NPF "Heritage" is a non-state fund that works with pension savings and operates on the terms of a closed joint stock company.

At one time, the organization was called NPF “Norilsk Nickel”; an attempt to carry out large-scale fraud with the Pension Fund’s savings is associated with that period. The foundation subsequently apologized about this.

History of the organization

In 1993, NPF Interros-Dostinostvo was registered. In 2006, it received the name “Norilsk Nickel”. In 2013, NPF Norilsk Nickel changed its name and became Heritage. In 2014, as a result of reorganization, a closed joint stock company appeared. The next significant stage in the work of the structure was the merger with Gazfond.

At the same time, Promagrofond and Kit-Finance became part of Gazfond. Since 2020, clients of all three organizations have been served here. Thus, NPF “Heritage” turns 24 years old. As a result of the merger, a systemically important fund emerged, accumulating over 400 billion rubles.

Its clients are about 6 million Russians.

Basic information about NPF Heritage

The non-state pension fund Heritage (hereinafter referred to as NPF) was formed 23 years ago. Until 2013, the NPF had the name “Norilsk Nickel” .

Over the entire period of its operation, the NPF received such awards as: “Pension Oscar”, “Financial Elite of Russia”.

In 2020, the NPF joined a large fund called Gazfond . NPF clients should now receive the necessary information at Gazfond branches or on the website: gazfond.ru.

At the same time, the document concluded with the Heritage Foundation retains its legal force.

Read more detailed information about the activities of the Gazfond in our material: NPF Gazfond!

Contact information of NPF Heritage:

- hotline number – 8 800-700-00-51;

- general number – 495 783 4784;

- head office address – Moscow, Sergeya Makeev Street, building 13;

- reception of citizens - offices of NPF Gazfond;

- INN – 7703481100;

- Checkpoint – 770301001;

- license – 1/2 dated July 27, 2004;

- official website – npfn.ru.

On the fund's website you can find information such as:

- reporting for the entire period of operation of the NPF;

- auditors' report;

- data on the formation of accumulated funds;

- expert opinion on the work of the fund.

Below we highlight the basic characteristics of the Heritage Fund:

- Own property worth 65 million.

- Savings – 50 million.

- Reserve funds – 15 million.

- Authorized capital – 210,000 rubles.

- Clients – 1.5 million.

- The number of persons receiving pensions is 25,000 clients.

Activities of the fund

NPF "Nasledie" works in the field of pension provision, as well as pension insurance. The structure serves pension programs of dozens of enterprises. Clients are offered additional opportunities to create savings using their own finances, as well as investment income from non-state pension funds and tax benefits.

The benefits of the fund's services include:

- Annual transfer of investment income, usually exceeding bank deposit rates;

- Flexible conditions for independently creating capital for a specific purpose;

- State support in the form of a refund of 13% of contributions in the form of a tax deduction (valid for pension contributions up to 120 thousand rubles per year);

- Inheritance of the entire amount in the account, along with investment income (excluding the conditions for lifetime payments);

- Protection from the imposition of penalties and seizure of money in such an account;

- Tax preferences – no personal income tax, regardless of the amount of investment income.

The main conditions for cooperation with the fund are additional cash contributions from 1 thousand rubles, an arbitrary payment regime and a choice of the frequency of pension transfers. The accumulation period is from 4 years, payments – from 1 year.

How people cheat when touring apartments

Sometimes agents deceive during door-to-door visits, when you can talk to a person one-on-one, without witnesses. For example, agents pose as employees of a pension fund. From the point of view of the law, everything is clean here, because NPF is also a pension fund, only non-state. The potential client thinks that they came to him from the Pension Fund of the Russian Federation, and trusts the guest.

When offering an agreement, agents can intimidate, saying that you must sign it, otherwise you may lose part of your future pension. This, by the way, is also a half-truth: the agent can show the fund’s profitability - if it is higher than your current NPF, then part of the future pension is actually lost.

Our competitors even opened and issued IDs for agents with this inscription - and sales soared. Conscientious non-state pension funds never do this - in our country the phrase “I am from a pension fund” was prohibited.

One of my clients told me how agents came to her home and told her that our fund had closed and she urgently had to sign an agreement with a new NPF. In fact, our company simply merged with another NPF and changed its name. Competitors found out about this and began to scare customers.

