Changes in the Russian pension system have caused extraordinary excitement and interest in this area on the part of citizens. The controversial reform to raise the retirement age has sparked much debate about how social security operates in different countries.

In this regard, for comparison, we should consider the features of pension systems in different countries of the world. This applies to the USA and Western European countries. They are the ones who have the most efficient social security mechanisms.

The French pension system is one of the best in the world, and French pensioners are the most financially secure. At the same time, this country is faced with a crisis in its pension system, which arose due to an increase in the total number of elderly people against the background of a decrease in the birth rate and, accordingly, a decrease in the share of the economically active population.

Russia has faced a similar problem, which is why the retirement age has increased. An overview of the French pension system is presented in the article below.

§ State social insurance system

First of all, it should be noted that Germany has a well-developed state social insurance system. It guarantees the protection of citizens in case of illness, unemployment, and also in old age. State pension insurance is part of the German social insurance system. Responsible for pension insurance throughout Germany is an institution called "Deutsche Rentenversicherung" . It deals with the calculation and payment of pensions (pension in German: Rente ). When starting work in Germany, a person becomes automatically insured in the state pension insurance system.

All insured persons in the pension insurance system receive a personal insurance number “Versicherungsnummer” and an account in this system. When contacting Deutsche Rentenversicherung, you must always have your insurance number. This number must also be provided to your employer along with the documents required when applying for a job in Germany. Registration in the state pension insurance system and obtaining this insurance number for a person who does not yet have one is carried out either by the employer, or by the labor exchange or health insurance office.

The Deutsche Rentenversicherung sends an annual information letter to every insured person over 27 years of age with information about how much pension they can expect upon retirement.

On separate pages of our website you can find information about social assistance and basic benefits in Germany, as well as benefits for the unemployed and child benefits.

Opportunities and options for using pension savings

However, receiving almost half as much as during their working life, American retirees would hardly look so happy and carefree. There is no doubt that the US pension program called Social Security remains one of the most rational in the world to this day. However, the quality of life of older Americans is made up of many other options for managing and investing retirement savings, which are implemented through a large number of different pension plans.

The peculiarity of this type of pension provision in the USA is that from monthly income a certain amount is transferred to the account of one of the pension funds, while it is tax-free, which significantly expands the possibilities of savings. Upon retirement, in addition to government payments, the employee receives income in the form of his own deferred funds. Moreover, he can begin to use them much earlier, receiving money in the form of a loan from his own savings set aside for the future (retirement) period. Then he pays the fund (and, in fact, himself) as with a regular loan. Americans often use these funds to buy real estate, pay for their children’s education, etc.

§ Retirement age for men and women in Germany for 2020, 2020

At what age a person in Germany can go on an old-age pension depends on his year of birth. People born before 1947 reach retirement age at 65 years, then the year of retirement gradually increases and everyone born since 1964 reaches retirement age only at 67 years. Thus, both men and women reach normal retirement age in Germany at 65-67 years , depending on the year of birth. See the table below for more details.

Table 1: Retirement age in Germany

| Year of birth | Retirement age |

| until 1947 | 65 years old |

| 1947-1958 | To the age of 65, another 1 month is added for 1 past year* |

| 1958 | 66 years old |

| 1959-1963 | 2 more months are added to 66 years for the previous 1 year** |

| since 1964 | 67 years old |

* For example, if you were born in 1950, your normal retirement age is 65 years and 4 months (since 4 years have passed from 1947 to 1950, 1 month is added for each year) ** For example, if you were born in 1960, your normal retirement age was 66 years and 4 months (since 2 years passed from 1959 to 1960, 2 months are added for each year)

Retirement age may come earlier due to special circumstances provided for by law:

- For persons who have paid into pension insurance for at least 45 years, reaching retirement age occurs 2 years earlier, at 63-65 years, depending on the year of birth.

- Women born before 1952 and fulfilling a number of other conditions provided by law can retire upon reaching 60 years of age.

- In addition, the disabled and some other groups of people also have the opportunity to retire at an earlier age.

