Russian pension abroad

A pension is the result of what a person has earned over the years of his working life. And if a person has Russian citizenship or a residence permit, a certain insurance period, a pension coefficient not lower than a certain level, and he has reached retirement age, such a person has the right to receive an old-age insurance pension.

As you can see, among the requirements there is no mandatory residence in Russia. This is true, and more than 330 thousand Russian pensioners living in 129 countries of the world

- confirmation of this. Moreover, several years ago the authorities recognized that even registration (that is, registration at the place of residence) is not necessary to assign a pension. A pension is what a person has earned, so he receives it regardless of his location.

Traveling abroad does not deprive a person of the right to receive a pension

, but various technical problems cannot be ruled out (such as unfavorable currency conversion rates, the inability to withdraw money from the Mir card abroad, etc.). Therefore, it is important to know the rules by which pensioners abroad receive a Russian pension.

People can live in another country for various reasons. This, for example, is a more favorable climate, low prices, living with a family who previously left for permanent residence in another country. By the way, NTV recently talked about several pensioners from Russia who settled well in Thailand, Egypt and other hot countries on 15-20 thousand rubles a month.

But even if they leave for permanent residence, Russians abroad for the first time receive a maximum of a residence permit - which does not always give the right to a pension. And in order to live for several years before receiving a passport, you cannot do without a Russian pension

.

You can’t just pick up and leave without warning anyone. The fact is that pension legislation establishes several grounds for suspending payments

pensions. Among other things, these are:

- failure to receive a pension for 6 consecutive months;

- those receiving a disability pension - in case of failure to appear for re-examination on time;

- students over 18 years of age receiving a survivor's pension - failure to provide proof of study (including abroad);

- receipt of documents on the pensioner’s departure for permanent residence abroad, if he has not previously submitted a corresponding application.

Accordingly, if a pensioner receives a pension, for example, via mail or on a Mir card, he will not be able to receive it abroad, and after six months the payment will stop

.

With recipients of a disability pension, it is even more complicated - they actually receive a disability group indefinitely upon reaching retirement age, and before that it will be problematic to leave for a long time.

Therefore, any pensioner must ensure in advance that the payment of his pension does not stop when he is abroad.

The pension stays with the person

Let’s say right away that paying pensions abroad is one of the responsibilities of the Russian Pension Fund.

Thus, the Russian pension for those living abroad is due to our fellow citizens and foreigners within the framework of the system of maintaining pension rights:

- When changing your country of residence.

- According to international treaties on social security.

It turns out that pensions for citizens living abroad, which were assigned by the Pension Fund, are paid independently:

- from the country of residence;

- citizenship/nationality of the pensioner.

The exception is social pensions provided by the state.

Pension amount

The amount of the pension depends on the period of payment of pension contributions, and the salary received by the late migrant in the country of origin in a certain period is adjusted to the average salary in Germany on the basis of relevant tables.

When paying pension contributions after 1950, the table values depend on the qualifications of the worker and the sector of the economy in which he was employed, which makes it possible to most accurately approximate the size of foreign wages to German values.

According to the FRG (Fremdrentengesetz) amendment of 1996, the pensions of late migrants who moved to Germany after May 6, 1996 are generally calculated differently from those for Germans who have always resided in Germany. In the fall of 2010, the Federal Constitutional Court of Germany confirmed this amendment to the FRG as not contradicting the German Constitution.

Thus, late migrants who moved to Germany for permanent residence after 05/06/1996 can receive a maximum of 25 credits per recipient (as of July 1, 2014, 25 credits represent a monthly pension of 715.25 € in the old days or 659.75 € in the new federal states). If both spouses are entitled to recognition of a foreign pension as late settlers, they can receive a total of no more than 50 credits (as of July 1, 2014 - 1,144.40 € per month in the old federal states and 1,055.60 € in the new federal states).

The pension received in the country of origin is taken into account in Germany - its amount is deducted in full from the amount of the pension calculated in Germany for the same period of payment of pension contributions.

Grundsicherung is the minimum allowance

| Family | Euro | rubles |

| One parent raising a child/children | 404 | 28’010.29 |

| Two parents living with children | 325 | 22’463.70 |

| Spouse or 2 adults living together | 364 | 25’236.99 |

Basic guide - everything is simple here

When a person reaches retirement age, or is no longer able to work, he is entitled to receive a pension - a basic benefit, or Grundsicherung.

