Innovations are coming into effect that will affect pension payments to civil servants in 2020. The reform will cause a gradual increase in the pension qualification. This is done both to save workers and to balance the Pension Fund. In the debut of 2020, the State Duma more than once discussed changes to the existing law on pensions. Reform is necessary, and during the year many deputies put forward their ideas, but there was no common opinion. Since 2016, the picture has become clearer, and reforms are slowly coming into effect. There is now a bill with a number of important topics for discussion:

- increasing the retirement age;

- civil servants' pension;

- indexing.

The government planned reform this year, but the financial situation forced it to postpone the moment until the following years.

It must be taken into account that the main postulates of innovation are simple. Increasing the working age for pensioners was unpleasant news for people who had only a few months left to work. For this reason, the state has postponed the reform, but it is necessary to implement it. The conclusion suggests itself is that the government is capable of doing anything to reduce payments from the budget, no matter how tough the decisions may seem.

Retirement age

A gradual increase in the retirement age allows the state, at the expense of freed-up funds from the Pension Fund, to increase the size of the pension of the oldest age categories. Simultaneously with the increase in actual payments, the requirements for pensioners also increase. In 2020, older people were able to receive the calculated part of the old-age insurance pension, from whose official salary contributions were made to the Pension Fund of the Russian Federation for more than 11 years and whose pension score was at least 18.6. have worked for 15 years and have accumulated at least 30 points by the time of retirement will be able to apply for an insurance pension in 2025

Gradual increase in retirement age

The age at which a Russian citizen can count on accrual of an old-age insurance pension will change by 5 years from 2020 to 2028. For those elderly people who are the first to fall under the pension reform, that is, in accordance with the previous legislation, must apply for a pension in 2020 and 2020, a preferential opportunity is provided to become a pensioner six months earlier than indicated in the current standards.

Benefits for men

| Age | Man's year of birth | Year of pension registration |

| 60,5 | II half of 1959 | I half of 2020 |

| 61,5 | I half of 1960 | II half of 2021 |

| 61,5 | II half of 1960 | I half of 2022 |

Benefits for women

| Age | Woman's year of birth | Year of pension registration |

| 55,5 | II half of 1964 | I half of 2020 |

| 56,5 | I half of 1965 | II half of 2021 |

| 56,5 | II half of 1965 | I half of 2022 |

Who can retire early?

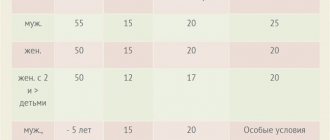

According to Russian laws, the right to early retirement depends on the worker’s age, pension points earned by him, profession, and length of service. Even the number of children can affect this date.

You can retire early:

- Citizens whose work history includes a long period of dangerous or hard work.

- In accordance with Art. 30 of Law No. 400-FZ, geologists, tractor drivers living in villages, and bus drivers for transporting passengers are allowed to retire before the period established by law.

- The right to retire based on length of service is granted to doctors, teachers and people in creative professions.

- Employees who have been laid off can retire early if they have enough length of service and pension points, and there are no more than two years left before the age threshold.

Retirement age for residents of the Far North

Elderly people living in the Far North and equivalent areas have the right to retire 5 years earlier than the age established by the state for the majority of the population. But since the general pension threshold for residents of the Far North, as well as for all Russians, is increasing in connection with the pension reform by 5 years, the preferential difference will be deducted from the age determined taking into account the requirements and benefits of the transition period of the pension reform.

Long service retirement

For teachers, doctors, opera singers, and ballet dancers, pensions are assigned based on length of service without taking into account age. The required work experience of people in such professions, as before, is 25–30 years. The transition period for raising the retirement age postpones the period for registering a pension by the same number of years by which the retirement period of an ordinary Russian has changed since the beginning of the pension reform.

That is, if by the time a doctor has completed his seniority in Russia, the general retirement age has risen by 4 years, then the doctor who has completed his seniority will have to wait 4 years after that before he can retire.

Retirement age for civil servants

The period for changing the pension threshold for civil servants is longer than for ordinary citizens, since their retirement age until 2021 increases per year by only 6 months. After this period, the pension threshold for civil servants will, like that of employees of commercial enterprises, be increased annually by 12 months. By the end of the pension reform, the retirement age for male civil servants will be 65 years.