Agents also came to my house. I let them in out of professional interest. They used this technique: they asked for SNILS “for verification,” then they immediately called somewhere and told me that I was no longer in the client database and that the contract urgently needed to be reissued. In fact, they checked SNILS with the combined database of several non-state pension funds, but I was not there, because my fund simply did not submit data there.

More on the topic Regional Maternity Capital in Tyumen 2020 description and conditions for obtaining the amount of family capital in Tyumen

NPF and Pension Fund scam

As for the well-known scam of the NPF Norilsk Nickel with the Pension Fund, its meaning was the illegal transfer of pension-type savings from a state fund to a non-state structure.

At that time, the NPF was headed by Dmitry Hort, who was able to use the Pension Fund database. The management of Norilsk Nickel created a front company and signed an agency agreement on its behalf with the NPF, providing for attracting people to the fund.

Using illegally obtained data, they forged people's signatures on money transfer agreements. The reward for the attackers was agency payments from Norilsk Nickel intended for the fictitious company.

Subsequently, high-ranking employees left the fund, and the NPF itself admitted guilt and apologized to clients.

Pension Fund scam [edit | edit code]

In 2011, insurance agents of the non-state pension fund "Norilsk Nickel" ("Norilsk Nickel" is one of the former names of the NPF "Heritage") organized a scam with the Pension Fund of the Russian Federation [10], which can be defined as an illegal transfer of pension savings from the Pension Fund of Russia in NPF:

According to investigators, the fraud was organized by the then general director of the NPF, Dmitry Hort, and several of his subordinates. They gained access to the Pension Fund database in a way that has not yet been established by the investigation, illegally obtaining information about the amounts of pension savings and personal information about citizens, such as date of birth, passport number and insurance number of the individual personal account of the insured person (SNILS). Next, using the lost passport, a company was registered, on behalf of which the scammers entered into an agency agreement with NPF Norilsk Nickel to attract clients to the fund. Using information from the Pension Fund of Russia database, fraudsters forged citizen applications and funds transfer agreements. “At the moment, it has already been established that in a similar way, 137 million rubles were withdrawn from state control to the NPF Norilsk Nickel,” investigator Andrei Starov told Kommersant yesterday. According to him, the scammers enriched themselves through agent payments from their fictitious money, which were cashed and appropriated by them.

Since the criminal group included a high-ranking employee of the fund, no checks were carried out on the contracts provided by unscrupulous agents [11]. A criminal case was initiated against members of the criminal group under Part 4 of Art. 159 of the Criminal Code of the Russian Federation (“Fraud on an especially large scale, committed by a group of persons by prior conspiracy”) [12]. As a result, the president of the non-state pension fund "Norilsk Nickel" Sergei Puchkov [13] and some managers resigned, the head of the fund's regional network Dmitry Hort and the head of the directorate for the Central Federal District Tatyana Maksimovskaya were fired, however, further results of the criminal investigation were not reported. despite the confident statements of representatives of the UEBiPK Main Directorate of the Ministry of Internal Affairs of the Russian Federation [14]. In 2011, three large NPFs, including Norilsk Nickel, were temporarily prohibited from independently operating in the compulsory pension insurance market for illegal transfer of pension savings [15]. At the same time, the question was raised about the exclusion of Norilsk Nickel from the National Association of Pension Funds (NAPF), and an admission of guilt and an official apology to the victims appeared on the website of the NPF Norilsk Nickel [16].

Read also: Url https www uralsib ru retail debit

It is curious that Russian non-state pension funds asked not to call this scam a theft [17], and the press secretary of the Russian Pension Fund explained that there are common cases when “agents simply forge the signatures of the insured persons on the application and transfer their funded part of the pension to the NPF” [ 18], among which was Norilsk Nickel, while almost all NPFs are transfer agents of the Pension Fund of Russia [19].

Information about the fund:

Since December 13, 1993, the non-state pension fund Heritage has been operating, which was renamed twice before receiving this name. It all started with the Interros-Dostinostvo fund, to which the NPF Norilsk Nickel was merged in 1996 - this is the name by which the fund is best known. In August 2013, a decision was made to rename Norilsk Nickel to NPF Heritage. The fund's experience in the pension services market goes back two decades, and the number of clients under the OPS program is over 1 million people. The list of founders of the fund is listed in documents on the official website.

