Long years of the commonwealth of the Union republics within the USSR left an indelible mark on the business and partnership relations between them. A striking example is the agreement signed in 1994, which gives the right to citizens of other countries not only to migrate to Russian territory, but also to receive guaranteed pensions. To receive a pension in 2020, migrants must, as a matter of priority, obtain Russian citizenship or a residence permit. And only under such conditions will the pension legislation of the Russian Federation apply to them.

Is she supposed to?

Yes, it does. In accordance with the “Agreement on Guarantees of Citizens’ Rights in the Field of Pensions” dated March 13, 1992, a citizen who has received Russian citizenship (including under the resettlement program) receives pension payments in the amount established in the country of emigration .

For example, if a person received a pension in Ukraine in the amount of 5,000 hryvnia, upon receiving Russian citizenship he will receive the same amount in rubles. Moreover, according to the law “On Labor Pensions in the Russian Federation”, foreign citizens residing permanently in the Russian Federation also have the right to a labor pension - in the same manner as citizens of the Russian Federation.

Are pensions retained for Russians emigrating from the country?

Russian citizens leaving for permanent residence retain the right to receive a pension. From 2020, the procedure for obtaining it has been changed. Before leaving the country, you must decide on the form of receiving your pension and submit a corresponding application to the Pension Fund of the Russian Federation.

Now the old-age insurance pension is paid only in Russia. It can be received by authorized persons or transferred to the account of a credit institution operating in the country. Find out what her size is for 2020 and how to calculate it.

Citizens traveling outside the country can receive a pension 6 months in advance. For such advance payments they need to write an application to the Pension Fund. Every year, every citizen living outside the country must confirm the fact that he is alive to the pension fund. It can be drawn up with special papers from a notary.

The absence of such documents automatically terminates pension accruals. To resume accruals, the pensioner will have to personally contact the Pension Fund with a corresponding application.

More about the documentary component

First of all, in order to restore payments, a migrant needs to apply for a temporary residence permit , and then go through the procedure for accepting Russian citizenship, if this has not been done previously. If the immigrant has already received Russian citizenship, you can move on to the next point.

In accordance with Order of the Ministry of Labor No. 958n dated November 28, 2014, the following documents are required to re-register a pension:

- Passport of a citizen of the Russian Federation, if the procedure for changing citizenship has been completed.

- Labor book of the Russian Federation.

- Application for a pension.

You can fill out and send it on the official website of the Russian Pension Fund through the option “Personal Account of a Citizen” (https://es.pfrf.ru); it can also be transferred to the territorial body of the Russian Pension Fund at the place of residence, place of stay or place of actual residence of the citizen. The service for accepting applications is available, including at multifunctional centers (MFCs), as well as by mail to the territorial body of the Pension Fund of Russia.It is allowed to submit an application not only personally by the pensioner, but also by a representative of the citizen to whom the pension is assigned, as well as through the employer.

- Certificate of income for any 60 months before January 1, 2002. To do this, you need to contact the organization where the citizen worked and receive a certificate, certified by seals and signed by the manager, as well as the chief accountant of the organization.

- Salary certificate from each place of work, indicating the payment of insurance premiums in national currency for submission to the Pension Fund.

Important! It is highly advisable to notify the accounting department about the purposes for which the certificates are taken. In this case, they can correct the standard salary certificate so that, for example, the certificate states not “Pension Fund”, but “Pension Fund of the Republic of Ukraine”.Also, the accounting department will indicate in places where records of monetary amounts are found, the currency unit - for example, the hryvnia. This will simplify the bureaucratic process.

If the organization in which the work was carried out no longer exists, it is necessary to obtain the relevant documents in the archives from the authorities in the country of emigration.

- You will need a certificate from the country of emigration stating that pension payments have been stopped there. You can obtain it from the authorities of the country of emigration.

- SNILS, as well as an extract from the personal account in the OPS system.

- Pension matter.