§ Pension insurance contributions in Germany

Contributions to the pension insurance system depend on the amount of wages; the more a person earns, the more he pays. The employer is responsible for transferring these insurance contributions. The contribution to pension insurance is taken from the employee’s salary and from the employer’s funds, i.e. 50% of the contribution is paid by the employee, and 50% by the employer . The total amount of the pension contribution is calculated as follows: 18.60% of the employee’s gross salary (that is, of the salary from which taxes and fees have not yet been withheld). However, there is a limit after which a person no longer pays insurance premiums: when receiving a salary of more than 6,900 euros, a person is charged pension insurance fees only for 6,900 euros, the remaining amount is free from payment of fees.

In August 2020, Germany decided that until 2025, pension contributions will not exceed 20% of the wages of employees.

If a person works as a minijob , earning less than 450 euros per month, then the pension insurance contribution is also 18.60% of the salary, but 15% is paid by the employer and only 3.6% by the employee.

Table 2: wage payments to the German social insurance system for 2020

| Insurance type | only % of gross salary | Employee's share | Employer's share |

| Pension insurance | 18.60 % | 9.30 % | 9.30 % |

| Health insurance | 14.60 % | 7.30 % | 7.30 % |

| Unemployment insurance | 2.40 % | 1.20 % | 1.20 % |

| Long-term care insurance | 3.05 % | 1.525 % | 1.525 % |

| TOTAL: | 38.650 % | 19.325 % | 19.325 % |

Chart 1 below shows the change in the pension insurance rate from an employee's salary in Germany.

Diagram 1. Change in % pension insurance rate from gross salary in Germany by year

As can be seen from this graph, the rate of contribution to the pension insurance fund in Germany from wages has been constantly increasing in recent decades, although in 2020 the level of pension collection has become lower and is at the level of 1990. Fee rates for other types of social insurance in Germany are also gradually increasing each year.

Comments (0)

Share your opinionCancel reply

Read other news on this topic

- 4 068 31.10.2019

Pensions in 2020, latest news

The pension system in Russia will continue to change in 2020 in accordance with the pension reform approved in 2020.

- 1 125 15.04.2020

Pensions in May 2020

The pension payment schedule for May is adjusted annually, which is due to the long May holidays, due to which banks and pension delivery services do not work.

- 2 851 11.10.2018

Retirement from 2020

.

All news

§ Work experience and pension receipt

The right to receive a pension under pension insurance occurs only if the insured has participated in pension insurance for a minimum number of years. This minimum period of participation in pension insurance in Germany is 5 years (Mindestversicherungszeit, Wartezeit). Only after this can he be entitled to receive a pension.

If the insured expects to receive a pension due to a long or especially long period of participation in pension insurance, which gives him the opportunity to retire at an earlier age, these periods of participation in pension insurance should reach 35 and 45 years, respectively.

Participation in pension insurance includes not only the time during which a person pays statutory insurance premiums while working at an enterprise, but also the time during which a person received unemployment benefits (ALG-I), cared for a child during the first three years of his or her life (Kindererziehungszeiten) or a sick family member. While caring for a child, despite the fact that the person does not pay insurance fees, he will be calculated a pension in the amount that is accrued on average to each insured person.

In general, it must be said that the size of the pension in Germany depends on the size of contributions and the duration of payment of contributions to the state pension insurance system.

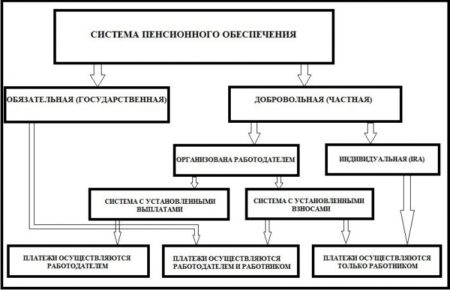

Features of the US pension system

For more than 80 years, the United States has had a law that allows older people to receive social benefits. During this time, amendments and changes were made to the law, but the essence remained the same. Today, the basis of all payments is savings on a voluntary basis. People who work privately make transfers to non-state pension organizations.

In addition, everyone has the right to open their own personal account in selected organizations. Thus, almost all citizens of the country take part in the federal program, which has a distribution principle.

Employees and employers pay the same tax, which is used to fund payments to pensioners. There is a maximum amount for paying tax, above which no tax is charged.

