When a person approaches old age, he begins to think about the size of his pension, as well as whether he can live on this amount or not. Therefore, even before this deadline, it is necessary to find out how pension payments are calculated, what components make up the final amount, and also how much you need to work to get a certain amount.

What determines the size of the pension?

What types of pensions are there and according to what regulatory laws are they calculated?

Many people cannot understand under what regulations a pension can be calculated. In Russia there are several legislative acts in force that regulate the issue of pension payment.

Today, the provisions of the Law “On Insurance Pensions” dated December 28, 2013 N 400-FZ are taken into account.

According to the law of 2013, pensions are calculated from the beginning of 2020. At the same time, when calculating for previous periods, the reference is to the law of 2001, which is no longer in force.

Excerpt from Article 1 of Federal Law No. 400

Currently, the concept of an insurance pension is increasingly used. If we talk about labor pensions, this concept has been used before. You can understand that now the insurance period is used, and the work experience is already somewhere in the past. Law number 400 allows you to take into account all the rules that were in force at the time of forming the length of service.

Therefore, the calculation usually uses data from several laws. An example is the situation: a woman studied at a technical school from 1972 to 1974, and after that she worked until 1979. From 1980 to 1982 she was on maternity leave, and after 2000 she worked. According to the rules of the Soviet Union, the period of training and maternity leave is counted as length of service, and work since 1992 will be taken into account according to Russian laws.

Note ! The main type of pension in our country is old-age insurance. At the same time, the calculation procedure also applies to insurance pensions for the loss of a breadwinner, as well as for disability. Only some coefficients will differ there.

The main type of pension in Russia is insurance

It may be noted that labor pensions, which were calculated before 2001, are paid as before. Other types of pensions, such as military, state and social, are calculated according to completely different rules. For example, social pensions can be determined by fixed amounts, and military pensions - as a certain percentage of monetary incentives. Therefore, it is necessary to consider all the rules by which pension payments are calculated for citizens who are now retiring.

There are also social and military pensions, which are calculated according to different rules.

Pension

There are two types of pension payments:

- Insurance pension. The amount of money in this case is related to the length of service.

- Social pension. A citizen receives it when he has not worked the required minimum years.

Insurance pension

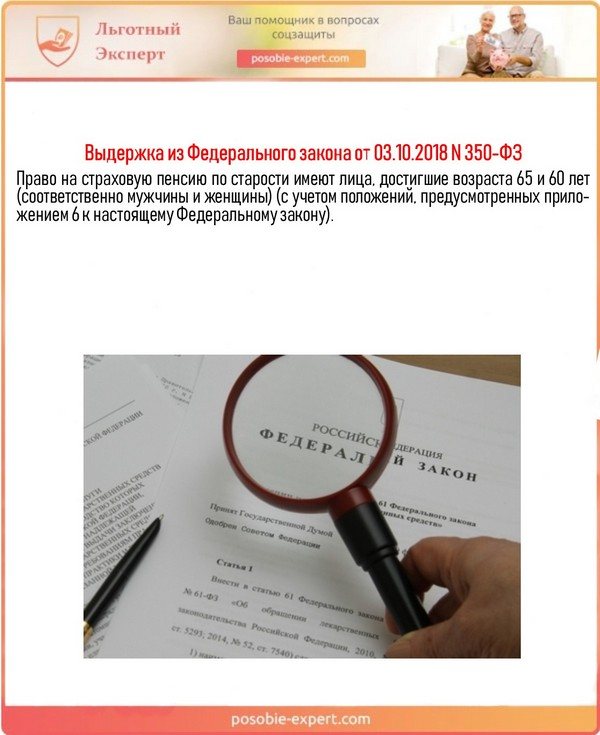

If a person is employed on an official basis, then in the future he will be able to receive insurance pension payments. Currently, women from 55 years of age and men from 60 years of age can receive a pension. Since 2019, the retirement age has increased (Federal Law “On Amendments to Certain Legislative Acts of the Russian Federation on the Appointment and Payment of Pensions” dated October 3, 2018 N 350-FZ)

