Monthly, individual funds from social security

According to official media sources, there are still few similar programs to provide these funds to pensioners in the country, but regional authorities are already engaged in their development and implementation.

The registration and assignment of these payments also occurs on the principle of identifying the actual expenses and income of the pensioner, where the minimum amount of monthly additional payment is 1000 rubles, but with a limited period (from 3 to 6 months

Deadlines for payment (payment) of sick leave by the Social Insurance Fund

Tatarstan residents are my fellow countrymen! Come live with us in Moscow, they live in palaces and the Moskvich card has free travel on all transport except taxis and trains, this is where paradise is and you all criticize Sobyanin, this applies to Muscovites.

Thus, only users who have an electronic signature can register an application and receive tax benefits in the taxpayer’s personal account! Otherwise, you will have to contact the territorial tax office in person and submit an application on paper!

In Chelyabinsk, social card pensioners pay 11.5 rubles per trip. That is, there is no completely free travel almost anywhere.

The Federal Tax Service recommends submitting an application for tax benefits before May 1 of the current year, before the distribution of notifications on property taxes begins. Although, in principle, you can submit an application to select tax objects for which a citizen wishes to receive benefits before November 1.

It is curious that initially the draft resolution of the Cabinet of Ministers of the Republic of Tajikistan assumed that the monthly allowance for pensioners with incomes above 25 thousand rubles would be reduced from 90 to 45 rubles, and for elderly people with incomes over 20 thousand rubles - from 180 to 90 rubles. It was in this edition that the project passed the anti-corruption examination by the Ministry of Finance of the Republic of Tajikistan.

There are unusual situations when the timing of applying for benefits goes beyond the general principles.

Registration of individual payments in social security

From the beginning of 2020, the Department of Social Protection of the Population (SPP) began the systematic implementation of a program to identify the needs of pensioners, where types of assistance will be provided both in kind (clothing, shoes, food, social assistance) and in monetary terms.

More information about this program can be found in the website article “Social Security will identify the needs of pensioners,” where questions about the new tasks of regional authorities within the framework of the “May” Decree of the President of the country are discussed in more detail.

So, social security sends information letters to pensioners, where SZN employees will offer individual support measures to each person who applies. In most cases, pensioners prefer additional payments, which are accrued at the time of transfer of regional funds that regulate the cost of living of a pensioner in the region.

According to pensioners who have already contacted social security departments, the minimum amount of monthly assistance/payment is 1,000 rubles, but the maximum is 3,000 rubles. To receive the maximum payment, it is necessary to comply with the Most Russian pensioners are on the verge of poverty, when, due to various factors, there is no money left to meet the minimum needs. This is also due to the size of payments received by pensioners from the state.

It is for these purposes that federal legislation has programs for assigning “low-income” status to various categories of citizens. So what exactly does this statute do for retirees?

What documents need to be prepared?

The list of documents for receiving benefits includes: passport, pension certificate, medical policy and others

To get on the waiting list for prosthetics, the patient must provide the following documents to the social security service:

- Passport

- Pensioner ID

- Document confirming membership in a preferential category

- Medical insurance policy

- Certificate of income (for persons who live alone)

- Certificate of income for each family member (for persons who do not live alone)

- If the patient is a cancer patient, he must also provide the appropriate certificate, which will give him the right to receive dental treatment without waiting in line

Compensation payments and subsidies

Regional programs also provide for compensation of expenses of pensioners with the status of “poor”, where, in addition to the housing and communal services sector, social protection pays attention to their urgency. In most cases, these expenses, albeit partially, are compensated when purchasing medications and other medical supplies.

Subsidized payments are assigned to low-income pensioners under a number of conditions set by the SZN:

— monthly reporting on pensioners’ spending (providing checks, receipts and other expense documents based on the pensioner’s spending); — absence of cohabitation with a pensioner of persons of pre-retirement age (accommodation of minor children is allowed); — unscheduled visits to a pensioner by a social security employee.

There are no special requirements for pensioners to receive the minimum payment (1000 rubles). It is enough to provide checks/receipts for the pensioner’s own expenses once every 3 months.

