Subscribe to news

A letter to confirm your subscription has been sent to the e-mail you specified.

February 10, 2012 04:15

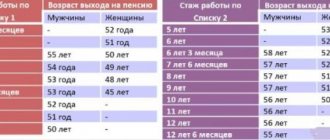

The right to assign an early labor pension to railway transport workers in accordance with the norms of the Federal Law “On Labor Pensions in the Russian Federation” comes to: - men who have reached the age of 55 years, having at least 12 years 6 months of experience in the relevant types of work and at least 25 years of insurance experience; - for women who have reached the age of 50 years, with at least 10 years of experience in relevant types of work and at least 20 years of insurance experience.

The determination of the right to early pension provision is carried out in accordance with the list of professions and positions (hereinafter referred to as the List), approved by Decree of the Government of the Russian Federation of April 24, 1992 No. 272. The list is specified and is not subject to broad interpretation, therefore the periods of labor activity carried out in professions and positions are not provided for in the List do not give the right to include them in the length of service in the relevant types of work for the purpose of granting an early retirement pension.

The list applies not only to railway workers working on the main railways of the Ministry of Railways of the Russian Federation, but also to railway transport workers of enterprises and organizations. For example, the List includes stokers of steam locomotives, drivers and assistant drivers of steam locomotives, diesel locomotives, electric locomotives, train compilers and some other professions without further clarification. These employees are granted a pension due to special working conditions regardless of which railway they work on, as well as regardless of whether they work on mainline railways or in railway transport workshops of enterprises and organizations.

Some railroad employees are entitled to pension benefits if they work on sections of mainline railroads with heavy or particularly heavy train traffic. These include, for example, foremen (exempt) for the routine maintenance and repair of tracks and artificial structures, track fitters, repairmen of artificial structures and others. The additional factor of train traffic intensity in this case is the main condition for assigning a pension and must be reflected in the certificate specifying the special working conditions. Some positions directly depend on what class the station the person works at belongs to. For example, duty officers at railway stations, at hump yards, dispatchers at railway shunting stations, hump operators, wagon inspectors, rolling stock mechanics and others. To count the period of work in the above-mentioned positions into the preferential period of service, it is necessary to know at which stations they work, since railway stations are divided into: extracurricular, I, II, III, IV, and V classes, and working employees enjoy pension benefits not at all stations, but at stations belonging to a certain class. Therefore, this factor must be indicated in the certificate confirming the preferential length of service.

The timeliness and correctness of the assignment of an early retirement pension depends on the quality of the preparatory information and the content of the information provided to the territorial departments of the Pension Fund.

Telephone "Hotline" 2-36-72

What it is?

The first thing to understand is what is preferential service? Preferential seniority is a kind of guarantee received by people who worked in special conditions (for example, such as hazardous industries) and retired early.

According to Law of the Russian Federation No. 173, the following categories of citizens can receive preferential service: women who have given birth to more than five children, as well as disabled children, underground rock workers, teachers, disabled people, rescuers, firefighters, military personnel, and people working in hazardous and harmful conditions (read about how to retire with mixed service for military personnel and employees of the Ministry of Emergency Situations here, and from this article you will learn what the procedure for calculating pensions in the Ministry of Internal Affairs is).

What is included?

In accordance with Resolution No. 516 of July 11, 2002, approved on the rules of working periods, the preferential length of service includes :

- main and additional vacation periods;

- temporary disability;

- direct work;

- probationary period (regardless of whether the employee passed it or not);

- maternity leave (read more about whether maternity leave to care for a child is included in the length of service when calculating a pension, and from this article you will learn how it affects the amount of pension payments).

Excluded:

- Time off to take exams (is studying at a technical school included in the length of service for calculating a pension?).

- Leave without pay.

- Incapacity of a citizen due to untimely completion of a medical examination, drunk appearance, or medical contraindications for performing certain types of work.

Early railway pension

Employees of Russian Railways, like everyone else, upon reaching a certain age receive the right to retire. Employees can receive this right early in old age if they meet the basic requirements:

- Age limit: 50 (women), 55 (men) years. This is the minimum age when a Russian Railways employee can apply for a payment.

- For early retirement, men/women in Russian Railways must have a certain number of years of experience as an employee in a locomotive crew, in the field of railway traffic safety, etc.

