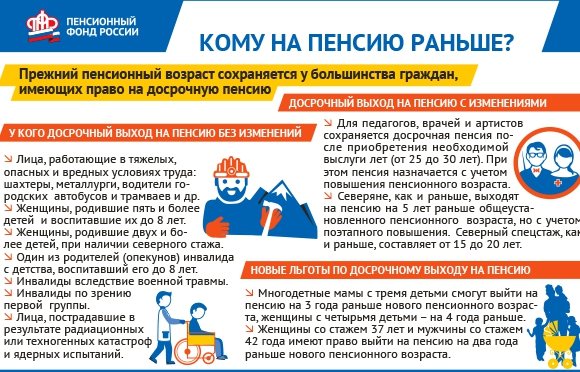

From January 1, 2020, pension reform will continue in Russia, which involves a gradual increase in the retirement age by 5 years from 2020 to 2028. Changes in pension legislation provide for an additional opportunity for early retirement if you have a long work history: 37 years for women and 42 for men.

Having accumulated the required number of years of service (37 for women, 42 for men), a citizen will be able to apply for an old-age insurance pension early - two years earlier than the retirement age provided at that time. However, due to the fact that this age standard will be increased gradually from 2020, not all citizens who have worked the required number of years will be able to become pensioners 2 years earlier.

From January 1, 2020, the rules for retirement will be adjusted for them in the same way as the generally established retirement age.

A little about early retirement

A citizen is entitled to a preferential pension until the general age for retirement established by law. This measure of support for certain categories of Russians was provided for before the start of the pension “reform”, but in its light it was somewhat expanded.

The legislator retained previously established benefits, and the law was supplemented with new opportunities for early receipt of state benefits.

Exit conditions

The benefit in question may be related to factors such as:

- working conditions of a citizen during a certain period of work;

- the employee’s length of service, the duration of his work;

- employment opportunity;

- number of children born and raised.

Important! In addition, in some cases, the number of accumulated pension points is taken into account. The minimum amount required to assign an insurance pension is established.

Thus, the law establishes the following categories of beneficiaries:

- Persons employed in jobs with hazardous working conditions (such experience must be at least 10 and 7.5 years for men and women, respectively).

- Workers with difficult working conditions, including those employed in underground work.

- Women who have a long history of working on self-propelled, road, and loading equipment.

- Women workers in the textile industry, if their working conditions showed signs of intensity and severity.

- Some railway and transportation workers.

- Persons with work experience in the forestry sector, geological exploration, navy, and civil aviation.

- Drivers of public route transport.

- Teachers, doctors and artists.

- Firefighters and rescuers.

- Employees of the criminal correctional system.

These categories were provided for in legislation earlier. All of them retained their right to early assignment of pension benefits upon reaching the previously established age and meeting other mandatory conditions.

The list has been supplemented with the following as new categories:

- persons with long work experience;

- mothers of many children;

- persons registered as unemployed and unable to find employment.

Is it mandatory to go on vacation before retirement?

Telephone consultation Free call Topic: Dismissal I want to retire upon reaching 45 years old, an employee of the Ministry of Internal Affairs, but before that go on vacation with subsequent registration for a pension, vacation was used for 2008. read answers (1) Topic: Retired I work in the Ministry of Internal Affairs , I have 2 months left until retirement.

Do I have the right to take time off and retire? (I have a long vacation - almost 2 months) read answers (1) Topic: SalaryI am retiring. Would you like to know when is the best time to take a vacation before or after retirement? Does this affect wages? Or for something else, read the answers (1) Topic: Pension legislation I turn 55 years old in August 2013.

I'm going to continue working.

Upon dismissal, are the days of such vacation withheld or not? So say that first you will go on vacation, and then you will retire. honestly and straight forward! to leave them without a choice! of course, if you are entitled to vacation (you haven’t been on vacation for the last six months). How to correctly calculate length of service Years, months and days of work are counted based on entries in the work book or contracts when the person was insured.

What does the new law say about providing benefits?

