What could be more exotic than celebrating the New Year at the End of the World? Do you dream of celebrating the New Year in an unusual, exclusive and excitingly cool way? Unique landscapes, the Arctic Ocean, frozen waterfalls, husky riding, reindeer sledding, tasting northern fish soup, visiting a Sami village, enjoying the snow-covered trees of the Arctic and, of course, friendly communication! We invite you to plunge into the atmosphere of harsh and incredibly beautiful nature, get the opportunity to see the Northern Lights, enjoy the gastronomic delights of seafood, and gain impressions and emotions that will remain forever in your memory! Are you ready to celebrate the New Year on the Kola Peninsula in a polar fairy tale? Then we are waiting for you!

Route

Murmansk - Teriberka village - Murmansk

Dates

December 30, 2020 – January 03, 2021 (5 days / 4 nights)

Who will be interested in this tour?

The tour is designed for all lovers of nature and photography, people looking for unusual routes and those in love with life! You can get to all the main main locations as close as possible by transport, so no special physical form is required.

Impression

✅ Everyone dreams of seeing the Northern Lights and under favorable weather conditions and solar activity you will have this opportunity!

✅ You are exploring a graveyard of sunken ships

✅ Wander through the unique landscapes of the Arctic coast

✅ Consider the patterns of the Barents Sea that the water draws on the sandy shore

✅ Visit beaches with huge boulders - “dinosaur eggs”

✅ See numerous art objects

✅ Be amazed by the raging sea elements

✅ Stop by to visit the Polar weather station

✅ Learn about the life of the inhabitants of the Arctic

✅ Get a boost of energy from reindeer and husky sledding

What is the “Northern” pension

Due to difficult labor, climatic and weather conditions in the regions of the Far North, the health of people living there, working permanently or employed on a rotational basis suffers. Often, such employees, due to their work, acquire chronic pathologies of the respiratory, nervous, reproductive systems, as well as circulatory and hematopoietic disorders. The state takes into account the labor characteristics of workers. They are provided with increased wages, as well as a special northern pension of increased size.

REFERENCE. Citizens of the Russian Federation who have length of service in the regions of the Far North can count on early payment of benefits. Men and women begin to receive it at 60 and 55 years of age, respectively.

What territories belong to the Far North?

A complete list of territories with special climatic conditions is listed in Resolution of the Council of Ministers of the USSR No. 12 of 01/03/1983. Among other things, it makes a distinction between the regions of the Far North and equivalent regions.

The list of the first includes:

- Islands in the Arctic Ocean, Bering and Okhotsk Seas.

- Complete territories: Murmansk and Magadan regions, Republic of Sakha (Yakutia), Kamchatka Territory, Chukotka Autonomous Okrug.

- Some areas: Arkhangelsk, Irkutsk, Tyumen, Sakhalin region, the Komi Republic, Karelia, Tyva, Khabarovsk and Krasnoyarsk Territories, Khanty-Mansiysk Autonomous Okrug.

The remaining territories of these subjects are predominantly equated to the northern ones.

Some regions of the following constituent entities of the Russian Federation are considered equal:

- Amur and Tomsk regions.

- Perm, Primorsky, Transbaikal regions.

- Republics of Altai and Buryatia.

Regulations governing the northern pension

Today in the Russian Federation, the establishment and payment of salaries is regulated by three main laws:

- Federal Law No. 166 “On State Pension Security” (for citizens receiving state support);

- Federal Law No. 173 “On Labor Pensions” (from the beginning of 2020, only part of the provisions governing the procedure for calculating and paying pensions assigned before the end of 2014 is relevant);

- Federal Law No. 400 “On Insurance Pensions” (for persons retiring after 2020).

Conditions for receiving a northern pension

According to established standards, men and women living or working in the Northern regions can qualify for a preferential pension under different conditions.

Experience

From 2020, a man can retire at age 60 if the following conditions are met:

- 15 years of work experience in the northern regions or 20 years in regions equivalent to them;

- 25 years of total experience.