When making a payment, the applicant’s profession must be on the List of professions that give him the right to early retirement. The list is quite long:

- railway station duty officers;

- conductors;

- dispatchers;

- repair team foremen;

- stokers;

- masters;

- drivers and their assistants;

- inspectors;

- mechanics;

- locksmiths;

- compilers and others.

The list of professions in the railway transport sector that require early retirement was first published in 1956 and has remained virtually unchanged since then. In addition to suitability for the profession, experience is also important. So, for women it is set at 10 years, for male railway workers - 12 and a half years. The overall length of service is also important - the minimum required length is 25 and 20 years, respectively.

Early retirement is possible even if the number of years of specialized experience is insufficient. The condition is this: those employees who, before the beginning of 1992, worked in the Russian Railways sector for at least 6 years and 3 months or 5 years can receive a preferential pension. However, in this case, the reduction in retirement age will not be 5 years as in the general case, but 2.5 and 2 years, respectively.

Where to contact

Retirement of public transport drivers is carried out by submitting a corresponding application to the Pension Fund. You can apply for pension benefits:

- in person, to the Fund’s Client Service;

- through the MFC;

- via the Internet, on a single portal of government services or on the Pension Fund website.

The law allows applying for pension benefits through a proxy. The representative submitting the application on behalf of the driver must provide identification in person and a duly drawn up and certified power of attorney.

Due to frequent updates to legislation and the legal uniqueness of each situation, we recommend obtaining a free telephone consultation with a lawyer. You can ask your question by calling the hotline number 8 (800) 555-40-36 or write it in the form below.

NGOs in the field of Russian Railways

Non-state support for railway workers is carried out within the framework of the corporate employee support system. NPF Blagosostoyanie acts as a guarantor for all Russian Railways employees participating in the pension formation program.

Today, more than 600 thousand railway workers take part in this corporate system, and almost 300 thousand receive pensions from the fund’s reserves. The corporate pension of Russian Railways last year had an average size of 6 thousand rubles.

The corporate pension is formed as a double deduction of funds from the Russian Railways employee and the employer. Part of the funds for the funded part of the pension is withheld from salaries, the rest is “reported” by Russian Railways. Employees have the opportunity to choose the optimal scheme for accumulating part of their pension:

- The insurance scheme offers employees the lowest possible premiums. A disadvantage is the fact that such a part of the non-state payment cannot be inherited.

- Savings and insurance. The pension can be inherited, but not earlier and not later than the established date.

- Insurance and savings. You can inherit funds immediately after the appointment of a non-state payment, but not before it.

- Savings. You can inherit funds at any time.

- Scheme 6 provides for the inheritance of money only by the closest relative (or several) even before the payment is assigned.

The funded part of the pension can be received after a Russian Railways employee retires after reaching a specified age. The length of service during which contributions were actively made is also important - at least 5 full years. The rights to the accumulated portion when choosing another NPF are retained by the employee if the new guarantor is a partner of Russian Railways.

The size of the corporate payment is determined by wages, has a minimum volume, and the maximum is not limited. For example, PF employees can show the calculation of the pension of a Russian Railways diesel locomotive driver based on the amount of his last salary - 18-26 thousand rubles monthly, depending on the region. Only days worked in full in the following positions can be taken into account in the length of service required to calculate payments:

- directly in the Russian Railways system;

- in the Ministry of Railways of Russia or the USSR;

- in organizations that were part of these organizations;

- in Komsomol/party institutions in the field of railway transport;

- in railway healthcare institutions;

- NPF “Blagosostoyanie”, as well as “Zhildoripoteka”, “Zhilsotsipoteka”;

- executive authorities in the railway sector and so on.

The average size of non-state payments is growing from year to year. If in 2008 its size was 2,736 rubles, today it has reached a value of 6 thousand rubles monthly. The amount depends on contributions made, length of service and other conditions. The employee chooses the program. In addition to the required contributions in accordance with the selected contribution scheme, each employee can make additional payments to further increase their future pension.

Preferential pensions of the state software are designed to compensate railway workers for health costs, since fulfilling work duties in the Russian Railways sector is often fraught with difficulties. The corporate pension is designed to increase the amount of payment and support employees financially after retirement.

