Is it necessary to transfer pensions when changing place of residence?

For people of retirement age, the circumstance associated with the timely payment of pensions and other social benefits is important. Many of them are wondering about the need to notify the Pension Fund about the move. Let's look at these nuances in more detail.

- When changing place of residence within the same locality. If the move is limited to one locality, the pensioner will continue to receive his pension in full. In addition, he can count on all the required indexations, increases and social benefits associated with his status. However, it should be taken into account that if a personal visit to the Pension Fund is necessary, he will need to contact the department where his payment file is kept, that is, at his old address. Therefore, if the locality is quite large and has, say, a regional division, then it is still advisable to notify the Pension Fund when moving within it.

- When changing your place of residence within the country. When moving from one region to another, citizens who receive a pension must notify the territorial bodies of the Pension Fund about this. This is due to the fact that different regions of the federation have different social allowances. Thus, moving may entail a change in the amount of material support, both up and down. If the Pension Fund discovers an “overpayment”, it will oblige the pensioner to return the funds he received in excess. In practice this happens in

- When moving outside the country. If a Russian pensioner decides to move to another state for permanent residence, then he can count on receiving the pension he has earned, even while living abroad. However, in this case, he is deprived of the rights to all required social allowances and benefits. When emigrating, the pension fund will be notified after the fact. In addition, to continue payments, the pensioner must provide current information about himself to the Pension Fund once a year. This can be done either by mailing the relevant certificate or by appearing at a Russian consular office abroad. This information, in fact, is necessary to confirm that the pensioner is alive.

Features of calculating the northern pension

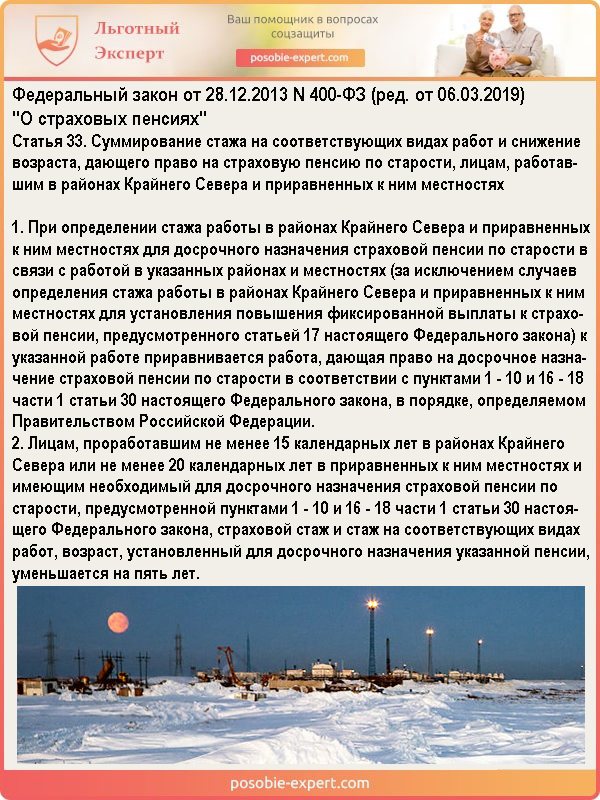

Residents of the Far North can receive two types of benefits at once. Law 33-FZ establishes the possibility of early retirement in old age. Article 17 No. 400-FZ approves an increase in the insurance share of the pension.

Important! Having northern experience allows you to receive the title “Veteran of Labor” ahead of schedule, taking into account additional multipliers and coefficients.

Features of calculating the northern pension

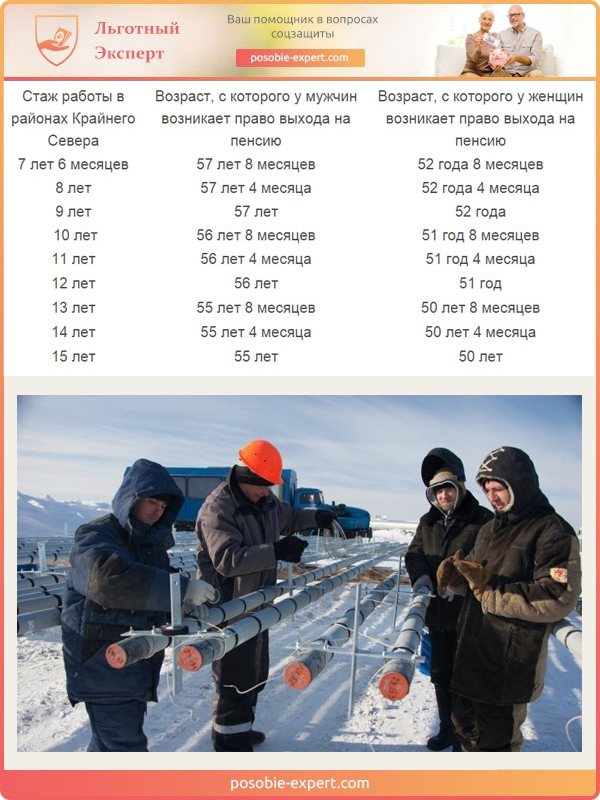

“Northerners” have the right to retire at age 55 for men and age 50 for women. In order to start receiving payments, a man must have at least 15 years of experience in the Far North or 20 years in equivalent areas.