Women civil servants will only be able to retire at the age of 63, so the adaptation period will last for them until 2034. At the same time, the length of service required to receive a long-service pension will increase by 6 months until it reaches 20 years by 2026. In 2020, female civil servants are granted pension benefits at the age of 56.5 years , and for men at 61.5 years . at least 17 years this year

Current pension reform

In Russia, there has already been an increase in the retirement age as part of the reform. This measure is forced: the country’s population is aging, the number of workers is decreasing. The Pension Fund of the Russian Federation has become unable to provide payments to citizens from its own funds. Therefore, subsidies from the budget were required. According to experts, the situation should only get worse over the years. The only way out that the Government saw in this situation was to raise the retirement age.

This decision caused a lot of negative emotions among the population. However, the President of the Russian Federation signed Federal Law No. 350-FZ dated October 3, 2018 “On amendments to certain legislative acts of the Russian Federation on the appointment and payment of pensions.”

The new law on pensions came into force on 01/01/2019. The retirement age for men was 65 years old, and for women - 60. The transition within the framework of the reform is carried out gradually, the entire program is designed for 2019-2028.

Average life expectancy of men and women in Russia - official statistics 2020

New rules for early retirement

Changes in pension legislation have introduced additional grounds for early retirement:

- Mothers with many children received the right to receive pension payments before reaching the age required by law if they have 15 years of work experience. A woman with three children will be able to retire 3 years ahead of schedule. Mother of four children - 4 years early. A woman with 5 or more children can still retire at age 50.

- Women (minimum 55 years old) whose work experience exceeds 37 years, and men who have officially worked for more than 42 years (not before turning 60 years old) can retire 2 years earlier.

- Unemployed people who are unable to find a job can apply for a pension benefit 2 years earlier than the officially established period, taking into account the transition period.

Retirement table by year

For men

| Year of pension registration | Man's year of birth | Age at which pension can be calculated | How many additional years will you have to work? |

| 2020 | 1959 | 61 | 1 (you can apply for a pension six months earlier) |

| 2022 | 1960 | 62 | 2 (you can apply for a pension six months earlier) |

| 2024 | 1961 | 63 | 3 |

| 2026 | 1962 | 64 | 4 |

| 2028 | 1965 and those younger. | 65 | 5 |

Women

| Year of pension registration | Woman's year of birth | Age at which pension can be calculated | How many additional years will you have to work? |

| 2020 | 1964 | 56 | 1 (you can apply for a pension six months earlier) |

| 2022 | 1965 | 57 | 2 (you can apply for a pension six months earlier) |

| 2024 | 1966 | 58 | 3 |

| 2026 | 1967 | 59 | 4 |

| 2028 | 1968 and those younger | 60 | 5 |

Minimum work experience for retirement

To retire in 2020, you must work at least 11 years, which includes:

- That period of official employment when a citizen or his employer paid insurance contributions to the Pension Fund.

- 1.5 years of maternity leave (no more than 6 years in total for several children), if the mother has work experience before the start of such a period or after its end.

- Time to care for a disabled person of group I, a disabled child or an elderly person over 80 years old.

- Time of military or equivalent service.

- In accordance with Article 12 of Law No. 400-FZ, work experience also includes the period of receiving benefits for temporary disability, unemployment, and time spent moving for employment in the direction of the employment service.

- 5 years from the period of residence in an area where it is impossible for spouses of military personnel and diplomats to find employment will be counted towards the pension experience.

Note! All this data is converted into pension points. To retire in 2020, you need to earn 18.6 retirement points. The number of years required to obtain official work experience and, accordingly, pension points will increase according to changes in the age threshold.

| Year of pension registration | Required work experience | A sufficient number of points to obtain an insurance pension |

| 2020 | 11 years | 18,6 |

| 2021 | 12 years | 21 |

| 2022 | 13 years | 23,4 |

| 2023 | 14 years | 25,8 |

| 2024 | 15 years | 28,2 |

| 2025 | 15 years | 30 |

Who are civil servants from the point of view of pension legislation?

We are talking about the provisions of clause 1.1 of Art. 8 of Law No. 400-FZ “On Insurance Pensions”. It lists the following categories of persons for whom a special procedure for determining retirement age is provided:

- Filling government positions in the Russian Federation.

- Filling government positions in the constituent entities of the Russian Federation.

- Filling municipal positions.

In fact, these are different categories of positions; their activities are even regulated by different regulations. Federal and regional civil servants are subject to the requirements of the law dated July 27, 2004 No. 79-FZ “On the State Civil Service,” and municipal employees are guided by the provisions of the law dated March 2, 2007 No. 25-FZ “On the Municipal Service in the Russian Federation.”

