state, since, most often, the invested companies undergo modernization, people working for them improve their skills, new jobs are created, etc.

Portfolio investments are directed to the purchase of shares of Russian companies in order to make a profit from the subsequent resale of their shares. Economic science classifies investments for a period of up to 2 years as short-term investments, 2-5 years as medium-term investments, and long-term investments as investments with an investment period of more than 5 years.

Foreign investment is a necessary factor in the development of any national economy. Thanks to them, it becomes possible to accelerate economic growth, create new jobs and gain access to advanced global technologies.

Foreign investment: basic concepts

Investment activity is simply necessary for any company in the modern market.

Time does not stand still, everything changes, businessmen and entrepreneurs need to search for new ways and opportunities to work in the market, and funds (investments) are needed to implement ideas. All investments can be divided into two main types: domestic and foreign. Foreign investments are subject to stricter government control and there are certain requirements for them.

Definition 1

Foreign investments are the entire set of property and intellectual values that have already been invested or are expected to be invested in any type of business activity.

Finished works on a similar topic

- Coursework Types of foreign investment 460 rub.

- Abstract Types of foreign investments 270 rub.

- Test work Types of foreign investments 240 rub.

Receive completed work or specialist advice on your educational project Find out the cost

Note 1

Foreign investments bring not only money to Russian business, but also new technologies, as well as labor potential, various types of developments, etc. All this allows Russian companies to be involved in global markets, to participate in the international exchange of experience, goods, skills, etc.

About foreign investments in the Russian Federation

Foreign investments in Russia are regulated by the federal law of the same name, which was adopted almost 20 years ago, in 1999. It contains legal guarantees for the preservation and unhindered withdrawal of financial resources by foreign investors. In addition, the law provides for separate conditions for investing in certain sectors of the economy, for example, the oil and gas industry, banking sector, etc. Moreover, it should be noted that this practice also exists in other countries, where the state also limits foreign investment in key sectors of the national economy.

Another feature of our country is that even loans received by domestic companies from foreign financial organizations are also considered foreign investments. Moreover, the share of such investments today is more than 90%. The worst thing is that most of these loans are short-term and their repayment period is less than a year. About 9% of all loans received from abroad are foreign direct investment, and less than one percent is portfolio investment. The main economic areas where foreign investors seek to invest their money in the Russian economy are information technology and the financial sector. Moreover, these industries are among the leaders in attracting foreign capital in other countries.

Main types of foreign investment

There are several types of foreign investment today.

- Direct foreign investments. In this case, the investor has full 100% control over the activities of the enterprise in which the capital was invested. There is also a certain feature in foreign direct investment, for example, an investor, be it an individual or a legal entity, must have at least 10% of all shares, bonds or other securities in the charter of the company where he is investing money. Also, it should be noted that the percentage is different in all countries.

- Portfolio investment. These are investments in which the investor himself only has the right to receive dividends from the invested capital, and another person is in charge of managing the company. Also in this case, it should be noted that the investor has the right to a share in the authorized capital of the company in which he invests in an amount of less than 10% of the total capital of the company.

- Other foreign investments. It is believed that other foreign investments can be both direct and portfolio, the only thing is that these are investments that are not tied and do not fall under the rules of contributing interest to the authorized capital of companies. An example of such investments are bank deposits, trade loans, etc.

Need advice from a teacher in this subject area? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Stimulating investment

Since investments improve the national economy, any state seeks to attract foreign investors, creating favorable conditions for them to invest their money. This can happen in several ways. Moreover, countries compete with each other in attracting investments, because the investor will also choose the most profitable offer for himself. The most common ways in which investment is stimulated are:

- The introduction of new technologies and production methods that make it possible to receive sufficiently large profits when investing investor money, which may be of interest to potential foreign investors.

- Development of the information technology and banking sectors, which are most popular among investors today, including foreign ones. Today, venture investments are often made in the field of IT technologies, that is, investments that almost completely finance projects that are sometimes still at the “idea” level. And although this method of investment allows the investor to acquire a significant share of the startup, this is a real chance to bring a business idea to life.

- Creating favorable conditions for the functioning of multinational corporations and joint ventures.

- Providing legal guarantees to investors - clarity and transparency of legislation, guarantee of safety of funds introduced into the state, stability of the legislative framework, its immutability for the worse for investors.

- Economic stability - a stable national economy that has been growing for several years.

- Political stability is a strong political system without shocks and with developed democratic institutions.

One of the main and most common ways to stimulate investment in the national economy is the creation of special free economic zones. As a rule, the effect of such a zone extends to the administrative area of the state (district, region, region). This establishes preferential treatment for enterprises with foreign capital, as well as for foreign investors.

Such benefits include a variety of tax reductions and simplifications in completing state-mandated procedures for doing business. A special case of free economic zones are the so-called offshore zones, where foreign investors are generally freed from the need to pay local taxes and fees. As a rule, to operate in such a territory, they must pay a registration fee once, as well as pay a fixed fee once a year, the amount of which does not depend on the type of activity of the company or on the size of its profit. Since the amount of such fees is much lower than taxes in their home countries, foreign investors en masse choose offshore companies for their investments.

Legal guarantees for foreign investment

Naturally, no investor will invest money in a state that cannot guarantee him legal support for such activities. An investor who makes portfolio investments, lends to a company in another country, or buys a controlling stake in its shares, has the sole goal of making a profit. This can only be done if he is confident that he can easily withdraw his funds from another country at any time. That is, the state must guarantee him this and legislate this possibility. No one will invest their money in the economy of a country with an unstable political regime in which laws are not respected.

That is why, to attract foreign investment, different countries are developing laws that guarantee the safety of foreign investors’ funds. In our country, this is stated in the already mentioned Federal Law, as well as other legislative acts, including decrees of the President of the Russian Federation. In particular, our country guarantees the unhindered withdrawal of foreign investments after investors pay all established taxes and fees in the currency in which these investments were made.

The presence of government guarantees for the unhindered withdrawal of investments and profits from the country into which they were introduced is one of the main factors in attracting foreign financial flows.

Summing up our conversation about foreign investments, we can note that today their use is an objective necessity for any state. They make it possible to solve a number of problems caused by globalization and internationalization of the world economy. Foreign investments create conditions in the country where they come, from which not only the investor himself benefits, but also all participants in this process. Thanks to the development of production and increasing the competitiveness of national goods, the state itself receives a profit. That is why countries are interested in attracting foreign investment, for which they create conditions that are attractive to investors from abroad.

Author Ganesa K.

A professional investor with 5 years of experience working with various financial instruments, runs his own blog and advises investors. Own effective methods and information support for investments.