Rest assured, you will not be left without government help! People are taken care of here... Even German pensioners sometimes turn to the social service to ask for additional assistance - payment for an apartment, heating...

If your monthly income is less than 789 euros, then you can also apply for a basic allowance. Its amount is not so large, only 324 to 404 euros. This is only a “pure” benefit. Money is added to it to pay for housing and heating. Funds may be issued for repairs, for example. You can contact the social service for additional funds, but you will need to justify it.

Be sure to read it! The insured person - who is he, his rights and obligations

Repairs, housing payments, etc. are paid upon actual expenses - all receipts must be kept. By the way, have you already read the article about taxes?

Average pension in Germany in 2020

There may still be changes in 2020, so it makes sense to make calculations based on last year's results.

When you reach retirement age, the state pays about 835 euros

or more than 70,000 rubles.

This is a very high figure when compared with Russian pensions. They rarely exceed 20,000 rubles.

At the same time, in the territory of the former GDR the amount of pension payments is slightly higher. On average, 20 euros.

Important.

In Germany, taxes are taken from pensions. That is, citizens receive approximately 200 euros less than indicated above. But this is still more than Russian pensions.

But do not forget that the standard of living in countries is very different. Yes, Germans can often afford to travel when they stop working and retire. But they are forced to pay taxes on their income, and they also do not have free treatment. If serious health problems arise, almost all of this money is spent on doctors’ services and on the purchase of medicines.

In Russia, a lot of money is spent on medicine. That is, under the compulsory medical insurance program you can get fairly high-quality services without paying anything. The same applies to a number of other benefits that exist in Russia.

Plus, we shouldn’t forget about the cost of utilities and food prices, which are also higher in Germany than in Russia.

Thus, if we compare all factors, we can say that Russian pensioners live approximately the same as German ones. But not all Russians take advantage of the preferences granted to them.

Payment of pensions to Russian citizens abroad

Citizens who have earned the right to a Russian pension, who live outside the Russian Federation or are just planning to move to another country, in 2020 must be guided by the following regulatory documents:

- Law of the Russian Federation of December 15, 2001 No. 166-FZ “On state pension provision in the Russian Federation”;

- Art. 27 Law of the Russian Federation dated December 28, 2013 No. 400-FZ “On insurance pensions”;

- Resolutions of the Government of the Russian Federation No. 1386 dated December 17, 2014 (approved Regulations “On the procedure for paying pensions to persons leaving for permanent residence outside the territory of the Russian Federation”), No. 793 dated August 13, 2016 and No. 1020 dated August 28. 2017;

- Order of the Ministry of Labor and Social Protection No. 338n dated 04/06/2017 “On approval of the Administrative Regulations for the provision of the Pension Fund of the Russian Federation with public services for the payment of pensions to citizens who leave (have left) for permanent residence outside the territory of the Russian Federation”;

- interstate agreements and treaties between the Russian Federation and the country of permanent residence of the pensioner (if any).

Conditions of receipt

Russian pension rules do not depend on residential address. To receive an old-age pension, a pensioner must confirm that the following conditions are met:

- Citizenship of the Russian Federation.

- Reaching retirement age. In 2020, the retirement age for women is 55.5, and for men – 60.5 years, but according to Federal Law No. 350-FZ (03.10.2018), it is planned to gradually increase it to 60 years for women and 65 for men.

- Insurance experience of more than 10 years (as of 2020). According to Federal Law No. 400-FZ (December 28, 2013), until 2024, the required length of service will increase by a year until it reaches 15 years.

- The pension ratio is more than 16.2 in 2019. In the future, the IPC value will increase by 2.4 points annually until it reaches 30.

How to submit documents

- Submit documents by mail

- Submit documents in person

Important documents for applying for a pension abroad

The most important thing, of course, is the list of required documents . So, to apply for a pension you will have to prepare:

- Pension application form

- Application for transfer of an assigned pension outside the Russian Federation.

- A certificate confirming permanent residence outside Russia (issued by a diplomatic mission or consular office of the Russian Federation).

- Certificate confirming the fact that the citizen is alive

- A certified copy of your general passport

- A certified copy of the marriage certificate (did you change your last name?)