However, the rules of pension legislation for them will be similar. State pensions for federal civil servants and pensions for municipal employees are assigned on similar principles. Therefore, further in the text we will call all these categories of persons civil servants.

At what age are state pensions granted to civil servants - we will consider in the next section

Retirement age in other countries

Raising the retirement age today is a global trend. Reforms similar to Russian ones are already underway or planned in countries such as Japan, Spain, Ukraine, the Czech Republic, and China. In England, for example, by 2046 it is planned to raise the pension threshold to 68 years. Belgium plans to raise the retirement age to 67 by 2030. From 2024 to 2033, Austrians will equalize the pension rights of men and women, raising the pension threshold for the latter to 65 years.

In Germany

The average life expectancy of a German is 81 years, of which only in the last 14 years does the average person become so frail that he is no longer able to ensure his existence. The reform, which began in 2012, should increase the retirement age to 67 by 2031.

Residents of Germany born in 1965 and later will only be able to apply for a pension benefit upon reaching the age of 67, that is, 2 years later than those born, for example, in 1950, and 1 year later than those born in 1960. The pension payment per month is on average 1,100 euros. The minimum benefit is 374 euros.

In China

In China, with an average life expectancy of 67 years, only government employees can receive a pension. On average it is 2350 yuan (almost $367). At the moment, the country is also undergoing a reform, as a result of which the age of transition to state support for the Chinese will increase from 60 to 65 years.

Women whose specific profession is physical labor will begin to retire at 55 instead of the current 50, and workers in the intellectual sphere will be able to apply for a pension benefit upon reaching 60 instead of the usual 55 for the previous generation.

IN THE USA

The average life expectancy of an American is 78.5 years. At the same time, American residents, regardless of gender, apply for a pension benefit, the average amount of which is $1,200, at the age of 66. Changes in the country's pension legislation, recently approved by the US Senate, are designed to annually increase the pension threshold for those born after 1954 by 2 months.

In France

The French, whose life expectancy is on average 83 years, retire at least at 62 years. But only disabled people will receive payments from the state at this age. The real retirement threshold in this country is 67 years. The average payment to an elderly Frenchman who has crossed the age limit set by the state is equivalent to 700 US dollars.

In Japan

Residents of this country, with an average life expectancy of 84 years, become pensioners between the ages of 62 and 71 (last year the upper limit was 70 years). The later a Japanese person retires, the greater the amount of benefits accrued to him. So, when applying for a pension at the age of 62, the amount of monthly payments will be equivalent to $1,050. For those who supported themselves until age 65, the benefit is paid in an amount equivalent to $1,500, and those who were able to survive until age 70 will receive the equivalent of $2,100.

In Ukraine

Ukraine, whose retirement age, with an average life expectancy of 72.5 years, as in Russia, was 60 years for men and 55 for women, and the average pension in hryvnia corresponds to an amount equal to 140 US dollars, is currently carrying out a reform, aimed at gradually increasing the pension threshold for women up to 60 years of age.

In Belarus

The reform to increase the retirement threshold in Belarus, with an average life expectancy of 74 years, has been going on for the third year, increasing the pension threshold by 6 months annually. In 2020, men aged 62 and women aged 57 can apply for pension benefits in this country. The average pension of a resident of Belarus is equivalent to 175 US dollars.

In Kazakhstan

The pension reform of this country, whose average life expectancy is 68.5 years, has increased the retirement age of Kazakhstanis to 63 years. And if for men the increase in the threshold was only 3 years, then for women the size of the adjustment was 8 years.

In order to adapt the female part of the population to the new rules, the transition to them is carried out in stages. The pension threshold will be increased annually by 6 months until 2027. The average pension benefit for a Kazakh citizen for 2020 is 90,000 tenge, which is equivalent to 216 US dollars.

Indexation of pensions for civil servants in 2020

Latest news on indexation of pensions for civil servants in 2020. At a time of increased inflation, indexation of pensions is one of the most important decisions of the state, which will help reduce spending in times of crisis. Last year, the inflation rate was 12 percent; indexation must be carried out to the same extent. The decision had to be made this year, so the percentage should increase in 2020. Additional costs in this regard will amount to 650 billion rubles. The country cannot afford such expenses, so indexation will not exceed 5.2 percent.

