How it works

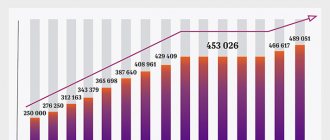

Maternity capital is a one-time assistance from the state to families who have a child or who have adopted a child. The payment amount is indexed every year. This year, parents will receive 616,617 rubles for their child.

Read on the topic: Matkapital 2020: who and how much will be able to receive at the birth of children

Matkapital is not cash, but a certificate for financial assistance. The certificate cannot be cashed, although there are situations when you can receive part of the amount in cash. Maternity capital can only be spent on certain purposes; you will not be able to manage the money at your own will. The family chooses where to spend the help, and the Pension Fund transfers the money to its destination. For example, to the bank for a down payment on a mortgage or to the education department to pay for kindergarten.

Matkapital is federal assistance, but regions can assign additional payments to parents. This is called regional maternity capital. The amount is determined by the regional administration. For example, in Primorye in 2020, mothers will receive 139,900 rubles, and in the Rostov region - 121,287 rubles. You can find out the amount on the official website of the regional administration, the social protection department, the Pension Fund or the MFC.

Unused capital or its balance is indexed annually. There is no need to pay personal income tax on maternity capital.

Who can receive maternity capital

Maternity capital is issued for children born or adopted. The right to maternal capital is valid from January 1, 2007 - if the child was born or adopted earlier, then it will not be possible to receive maternal capital. Here's who can qualify for government assistance:

- Mother

- if she is a Russian citizen and has not been deprived of parental rights. - Father

- if the child’s mother died or was deprived of parental rights. The father's nationality does not matter. - Adoptive parent

- if he is a citizen of Russia and the child was adopted no earlier than January 1, 2007. Maternal capital will also be issued for the first adopted child if the court decision on adoption came into force on January 1, 2020. - The child himself

- if the parents or adoptive parents have died or been deprived of parental rights. The child must be a citizen of Russia, although he can live in another country. If the child is an adult, he himself submits an application for maternity capital; if not, the guardianship authorities do this for him.

Other relatives and guardians are not entitled to maternity capital.

Certificate of maternity capital balance

The fact is that the Pension Fund, which is responsible for providing maternity capital to families, does not limit them to investing money in one direction. Families can spend only part of the money or spend half the capital on one business and half on another. There is no prohibition on dividing maternity capital into shares; you just need to choose one of the possible directions. Since maternity capital is designed to quickly and significantly improve the living conditions of the family, it can be spent only in a few cases. This cannot be the purchase of a car or land, since these purchases cannot quickly and reliably help children and parents in all cases. These points should be adhered to:

- Expenses associated with the purchase, renovation or construction of a home. The most popular and important option. If a family wants to exchange apartments or restore a private house, they will be able to use maternity capital for this. Also, with the help of capital, you can repay, partially or fully, a targeted loan, if it was taken out for the construction of a house or the purchase of an apartment;

- Mother's pension. Another opportunity that can ensure a calm and stable future. Maternity capital can be placed as a funded part of a pension, and after that the mother will receive additional interest;

- Education. This item can also be covered by maternity capital, including tuition and dormitory fees;

- Help for a disabled child. Maternity capital can be used to cover the cost of purchases and services for a disabled child;

Previously, another item was canceled - a lump sum payment for the daily needs of the family. Later it is planned to restore this direction.

Where can you send maternity capital?

The law strictly defines the purposes for which maternity capital can be spent. These are education, a funded pension for the mother, improved housing conditions, monthly payments for low-income families, and goods and services for the adaptation of disabled children. You cannot buy a car, building materials or pay for an operation.

You can choose one direction or distribute maternity capital for different purposes - the law allows this. For example, leave part of it for a funded pension, send part to pay for the child’s education, and send part to improve living conditions. You can change your goals at any time until all your capital has been used.

An application for the distribution of maternal capital funds is submitted to the Pension Fund. You can do it in person, then the form will be issued at the branch, or through the official website of the Pension Fund or State Services. True, you will still need to come to the Pension Fund office with your passport and SNILS within five days after submitting your application online and sign the documents.

