NPF "Captain" was founded in 1994 thanks to the efforts of several major founders of St. Petersburg. The development of the Internet segment made it possible to present to clients the official website of NPF Captain. Until recently, the fund worked in the field of public security and non-profit organizations, until the Central Bank revoked the relevant license.

Information about NPF Captain

The main task of the fund was to provide additional pensions to the citizens of our country. According to information from the official website, pension reserves reached 520 million rubles, and the number of clients was approximately 23 thousand people.

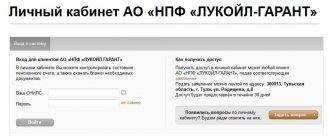

The main page of the organization's official website has a navigation menu on the left side and links to a pension calculator and glossary on the right side. All the necessary information on the menu sections is located in the center.

2014 was marked by the merger with the NPF “Zhilkomfond”, which served to increase the number of investors (primarily enterprises in the housing and communal services industry). In 2020, the company was reorganized into the joint stock company NPF Captain.

Information on payments to former clients of NPF Captain – DomashnyYurist

NPF For detailed advice, call +7 (800) 775-65-18.

Calls within Russia are free Become our client Question #1 What should I do if I later want to transfer to another non-state pension fund? You will just need to sign an agreement with any NPF or management company (management company) of your choice, and from the next year following the year in which you signed the agreement, your pension savings will be transferred to the NPF or management company of your choice. Question #2 What assets will JSC NPF Federation invest my pension savings in? Our main goal is to protect your money from inflation, without putting your savings at risk and without freezing them in illiquid assets. For this, investments in highly liquid bonds, payments on which are tied to inflation or related to an inflation indicator (Central Bank of the Russian Federation rates, interbank market rates, etc.).

Non-state pension fund Captain

NPF "Captain" was founded in 1994 thanks to the efforts of several major founders of St. Petersburg. The development of the Internet segment made it possible to present to clients the official website of NPF Captain. Until recently, the fund worked in the field of public security and non-profit organizations, until the Central Bank revoked the relevant license.

NPFs in liquidation

Three months after the liquidation of the fund, the balance for payments of non-state pensions is determined, says Smirnova from Personal Advisor. It is established by the temporary administration of the fund, consisting of representatives of the Central Bank and the DIA, based on a comparison of the assets and liabilities of the NPF.

If funds are available, they will be paid to the client. Otherwise, no, says Okolesnov. Guarantee system In order to work with the funded part of pensions in the future, NPFs must join the pension guarantee system by mid-2020.

Funds must submit applications to join it before the beginning of 2016.

The fund's total obligations for the payment of assigned lifelong non-state pensions and funds from pension reserves, in relation to all fund participants who have been assigned a lifelong non-state pension, are subject to transfer to another non-state pension fund, determined by the liquidator through competitive selection, to fulfill these obligations, taking into account the arrears of payment pensions formed on the date of cancellation of the fund’s license.

Captain pension fund reliability rating

Despite the trust of the population (a considerable number of clients!), the organization in question is not a participant in the rating by Expert RA.

The national rating agency also does not provide information about the level of reliability of the company. For many, this question is quite significant, since investing in an unnoticed (from a rating point of view) fund seems like a risky proposition.

Liquidation of NPF Captain

In February last year, the court decided to liquidate the pension fund, placing an obligation on the founders to carry out the process. Six months later, official information about the liquidation of the organization appeared on the website.

After this, creditors (in essence, clients) received the right to present their claims and receive funds accumulated as a result of participation in one of the company’s programs into their accounts. Moreover, there was no need to leave a written statement at the head office.

According to the data available in the system, each client was automatically included in the register of creditors and received a corresponding notification.

Information on payments to former clients of NPF captain

News Pensions The Central Bank announced the cancellation of the license of the NPF "Captain" The Central Bank announced the cancellation of the license of the NPF "Captain" The Bank of Russia, by order of October 27, canceled the license to carry out pension provision and pension insurance activities from the non-state pension fund "Captain". The corresponding message was published on the regulator’s website. As explained, “the basis for the application of extreme measures of influence were violations of the requirements of the Federal Law of May 7, 1998 No. 75-FZ “On Non-State Pension Funds” in terms of repeated violations during the year of the requirements for the dissemination, provision or disclosure of information provided for by federal laws and normative legal acts of the Russian Federation adopted in accordance with them.”

JSC NPF Captain - profitability rating and customer reviews

Important This means that we select investment objects impartially, and the main goal of NPF Federation JSC is to earn maximum income for clients, and not to finance the owners’ projects. c) The Fund is ready to disclose detailed reports on the structure of its investments and transactions with them.

Only a small part of non-state pension funds in the Russian Federation discloses such information. And we hope that there will be one more difference - that your money is invested in our fund. All questions and answers May 22, 2020 JSC NPF “FEDERATION” informs that 14.05.

2018 The Bank of Russia decided to register changes to the Insurance Rules of the Joint Stock Company “Non-State Pension Fund “FEDERATION” ... Attention Read in full May 29, 2017 JSC NPF “FEDERATION” announces a change in the address of servicing the Fund’s clients in the city.

Moscow and addresses for sending postal correspondence. New address for personal appeal to the Foundation and directions...

NPF captain

- Will the assigned non-state pension be paid? Payment of the lifetime non-state pension will continue in another non-state pension fund. In order to determine the amount of the Fund's obligations to pay the lifetime non-state pension, the bankruptcy trustee (liquidator) engages an actuary. The Fund's obligations to pay assigned lifelong non-state pensions and funds from pension reserves are subject to transfer to another non-state pension fund to fulfill these obligations (payment of the assigned pension). Payment of a fixed-term non-state pension will be terminated. The Fund's obligations to pay a non-state pension for the period specified in the pension agreement are calculated by competitive manager (liquidator) and are subject to payment to the participant (legal successor) in the form of a redemption amount.

