The United States of America is famous not only for its high level of wages, but also for its decent pension provision. Very often we hear about how comfortable life is for American retirees who, upon retirement, travel the world and move to sunnier corners of America. In the article we will touch on the basics of the US pension system and will focus in particular detail on the size of pensions.

Compare the standard of living in Russia and the USA - it’s quite interesting.

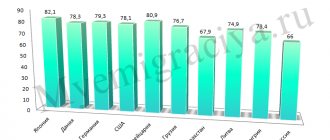

Pensions in the US are the highest compared to other countries

Return to contents

Features of the US pension system

For more than 80 years, the United States has had a law that allows older people to receive social benefits. During this time, amendments and changes were made to the law, but the essence remained the same. Today, the basis of all payments is savings on a voluntary basis. People who work privately make transfers to non-state pension organizations.

In addition, everyone has the right to open their own personal account in selected organizations. Thus, almost all citizens of the country take part in the federal program, which has a distribution principle.

Employees and employers pay the same tax, which is used to fund payments to pensioners. There is a maximum amount for paying tax, above which no tax is charged.

Sources of financing

The US pension program is pay-as-you-go (solidarity). The same type of system operates in the CIS countries. Payments to unemployed citizens are made from a fund that is replenished from the tax contributions of employed Americans. Each able-bodied citizen pays 6.2% of his own income to the pension budget (as of 2020; in 2014 the tax was set at 7.65%). The hiring company pays a similar amount. Private entrepreneurs contribute double tax to the fund - as an employee and as an employer.

At the same time, the Social Security program fund has the right to conduct business activities. It holds a significant amount of US government debt (bonds). About $115 billion is deposited into Social Security accounts annually as interest payments on the government loan (the loan size is about 3 trillion). These funds are also used to provide pension payments.

How is a pension formed in the USA?

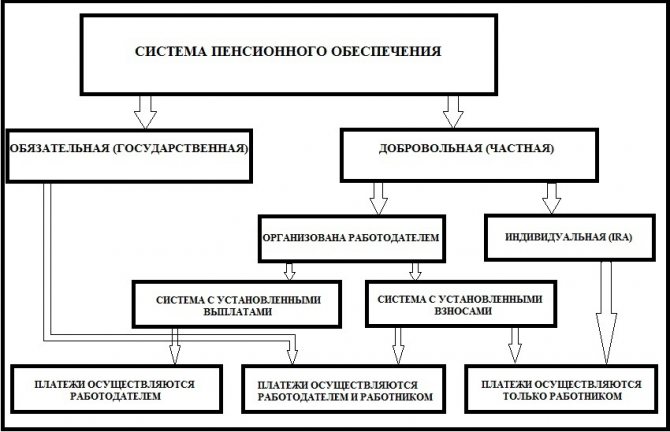

The pension system in the United States is not particularly new in structure.

In America, there are both public and commercial pension funds.

Thanks to the large number of funds, Americans with good wages are able to save up 2-3 pensions for themselves:

- Private pension funds are based on the accumulation of funds, have defined payments and contributions, and are divided into 2 types. With a fixed pension amount that does not change and is guaranteed to be paid to the pensioner. Its size depends on salary and length of service in the company. A certain pension amount is not guaranteed, since the citizen himself deposits money into the account in any quantity.

- State funds are formed as a result of contributions from employers and citizens themselves, as well as government investments.

State pensions

Paid from your SSN (Social Security Number), to which the employer transfers 6.2% of your income. If you hired yourself (that is, an entrepreneur), then you pay 12.4% of income.

Well, what is a pension in the USA without years of service? That's right, none. Payments go only to those who have worked for the benefit of the state for at least 10 years. It is during this time that 40 credits necessary to receive payments are earned. That is, it turns out that 4 credits are earned in one year, 1 credit every 3 months. Your loans accumulate on your account; if you are not working temporarily, they are terminated, and when you get a new job they are resumed.

Non-state funds

This money is your own, acquired through back-breaking labor, and you decide how much to transfer to your account. You can transfer a maximum of 15% of your salary. You don't have to list anything at all. The most common non-government fund is the 401(k), which many people deal with. Disadvantages - your money is frozen in the account until your retirement, and if you want to withdraw it earlier, you will have to pay penalties, which amount to 30%.

Employer pension

Not all companies receive pensions from employers. To receive it, you need to apply only to large companies that offer benefits (essentially a social package).

