Old-age pensioners who support a dependent family member are entitled to additional payments. The question may arise in every person’s mind whether a pensioner who is still working is entitled to any additional payment to the pension received for a dependent. Even in this case, the state will not leave a disabled person to support only one pensioner. The government provides a supplement to the pension benefit in the amount of 1/3 of the amount equal to the size of the fixed supplement to the pension.

Who is considered a dependent: 2020 list

The rules and regulations regarding payments for dependents are regulated by Federal Law No. 400.

According to the law, additional payments for dependents are calculated exclusively for those family members who are not assigned any other types of benefits. These may be the following categories of citizens:

- minor child;

- disabled since childhood;

- a person caring for a group I disabled person or an elderly family member;

- a student under 23 years of age studying full-time at a university.

In addition to these persons, pensioners and disabled people can be considered dependents, but the state is responsible for their maintenance. Thus, they are considered citizens dependent on the state.

Important! If a student is expelled from the university, he will no longer be considered a dependent.

Additional payment for having a dependent for disabled people

According to paragraph 1, Article 16 of the Federal Law*, its size (as of February 2020) is set at 4,383.59 rubles per month. An increased fixed payment to the old-age insurance pension and to the disability insurance pension is provided to persons who are dependent on disabled family members.

Article 15. Amounts of labor disability. 4. For persons who are dependent on disabled family members specified in subparagraphs 1, 3 and 4 of paragraph 2 and paragraph 3 of Article 9 of this Federal Law, the fixed basic amount of the labor disability pension is established in the following amounts: 3) for group III: for the presence of one such family member - 2,135 rubles per month;

What categories of pensioners are entitled to receive additional payment?

There are a lot of benefit recipients in the Russian Federation, and not everyone is entitled to payments for dependents.

Additional amounts of money are due to the following categories of citizens:

- old age pensioner;

- former military man on a preferential pension;

- WWII veteran;

- disabled person supporting a minor child.

These are the requirements for people counting on additional payments to pensioners and other recipients of benefits for minor children in 2020.

Supplement to pension for disabled people of group 2: amount, conditions of assignment

Citizens with physical and social disabilities who have the status of a disabled person are the most vulnerable segments of the population, both from a social point of view and from a financial perspective. Due to limited capabilities caused by injury or congenital pathologies, citizens of this category, as a rule, are disabled, and therefore are in dire need of financial support, including from the state.

Currently, there are provisions at the legislative level that allow disabled people to apply for a pension on a preferential basis.

Current payment amounts

Even a professional lawyer will not be able to immediately say what is more in our laws: types of additional payments or categories of beneficiaries. Accordingly, it is unlikely that recipients of social benefits themselves can independently calculate the amount of the required additional payment. However, all these amounts are clearly stated in the laws.

| Category/amount | Whole fixed payment | For one dependent | For two | For three |

| Pensioner up to 80 years old | 5334,19 | 1778,06 | 3556,12 | 5334,18 |

| Pensioner over 80 years old | 10668,37 | 3556,12 | 7112,25 | 10668,37 |

| Group I disabled person | 10668,37 | 3556,12 | 7112,25 | 10668,37 |

| Disabled person of II, III groups | 5334,19 | 1778,06 | 3556,12 | 5334,18 |

Important! Payments for caring for a child with a first degree disability amount to 5,500 rubles.

What is the surcharge amount

The amount of additional payment to the pension for dependents directly depends on the amount of the fixed part of the insurance pension valid in the current period. From January 1, 2020, this is 5334 rubles 19 kopecks.

For each dependent, it is possible to assign an additional payment to the pension in the amount of 1/3 of this amount, that is, 1,778 rubles 06 kopecks for each dependent. The maximum you can receive is a supplement for three dependents, which means that the maximum amount of an increase in pension can be 5,334 rubles 19 kopecks for three dependents.

For those pensioners whose fixed part of their pension has already been increased for the northern period of service, the premium is set additionally. Formally, this is not considered an additional payment, but an increased amount of the fixed part of the insurance pension.

Establishing the fact of dependency in court

To establish the fact of being a dependent in court, it is necessary to file a claim in court, which should include the following main points:

- The corner stamp includes: the name of the court to which the application to establish the fact of being a dependent is submitted, personal information about the applicant (full name, address) and data of the interested person (name and address).

- The descriptive part states:

- Full name and date of birth (day, month, year) of the person claiming to establish the fact of dependency;

- period of incapacity and its cause;

- who was the dependent of the applicant (full full name of the deceased, date of death, relationship);

- justification for being a dependent;

- the purpose for which recognition of the fact of being a dependent is required;

- a statement of the fact that there are no other documents or methods to confirm dependency and the absence of a dispute about the right.

- The petition indicates the person who should be recognized as a dependent. It is also necessary to indicate the person on whom the applicant will be dependent.