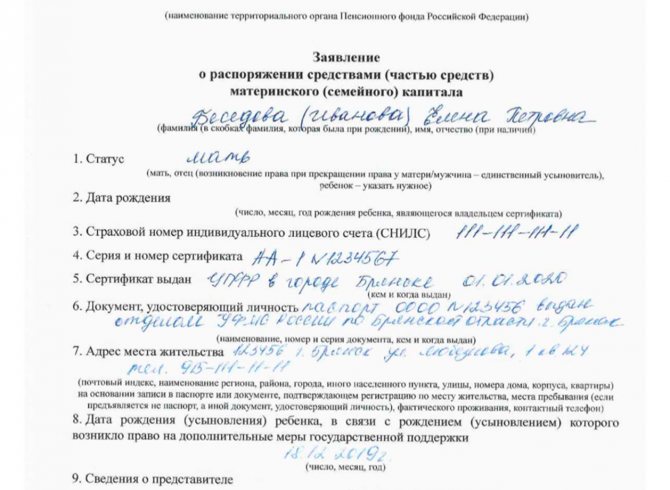

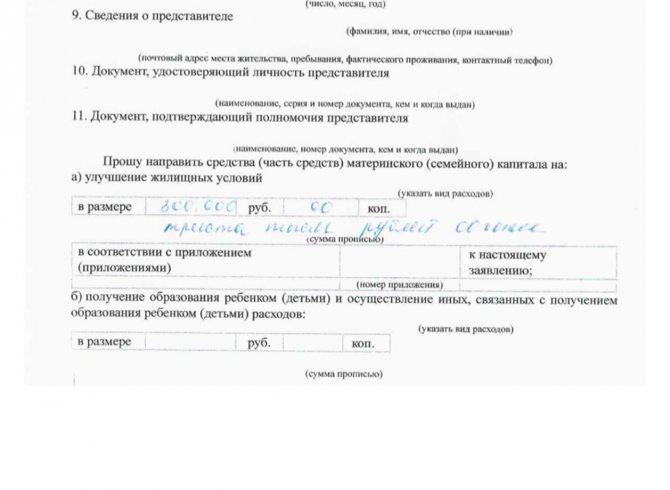

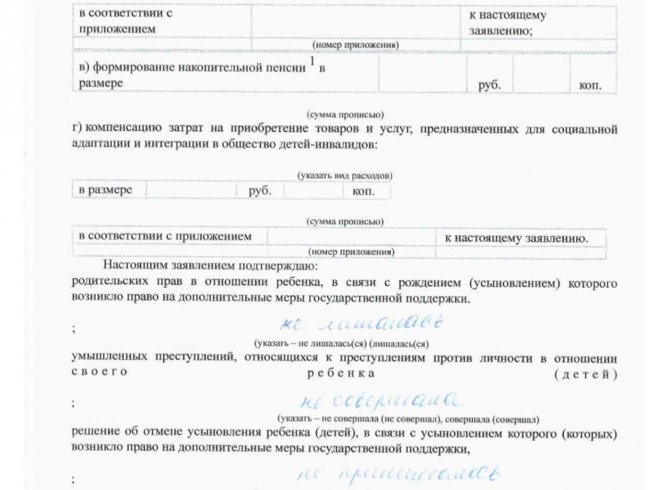

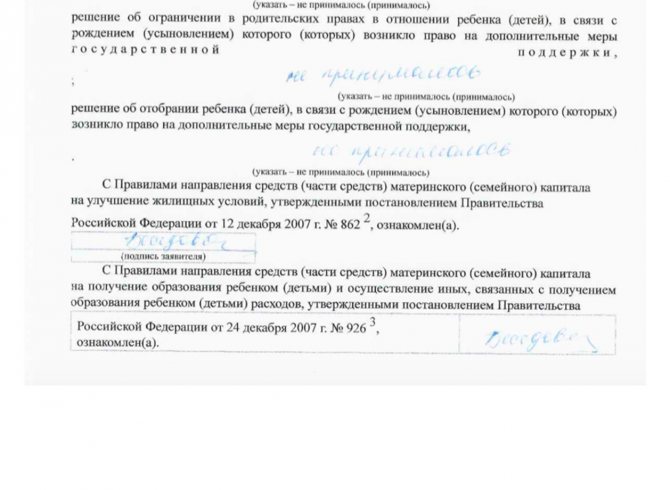

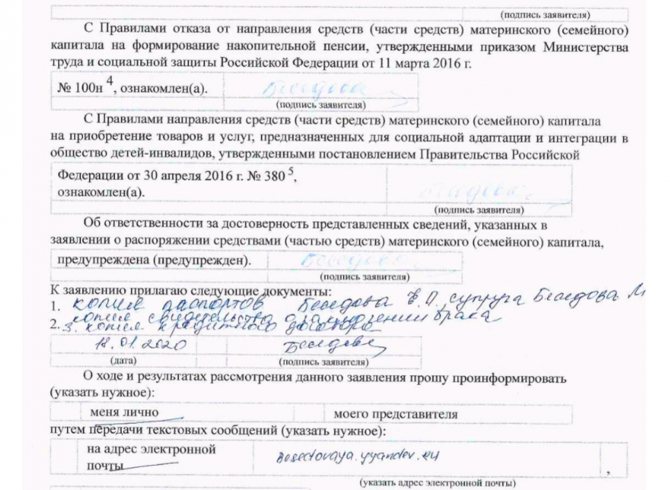

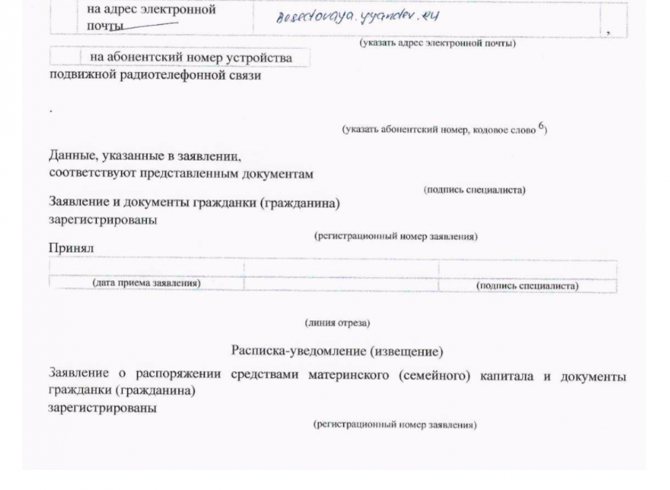

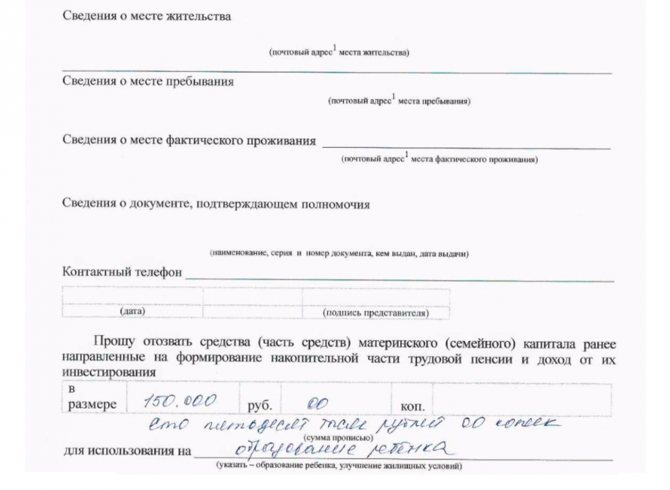

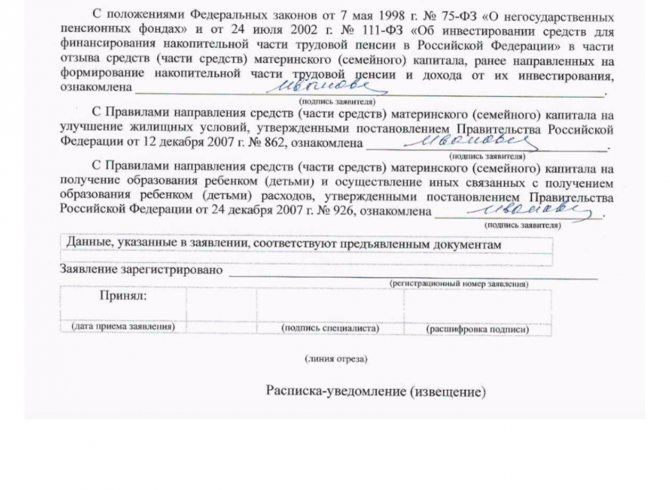

Sample of filling out an application for disposal of maternal capital

Sample of filling out an application for disposal of maternal capital

Sample of filling out an application for disposal of maternal capital

Sample of filling out an application for disposal of maternal capital

Sample of filling out an application for disposal of maternal capital

Sample of filling out an application for disposal of maternal capital

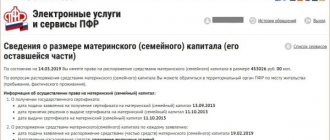

How to find out about the presence of MSC residues

Many people are interested in how to check the amount of maternity capital and its balance.

You can calculate it yourself using simple mathematical calculations. From the amount of MSK that was at the time of partial exercise of your right, you must subtract the money already spent.

If indexation was subsequently carried out, the remainder must be multiplied by the appropriate coefficient.

Attention! Only the Pension Fund can provide accurate information about the account status.

The all-Russian MSC database is kept by this fund, since it is the fund that stores all family savings and manages these funds.

Every year (usually no later than September 1), all certificate holders from the Pension Fund receive a written notification about the status of their personal account.

Such notification is mandatory if the remaining amount is more than 30 rubles.

If notifications do not arrive:

- the entire amount of MSC has been spent;

- the balance does not exceed 30 rubles.

How to get a certificate of funds balance

If the owner of the MSK certificate wants to personally find out the size of the unused balance of the MSK, you can obtain the appropriate certificate from the territorial division of the Pension Fund.

Such background information is required, in particular:

- when selling the nominal amount of MSC within the framework of mortgage lending;

