Even though older people are very skeptical about changing their permanent address, sometimes they do move. In this case, it does not matter at all what the reason for the change in dislocation was associated with. The main thing is that in such situations a lot of new problems and questions related to them arise. One of them: “How to transfer a pension when changing place of residence?” We will tell you more about it in this article.

How and where to contact: a brief action plan

When staying outside your usual abode, you must first figure out where you should go due to your recent move. So, first of all, you need to go to the territorial office of the Pension Fund, located at the actual place of residence of the pensioner. Here you need to write a statement indicating the reason for the application - “change of residential address.” We will tell you more about the rules for filling out the form below.

Where can I get the application form?

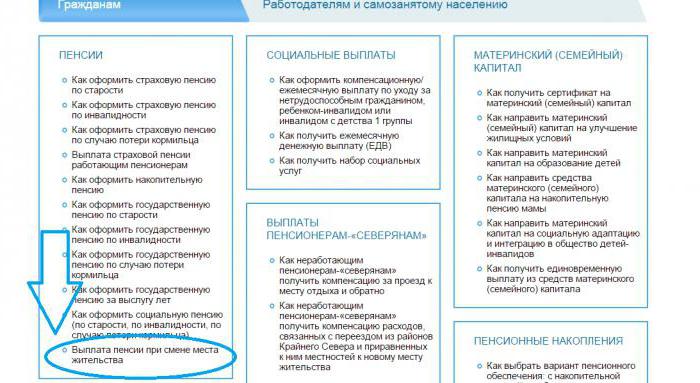

As we have already said, payment of a pension when changing place of residence to a new residence address is possible only when writing an application to request a pension or payment file. This application form can be obtained directly from the Pension Fund representative office or on the official website.

To do this, go to the main page of the government agency, go to the very bottom and follow the link “Life situations”. Next, pay attention to the first column on the left. It's called "Pensions". Scroll down and click on the glowing link “Payment of pensions when changing place of residence” (located at the very end of the column). Then you should do the following:

- click on the “Where to contact” link that opens in a new window;

- select “Application form for requesting a pension file”;

- to your computer;

- print the form and fill it out.

We will talk further about how the pension is paid when changing place of residence.

Conclusion

The Pension Fund is interested in reducing the size of the pension, as this allows it to reduce costs, so citizens themselves need to take measures aimed at equitably assigning pensions. If possible, it is advisable for each pensioner to study the information contained in his personal pension file. This will allow you to identify errors and eliminate violations made during the pension calculation process. Thanks to this, many citizens will be able to increase the size of their pension.

With the topic Leakage of a person's personal data, everyone is at risk

can be found at the link More details>>>

With the topic Taxes for rich and poor, why does the state divide citizens?

can be found at the link More details>>>

With the topic How to legally pay less for a loan

can be found at the link More details>>>

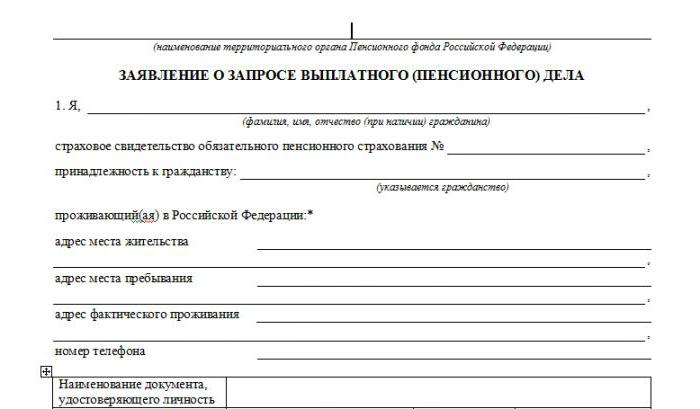

What information should I include on the form?

On the form you receive, you must first enter the name of the territorial body of the Pension Fund of the Russian Federation. The following data is indicated below:

- Full name of the pensioner;

- number of the insurance certificate of compulsory pension insurance;

- citizenship;

- address of the place of residence;

- address of place of residence (indicated if there is official registration at the new place of residence);

- address of actual location (indicated if the place of residence and stay does not coincide);

- contact phone number;

- passport details;

- floor;

- conducting current activities (working, not working);

- contact information about the guardian or proxy (if any);

- documents confirming the powers of the guardian or principal (if necessary).

After this, you must indicate the reason for the application (a request for the issuance of a pension file), the address of the previous place of residence (at which the pension was previously paid) and the actual location. Next, select the type of pension, indicate the terms of the previous payment and the method of receipt convenient for you (by courier, by mail). All this must be specified as accurately as possible so as not to violate the entire procedure for transferring pensions when changing place of residence.

