A pension is a monetary compensation that is the only source of income for some social groups. It is paid every month in case of:

- reaching a specified old age;

- permanent inability to perform vital functions;

- death of a person supporting a dependent;

- established service life of the Russian Federation.

The payment can be made by the state or by a private institution, for example, a non-state pension fund.

Cash provision for needy persons can be of several types.

Pension points

What are pension points and how are they calculated?

Everyone knows that a pension consists of two parts: insurance and funded. Pension points that determine length of service, including official salary. The size and right to insurance pension payments depend on them.

Pension points are paid for each working year. The more points accumulated before entering pension registration, the more the state will pay the pensioner. And also the size of the pension depends on the size of the salary, because the employer pays for the employee to the Pension Fund of the Russian Federation.

Labor payment

These monetary compensations are regulated by Federal Law No. 400-FZ dated December 28, 2013. Insured citizens of the Russian Federation or foreigners can apply for the benefit. After 2020, each employee has the opportunity to make a choice: invest only in an insurance pension or in an insurance + savings pension. At the same time, there is a different percentage of contributions to the company. 22% is distributed as follows:

| Insurance + savings | Insurance |

| 16% - for insurance, 6% - for savings | 16% - for insurance, 6% - for established compensation in cash |

The first option for registering a pension consists of 2 components, which have their own characteristics:

| Insurance | Cumulative |

| Replenishes the persons mentioned in the law with their earnings due to the current impossibility of carrying out work activities. | Provided to citizens born in 1967 and younger if they decide to choose this pension option |

| Calculated in points | Presented in material form |

| Formed from accruals of citizens currently working | Formed as a result of investment investments by professional managers |

| No inheritance provided | It is possible to inherit before achieving the necessary conditions for receiving |

| Paid by the Pension Fund | It is possible to obtain from the Pension Fund or any other non-governmental institution specializing in deposits |

You can choose the double accrual method for 5 liters. from the time of accrual of insurance contributions. To confirm, you need to decide on the fund that forms the savings part, and then contact the Pension Fund with an appeal.

Federal Law “On Insurance Pensions” N 400-FZ. Chapter 1, Article 4

The cost of 1 pension point in the table for 2020

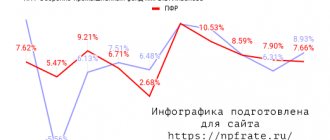

The pension score is constantly changing. This value and fixed payments are indexed annually. Therefore there is no single value to calculate. You can track changes in points since 2015 and the cost of a pension point in rubles in 2020, which will be active from January 1, in the following table:

| Year | Cost of 1 point in rubles |

| 2015 | RUB 71.41 |

| 2016 | RUB 74.27 |

| 2017 | RUB 78.58 |

| 2018 | RUB 81.49 |

| 2019 | 93,00 |

| 2020 | 93 rub. |

To calculate your pension yourself, you need to understand how to convert points into rubles. There are calculations here that the calculator calculates points for, or you can calculate it yourself.

How to convert points to rubles

To convert points into rubles, you just need to perform one simple step. You need to multiply the points by the cost of one. This will give you the amount of insurance pension payments. To understand the formula, let's use an example.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

The teacher earned 20 thousand rubles a month. Over the entire period of work, he accumulated 110 points . It is impossible to calculate the size of the pension in advance, because the price of one point changes annually. Suppose that in our example the man will retire in 2020, the cost of 1 pension point this year was 87 rubles 24 kopecks. So you need to calculate: 110 x 87.24 = 9,596.4 rubles .

If we add fixed old-age payments to this, we get 14,930.59 rubles.

Maximum number of pension points in 2020

The more points you earn, the greater the pension the state will pay. To calculate the number of points you can use the formula:

IPK = (IPKs + IPKn) x KvSP

Where:

- IPC is an individual pension coefficient, that is, how many points a pensioner has, starting from the date of receipt of the insurance portion of payments.

- IPKs – the number of points calculated from January 1, 2015.

- IPKn – points that are accrued starting from January 1, 2020 from the time when the pensioner began receiving insurance pension payments.

- KvSP is an increasing coefficient when the insurance pension increases, for example, upon the death of the breadwinner.

What determines the size of the pension?