Savings system and company support

Another source of pension payments is savings funds. They can be either private or public. Every citizen has the right to transfer part of his income to such an account. The transferred amount is not subject to tax. Funds accumulated in the bank are available at any time. The employing company can operate according to a similar scheme. By transferring funds into employee retirement accounts, corporations can reduce their tax rate. The period after which the employee gains access to accumulated assets is specified in the contract (usually 5-6 years). A deposit program is applied to funds in savings accounts - the amount grows by an average of 9% per year, which exceeds the rate for conventional banking programs.

The first fund, to which contributions were made only by employers, appeared in 1875. The Basic Law on Voluntary Pension Provision was adopted much later, in 1974. Among other things, the legislation enshrines benefits for retirees in the United States. When developing the law, the experience of previous years was taken into account; the result was tightening control over the work of organizations operating in the field of corporate pension insurance. According to the law, a separate employee, the so-called fiduciary, monitors the company’s assets. He is obliged to act in the interests of the corporation's employees and control the operations carried out by the pension fund. Additional liability is provided for such a person for dishonest performance of duties.

The scheme for calculating additional pension benefits varies depending on the policy of the corporation. Previously, a scheme to transfer some percentage of wages with a gradual increase was popular (for example, paying 2% of the employee's rate with an annual increase of another 2% and a limit of 80%). This model of employee incentives is called “defined benefit” (fixed payments). It is gradually being replaced by more flexible schemes, since employees are not ready to commit themselves to a virtually lifelong contract (the maximum amount of contributions can be achieved by working for one company for 40 years). The fixed payment model is used by government agencies and major companies.

Greater freedom, but less stability, is provided by the Defined Contribution payment scheme. In some shares (specified in the contract), the employer and employee transfer funds to the selected investment fund. The actual amount of savings in an employee's pension account depends on the success of the specific investment company. Under the same scheme, Americans are allowed to invest in securities and purchase stocks and bonds. This model makes it possible to additionally finance the economy from pension savings, ensuring business development. The total volume of such injections in 2010 amounted to almost $10 trillion (more than half of US GDP, $16.8 trillion for the same year). Investments from personal pension savings can increase your overall income. But the model also comes with additional risks. During a sharp economic surge or financial crisis, losses are possible due to the depreciation of selected assets (bonds or stocks).

Payment of pensions from such accounts is possible only when the citizen reaches full retirement age. After a few more years (depending on the conditions of the specific program), an American can withdraw all accumulated funds and use them as he chooses (for example, spend them on purchasing real estate or transfer them to his heirs). In this case, the pension account is closed.

Pension size in the USA

The average pension in the United States as of 2019-2020 is about $1,160 (about 66,000 rubles). However, benefits can vary greatly depending on the state, the retiree's profession, length of service and salary.

- The minimum pension in the United States ($300) is received by persons who have not worked a day officially.

- Citizens who have managed to work at least a little legally are entitled to monthly payments in the amount of $600.

- Most ordinary middle-income workers receive about $750.

- Highly qualified specialists who once received good salaries can count on $1,500.

- The most privileged group of American retirees are considered to be veterans, military personnel, firefighters, teachers, government officials and police officers. Their pension can reach up to $3,000.

- And finally, the monthly pensions of living US presidents exceed $16,000.

Receiving a minimum pension does not mean that a citizen’s entire monthly income will be only $300 or $600. According to data for 2020, the minimum income level for a single person should be 733 dollars, and for a married couple - at least 1100. Persons receiving a lower amount are entitled not only to an old-age pension, but also to social benefits. Working pensioners who have reached the age of seventy can also count on additional bonuses.

Principles for calculating state pensions

For every year worked, an American receives 4 points. Upon reaching the amount of 40 points, the right to receive government payments is acquired. At the end of each year, the state pension fund sends information letters to its clients with detailed information about the status of their accounts. The amount of state contributions for employees is 6.2%, for employers 12.4%. Pension amounts are adjusted depending on the cost of living parameter in the United States (COLA scale). According to data for 2019, indexation will be 2.8% per month or $39.

If the accumulated points are less than 40, pension payments cannot be accrued, however, the right to social benefits is granted. The average monthly social benefit is calculated by dividing the average amount accumulated over 35 years of work experience by 12.

If necessary, the law allows for funds to be received in the form of a loan at a preferential rate. This is a kind of analogue of a conventional loan, in which Americans borrow from themselves.