One-time targeted assistance and social contract

This type of benefit is provided at the regional level. One-time targeted assistance is of an application nature. After an official application, the OSZN can provide a low-income pensioner with:

- fuel;

- rehabilitation products;

- transport for moving around the city.

A social contract is concluded between a low-income pensioner and a social security agency. It gives a citizen the right to receive a certain amount to pay for services or purchase vital goods. By signing a social contract, a low-income individual agrees with the need to fulfill obligations to the Social Protection Fund. For example, with visiting a social adaptation program.

Registration of individual payments to a pensioner

To arrange individual payments to a pensioner, first of all, it is recommended to find out about the availability of such a program in a particular region, since not all regions have currently launched a similar “pilot” project.

Below is a number of documents that may be required (depending on the procedures and norms established by regional authorities) for pensioners to process an individual payment:

— expense documents (receipts for housing and communal services payments for the last 3-4 months, receipts from pharmacies, etc.); — certificate of pension amount from the Pension Fund; — pensioner’s passport; — an extract from home books (social security requires, but not always); — a statement of the established form (issued by SZN employees at the department).

Thus, each pensioner can increase the total amount of payments from the state from 1000 to 3000 rubles by performing a number of actions described above.

Social benefits for pensioners

To finance subsidies, the budget of the region in which the recipient lives is used. Social assistance for pensioners includes:

- Subsidies for housing and communal services. This type of assistance is territorial. If utility costs exceed 10–22% of total family income, a pensioner can apply for a subsidy. The compensation payment cannot exceed 50% of housing and communal services payments.

- Reimbursement for telephone expenses. Employed pensioners can take advantage of this benefit. Unemployed citizens, with the exception of veterans and disabled people, must pay for the use of the telephone themselves.

- Free vouchers for sanatorium-resort treatment. They are given preferential treatment to disabled people and combatants. On a first-come, first-served basis, you can receive a free voucher once a year if you have a referral from your attending physician.

- Tax benefits. For military pensioners, the tax on one vehicle has been completely abolished since 2020.

- Medical benefits. All pensioners can visit city and district clinics free of charge. Citizens over 60 years of age must undergo medical examination every 3 years. Disabled people will be able to receive some medications for free.

- Free travel on public transport and commuter trains. Tickets with a 50% discount are available for water and rail transport.

How are things really going?

As mentioned above, there are many pensioners who have the actual status of “low-income”. Only support programs, unfortunately, are distributed extremely rarely and not always targeted. Pensioners themselves say this.

“It seems that budget funds allocated for additional payments remain in the pockets of unscrupulous officials,” pensioners say.

In addition, given the bureaucratic delays and the difficulty of obtaining additional assistance, pensioners themselves often refuse to apply for it. In some cases, social security does not recognize pensioners as low-income, which is often reported in various media.

It is also worth noting that each region has its own standards for recognizing pensioners as low-income, which implies its own types of support. It is the regional authorities who regulate this norm with the appropriate legal framework.

In reality, it turns out that there are programs for additional support for pensioners, but they are not actually applied due to various difficulties.

What services are provided to pensioners free of charge?

If a patient of retirement age has a health insurance policy, then he can visit a municipal dentistry or a clinic that has a dental office, where he will be treated for free.

There is a certain list of types of treatment that pensioners are entitled to. This includes:

- Examination and consultation with a dentist

- Treatment of caries and other oral diseases (gingivitis, periodontitis, pulpitis, abscess)

- Installation of fillings, filling of root canals

- Sanitation of the oral cavity

- Tooth extraction

- Jaw reduction

- Remineralization procedure

- X-ray

- Treatment of oral inflammation

- Physiotherapy

- Removing foreign objects caught in the tooth or oral cavity

- Cleaning from plaque, removing tartar

- Certain types of prosthetics

Social Security does not recognize pensioners as low-income

Increasingly, complaints began to be received from pensioners about the actions or inactions of social security departments. Thus, deprivation or temporary provision of additional types of support is the main reason for complaints. This problem, unfortunately, is heard from many regions of the country.