According to the latest data, wages for workers in the public sector will increase slightly. According to information, the increase figure is even doubled, complaining that these expenses are planned in the budget. Indexation for civil servants has not been carried out for a long time, however, the amount of funds is included in the budget and citizens of this category will be able to receive an indexation payment of five percent. This will become real if the number of civil servants decreases at the end of 2020. However, people should not worry about the lack of work due to the shortage of personnel in the Caucasus, Far East and Crimea, but they will receive salaries depending on new positions.

The Ministry of Finance decided to update the regular wage fund, increasing it two and a half times. At the moment, the required amount is being allocated from the treasury.

The government plans to raise the retirement age and will start with itself

What can people of pre-retirement age expect?

The older a person gets, the more difficult it is for him to find a job. And if earlier men, starting from the age of 60, and women from 55 years old, could no longer think about tomorrow, now, due to the increase in the retirement age, this age group has turned out to be the most vulnerable in social terms. To smooth out the period of adaptation to the pension reform measures, Russian legislation has provided a number of benefits for “pre-retirees”.

Who are pre-retirees?

The concept of “pre-retirement age” was introduced by Art. 5 Federal Law No. 1032-1 “On employment in the Russian Federation” dated April 19, 1991. Art. 1 Federal Law No. 350 dated October 3, 2018 changed the number of pre-retirement years from 2 to 5. The moment of pre-retirement age is counted by subtracting 5 years from the retirement age that has increased due to the pension reform. The beginning of the pre-retirement period is also calculated for employees who have the right to receive early retirement benefits.

How to apply for pre-retirement status?

Pension Fund employees automatically assign pre-retirement status to an elderly person based on information received by the Pension Fund. You can clarify the status of a pre-retirement person using a certificate that he can receive from the Pension Fund, through the “Personal Account” of the pre-retirement fund on the Pension Fund website, or through a special service of the Pension Fund through a request made by an organization that needs confirmation of the status of a pre-retirement person, based on his application submitted to this organization.

Attention! Pre-retirement status can only be assigned to a citizen whose work experience and pension points entitle him to receive an old-age insurance pension. The titles “Veteran of Military Service” and “Veteran of Labor” give this right.

Benefits for people of pre-retirement age

For pre-retirement people, municipalities provide a number of benefits:

- Free travel on public transport, metro and intercity transport to the place of sanatorium-resort treatment if such treatment is required for medical reasons.

- Free trips to the sanatorium.

- Free dental prosthetics.

- Benefits in real estate taxation.

The titles “Veteran of Military Service” and “Veteran of Labor” in combination with pre-retirement age give the right to a discount in payment for utilities, telephone communications and cash payments, both one-time and permanent (for example, a monthly cash payment for veterans living in Moscow).

Advanced training program

For people of pre-retirement age, in case of problems with employment, the legislation provides for a program of professional retraining in employment centers with a scholarship equal to the minimum wage (Government Order No. 3025-r dated December 30, 2018).

Exemption from work to undergo medical examination

Free medical examination for people over 50 years of age is provided regardless of pre-retirement status. But the state allocates 2 paid working days for this event to pre-retirement people (Part 2 of Article 185.1 of the Labor Code).

Responsibility for the dismissal of pre-retirees

For the unjustified dismissal of a pre-retirement employee, the state punishes the employer with a fine of 200,000 rubles. or in the amount of 18 months' salary, 360 hours of forced labor. Denial of employment due to pre-retirement age entails criminal liability under Art. 144.1 CC.

Increased unemployment benefits

In accordance with Art. 34.2 of Federal Law No. 1032-1, in case of registration with the Employment Center as an unemployed person, for the first 3 months the pre-retirement worker will receive 75% of the lost salary, then 4 months - 60% and 45% before the end of 2 years, if the man’s experience is 25 years, and for women - 20. The maximum amount of unemployment benefits paid cannot exceed 11,280 rubles.

What remains the same?

The retirement age for Russians who have the right to receive early retirement benefits will not change:

- Before the established deadline, pensions will be assigned primarily to those citizens for whose work in difficult or dangerous conditions the employer made additional insurance contributions at special rates. As before, workers in hot shops, railway transport, the mining industry, rescuers, and bus drivers will be able to retire earlier.

- Mothers of many children, people with disabilities and trade workers living in the Far North and equivalent regions will be able to retire early.

- Women and men whose pensions are granted before they reach retirement age due to man-made and radiation disasters.

- Test pilots and other citizens, the full list of which is determined by Art. 30 of the Law of December 28, 2018 No. 400-FZ “On Insurance Pensions”.