Please note that providing a pension file is not mandatory, but it helps if for some reason the case materials do not contain information about the type of pension and the date of termination of its payment. This information can also be confirmed by a certificate from the pension authority at your previous place of residence.Also, having a pension file may be necessary to provide authentic documents on work experience and earnings - if they comply with the requirements of Russian legislation. To summarize, it is best to have this document with you.

In accordance with the current Labor Code of February 1, 2002, the main document confirming that an employee has work experience is a work book . It is worth noting that the Labor Code does not oblige the provision of this document, but it is listed as “the main document on the employee’s work activity and seniority.”

Moreover, from the point of view of data on labor activity, the work book lost its significance simultaneously with the introduction of personalized accounting in the state pension insurance system.

Personalized accounting contains more detailed and detailed information about the employee’s length of service, places of work, etc. However, the Pension Fund still requires the provision of an original work book.

And it is based on the entries in the work book that the final decision on the amount of the pension is made, because the book contains data on ordinary and “harmful” service recognized by the Pension Fund. The easiest way for a migrant who has already obtained Russian citizenship .

This is not prohibited by law; moreover, work books are also sold in those stationery stores whose existence is closely connected with the state (Rospechat). However, under no circumstances should you fill out the document yourself. A citizen may make mistakes, and this will significantly complicate the process of both obtaining a work record book and re-issuing a pension.

The migrant needs to buy a work permit, take documents with him and report to the Pension Fund . The title page is filled out on the spot (full name, education, date of birth, etc.), the rest is filled out in accordance with the declared certificates from former jobs, as well as in accordance with the no longer valid national work book.

Our experts have prepared many interesting and useful articles on participation in the resettlement program for compatriots. Among them there are publications on the following topics:

- What documents must be submitted to participate in the resettlement program for compatriots?

- What payments are due to immigrants in the Russian Federation under the State Program and how to apply for receiving the money?

- How to get on the waiting list and complete documents for participation in the resettlement program?

- How to correctly fill out an application for participation in the state resettlement program?

- How to choose a region for the resettlement program for compatriots?

- What is a certificate of participation in the state program for the resettlement of compatriots?

What to do if you don’t have the necessary documents to apply for a pension?

The status and registration of a Russian citizen is confirmed by a passport with a mark of registration at the place of residence. If you do not have a place of residence, you must provide a certificate of registration at your place of residence. If there is neither registration at permanent residence nor registration at the place of stay, then a citizen of the Russian Federation can apply without them, indicating the address of actual residence in the application.

ATO is a symbol of the anti-terrorist operation carried out by the current Ukrainian government in certain areas of the Donetsk and Lugansk regions, which have currently declared themselves independent republics: the DPR and the LPR.

If there is a mark in this document about registration at the place of residence on the territory of the Russian Federation, the pension authority will be able, if necessary, to make an additional payment of the pension for 6 months ago from the month of registration at the place of residence on the territory of the Russian Federation. This is necessary, for example, if the pension payment was stopped in Ukraine or Kazakhstan many months ago.

Women with five or more children, as well as those who worked in hazardous industries, the list of which is approved by the Government of the country, can apply for a reduction in the retirement age.

Where and how to submit papers to resume payments?

So, how can you apply for a pension benefit in rubles?

- First, you need to collect all the documents necessary for re-registration; they are listed in the list above. If any important documents were not attached to the application, the applicant will be given an explanation as to what additional documents need to be brought, as well as the maximum period for their provision - no later than three months from submitting the application.

At the same time, the applicant is given a notice with a detailed list of documents attached to the application, documents, the obligation to submit which is assigned to the applicant within the specified period, as well as other files at the disposal of authorized bodies other than the Pension Fund.The last point is relevant if the files were requested by the territorial body of the Pension Fund of Russia; the applicant has the right to submit or not submit them to the application, that is, the procedure occurs on the applicant’s own initiative.

- Notify the Pension Fund of the country of emigration about the change of place of residence and the need to stop payments. Obtain a certificate confirming the termination of payments in the country of emigration.

- Next, you need to send the application along with all the necessary documents to the territorial body of the Pension Fund, in person, by mail or through a representative; It is also possible to submit an application to the MFC or submit it through an electronic account. All the options listed above are equivalent: the terms of consideration, payments, etc. do not depend on where the pensioner applied to if the application was submitted to the authorities (see the beginning of the paragraph).