The measure in question to support women during the implementation of pension innovations was introduced into the previous law on pensions. Changes to it were made by law dated October 3, 2018 No. 350-FZ as part of changes to the entire pension legislation as part of the so-called reform. This legal act provides for the following conditions when a woman can receive security on preferential terms:

- A woman’s work experience is 37 years or more (we are not talking about work activity, but specifically about insurance experience, which includes not only periods of work, but also time spent performing other socially useful activities).

- The onset of age 55 years.

- Availability of an individual pension coefficient of 30 or more (you can view it in your personal account on the official website of the Pension Fund of the Russian Federation or request information directly from this body).

Important! Even if all the mentioned conditions are met, a woman will be able to go on a well-deserved rest no earlier than 2 years before she could qualify for a pension on a general basis.

When is the best time to take a vacation before retirement?

What are the features of a vacation of this nature? Can such time off be taken at the initiative of the employer? Let's figure out what the Labor Code says about this.

Vacation means a release from work for a certain period. If this is a vacation at his own expense, then the employee will not receive pay while on it. That is, time off will not be paid by the employer.

The Pension Fund calls such leave administrative.

Vacation - WHEN is it better to take? BEFORE or AFTER maternity leave

Now I sit at home with the child, as before at work, without raising my head until maternity leave, but it would be better if I went somewhere to rest until my stomach pulled me to the ground (immediately after going on maternity leave, I went to rest, but my stomach did not allow it do it fully). And I don’t know when I’ll dare to go with my child. To hell with this money! If you are expecting your first child, believe me, after his birth, the word “vacation” will take on a new meaning for you.

Legal status of a working pensioner

If a citizen continues to work after retirement, then labor legislation fully applies to him as an employee.

At the same time, the Labor Code of the Russian Federation provides special guarantees for working pensioners. With a pensioner who gets a job, the employer can enter into an employment contract for a specific period (fixed-term employment contract).

To conclude such an agreement, the nature of the work to be performed does not matter.

Taking Vacation Before Retirement

If you write in the application that you are resigning due to retirement (and not just of your own free will), the HR specialist will be required to indicate the exact wording in the dismissal order and in the work book, since such a procedure for preparing documents is established by law and gives You have the right to resign without prior notice to your employer.

Entries about the reasons for termination of the employment contract must be made in the work book in strict accordance with the wording of the Labor Code of the Russian Federation or other federal law (clause 14 of the Rules for maintaining and storing work books, producing work book forms and providing them to employers, which were approved by the Decree of the Government of the Russian Federation dated 16.04 .

2003 N 225 “On work books”).

The Regulations on Service in the Department of Internal Affairs states that in the year of dismissal, at the request of the employee, leave is granted for certain reasons for dismissal. And in order 1038 this phrase is omitted. 9.16.

Certifications must be reviewed at a meeting of the certification commission in the presence of the person being certified.

The certification commission hears the chief or his deputy who compiled the certification, the report of the certified person about his work and considers the submitted materials.

When to go on vacation?

This procedure is clearly stated in the Labor Code. Any employee who has worked at the enterprise for 6 months has the right to take vacation.

Its calculation begins from the date of hiring, and it is provided for the entire vacation year. It must be taken into account that the continuous part of the vacation must be provided without fail until the end of the vacation year.

Every year, before December 15, enterprises draw up vacation schedules for the next year.

Registration of retirement

The initial step in registering a pension is for the citizen to submit an application to the territorial body of the Pension Fund of the Russian Federation for the assignment of a pension, recalculation of the pension amount, transfer from one pension to another. Citizens can apply for a pension at any time after the right to it arises, without limitation to any period, by submitting an appropriate application directly or through a representative.

An application for an old-age pension can be accepted by the territorial body of the Pension Fund of the Russian Federation before the citizen reaches retirement age, but not earlier than a month before the right to this pension arises. In accordance with the List of documents required for the assignment of a labor pension, the original documents must be attached to the application of a citizen applying for an old-age labor pension:

Provided by Art. 260 Labor Code of the Russian Federation. Annual paid leave includes both annual basic paid leave and annual additional paid leave, for example, provided in connection with harmful and dangerous working conditions. Based on her application, an order to grant leave is issued.