For women, the list of opportunities to retire early is somewhat broader:

- the birth of two or more children;

- exceeding 20 years of total insurance experience;

- having at least 12 years of northern experience or 17 years in equivalent conditions.

For fishermen, hunters and reindeer herders, the age limit is shifted another 5 years lower (50 men, 45 women), while the length of service must be at least 25 (20) years.

In addition, for residents of the North, the insurance portion of their pension is increased by a special coefficient. The amount of the supplement is set by the federal government, and to receive it you must live in the region.

Federal Law N 400-FZ. Article 33

Northern experience

The basis for increased payments to northern pensioners is the northern length of service. This type of length of service is accrued according to a special scheme, and in case of sufficient accumulation, it gives the pensioner various benefits and advantages.

Important! According to 400-FZ, persons who have worked for 15 years in the Far North and have 25 years of insurance experience (20 years for women) are entitled to an increase in the fixed part of payments by 50 percent. For regions equated to the KS, at least 20 years of work will be required, and the increase in payments will be 30 percent.

The basis for increased payments to northern pensioners is the northern length of service

The minimum unit of calculation is the calendar month. In the northern work experience, unlike the usual one, periods of unemployment with registration at the employment center, child care for up to one and a half years, and part-time work are not taken into account.

Also, the following periods will be deducted from the term, which would be counted for regular length of service:

- refresher courses;

- study leave;

- leave to care for a disabled person;

- other types of vacation at your own expense.

For men, military service time is taken into account. This will not provide any particular advantage for conscripts, but professional military personnel will be able to receive a significant increase in their pension.

Conditions of retirement

To confirm the period of work in the Far North before registering a SNILS identifier, a citizen can provide a work book, a concluded contract, certificates, salary slips and other archival documents. In this case, the decision to confirm the length of service or refuse the request is made by the Pension Fund. After receiving SNILS, it is enough to provide the card number - all information on work is entered into the database automatically.

How to transfer pension

So, it has been determined that when changing place of residence, it is necessary to transfer the pension. Next we will talk about the features of translation when moving exclusively within the country.

When changing place of residence, a pensioner is required to contact the pension fund with a corresponding application.

It can be submitted in the following forms:

- By personal contact. Documents must be submitted to the fund branch located at the new place of residence.

- Through the multifunctional center. MFCs also accept documents related to pension provision. However, the processing time for papers sent through the multifunctional center is longer than when applying directly to the pension fund office.

- Through the Internet. The fastest and most convenient way to apply for a transfer is to use the opportunities provided by the State Services portal. In addition, it is permissible to send an electronic document through your personal account on the official website of the state pension fund.

Important! To be able to send applications to the Pension Fund in electronic form, you must have a registered and verified account on the State Services portal.

In addition, when moving, the pensioner must decide on the method of delivering funds to him.

Let us remind you that today you can receive a pension:

- Through Russian Post branches. Remains the most popular. The money is delivered to the pensioner in cash to their home or issued directly at the post office.

- To a bank card. The money comes directly from the pension fund to the social card. You can use it to pay for purchases in stores, pay for utility bills, etc. If necessary, cash is withdrawn from the card at an ATM.

Since 2020, payments of pensions, social benefits and other payments from the state are made only to plastic cards of the MIR system. However, if a pensioner already uses a card from another payment system, then he can continue to receive money on it until the “plastic” expires.

Criteria for assigning a pension in 2020

Cash support from the state is divided into 2 types. For each, categories of people who can qualify for benefits are defined.

Social pension is assigned:

- people who have reached retirement age and do not have the required amount of insurance coverage or are unemployed;

- disabled people with no work experience and disabled children;

- minors whose parents are unknown;

- children from orphanages immediately after birth;

- foreigners and stateless people who have lived in the Russian Federation for more than 15 years and have reached old age;

- children without one or both parents (payments are made until adulthood);

- young citizens 18-23 years old in case of loss of a breadwinner, if they are undergoing full-time education.

The insurance pension is guaranteed:

- those who have reached retirement age and have the necessary insurance coverage;

- disabled citizens (disabled persons) with insurance coverage;

- children due to loss of means of subsistence due to the death of the breadwinner.

Interesting article: Do I need to change the STS when changing my registration in 2020?