For women, the retirement age will be 55 years under the following conditions:

- 15 years of work in the Far North or 20 years in equivalent territories;

- 20 years of total work experience.

IMPORTANT! For women with two or more children, a simplified condition for early retirement is provided: 12 years of work in the regions of the Far North and 17 for those equivalent to them.

Age

Since 2020, the retirement age for northerners has increased to 60 and 55 years for men and women, respectively. Women who have completed northern work experience and have given birth to at least two children can begin receiving salaries at the age of 50.

REFERENCE. For every 12 months of work in the Far North, the retirement age will be reduced by 4 months. For regions equated to the northern regions, a recalculation is performed.

How is northern experience calculated?

The main principle of calculation is the calendar determination of the time actually worked in the North. In this case, full calendar days of work are taken into account. Periods when citizens were looking for work or were on stock exchanges in the Northern regions will not be counted.

To qualify for a northern pension, you need to work in extreme regions for at least 15 years and at least 20 years for equal regions. Experience requirements are reduced for those who have worked in hazardous industries for some time.

The retirement age may be reduced by four months for each year of work in the North after 7 years.

What is included in the northern experience?

Labor activity in the Far North includes single-shift, rotational, and combined work. If a person works part-time at two enterprises at the same time, the length of service is added to the northern one. The same rule is relevant for young professionals working full time.

Northern experience includes:

- periods when the person officially performed work duties;

- time spent on professional development;

- obtaining higher or secondary specialized education;

- child care time up to 1.5 years;

- paid holidays;

- sick leave time.

When working on a rotational basis, the following are taken into account:

- the time the employee performs his duties;

- rest periods between shifts;

- the time an employee spends traveling to the site from home or dorm.

What periods are not included in the northern experience?

The following periods are excluded from the northern period of service, but are included in the general insurance period:

- the period of military service in normal climatic conditions;

- child care time 1.5–3.5 years;

- leave to care for a disabled child;

- the duration of a person’s unemployed status, regardless of whether he was registered with the Employment Center.

When calculating work experience, the following are not taken into account at all:

- the time required to dismiss an employee due to reduction;

- periods of unpaid leave;

- time spent donating blood (donation).

An example of calculating the northern length of service for a pension

If the employee’s working time exceeds 15 years, then everything is simple - retirement age will come 5 years earlier. However, there are more complex cases:

- 1 case: an employee worked in the north for less than 15 but more than 7.5 years.

- Case 2: the employee worked in areas that are equivalent to the northern ones.

- Case 3: a person working in the Far North worked in difficult conditions included in the lists and 1 2 approved by Resolution of the USSR Council of Ministers of August 22, 1956 No. 1173.

In the first case, the citizen’s retirement age will decrease by 4 months for each year. You will get the following:

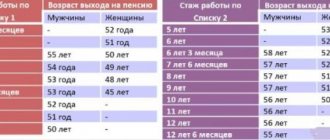

| Term of the work | Time by which the retirement age is reduced |

| 7 years 6 months | 2 years 4 months |

| 8 years | 2 years 8 months |

| 9 years | 3 years |

| 10 years | 3 years 4 months |

| 11 years | 3 years 8 months |

| 12 years | 4 years |

| 13 years | 4 years 4 months |

| 14 years | 4 years 8 months |

| 15 years | 5 years |

In the second case, 12 months of work in equated northern regions is equal to 9 months of work in the Far North.

The following formula is used for calculation:

length of service (in days) 12 * 9. example:

the person has 18 years of experience = 216 months = 6570 days.

6570 / 12 * 9 = 4927 days = 162 months = 13 years and 6 months.

In the third case , when combining two benefits (early retirement) for work in the Far North and work in difficult conditions, they will be summed up.

Do I need to confirm northern experience and how?

As a rule, information from the work book is sufficient to confirm northern work experience. But if a person worked in a division of a Moscow or other company, there may be incorrect records in it. Then you need to request certificates indicating specific periods of work on a rotational basis.