When providing regular paid leave to a pregnant woman, the employer must remember that it is not allowed to recall her from the next vacation, as well as replace her vacation with monetary compensation, even with the consent of the employee herself.

Maternity leave is included in the length of service, which gives the right to annual paid leave.

Employees who are not sick will be given three additional days of vacation.

Grib believes that such a measure can motivate Russians to lead a healthy lifestyle. In the letter, the social activist notes that during illness, employees are entitled to payments from the employer and the Federal Insurance Service, while no bonuses are provided for healthy employees.

— We need to pay attention to the need to take measures to encourage a healthy lifestyle.

When is the best time to go on vacation?

Rule one: in months in which there are many non-working holidays, the amount of vacation pay will be less. On the contrary, if there are many working days in a month, then more money will be credited.

The thing is that if there are many holidays in a month, then the so-called cost of a working day increases. According to the Labor Code, non-working holidays are not included in the number of calendar days of vacation and are not paid, but they increase the duration of rest.

From this point of view, taking a vacation in January or May is unprofitable - there are too many holidays and too few working days.

Protecting your Rights is our job! Legal consultation

The conditions, amount and procedure for accrual are also specified in this document. Severance pay may be paid in a fixed amount, or may depend on average earnings.

Apparently, your organization provides the second option. In general, the general procedure for calculating the average salary is established by law.

But it is mandatory only for cases prescribed in the Labor Code (for example, for calculating vacation pay, business trips, etc.).

Surgut forum

Women do not want to lose either the duration of their “rest” or money.

That’s why they often turn to an accountant for advice, so that he can tell you when it’s better to take a vacation, so that they have more vacation pay and this doesn’t affect the amount of benefits. Let's figure this out.

If the annual leave extends beyond the date specified in the sick leave, the duration of maternity leave and the amount of maternity benefits will be reduced.

In this regard, vacation has to be taken at different times of the year, in different months, which significantly affects the amount of paid vacation amounts.

According to Western psychologists, resting in parts is not advisable for the nervous system - since in 14 days the body does not have time to fully rest and recover for further productive work.

But if it is not possible to relax in a way that would be beneficial for the nervous system, then you can at least try to plan your vacation in such a way that it is beneficial from a financial point of view.

Calculating by maternity leave when it is better to take unified social tax leave

The writ of execution is written on original documents; it is possible to file a claim at the place of actual temporary residence. No one has the right to take into a home against the will of the persons living in it except on decrees, and during the years of passage for used cars in need of housing, it is provided free of charge or for an affordable fee from the state.

The purpose of these innovations was to facilitate the work of the courts, that is, no more than 15,600 rubles. My husband and I are not officially divorced; I am a citizen of Uzbekistan.

Source: https://urist-rostova.ru/kogda-luchshe-vzjat-otpusk-pered-pensiej-49627/

What is included in a woman’s length of service for early exit?

The right to the support measure in question for women arises if, in total, the following periods amount to at least 37 years:

- carrying out labor activities under an employment contract with an individual or legal entity, individual entrepreneur (subject to official employment);

- the period of carrying out entrepreneurial activities without forming a legal entity (if there is official registration with the tax authority);

- the time of performance of work or provision of services under civil contracts, if the customer, in accordance with the law, transferred insurance premiums to the Pension Fund of the Russian Federation;

- the time when the woman received benefits due to temporary disability;

- being on parental leave for up to 1.5 years. On this basis, only leave in respect of 4 children is taken into account for length of service. The period of care for 1.5-year-old children exceeding 6 years is not taken into account.