Deprivation of regional social supplements to pensions and other forms of payments is possible only in cases, based on the law, that the pensioner has changed status. For example, he ceased to be poor or became employed. In reality, pensioners deprived of additional forms of support did not change their status, but social security departments deprived them of additional payments without warning.

“Without notification, social security canceled my additional payments, which is why I didn’t receive a penny from social security in July, although I am alone and there is no one to help me,” says the pensioner.

It turns out that social security temporarily recognizes pensioners as low-income, assigning additional payments, but then cancels them unilaterally, without being convinced that the pensioner’s material well-being has improved.

We can only hope for changes in legislation that would not allow social security to treat pensioners in such a dishonest manner.

Benefits for pensioners - who is entitled to

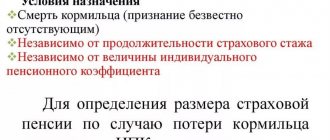

Persons who have retired due to disability, as well as people receiving survivor assistance, can count on it.

The legislation also provides support for those people who do not receive a retirement pension due to lack of work experience. Help also applies to people whose accumulative part of pension savings is less than 5% of the total amount.

First of all, citizens who belong to one of the following groups can receive one-time assistance:

- receiving financial support for disability,

- having payments for the loss of the sole breadwinner,

- those who have been assigned a social pension due to lack of work experience,

- citizens who receive a labor pension if the funded part is minimal.

A one-time benefit to pensioners is not provided to everyone who wishes to receive it. Perhaps the situation will change in the future.

How to get financial assistance at the MFC: step-by-step instructions

In order to apply for social support in monetary or material terms, you first need to contact the local department of the MFC and write a corresponding application. It's better to make an appointment in advance.

Required documents

The second step involves collecting a certain list of papers.

- Application form (to be completed on site)

- passport;

- registration;

- certificates of total income for the last three months from each family member;

- certificate of family composition;

- pensioner's ID;

- employment history.

It is important to understand here that to complete the application you need the originals of all documents without exception, but do not forget to make photocopies in advance, they will need to be submitted.

If a pensioner does not currently have the opportunity to visit a multifunctional center, then he will be able to send the same documentation by registered mail, or fill out an application on the government services website, which has recently been gaining great popularity due to its accessibility.

Read also: Abandonment of a child in the maternity hospital

Please note that this portal can facilitate the process of obtaining many types of financial support from the state.

Samples (forms) of applications for financial assistance

- for low-income families (download: blank form, completed sample)

- in connection with the death of a close relative (download: sample application)

- financial assistance for vacation (download: sample application)

- financial in connection with treatment and operations (download: sample application)

- financial assistance due to a difficult family situation (download: sample application)

- financial assistance in connection with the birth of a child (download: sample application).

Payment amount in 2020

Payments are subject to indexation every year, in accordance with the previous period. Thus, from January 1, 2018, insurance pensions will increase by 3.7 percent, which, taking into account the average pension size, will range from 250 to 500 rubles (each case is calculated individually).

From April 1, 2018, social pensions are expected to increase by 4.1. percent, but this applies only to those who do not have experience, namely the disabled, people who have lost their breadwinner and other similar categories. In August, a slight increase in payments is also expected, which will amount to a maximum of 245 rubles.

As for the one-time payment, it will be 5,000 rubles. Another aspect that is important to pay attention to is the region of residence, since targeted assistance directly depends on the living wage established in the region at the moment.

Deadline for receiving financial assistance

First of all, please note that the package of papers is submitted before the 20th, since in this case, the social supplement will be made from the next month after the current one.

This issue is considered within 30 calendar days from the moment all the conditions for filing an application are met, namely, all documents are provided and everything is completed correctly.

Read also: Single hotline MFC 8800 for inquiries

Privilege monetization process

Monetization of benefits for pensioners - replacing the privilege with monetary compensation. It applies only to three types of government. help. These include benefits for:

- Travel by transport.

- Purchasing medications.

- Vouchers to a sanatorium for treatment.