When formulating pension payments, the following factors are taken into account:

- work experience;

- valorization amount;

- estimated pension capital;

- the amount of insurance contribution by the employer.

You can add points to the amount of work experience that depend on this value. By law, the pension amount is calculated by multiplying the number of points by the price of one and adding other values (increasing factor, fixed payments).

Until 2020, pension amounts were calculated as follows: the insurance portion was divided by the cost of the point.

How many points do you need to retire?

To receive pension insurance payments, you must meet one more rule. Legislation for 2020 established a requirement for a minimum insurance period of 10 years .

There are also requirements for points - the minimum number is 16,2.

Payment of the savings portion

The savings part is issued in 3 ways:

- One time . Persons whose accumulative payment is 5% or less of the labor amount can receive it.

- Urgently . Produced for a period of at least 10 liters. for citizens participating in the state project. financing and paying additional contributions to this type of pension, as well as for persons who are owners of family capital, used to form the accumulation of future benefits.

- Indefinitely . The appointment occurs if there are necessary requirements for payment of the age-related subsidy and with savings of 5% per month of the entire amount of labor compensation.

If you want to know the calculation of perpetual funded pension payments, you can follow the link to our article with a calculation calculator by clicking here.

Cumulative compensation can be calculated using the formula:

NK = OH / P , where NK is the accumulative part, OH is the total accumulation, P is the survival period.

| Year | Expected period |

| 2019 | 21 |

| 2018 | 20.5 l. |

| 2017 | 20 l. |

| 2016 | 19.5 l. |

Cumulative compensation calculator

Go to calculations

You can find out more detailed information about the savings part, as well as terms, payments and amounts, from our new article.

Accrual of pension points for individual entrepreneurs

An individual entrepreneur pays insurance to the Pension Fund, so he can also receive a labor pension. To obtain it you must meet the following requirements:

- Reach retirement age. As of 2019, the retirement age for men is 60.5 years, and for women 55.5. But every year it increases, in 2028 it will be fixed at 60 years for women and 65 years for men.

- Insurance experience . This value refers to the period of insurance payments to the Pension Fund. Individual entrepreneurs pay it themselves, while their employer pays for ordinary workers. In 2020, the insurance period must be at least 10. But it increases every year, and in 2024 it will be 15 years.

- Minimum number of points. In 2020, this figure is 16.2 points. In 2025 it will increase to 30 points.

What should be the coefficient for calculating a pension?

You have already learned that the minimum IPC for calculating a pension must be at least 16.2 points in 2020. In the following table you can track the change in this criterion since 2020 and find out how it will increase:

| Year | Minimum IPC required |

| 2015 | 6,6 |

| 2016 | 9 |

| 2017 | 11,4 |

| 2018 | 13,8 |

| 2019 | 16,2 |

| 2020 | 18,6 |

| 2021 | 21 |

| 2022 | 23,4 |

| 2023 | 25,8 |

| 2024 | 22,4 |

| 2025 | 30 |

Which IPC is the highest?

The maximum number of pension points in 2020 , as we have already discussed, is 9.13 per year. You can also consider the following scheme for changing this value from 2020, which comply with Russian legislation when forming the insurance part:

| Year | IPC value |

| 2015 | 7,39 |

| 2016 | 7,83 |

| 2017 | 8,26 |

| 2018 | 8,70 |

| 2019 | 9,13 |

| 2020 | 9,57 |

| 2021 and next years | 10,00 |

The amount of the IPC depends on the investments that the citizen or his employer regularly deducted from wages to the fund. The IPC coefficient increases depending on work experience. For example, if a person wants to retire after 5 years of eligibility, he will increase his IPC by 1.45 times.

Receiving insurance compensation

The second option is only an insurance subsidy, issued according to:

- death of the breadwinner;

- establishing disability and, as a result, incapacity for work;

- old age specified by law.

Receiving insurance compensation

Moreover, in any of the listed situations, the person must have worked at least a day before submitting an application for receiving the pension amount.

In the first situation, dependents are relatives:

- not older than 18 years old. or from 60/65 l. (depending on age);

- with children under 14 years old;

- those undergoing full-time education who are not older than 23 years old;

- disabled people of any age who were supported.

They have the right to receive monthly compensation upon provision to the Pension Fund of the Russian Federation:

- passports;

- a document confirming the death of the person holding them;

- necessary information about family ties;

- extracts from the breadwinner's work.