Excerpt from Federal Law dated October 3, 2018 N 350-FZ

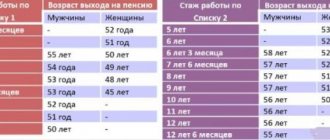

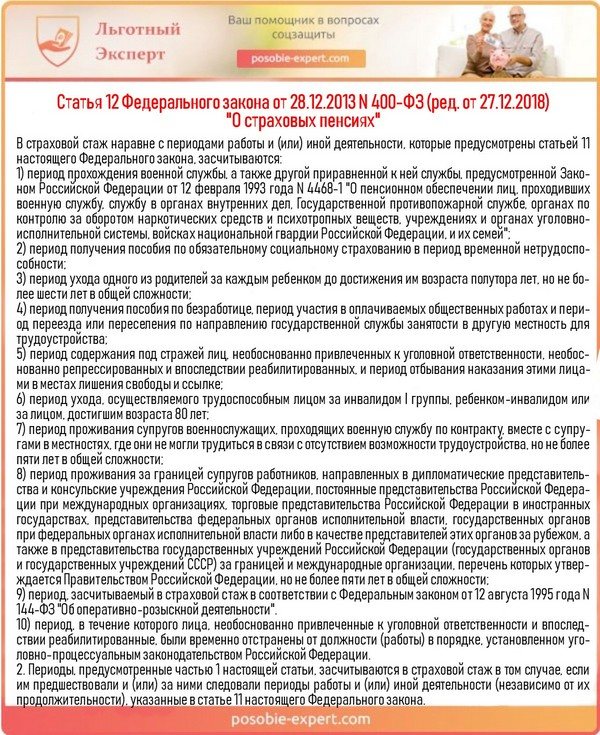

It is possible to take a well-deserved retirement ahead of the legal time if a citizen is fired due to layoffs, if he has 20 years of experience (for women) or 25 (for men). The amount of pension payments depends on the period worked by the person. This time can include time periods during which the employee could not perform his duties for a certain reason.

- Carrying a baby, caring for children. The period for each child is one and a half years, and the maximum permissible period of care is 6 years.

- Compulsory military service in the army, internal affairs bodies.

- Job search (applies to people registered with the Employment Service).

- Works that benefit society.

- Stay in places of deprivation of liberty (in case of undergoing rehabilitation).

- Caring for a disabled person of the first group, a disabled person from childhood, an elderly person (over 80 years old).

Important ! This is stated in Article 12 of the Federal Law of December 28, 2013 N 400-FZ (as amended on December 27, 2018) “On Insurance Pensions.”

Article 12 of the Federal Law of December 28, 2013 N 400-FZ (as amended on December 27, 2018) “On Insurance Pensions”

All these time periods are taken into account in the case when a person worked before or after them.

Note! Each socially significant non-work period involves receiving a given number of pension points. For example, a man served in the army for a year, which means he will receive 1.8 points. A year of caring for a child with a disability, a disabled person of the first group, or the first healthy child is assessed in the same way. After the birth of the second child, care for him is estimated at 3.6 points / year, and after the third it is already 5.4 points.

When calculating a pension, the number of pension points a citizen has must be taken into account.

Social pension

This type of pension payment is designed to protect the interests of citizens who are unable to obtain the minimum length of work experience due to health problems, life problems, and unofficial employment. The availability of a pension in the absence of minimum work experience is associated with a number of factors:

- Russian citizenship, permanent residence in the country for at least fifteen years.

- Completion of sixty years of age (women) and sixty-five (men), excluding citizens living in the Far North. Since the climate in this area is very harsh, the retirement age limit is also lowered by ten years.

If you have no work experience, your pension benefits will be very small. However, this issue is relevant for citizens who can receive money upon the loss of a breadwinner. Then the person receives both types of payments, if the second is not social, and is formalized:

- To the parents or wife of a soldier in the army who died during the fighting.

- To the families who survived the accident at the Chernobyl nuclear power plant.

- To the relatives of the deceased astronaut.

Article 5 of the Federal Law of December 15, 2001 N 166-FZ (as amended on December 27, 2018) “On state pension provision in the Russian Federation”

What is the average pension for Russia?

