Elderly people in Russia often complain that they receive too low pensions from the state. You can even hear indignation that the government is trying to save money on the elderly. They cite European countries as an example, where older people can not only live a comfortable old age with their pensions, but also travel to other countries. But not all Russian pensioners know this fact: there are states on the planet where old people do not even know what a pension is. True, this does not apply to those who worked in government agencies.

Tanzania

Which countries do not have old age pensions? The list opens with the state of Tanzania. This East African country has absolutely no government or social programs to provide for the elderly. The majority of residents are below the poverty line, and mortality is quite high in all age groups of the population. Only five percent of older Tanzanians have the privilege of staying at home and living off their children and grandchildren. And those whose relatives cannot or do not want to support the elderly, or those elderly citizens who, unfortunately, buried children, have to continue working until their death. Thus, 95% of Tanzania's elderly population is forced to work.

But not everyone has even this privilege, because it is extremely difficult for a frail old man to keep his job if there are a lot of unemployed youth around in the prime of life. As mentioned above, there are no social protections for the elderly. That’s why those who were fired because of their age take on any job, even under the most slavish conditions. Many work for a piece of bread and a bowl of stew.

Average salaries in India for the most in-demand professions

India is a very colorful country with a rich cultural heritage, which also has a strong division of people into classes. According to tax reports: out of 1.353 billion residents, only 1% of residents pay taxes, although about 400 million people are officially employed. It turns out that most earn very little and are exempt from the tax burden.

Often locals work unofficially - on construction sites, in agriculture, in fishing, in the service sector. If we talk about average salaries in India, they are very different; many factors influence this. First of all, you can count on the median income only in large and popular cities and administrative centers, such as Mumbai, Delhi, Goa, Kolkata, Bangalore. A large number of tourists come there, and a large number of companies operate there, formed at the expense of investors and the state.

Among the professions to which the concept of average salaries applies are doctors, civil servants, workers in the tourism sector, financiers, programmers, actors, and salespeople in large retail outlets. Their income ranges from 20,000-30,000 rupees, which is 260-400 dollars or 18,000-27,000 rubles.

Average salary of doctors

Due to the high population, healthcare professionals are in high demand in India. These include doctors, dentists, physiotherapists, and Ayurvedic doctors. They work in public and private clinics, and may also have their own office for receiving patients.

Iraq

Most often, countries that do not pay old-age pensions have the lowest life expectancy. This is exactly the situation in Iraq. Here, too, there are no government benefits for the elderly, so 80% of residents do not even live to be 70 years old. Out of two hundred countries in the life expectancy ranking, Iraq ranks 136th. Of course, such a low rate is contributed not only by the lack of old-age pensions, but also by the low level of medical care, constant martial law and unsanitary conditions.

Only those elderly people who worked in the oil industry or in the public service can count on pensions here, but only on the condition that the employee made contributions to his future pension for ten years before ending his working career due to old age. If an elderly person does not live to receive payments, the state does not return the amount of contributions even to relatives.

Japan

The average Japanese pension, which today is about 1,700 USD, allows pensioners of the Land of the Rising Sun not to experience financial difficulties and feel quite comfortable. This money is quite enough for food and to pay for utilities; there is also some left over for leisure activities, which, however, at this age can be quite moderate in terms of expenses.

A Japanese can retire at the age of 65, this applies to both men and women. However, if a citizen of the country expresses a desire to retire earlier, state laws allow him to do this: you can stop active work at the age of 60, but the pension amount will decrease by 25%.

If a Japanese person continues to work after reaching retirement age, each year worked adds a certain amount to pension payments, and by the age of 70, the pension may increase by a quarter.

According to statistics, the Japanese are the longest living nation in the world. The number of citizens who have passed the century mark exceeds 60 thousand people, the average life expectancy is 84 years.

Experts believe that proper nutrition helps the Japanese achieve such years: the diet of residents of the Land of the Rising Sun is dominated by rice, soy, and seafood. In addition, upon retirement, the Japanese continue to lead an extremely active lifestyle. Japanese pensioners can be seen in any part of the world as restless tourists.

The vast majority of Japanese elderly people do the so-called morning exercises “by radio”; older Japanese people try to prefer walking to traveling by car. In addition, the country has a healthcare system recognized by many experts as the best in the world. After 60 years, every Japanese regularly undergoes medical examinations, keeping their finger on the pulse, literally and figuratively.