Early retirement for railway workers

Employees of Russian Railways, like everyone else, upon reaching a certain age receive the right to retire. Early retirement pensions for railway workers are granted if the following requirements are met:

- Age limit: 50 (women), 55 (men) years. This is the minimum age when a Russian Railways employee can apply for a payment.

- For early retirement, men/women in Russian Railways must have a certain number of years of experience as an employee in a locomotive crew, in the field of railway traffic safety, etc.

When making a payment, the applicant’s profession must be on the List of professions that give him the right to early retirement. The list is quite long:

- railway station duty officers;

- conductors;

- dispatchers;

- repair team foremen;

- stokers;

- masters;

- drivers and their assistants;

- inspectors;

- mechanics;

- locksmiths;

- compilers and others.

The list of professions in the railway transport sector that require early retirement was first published in 1956 and has remained virtually unchanged since then. In addition to suitability for the profession, experience is also important. So, for women it is set at 10 years, for male railway workers - 12 and a half years. The overall length of service is also important - the minimum required length is 25 and 20 years, respectively.

Early retirement is possible even if the number of years of specialized experience is insufficient. A pension for railway workers is provided for those employees who, before the beginning of 1992, worked in the Russian Railways sector for at least 6 years and 3 months or 5 years. However, in this case, the reduction in retirement age will not be 5 years as in the general case, but 2.5 and 2 years, respectively. More details can be found in the PF explanations.

Pensions for drivers and employees of Russian Railways

In 1956, some categories of railway workers received the right to retire without waiting for retirement age. To do this, they need to work in this industry for a certain number of years.

In 2020, pensions for Russian Railways employees are paid by the Pension Fund of Russia. In addition, railway employees have the right to participate in the corporate pension program implemented by a non-state pension fund.

Pensions for railway workers

Citizens who work for JSC Russian Railways can count on old-age pensions on a general basis. However, some categories of such workers have the right to take early retirement based on their length of service.

Destination Features

Those railway employees who meet the following requirements can take a well-deserved retirement based on length of service:

- The minimum age for early retirement is 50 years for women and 55 years for men;

- The total experience must be at least 20 years for women and 25 years for men;

- To receive a long-service pension, Russian Railways employees must work as employees of locomotive crews, transportation organizers or persons ensuring traffic safety on railway transport: women - 10 years, men - 12 years 6 months.

After the appointment of payments to railway workers for years of service, they occur for life.

Early retirement for railway workers

The possibility of early assignment of pension provision is provided for citizens whose positions and professions are included in the List of Professions (List No. 1 and 2). This list was approved in 1956 and has remained virtually unchanged. In 2020, this list includes the following professions in the field of railway support:

- Drivers and assistants;

- Dispatcher;

- Conductors;

- Heads of repair teams;

- Train station attendants;

- Inspectors;

- Stokers;

- Masters;

- Locksmiths;

- Mechanics;

- Compilers;

- Workers ensuring the safety of locomotives.

Important: special length of service includes only periods of employment during a full working year. Periods of absenteeism, unpaid leave, downtime, and completion of advanced training courses are not taken into account.

In the absence of the required special experience, a Russian Railways employee may also be granted benefits ahead of schedule. According to the Explanations of the Pension Fund, men who worked on the railway for 6 years and 3 months before 1992, or women who have at least 5 years of experience during the designated period, are entitled to receive a long-service pension.

Important: the right to early payments in this case appears not at 50 and 55 years (women and men, respectively), but at 52 years for women and at 57 years 6 months for men. Download for viewing and printing:

List No. 1

List No. 2

Will early retirement for railway workers continue in 2020?

On January 1, 2020, Federal Law No. 350-FZ came into force, which launched the pension reform developed by the Government of the Russian Federation. It involves a gradual increase in the retirement age. For the first 2 years, the increase will be for 6 months, then for 12. In 2028, men will become eligible to receive pension payments at age 65, and women at age 60.

The adopted Law preserves the right of certain categories of citizens to early assignment of pension benefits. These categories include persons whose professions are included in List No. 1 and 2. According to this provision, employees of Russian Railways who had the right to early retirement still have this opportunity.