In addition to the waiver of benefits for pensioners in 2020, indicated above, a citizen has the opportunity to replace some benefits with payment for utility services. At the local level, monetization is also provided for regional subsidies.

What acts are it regulated by?

The procedure for replacing benefits with cash payments to pensioners is regulated by Federal Law No. 122-FZ (as amended) “On amendments to legislative acts of the Russian Federation and the recognition as invalid of certain legislative acts of the Russian Federation in connection with the adoption of federal laws “On introducing amendments and additions to the Federal Law “On the General Principles of the Organization of Legislative (Representative) and Executive Bodies of State Power of the Subjects of the Russian Federation” and “On the General Principles of the Organization of Local Self-Government in the Russian Federation”. It stipulates that beneficiaries have the right to refuse privileges in favor of material compensation if they have no special need to use them. There is also the Federal Law “On State Social Assistance” from N 178-FZ (latest edition), which lists benefits that can be replaced with money.

What payments can you expect?

Elderly people are provided with support in the form of the following payments:

- improving living conditions;

- paying half of the utilities;

- compensation for additional expenses during major repairs;

- purchasing medicines (for some categories of elderly people);

- fiscal deduction;

- dispensing medications on preferential terms.

In Moscow and the Moscow region, older citizens on average receive a social supplement of 5,600 rubles.

In this case, the following conditions must be met:

- The pensioner does not work.

- The size of his pension does not meet the standards approved in Moscow (considered low-income).

- The senior citizen has lived in the capital for at least 10 years.

In addition, Muscovites have the right to receive a monthly city cash payment (EGDV).

To do this, they must confirm that:

- are residents of Moscow;

- do not receive federal benefits.

After 80 years of age, a person can count on an increase in pension, which consists of 2 shares:

- insurance, taking into account length of service, the amount of contributions to the Pension Fund and the characteristics of the region;

- fixed, or state (established by the government).

Documents required to submit an application in person to the RCMP (mandatory to submit)

Documents required to submit an application in person to the RCMP (mandatory to submit)

- Statement;

- Passport or other identification document;

- Bank details for transferring funds (bank name and bank account number). If, for health reasons, age, walking or transport inaccessibility, the applicant is not able to open bank accounts and use them, the assigned payments are made through a branch of the Russian Post;

- Documents on income for the six months preceding the month of filing the application received by the recipient of the public service (with the exception of payments, information about which is available in the Pension Fund of the Russian Federation, and pensions paid by the Ministry of Internal Affairs of Russia);

- A document confirming their authority as a legal representative or a person authorized by the recipient of a public service to represent the interests of the recipient of public services, if the recipient of the service is a child pensioner or an incapacitated adult pensioner.

If the employer violated payment deadlines

According to paragraphs. 10 p. 1 art. 407 of the Tax Code of the Russian Federation, pensioners are exempt from paying property tax, but only for one of each type of real estate of their choice. For example, if a pensioner is the owner of 2 apartments, 1 house and 1 garage, then he is completely exempt from taxes on the house, garage and one of the apartments of his choice (clauses 2-4 of Article 407 of the Tax Code of the Russian Federation).

Many chain supermarkets provide discounts to pensioners using a social card. You can check this at the checkout or on the store’s website. As a rule, this applies to large grocery chains. Sometimes discounts are only valid during certain hours or on certain products.

Property tax can be paid through the State Services portal · News of Arkhangelsk and the Arkhangelsk region.

Complaints about decisions, actions (inaction) of the head of the Center department are submitted to the head of the Center or the head of the Department (department).

Decisions, actions (inaction) of the deputy minister (minister) can be appealed to the Cabinet of Ministers of the Republic of Tatarstan.

In order to receive a certificate of pre-retirement status in 2020 in the Russian Federation, you need to know where to go. Although the document is electronic, you can order it in several ways:

- Contact the Pension Fund in person or send an application by mail

- Send a request through the Pension Fund website

- Send a request through the State Services website

This type of benefit is regional. By decision of local authorities, compensation for travel to pensioners can be provided in two cases:

- The beneficiary has the right to full compensation. He is assigned an EDV instead of a travel ticket provided for free use of public transport.