Afghanistan

According to the results of the British AgeWatch rating, which was aimed at identifying the best places to live for older people and pensioners, Afghanistan was recognized as the worst place. This is not just a country where there is no old age pension. There is practically no old age here, because the average resident of the state lives to a maximum of 45-50 years. Those who managed to overcome this milestone and live, for example, to 60 years old, will most likely die of starvation, unable to fight and work for the export industry.

External military conflicts, an ongoing civil war, a high crime rate, total illiteracy, poverty, drug trafficking - these are what can be observed in modern Afghanistan. There are no social programs here at all. About 40% of the country's residents are unemployed. The extreme level of economic poverty does not imply the creation of any benefits, benefits or payments.

What can pensioners count on?

If the plans of the government of the country, which were mentioned at the beginning, are implemented, then elderly people over 60 years of age will be able to receive from 1,600 to 2,500 rupees ($25 - $39). For this purpose, it is planned to attract additional funds at the level of each state.

As for the protests, they were carried out by participants in the EPS-95 scheme. They demanded that their labor pensions be increased to 7,500 rupees ($117). In addition, they accused the management of the savings funds of abuses and errors in managing the funds. And although the government expressed its sympathy to the protesters, the matter has not yet gone further.

Nothing is impossible or a life-long feat

"School for grannies" in India

Tags:

2017, life the Indian way, lifestyle, society, pensioners, pension, economy

Previous news Next news

Other news on the topic

News from our friends

1 Comment to “Pension in India, or how Indian old people live”

- Zhanna 03/09/2020 — Reply

This is a complete scam. People don't believe me.

Pakistan

What other countries do not have an old-age pension at all? Pakistan is also on this list. As in Iraq, any willing Pakistani, being young and able-bodied, has the right to save money for his old age by paying contributions. As in Iraq, you need to start doing this 10 years before retirement. But if in Iraq, as mentioned above, workers in prestigious professions can count on a pension, then in Pakistan only those who “bought a pension” for themselves can count on a pension. Why do old people need to make contributions to their old age through contributions to the state, and not save on their own, for example, in a piggy bank? The point here is the fear of being robbed.

Although, when saving independently, an elderly person does not risk losing all his deposits in the event of an unexpected death, he is at risk of losing money during his lifetime. Theft rate in Pakistan is very high. Anyone can easily rob a poor, lonely old man or woman. Thus, in Pakistan, a country that does not provide old-age pension, it is beneficial to save money for your pension yourself by paying contributions to the government.

The trouble in many Asian countries is that they have a predominantly male workforce, and most women are housewives all their lives. Of course, they do not officially work anywhere, so they cannot provide themselves with social protection in old age.

Living wage in India

The cost of living in the Indian understanding is very different from the Russian one. If in Russia the amount is tied to the consumer basket, then in India this method of assessment is hardly suitable. For the poor, an income of $60-100 is hardly enough for a bag of rice or a couple of kilograms of vegetables and fruits. It is very difficult to change the caste system of Indians, but many volunteers go there to help them get out of severe poverty.

If we take official sources, the cost of living in India is $145-200. With this amount you can feed yourself, but not your family, which is why many children drop out of school and from the age of 8-10 help their parents at construction sites and plantations. The cost of living for Indians belonging to the Brahmin and Kshatriya castes is several times higher than those who belong to the Vaishya and Shudra castes.

Nigeria

We continue to look at which countries do not have old-age pensions. The same situation as in Iraq and Pakistan is with the elderly people of the state of Nigeria. Unlike most West African countries, it pays a pension to those who work in any formal job. Unfortunately, however, of the eighty million Nigerian workers, only 6 million are employed in the formal services. All others can receive a pension only on the basis of their own contributions to the state. This must be done within 10 years before the expected receipt of pension payments. However, just a decade ago, elderly Nigerians did not have any pensions, even from their own contributions. Therefore, we can say that in this country the situation with social payments is developing in the right direction.

Denmark

When considering the topic of pension provision for citizens in different countries of the world, it is impossible not to mention Denmark - the country with the highest pension in the world today. On average, a Danish pensioner receives 2,800 US dollars every month, and this is no joke. It can be difficult for a Russian pensioner to understand how this is possible.

The average life expectancy in Denmark today is 80 years, while Danes retire at 65–67 years of age.

The priority direction of government policy today is to create the most favorable living conditions for people of retirement age, which is why many people call Denmark a paradise for retirees. Often a pensioner in a country feels more secure than a working person.