§ How to get a pension in Germany: applying for a pension

Receiving any type of pension in Germany is only possible after submitting an application for a pension (Rentenantrag). This application can be written without a specific form, and also, to speed up its consideration, using the special forms provided. These forms are available on the Deutsche Rentenversicherung Antrag auf Versichertenrente page

The application for a pension must be accompanied by documents that were not taken into account by Pension Insurance, for example: confirmation of completion of education, time of receipt of unemployment benefits, birth certificates of children and others.

In addition, when submitting your application, you will be required to provide the following information:

- Tax identification number (Steueridentifikationsnummer)

- Bank account number and bank code (IBAN and BIC)

- Passport or International Passport (Personalausweis or Reisepass)

- Health insurance card

It is recommended to submit an application for a pension three months before retirement age. Late application for a pension may result in a later start to receiving your pension.

Waiting for change

In America now the average pension is $1200-1500 , old age benefits are issued on average upon reaching 63 years of age. But it is expected that the financial state of pensions in the country will deteriorate and pension reform will be required. This topic is widely discussed.

Some have proposed increasing tax rates, which could preserve the structure of Social Security benefits. Democrats demand the status quo be maintained. Republicans believe it is necessary to pay benefits only upon reaching full retirement age, which will certainly cause public discontent.

§ Types of pensions in Germany

Depending on the life situation, age, gender and other conditions, a person can be paid different types of pensions starting at different ages. The following list shows all the main types of pensions in Germany:

- Regular old age pension (Regelaltersrente);

- Pension from 63/65 years depending on the year of birth for persons working for a long time (45 years of participation in pension insurance);

- Increased pension for persons who, due to illness or accident, can no longer work or can only work on a limited basis (Erwerbsminderungsrente);

- Pension for women over 60 years of age, born before 1952 and meeting certain other requirements (Altersrente für Frauen);

- Pension for miners who work permanently underground, from the age of 60;

- Pension for a widow or widower, or orphan of the deceased (Hinterbliebenenrente);

- Grundsicherung - benefit due to a low amount of earned pension.

Social protection programs in the USA

Most American retirees live quite comfortably by visiting inexpensive stores. Many people have enough money to travel. There are thousands of social programs in the country for recipients of modest benefits.

There is an SSI program. According to its terms, an elderly person is given a monthly amount that is not enough to meet the subsistence level. The “Eighth Program” is widespread in the country, providing a voucher that allows you to save 25 to 30% of the pension on rent.

§ Pensions for disability, illness

As noted earlier on the page, in the event of incapacity for work (total or partial) due to illness or accident, a person can count on receiving a pension until reaching retirement age (Erwerbsminderungsrenten). A person can start receiving this pension even if he has not paid into pension insurance for the minimum period currently set at 5 years. If an accident occurs at work, already at the very beginning of work (if only one contribution to pension insurance is paid), a person can count on receiving a disability pension. Occupational disease that limits ability to work is also taken into account. If the disability occurs due to a domestic injury or illness, only those who have paid contributions to pension insurance (12 contributions) for at least 1 year can receive a pension.

Before a decision is made to pay a disability pension, it must generally be determined whether restoration to work is possible through medical or vocational rehabilitation. A partial disability pension is paid if a person can work less than 6 hours a day, not only in his specialty, but in any job. This is established on the basis of medical examinations and expert opinions.

For disabled people with a degree (Grad der Behinderung, GdB) of 50% or more in Germany, it is possible to retire at an earlier age. This also requires meeting certain conditions and prerequisites. More details can be found in the brochure, link at the bottom of the page.

Formula for calculating pension payments

Calculations are made using the following formula:

Pension (Rente) = PB x VK x KOVP x AStPB

Odds

PB (EP) - pension points. They consist of the sum of all deductions during work and:

- assess how individual income in a particular year relates to the national average;

- compare the amounts of transfers in different years;

- create a part that depends on salary.

VC (ZF) - output or age coefficient. Its value is determined by the age of the person who retired and is equal to:

- 1 - corresponds to the year established in the country.

- Less than 1 - earlier than this period. For each month, 0.003 or 0.3% is removed. After the calculation, the payment does not change.

- More than 1 for late departure. One month gives an increase of 0.005 or 0.5%.