Full name of the organization: Heritage CJSC NPF (Norilsk Nickel)

Data for 2013: The NPF Heritage rating according to the NRA corresponds to the AA mark, which means a high level of fund reliability and quality of services. However, Heritage is still far from achieving maximum ratings, such as those of the Lukoil-Garant pension fund (you can see it here).

Reliability rating in 2017

Expert RA: not participating National Rating Agency (NRA): the rating will be withdrawn in 2017

The National Rating Agency confirmed the reliability rating of NPF Heritage CJSC at the AA+ level with a stable outlook. The rating was first assigned to the Fund on August 7, 2014 at the level of “AA+”. The last rating action was dated July 23, 2015, when the rating was confirmed at “AA+” with a stable outlook.

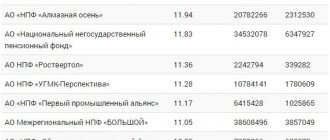

Statistics of NPF Heritage (Nornickel)

Statistics on NPO (non-state pension provision) as of July 1, 2013

- Pensions are received by: 19,450 people

- Number of participants: 98,600 people

- Pension reserves: 13,626 people

- Pensions paid in the amount of: 409,327 thousand rubles

Statistics on compulsory pension insurance (compulsory pension insurance) as of July 1, 2013

- Pension savings: 42,872,819 thousand rubles

- Profitability (for 2012): 6.75%

- Number of insured clients: 1,032,022 people

Pension savings managed by the NPF Heritage increased from every thousand to 1,564 rubles from 2006 to 2010. The larger pension fund VTB NPF, over a similar period (4 years), managed to increase savings by only 384 rubles.

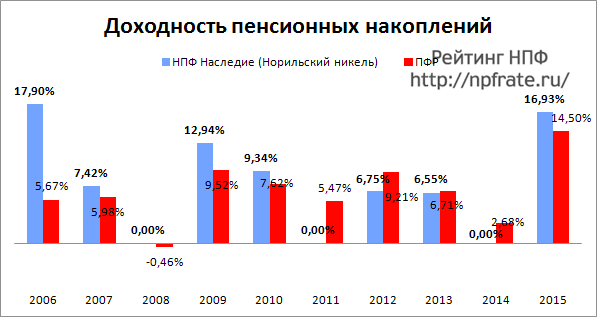

Profitability and reliability

In the period from 2006 to 2010 (from publicly available statistics), the Norilsk Nickel pension fund achieved the highest return on investment in 2006: 18% per annum. In 2008, the yield was 0%, however, like the vast majority of pension funds. The total return for 2006-2012 was 85%, according to information from the official website. Profitability indicators have been available since 2005, similar to the non-state PF Electric Power Industry, reviews of which you can read on the corresponding page.

Read also: OTP bank new Cheryomushki opening hours

Data on the profitability of NPF Heritage (Norilsk Nickel) JSC as of January 1, 2017, including information for the previous 10 years in comparison with the profitability of the Pension Fund of the Russian Federation:

Profitability of NPF Heritage (Norilsk Nickel) for 2014-2015 and previous years

The fund has not currently provided a profitability rating for 2016-2017, but the profitability indicator as of September 30, 2016 is known: it is 6.37%.

The distribution of investments between groups of assets under the non-state pension program is as follows: 60.2% - shares of a closed mutual investment fund (Closed-end mutual investment fund) 18.1% - bonds 12.8% - bank deposits 4.6% - shares 3.6% — funds in the current account 0.7% — other types of assets

The table presented above is taken from documents (Actuarial Report for 2012) located on the official website of the fund.

Official website and contacts

The official website of the Heritage Pension Fund (formerly Norilsk Nickel) is located at https://npfn.ru/. The site is very informative; many documents are available with the results of the fund’s activities by year. There is a client’s personal account and several calculators, for example, for calculating pensions under the compulsory pension program.

Address

The central office is located in the capital: 123022, Russian Federation, Moscow, Sergei Makeev St., 13. Open Mon-Fri 9-18 (*Fri 9-16:45). There is a toll-free (within the Russian Federation) telephone number for calls.