According to information provided by the Pension Fund, the average pension at the beginning of 2020 was 14,100 rubles. If we compare this with wages, then the amount is approximately 40% of the average wage in the country. In 2020, the average pension is 15,414 rubles. This is one thousand more than in 2020.

Note ! The average social pension is 9,215 rubles. For disabled children, the average pension is 12,432 rubles.

It should be noted that Russia throughout the post-Soviet space is considered one of the richest countries that provides for its pensioners. Competition comes only from the Baltic region, but the amount of payments is higher due to high utility costs.

The size of pensions may vary depending on the type and the reason for its assignment

But if we compare the situation with the 90s of the last century, then in this area there is an improvement in the general situation. In addition, the average pension is growing almost 2 times. This is also facilitated by an action such as indexing. It is held several times a year for different types of pensions.

Average monthly wage in the USSR by year

To determine the SSC, you need to divide the average monthly earnings of a pensioner by the average salary in the country for the same period of time. From 2001 to 2002, a single value was used - 1,495.5 rubles. Pension Fund employees use the following Soviet salaries when calculating pensions:

- 1980 – 174 rubles;

- 1981 - 178.30 rubles;

- 1982 – 184 rubles;

- 1983 – 188 rubles;

- 1984 - 193.20 rubles;

- 1985 - 199.20 rubles;

- 1986 – 206 rubles;

- 1987 – 214 rubles;

- 1988 – 233 rubles;

- 1989 – 263 rubles;

- 1990 – 303 rubles;

- since 1991 – determined separately for each region. This is due to the unstable economic situation in Russia as a whole until the 2000s.

What is the minimum age pension?

Having reached a certain age, every person must remember that he has a minimum pension amount. But what is he like?

In the legislation of our country today there is no concept of a minimum pension. The size depends on several factors. The minimum amount should not be lower than the subsistence level for pensioners. It is installed in each region separately. If the payment underestimates this amount, then additional social benefits are established for the pensioner. And then the pension will be “adjusted” to the cost of living.

Excerpt from Article 4 of Federal Law No. 134

Social supplement is established only when there is an application from a pensioner. If a person continues to work, then such payment does not exist. The minimum pension amount is increased only under certain circumstances:

- citizen is over 80 years old;

- there are several dependent relatives;

- indexation of insurance pension;

- pensioner goes to work.

Note ! To receive the minimum pension, you must have more than 15 years of work experience. But this is not the case for everyone. In this case, we will talk about the payment of a social pension.

At least 15 years of work experience is required to receive an insurance pension

What does the old age pension consist of?

According to Law No. 400-FZ, the old-age insurance pension is paid every month and consists of three main parts:

- Basic. The fixed payment (FP) is assigned to everyone without exception in the amount determined by law.

- Insurance. The amount depends on the number of pension points (PB) earned by a person during his working life.

- Cumulative. Assigned if the employee individually and/or the employer made contributions to finance a funded pension.

What is the maximum age pension?

There is currently no maximum size. This figure will depend on several circumstances.

- Amount of work experience.

- Wage.

- Contributions to the pension fund.

- Retirement age.

To understand this issue, it is necessary to refer to the law that regulates the payment of insurance pensions.

Article 8 of Federal Law No. 400

Since the beginning of this year, the retirement age has increased. Now women can retire only after 60 years, and men after 65. If a person retires later than this age, he receives an increase.

Note ! Everything will depend on the time the person spent at work when he was retired. The later you leave, the higher your monthly payment will be in the future.

What are pension points and how to calculate them

Retirement can be affected not only by salary, but also by length of service.

The number of points earned throughout life depends on the activity of work, as well as on the “transparency” of salaries.

Naturally, salary in envelopes will not affect your future pension in any way.

Thanks to a special formula, which is a fraction, you can calculate your pension, however, this is a very labor-intensive process. Not everyone can make the correct calculations.

The best option would be to use an online calculator to calculate pension points. Currently, there are a huge number of them on the Internet, which greatly facilitates calculations.

It's worth understanding the terminology.

- A fixed payment is a guaranteed amount for pensioners from the state, in some way a starting capital to which other payments will be added.

The bonus coefficient is a coefficient that motivates pensioners to retire as late as possible.

- IPC - this amount is proportional to the size of the salary and is calculated from it.