If it is necessary to confirm service in the Armed Forces for length of service, a military ID is required. Relevant extracts and certificates are also used to confirm other facts.

Payments to beneficiaries

In addition to basic pension payments, an elderly citizen can receive a monthly supplement (USB) and monthly security (DEMO). The groups of persons who may qualify for such additional payments include more than 60 beneficiaries. So, for example, payments can be assigned:

- combat veterans, as well as their relatives;

- children with disabilities;

- disabled people of groups 1,2,3;

- citizens affected by the explosion at the Chernobyl nuclear power plant;

- participants of the Great Patriotic War, as well as members of their families;

- Heroes of Russia, USSR;

- residents of besieged Leningrad.

The state provides some categories of citizens with EDV and DEMO

And this is not a complete list of beneficiaries entitled to receive additional benefits.

From the beginning of February 2020, there will be an increase in EDV and NSU by 4.3%. The beneficiary can receive compensation from the state in the form of social services or financial assistance. And if he completely abandons the first option, he will receive all the funds that belong to him according to the law.

It is important to know! However, in order to receive such payments, a citizen must contact a special body with an appropriate application for payment of NSO. In this case, you must apply before October 1, 2020.

New retirement age requirements for northerners

Since 2020, the retirement age has increased. Now you need to work an additional five calendar years. For men, the retirement age is 65 years, for women – 60. Transitional periods last until 2028. Officials have determined a grace period, and if a citizen during this time receives the right to benefits according to the rules that were relevant earlier, he will need to work not for five years, but significantly less. The table will help you understand the transitional rules of age and retirement dates.

Pensioners working in the north retained the right to retire early. But the previously established values are also increased by five years. Thus, for men the time to retire is 60 years instead of 55, for women – 55 instead of 50.

For men

The new age for the “northern pension” for men is 60 years.

In addition, the following general rules apply:

- The “period of working capacity” in 2020 is extended not by a year, but by 6 months.

- The increase is envisaged not for 2, but for 1.5 years.

The retirement schedule for northerners from 2020 is presented in the table.

Women

For women, the retirement age is increased from 50 to 55 years. Otherwise, all promotion rules are similar to those for men. An exception is women who have given birth to 2 or more children and have a total experience of at least 20 years (of which 12 in the regions of the Far North or 17 in equivalent regions) in accordance with clause 2, part 1 of Art. 32 No. 400-FZ, as before, they can issue payments early at the age of 50 years.

Early retirement for residents and workers of the Far North

Persons who worked in the North may retire much earlier than others. Thus, men with a total experience of 25 years, of which 15 were work in the regions of the Far North or 20 in equivalent regions, according to the new rules, become pensioners at 60 years old, women - at 55. For other citizens, according to the new law, the retirement age is 65 years for men or 60 years for women.

Persons who have 25 years of experience in the Far North as hunters, fishermen or reindeer herders for men and 20 years for women can retire another five years earlier.

Like all residents of the Russian Federation, for workers in the northern regions the transition period to raise the retirement age will last until 2028. Below is a table of retirement taking into account innovations.

Northern pension size

The pension includes two parts - insurance and fixed. The insurance part does not change depending on whether the person worked in the North. A fixed payment in accordance with clause 4 of Art. 17 No. 400-FZ increases by 50% for:

- men with 25 years of experience or more, of which at least 15 years in the Far North;

- women with 20 years of experience, of which 15 or more have undergone CS.

The amount of the bonus will depend on the size of the fixed payment. In 2020, it was raised to 5,686.25 rubles. Thus, pensioners with sufficient work experience receive additional payment:

- 2843.13 rubles when working in the Far North (1421.56 rubles for disabled people of the third group);

- 1,705.87 rubles when working in areas equated to the CS (852.94 rubles for disabled people of the third group).

If a pensioner is entitled to an increased fixed payment for other reasons, the increase for work in the North will be set in addition to the previously assigned increases. This applies to disabled people of group 1, persons over 80 years of age, citizens who are dependent on disabled family members.