NPF Heritage (Norilsk Nickel) on the Yandex map:

As of 2013, NPF Heritage has 23 branches in 6 districts of the Russian Federation and is constantly developing its territorial network.

Personal account: find out your savings

Login to the personal account of the Heritage Foundation is located at the link: https://npfn.ru/ru/account/

Customer Reviews

On this page you can leave your feedback on the work of the Heritage pension fund and the quality of the services it provides. Did you not like the attitude of your employees or were you deceived when calculating your pension? Share your problem and let others know about it. If you know of cases of fraud in NPF Heritage, for example, when fund employees go door to door and sign pension agreements under false pretenses, write in the comments.

Heritage Reliability Rating

NPF Heritage does not take part in the rating compiled by the Expert RA agency, and the National Rating Agency confirmed the fund’s reliability rating as “AA+” with a stable forecast.

The first time the organization received such an indicator was in 2014. This rating indicates the high efficiency of activities in relation to insured citizens.

The rating is based on data in the field of compulsory insurance, profitable placement of assets, high-quality implementation of projects in the business sphere and management stability. After being included in the Gazfond, Heritage is not assigned a rating by these agencies.

Advantages and disadvantages

What could be the pros (and cons) of a fund that ceased to exist in 2020?

On the positive side I would like to note:

- the pension savings of the NPF “Nasledie” were not lost;

- The legal successor is considered to be Gazfond Pension Savings (AAA rating, ruAAA, NAKDI award).

More on the topic Pension for municipal employees in 2020 - for length of service, exit, additional payment, federal state

The main drawback is the red tape with documents. If this did not affect the investors, the delights of communicating with the bureaucratic system will be experienced by the heirs (if they receive anything).

Profitability of NPF "Norilsk Nickel"

The profitability of Norilsk Nickel in the period from 2005 to 2013 reached 93.1%. In 2020, savings in the fund exceeded 50 billion rubles. By the end of 2020, additional pension payments were intended for 70 thousand pensioners, the volume of reserves amounted to over 15 million rubles.

Investment funds in the fund are distributed among shares of a closed investment fund, bonds, bank deposits, shares and other assets. Based on the results of 2020, Heritage became the leader among non-state pension funds in terms of return on investment of pension funds and savings, the figure was 16.93%.

What to do

To do this, request by registered mail from your new fund an agreement and consent to the processing of personal data that you allegedly signed. They can be used in court as evidence. When I received my documents, I saw that the signatures for me were made by someone else. Now I have filed a lawsuit.

More on the topic Russian Pension Fund hotline Tula phone 8-800

You can go to court even if you signed the agreement yourself, but you were not told about the loss of profitability. As practice shows, the courts also satisfy such claims.

Remember that the law is on your side. If you yourself did not sign the contract or you were misled, then you will be able to prove everything in court.

Unfortunately, many people, when they learn about a transfer to a new non-state pension fund, simply wave their hand at it: they say, the money is small, why bother now, maybe the new fund will be better. There are three things you need to understand here:

- Now the money is small, but in 10-20 years it will accrue significant interest.

- Choosing an insurer for compulsory pension insurance is your legal right. If you did not choose this NPF, there is no reason to stay in it.

- Most likely, you will only be required to collect documents and appear at the court hearing. My lawyers say that they are not needed there and that I can do everything myself.

What's not to like

Among the reviews of dissatisfied investors there is information that representatives of this organization walk through the entrances of residential buildings in order to draw up false documents on the transfer of a person’s personal pension account to their fund. In addition, the excessive persistence of employees in trying to attract clients also does not suit many.

In general, people are satisfied with the activities of the Norilsk Nickel pension fund and often say that any problematic situation is resolved quickly by employees, and clients receive competent answers to all questions. In addition, depositors constantly receive new information about the status of their accounts. It is also worth noting that often people in reviews of the non-state pension fund Norilsk Nickel positively evaluate the corporate ethics and high level of services of this fund.

On this page you can find out the address, contacts and operating hours of the PFR branch in Nikel. Clarify information about the calculation, accrual and payment of pensions, find out what documents are needed to register maternity capital, social benefits and allowances.