In addition to a more than decent state pension, Danes often have savings in non-state pension funds, which can result in even higher income for a pensioner. Such a state strategy is aimed, among other things, at ensuring that pensioners remain independent and capable for as long as possible, since the maintenance of elderly people in nursing homes is carried out at the expense of public funds.

In order to provide additional support to the country's pensioners, a branch of the public organization DanAge has been created in each Danish municipality.

India

What other countries do not have old-age pensions? India is included in this list because only 12% of the population can count on government support after retirement due to old age. These are those who have worked all their lives in public services. This is not to say that these lucky ones get a lot. In terms of our currency, this is only 180 rubles per month. However, against the backdrop of general poverty, especially among the eternally hungry, begging old people, this money allows us to have some kind of food for lunch.

Note that India also occupies one of the last places in life expectancy rankings. Only wealthy Indians or villagers who grow food in the fields can live to be 70-80 years old. To be fair, it must be said that individuals live here to be 100 years old, but there are only a few of them. Such old people survive without pensions due to their ascetic lifestyle, religious hunger and ability to meditate.

Salary levels in India - complete list

| Professions | Average salaries | |||

| in rubles | in rupees | in dollars | ||

| 1 | Top manager in the company | 639 566 | 700 000 | $9 269 |

| 2 | President of India | 483 000 | 528 640 | $7 000 |

| 3 | Business Management Consultant | 468 253 | 512 500 | $6 786 |

| 4 | Professional actor | 448 610 | 491 000 | $6 502 |

| 5 | Pilot | 345 365 | 378 000 | $5 005 |

| 6 | State Governor | 338 100 | 370 048 | $4 900 |

| 7 | Hotel manager | 329 861 | 361 030 | $4 781 |

| 8 | Engineer | 274 100 | 300 000 | $3 972 |

| 9 | Medical worker | 271 724 | 297 400 | $3 938 |

| 10 | Prime Minister | 269 100 | 294 528 | $3 900 |

| 11 | Network Administrator | 198 182 | 216 909 | $2 872 |

| 12 | Product Manager | 186 936 | 204 600 | $2 709 |

| 13 | Architect | 137 050 | 150 000 | $1 986 |

| 14 | Chartered Accountant | 114 208 | 125 000 | $1 655 |

| 15 | Marine Engineer | 107 253 | 117 388 | $1 554 |

| 16 | Lawyer | 103 153 | 112 900 | $1 495 |

| 17 | Programmer | 95 204 | 104 200 | $1 380 |

| 18 | Data Scientist | 72 331 | 79 166 | $1 048 |

| 19 | Captain on a sea vessel | 68 982 | 75 500 | $1 000 |

| 20 | Lecturer at the university | 38 557 | 42 200 | $559 |

| 21 | Chef | 36 273 | 39 700 | $526 |

| 22 | SPA manager | 28 378 | 31 059 | $411 |

| 23 | Financier at the bank | 26 314 | 28 800 | $381 |

| 24 | Salesman | 25 948 | 28 400 | $376 |

| 25 | Model | 24 043 | 26 315 | $348 |

| 26 | Journalist | 20 101 | 22 000 | $291 |

| 27 | Travel agent | 20 009 | 21 900 | $290 |

| 28 | Aspiring actor | 19 461 | 21 300 | $282 |

| 29 | Event organizer | 18 822 | 20 600 | $273 |

| 30 | Electrician | 18 515 | 20 265 | $268 |

| 31 | Builder | 17 229 | 18 857 | $250 |

| 32 | Guide | 17 177 | 18 800 | $249 |

| 33 | Electrician | 13 705 | 15 000 | $199 |

| 34 | Junior accountant | 13 435 | 14 705 | $195 |

| 35 | Driver | 8 680 | 9 500 | $126 |

| 36 | Worker in agriculture | 8 223 | 9 000 | $119 |

| 37 | Postman | 7 309 | 8 000 | $106 |

| 38 | Housekeeper | 4 568 | 5 000 | $66 |

China

When answering the question of which countries do not have old-age pensions, China should also be mentioned. As in India, of the entire population of this huge country, only government employees can count on a pension. It happens that in the case of long service or any outstanding achievements, the owners of large companies assign a long-service pension to their elderly employees on their own. But these, of course, are isolated cases. This situation is not fixed at the state level. Therefore, the Chinese are doomed to grow old in poverty, and they most likely manage to live to gray hairs only thanks to knowledge of Eastern philosophy, meditation and compassionate relatives.

What is the reason for this in such an economically developed country as China? Most likely, the state does not benefit from long-livers at all. Overpopulation in China is a well-known problem, so the authorities of this country are not going to support old age in the near future.