- improving living conditions by purchasing new housing.

Advice!

If you do not know how to check the balance of maternity capital, contact the Pension Fund in writing with a corresponding statement. It can be submitted:

- directly to the PF;

- through the MFC in paper form;

- electronically - through the government services website or the PF web resource.

After 3 business days, a written response will be provided about the status of the personal account and the remaining funds on it.

Pay for education

You can pay for a kindergarten, school or university, pay for clubs, courses, developmental programs and the child’s accommodation in a hostel. In this case, it does not matter which child “helped” to receive maternity capital - the money can be spent on any child in the family or on several at once. For example, a third child was born in a family, the second is still in school, and the first is already entering college. The mother can pay for the school activities of the second child and pay for university tuition and hostel fees for the first.

If the child is an adult, then you can use the money until he is 25 years old. After this age, you won’t be able to get maternity capital; it will “burn out.”

Required conditions:

- the educational institution must be located on the territory of Russia, have a license to provide educational services and be a legal entity - private institutions and individual entrepreneurs are not suitable;

- At the time of receiving the money, the child must not be more than 25 years old and must be a full-time student at an educational institution.

If parents receive compensation from the local budget for paying for kindergarten, then the amount minus this compensation will be allocated from maternity capital.

The pension fund will transfer money for the entire period specified in the agreement. If the child stopped studying or moved out of the hostel before the end of the contract, the mother must write a statement of refusal to send money and indicate the reason. For example, in connection with the expulsion of a child from university.

The pension fund transfers money to the account of the educational institution for about two months, so you need to conclude an agreement in advance.