Preferential benefits

US citizens who receive pensions in the amount of $300-600 can count on government support for the poor:

- copay up to $733 per person;

- up to $1,100 for a family of 2 people.

Insurance contributions include a percentage of contributions to health insurance after retirement. An insufficient number of points will also affect the receipt of medical services. The exception is for wives who did not receive points for a good reason (child care, illness).

If the husband has 40 credits, then she has the right to health insurance, regardless of her own points. Participation in hostilities provides veteran status and corresponding pension benefits.

Social Security in the United States helps low-income retirees enroll in programs to increase their income or reduce expenses.

In addition, each state takes its own measures to provide material support: the higher the level of economic development, the more significant the additional payments to state benefits.

Results

The United States of America is a leading country in pension provision, guaranteeing its citizens and residents a more than decent standard of living in old age. The opportunity to receive not only a state pension, but also funded and non-state pensions allows many people to plan the distribution of their savings and already have substantial capital by the time they reach retirement age. Perhaps this explains the fact that US retirees are much happier than older people in other countries.

When Americans retire

There is no single indicator when it comes to output. The exact period depends on the age group.

| Year of birth | Full retirement age |

| 1943-1954 | 66 years old |

| 1955 | 66 years and 2 months |

| 1956 | 66 years and 4 months |

| 1957 | 66 years and 6 months |

| 1958 | 66 years and 8 months |

| 1959 | 66 years and 9 months |

| 1960 | 67 years old |

Gender issue

Legislatively, the time of retirement is no different for both sexes. However, statistics show the following data: women prefer to retire at 65, and men at 67.

Special cases of early care

US citizens are also allowed to retire early - this can be done at 62 years of age. Usually, for such a step it is enough to write a special statement justifying the reasons. But such a measure is not popular - in this case, a person will receive only 74% of the allotted amount. And this figure will not change even after reaching retirement age.

There is an exception to this rule - 100% payments are due to a person from the poorest segment of the population earning less than $15,000 a year.

Usually they do this:

- people fired by their employer;

- those who engage in heavy physical labor;

- citizens with sufficient savings.

Additional payments

If an American's earned pension is less than the threshold, he has the right to apply for additional social support. For 2020, the minimum allowable pension amount was $733 for a single person and $1,100 for a married couple. If pension payments are below these values, US citizens receive an additional payment equal to the difference between the minimum rate and actual income.

However, the state pension is not the only source of income for older Americans. On average, it accounts for only 38% of monthly receipts.

Pensions for different categories of people

The wages of citizens in the United States significantly exceed the world level. There are professions in the country that are in great demand and highly paid: programmers, doctors, military, police. Accordingly, the size of pensions is significant.

In the Russian understanding, a pension is the amount that a person receives monthly; in America, it exists only for police officers, military personnel, firefighters and postal service workers; they have a government subsidy of $40,000 or more. The rest of the citizens determine it themselves, that is, based on contributions to the pension fund.

Sooner or later, the presidents of the country also become pensioners. They, naturally, are in a more advantageous position than other citizens, since they can themselves initiate an upward indexation of payments for high-ranking officials.

How do retirees live in the USA?

The concept of standard of living includes wages, cost of living, and the balance between the income and expenditure parts of the family budget.

American regions have significant differences in all major indicators, but there are general patterns in their relationships.

As an example, consider the budget of an average married couple from Houston per month (dollars):

- The salaries of spouses, office workers, total 4600.

- Federal property tax and local school tax (paid once a year): – 1000 for a house worth 150 thousand; – 2500 (regardless of the presence of schoolchildren in the family).

- Car insurance for a year – 1500.

- Groceries costs for 2 people are about 1000 + purchase tax (each supermarket has its own).

- Public transport fare – 90.

- Internet – 500.

- Mobile communications – 100.

- Fitness center subscription – 35.

- Dinner at a restaurant – 35.

- Education – 20,000-40,000 per year, depending on the prestige of the university. The amount is deferred from the birth of the child.

- Medicine: – 1000 – call an ambulance; – 20 – consultation with a doctor. * – The insurance company does not pay for calling an ambulance and subsequent hospitalization, or the cost of medications. Operations are partially paid.

- Real estate. The rental price depends on the region and location of the block. In Houston, in areas that are safe to live in, the cost of a 1-room apartment is 1000/1300 (outskirts/center).

The income of pensioners is comparable to the salary of a young couple, while there is no need to save money for children’s education, and there is old-age insurance. Many U.S. retirees are giving up a car to cut insurance and fuel costs. With an average benefit, citizens of retirement age can afford to travel around the country and abroad.