- A pensioner is entitled to a discount. He will be paid a partial cost of travel. Discounts usually range from 30–80% of the cost of the service.

Documents containing information are received through interdepartmental interaction channels:

- on the amount of social payments of the insured person from budgets of all levels (Pension Fund of the Russian Federation);

- on the amount of payments and other remuneration accrued in favor of an individual by the employer (policyholder) (Pension Fund of the Russian Federation);

- on receipt, assignment, non-receipt of pensions and termination of payments (Ministry of Internal Affairs of Russia);

- on monthly insurance payments for compulsory social insurance against industrial accidents and occupational diseases, paid to insured citizens, if, according to the conclusion of a medical and social examination institution, the result of the occurrence of an insured event was the loss of their professional ability to work, or to persons entitled to receive them - if the result of the insured event was the death of the insured person (Social Insurance Fund of the Russian Federation);

- on payments (lack of payments) of all types of unemployment benefits and other payments to the unemployed (employment centers);

- on state registration of birth (registry office) to confirm the powers of the legal representative if the recipient of the public service is a minor;

- on deprivation of parental rights (local government bodies) to confirm the powers of the legal representative if the recipient of a public service is a minor;

- Information about the insurance number of an individual personal account (with the Pension Fund of the Russian Federation).

As can be seen from the above, registration of tax benefits is not carried out directly on the State Services portal, since the application is submitted in the Personal Account on the website of the Federal Tax Service (FTS). In fact, if the user does not have an electronic signature, then they will not be able to apply for tax benefits!

Applicants have the right to pre-trial (out-of-court) appeal against actions (inaction) of officials and decisions carried out (adopted) in the course of providing public services.

It’s true, on April 1, 2020, the State Council adopted such a law the first time, without discussion. Communist Party deputy Artem Prokofiev tried to put this law up for discussion, but the ruling comrades-gentlemen did not consider it necessary. Such pensioners will have to move en masse into sheds. Probably, successful business women and wives of officials did not have enough money for something.

If an appeal (complaint) is left without an answer on the merits of the questions posed in it, the citizen who sent the appeal is informed of the reasons for the refusal to consider the appeal (complaint) or for the redirection of the appeal (complaint).

A certificate of pre-retirement status can be obtained remotely through the website of the Russian Pension Fund. To do this, just log into your personal account and make an application. According to Parliamentary Gazette, the service will also be available on the government services portal from the second quarter of 2020.

Thus, according to current legislation, an employee can receive temporary disability benefits only if he has provided the employer with sick leave no later than six months from the specified date. If this period was exceeded by at least a day, the employer will be obliged to refuse the employee such payment.

To find out the procedure for receiving a specific benefit, as well as to get acquainted with the full list of preferences provided for by current legislation, you can visit the social protection office located at the place of permanent registration. The period during which the employer is obliged to transfer to the local Social Insurance Fund the necessary data about an employee who went on sick leave is 5 days.

The pre-trial (out-of-court) appeal procedure does not exclude the possibility of appealing actions (inaction) and decisions taken (implemented) in the course of providing public services in court. The pre-trial (out-of-court) appeal procedure is not mandatory for applicants.

Pensioners have the right to:

- Monthly cash payment

- Compensation for landline telephone

- Right to free travel and certain medications (in Moscow)

- Supplement to pension

- Tax benefits

- Mastering a new profession at the expense of the state budget

- Free travel to and from your holiday destination (for northerners)

- Food discounts

- Free entry to museums.

The applicant may submit documents (if any) confirming the applicant’s arguments, or copies thereof.

Pensioners are entitled to compensation for costs associated with major repairs:

- 50% of the amount - for citizens who have reached the age of 70, as well as labor veterans;

- 100% of the cost - upon reaching 80 years of age, for pensioners who have reached 80 years of age.

FSS as a subject of legal relations regulated by Decree of the Government of Russia dated April 21, 2011 No. 294.

If each of these conditions is met, then the citizen is recognized as a pre-retirement person, and accordingly, he will be able to enjoy benefits.