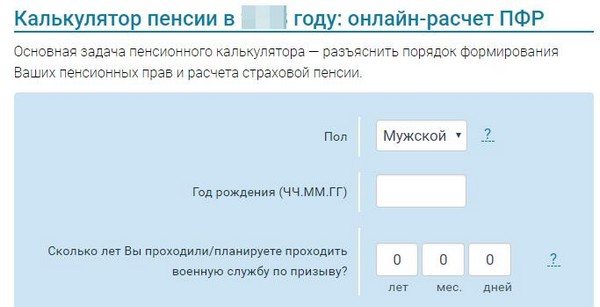

Pension calculator

Since 2013, a calculator has been posted on the website of the Ministry of Labor and the website of the Pension Fund, with which you can calculate future payments. But the exact size is not displayed there. A person can only predict the future amount of payments based on various indicators. When calculating, you will need to enter the salary, gender, if any, the length of military service and much more.

The calculator will give you the amount for today. In addition, it is based on a formula that was considered in the legislative act on insurance pensions and has been in force since 2020. It must be remembered that this formula contains an instrument that will reduce the size of the pension.

Note ! It is set depending on the situation in the country in the economic sphere, demographic and many others.

On the Pension Fund website you can roughly calculate the size of your future pension.

Video: There will be no pension without work experience?

You can learn in detail about the influence of length of service and other nuances on the registration of a pension from the following video, which also lists the main requirements for persons to apply for a pension: The pension is calculated on the basis of the insurance period, that is, the time during which the person contributed to the Pension Fund RF. Today, continuous and total length of service is not taken into account in calculations. In addition, by 2024, the minimum amount of insurance coverage required for retirement will reach 15 years.

How is a funded pension calculated?

How is 5% calculated?

In order to immediately receive the funded part of the pension, it is necessary that the funded payment be less than 5% of the total benefit. Otherwise, the payment will be set either urgent or indefinite. When the monthly accrual is calculated, the amount is divided by the planned payment period. It is 252 months in 2020.

What is the calculation formula?

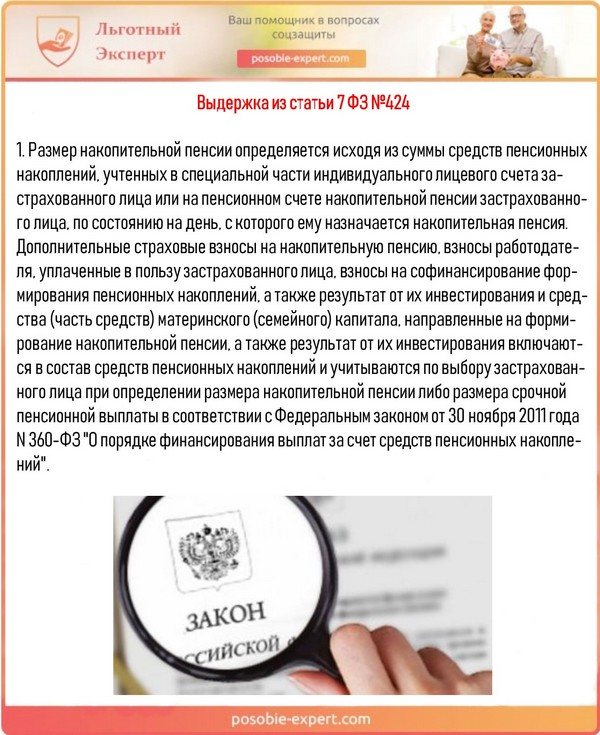

According to Article 7 of Law No. 424, urgent payment is available only to those persons who have formed their own savings due to the following factors:

- additional contributions that were paid either by the person himself or by the employer;

- making contributions for co-financing;

- maternity capital or any other income.