Individual accounts

In addition to corporate and government programs, US citizens have the opportunity to open an individual retirement account in a bank. The rules for working with an individual retirement account (IRA) are regulated at the state level.

Contributions to a personal account up to $2,000 per year are tax-deductible. An American will be able to access the funds only after reaching 59.5 years of age. The accounts of persons whose age has exceeded 79.5 years are closed. There is no lower age limit for opening an account; an IRA can be created even for a newborn.

There are no taxes on the IRA during the accumulation period. An income tax is paid on withdrawals and on account liquidation.

Individual pension accounts are most often opened in private banking institutions, insurance and mutual funds. You can transfer your deposit to another company at any time. The investor can choose the direction of investment himself or delegate investment management to a third-party company. There are no restrictions on the direction of investment from a personal account. You can invest in both American and foreign companies. The bank client manages finances at his own peril and risk. Most often, a distributed investment scheme is used: the investor or his representatives buy securities of various types (usually shares of stable growing large companies). A less common, although acceptable option is investing in gold, oil futures and other valuable resources, investing in real estate and land.

How Russian pensioners live in the USA

Migrants who have moved to their place of residence in the United States can earn a full pension after a working period of 35 years (if they have citizenship or a Green Card). To retire at 67, the starting age is 32.

At an older age, social benefits will be calculated in a smaller amount. Changing your place of residence after age 50 means you will have to work after age 65 or receive a minimum pension.

To reduce costs, retirees in the United States, including Russians, change their place of residence, moving to the southern states. In the northern regions, which are more economically developed than the southern ones, wages are higher, but living costs are also higher.

Social protection programs in the USA

Most American retirees live quite comfortably by visiting inexpensive stores. Many people have enough money to travel. There are thousands of social programs in the country for recipients of modest benefits.

There is an SSI program. According to its terms, an elderly person is given a monthly amount that is not enough to meet the subsistence level. The “Eighth Program” is widespread in the country, providing a voucher that allows you to save 25 to 30% of the pension on rent.

Social Security System

To receive a pension in the United States, you must work for at least 10 years. The state implements the SSI (Supplemental Security Income) program for:

- disabled people;

- persons with chronic diseases;

- the poor;

- elderly emigrants who have not received the necessary experience.

It accrues monthly payments of at least the subsistence level. People whose calculated pension is less than the minimum acceptable level can also count on benefits. The state government pays the difference.

In addition to a fixed amount each month, such citizens are entitled to:

- free medical care;

- payment of part of the rental housing in specialized complexes from 70 to 75%.

Americans of retirement age receive old-age benefits no less than the cost of living, regardless of length of service.

Ordinary pensioners also receive additional benefits in the form of:

- extended health insurance with payment for medications and travel to the hospital;

- visits to special clubs for the elderly;

- discounts on housing and communal services;

- food delivery home.

Advantages of a distributed pension system

Thanks to a growing, stable economy and a basic government pension program, all citizens of retirement age in the United States receive defined benefits. The investment model of pension funds ensures the infusion of additional funds into the business.

Private funds compete for investment assets, improving reliability and quality of services. Companies offer employees favorable terms of the social package and increase rates on pension payments, winning the loyalty of employees.

At the same time, the practice of opening an IRA allows Americans not to rely on the state or employers, but to take care of the future on their own. Many US citizens use the funds accumulated over years of constant work to open their own business or invest in the business of younger relatives, ensuring an increase in family income.

In fact, retirement under this model becomes not a refusal to work, but a change in type of activity. The period of employment allows you to collect significant start-up capital. The ability to claim a partial payment of a state pension before reaching full retirement age and the availability of funds in the account encourages Americans to give up office work much earlier than 67 years of age.

A system of pension payments coming from unrelated sources allows Americans to count on at least a minimum amount of monthly cash income.

This model insures pensioners against the loss of all savings in the event of a government crisis or bankruptcy of an individual company.

Types of pensions

Payment of pensions is tied to the social insurance system, which has been successfully operating in the United States for many decades. In the event of an insured event (reaching a certain age), the state guarantees the person, if the latter meets certain conditions, a monthly pension payment for life.

At the same time, the entire pension system can be divided into three types:

- State insurance pension system. According to it, the employer and the employee themselves pay appropriate pension contributions from income. It is these contributions that serve as the basis for the formation of a future pension.