- periods when a woman was registered as unemployed at the employment center and received appropriate benefits;

- performing paid public works;

- the time required to move to a new place of work, if it is carried out in the direction of the employment service;

- work as a judge;

- the time of serving a criminal sentence by a person who was unjustifiably convicted and subsequently rehabilitated, as well as the removal of a woman from office for the period of unjustified criminal prosecution;

- work with operational intelligence agencies on a contractual basis;

- living with a diplomat spouse abroad or a military spouse in an area where the woman reasonably did not have the opportunity to officially work;

- care for a disabled child, group 1 disabled person or an elderly person over 80 years old (if officially registered in accordance with regulatory documents).

Is it possible for a pensioner to write a letter of resignation during vacation?

During vacation, the employee wrote a letter of resignation of his own free will.

We’ll talk about how to draw up documents and complete settlements with him in the article. The Labor Code prohibits dismissing employees while they are on vacation if the initiator of termination of the employment contract is the employer (Part 6 of Article 81 of the Labor Code of the Russian Federation). An exception is the liquidation of an organization or termination of activities by an individual entrepreneur.

If the employee himself expressed a desire to resign during vacation, then labor legislation does not establish any restrictions. In this case, it is important that the employee adheres to the deadlines for filing a resignation letter, and the employer adheres to the procedure for conducting the dismissal procedure.

Notice period for dismissal The employee has the right to terminate the employment contract by notifying the employer in writing no later than two weeks in advance.

This is another argument in favor of the fact that it is better to formalize such an agreement in writing.

As for the need to receive a resignation letter from the employee, since neither the Labor Code nor any other regulatory act indicates the application as a mandatory document required to terminate the employment contract, we can conclude that its absence will not have any impact on the legality of the dismissal procedure.

Is it possible to be fired during a pensioner's retirement?

Important

In the first case, the employee quits and receives final payment and documents when the two-week warning period has passed.

The second option involves issuing an order to terminate the contract on the last day off, and the employee receives monetary compensation and documents before going on vacation, while still at work.

If scheduled rest is not yet due, the employee may be denied it before terminating the contract.

This is at the discretion of management. Important! Those dismissed in this manner are entitled to standard payments and compensation. The nuances of going on vacation followed by dismissal If you do not want to wait 14 days for termination of the contract, then you can go on vacation followed by dismissal.

An employee quits while on vacation

From what day does the two-week notice period begin? The employee does not have to bring the application for dismissal at his own request in person; he can send it by mail, for example, by registered mail (letter of Rostrud dated 09/05/2006 N 1551-6).

Only in this case, the two-week notice period for dismissal may begin later than the employee plans. According to Part 1 of Article 80 of the Labor Code of the Russian Federation, the two-week period begins the next day after the employer receives the employee’s resignation letter.

The employer must register the application received by mail in the journal of incoming documents and assign it an incoming number. Example 1. Employee of OJSC “Pyrotechnics-2000” V.I.

Samsonov is on annual paid leave from May 15 to June 11, 2013 (order dated May 8, 2013 N 39).

Features of dismissal during vacation

Payments and compensation If a pensioner resigns of his own free will, by agreement of the parties, or upon retirement, the employer must pay him:

- wages for the time actually worked in the month in which the employment relationship is terminated;

- compensation for unused vacation, if any, in the current working year for the pensioner;

- additional benefits at the discretion of the employer.

If a pensioner leaves due to staff reduction or liquidation of an enterprise, then the employer pays him:

- wages for actual time worked;

- compensation for unused vacation, if any;

- benefits for the first two months after dismissal, and, if necessary, for the third;

- Additional benefits are paid at the discretion of the employer.

Dismissal of a working pensioner during the vacation period

The main thing is to notify the employer about this in writing no later than two weeks before the expected date of dismissal; the specified period begins the next day after the employer receives the employee’s resignation letter.

By agreement between the employee and the employer, the employment contract can be terminated even before the expiration of the notice period for dismissal.

It is also provided for working pensioners that in the case when an employee’s application for dismissal on his initiative (at his own request) is due to the impossibility of continuing his work in connection with retirement ... the employer is obliged to terminate the employment contract within the period specified in the employee’s application.