Excerpt from Article 7 of Federal Law No. 424

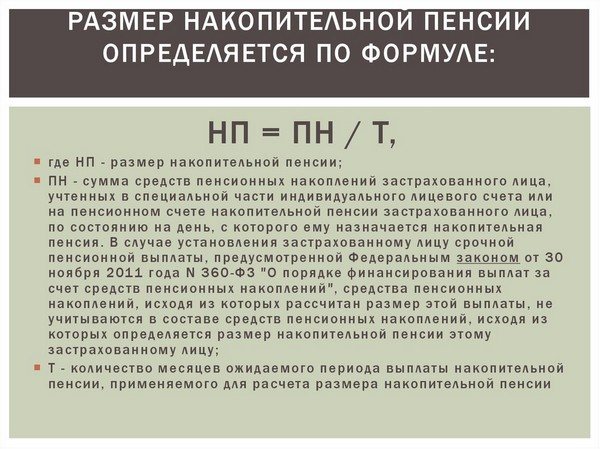

When an urgent payment is calculated, the amount of savings is divided by a certain planned period. This cannot be less than 10 years. In this case, the formula will look like this.

NP = PN / T,

Where:

NP – monthly payment amount;

PN – total amount of savings;

T – planned number of months for payments.

Every year on August 1, the amount of pension payments is adjusted depending on the amount of contributions that were not taken into account when determining the amount of savings.

You can use the calculator below to calculate your payouts conveniently and accurately.

Go to calculations

The size of the funded pension is calculated according to a certain formula

Example

When citizen Anton Igorevich Mikhailov retired, he began to receive a payment of 7,900 rubles. The amount of savings at this time amounted to a total of 280 thousand rubles.

If an indefinite payment is established, then the amount of monthly income will be: 280000/252 = 1138.21 rubles.

If we take into account the insurance pension, then the amount of income will be: 7900 + 1138.21 = 9038.21 rubles.

You can calculate what part of the funded pension is taken into account in the total: 1138.21/9038.21=12%. If we consider this value, then the figure is more than the required 5%. It is not possible to receive a lump sum payment under any circumstances.

But if you wish, you can reduce the period to 10 years. Then the monthly payment will be as follows:

280000/120=2333.33 rubles. Citizen Mikhailov will be able to receive exactly this amount every month for 10 years.

You can receive parts of your funded pension for 252 months, or you can receive parts for 120 months.

How is a lump sum payment of a funded pension calculated?

If a lump sum payment occurs, then the person receives the entire amount at one time and in full. But this only applies in some cases. Among the people who may receive additional payment are:

- persons whose accumulative component is less than 5% of the total number of payments;

- persons who are assigned a payment as a result of the loss of a breadwinner, but there are no grounds for assigning an insurance pension;

- persons who act as heirs of the deceased with whom the account was opened.

In some cases, a funded pension can be received at one time

Note ! Those persons who have already received this type of payment can count on re-accrual only after a period of 5 years.

What can you get besides pension payments?

Pensioners are considered a vulnerable group of citizens because they, as a rule, do not carry out work activities. In rare cases, they may work in retirement. That is why they can expect to receive other additional benefits and benefits. In this case, the following category of deviations can be noted:

- exemption from property tax;

- no pension tax;

- It is possible to receive a property deduction if real estate was purchased within 3 years after retirement.

Pensioners have certain benefits

If we talk about healthcare, there are the following concessions.

- All pensioners can be insured for free.

- You have the right to receive free assistance.

- If a person receives an old-age or disability pension, then some prescription medications are sold at a 50% discount.

In addition, there is compensation for payment for housing and communal services. If the pensioner is low-income, then it is possible to receive a subsidy for utility bills. In some regions, it is possible to receive reimbursement for housing costs.

In addition, pensioners are also provided with discounts on public transport. But everything will depend on the legislation of the region.

Benefits may vary by region

Note ! To summarize all of the above, citizens can receive additional benefits in addition to pensions.

How many points can you earn with a salary of 36,000 rubles and 37 years of experience?

First, you need to calculate how many pension contributions were transferred from such a salary for the year: 36,000 × 12 months = 432,000 rubles.

The total amount of contributions at the 22% tariff: 432,000 × 22% = 95,040. Of which, for the insurance pension - 16% (69,120 rubles), for the solidarity part of 6% - 25,920 rubles. To convert this amount into pension points, you need to divide it into contributions, which are transferred to the pension from the maximum annual salary set by the state for the year each year. In 2020 it is 876,000 rubles. Now 876,000×16%=140,160 rubles. Next 69,120: 140,160 rubles = 0.4931. The resulting result must be multiplied by 8.26 (the maximum annual score in 2020). 0.4931×8.26= 4.073 points. This is how many points a person earned in 2020 with a salary of 36,000 per month.