- A certified copy of the work book (all pages)

- Documents about work experience and salary (each copy must be stamped “Copy is true to the original”, all the necessary signatures and seals)

- An extract from salary statements (the same thing here: each copy must be stamped “Copy is true to the original”, all the necessary signatures and seals)

- A certified copy of a military ID or an original certificate from the military commissariat about the period of military service under conscription (for men).

- In some cases - a certificate of performance (non-performance) of paid work outside the Russian Federation, which is issued by a diplomatic mission, consular office of the Russian Federation or a competent authority (official) of a foreign state.

Usually, you are asked to attach a piece of paper with your phone number and your postal address - in Russian and in the language of the country where you live, so that the necessary papers will be sent to you from the Pension Fund.

Point 4 scares most newly minted retirees. A certificate confirming the fact that a citizen is alive is issued on December 31 of each year by an American or Canadian notary, then an apostille is obtained for it and translated into Russian. The accuracy of the translation must be notarized at the Russian Consulate. Such a statement is drawn up one year from the date a citizen living abroad submits an application for payment of a pension outside the Russian Federation to the Pension Fund of the Russian Federation.

But it can be replaced with an act of personal appearance - no apostilles, but you will have to appear in person at a diplomatic mission or consular office of the Russian Federation abroad and ask to draw up an act (the service is free).

Who can claim a Russian pension when traveling abroad?

Most retired Russian citizens, if they leave the Russian Federation for permanent residence outside the country, have the right to transfer their pension abroad, with the exception of those who:

- receives a long-service pension for federal civil servants or a social pension of the Russian Federation (for disability, due to lack of insurance experience);

- lives in states with which the USSR/RF have concluded bilateral agreements on pension provision. The payment of pensions to such citizens has its own characteristics and occurs according to agreements.

Pensioners who have already issued a pension for themselves, in order to receive pension payments abroad, must submit a corresponding application to one of the Pension Fund branches 30 calendar days before the planned date of departure.

Please note that the application must specify the procedure for receiving money.

Those citizens who worked in Russia but have reached retirement age – 60 years for men and 55 years for women – while already living outside the territory of the Russian Federation can also apply for a Russian pension when moving abroad.

In this case, it is necessary that they satisfy all the conditions for assigning an insurance pension in accordance with Russian legislation: the presence of a minimum insurance period (in 2020 - 9 years), a minimum amount of pension points (in 2020 - 13.8 points).

Interesting fact. Pension provision in Russia was first introduced by Peter I. It was primarily about former military officers - “So as not to disgrace the honor of the uniform.” The soldiers who survived after 25 years of service were simply sent back to their native village, the disabled - to the monastery “to survive.”

What types of pensions are available to Russians living abroad

Russians who live abroad can count on receiving:

- labor pensions, both insurance and funded;

- state security pensions (state pensions);

- military pensions (but not in all countries);

- additional payments to pensions for special working conditions: pilots, miners, nuclear industry workers, persons with special services to the state;

- social monthly payments for veterans of the Great Patriotic War (DEMO).

The labor pension for Russian pensioners who left and live abroad, according to the legislation of the Russian Federation, compensates for the loss of wages and other remunerations related to the professional activities of the insured person upon the onset of his incapacity for work, and there are three types:

- old age pension;

- disability pension;

- survivor's pension (compensates disabled family members of the insured person for wages and other benefits lost due to the death of the breadwinner).

Be sure to read it! Housing and communal services benefits for pensioners in 2020: step-by-step instructions for registration, necessary documents, refusal to provide and nuances

The state pension compensates for:

- earnings lost upon termination of federal civil service, upon reaching the required length of service, or upon retirement for old age or disability as a civil servant;

- lost earnings upon retirement for long service for cosmonauts and test pilots;

- harm caused to the health of Russian citizens while performing military duty as a result of man-made disasters;

- livelihood in case of loss of a breadwinner.

Military pensions are assigned to military personnel, employees of the Ministry of Internal Affairs, the fire service, the National Guard, who have reached the required length of service, as well as members of their families in the event of the loss of a breadwinner.

Payments in the Russian Federation

A Russian pension abroad can reach its recipient in three ways:

- Transferring a pension abroad to the recipient’s bank account is relevant for citizens who received a pension before 2015. After this time, payments outside of international treaties are paid only on the territory of the Russian Federation through banks or representatives.

- Transfer or accumulation of funds in one of the domestic banks.

- Withdrawal by power of attorney (carried out by the person chosen by the pensioner).