The table below shows the amounts of fixed payments for various additional payment options for 2020.

Cash supplement for migrants to the North

Those who move to the Far North from other regions are entitled to a salary increase. This is a premium for the regional coefficient that is relevant for a specific territory. Recalculation will be carried out from the date of registration in the Northern region.

Regional coefficient table

The fixed payment for persons living in the North increases by the regional coefficient established in a particular region. This is stated in Part 9 of Art. 17 No. 400-FZ. The rules for establishing additional payments are determined by Decree of the Government of the Russian Federation No. 249 of March 18, 2015.

Thus, for the Chukotka Autonomous Okrug the fixed payment will be doubled, since the coefficient is 2.0, for the Magadan Region - by 70% (1.7, etc.).

The additional payment is calculated at the request of the citizen himself. The pension increase will be established for the entire period of residence in the Northern Territory. An application for the use of the regional coefficient is submitted to the Pension Fund every year. There is no need to do this annually if the pensioner receives payments through the mail or another delivery organization.

IMPORTANT! Please note that a pensioner can only use one way to increase their pension - using a coefficient or receiving additional payment for northern experience.

Formula for calculating the northern pension

The amount of state benefits for northerners is determined by a general formula, but some indicators have increased values.

The formula is as follows: SP = IPK × CostIPK + FV , where:

- SP – northern pension.

- IPC is an individual pension coefficient accumulated by a person at the time of retirement. The calculation takes into account the total length of service, salary and insurance contributions. The IPC has minimum values. In 2020 it is 16.2 points. Until 2024, this figure will increase until it reaches 30 points.

- CostIPK is an indicator of the cost of one pension point in monetary terms. In 2020, this value is 87.24 rubles. The amount of indexation is determined based on the inflation rate for the reporting period.

- FV is a fixed payment, the amount of which is determined by law and is indexed annually. In 2020 it is 5334.19 rubles.

REFERENCE. The number of pension points can be found through the State Services portal. Access there is provided through a verified account. Data can also be obtained through the Pension Fund or MFC, where you need to call and make an appointment.

The additional payment to the state benefit is determined based on the increasing coefficient for a specific region. On average, the amount increases by 50–60%.

Online calculator for calculating the northern pension

You can easily and quickly calculate the amount of your northern pension. To do this, you need to look at the last letter received from the Pension Fund. If for certain reasons it does not arrive, you need to visit the regional branch of the Pension Fund to enter the database.

The online calculator will do the rest of the work for you. You can find it on the websites of non-state pension funds and a number of other organizations. A convenient calculator is located on the “Pensioner's Office” website.

ATTENTION! For correct calculations, enter only relevant and reliable information into the calculator.

To calculate in the calculator indicate:

retirement age;

amount of children;

period spent in the army or on maternity leave;

the amount of pension savings;

amount of additional contributions – if any;

estimated return on funds (when transferred to the state Pension Fund is 7%, in non-state ones it may vary).

After entering all the data, click on the “Calculate” link. The calculator will give you the size of your future pension – both the funded and the insurance part.

IMPORTANT! The resulting figure will not be 100% accurate. It may change taking into account external factors (for example, a surge in inflation).

Northern pension indexation

The size of the fixed salary payment is indexed every year, that is, it increases by a percentage established by law. Due to this, the bonus for northerners for work experience also increases. Since 2020, the rate of indexation has outpaced inflation. The interest rates by which the amounts of fixed payments will increase until 2024 are now known.

Thus, in 2020, the fixed payment was indexed and amounted to 5,686.25 rubles. The amounts of northern surcharges are determined taking into account this value. That is, they are 2843.13 and 1705.88 rubles.

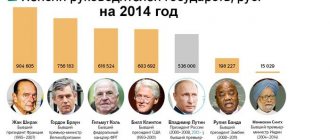

Presidential Statement

Russian President Vladimir Vladimirovich Putin made a statement that pensions will be increased. His speech took place at the end of February 2020, and in the process several issues were raised, most of which related to vulnerable sections of the population. For example, in addition to the issue of increasing pensions, questions were considered regarding the mortgage lending program for families with a large number of children, as well as regarding material support from the state in the case of people with disabilities and low-income citizens of the country.