- The following documents serve as attachments:

- copy of the application;

- receipt of payment of state duty;

- documents confirming being a dependent (receipts, receipts, etc.).

- The application is signed by the applicant personally, indicating the date of submission of the application.

As a result of recognition of the fact of being a dependent in pre-trial or judicial proceedings, the person who filed the corresponding claim has the opportunity to obtain means of subsistence, which is often impossible to obtain in any other way, due to incapacity. Thanks to the funds received, a person will be able to continue a dignified existence, as if his breadwinner had not passed on to another world.

Second pension

Military pensioners receive their main pension from the Ministry of Internal Affairs and other structures in which they served. But after leaving office, some of them still continue to work in other jobs that do not relate to military specialties.

Then employers begin contributing funds to the pension insurance fund, which allows such citizens to receive a pension from the Pension Fund.

To receive a second pension, a military pensioner must register in the compulsory pension insurance system. In this case (if there are certain years of insurance experience), he will be able to receive two types of pension benefits.

Appointment dates and payment

10 working days are allotted for review of documents. The pension supplement for student children is assigned from the month following the month of filing the application and the full package of documents. A fixed payment in an increased amount is accrued throughout the entire period of study, but no longer than until the child turns 23 years old.

If circumstances arise that are considered a reason for termination or recalculation of payments, the recipient of the security must immediately notify the Pension Fund:

- by written notification (during a personal visit, by mail, through a representative);

- by filling out a special form in your personal account on the fund’s website.

The reasons may be:

- expulsion of a child from an educational institution;

- transfer from full-time to part-time study;

- conscription into the army as a conscript soldier.

How does the calculation work for military personnel?

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

A supplement to a military pension can be assigned in a variety of situations, including disability and loss of a breadwinner. Its size depends largely on the social pension.

Also factors influencing the amount of benefits for military personnel are:

- salary, which depends on rank;

- wage;

- various bonuses for length of service;

- salary indexation, etc.

Based on this information, we can come to the conclusion that rank, position held and time of service are very important when calculating pensions for military personnel.

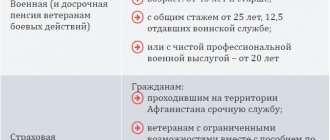

Changes in the amount of the premium occur if:

- The service life is at least 20 years. In this case, the payment will be half of the monthly allowance that the employee received for these 20 years, plus 3 percent of that number for each additional year. But this number cannot exceed 85 percent.

- Work experience is at least 25 years, and activity in the armed forces is more than 12.5 years. In this case, the pension will be 50 percent of the average monthly salary for 25 years, plus 1 percent for each additional year of service.

- An employee becomes disabled after being injured - payments will be 75 percent of the full salary.

- If a serviceman dies while performing his direct duties, then the family is entitled to 40 percent of his salary.

- If the death of a military personnel did not occur while performing combat missions, then this number will be set at 30 percent.

The resulting amount must be multiplied by the regional coefficient. This indicator depends on the region.

Who is considered a dependent?

Disability goes through several stages during a person's life:

1. The child is a dependent due to not reaching working age. Such dependency does not require confirmation and follows from family relationships.

2. In adulthood, loss of ability to work is possible, as a result of which a citizen loses the opportunity to earn his own living. Depending on the severity of the injury or illness, the inability to perform work may be temporary or permanent.

A short-term loss of ability to work (injury or illness) does not lead to disability, since health is restored in the short term. Establishing dependency in case of temporary disability has no prospects.

Also insignificant, that is, does not require judicial or other confirmation, is the establishment of dependency due to the parasitic lifestyle of a physically healthy and capable individual.

Permanent disability is characterized by the impossibility of restoring the state of health to the level necessary to perform a socially significant job duty. With a permanent loss of ability to work, a citizen is assigned a disability, which is divided into 3 groups depending on severity. It is legally justified to consider as a dependent a person with a disability of group 1 or 2, which has official confirmation in the form of a conclusion from a medical commission.

3. In old age, a person can become a dependent in the event of permanent loss of ability to work due to age-related illness or injury, as well as due to natural aging of the body.

Establishing a dependent status (Article 264 of the Code of Civil Procedure of the Russian Federation) allows an individual to acquire, change or terminate personal or property rights.

The purpose of establishing the fact of being a dependent

The procedure for establishing the fact of being a dependent is determined by the ultimate goal pursued by the disabled citizen, which may be as follows:

- Allocation of a share in inherited property and funds, or increasing its size.

- Assignment of a monthly cash benefit for the loss of a breadwinner.

- Compensation for damage due to the loss of a breadwinner.

- Mitigation of punishment when committing a criminal offense.

- Taking measures to transfer dependents, the arrested breadwinner, into care.

- Receiving social benefits provided for family members of military personnel.

- Renewal of residence permit and acquisition of citizenship.