You can apply for monthly compensation at one of the Pension Fund branches

Payment is provided within 10 days. from the date of filing, but only if the necessary documents were provided no later than one year from the death.

An increase is added to the insurance pension - a cash benefit. For dependents left without support, it is 2667.10 rubles. for everyone (full orphans - 5334.19 rubles).

If a special medical commission assigns a disabled group, such a person also has the right to receive an insurance subsidy. In this case, the condition must be met that the injury was not caused intentionally.

The monetary increase for each disability group is:

| Disability | 2019 |

| 1 gr. (inability to talk, walk, care for oneself, disorientation) | RUB 3,782.94 |

| 2 gr. (ability for self-care, movement, communication, but inability to learn and carry out work activities) | 2701.62 rub. |

| 3 gr. (movement, communication, doing work, but with more time) | 2162.67 rub. |

| Disabled children (inability to live independently acquired before adolescence) | 2701.62 rub. |

The amount of the single benefit includes the NSO (complexity of social services). If a person does not want to use this type of assistance, it is exchanged for compensation in material form. In 2020 it is equal to 1121.42 rubles.

In case of assignment to a disabled group, a person has the right to receive an insurance subsidy

For old age payments, the following points must also be met: age must be at least 60 years old. (women) and 65 l. (men).

Due to the pension reform in 2020, the opportunity to work was increased by 5 years. In this case, the age increase is carried out sequentially according to the following scheme:

| Time | Men | Women |

| 2019 | 60 l. + 1 year | 55 l. + 1 year |

| 2020 | 60 l. + 2 g. | 55 l. + 2 g. |

| 2021 | 60 l. + 3 g. | 55 l. + 3 g. |

| 2022 | 60 l. + 4 g. | 55 l. + 4 g. |

| 2023 | 60 l. + 5 l. | 55 l. + 5 l. |

At the same time, the retirement age for female civil servants has been increased in the same way in stages to 63 years. For men in civil service, the period is equal to the above - 65 years. If such persons have an accumulated experience of 42 years (men) and 37 years. (women) payment can be issued earlier than the specified age for 2 years.

- working experience more than 15 years. Similar to increasing the age category, the increase is 1 year for every 1 year (in 2020 - 10 years);

- Pension points must be equal to a certain minimum value established in the selected year.

The retirement age for female civil servants has been increased in stages

Features of calculating pensions in 2024

Every year the legislation puts forward new requirements and rules. Pension laws are changing completely. Even the formula for calculating points, as mentioned above, has completely changed. In 2014, in order to receive the insurance portion upon retirement, you must have at least 15 years of work experience.

To understand the speed of change, we suggest that you familiarize yourself with the data in the table, which shows the year of the pension reform and the length of service in years:

| Year of reform | Number of years of experience |

| 2015 | 6 |

| 2016 | 7 |

| 2017 | 8 |

| 2018 | 9 |

| 2019 | 10 |

| 2020 | 11 |

| 2021 | 12 |

| 2022 | 13 |

| 2023 | 14 |

| 2024 | 15 |

This table was taken from the website of the Pension Fund of the Russian Federation; on it you can see that every year from January 1, the work experience requirements increase by 1 year.

As of 2024, the minimum IPC for retirement should be 28.2, and the maximum 10 points per year. Men born in 1966 will be able to retire in 2024 at the age of 58 , and women born in 1971 at the age of 53 .

FAQ

The pension system is so unpredictable and very complex, so you have to rack your brain to search the entire Internet and find the answer. If you have any question, you do not have to re-read the entire article, but only those subheadings that interest you. They contain the answer to the question that is in the title of the subtitle. Below are some of the most common questions and their answers.

What are E-points from the Pension Fund?

Recently, there have been rumors circulating online about so-called E-points that will replace real money in retirement. Some say this is a new government bill that was presented at a recent presentation. In any case, this information was not published on the website of the Russian Pension Fund, which refutes the rumors.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Most users on the network were not happy about this information and began to spread rumors. Therefore, such information is, in fact, not true. Although innovations have been introduced recently, such a system may be invented in the future.

What to do if you don’t have enough pension points to retire?