Citizens who meet the following criteria are able to apply for old-age benefits:

- reached the age of 60 years for men, 55 years for women;

- you have 11 years of insurance experience (increases annually, from 2024 15 years will be required);

- pension coefficient from 18.6 (in 2024 the figure will be 28.2).

The preferential pension is intended for people with extensive experience who have worked for a long time:

- in the northern regions of the country;

- in the field of education or health services;

- in positions with difficult and dangerous working conditions, etc.

Mothers of many children can retire early under the following conditions:

- having three or more children;

- total experience of 15 years.

What documents need to be collected

To transfer your pension to a new place of residence, you do not need to provide a large number of documents. To do this, it is enough to submit an application to the Pension Fund or MFC in the prescribed form. It will be issued by the responsible employee, who will also check that it is filled out correctly.

The following must be attached to the application:

- passport;

- SNILS (if available);

- pension certificate (if available).

It often happens that a pensioner does not have the opportunity to come in person to the Pension Fund or MFC. In this case, the application may be submitted by his representative. However, in order for it to be accepted, the powers of the trustee must be confirmed by a notary.

Reference! The power of attorney itself is presented to the responsible employee, and a copy of it is attached to the main set of documents.

Payment case

It makes no sense to demand any documents related to the payment case from the Pension Fund of Russia branch at the old place of residence, since they are not issued to citizens.

You should contact the Pension Fund office at your place of residence. Department employees will independently make a request to receive the payment file.

The existing regulations establish specific deadlines for this. Thus, it is established that the request is drawn up and sent to the old place of residence no later than the next working day after the submission of the corresponding application from the citizen.

After receiving the request, the payment case must be sent to the new place of residence within no more than 3 working days. Thus, the entire procedure of interaction between the territorial bodies of the state pension fund takes, as a rule, no more than a week.

After receiving the payment case, Pension Fund employees at the new place of residence recheck the documents to determine the validity of the accrual of pension payments.

Attention! If errors or inaccuracies are discovered, she is obliged to notify the pensioner and has the right to request additional documents.

The legislative framework

Article No. 39 of the Constitution of the Russian Federation clearly defines that every citizen has a legal basis to receive pension payments in the following cases:

- reaching a certain age;

- disability;

- loss of a breadwinner.

The basic rules for registration were established by Federal Law No. 173 (Article 18, paragraph 1). It also determines that when submitting documents, a citizen must contact the department at the place of registration. But a pensioner without registration has the right to receive a pension; such a derogation is regulated by Resolution of the Ministry of Labor No. 17 of 2002. Paragraph 6 contains information that everyone can apply for pension payments, and in the absence of a place of registration, they are allowed to apply to the Pension Fund at their place of residence.

Will the pension amount change upon re-registration?

Many citizens of retirement age are concerned about the issue of changing the size of their pension upon transfer. It should be noted that the basic and insurance parts of payments remain unchanged. However, the same cannot be said about the available allowances.

So, first of all, it should be noted that payments are made at the expense of the regional coefficient. They are received for retirement by citizens who, as a rule, live in unfavorable climatic conditions. Moreover, the value of the magnifying factor itself may vary depending on the specific area.

Accordingly, if a pensioner moves within his locality, the pension does not change. When leaving for an area where regional coefficients are not assigned, the citizen loses the right to the usual allowance. In addition, the size of the allowance can increase either up or down when changing place of residence within the northern regions, depending on the type of terrain of the settlement of arrival.

It should also be taken into account that different regions have their own indicators of the living wage for a pensioner (PM). If the assigned pension does not exceed it, then the citizen is assigned a social supplement up to the PM level. Accordingly, when moving, the size of this allowance is subject to change depending on the accepted cost of living in the region where the pensioner moved.

When changing place of residence, a pensioner or his representative must contact the Pension Fund or MFC to submit an application for transfer of the payment file. This procedure is carried out by the pension fund independently.

Important! It should be noted that in some cases, the size of the pension may change when moving, which is due to the peculiarities of calculating social benefits in a particular region.

Transfer to a new military pension address

In accordance with Federal Law No. 4468-1 of February 12, 1993, a military pensioner when moving is obliged to do the following:

- Contact the military commissariat at the new address.

You may also be wondering how military pensions are calculated.

- Fill out the application in the prescribed form.

- Provide a complete package of documentation, namely:

- passport details;

- military ID;

- employment history;

- SNILS;

- pensioner's ID;

- other documents required by a specific region.

The pension is assigned from the 1st day of the next month, after submitting an application with a list of documentation.

Look at the incidents from the lives of our citizens!

The procedure for transferring pension payments when moving to a new region is not complicated. The problem is different - almost every pensioner is afraid of losing part of their pension. In order not to make mistakes with actions, every pensioner should carefully study all the nuances on this issue, which are enshrined in this article.