Until 2020, according to Law No. 88-FZ (05/01/2017), all Russian pensioners must switch to the domestic payment system MIR, and all their bank cards will be automatically replaced with the corresponding new ones. This measure does not apply to Russian citizens living in other countries.

Registration procedure

In the absence of international agreements, documents are submitted to the territorial representative office of the Pension Fund at the place of residence or to a special Department of the Fund for persons living abroad. His postal address: 119991, st. Shabolovka, 4, GSP-1, Moscow, RF. Submission of documents can be done in person, by mail or through a representative.

An additional convenient way is to apply through the State Services portal or through the Pension Fund website.

To assign a pension, you need to submit an application for its assignment and the following documents:

- 2 copies of the delivery statement;

- copy of Russian passport;

- an extract from the employment record certified by a notary to confirm the length of service;

- salary certificate;

- copy of military ID (if available);

- a certificate from the Russian consulate confirming the fact of permanent residence abroad.

Existence of an agreement between countries

“Russian foreigners” should have no doubt whether it is possible to receive a Russian pension abroad. Our state guarantees pensions to foreign citizens who worked in Russia and retire in their homeland. Condition: if this country has an international agreement on pensions with the Russian Federation.

STATISTICS

In 2020, 19 international treaties were in force regulating Russia’s relations in the field of pension provision with 23 states. Pension Fund payments under these agreements were received by 45.1 thousand pensioners abroad (43.4 thousand in 2020). And the Pension Fund’s expenses on pensions under international treaties increased by 8.6% and amounted to 3.8 billion rubles (in 2020 - 3.5 billion rubles). At the same time, the number of foreign pensioners living in Russia and receiving payments under these agreements is significantly smaller - 4.3 thousand people (in 2016 - 3.4 thousand people). Expenses for paying pensions to them amounted to 392 million rubles, which is 21% more than expenses for the previous year (323 million rubles).

Among the countries with which Russia has agreements on pension provision, the largest number of Russian pensioners live:

- in Abkhazia;

- Belarus;

- Latvia;

- Bulgaria;

- Israel;

- Estonia.

Of the countries with which Russia does not have such agreements:

- Germany;

- USA;

- Finland;

- Canada.

In total, pensioners living in 129 countries of the world receive Russian pensions abroad. By the end of 2020, their number grew to 307,000 people (+ 3.5%).

The ranking of states with the largest number of pension recipients this year looks like this:

- Germany – 101.4 thousand people.

- Israel – 41.4 thousand people.

- Abkhazia – 32.9 thousand people.

- Latvia – 24.6 thousand people.

- Belarus – 24.3 thousand people.

- USA – 21.8 thousand people.

- Other countries – 60.6 thousand people.

Pensions for people living abroad

Since pension rights are regulated by Russian legislation and international agreements, most payments are available abroad:

- labor;

- government;

- military;

- veterans;

- additional payments for difficult working conditions.

The following types of pensions are exceptions:

- by length of service for civil servants;

- social disability benefits;

- payments in the absence of insurance experience.

- State pension for long service - conditions of appointment, amount of additional payment and procedure for registration

- 7 healthiest foods for blood vessels after 50 years

- 7 consequences if you don't drink enough water

Conditions of receipt

Russian pension rules do not depend on residential address. To receive an old-age pension, a pensioner must confirm that the following conditions are met:

- Citizenship of the Russian Federation.

- Reaching retirement age. In 2020, the retirement age for women is 55.5, and for men – 60.5 years, but according to Federal Law No. 350-FZ (03.10.2018), it is planned to gradually increase it to 60 years for women and 65 for men.

- Insurance experience of more than 10 years (as of 2020). According to Federal Law No. 400-FZ (December 28, 2013), until 2024, the required length of service will increase by a year until it reaches 15 years.

- The pension ratio is more than 16.2 in 2019. In the future, the IPC value will increase by 2.4 points annually until it reaches 30.

How to start receiving a pension?

To receive the minimum pension, you need to live to 60 years (men) and 55 (women), and you also need five years of continuous service. When five years are not reached, the years of higher education and the birth of children are included in the length of service (one and a half years for each). In such cases, it is necessary to prepare notarized copies of the birth certificates of each child and a copy of the document indicating that the child was alive for these one and a half years (his/her passport or other identity document). A document on work experience and salary, as well as an extract from salary statements, can be obtained exclusively at your place of work, that is, you will either have to fly to the Russian Federation or issue a power of attorney for someone in Russia.