From these calculations we can conclude that the higher the salary, the higher the pension. If the employer has not made full contributions for his employee to the compulsory pension insurance system, then this earnings do not participate in the formation of the pension.

When do payments occur?

The payment period is based only on official statistics depending on the life expectancy of pensioners. A special method is used for calculation

For 2020, the period was 252 months. But there is a note here. Citizens who hold state and municipal positions have the right to determine the period using a different method. It is based on the expected payment period, which will be reduced by the number of full months from the date of reaching the age for which the period is specifically established on a general basis for civil servants. All this can be read in the law No. 400 and in Appendix 5 to this law.

In 2020, the expected pension payment period is 252 months, and it increases annually

Note ! If you apply later, the pension amount will increase. This is due to the fact that for each full year that has passed since the date of acquisition of the right to assign a funded pension, the mark increases. But, the expected payment period cannot be less than 168 months. This amounts to 14 years. It is currently possible to postpone the assignment of a pension, but only for no more than 6 years.

Example of calculating a funded pension

In January 2020, Kalinkina M.N. turned 55 years old. She contacted the Pension Fund and wanted to transfer her savings into a pension. The amount of insurance premiums that had been collected by this time amounted to 840,000 rubles. The expected payment period is 240 months, and her monthly payment will be 3,500 rubles.

Fixed payment

The amount is determined by government decree and is subject to review annually from February 1. The growth rate is taken as the inflation rate at the end of the previous year. The government has the right to revise the size of the pension fund again from April 1, subject to the availability of funds in the Pension Fund (PFR).

When retirement is delayed, a correction factor (PC) is used to the PV. The size of the PC depends on the number of years worked after retirement.

For 2020, the size of the PV is 4,892.90 rubles.

For certain categories of applicants it is set at an increased rate, for example:

- 9,965.80 rub. – for persons over 80 years of age;

- RUB 11,626.77 – for disabled people of group 1 who have 1 dependent.

Pensions at present

Many people now have a huge number of questions about the pension reform, which began to take effect not so long ago. It should provide for the recalculation of the value in points, as well as an increase in length of service for the correct calculation of the amount.

When calculating a pension, the number of pension points is taken into account

Pensioners should only be reassured by the fact that all those people who managed to retire before 2020 will not violate any of their pension rights. They will have the same strength. Now it will be beneficial for citizens to receive a net salary without envelopes, because its size in the future directly affects the size of the pension.

The new legislation also includes such a concept as the annual pension coefficient. It will mean how the person worked throughout the year. The coefficient can be calculated as the ratio of the amount that is paid by the employer to the amount that can be paid from the maximum amount multiplied by the maximum value of the coefficient.

Among the advantages, it can be noted that the length of service, which is taken into account when assigning pension contributions, also includes maternity leave, which is 4.5 years. Moreover, it is not necessarily counted towards the mother, but specifically to the person who was officially on maternity leave.

The pension, as before, will remain in the form of two parts. It will be insurance and savings. Insurance will be calculated according to the law of the same name, and savings according to law number 424, which came into force in 2020.

The pension consists of two parts – insurance and funded

Note ! If you look closely at all the changes made to the pension reform, as well as changes in legislation, you can see that the state is taking the country out of the period of paying low pensions. Among the evidence for this is indexation, which is carried out 2 times a year. There may also be various recalculations for pensioners and much more.

But it is under no circumstances possible to provide an unambiguous conclusion that everything is fine in this type of activity. It is necessary for the new reform to take root and only then look at any positive changes.

Which earnings to choose for calculating your pension?

It is approximately possible to calculate whether the Soviet salary will be beneficial for calculating pension benefits. First, you need to visit the territorial office of the Pension Fund of the Russian Federation and find out the value of the coefficient. If for the period from 2001 to 2002 it already has a maximum value, there is no point in turning to Soviet earnings for a pensioner.

- Pharyngitis - symptoms and treatment in adults

- How to clean and disinfect an apartment

- Semolina cream for cake - step-by-step recipes for making it at home with photos

Provided that the value is not entirely profitable, since it does not reach the limiting value, it is important to present a certificate of salary for the Soviet era.