Average salaries of emigrants from Russia in India

Vacancies for Russians and other foreigners are published on international portals, in Russian-speaking groups, and on social networks. The most common areas where non-residents can be accepted in India:

- medicine;

- education;

- logistics;

- tourism;

- sports entertainment;

- social work;

- management;

- finance.

Getting a job in India is difficult, since according to local legislation, the contract with a non-resident must stipulate a salary of at least $25,000 per year, which is simply a huge amount for local employers. But, it is possible to find an international company willing to pay an average salary of $2,000 per month for professionalism.

Thailand

The state of Thailand is not one of the countries that do not have an old-age pension, but this pension is so small that it is simply ridiculous to say. For all elderly residents of Thailand who have grown old unemployed or have worked for less than fifteen years in their entire life, a monthly pension of 700 baht is due. In terms of Russian rubles, this is only about 1,407 rubles per month. Considering prices in this country, we can say that this is very little. Unfortunately, this applies exclusively to officially employed citizens, and there are less than half of them in the country. Everyone else is forced to live into old age with minimal monthly payments.

conclusions

We can name several more countries where a pension program, if it exists, is only for a certain category of citizens. The following fact should be noted: in most cases, residents of rural areas, upon reaching old age, cannot count on financial assistance from the state at all.

For example, in Kenya only 15% of old people can count on it, while in Gambia this figure is slightly better - 20%. Russian pensioners should know this, who, regardless of their region of residence, gender and specialty, can count on monthly payments.

Ghana

Countries that do not have old-age pensions include this West African country. For those who worked, a small pension is paid, but only in cases where the employment was official. The monstrously developed shadow economy in this country has led to the fact that only 10% of elderly Ghanaians receive government support in the form of pension payments. These are those who at one time managed to get a government job or engage in entrepreneurship or farming.

USA

In the US, men retire at 67, women at 65 and receive an average of $1,503 per month. One of the features of the American pension system is the opportunity to accumulate the necessary pension amount by working in one of the country’s companies for 10 years. Many citizens manage to collect savings for two or even three pensions during their working career.

If an American wishes to retire earlier than expected, for example, at 62 years old (early retirement age in the States), then he will have to submit a corresponding request indicating the reasons that prompted him to take such a step. At the same time, the early retiree must be prepared for the fact that the pension amount will be 70% of the amount that he would receive if he retired at 67 years old, and that it will not be possible to reach 100% in the future.

The amount of contributions to the state fund is about 15% of the salary, half of which is paid by the employee himself, and the other half by the enterprise. After reaching retirement age, about 30% of American citizens continue to work.

Kenya

As in Iraq and Pakistan, in Kenya older people who have not previously worked or are working informally can only rely on their own savings through public financial systems to rely on their pensions. However, the situation is not the best for those who worked. Despite the fact that a good regular pension is provided for the elderly, and the retirement age is 55 years old, half of the population does not cross this age threshold. At the same time, the authorities are going to raise the retirement age to 60 years. The HIV epidemic that has been raging in the country for many years has created a situation in which Ghanaians, on average, live up to 59 years.

The same problem exists in another African country - Niger. Despite the fact that this country cannot officially be called a state without old-age pensions, the payment system is practically non-functional. On average, Niger residents live to be 52 years old, and the retirement threshold starts at 55.

Germany

The level of development of the state depends, among other things, on the attitude towards pensioners. As an example, consider the German pension system. A state with one of the most powerful economies in the world provides its citizens who have reached retirement age with all the conditions for a decent life.

The pension threshold established in the country is the same for men and women and is equal to 67 years. Despite this, citizens of the country can retire without waiting for this age: this is possible in the case when the pensioner pays from personal savings a certain amount necessary to compensate for the funds not received by the pension fund (about 0.3% of the existing savings for each unearned month).

It would be logical to assume that everything is in order with the size of the pension in Germany. On average, women in Germany receive 630 euros, and men - 1080. The average pension is 770 euros.

It should be said that, despite the reunification of the two Germanys, which occurred after the fall of the Berlin Wall, the difference in the development of the east and west of the country still exists to this day.

Working at one of the German enterprises, a citizen of the country contributes about 20% of his earnings to the Pension Fund during his work experience. In this case, half of the contribution amount is collected directly from the employee, the second half is paid by the employer.

Every German has the opportunity to resort to the services of one of the insurance companies in order to independently determine the amount of pension payments and accumulate a pension amount.