Send the power of attorney and all documents certified at the consulate to the principal in the Russian Federation - he will transfer them to the Department of the Pension Fund of the Russian Federation for those living abroad.

Transfer abroad

Until 2020, Russian pensions were transferred in foreign currency to the pensioner’s account at the current exchange rate. For those who filed for retirement before this time, transfers occur in the same manner. Another case when money is transferred abroad is existing international treaties.

According to the new rules, payments to pensioners occur only on the territory of Russia and are paid in rubles to a specially opened account or to a trusted person.

Passport and visa services

- Foreign passports

- Proof of citizenship

- Foreign passports for children

- Russian citizenship for children

- Internal passports

- Visa to Russia

- Change of surname or first name

- Certificate of return to Russia

How is a pension paid?

Now about how to receive a Russian pension abroad. A method that is now gaining popularity is on the territory of Russia to your own bank account or by power of attorney.

Through this mechanism, 162.7 thousand pensioners abroad receive pensions, and the amount of payments to them in 2020 amounted to 25 billion rubles.

The second most popular method was chosen by 144.3 thousand pensioners. They receive payments by transfer abroad in the currency of the foreign state in whose territory they reside. The Pension Fund's expenses for these payments amounted to 16.5 billion rubles.

Pensions assigned after 01/01/2015 outside of international treaties and agreements on pension provision are paid to Russian pensioners living abroad exclusively on the territory of the Russian Federation through Russian banks or representatives of the pensioner.

Pensions are different in different countries

In some cases, the size and procedure of the pension will depend on the country where the pensioner lives. Russia has concluded international agreements and agreements on the payment of pensions abroad with 24 countries. Many pensioners continue to work after moving, earning seniority and the right to a pension from a foreign state. In such cases, the pension will be calculated based on the principles of such agreements.

- Territorial principle.

The pension is calculated and paid at the expense of the country in which the citizen lives. In this case, the length of service earned in Russia is taken into account.

Such agreements have been concluded with Armenia, Georgia, Kazakhstan, Kyrgyzstan, Lithuania, Moldova, Tajikistan, Turkmenistan, Uzbekistan and Ukraine.

If a Russian pensioner moves to one of these states, according to the laws of which he is not yet entitled to a “local” pension, Russia will continue to make the payment.

After acquiring the right to a pension in a new country, it is paid by the foreign state.

- Proportional principle.

The costs of paying pensions are distributed between the two countries: each pays for the length of service worked on its territory.

Such agreements have been concluded with Belarus, Bulgaria, Israel, Spain, Latvia, Estonia, and the Czech Republic.

If a Russian pensioner lives in a country with which the Russian Federation does not have agreements, the pension is paid to the Pension Fund in accordance with Russian legislation.

What if you apply for a pension without coming to Russia?

Russians go abroad under different circumstances. It happens that this happens a year or two before retirement age. Registration of a pension even on the territory of Russia is a very difficult process, but what if a person lives abroad at this time and does not want to return?

There is a way out; the legislation allows for the possibility of obtaining a pension for a person who lives abroad. By the way, some relaxations have been introduced since May 2020: it is no longer necessary to contact the Pension Fund unit at your place of residence

, the principle of extraterritoriality applies.

In general, while abroad, you can receive several types of payments from Russia:

- insurance pensions;

- state pensions (except social);

- additional payments to pensions for labor merits;

- additional monthly financial support for WWII veterans.

All these types of payments can be issued while living in another country. But this process can take a lot of time and effort.

All communication with the Pension Fund can only be carried out by mail (regular, paper). Pensioners living abroad can send all their documents for registration of a pension to one address - 119991, Moscow, GSP-1, st. Shabolovka, 4 (this is the main address of the Russian Pension Fund).

So, if a person, while abroad, has reached retirement age, he can apply by mail to the Pension Fund with an application for a pension. To do this, he will have to collect the following package of documents:

- application for assignment and delivery of pension in two copies;

- a copy of the passport of a citizen of the Russian Federation and SNILS;

- employment documents: original work book (a high-quality copy is allowed), original certificates of periods of work, if it is difficult to determine them from the work book;

- salary certificate for any period of 5 years, if the citizen had such a period of employment before 2001. The certificate must contain all the necessary data;

- a copy of a military ID or other document confirming military service;

- certificates or other documents confirming the change of surname (if the surname has changed);

- copies of children’s birth certificates (if there was a period of parental leave before they reached 1.5 years of age);

- a certificate confirming permanent residence outside Russia (issued by the Russian embassy or consulate).