Legal regulation

The main document that explains all issues of assignment, payment and receipt of an insurance pension is Federal Law No. 400-FZ (December 28, 2013). Additional attention should be paid to the following regulatory and legislative acts:

- Law No. 166-FZ (12/15/2001) “On state pension provision in the Russian Federation.”

- Government Decree No. 249 (03/18/2015) “On approval of the Rules for establishing and paying an increase in the fixed payment to the insurance pension for persons living in the Far North and equivalent areas.”

- Letters from the Ministry of Labor explaining certain aspects of the appointment of the northern pension.

Further actions and deadlines

After receiving an application from a pensioner, representatives of the government agency will be required to make a corresponding request to the Pension Fund from which he previously received his pension. According to PF employees, the entire procedure for sending the form takes no more than one business day. In turn, the required pension file will be transferred upon request within three days (from the date of receipt of the application).

After receiving the case, the Pension Fund department, as a rule, gives an order to register the pensioner at the new place of residence. According to experts, the entire procedure for registering and making a decision on extending pension payments takes no more than two working days.

Additional benefits and advantages

If we talk about any significant advantages, here they lie precisely in the northernmost pension . And this is even despite the fact that it is assigned in an amount that directly depends on the regional coefficient where the pensioner lives. However, there are also other benefits for those citizens who were able to earn northern experience.

For example, having northern experience allows its holder to apply for the title of “Veteran of Labor” before the age required for this award.

If in a specific region where work was carried out it is permissible to claim the title of “Veteran of Labor”, then this benefit will also apply to the work experience itself, which must be achieved to achieve this title.

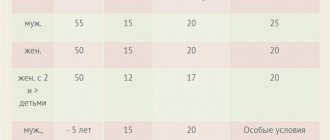

In addition, according to the current legislation of the Russian Federation, citizens who worked in the Far North have the right to early retirement. To qualify for an old-age insurance pension, you must have work experience :

- not less than 15 years for the territory of the Far North;

- or at least 20 years of work in a territory that is equivalent to the Far North.

If you have such experience, retirement will be 5 years earlier than the required age.

An old-age insurance pension is assigned early to women who have given birth to two or more children, who have reached the age of 50, if they have an insurance record of at least 20 years and have worked for at least 12 calendar years in the Far North or at least 17 calendar years in equivalent areas.

In addition, special attention should be paid to another benefit - the possibility of receiving a housing subsidy. This opportunity can only be used by that category of persons who are recognized as being in dire need of improving their living conditions. In addition to this condition, it is also necessary to have a work experience in the Far North of 15 years, and up to January 1992 inclusive.

It is also necessary to take into account the fact that commercial institutions themselves have every right to provide additional benefits and guarantees for those citizens who have northern work experience.

It is worth noting that today the personnel issue in the Far North region is difficult to resolve by self-government bodies, and for this reason, many commercial organizations in those regions strive to provide as many benefits as possible so as not to experience a shortage of personnel.

Each region of our country provides its own regional benefits for citizens who have northern experience, so it is recommended to find out about their availability in the territorial departments of the Pension Fund.

How to get a pension when changing your place of residence: tips

Before you start registering your pension at your new place of residence, you should pay attention to some details. Firstly, before moving, it makes sense to find out the full name of your previous pension fund (you will need it when writing your application). Secondly, find out the exact address of your moving location, taking into account the post office zip code. This will allow you to avoid possible misunderstandings when filling out the application.

And finally, when applying to the new PF branch, take your passport and pension certificate with you. If you plan to receive your pension through a proxy, you must take care of drawing up a power of attorney in advance. If you do everything correctly, you will receive a timely payment of your pension when you change your place of residence (we described the procedure above).

How to transfer a pension when traveling abroad?

Don’t know how to transfer your pension when changing your place of residence when traveling abroad? This can be fixed. Let's start with a couple of useful tips. So, before leaving (but no later than a month in advance), you need to come to the fund’s branch, write a corresponding application and submit the following documents:

- Russian passport;

- pensioner's ID;

- original certificate of change of residence indicating the exact address abroad (issued by a consul or embassy);

- original work certificate (if any).

Transfer of pension payments

A move may be accompanied not only by a change in the region of residence within the country, but also by a change of state. That is why there are several options for transferring Pension Fund payments to a specific person.

The procedure for transferring pension payments within Russia

This option has a simplified re-registration scheme. It is also possible to choose a delivery method.