KOVP (RAF) - coefficient for determining the type. It was introduced in 1992, which made it possible to use the formula when calculating other pensions. KOVP = 1, if payments are prescribed for old age, with complete or partial disability, raising one’s own or a deceased child. In all other cases, it has a different defined value - less than 1.

AStPB (aRW) - the current value of the pension point. Its value is set once a year - July 1. A certain formula is used for calculation.

Examples of calculations

A citizen born in 1948 applied for a pension in 2014. His experience is 20 years in East Germany, the salary is 50% above the average, which gave him 1.5 points for each year.

P (Rente) = PB * VK * KOVP * AStPB

PB = 1.5*20 = 30

VK = 1 and KOVP = 1 - retires due to old age.

AStPB = €26.39 - the amount established in 2014 for the Eastern part and €28.61 for the Western part.

Amount = 30 x 1 x 1 x 26.39 = €791.7

It is less than the minimum, which means that a person can count on Grundsicherung benefits.

Under the same conditions, but living in the Western part, will receive other payments:

30 x 1 x 1 x 28.61 = €858.3

The difference is not very big.

Increasing your experience by 10 years will give the following calculation:

45 x 1 x 1 x 26.39 = €1187.55 - in the Eastern part.

45 x 1 x 1 x 28.61 = €1287.45 - in Western.

§ How many pensioners are there in Germany?

The number of pensioners in Germany is not much more than 25 million people. Detailed information with distribution by gender and land is presented in the following table.

Table 3: Number of pensioners in Germany as of July 1, 2019

| Lands of Germany | Number of men retired | Number of women retired | Total number of pensioners |

| Western part of Germany (FRG) | 7’633’245 | 12’269’439 | 15’266’490 |

| Eastern Germany (GDR) | 1’943’889 | 3’225’790 | 3’887’778 |

| TOTAL | 9’577’134 | 15’495’229 | 25’072’363 |

§ Pension and divorce

Upon divorce in Germany, the principle of equalization of pension savings (Versorgungsausgleich) applies, according to which both spouses' pensions will be divided equally between the husband and wife. Thus, if one of the spouses earned a larger pension than the other, for example, if the woman was raising children and housework, then upon divorce, the monthly pensions will be divided equally. The distribution of pensions in this way is made by the court during a divorce without any statements.

§ Links to laws and official websites on the topic: pensions in Germany

Basic information about pensions in Germany is presented on the official website of the Deutsche Rentenversicherung Pension Insurance and the website of the Ministry of Labor, as well as in the legislative documents governing the provision of pensions.

- Deutsche Rentenversicherung, official website

- Brochure "Reha und Rente für schwerbehinderte Menschen"

- Sozialgesetzbuch (SGB) - Retirement age

- Sozialgesetzbuch (SGB) - § 50 Wartezeiten - Minimum period of participation in pension insurance

- BMAS, website of the Ministry of Labor

- Rentenwertbestimmungsverordnung - RWBestV - pension calculation, current figures

Detailed information about the size and calculation of pensions in Germany is available on a separate page on our website.

Footnotes:

The euro exchange rate in the tables is taken as of October 1, 2020 and is 90.61 rubles at the rate of the European Central Bank. Exchange rates in Germany

- Pages:

- 1

- Pension in Germany: length of service, age, types of pension, registration

- Average and minimum pension in Germany, pension calculation

- Related topics:

- Unemployment benefits in Germany

- Minimum salary in Germany

- How and where to look for work in Germany

- Employment agencies and intermediaries in Germany

- Fraud and deception in job advertisements

- Documents for applying for a job in Germany

- Advice and help centers in Germany for migrants

- Free German courses in Germany

Volume of funds

However, retirement age is hardly a reliable indicator of the quality of life of pensioners. After all, the size of the resulting payments has the greatest impact on it. Taking it into account, we can identify completely different leaders among the countries of the world community.

These include:

- Denmark - $2800;

- Finland - $1900;

- Norway - $1542;

- Israel - $1350.

The last places in the payment ranking are traditionally occupied by the CIS countries and Eastern Europe. Thus, citizens of Georgia, Uzbekistan, Moldova, as well as Azerbaijan and Ukraine receive the least payments.

Return to contents