Note: in 2020, railway employees can retire early (women at 50 years old, men at 55 years old) if the conditions for assigning such content are met. Download for viewing and printing:

Federal Law of the Russian Federation dated October 3, 2018 No. 350 “On amendments to certain legislative acts of the Russian Federation on the appointment and payment of pensions”

Corporate pension for railway workers through NPF “Blagosostoyaniye”

The employer JSC Russian Railways strives to provide its employees with an additional source of income after retirement. The Russian Railways corporate pension system helps achieve these goals. Any employee of the company can become a participant in this program, regardless of how long they have worked for the company.

The corporate pension system of Russian Railways is built on the principle of shared participation of the employer and employee in the formation of a funded pension. Contributions are sent to the NPF Blagosostoyanie, which invests pension contributions in various sectors of the Russian economy and annually accrues interest on the amount of savings of the insured person.

The formation of an employee’s funded pension occurs through his/her independent contributions from wages and constant transfers from the employer’s funds. A participant in the Russian Railways corporate pension program can choose the best option for forming a funded pension:

| Scheme | Distinctive features |

| Insurance | Minimum contributions, impossibility of inheriting insurance funds |

| Savings and insurance | Inheritance can be carried out strictly on the designated date (not earlier and not later) |

| Insurance and savings | You can inherit only after a funded pension has been assigned |

| Savings | Accumulated funds can be inherited at any time |

| Scheme 6 | Only immediate family members can inherit funds at any time |

A corporate pension was assigned to a Russian Railways employee after retirement (based on age or length of service). However, in connection with the new pension reform, which started on January 1, 2020, the board of Russian Railways decided to increase social protection for railway workers.

The age of employees receiving the right to receive corporate benefits remained at the same level: men - 60 years old and women - 60 years old. Employees are also given the right to choose: start receiving a funded pension at the “previous” age, or continue working until the general retirement age (60 years for women and 65 for men) and increase the amount of insurance savings.

A project is under consideration that implies the possibility of assigning a corporate pension when an employee moves to a lower-paid position. If this innovation is approved, a list of such positions will be additionally determined.

Formation of pension amounts for railway employees

The amount of the state pension is calculated based on:

- Average employee salary;

- The region in which he worked;

- The total duration of the insurance period.

The amount of corporate payments is calculated based on the total amount of savings generated through:

- Personal contributions of the insured person;

- Employer transfers;

- Investment interest accrued by non-state pension funds.

Also, when calculating the amount of payments, the period of receiving the payment chosen by the insured person is taken into account: for life or for a certain period.

The amount of monthly savings payments is constantly increasing. If in 2008 the average size of such a pension was 2,700 rubles, then in 2020 it was equal to 9,000 rubles.

The pension reform retained the opportunity for railway workers to retire early.

Also, JSC Russian Railways, in care of its employees, launched a corporate pension program that allows them to create a funded pension and thereby increase the amount of benefits after retirement.

Watch the video about Russian Railways pensions August 19, 2020, 09:00 January 7, 2020 02:05 Retirement age Link to current article

Corporate pension for railway workers through NPF “Blagosostoyaniye”

Non-state support for railway workers is carried out within the framework of the corporate employee support system. NPF Blagosostoyanie acts as a guarantor for all Russian Railways employees participating in the pension formation program.

Today, more than 600 thousand railway workers take part in this corporate system, and almost 300 thousand receive pensions from the fund’s reserves. The corporate pension of Russian Railways last year had an average size of 6 thousand rubles.

The corporate pension for railway workers is formed as a double deduction of funds from the Russian Railways employee and the employer. Part of the funds for the funded part of the pension is withheld from salaries, the rest is “reported” by Russian Railways. Employees have the opportunity to choose the optimal scheme for accumulating part of their pension:

- The insurance scheme offers employees the lowest possible premiums. A disadvantage is the fact that such a part of the non-state payment cannot be inherited.

- Savings and insurance. Pensions for railway workers can be inherited, but not earlier and not later than the established date.

- Insurance and savings. You can inherit funds immediately after the appointment of a non-state payment, but not before it.

- Savings. You can inherit funds at any time.

- Scheme 6 provides for the inheritance of money only by the closest relative (or several) even before the payment is assigned.

The funded part of the pension can be received after a Russian Railways employee retires after reaching a specified age. The length of service during which contributions were actively made is also important - at least 5 full years. The rights to the accumulated portion when choosing another NPF are retained by the employee if the new guarantor is a partner of Russian Railways.