Ways to receive pension payments

Today there are the following ways to receive pension payments:

- through the post office. This method involves assigning a specific citizen to a specific post office. To do this, when submitting an application, you must indicate the exact address of the intended place of receipt of money. It should be taken into account that delivery is made strictly on the allotted days for a given area or city, if missed, it is possible to receive a pension before the end of the payment period established in the region. Usually this is the 23rd-25th of every month. If this period is missed for some reason, then the money will be provided in full next month on time;

- through the bank. The most acceptable method of pension delivery. There are two options. The first and more familiar for senior citizens is to receive money from a teller at the cash desk of a branch of the selected bank. The second, more convenient option, is transferring pension accruals to a card. In this case, there is no need to receive cash, since most stores have the ability to pay for purchases by card. If you need to have cash, you can withdraw it from ATMs that operate 24 hours a day. Typically, pensioners are provided with cards from the MIR payment system;

Pensioners are provided with cards of the MIR payment system

- through a special organization. The Pension Fund of the Russian Federation concludes a special agreement with some institutions for the delivery of cash payments to citizens of retirement age. This method is convenient for those citizens who, due to their age, find it difficult to go outside. An employee of such an organization brings his pension home. The disadvantage is that it is tied to the date of receipt.

To transfer a pension within Russia, it is proposed to perform the following actions:

1 step. You should contact the Pension Fund office at your new place of residence. You must have the following documents with you:

- passport with registration at the new place of residence;

- pension accrual document;

- SNILS;

- an application in which a request is made to forward the pensioner’s personal payment file.

To transfer a pension within Russia, you should contact the Pension Fund branch

The appeal can be initiated by the citizen himself by submitting the paper to the Pension Fund office. A pensioner can also use the services of the Russian Post or transfer documents electronically using the State Services portal. In most cities, it is possible to send documents to the Pension Fund through one of the MFC branches closest to the place of new residence.

Step 2. Then, within 1 day, the request is sent to the previous address of the pension file. After another 3 days, the case is sent to the new location. As a result, registration occurs within 2 days.

Important! If the place of registration differs from the place of actual residence, then within the country the law allows payments of pension money to the address where the citizen is actually located.

Video - How to transfer a pension to another city due to relocation

Procedure for transfer from abroad

An option is possible when a person of retirement age from the CIS countries comes to Russia for permanent residence. In this case, if Russia has signed a corresponding agreement with a state that is part of the CIS, and if all supporting documents are available, it is entitled to payments. The pension is paid regardless of the presence or absence of Russian citizenship. It is only important to have a completed and not expired residence permit.

When a pensioner moves from the CIS countries, in order to receive a pension it is important to have a document - a residence permit

Important! A person who has documents in a foreign language, when submitting them for registration, will need to have a Russian translation, as well as undergo legalization of papers in accordance with the Hague Convention. This can be done in two ways: consular legalization or affixing a special “apostille” stamp.

Procedure for transfer abroad

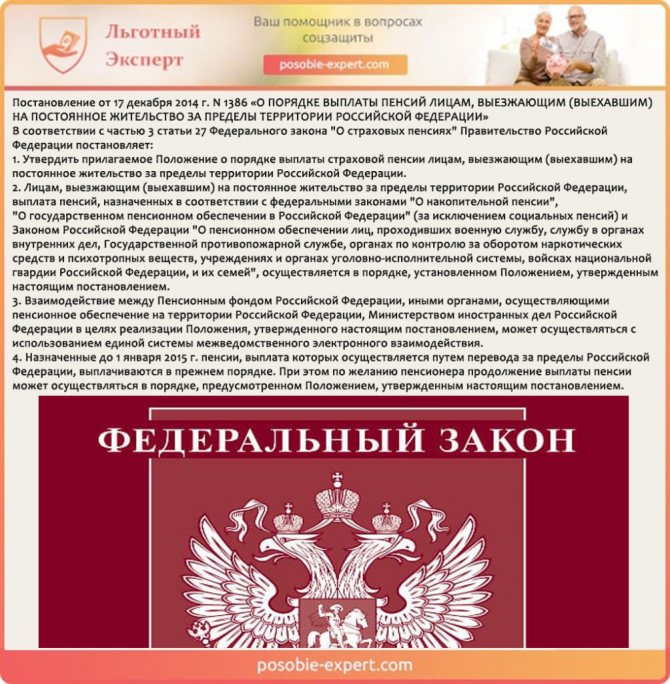

More than 128 countries list various types of pensions earned by Russian citizens. The procedure for such operations is determined by law (Government Decree No. 1386 of 12/17/2014).

An important difference between the formalization of the transfer of state old-age accruals abroad and the same procedure within the country is the annual confirmation of the fact of life of a particular citizen. Such a document is issued at the Russian consulate, which is located in the new country of residence. When sending to the Pension Fund of Russia, this certificate must first be notarized.

Decree of the Government of the Russian Federation dated December 17, 2014 N 1386 “On the procedure for paying pensions to persons leaving for permanent residence outside the territory of the Russian Federation”

Important! When changing citizenship, pension payments are not due, since the Pension Fund of the Russian Federation provides cash benefits only to citizens of the country.