- If the package of documents is drawn up correctly, and the situation of the migrant is taken into account (whether Russian citizenship has been issued or a residence permit has not been issued), the review process begins. It lasts 10 days, and if the application is approved, the start date of pension payment is considered to be the day on which the application was submitted.

Attention! If the answer is negative, the authorities will request the missing documents; in this case, the period for consideration of the application may be suspended for no more than three months.Please also note that filing an application is possible no earlier than a month before retirement age. This is relevant for citizens who are on the threshold of retirement age.

Documents for registration of pensions for migrants

Pensions for migrants are assigned on the basis of bilateral agreements between the CIS countries or in accordance with federal laws.

This is necessary, for example, if the pension payment was stopped in Ukraine or Kazakhstan many months ago.

The pension authority will evaluate this fact on the basis of a set of documents, taking into account their comprehensive and objective consideration. A request for the pension file of a citizen who previously received a pension in the territory of the CIS state is carried out by a specialist from the Pension Fund of the Russian Federation, for which the pensioner should contact the Office for an appointment.

To apply for a pension, people with disabilities must undergo a medical and social examination in Russia.

Nuances

It is important to remember that not all displaced persons have the right to receive a pension. Payments are possible only if two conditions are met:

- The citizen has at least 9 years of insurance experience;

- age if the citizen is a man at least 60 years old and 55 years old for women.

All pensions in Russia can be divided into the following groups: insurance (in the Soviet Union it was called labor), state. provision of pensioners, non-state pension.

- In accordance with Federal Law No. 400 of December 28, 2013, Art. 8, citizens who have crossed the retirement age threshold and have the required length of service (for 2020, at least 9 years) can apply for an old-age pension.

- According to Federal Law No. 400, Art. 10, a survivor's pension is issued to those citizens who provide supporting documents to the state.

- A disability pension is issued to those displaced persons who have repeatedly undergone the ITU certification procedure in the Russian Federation. It establishes whether a citizen has lost their ability to work, and also indicates its degree (in accordance with Federal Law No. 400, Article 9).

- Those citizens who have received so-called “harmful” work experience in production have the right to a long-service pension. If the length of service is included in the list of ETKS of the Russian Federation, the citizen receives the right to payments based on length of service (Federal Law No. 400, Article 30).

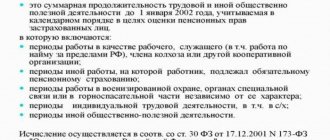

Calculation and recalculation of pensions occurs in accordance with the citizen’s length of service , IPC (i.e., individual pension coefficient, depending on the amount of contributions to the Pension Fund) and the value of the pension point.

Any payment received by a citizen from the Pension Fund includes two components:

- fixed payment according to the norms of Article 16 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”;

- insurance payment calculated in accordance with Article 15 of Federal Law No. 400.

For 2020, the state has established the following fixed payment amount: 4982 rubles. 90 kopecks . At the same time, the cost of 1 pension coefficient is 81.49 rubles, payments also depend on this. Calculations are made in the Pension Fund itself using formulas taking into account the IPC, pension coefficients and length of service; if the immigrant’s pension was issued in the country of emigration in the national currency, it will be recalculated into Russian rubles according to the official exchange rate.

Reference! IDPs receive pensions in the same manner as citizens of the Russian Federation. The only exception is the re-registration procedure.

If, for example, all required documents have not been provided to the Pension Fund, the process is extended for a period of no more than three months. The migrant will receive a pension only after complete re-registration: verification of documents, decision on making payments, etc. We remind you that the day the pension payment begins is considered the day the application is submitted.

Why, when moving for permanent residence to another country, it will not be possible to withdraw pension benefits?

First. If we are talking about the funded part of the pension, which is deducted specifically from the employee’s salary, then this is his property, and there are no problems with receiving it. You can even inherit it. But these deductions are very small, only 4% of earnings. And this norm was introduced quite recently. In addition, its action has been suspended for today. So, everyone literally has pennies lying around there.