Improve living conditions

Improving living conditions is the purchase of a new home, construction or reconstruction of a house or cottage. Repairs and the purchase of building materials are not considered an improvement in living conditions; maternal capital cannot be spent on this. Gasification of the house and installation of water supply, oddly enough, is also not an improvement; maternity capital will not be issued for such purposes.

How you can use maternity capital:

- add to your own savings and buy an apartment;

- use it to repay a housing loan;

- make a down payment on a mortgage;

- compensate for construction costs if the house has already been built;

- pay an entrance fee to the developer if you are participating in shared construction;

- pay the amount or part thereof under a shared construction agreement.

They do not give out money in person - the Pension Fund transfers the required amount to the bank, development company, contractor or individual who is selling the apartment. An application for the disposal of maternal capital can be signed at the bank, when applying for a mortgage or repaying a debt. The bank itself will transfer the information to the Pension Fund.

You can only receive cash capital in one case - if you are building or reconstructing a house yourself. Then they will transfer you up to 50% of the amount for construction, and after six months they will check what you built with this money. If the box of foundation, walls and roof is already ready, or the old house really gets bigger, the second part of the capital will be issued.

If a third child is born in the family, then you can add 450,000 rubles to the maternity capital, which the state gives to repay the loan. We told you how to get them.

Nuances you need to know:

- Matkapital can be used to pay off a mortgage if the loan agreement is signed to the husband.

- And even if it was concluded long before the birth of the child.

- The money can be used to build a house or cottage on a garden plot. Ownership of land is mandatory.

- There is no need to obtain a building permit - just submit a notification to the urban planning department of the city administration that the family will build a house. Forms have been developed for notifications; they must be filled out without errors or omissions, otherwise they may not be accepted.

- Mortgages using maternal capital can only be issued in Dom.rf, licensed banks, credit and agricultural consumer cooperatives that have been operating for at least three years. The date that matters is March 29, 2020. If you took out a loan not from a bank, but from an employer, a private lending company or an MFO after this date, you will not be able to repay the debt with maternity capital. For contracts executed before the 29th, the restriction does not apply; maternity capital must be issued.

- If in order to purchase a new home it is necessary to sell the old one in which the children had shares, then the consent of the guardianship and trusteeship authorities will be required.

- You cannot use maternal capital to purchase housing that has been declared in disrepair or unfit for habitation.

- It will not be possible to pay fines, commissions or penalties for late loans with Matkapital.

- Housing purchased with the help of maternal capital must be registered as the common property of all family members, and shares must be allocated to children.

- You can buy housing using maternal capital in any region of Russia, regardless of where the certificate was issued.

For mortgage loans using maternal capital, banks offer reduced rates - from 5% per annum. You can refinance your mortgage with another bank if part of the loan was repaid with maternal capital. True, not everyone agrees to such a deal - difficulties may arise with allocating shares in the apartment to children. You need to check with a specific bank to see if they will do such refinancing.

Mortgage calculator and bank selection

Maternity capital alone is not enough to buy a home. To buy a house, we also took advantage of the “Young Family” program of the city of Yalutorovsk. We waited our turn for almost 3 years. In 2020, when my first son turned 6 years old, the turn finally came. The certificate for the program amounted to just over a million, and the maternity capital for the second child was 453,000 rubles. It turned out to be 1,497,000 rubles.

At the same time, I had to fight a little with the bureaucracy. My second child was born in the Krasnoyarsk Territory, and I received a certificate for maternity capital there. And then we moved and decided to use the certificate in the Tyumen region. Therefore, I wrote an application for the disposal of maternal capital funds and sent it to the Krasnoyarsk Territory. The regional Pension Fund reviewed the application, allowed the use of maternity capital funds and transferred them to the Tyumen Pension Fund.

Certificate expiration date

Most of all, people who have received the right to benefits are concerned about the period of use of maternity capital in 2020. The answer to the question directly depends on what purposes the family plans to use the money for. If this is an increase in the mother’s pension or payment for tuition at an educational institution, the money can only be used after the child reaches the age of 3 years. However, if the money is used to purchase a home or take out a loan to purchase it, the rules change.

| Deadline for allocating maternity capital to purchase housing or improve living conditions | |

| After the baby is born | When the child turns 3 years old |

| The family will be able to freely use maternity capital if they decide to use it to repay a previously issued mortgage, pay interest or principal payment. | The money can be used as a down payment to obtain a mortgage, used for the construction or reconstruction of premises, used for equity participation, or used to purchase housing in a new building. |

The period for consideration of an application for sending maternity capital for the purchase of housing through a mortgage or other means is one month. Then, within 5 working days, the applicant is notified of the decision.

Video

Save for retirement

Maternity capital can be used to form a funded pension for the mother - all or only part. The amount is transferred to the woman’s individual savings account. When she reaches retirement age, she will be able to use the money. Or the husband or child will receive them if the mother passes away. Other relatives are not entitled to these savings.

Mom decides where to keep the money. You can leave them in the State Pension Fund, or transfer them to a non-state pension fund. If the mother decides to keep money in a non-state pension fund, then she must write an application to the Pension Fund to transfer to the selected non-state pension fund, and the Pension Fund will transfer the maternity capital or part of it there. If you change your mind, you can transfer the money back at any time before the pension is assigned.