To count on an insurance pension, a German citizen must work at one of the country's enterprises for at least 5 years. If certain conditions are met, a pension in Germany can also be accrued to foreigners.

Countries without pensions

To begin with, yes, such countries really exist. But their number also includes states in which there is a pension , but is available to a small part of older citizens, as well as those where simply no one can live to see retirement. We will consider both. Let's briefly go through the list:

- China;

- Pakistan;

- Afghanistan;

- Vietnam;

- Tanzania;

- Thailand;

- Nigeria;

- India;

- Iraq;

- Philippines;

- Honduras;

- Turkmenistan (during the time of Turkmenbashi).

You can see that there are quite a few states without pensions (or with limited benefits). This will allow you to go through some of them in more detail, because each country has its own characteristics of calculating pensions. As already mentioned, the percentage of elderly people in the state is of considerable importance:

Percentage of elderly people over 65 years of age

China

The largest country in the world by population stands out from the rest in terms of economic and budget growth rates. It’s surprising why pension payments and support for the elderly are treated carelessly here. Thus, pensions are paid only to former employees of government services and major industrial plants. Residents of villages, agricultural communities and small settlements are not entitled to receive payments. This is due to the fact that the urban population is about forty percent , and the authorities are trying to get away from agricultural roots and move to dense urbanization.

Pensions in China are paid only to former employees of government services and major industrial plants.

There are no private pension funds in China - all payments (of which, of course, there are few) are made strictly by the state. There are cases when business owners, at their personal request, make payments to distinguished but retired employees. But not everything is so bad: large social benefits are provided . They really help in everyday life: for example, they reduce the cost of utilities (sometimes they can be canceled altogether) and travel on public transport. In addition, there are discounts in stores for pensioners.

The Chinese are a proud people who respect their traditions, so they treat the elderly with respect. There are practically no elderly people living alone, because families take care of their relatives. It is because of traditions that concern for pensions has faded into the background, and the elderly have a decent standard of living.

Elderly people are treated with respect in China

Important! In 2020, China is undergoing a reform of the benefit and pension system. As a result, the categories of citizens who have earned an impressive pension have been significantly expanded in large cities.

India

Another of the largest countries in terms of population, India , has a unique pension system. To begin with, do pensions exist there at all? Many believe that they do not exist here at all (except for payments to government employees), but now the situation has changed and continues to improve.

In India, each state sets its own pension amount

Firstly, each state manages pension payments independently, which has led to different conditions in individual regions (there are still states where poverty is rampant and there are no pensions, but in Indore, for example, the standard of living of older people is high), and secondly, In addition to pension payments to civil servants, support programs for ordinary citizens also appeared. Another feature is the system of assistance to the poor and low-income people, called NSAP.

Unlike other pension programs in the country, NSAP is managed by the state itself, and provides financial assistance to citizens in trouble and older people who have worked their jobs. But there is one problem - to receive such payments you need to submit an application, which will be considered by the fund administration. Due to the low standard of living throughout the country, the authorities are forced to make such sacrifices in order to somehow provide for the residents.

In India, not all pensioners can count on financial support from the state

The improvement of the pension system is in full swing, and now indeed not all pensioners can count on financial support from the state, but over time there are plans to increase pensions and make them available to every resident over 60 years of age.

Vietnam and Philippines

Two Asian countries that are very different from China in their treatment of the elderly and pensions. For example, a country with developed infrastructure and tourism - the Philippines - has a weak pension program with low benefits and an increasing retirement age. This is due to the lack of funds to maintain the pension program. The President of the Philippines even offered to sell his property in order to somehow provide for the elderly residents of his state. An interesting fact is that some elderly people from other countries choose the Philippines for “retirement immigration” - they move here and live out their lives. But this in no way compensates for the problems with pensions among indigenous residents.

The Philippines has a weak pension program

In Vietnam , newly-minted pensioners learn about the amount of their benefits only after their retirement. These sizes depend on the volume of labor and place of work. Pensions are not that impressive - on average $100 (which is only enough to survive). Only city residents and workers receive pensions - but peasants (of which there are many in Vietnam - this is how it happened historically) and entrepreneurs (both large and small shop owners) cannot count on help.

In Vietnam, only city residents and workers receive pensions.

Due to the small size of pensions, there are many working elderly people in this country. This is not even connected with the desire to somehow provide for oneself at this age, but also with the worldview of a typical Vietnamese: as long as there is an opportunity to work, one must work. By the way, in addition to the similarities with China, in Vietnam old people are respected, and they most often live under the same roof with their family.