If a citizen does not have enough pension points to retire, he can buy more. You need to conclude an agreement with the Pension Fund of the Russian Federation and transfer money according to the agreement. You can purchase additional insurance experience at any time. You will need this feature:

- pensioners working abroad;

- self-employed, individual entrepreneur;

- temporarily residing in Russia;

The service may also be needed by an ordinary person who lives in Russia. For example, to save for old age or to pay for a friend if the employer does not pay for him.

Is it possible to buy pension points?

As we saw above, there is such a possibility. To calculate the cost of 1 working year for work experience, you need to use the following new formula: minimum wage × 22% × 12. The minimum wage in 2020 is 11,280 rubles. If you do the math, one year will cost 70,390 rubles. In Russia, the average pension is 13 thousand, that is, a purchased year of experience will pay for itself in six months of receiving a pension.

Previously, the following formula was used : minimum wage × 2 × 26% × 12 . When calculating, the amount obtained was twice as large as that established by the cost of work experience now.

Child care points

During the period when a parent is caring for a small child, pension points are also accrued. For caring for a child under one and a half years old, 1.8 points are awarded, for the second child - 3.6, for the third and fourth - 5.4. The total time of care should not be more than 6 years.

Peculiarities of accrual of pension points during the Soviet period

The period of military service in Soviet times is divided into several groups:

- before 1991 (Soviet);

- from 1991 to 2001 (post-Soviet);

- from 2002 to 2014 (before the introduction of the point system);

- from 2015 to today (the period after the introduction of the points program).

Citizens who have served in the military can receive 1.8 points.

Important! To receive points for these periods, you must provide evidence. Unfortunately, many papers become unusable, so you need to use a work book. If the period of military service is not indicated there, it will not be possible to restore the data.

How much is 30 points for a pension?

To convert points into rubles we will use the formula mentioned above. You need to take data from the table of the cost of a point in 2020 - 93.00. Now you can calculate: 30 x 93.00 = cost of 30 points in rubles .

State compensation

Intended for persons who have distinguished themselves before the state and have a certain work experience. According to Federal Law No. 166-FZ dated December 15, 2001, both citizens of the Russian Federation and foreigners who have a permanent place of residence here have the right to it:

- victims of an accident resulting from an industrial error or radiation disaster;

- participants of the Second World War, as well as residents of Leningrad, which was blocked during the Second World War;

- persons performing military service;

- pilots flying into space, as well as flight crew of the test team with 20 years of experience. (women) and 25 l. (men);

- persons who, according to a medical certificate, are not capable of working;

- civil servants upon reaching 15 years of age at their place of work.

The size of this payment depends on the reason for receipt, and then on the social subsidy or allowance paid. For example, a citizen with a 1st group disability who became incapacitated due to a combat injury during military service receives 300% of the social pension, and an astronaut with 1st degree of disability acquired during a flight or performing a work assignment receives 85% of the allowance.

The amount of state compensation payment depends on the reason for receiving the disability group

So, a pension is a payment received every month by a person entitled to it by law. In Russia, the system of pension subsidies includes labor, social and state. In the first case, the possible amount is calculated depending on the choice made by the working citizen himself: receiving insurance or insurance and funded compensation. Cumulative is calculated according to the principle that existed before 2020, that is, in material equivalent. Insurance is calculated in points, which directly depend on the person’s own earnings for each year.

There are several cases in which the coefficient is added for non-working time: for example, for caring for 1 child under 1.5 years old. You should also pay attention to the minimum points required to receive a pension benefit: without it, you must continue to work after reaching the age of 65 years. for men and 60 l. for women. As you continue to work, the percentage when calculating future compensation also increases.

There are several cases in which the coefficient is added for non-working time, for example, caring for 1 child under 1.5 years old

To determine the size of the pension, a certain coefficient is used every year: in 2020 it is 87.24 rubles. Due to the presence of work experience before 2020 or before 2002, you should use the necessary formulas to convert the accumulated pension benefits into points.

People who do not have work experience or have not accumulated the personal coefficient necessary for labor payments can apply for social benefits, but under certain conditions: their age must be at least 70 years. (men) and 65 l. (women). Also, this subsidy can be applied for by disabled people, residents of the North and dependents who have lost their breadwinner. Government compensation is intended for persons who are injured or ill during service or work of public importance.