All copies of documents must be certified by a Russian diplomatic or consular office

.

You can submit all these documents in person to the Pension Fund in Russia, you can send them by mail, or you can send them through a representative for whom a notarized power of attorney has been issued.

Considering how often when applying for a pension they are required to “deliver” some documents, there is no point in hoping that the pension will be assigned at the very first written application to the Pension Fund. Most likely, you will have to collect additional certificates and documents

.

Be sure to read it! Work experience calculator using a work book: we calculate it ourselves, examples

Another problem is the method of payment of pensions. There are no problems with this on the territory of Russia, but a citizen of the Russian Federation living abroad may not have a single payment card from a Russian bank.

Therefore, it is better to take care of such a card in advance - when leaving Russia or during one of your visits to the country. Apply for a card remotely

It’s unlikely to work, one option is to issue a power of attorney for someone in Russia.

Celebrate once a year

Since the Pension Fund does not have a single database with foreign government agencies, the pension of those who have gone abroad must be renewed annually. To do this, it is necessary to send a document to the Pension Fund once a year confirming that the citizen is alive.

You can do this in one of the following ways.

1. During a visit to Russia, contact any territorial branch of the Pension Fund.

2. Draw up a document confirming the fact of being alive from any notary on the territory of the Russian Federation (clause 9 of the Procedure).

3. If the pensioner does not visit Russia, he will need to appear in person at a diplomatic mission or consular office of the Russian Federation on the territory of a foreign state. Their employees will draw up an act of personal appearance of the citizen and send the document to the Pension Fund of Russia via their electronic channels (clause 10 of the Procedure).

Important!

To avoid receiving fraudulent payments, you can only confirm that you are alive in person. It is not possible to issue confirmation through electronic services or a representative.

Supporting documents are drawn up and sent to the Pension Fund after 12 months from the date of filing an application to travel abroad or providing similar documents for the previous year (clause 12 of the Procedure). If this is not done, pension payments will be suspended until they are received.

Important!

Due to the coronavirus pandemic, until July 1, 2020, the payment of pensions to pensioners living abroad is extended without documentary proof of being alive (RF Government Decree No. 530 dated April 17, 2020).

Assignment and payment of DEMO

DEMO is an additional monthly financial support that is assigned to certain categories of people. They also include Russian citizens who live abroad. Persons who have special achievements and services to Russia can apply for this payment, such as:

hero of Socialist Labor; various types of orders; award winners; hero of the Soviet Union and the Russian Federation; game champions.

This additional payment is accrued along with pension payments.

What to do if you temporarily leave Russia

You can go to Turkey for a week in winter very inexpensively - so much so that sometimes even pensioners can afford it. And in the case of such a short trip, there is no need to worry about the pension: if a person receives it with the postman, he will receive the money at the post office when he returns to Russia, and he can withdraw it from the card at any time (and if it is a Visa or MasterCard, then and directly abroad).

The main thing here is to avoid a 6-month delay in receiving your pension.

and more, otherwise the law allows the Pension Fund to suspend pension payments.

If this happens, you need to go to the Pension Fund and apply for renewal of payments. The pension for the period of suspension will not go anywhere and will be paid to the pensioner in full. By the way, you can also submit such an application through the State Services portal, which is actually available all over the world.

However, this is not all the problems. Pensioners who are accustomed to living in another country for a long time (for example, six months at a time with their family and at home) can issue a power of attorney to receive a pension so that another person receives it - and, for example, transfers it to a pension recipient abroad.

The pension fund will consider that the pensioner is receiving a pension, but with one caveat: at least once a year such a person must appear at the Pension Fund or personally receive a pension

. Of course, it is much easier to issue a payment to a bank card and transfer it to a trusted person, but this is too difficult for older people.

Accordingly, if a power of attorney is issued

to another person, then the pension recipient will not be able to continuously stay abroad for more than a year - he must come and “check in” in Russia at least once.