Second. Contributions to the Pension Fund from the income of employers . The sums here are large, but this is not the property of the workers. Accordingly, this money will not be given to any of them. Employers pay them to the Pension Fund for the right to create jobs, and the Pension Fund receives them and transfers them into ownership to existing pensioners.

Social benefits for residents of Kazakhstan

To receive any payments, persons arriving in the Russian Federation from the Republic of Kazakhstan must confirm:

- fact of legal border crossing;

- legal stay in the Russian Federation;

- availability of grounds for receiving social benefits.

Participants in the State Resettlement Program must obtain the appropriate certificate. All other candidates will have to obtain a residence permit, on the basis of which they will have equal rights to Russian citizens in most matters, including receiving a pension.

Payments such as maternity capital for migrants from Kazakhstan will become available only after they receive citizenship. This is due to the fact that one of the requirements for participation in the program is Russian citizenship.

Pension savings in the EAEU when citizens move will remain in the country of former residence

“And they, naturally, did not go to pensions. Therefore, experts from the Russian Federation and the Belarusian side insist that upon reaching retirement age, the state of residence, a state that has certain savings, will export these payments monthly,” she explained the mechanism for transferring the contributions accumulated by the depositor when moving to another EAEU state.

“The draft agreement is already being discussed at the expert level, and it provides for the export of pensions both from Russia to Kazakhstan and from Kazakhstan to Russia, and exactly the same relationship with Belarus. In this case, both the Russian side and the Belarusian side insist that payments be made monthly. That is, let’s say, if this agreement is adopted, then we will already consider the issue of exporting (pension payments - Author),” she explained.

How to get pension savings if you are leaving for permanent residence

Many former Kazakh citizens who recently changed their citizenship and left for another country are now unable to receive their pension savings. This is due to the fact that citizens did not properly comply with the exit procedure, reports a YK-news.kz correspondent.

— If you go through the procedure for changing citizenship correctly, then the state database of individuals will indicate that the person has permission to travel for permanent residence outside of Kazakhstan. Therefore, you must first contact the migration police of our country and go through the exit procedure, and then go to Russia and obtain citizenship. In this case, you will be able to easily receive your pension savings,” says Dmitry Bogomolov, director of the East Kazakhstan regional branch of UAPF JSC.

Other types of support

It would not be superfluous to note that the Russian state’s assistance to forced migrants does not end there. Among the types of assistance, we highlight the main ones:

- The right to education - children of migrants and refugees have the opportunity to enter kindergartens and secondary educational institutions of both state and municipal property on a free basis. Moreover, they can become students of vocational institutions within the established quotas. As for higher education, they do not receive any privileges when enrolling, although they can also study on a budget if all formalities and requirements are met.

- A one-time payment upon receipt of a resettlement certificate.

- The right to work and to.

- Housing for displaced people is usually temporary and most often presented in the form of dormitories or specially created camps.

We recommend that you understand in more detail what exactly a family can expect from the host state in terms of support and support.

How to receive the funded part of your pension early in 2020

Persons not younger than 1966 It is not possible to choose the option of providing a pension. If a person refuses to form a funded pension option, all savings received will go to the use of one of the managers (NPF or Pension Fund). They will be paid in full when the person applies for a pension. The insured have the right to manage their savings and choose who to trust to manage them.

Hello! I am a military pensioner. After being transferred to the reserve, from 2009 to 2014, he worked officially in civilian organizations (with the payment of insurance contributions by employers - “civilian experience” - 4 years 3 months and 2 days, IPC - 31.505). According to the Pension Fund of Russia, my individual personal account has accumulated the Nth amount of funds. Can I receive this amount after reaching the age of 60? If “no,” then why. If “yes” - then how. Thanks for the answer

16 Jul 2020 uristland 257

Share this post

- Related Posts

- Judicial practice of collecting alimony in a fixed amount of money

- What the bailiffs cannot arrest

- Can Husband's Property Be Confiscated for Wife's Debts?

- What will happen in the near future with retirement