Iraq, Afghanistan and Pakistan

Due to numerous wars and coups that have shaken up the economy and wealth of Iraq, now old people cannot afford a dignified old age. And what can we talk about if the number of elderly people is very low in itself? And among the few elderly people, only civil servants receive pensions (as in most of the above countries), which forces the rest of the elderly to live with the families of their children and grandchildren.

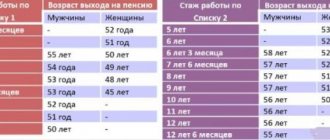

Retirement age in different countries

Another, more depressing example is Afghanistan, also battered by war and drug trafficking. Life expectancy does not exceed 50 years, and there are no pensions at all. The authorities are not even trying to solve this problem - why, with such years of life, when in principle you won’t live to see retirement?

In Pakistan, things are not so bad, but, again, only a small category of citizens can count on pensions. Elderly people can choose the option of a one-time payment in the amount of all funds accumulated during their work (in this case, the citizen is obliged to make contributions independently for at least 10 years in order to ensure his old age). The payouts are not that big, but food prices in Pakistan are low.

Video - How pensioners live in different countries

Thailand

You can often find people who believe that in Thailand, like in India, there are no pensions or they are available only to a limited number of residents. Over time, the situation, as in India, has changed. Yes, indeed, until recent years, payments were available only to officials. Now it is mandatory for every resident to participate in a pension program: part of the salary from the employer + a percentage from the state is invested in the fund, and after 55 years the citizen can count on pension payments. This is still not available to everyone.

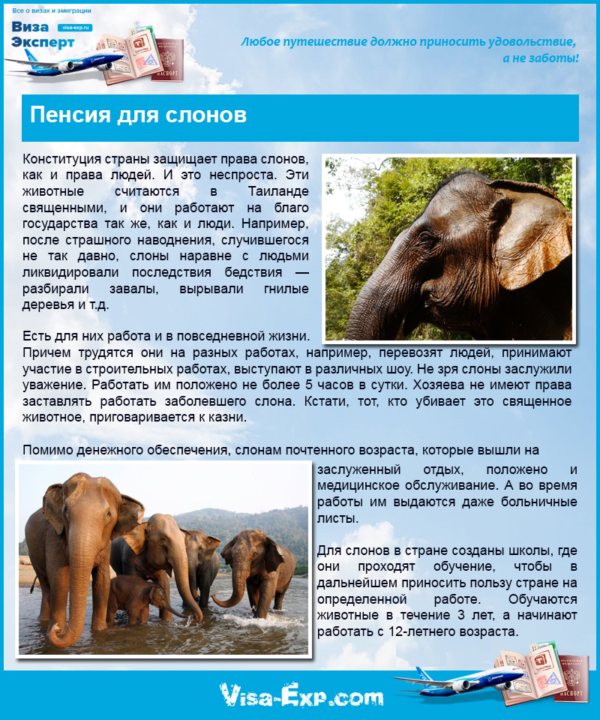

And this is due to the huge number of illegal companies. If ten million people work in official firms and employers make contributions for them, then for 20 million no one makes contributions at all. Well, as before, the luckiest people were state employees and officials... as well as elephants! Elephant rights are protected as much as human rights, so elephants can receive pensions after age 60. Elephants require a lot of food (a quintal per day), so 15 thousand baht is spent entirely on feeding the animal. Elephant owners cannot always count on the same support from the government.

Pension for elephants

Tanzania and other countries

Indeed, there are quite a few states on the list where it is more likely that there is a pension than not. Now it’s worth turning to the ranking of the best countries for older people - more precisely, to the anti-rating, where Tanzania ranks first as the country with the worst standard of living for retirees. There is no pension system here. A huge part of older people work until their last days to support themselves. This makes Tanzania one of the few countries where there are truly no pensions (as opposed to those where pensions are limited).

Also worthy of mention:

- Nigeria , where 5% of the elderly can count on government support. However, a small percentage of the population lives to old age - the country has a serious malaria epidemic and a high incidence of AIDS. The prices for medical care are very high, and therefore the mortality rate is higher than in many countries.

- Honduras , where only 4% of citizens over 60 years old count on financial support. The problems are still the same - high morbidity and low life expectancy. Financial problems make this country's pension system severely underdeveloped.

- Until recently, the number of countries without pensions also included Turkmenistan , but after the death of President Niyazov, a decent pension program was created in the country.

5 best and worst countries for retirees

But now let's consider the opposite question - where do old people have the best time?