Dependency when establishing inheritance rights

The procedure for establishing dependent status is determined by the degree of relationship of the persons applying for a share in the inherited property and funds.

A person who is related to the deceased (Part 1 of Article 1148 of the Civil Code of the Russian Federation) or who is not a relative (Part 2 of Article 1148 of the Civil Code of the Russian Federation) can be recognized as a dependent.

A dependent is a relative of the deceased

If there are family ties between the applicant for inheritance and the testator, the fact of dependency may change the order of inheritance provided for by inheritance law.

That is, if the degree of relationship does not allow one to claim priority accession to inheritance rights, establishing dependency in court allows one to include a distant relative in the list of persons of first priority inheritance.

For example, if a disabled nephew was a dependent, and the legal heirs are the wife of the deceased and his children, establishing the fact of dependence allows the nephew to claim equal shares in the property of the deceased.

In order for an applicant to be recognized as a dependent, it is necessary:

- So that the person claiming inheritance rights is officially recognized as permanently disabled (permanent loss of ability to work). The supporting document will be a certificate of disability of group I or II, issued based on the results of a medical and social examination.

- So that the duration of dependent status exceeds one year. Judicial practice has the following precedents for establishing the period of dependency:

- in a continuous count immediately before death (for example, death occurred on October 15, 2015, and the niece has been a dependent since October 1, 2014);

- in continuous calculation with an interval from the time of death (for example, three years before death, the sister of the deceased was dependent on him for one and a half years due to permanent disability);

- in cumulative terms (for example, during his life, the brother of the deceased was dependent three times for a period of four months, that is, the total duration was 1 year and 2 months).

- So that the income of the applicant for inheritance consists mainly of the maintenance allocated by the deceased. This circumstance is proven by providing certificates of income of the testator and potential dependent.

The dependent is not a relative of the deceased

In the absence of family ties, recognition of the fact that a person is dependent on the deceased allows him to be included in the list of heirs of the corresponding line. Judicial practice has a number of precedents establishing the dependent status of persons who were not legally married but lived together.

In order to claim inheritance rights in this case, you must:

- Be a disabled person of group I or II, and the date of issue of the ITU conclusion must be earlier than the date of death of the testator.

- Live together with the deceased. Evidence of this fact can include testimony from relatives, neighbors or officials (for example, representatives of social services).

- Be a dependent, that is, supported by the deceased, for more than one year. The duration of dependency is determined similarly to the case of the presence of family ties (see above).

- To be financially dependent on the deceased due to the fact that the funds allocated to him constituted the main part of the dependent’s income.

Where you might need it. Filling Features

Help needed:

- To the Pension Fund to issue a certificate.

- In the Pension Fund for registration of a survivor's pension and early retirement.

- To the place of work of the breadwinner. The employer does not have the right to dismiss if such a document is available.

- To receive an inheritance (application for the right of inheritance).

- In other cases provided by law.

Documents for receiving an old-age pension:

Filling Features

The certificate of presence of a dependent must contain the following details:

- Corner stamp of the organization that issued the certificate.

- Document's name

- Last name, first name, patronymic of the recipient of the document.

- Residence address.

Pensioners who have dependents receive an increase of 900 rubles.

- Last name, first name, patronymic of a dependent citizen.

- Grounds for issuance.

- Where is the document submitted?

- Position, surname, initials, signature of the employee who issued the certificate.

- Date of issue.

- Wet printing.

Filling example

Application to establish the fact of being a dependent

Form for certificate of presence of a dependent

Results, the document confirming the presence of a dependent will be a certificate. It will not be so easy to obtain it, so you should collect all the necessary documents for proof in advance.

How to apply?

To receive an additional payment, a pensioner must contact the local branch of the Pension Fund and submit an application. This document will serve as the basis for considering a specific case. Review of documents takes an average of five days, provided that the entire required package is provided.

The list of documents is compiled in each individual case on an individual basis after preliminary consultation with representatives of the Pension Fund.

In addition to your passport, you are required to present the following basic documents (mostly certificates):

- from housing authorities;

- local government (on family composition);

- about income;

- about studying at a university or other educational institution (required full-time!);

- birth certificates of family members.

Additionally, receipts and contracts may be required confirming payment for the educational process, or any documents to confirm other expenses (for example, receipts from pharmacies and stores, and so on).

If we are talking about additional payment in connection with caring for a sick spouse, you must provide:

- marriage certificate;

- a document from the place of residence to confirm residence in the same apartment (house);

- SNILS;

- both passports (wife and husband);

- both work books;

- a certificate recording income (only if one of the two spouses continues to work!).

The additional payment will be accrued to the spouse whose actual income is higher.

The period of maternity payments is knowledge that will never hurt and will definitely be useful to you. Pay sick leave if you are on vacation, you don’t know how to do it correctly? The link has the information you need.

How the state can help you get a decent pension, you will read in our material.