Based on data on average wages in the USSR, it is possible to determine what minimum one needed to receive at that time and choose the optimal, more profitable 60-month period in terms of earnings. To do this, you need to multiply the amount of earnings by 1.2 (northerners use the corresponding indicator established for them):

- 1980 - 209 rubles;

- 1981 – 214 rubles;

- 1982 – 221 rubles;

- 1983 – 226 rubles;

- 1984 – 232 rubles;

- 1985 – 240 rubles;

- 1986 – 248 rubles;

- 1987 – 258 rubles;

- 1988 – 280 rubles;

- 1989 – 315 rubles;

- 1990 – 364 rub.

If the limit coefficient does not reach the maximum

The Constitutional Court of the Russian Federation ruled that the rights of citizens who earned a pension during Soviet times cannot deteriorate regardless of changes in legislation. For this reason, a person has the right to demand a recalculation of pension benefits for work during the Soviet era.

The Soviet salary must be officially confirmed to calculate the pension. It is better to prepare in advance and provide information to the Pension Fund before the appointment of the insurance pension, so as not to have to recalculate it later.

To obtain a certificate of earnings, a citizen needs to contact the enterprise where he previously worked.

If the organization is liquidated, the application is written to the archives. You can find out the exact address and departmental affiliation of the archival organization directly from the Pension Fund of Russia. You can also obtain a certificate by contacting the Multifunctional Center (MFC) or filling out a special application on the Rosarkhiv website. Services are provided free of charge.

What will happen to pension growth this year?

In 2020, we can observe several pension increases that were planned at the state level in advance. This is why people will be able to increase their income level.

In 2020, insurance pensions were indexed by 7%

From January 1, there was an increase in the insurance pension for those pensioners who do not work. The increase was slightly more than 7%. It should be noted that this figure is almost 2 times higher than inflation in the country. Thus, the average size will increase by about 1000 rubles. But as Minister of Labor and Social Protection Maxim Topilin previously noted, this does not mean that each pensioner will have an additional payment of 1,000 rubles. This indicator is average, which means that it will vary within certain limits for everyone. For some, the increase will be a large part of the amount, for others it will be less.

The size will depend on the salary that the citizen received when he worked. In addition, the period of work activity will also be taken into account here. However, the pension amount increases to an average of 15,400 rubles.

In addition, residents of rural areas will receive an additional increase in pension payments. It will be 25% of the amount that is established. In 2020, it amounted to 5,334 rubles. If we do a recalculation, then every villager who is retired will receive an increase of 1300-1400 rubles. It is received by those citizens who have worked for more than 30 years in agriculture and are currently pensioners. In addition, they must still live in rural areas. If a person moves to live in the city or continues to work, then in no case will he be given an increase. According to preliminary calculations of the pension fund, about 950,000 citizens may receive an increase. There is no need to apply for it, because it is credited automatically.

Retired rural residents who have worked for more than 30 years in the agricultural sector receive a 25% bonus

In addition, in the new year, namely from April 1, social pensions or other various pension accruals will increase. They are expected to increase by almost 2.5 percent. But this figure is not final. It depends precisely on how much the cost of living increases over the year. But this information will be provided by the statistical department a little later. If it coincides with the forecast of 2.4%, then the pension amount will be 9,200 rubles.

Note ! It should also be noted that pensions for working citizens will increase from August 1. The mark of the increase will depend on how many contributions were made at the expense of pensioners. But in any case, it cannot be less than 3 points. One point is equal to 87.24 rubles. The maximum increase can grow to 262 rubles.

Pension largely depends on the cost of living

Northern experience

Citizens living in the Far North, taking into account the recently adopted law, have the right to retire upon reaching the age of 55 for women and 60 for men. For this, both the first and second need 15-20 years of accumulated experience. The insurance year in the northern regions is 9 months.

For example:

- A resident of the Republic of Sakha (Yakutia) is planning to retire upon reaching 55.5 years of age. In fact, she worked for 30 years and was on maternity leave twice. Her IPC, taking into account maternity leave, is 90 points. Using the above formula in the calculation, we get a pension of 14,038.25.