- Provision within the non-state system. The key here is the opening of special accounts, where a citizen has the right to voluntarily transfer money towards a future pension.

- The pension savings system, the essence of which is that an organization (can be either public or private) accepts into its account part of the employee’s pension contribution (with his consent), and in the future these amounts are increased, serving as an additional payment to the general state pension.

US pension system

Return to contents

State support

This system is formed by insurance pension contributions, which are paid to the pension fund. Pension insurance in the United States is part of the social insurance system. The contribution rate is set at 7.65%, this amount is required to be paid by both the employee and his employer: thus, the total contribution amount is 15%.

At the same time, part of the percentage will be used for further medical care in old age, but the main part will be used exclusively for the formation of a pension. Moreover, if you work as an individual entrepreneur, then you pay double for yourself, i.e., both as an employee and as an employer.

State Old Age Security is the main type of pension that most Americans receive. This is what we will talk about in the future in the context of age, conditions of receipt, size. Now we will briefly describe other types.

The United States has one of the highest retirement age thresholds, but Americans see only advantages in this. More details in the next video.

Cumulative part

Of the percentage that is paid to the pension fund, you can send part of it to the savings fund to form the savings part of the pension. Such funds can be both public and private. The benefit of this method is that the funds deposited in the funds grow at interest (usually 9% per year), and by the time you reach retirement age you can get a good increase in the main insurance state pension.

Access to funds is usually provided to a citizen after a certain period (5-7 years).

Return to contents

Non-state provision

In addition, American citizens have the right to independently enter into agreements with non-governmental organizations regarding the payment of a “private” pension in the future. In such cases, an account called an individual retirement account (IRA) is opened in the name of the future pensioner, into which the citizen has the right to deposit sums of money. However, if you deposit less than $2,000, the transaction is not subject to taxation.

When a person turns 60, they have access to the money in this account. If he decides to withdraw money, he will have to pay a fee, but until that moment the money in the account is again not subject to any taxes. When a pensioner reaches the age of 80, the account is closed.

Average life expectancy of pensioners in different countries

Typically, such services are provided in the banking sector, as well as in private mutual funds and investment funds. The conditions are negotiated individually.

Return to contents

Disadvantages in the American pension system

Economic analysts have been predicting the collapse of this “house of cards” for years now. Lately their voices have sounded more concerned.

Here are the reasons:

- Since 2014, there has been a decline in the birth rate. The largest age group in the US population is also retiring. It is believed that it will be difficult to provide them with pensions.

- The number of officially registered unemployed is growing.

- Over the past half century, household incomes have declined significantly. The consequence of this phenomenon will be that the state does not receive taxes.

- The value of the yield of securities is lost (they were purchased by funds with the money of investors).

- From time to time, regional authorities borrow funds from the pension treasury.

But the most important problem of the looming crisis is the increase in the retirement age with a simultaneous reduction in pensions.

Waiting for change

In America now the average pension is $1200-1500 , old age benefits are issued on average upon reaching 63 years of age. But it is expected that the financial state of pensions in the country will deteriorate and pension reform will be required. This topic is widely discussed.

Some have proposed increasing tax rates, which could preserve the structure of Social Security benefits. Democrats demand the status quo be maintained. Republicans believe it is necessary to pay benefits only upon reaching full retirement age, which will certainly cause public discontent.

Pension and other social benefits

Most American retirees live quite comfortably on their Social Security benefits. But, since pension insurance in the United States is part of the general social protection system, for those whose coverage is not sufficient, there are a large number of programs supported at the state or national level:

- SSI is an additional payment to the basic benefit that compensates for the difference between the basic pension and the cost of living.

- “The eighth program” is the provision of a special voucher, which makes it possible to save about 25-30% on payment for rented housing.

- Welfare - involves the issuance of coupons for the preferential purchase of food stamps (Food Stamps), the provision of municipal real estate to people in need of housing. Issued to citizens and Green Card holders.

- Social Security – provides protection for low-income citizens, including retirees, refugees, the homeless, and former prisoners. About 25% of the state's residents use it. Full pension coverage under this program is only possible after age 65 (the so-called old-age benefit). Social Security provides pension benefits themselves, as well as disability and health care coverage.

Disability benefits in the United States are paid not only to those who are unable to work as a result of injury, but also to those who acquire an occupational disease.

Some states provide transportation for seniors to go shopping. Almost all states provide a nurse home call service.