Formation of pension amounts for railway employees

The size of the corporate payment is determined by wages, has a minimum volume, and the maximum is not limited. For example, PF employees can show the calculation of the pension of a Russian Railways diesel locomotive driver based on the amount of his last salary - 18-26 thousand rubles monthly, depending on the region. Only days worked in full in the following positions can be taken into account in the length of service required to calculate payments:

- directly in the Russian Railways system;

- in the Ministry of Railways of Russia or the USSR;

- in organizations that were part of these organizations;

- in Komsomol/party institutions in the field of railway transport;

- in railway healthcare institutions;

- NPF “Blagosostoyanie”, as well as “Zhildoripoteka”, “Zhilsotsipoteka”;

- executive authorities in the railway sector and so on.

The average size of non-state payments is growing from year to year. If in 2008 its size was 2,736 rubles, today it has reached a value of 6 thousand rubles monthly. The amount depends on contributions made, length of service and other conditions. The employee chooses the program. In addition to the required contributions in accordance with the selected contribution scheme, each employee can make additional payments to further increase their future pension.

Preferential pensions of the state software are designed to compensate railway workers for health costs, since fulfilling work duties in the Russian Railways sector is often fraught with difficulties. The corporate pension is designed to increase the amount of payment and support employees financially after retirement.

Subsidies for masons

Many employees of construction companies, in particular masons, are interested in whether a preferential pension is possible for them. Yes it is possible.

According to List No. 2, approved by Resolution of the Cabinet of Ministers of the USSR No. 10 dated January 26, 1991, the right to a pension on preferential terms is granted to masons who constantly work in brigades of masons and in specialized units of masons of complex brigades.

How long do you need to work to receive benefits?

To receive a preferential pension, 25 years of work experience for men and 20 years for women is required . For 2020, the pension coefficient is 11.5 and amounts to 78.28 rubles, and the amount of payments is 4801.11 rubles.

Pensions for railway workers: specifics of purpose

Working on the railway requires increased responsibility, therefore the state provides special conditions for retirement to locomotive drivers, conductors, fitters and other railway workers. Moreover, you can choose a pension for long service or according to Lists No. 1 and No. 2.

Long service pension

Workers of locomotive crews and certain categories of workers who organize transportation and guarantee traffic safety on railway transport and in subways can retire for long service. This provision is provided for in Art. 55 of the Law of Ukraine “On Pension Security”, however, this is possible subject to several conditions.

Firstly, the work must be included in the List of professions and positions of locomotive crew workers and certain categories of workers entitled to a pension for long service (Resolution of the Cabinet of Ministers of Ukraine No. 583 of October 12, 1992).

Secondly, you need to have:

– men – at least 25 years of general experience, of which at least 12 years 6 months – special;

women - at least 20 years of general experience, of which at least 10 years - special.

Thirdly, a prerequisite for receiving a long-service pension is dismissal from a job that gives the right to this pension.

If all conditions are met, railway workers have the right to early retirement for length of service, regardless of age.

Disability pension

In addition, some railway transport workers are entitled to a preferential pension according to List No. 1 and List No. 2 for production, work and professions with particularly difficult and harmful working conditions. They were approved by Resolution of the Cabinet of Ministers No. 36 of January 16, 2003.

According to List No. 1, men will retire at 50 years old, and women at 45 years old. According to List No. 2, men have the right to a well-deserved rest at 55 years of age, women - at 50 years of age.

To receive such a benefit, you must have the required amount of experience . To qualify for a pension under List No. 1, men need 20 years of general experience and 10 years of special experience, and women – 15 years and 7 years 6 months, respectively. At the same time, male workers who have more than half of the length of service in List No. 1 can retire 1 year earlier for each year worked in hazardous work, and women - 1 year 4 months.

According to List No. 2, the working experience of men must be at least 25 years, of which 12 years 6 months. - at the specified works. For women, these figures are 20 and 10 years, respectively. At the same time, men who have at least half of the preferential length of service retire a year earlier for every 2 years and 6 months they work under such conditions. Women, if they have at least half the length of service under List No. 2, receive the right to a pension a year earlier for every 2 years worked in difficult and harmful conditions.

One of the necessary conditions for granting a preferential pension is the certification of jobs after August 21, 1992. According to the Law “On Pensions”, it was from this date that the Cabinet of Ministers established a procedure for certifying workplaces according to working conditions, confirming the right to a preferential pension.