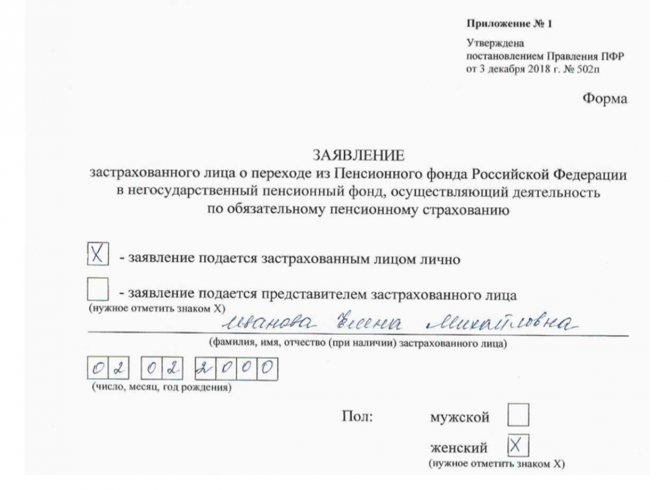

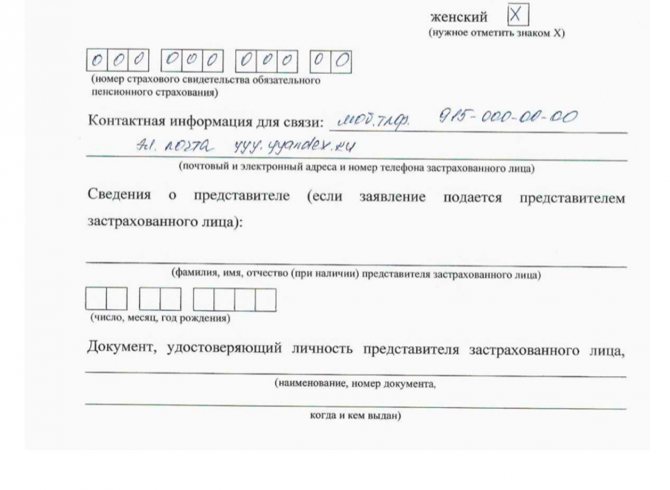

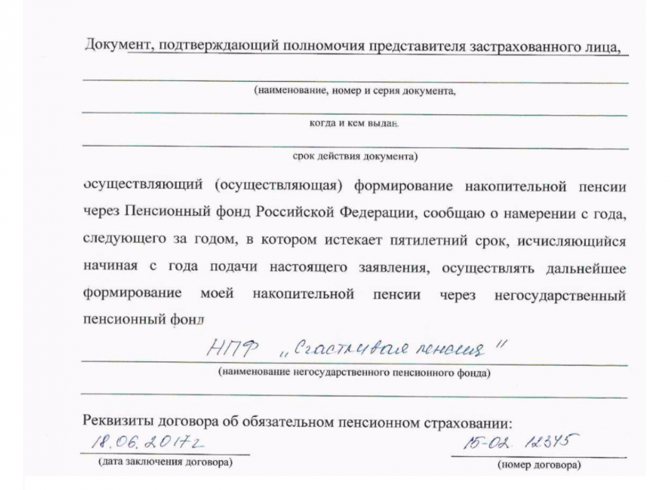

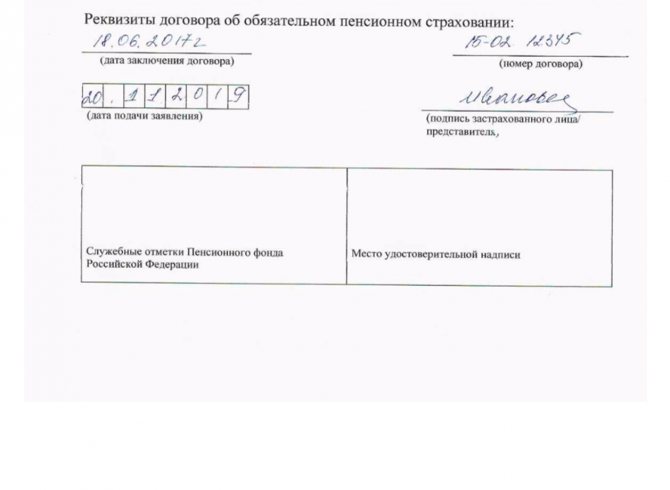

Sample application for transfer from Pension Fund to Non-State Pension Fund

Sample application for transfer from Pension Fund to Non-State Pension Fund

Sample application for transfer from Pension Fund to Non-State Pension Fund

Sample application for transfer from Pension Fund to Non-State Pension Fund

The mother herself chooses how to receive a funded pension from maternity capital:

- As an increase to your pension .

The increase is calculated based on the survival period - in 2020 it is 258 months. The amount of maternity capital is divided by 258, and every month the resulting result is added to the pension. They pay for life. - Equal parts .

Matkapital is paid in equal installments every month. The minimum term is 10 years, the mother can set a term longer, but not less. How much will be paid per month depends on the amount of maternity capital. For example, the mother allocated the entire amount - 616,617 rubles - to a funded pension and ordered it to be paid over 10 years. Every month she will receive 5,138 rubles in addition to her pension. - One-time payment .