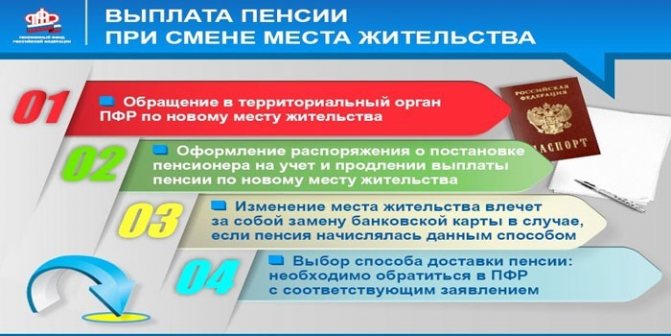

Moving and returning

When a pensioner moves to a permanent place of residence from one foreign state to another, it is necessary to notify the Pension Fund about this no later than the working day after the move (clause 17 of the Procedure). If you return to Russia, you must notify the Pension Fund of this by providing a passport of a citizen of the Russian Federation with a mark of registration at the place of residence (clause 18 of the Procedure).

Payment of pensions immediately for six months - is it possible?

On the Internet you can find information that when traveling abroad for permanent residence, the Pension Fund can pay a pension for 6 months immediately in advance. This is necessary so that a person is not left without a livelihood in the first months after moving and can settle down.

Information on pension payments for six months

It’s even on the website of the Russian Pension Fund – although it dates back to the first half of 2014.

And indeed, according to Russian government decree No. 510 of July 8, 2002 “On approval of the Regulations on the procedure for paying pensions to citizens who leave (have left) for permanent residence outside the Russian Federation,” such payments were provided for.

A pensioner could receive such a payment at will - the Pension Fund made a payment if the foreign passport contained a note about leaving for permanent residence outside of Russia. Pensions were paid in advance only if a person moved to a country with which Russia did not have an Agreement on the payment of pensions.

However, this decree was repealed on January 1, 2015

(however, the information has not yet been removed from some pages of the Russian Pension Fund).

Now the procedure for paying pensions to Russian citizens outside the country is regulated by Decree of the Government of the Russian Federation of December 17, 2014 N 1386, and there is no mention of paying pensions for six months.

At what age is a pension in Germany?

When a citizen of respectable age reaches old age and receives assistance from the state depends on the year of his birth. Periodically, the German government discusses raising the retirement age. There are plans to increase it first to 68, and after 2069 to 70 years.

Old age pension age in Germany

| Year of birth | Retirement age | retirement |

| 1819 — 1851 | 70 years old | |

| 1851 — 1946 | 65 years old | |

| 1947 | 65 years + 1 month | 02.2012 — 01.2013 |

| 1948 | 65 years + 2 months | 03.2013 — 02.2014 |

| 1949 | 65 years + 3 months | 04.2014 — 03.2015 |

| 1950 | 65 years + 4 months | 05.2019 — 04.2016 |

| 1951 | 65 years + 5 months | 06.2019 — 05.2017 |

| 1952 | 65 years + 6 months | 07.2019 — 06.2018 |

| 1953 | 65 years + 7 months | 08.2019 — 07.2019 |

| 1954 | 65 years + 8 months | 09.2019 — 08.2020 |

| 1955 | 65 years + 9 months | 10.2020 — 09.2021 |

| 1956 | 65 years + 10 months | 11.2021 — 10.2022 |

| 1957 | 65 years + 11 months | 12.2022 — 11.2023 |

| 1958 | 66 years old | 01.2024 — 12.2024 |

| 1959 | 66 years + 2 months | 03.2025 — 02.2026 |

| 1960 | 66 years + 4 months | 05.2026 — 04.2027 |

| 1961 | 66 years + 6 months | 07.2027 — 06.2028 |

| 1962 | 66 years + 8 months | 09.2028 — 08.2029 |

| 1963 | 66 years + 10 months | 11.2029 — 10.2030 |

| 1964 and later | 67 years old | from 2031 |

Be sure to read it! Minutes of the general meeting of SNT: sample 2020

Residents of Germany have the right to retire two years earlier if they have a disability. The same opportunity is available to people whose working experience is 45 years or more, and they have made appropriate tax deductions. But there are practically no such people in Germany.

What to do if your pension is suspended or terminated

The situation when pension payments may be suspended or terminated occurs quite often. The following may lead to a suspension of payments for 6 months:

- non-receipt of pension for 6 months;

- reaching the age of majority by a person receiving a survivor's pension, without confirmation of his full-time studies;

- receipt of documents by the Pension Fund on the departure of a pensioner outside Russia for permanent residence in the absence of his application for departure.