The president gave meaningful answers to many questions, but more attention was still paid to the discussion of indexation of pension payments. During his speech, Vladimir Vladimirovich said that this year the pensions of the majority of citizens were indexed.

It is important to know! However, it later turned out that there were no increases in pension payments as a result, and for some residents of the country the size of their pensions even decreased.

Despite the indexation of pensions, due to the loss of social benefits, people received even less money

It is also worth taking into account that if, based on the results of indexing, the monthly pension benefit was increased, then the citizen automatically lost a social supplement equal to the amount that was not enough to reach the subsistence level. As a result, the amount of pensions paid changed. And, despite the logic and fairness of the calculation algorithm, people lost money.

Thus, the results of reforming the pension system and its indexing led to the fact that pensioners were ultimately paid less than they expected. So, for example, an elderly person expected that he would first receive a social supplement to his pension, and then it would be recalculated and increased to the subsistence level. However, everything happened completely the opposite: first the pension was indexed, and then social supplements were removed. In addition, it is worth noting that if, according to the results of indexation, it turned out that the pension reached the subsistence level, then its size was left the same and in any case the social supplement was removed.

As for the president’s attitude to what is happening, he shared his opinion. Vladimir Vladimirovich does not agree with this approach and believes that the citizens of the country did not receive their money in full. Therefore, he proposed to recalculate.

It is important to know! At the same time, according to him, it is necessary to recalculate in such a way that in the end people receive all the funds that were allocated from January 1, 2020.

The President of the Russian Federation ordered to recalculate and give citizens the missing amounts

The president also noted that this type of indexation is a real injustice. According to him, the problem that has arisen requires careful investigation and elimination. Vladimir Vladimirovich called for changes to the algorithm for calculating pensions and demanded that this be done before the beginning of March 2020.

Procedure for obtaining a northern pension

The procedure for applying for a northern pension is almost identical to applying for a regular one.

It includes the following steps:

- Preparation of documents. The list may change depending on your specific situation.

- Checking all papers and rights. This step is optional, but it's better to be on the safe side.

- Apply for benefits and receive a decision. The application is submitted along with all documents.

List of documents

When applying to the Pension Fund, a person must confirm the circumstances affecting the fact of receiving a pension and determining its size. The list of documents may vary.

The general list includes:

- passport;

- work book and other documents to confirm work activity;

- salary certificate for 5 consecutive years;

- certificates of change of surname, name or other data.

Additionally, other papers may be needed.

Standard application form for pension. It can be obtained from the Pension Fund.

Where to contact?

You can apply for a pension at the territorial branch of the Pension Fund or MFC. The first method is good because you can immediately get a consultation, while the second makes it possible to speed up the procedure and carry it out on a more convenient schedule.

It is also possible to submit an application through the State Services portal. But in this case, the original documents will still have to be provided to the MFC or Pension Fund. They can be sent by mail or transmitted through a representative. In the latter case, an additional power of attorney is required.

Deadlines

The established period for making a decision on granting a pension is 10 working days. But in fact it may increase, for example, if the set of documents is incomplete. It is recommended to first obtain advice from the Pension Fund.

Changes March 1

The main change that took place in March was the increase in all pensions to the subsistence level. Thus, the calculation algorithm must take into account the cost of living, and at the same time it is necessary to take into account the characteristics of each region, since this indicator may be different in different subjects of the Federation.

The second change is that it is necessary to index the pension after it has been increased to the subsistence level. This will lead to optimization of the calculation, and will also make it possible to improve the algorithm for calculating pension payments to citizens of the country.

Pensions were indexed after they increased to the subsistence level

Representatives of the Pension Fund of the Russian Federation assured the president that they would take into account all his recommendations, and also agreed with the ineffectiveness of the algorithm that currently exists. If we leave everything as it is, it will turn out that there will be some kind of “equalization” of pensioners whose pension was below the subsistence level.