Assignment of social pension

If the required number of pension points has not been accumulated and there is no 11 years of service (as of 2020), upon reaching the age of 65 for men and 60 for women, a social pension will be assigned. The pension reform involves a gradual increase in this age to 68 years for women and 70 years for men.

Payment of pension savings

The age limit for receiving urgent and one-time payments and using the funded part of pension deposits remains for women 55 years old and 60 years old for men.

Important! The assignment of savings in accordance with the conditions of reforming the Russian pension system is possible only if there is a minimum length of service and pension points required for the current year.

Latest news about changes

The head of the Russian Federation introduced his own adjustments to the legislative act prepared by the government on changing the PV. In order to inform the Russians about the adjustments made, President V.V. Putin gave a speech on TV.

The key points of the legislative draft are:

- Increasing PV . Initially, it was planned to increase the PV to 65 and 63 years for males and females, respectively (previously, the PV was 60 years for men, 55 for women). The updated bill proposes to increase the life limit to 65 and 60 years for males and females, respectively.

- Early retirement for mothers with many children. Women who have at least 3, 4, 5 children have the right to begin receiving pension payments at 57, 56, 50 years old, respectively.

- Possibility of obtaining pension benefits 6 months earlier than the start date. Provided for those who, according to the previous law, were supposed to become pensioners in the next 24 months.

- Social protection of Russians of pre-retirement age (PPV). Liability is provided for employers (including criminal liability) for the dismissal of PPV employees and unwillingness to employ a person because of their PPV.

- Business stimulation . Aimed at keeping PPV persons employed, retraining them and improving their qualifications.

- Increase in maximum PPV payments to unemployed persons. In accordance with the new law, unemployment benefits for PPV people should be equal to 11,280 rubles. According to the old law, it was equal to 4,900 rubles. Payments are provided to an unemployed person for a maximum period of 12 months.

- Every year, PPV employees are given 2 days off for free medical examinations.

- Use of benefits . Provided for miners, workers of hot shops and chemical production, applying for pensions.

- Support for Russians living in rural areas. For PV Russians who do not work, are registered in a village and have worked at least 30 years in an agricultural enterprise, pension benefits are increased by 25 percent.

- Reducing the length of service required to become a pensioner earlier. Now it is equal to 37 years for female Russians, 42 for males. According to the old laws, it was equal to 40 and 45 years, respectively.

- Use of tax benefits during reform. While the reform is being carried out, PV persons (according to previous laws) are not required to pay taxes on real estate and land.

Increased indexation of insurance pensions

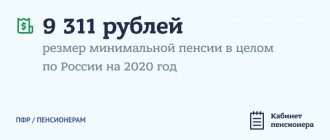

The indexation coefficient of the fixed part of insurance pensions, which began in Russia in 2020, from January 1, 2020 is 6.6%, which exceeds the forecast inflation rate for 2019 by 3.6%. The size of the fixed payment today is 5,686 rubles 25 kopecks.

To calculate the amount of the additional payment, you need to multiply the amount corresponding to the fixed share of the pension by 0.066. The cost of a pension point, on the basis of which the size of the future pension of a person who has reached retirement age is determined, is 93 rubles for 2020.

Increasing pensions for rural pensioners

Since 2020, elderly village residents with 30 years of work experience in agriculture have received the right, in case of living in rural areas after retirement and from that moment on they have no official employment, to a 25% bonus to its fixed part upon reaching the established state retirement age.

Significant changes due to the pension reform that have taken place over the past 16 years in Russia and have affected all older people require careful monitoring of annual changes in Russian legislation. Timely acquaintance with the conditions for receiving an old-age insurance pension can not only bring your retirement date closer and increase the amount of monthly payments, but also help you obtain additional benefits before this moment arrives.

What's new in pension reform 2020

At the end of December 2020, the President of the country signed a law that introduces a system of guaranteed pension savings. Only this law should be called only one of the general package of government initiatives that relate to pension reform. If you believe the law, then a 2-level system of guaranteeing the rights of a person who has been insured is being created in the country.

In other words, this system includes a reserve of compulsory pension provision, as well as a nationwide guarantee fund. The guarantee fund will be required to unite all the people who take part in the compulsory pension system. The background itself is formed from several sources: non-state pension funds and contributions from the Russian Pension Fund.

As for the control of contributions, this will be handled by the Deposit Insurance Agency. He was also entrusted with questions regarding guarantee compensation for payments. It is also worth mentioning one unpleasant news of pension reforms. The Russian government has decided to freeze the funded part of pensions. This is planned for 1 year.