To transfer payments abroad you will need the following documents:

- passport;

- a document from the consulate indicating the new address and departure date;

- SNILS;

- an application indicating all the basic personal information of the departing citizen;

- a certificate confirming the presence or absence of work activity abroad for the person who has left;

- certificate on the pensioner’s payment file;

- an act of appearing at the consulate in person.

| Type of document for transferring pension payments abroad | completed form | |

| Application for changing personal data | ||

| Application to request a payment case | ||

| Certificate confirming permanent residence outside the Russian Federation | ||

| Certificate of performance (non-performance) by a citizen of paid work outside the Russian Federation | ||

| An act of personal appearance of a citizen (his legal representative) in order to continue payment of a pension during the relevant period |

For persons who received a pension before 2020, the money will be sent to their new address abroad. After 2020, the money is transferred through a Russian representative to the pensioner’s bank account. If for citizens who are entitled to PFR payments, within Russia they are accrued only to bank cards of the MIR payment system, then for those abroad the pension is transferred to Visa or MasterCard cards.

For persons who received a pension before 2020, money will be sent to their new residence address abroad on Visa or MasterCard cards

Important! Pension accruals are not indexed while continuing to work. For non-working persons, the recount occurs annually from January 1.

Some people, when moving abroad, prefer to give up a Russian pension, since receiving it may reduce the amount of social assistance provided to foreigners in a given state. If after some time a citizen living abroad changes his decision, he can always apply for the renewal of pension accruals.

How to receive a pension while living abroad?

If everything is clear with submitting documents and informing the Pension Fund, then it is not at all clear how to receive a pension when changing place of residence when moving abroad. According to PF employees, the personal presence of the pensioner is not at all necessary to receive a pension.

It is enough to open an account in one of the Russian banks or give the appropriate powers to your authorized representative. However, in such a situation, you should provide the PF with the contact and passport details of a third party in advance. And, of course, he must have a document signed by a notary giving him the right to receive your pension.

Does the payment amount change?

The pension amount is reduced when moving in the following cases:

- if a citizen of retirement age left the Far North for another region of the country;

- returning to Russia from another country;

- the pensioner moves to a region where a lower regional coefficient applies.

The pension may increase if the pensioner moved to a region with a higher regional coefficient, for example, to Moscow or St. Petersburg. An important condition is the presence of permanent registration.

In other cases, the pension remains unchanged, for example, the pension of former military personnel.

If you lived in the territory of another state and returned to Russia?

There are cases when native Russians leave the country for some reason and return after some time. How then is the pension calculated? In this situation, payments are credited after the pension file of the country of the previous place of residence is finally closed. To do this, you also need to write an application and wait for the closed pension file to be transferred to the new destination address. However, to calculate a pension, you must have Russian citizenship or a residence permit confirming the fact that the pensioner lives in the Russian Federation. This is all about how to transfer your pension when changing your place of residence from one country to another.

Transfer to a new military pension address

In accordance with Federal Law No. 4468-1 of February 12, 1993, a military pensioner when moving is obliged to do the following:

- Contact the military commissariat at the new address.

You may also be wondering how military pensions are calculated.

- Fill out the application in the prescribed form.

- Provide a complete package of documentation, namely:

- passport details;

- military ID;

- employment history;

- SNILS;

- pensioner's ID;

- other documents required by a specific region.

The pension is assigned from the 1st day of the next month, after submitting an application with a list of documentation.

Look at the incidents from the lives of our citizens!

The procedure for transferring pension payments when moving to a new region is not complicated. The problem is different - almost every pensioner is afraid of losing part of their pension. In order not to make mistakes with actions, every pensioner should carefully study all the nuances on this issue, which are enshrined in this article.

Can I change my pension provider?

Once you move, you have the perfect opportunity to change your pension provider (if for some reason you are not happy with it). To do this, you need to go to the branch of your Pension Fund and write an application. It should indicate the reason for switching to another supplier and detail its contacts. If you do not want to make such a statement personally, just go to the Pension Fund website and do this through your personal account (if you have already previously registered).

Now you know how to transfer your pension when changing your place of residence. In short, follow our advice and you will definitely not miss your next pension payments.

Advantages of registration in the capital for pensioners

To receive an increased pension under Moscow registration, a citizen must live under it for at least 10 years. Therefore, it will not be possible to register temporarily in Moscow and immediately receive an allowance. The Pension Fund strictly monitors this and makes no concessions.

The amount of payments is calculated based on the amount established in Russia according to the subsistence level. And since it is formed depending on the region, the question “Does registration affect pension?” The answer can be unequivocally positive.

Of course, there are many other factors in determining benefits, such as length of service and salary, but if a citizen lives in the capital, he receives full support from the state.

Pension amount in Moscow

Moscow pensioners, in addition to the benefits introduced in all territories of Russia, are provided with an allowance, since the price level in the capital is much higher than in other regions.

For citizens living in the Moscow region, such bonuses have been revised. Now the difference in pensions in Moscow and the Moscow region is about two thousand rubles.