Thus, Pension Fund employees assured the president that indexation and social pension supplements would be recalculated for those who are actually entitled to it. At the same time, pensioners should not run to the Pension Fund and submit any applications for recalculation, since the system will do this automatically.

It is important to know! Pensioners will soon receive fair indexation, as well as compensation for reduced payments from previous months.

Pensioners will soon receive compensation for missing payments

Northern pension for military personnel

Military personnel are recruited to serve in the army in the Far North under standard contracts. They do not indicate benefits and allowances, but they do contain information about the locality where the military man will serve.

Persons serving in the regions of the Far North can count on increased pensions. As in other cases, it depends on the regional coefficient. Pensions for military personnel are generally higher than for civilians, and northern coefficients provide an even greater advantage.

REFERENCE. After discharge, military retirees can claim a second pension earned in civilian service. To do this, you need to register with the Pension Fund, receive an insurance certificate and start accumulating points by getting a job at a civilian enterprise.

What is required for military personnel serving in the Far North?

Military personnel in the Far North are entitled to a number of benefits, including an increase in pensions, a reduction in service life and the opportunity to retire earlier.

However, for privileges to become available, three components are needed:

- age of the person;

- life time;

- insurance experience.

All these indicators are clearly stated in the law. Thus, the period of service for military personnel in the Far North, regardless of their level, is 15 years, and for territories equated to the CS - 20 years or more.

The insurance period is 20 years for women and 25 years for men. According to the new rules, the retirement age has increased from 50 to 55 for women and from 55 to 60 for men. Since this figure increases gradually, in 2020 it is 51.5 years for women and 56.5 years for men.

When determining a serviceman's length of service, only service in the Far North and equivalent territories is taken into account. Business trips are not taken into account. For military personnel, preferential northern experience is provided. Its calculation assumes that the total service life is calculated not by its actual time, but by taking into account an additional factor. The coefficients differ depending on the region and position:

| 2 | Regions of the Far North and equivalent to them for investigative units, physical protection departments, and operatives. |

| 2 | For employees in the Department of Internal Affairs and fire safety in the Far North in the first category. |

| 2 | For employees of the National Guard in the regions of the Constitutional Court in the first category. |

| 1,5 | For members of expeditions of ships and vessels along the Northern Sea Route. |

| 1,5 | Northern regions in the second category - for employees in the Department of Internal Affairs, the National Guard, fire safety, and so on. |

Military personnel belong to categories entitled to a pension for long service. This figure is at least 20 years, taking into account the preferential length of service. In fact, northerners who served in the territories of the Far North, classified as category 1, receive the required length of service after 10 years of continuous service. For each year of service beyond the length of service they are entitled to an additional 3% to their pension.

IMPORTANT! When retiring, a military man must choose what type of benefit he wants to receive: a labor pension or for long service.

A serviceman who retired due to length of service and has never worked anywhere else cannot count on a second pension. If he gets a job as a civilian, then, having reached retirement age and having worked in civilian life for at least five years, he has the right to another pension - a labor pension, which is combined with the military one.

Conscripts who served under the Conscription in the Far North and equivalent territories can count on preferential inclusion of this period in their work experience. So, if you served for 2 years, 4 will be taken into account.

Nuances of calculating pensions for northern military personnel

The size of a military personnel's pension is calculated based on:

- official salary;

- salary according to rank;

- bonuses for length of service;

- northern coefficient.

The regional coefficient depends on the region and is 1.15–2. The law determines that the amount of the pension cannot exceed the allowance of a career military personnel, therefore, a reduction factor may be taken into account in calculations. In 2020 it is 0.7368.

How to apply for a pension for a soldier who served in the North?

Military pensions are paid from the federal budget, so they, unlike civilians, do not apply for it to the Pension Fund.

To process payments, the following documents are required:

- passport;

- military ID;

- papers confirming residence in the northern regions;

- documents confirming service in the North.