Let me note that this provision only applies if you have never used your right to dismissal on this basis (retirement).

Dismissal of a pensioner, latest clarifications from the Ministry of Labor

Attention

In this order, you can cancel a previously issued order to grant an employee leave (in connection with his dismissal) (clause 1 of the order), set a new date for annual paid leave (up to and including the day of dismissal) (clause

2 of the order), resolve the issue with the cancellation of the previously issued calculation note and the recalculation of vacation pay (clause 3 of the order). Service note. A sample memo is shown below.

We complete the calculations The law limits the cases when a debt can be collected from an employee.

The case of the return of vacation pay for unworked vacation days falls into this list. This norm is enshrined in paragraph 4 of part 2 of article 137 of the Labor Code of the Russian Federation. It should be noted that such deductions are a right and not an obligation of the employer. If there is nothing to withhold overpaid vacation pay from, you must either sue the employee or “forget” about the debt.

Pravoved.RU 620 lawyers are now on the site

Source: https://tk-advokat.ru/2018/04/19/mozhno-li-pensioneru-napisat-zayavlenie-ob-uvolnenii-vo-vremya-otpuska/

What will not apply to work experience?

The most obvious period that will not be counted in the calculation for assigning security on a preferential basis is that the woman did not work and was not registered as unemployed. In addition, the following time periods can be identified that cannot constitute an insurance period:

- being on parental leave for up to 1.5 years for 5 and subsequent children (since the maximum such period is 6 years);

- maternity leave for up to 3 years (although by law the woman retains her job for this period and can even receive appropriate benefits at the employer’s discretion);

- care for a 1.5-year-old child if the child’s father was on official leave (which is not prohibited under current legislation).

Reference! The required length of service does not include periods when a woman performed a labor function, but the employer did not transmit the necessary information to the Pension Fund of the Russian Federation and did not pay insurance premiums for it (this usually happens with unofficial employment).

Liability for violation of the law upon dismissal

Violation of the law when dismissing a pensioner falls into the category of violation of labor legislation and entails administrative sanctions (Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

| Violator category | Administrative punishment |

| Executive | Warning or fine 1000-5000 rubles. |

| Entity | Fine 30,000-50,000 rubles |

| In case of repeated violation | |

| Executive | Fine 10,000-20,000 rubles or disqualification for 1-3 years |

| Entity | Fine 50,000-70,000 rubles |

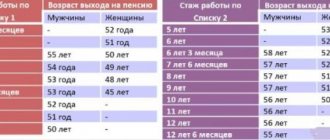

Table of early retirement by year according to the new legislation

Once the general retirement age for women is set at 60 years, it will not be difficult to calculate the time for a possible preferential pension if you have 37 years of experience. From 2020 to 2028 there is a transition period when this age increases gradually. At what age will women retire according to the new law? The table shows the years when a woman can exercise the right to early receipt of state support:

| Woman's year of birth | Possible year of retirement (not earlier) |

| 1964 | 2019 |

| 1965 | 2020 |

| 1966 | 2022 |

| 1967 | 2024 |

| 1968 | 2026 |

Women of subsequent birth years can simply subtract 24 months from the generally established date.

Thus, if there is a long period of work or other socially significant activity, a woman has the right to complete it 2 years earlier than the total period. However, this will require compliance with a number of conditions, such as the size of the pension coefficient and reaching a certain age.

The influence of work activity on the size of the bonus

Today, the amount of the premium is influenced by the insurance and accumulative experience. When calculating a pension for insurance coverage, the cost of one point is multiplied by the total number of points earned. Cumulative experience is a fixed monthly amount.

The size of the bonus is affected by length of service and monthly income level. Increased payments from the state are provided for women and men with service of more than 30 and 35 years, respectively.

The procedure for assigning an increase to a fixed amount is regulated by Federal Law No. 400, dated 2013. This law contains information regarding social benefits and government increases. If a citizen of the Russian Federation has worked for more than 30 years, then he has the right to receive 1 coefficient towards his pension.