What to consider?

The law on calculating insurance pensions applies specifically to those people who receive payments depending on their age. If we talk about disability or survivor pensions, then additional coefficients are used. The total amount will be much less. To make the calculations simpler, increasing coefficients for those people who decide not to retire early are not taken into account here.

If there is a deferment for a year, the payment will increase by 5.6%. If a person left 2 years later, then by 12%, and if 3 years later, then by 19%. Over 10 years, the figure reaches 111%.

Disability and survivor pensions are calculated differently

Note ! The cost of a point for a year with a deferment will increase by 7%, for 2 years - by 15%, and if for 3 - then by 24%. Over 10 years, the figure reaches 132%.

Those people who are planning to retire in the coming years can use some tips.

- Collect all certificates from any place of work up to 2002. At that time, there was still an accounting system in place for each person separately. You need to collect certificates in order to confirm your fact of work. We must not forget about the documents that will indicate a change in the name of the enterprise or organization.

- When there were periods of study that could be included in the experience, then you need to collect all the supporting documents. These may be educational documents or entries in the work book. In addition, there is also a certain list of additional documents.

It is recommended to prepare all documents for timely and correct registration of pension

- If you receive a salary certificate for 5 years before 2002, then you need to select those periods where the income mark was the highest.

- Before carrying out the procedure, it is better to contact the Pension Fund. This can be done 9 months before retirement. This may require an additional list of documents, the collection of which may take some time.

- An application for a pension can be submitted one month before retirement age.

If we consider all the current provisions, then the main thing should be noted: you must be officially employed at any time, and also pay insurance contributions to the Pension Fund. Without such contributions, there will be no pension points, which means that you will not be able to receive an insurance pension in any way.

We calculate the IPC for each stage

For each period of time, the IPC is calculated differently. The first period lasts until 2002, the second covers 2002-2014, and the third begins after 01/01/2015.

Period until 2002

It is heterogeneous, the following parameters matter here.

- Duration of Soviet work experience (until 1991);

- Number of years worked before 2002;

- Amount of earnings.

The Pension Fund of the Russian Federation does not have complete information about the labor activities of citizens before 2002.

Therefore, potential pensioners often have to defend their rights in court, providing documents obtained from the archives and ensuring that the years worked are counted as length of service. It is at this stage that active citizens achieve significant success in increasing their pension security. It also matters how successfully, or rather, how competently the options for calculating earnings are chosen. Everything that was taken into account is collected, the pension is calculated in rubles, and the final figure is converted into pension points (IPC), acting according to a specially prescribed algorithm.

Period 2002-2014

Starting from 01/01/2002, the Pension Fund of the Russian Federation has all the information about the labor activities of citizens. The pension capital is formed from the amount of contributions, and the length of service itself (the amount of time worked) does not play a role at this stage. Unless it is a permit - it should be enough to receive an insurance pension.

This fragment is calculated in rubles and then converted into IPC pension points.

IPC after 01/01/2015 and for other periods

From this moment, Federal Law-400 begins to work, and the pension capital, again, depends only on the amount of contributions to the Pension Fund. The very method of calculating pension points is changing again; the “annual IPC” coefficient is calculated using a new formula, taking into account changes in key parameters.

When forming accruals for non-insurance periods (SPnst), activities that have social significance are taken into account. This includes caring for children and the disabled, military service, and so on. For such work, pension points are awarded; the accrual method is regulated by Federal Law No. 400, Article 15, Clause 12.

Final calculation

After the necessary calculations have been made for all periods, the final IPC is formed. And then it’s easy to calculate the pension:

- the number of points (IPC) is multiplied by their value (SPK), plus a fixed payment (FP).

The SPK and PV values are selected those that correspond to the year of retirement. For example, when applying for a pension in 2020, its size will be calculated according to the formula:

Pension 2020 = IPC x 93 rubles. + 5,686.25 rub.

This is how a typical old-age insurance pension is calculated for an ordinary citizen who does not have benefits. If they exist, then specific calculation features are applied.

The funded part of the pension is taken into account separately for those who formed it through special contributions. It will be added to the insurance, or the pensioner will receive it in another way.