Additionally, documents may be required on family composition, confirming the presence of dependents, etc., a package of documents is sent to the relevant department of the Ministry of Turnover. Most often this is the pension department of military commissariats at the place of residence.

Indexing Features

It is worth considering what features were discovered during the indexation that arose at the beginning of the year. Thus, the majority of pensioners were able to experience the benefits that arose as a result of the pension reform.

First of all, it is worth noting the monthly increase in pension. Its size was increased by about a thousand rubles, and if we talk about the percentage, this number will be equal to 7.05 units. Thus, the indexation rate has become significantly higher than the inflation rate last year, which is quite fair.

The pension was increased by 7.05%

However, it is worth noting that prices in the country have not remained stagnant, and already at the beginning of the year there was an increase in the cost of many products and services by an average of 4%. If you believe the information of Pension Fund employees, then today the average amount of pension payments is 15,400 rubles. But at the same time, when calculating the average, it is worth taking into account the difference in pension payments between individual categories of citizens.

It is important to know! So, for example, while some receive a pension of 9,000 rubles, others are content with payments amounting to 25,000 rubles or more.

The difference that arises is associated with several factors, and the main one is considered to be length of service. The higher it is, the larger the size of pension payments. Also, recently the Pension Fund has introduced points into the pension calculation system, the number of which also affects the amount of payments. Finally, the last most popular factor is age.

It was noted that insurance pensions for people who have reached retirement age, but at the same time have the opportunity to continue working, have increased for approximately 30 million citizens. However, such changes affected only those residents of the country who were not officially employed at the time of counting.

Only pensions of non-working citizens were indexed

Pensioners who continue to work may not expect such additional payments. Their only additional payment can only occur in August, and at the same time it will amount to a maximum of 200 rubles.

Benefits for northern pensioners

Today, northern pensioners are entitled to the following types of benefits:

- regional coefficients;

- interest allowances;

- pension benefits (increased payments, the right to retire early);

- housing subsidies;

- additional paid leave;

- compensation for transportation costs (twice a year to the vacation spot and back).

For persons living in the Far North and residents of regions that are equivalent to it, the benefits are the same. The only difference is in their volume - residents of the Far North receive higher payments and longer paid holidays.

Results: pension innovations for northerners in 2020

Living and working in the Far North and nearby territories involves difficult labor and weather and climatic conditions that can affect the health of citizens. An increased pension is compensation for them. The amount of the benefit will depend on the regional coefficient.

There is another point - increasing the retirement age for residents of the northern regions. The authorities did not take into account that after the collapse of the USSR, these regions are constantly becoming less and less attractive as a permanent place of residence. Innovation will only make this worse. For young people, they can become an incentive to leave the Far North to improve living conditions, but there will obviously be even fewer people willing to change from a warmer region to a northern one.

What other issues did the president raise?

In addition to the issue of paying pensions to the country's citizens, the president touched upon several other pressing topics. Among them are topics devoted to social protection of the population.

Vladimir Vladimirovich assured citizens that demographic reform will continue, and large families can still take advantage of the mortgage lending program. In addition, the maternity capital program was extended, and some changes occurred in it, including an increase in the list of possible uses of funds from the state.

Over the next few years, clinics and hospitals for children will be reformed. Already this year, the state plans to begin repair work in children's medical institutions.

It is important to know! The president also promised to update the material base of such organizations.

The President touched upon many topics as part of his address to the Federal Assembly, but the most pressing was the increase in pensions

Kindergartens and nurseries will not be left without the country's attention, and in the next three years it is planned to increase the number of places in these institutions.

It was noted that during the period of comprehensive reform, the poverty threshold of the country's population dropped to 10 percent from the previously established 30. One of the reasons contributing to such progress is the increase in wages to the subsistence level.

During the speech, many more facts were announced, more than a dozen pressing issues of today were discussed, a huge number of figures were spoken, but the increase in pension payments since March 2020 attracted more attention.

It is important to know! It was this news that became the most anticipated among pensioners.