Pension system

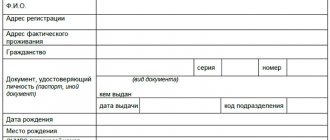

- How can a representative of an individual creditor file a claim? If the claim is submitted on behalf of the creditor - an individual by his representative under a power of attorney, the claim is signed by the representative of the creditor. In this case, the request must be accompanied by a power of attorney from a representative of the creditor - an individual, certified by a notary, or a notarized copy thereof.

- Can a successor in title receive funds due to a creditor? Yes maybe. To do this, you need to replace information about the creditor in the register of claims of creditors of the Fund.

Review of JSC "NPF "Federation" (JSC "NPF "Captain")

- How can I find out which funds have had their license to carry out pension provision and pension insurance activities (license) revoked? Information about the decision to revoke the fund’s license is posted on the official website of the Central Bank of the Russian Federation (Bank of Russia) www.cbr.ru no later than the next business day after the day of its adoption.

- What is a temporary administration, when and for how long is it appointed? The temporary administration of a fund means a special temporary fund management body appointed by the Bank of Russia, no later than the business day following the day of the decision to cancel the fund’s license with the suspension or termination of the powers of the fund’s executive bodies. The activities of the temporary administration are terminated from the date of approval by the arbitration court of the bankruptcy trustee (liquidator) of the fund.

What to do if your NPF’s license has been revoked

- How will funds be paid to creditors? Settlements with the Fund's creditors, individuals and legal entities, are made in non-cash form in the currency of the Russian Federation, according to the bank account details provided by the creditors.

- How are the claims of creditors recorded in the register satisfied? Claims of creditors declared after two months from the date of publication of information about the Fund’s bankruptcy (forced liquidation), and therefore recorded in the register, are satisfied at the expense of the property remaining after satisfaction of the claims of the Fund’s creditors, declared within the prescribed period and included in the appropriate queue of the register.

The Central Bank announced the cancellation of the license of NPF “Captain”

Under non-state pension agreements, the fund's obligations to investors and participants will be fulfilled at the expense of pension reserves by paying or transferring redemption amounts to another fund (with the exception of accrued obligations to pay a lifetime non-state pension). These redemption amounts are calculated based on information available to the fund, based on pension agreements and fund rules.

The determination of the fund to which the obligations are transferred is carried out by the bankruptcy trustee (liquidator) on a competitive basis.

Questions and answers

- In what order and priority are creditors' claims satisfied? Settlements with the Fund's creditors are made in the order of priority established by Federal Law No. 127-FZ dated October 26, 2002 “On Insolvency (Bankruptcy)” (hereinafter referred to as the Bankruptcy Law), based on information entered in the register of creditors’ claims at the expense of: 1) funds pension savings of the Fund; 2) funds from the Fund’s pension reserves; 3) the Fund’s own funds (property intended to ensure the statutory activities of the Fund); (bankruptcy estate). In the event that pension savings (reserves) are insufficient to satisfy the claims of creditors to be satisfied at the expense of pension savings (reserves), the claims of such creditors are subject to satisfaction at the expense of the bankruptcy estate, in the manner prescribed by the Bankruptcy Law.

Fonda; in the absence of documents confirming the authority of the person making the demand; failure to provide documents substantiating the claim; impossibility of establishing the amount of the claim, the bankruptcy trustee (liquidator) submits an objection to the arbitration court within the framework of the case of bankruptcy of the Fund (forced liquidation), in relation to the stated claim of the creditor. The claim is considered established in the composition, amount and priority declared by the creditor in the absence of objections filed by the bankruptcy managers to a creditor's claim. Objections to creditors' claims may be submitted to the arbitration court by a bankruptcy trustee (liquidator), a representative of the founders (participants) of the Fund or a representative of the owner of the Fund's property, as well as by creditors whose claims are included in the register of stated creditor claims.

In connection with the cancellation of the license, the Bank of Russia appointed a temporary administration to the NPF “Captain”.

From the data of the Unified State Register of Legal Entities it follows that the legal entity with the main state registration number (OGRN) 1037811011150 (NPF “Captain”) indicated in the message of the Central Bank (NPF “Captain”) is the legal predecessor of JSC “NPF “Captain”.

The page of the first organization states that “the legal entity is in the process of reorganization in the form of a spin-off.” According to the Unified State Register of Legal Entities, NPF Captain JSC, which has a different OGRN, was registered on November 6, 2020 in St. Petersburg at the same address as its legal predecessor.

At the beginning of the summer of this year, NPF Kapitan JSC was included in the system of guaranteeing the rights of insured persons. In May, the capital bank “Derzhava” became the key owner of NPF “Captain” JSC, and remains so at the moment.

Source: https://pbcns.ru/svedeniya-o-vyplatah-byvshim-klientam-npf-kapitan/

Contact Information

In connection with the events outlined above, clients had questions or even objections, with which they were given the opportunity to contact the head office: St. Petersburg, Revolution Highway, 84. For a personal visit, a preliminary appointment was required by calling +7 ( 812) 363-19-70.

A little later, the reception of citizens at the central office was suspended. If creditors did not have time to submit claims, then they were given the opportunity to send them by mail: Moscow, st. Tverskaya, 7, post office box 95, Volkova V.A. The latter was appointed liquidator, so the main issues passed through this person.