Termination of pension payment occurs when:

- establishing the death of a pensioner or recognizing him as deceased or missing in the prescribed manner;

- the expiration of 6 months from the date of suspension of the pension and failure to submit an application for its renewal;

- loss of the right to a pension: acquisition of working capacity, entry to work, expiration of the period of recognition as disabled.

Thus, there are two options for returning payments - renewal and restoration of the pension.

To resume pension payments, you must submit an application.

The following documents must be attached to it (depending on the reasons for termination of payments):

- confirmation of the applicant's full-time studies at an educational institution;

- confirmation that the applicant does not have the right to receive a pension in the state of residence (if there is an agreement with the Russian Federation);

- certificate of permanent residence;

- a certificate of performance/non-performance of paid work outside the Russian Federation (when paying a survivor's pension to a person caring for children under 14 years of age);

- document confirming that the applicant is in good health - a notarial deed, a document from the competent authority of the state of residence, a personal appearance certificate;

- a document from the diplomatic mission of the Russian Federation abroad or the territorial branch of the Pension Fund of the Russian Federation, which would confirm the termination of activities or work, during which pensions were not paid to those working abroad.

If the reason for stopping the payment was the receipt of documents on the citizen’s departure for permanent residence abroad, no additional documents are required - just an application is enough.

Pensioners whose pension payment was suspended due to a court declaring them dead or leaving for a new place of residence abroad must contact the Pension Fund and submit an application for the restoration of pension payment.

The application must be accompanied by:

- a document canceling a court decision declaring a citizen dead or missing;

- confirmation of full-time education of a disabled citizen at an educational institution (except for additional educational programs);

- confirmation of termination of work or a certificate stating that the applicant is not working;

- certificate of permanent residence abroad;

- a certificate of the applicant’s performance/non-performance of paid work in the host country (required for payment of a survivor’s pension to persons caring for children, brothers, sisters or grandchildren of the deceased breadwinner under 14 years of age);

- document confirming that the applicant is in good health - a notarial deed, a document from the competent authority of the state of residence, an act of personal appearance.

For pension restoration, the presence or absence of Russian citizenship does not matter. 12 months after the restoration of pension payments and thereafter, the applicant must annually submit to the Pension Fund a certificate of being alive.

New assignment of pension to a citizen living abroad

To assign a pension to a citizen of the Russian Federation who has gone abroad for permanent residence, he should submit to the Pension Fund an application for a pension (in two copies).

In addition, other documents must be attached to the application (the case will be considered only if they are available):

- application for pension delivery, completed in duplicate;

GDE Error: Error loading file - Turn off error checking if necessary (403:Forbidden) - a copy of the passport of a citizen of the Russian Federation;

- a copy of SNILS (if available);

- confirmation of work experience - original or a clear, notarized copy of the work book, certificates of periods of work (originals);

- original salary certificate for any five years of service with the number and date of issue, seal and signature of the manager, indicating the basis for issuance, clearly stated full name of the certificate recipient. For certificates for the period from 1991 to 2001, data on contributions that were transferred to the Pension Fund is required;

- a copy of your military ID (if you don’t have one, a certificate from the military registration and enlistment office confirming your military service);

- certificate confirming permanent residence in a foreign country indicating the date of move from the Russian Federation. Such a certificate can be obtained from the diplomatic institutions of the Russian Federation in the country of residence.

In some cases, additional paperwork may be required:

- upon entry into/divorce of marriage and change of surname - a copy of the relevant document;

- if a woman has parental leave for up to one and a half (three) years, a copy of the child’s birth certificate;

- when changing the name of the enterprise or organization in which the applicant worked - a certificate of its renaming.

All copies must be certified by the Russian consulate.

Documents for applying for a pension

To properly process pension payments, people who live outside the territory of Russia must send all documents along with the application, namely:

1. Work book, which determines the length of service. 2. Passport (copy), which contains information about the person’s citizenship. 3. Certificate of residence, which is issued by the consulate. 4. Salary certificate for the last 60 months. With its help, Pension Fund employees will be able to identify their average monthly earnings.

In order to apply for other types of pensions, you need to provide additional documents, but together with the main ones:

1. Certificate of disability, which is provided by a medical institution. 2. Documents for changing data in the passport (if any). 3. Certificate of dependents, as well as the income of all family members.