Matkapital can be received immediately in the entire amount after retirement, if the amount of the funded pension is less than 5% of the old-age labor pension. Usually the cumulative amount of maternity capital is more than 5%, so this option does not always work.

Matkapital for a funded pension is an investment. You can calculate approximately what increase in pension a woman will receive if she sends maternity capital for this purpose.

How to calculate approximate income.

For example, a 20-year-old woman gave birth to her first child in 2020. She decided to direct the entire maternity capital - 466,617 rubles - to a funded pension in a non-state pension fund. The mother will retire in 2060, and for 40 years the money will be invested in the company she chooses. The average yield of the selected non-state pension fund is 11%. The amount of savings after 40 years will be: 466,617 ₽ * (1+11%)40 = 30,330,478 ₽

Payments will be calculated from this amount:

- The monthly increase

will be RUB 30,330,478/258 months = RUB 117,560. - In equal parts

over 10 years - 30,330,478 ₽/120 months = 252,754 ₽.

The calculation will be approximate, since the profitability of NPFs is different every year. You can find out the rating of NPFs on the website of the rating agency “Expert RA” or the National Rating Agency.

Select NPF

Before the pension is assigned, you can change the goal at any time and redirect the money to something else, for example, to educate your children. To do this, you need to submit an application to the territorial pension fund to refuse to send funds.

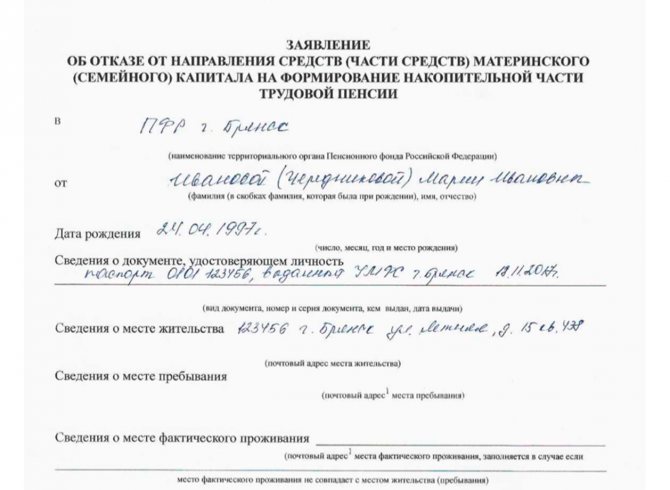

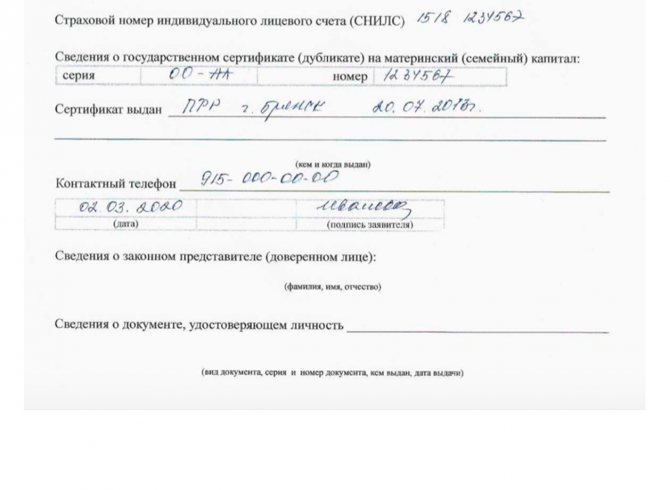

Sample application for refusal to send funds

Sample application for refusal to send funds

Sample application for refusal to send funds

Sample application for refusal to send funds

For adaptation of disabled children

Maternity capital can be used to purchase goods and services that help disabled children live in society. The Order of the Government of the Russian Federation defines a list of goods and services for adaptation. There are only 48 of them. You can buy wheelchairs, lifts, special baths and reading devices, but you cannot pay for therapy, diapers or medicine. The only available service on the list is the help of a reader-secretary. The list does not include nannies and nurses.

The money cannot be received immediately - first, the parents buy the goods themselves, and then send an application for payment and a report on expenses to the Pension Fund, and the Pension Fund transfers compensation to the mother’s account within 40 working days after submitting the application.

What to do before submitting an application to the Pension Fund:

Pass a medical and social examination.

The hospital where the child is being seen will issue a referral for an examination. With him, the parents go to the medical and social examination institution and write a statement that, for medical reasons, the child needs specific goods. The application must be accompanied by a referral, birth certificate or passport of the child, SNILS, certificate of disability, individual adaptation program for a disabled child (IPRA, it is developed at the medical and social examination institution), medical documents (outpatient card, extracts from medical institutions ).

The application will be reviewed and a conclusion will be issued that the goods are really needed. The application must be attached to the package of documents to the Pension Fund for payment of compensation.

The individual rehabilitation program must be valid on the date of purchase of goods or services. Otherwise, you will not be able to receive compensation from maternity capital.

Receive an inspection report from the social security authority.

It is compiled by a social security employee - you need to leave an application with social security, within five days after the application, an employee will come to your home, check whether the goods were actually purchased, and draw up an inspection report. It must be attached to the documents for the issuance of maternity capital.

How to withdraw the balance of maternity capital?