The pension amount will be calculated according to general rules

After submitting the necessary documents, the railway worker will calculate pension payments. The amounts of pensions for long service and according to List No. 1 and No. 2 are established in accordance with Art. 27 of the Law of Ukraine “On Compulsory State Pension Insurance”. They are calculated like old-age pensions - depending on the insurance period and earnings from which insurance premiums were paid.

It happens that the pension amount does not reach the minimum established at the subsistence level for disabled persons. Then, according to Art. 28 of the above Law, pensioners receiving benefits can receive an additional payment up to the “minimum wage”.

Thus, pension payments to railway workers are assigned according to two Laws - “On Pension Provision” and “On Compulsory State Pension Insurance”. In both cases, certain benefits are provided for them. What pension will be provided to a beneficiary often depends on his specialty and work profile, and sometimes on the choice of the pensioner himself.

Will there be additional pay for extra work experience?

When calculating a preferential pension, an additional payment for overtime is established, as when calculating an old-age pension. According to the Law “On Compulsory State Pension Insurance”, such an additional payment is due for each full year of insurance experience over 35 years for men and 30 years for women. In this case, the pension increases by 1% of the pension amount calculated in accordance with Art. 27 of the Law, but not more than 1% of the minimum age pension.

Who will retire earlier?

In accordance with the List of professions and positions of locomotive crew workers and certain categories of workers who directly organize transportation and ensure traffic safety on railway transport and in subways, the following have the right to a long-service pension:

- foremen of mainline railways engaged in the routine maintenance and repair of tracks and artificial structures in areas with heavy train traffic;

- electricians and electromechanics of the contact network of mainline railways;

- freight train conductors;

- stokers of steam locomotives and railway steam cranes;

- foremen (track, bridge, tunnel) of mainline railways engaged in the routine maintenance and repair of tracks and artificial structures in areas with heavy train traffic;

- drivers of railcars and motor vehicles;

- drivers and assistant drivers of steam locomotives and railway steam cranes;

- drivers and assistant drivers of diesel locomotives;

- drivers and assistant drivers of electric locomotives;

- drivers and assistant drivers of diesel trains;

- drivers and assistant drivers of electric trains (sections);

- driver-instructors of locomotive crews;

- mechanics of refrigerated trains (sections);

- track linemen of mainline railways , engaged in the routine maintenance and repair of tracks and artificial structures in areas with heavy train traffic;

- caretakers of mainline railway cars, employed at points of technical (technical and commercial) maintenance of cars at extra-class, 1st and 2nd class stations;

- caretakers-repairers of mainline railway cars, employed at points of technical (technical and commercial) maintenance of cars at extra-class, 1st and 2nd class stations;

- train dispatchers and senior train dispatchers;

- wagon speed controllers

- repairers of artificial structures of main railways in areas with heavy train traffic;

- train makers;

- mechanics for the repair of rolling stock of mainline railways, employed at points of technical (technical and commercial) maintenance of cars at extra-class, 1st and 2nd class stations;

- duty officers at extra-class and 1st class stations, engaged in the reception, departure and passage of trains on sections of mainline railways with particularly heavy traffic;

- duty officers and operators of sorting humps at extra-class and 1st class stations.

* For mechanics of refrigerated trains (sections), the period of service in 1978–1990 as heads of refrigerated trains (sections) when servicing refrigerated trains (sections) with fewer workers than was established by industry technically sound standards for servicing refrigerated trains (sections) is included in the length of service for pensions. trains (sections), in the presence of supporting documents on additional payment for holding multiple positions.

*If you find an error, please select a piece of text and press Ctrl+Enter.

How is the right to a preferential pension confirmed?

The main evidence of a driver’s right to claim a preferential pension is a waybill. The document displays information about departure and arrival times.

Based on this information, the actual time for fulfilling labor obligations during the month on regular city routes is calculated.

The flight is considered completed if the following conditions are met:

- the vehicle departed on schedule;

- completed all required points on time;

- arrived on schedule at the final destination of the route.

If there are no waybills, a certificate from the employer is provided. It specifies the basis for calculating actual time. For example, such documents include a payroll slip and a personal account. Also, confirmation of periods of work is established on the basis of witness testimony.