Everything related to family capital is a subject of increased interest from a certain part of the Russian population. We are talking about those families who are expecting the birth of a second, third, and so on child. Answers to any, even the most complex, questions can be found on the Internet if desired. In particular, our portal bukva-zakona.com discusses in detail frequently encountered questions regarding the accrual and expenditure of maternity capital, allowing everyone to obtain the necessary information.

Despite the large amount of information, there are often misconceptions and erroneous judgments on this issue. One of these misconceptions is the idea that the unspent part of maternity capital can be received in the form of cash.

Let's imagine such a situation. After the birth of her second child, the mother received a certificate and used it to pay off her previously taken out mortgage loan from the bank. But not all capital funds were used to fully pay off the mortgage, and a certain part of it remained unspent. In this regard, she may wonder whether it is realistic to receive this part in the form of cash.

If she asks a similar question to the Pension Fund of the Russian Federation, which resolves all issues of accrual and expenditure of state aid funds, she will receive an unequivocal negative answer. At the same time, she will be pointed to the provisions of the relevant Federal Law, which does not imply any form of cashing out this state support.

This means that it is impossible to receive in the form of cash that part of the family capital that remains unspent. Any attempts to take this step will be illegal and will be prosecuted in accordance with current legislation.

There are several legally permitted ways to use state support funds. Most often, and this is quite justified, the funds from the certificate are used to change the living conditions of the family. But situations are possible when a family already has decent housing and does not need to improve it.

Then you can choose to use the funds to pay for the child’s education or to form a mother’s pension. The law does not establish the use of capital funds for only one specific purpose, for example, improving the living conditions of a family.

At the request of the certificate holder, funds can be used for various purposes. This allows you to use funds more rationally. It is possible to use part of the capital to pay off the mortgage, and part for the future education of the child.

The portal bukva-zakona.com reminds that the validity period of the family capital certificate is limited by the age of the child. Before he reaches 23 years of age, he may have time to competently manage state support funds.

Moreover, we should not forget that the funds in the certificate account are subject to annual indexation, that is, their dependence on inflation is insignificant.

If you have funds left in the certificate account, then do not rush and try to use them completely. This can always be done before the child turns 23 years old. During this time, any new needs may arise when the law allows the use of funds under the certificate. As a last resort, you can use the remaining funds to create your mother’s pension at any time.

The emergence of a misconception about the possibility of cashing out part of the family capital was most likely facilitated by the decision of the Government of the Russian Federation to provide financial assistance to families on account of the certificate. This is what we are talking about in this case.

Several years ago, due to the worsening economic situation in the country and the falling standard of living of the population, amendments were adopted to the Federal Law on the possibility of making one-time payments to needy families from funds in the maternity capital account. Each year these payments increased and, for example, in 2020 they amounted to 25 thousand rubles.

That is, the certificate holder, having written a corresponding application at the Pension Fund branch, could receive cash in hand. This is what caused the misconception that the balance in the maternity capital account can be received in person. The bukva-zakona.com portal emphasizes that these payments are one-time payments and are in no way tied to the size of the certificate account balance. Moreover, it is incorrect to consider this financial assistance as one of the options for cashing out government support.

Amendments adopted to the Federal Law on maternity capital do not provide for one-time payments in 2020. It is not known whether they will be accepted or not.

If the funds of the family capital have not been fully used and the account has not been closed, then naturally the question of how to find out about the presence of a balance and its size becomes relevant. The only way to quickly obtain such information is to make inquiries at the Pension Fund. Upon request, the certificate holder will be provided with detailed information about the balance and its size, as well as about all movements of family capital funds (when and for what purposes they were used).

The Pension Fund annually sends the same data to holders of family capital certificates until the funds in the account are less than 30 rubles.

(

1 votes, average: 5.00 out of 5)

Receive monthly payments

You can receive monthly payments from maternity capital if the family has a difficult financial situation. In this case, the maternity capital will decrease by the amount of payments, and annual indexation will be done on the balance. The amount of payments depends on the region, for example, in Moscow it is 15,225 rubles, and in the Leningrad region - 10,379 rubles.

If an application for payments is submitted within six months after the birth of a child, then payments will be made for all months before the application, if later - from the moment the application is submitted. The money will be transferred to the mother’s card until the child turns three years old (previously - 1.5 years). There is no need to report expenses.

If you received monthly payments according to the old rules - until the child was 1.5 years old - you need to write an application to the Pension Fund for the resumption of payments from maternity capital - the money will begin to be transferred from the date of submission of the application.

Payments will be assigned if all conditions are met:

- monthly income for each family member is less than two subsistence levels in the region;

- the child was born no earlier than 2020;

- The baby is not yet 3 years old.

Income is wages, pensions, benefits, scholarships, and allowances. One-time financial assistance from the state, for example payments to flood victims, is not counted as income. Amounts are taken before taxes.

The minimum cost of living in your region can be found in the Pension Fund of your city or viewed on the official website.

How to calculate income per family member:

add up all family income for the last 12 months and divide the amount by 12 and the number of people in the family. If the amount is less than two regional subsistence minimums, you can make monthly payments from maternity capital.

For example, there are 4 people in a family - a mother, a father and two children. They live in Yeniseisk. The cost of living in the Krasnoyarsk Territory at the beginning of 2020 is 13,425 ₽, double - 26,850 ₽.

Family income for the year is 540,000 rubles.

540,000 ₽/12/4 = 11,250 ₽ - income for each family member.

This is less than two subsistence minimums; the mother can apply to the Pension Fund for monthly payments from maternity capital.

You can calculate the amount of monthly payments using an online calculator.

How can I find out my account status?

- Provide a certificate.

- Written statement.

- Document Number.

The stages of obtaining are described in more detail below. Information will be available only to a certain category of persons:

- Citizens of the Russian Federation who have not spent the rest of their maternity capital in full.

- Citizens who have sent funds in full to legal resources and want to receive information about the write-off or balance of funds.

- Citizens who have only managed to partially spend the funds and have a balance in their account that exceeds 30 rubles.

It is worth noting that the period during which the funds can be spent has not yet been established. Since they can be spent on 1 or 3 children, there is no time limit.

Federal Law No. 288 speaks about this. The guardianship authorities and the Pension Fund do not have the right to determine who is the last and first child in the family , so even the purchase of an apartment or the construction of a new house can be evidence of an improvement in the quality of living conditions for all family members, including children.

If the mother (the owner of the certificate) wants to personally establish what balance she has in her account, she must contact the Pension Fund of the Russian Federation at her place of residence and submit in writing all the missing documents on the basis of Federal Law No. 241. This is described in detail in the corresponding section of the article.

About how to find out the remainder of the mat. capital, we talk in more detail here.

When is maternity capital issued?

There are rules for receiving money: you can apply for payment of maternity capital only when the baby turns three years old. Immediately after the birth of a child, you can receive money only for certain purposes.

| When to receive maternity capital | Where can I send |

| Immediately after birth | → Monthly payments; → payment for kindergarten; → adaptation of disabled children; → down payment for a mortgage; → mortgage repayment. |

| After the child turns three years old | → Buying a home with your own money; → compensation for building a house; → school tuition, payment for courses, sports and music clubs, accommodation in a dormitory; → house construction; → funded pension. |

How much can you get

Maternal capital for first-born children is issued only for children born after January 1, 2020. If the first child was born on December 31, 2020, the mother does not have the right to maternity capital - this is the law.

Maternity capital for the first child - 466,617 ₽. For the second and subsequent ones more - 616,617 ₽. For example, the first child was born in the family on January 15, 2020. The mother will receive maternity capital of 466,617 ₽. If she already had a child and did not receive maternity capital before, then she is entitled to 616,617 rubles.

The amount of maternity capital does not increase if twins or triplets are born in the family. One child is recognized as the firstborn, the other as the second born. In this case, the capital will be 616,617 ₽.

The mother has the right to maternity capital; if the first child has died, the documents for the certificate will need to be accompanied by a birth certificate of the deceased child. Then, at the birth of the second child, the amount of maternity capital will be maximum - 616,617 rubles. It happens that a child dies in the maternity hospital and there is no birth certificate, only a registration certificate. In this case, you won’t be able to get maternity capital; you just need a birth certificate.

Adopted children are considered equal to their own children. If a family adopts a child, the mother can receive maternity capital - if this is the first child, then 466,617 rubles, if the second or third - 616,617 rubles. There is a nuance: maternity capital is not provided for the adoption of a husband’s or wife’s children (stepchildren).

How to obtain a certificate

You can apply for a certificate for maternal capital at any time, even if the child is already 10 years old - the law does not limit the submission period. The place of registration is also not important - at the place of birth of the child, at the place of permanent or temporary residence.

From April 15, 2020, the certificate is issued automatically at the birth of a child. The electronic certificate will be located in the mother’s personal account on the website of the Pension Fund or State Services. You do not need to print it out to confirm your right to maternity capital - the number and details of the owner will be in the Pension Fund database.

Families with adopted children do not automatically receive a certificate; they will need to write an application to the Pension Fund for the issuance of a certificate.

The Pension Fund will notify you of the decision one day after receiving the application and will issue a certificate within 15 days. From 2021, certificates will be issued within five days, as stated in the law.

Where and how to get it?

The rest of the maternity capital can be taken in the same place where it was originally requested. To receive the remaining amount, you should contact the regional office of the Pension Fund.

If you pay for accommodation during your studies, the following documents will be required:

- A rental agreement, including the term and time of payment.

- A certificate from the place of study confirming the fact of residence in the hostel.

Documents to be submitted:

- Statement of intent to dispose of funds;

- An agreement with a preschool institution containing the conditions and cost of child care (payment receipts are not accepted).

The law provided for and supported the desire of some citizens to give their children additional education, for example, art, music, or in-depth study of foreign languages. Then, along with the application for payment of basic education, an application for additional training expenses should be submitted. The list of documents is similar: an application and an agreement with an educational institution. To find out how to get maternity capital for your father, read here.

How to restore a lost driver's license? Where should I contact?

Remaining regional maternity capital should be applied for at your place of residence. This issue is dealt with by the local department of the Ministry of Health and Social Development. To find out the conditions for receiving regional maternity capital, follow the link.

The nuances of directing capital funds to education:

- the child who brought the family capital must be 3 years old;

- the capital can be used in parts - for one child or for several, buy housing, increase the mother’s pension at the expense of it;

- The deadline for claiming family capital is set from January 1, 2007. until December 31, 2016;

- It should be noted that the legislation relating to the sphere of motherhood and childhood is very dynamic, and all changes can be tracked on the website of the Pension Fund.