Transfer of pension to a non-state pension fund

To transfer your pension to a private pension fund, you must first decide who you are willing to entrust your savings to. First of all, you need to consider several funds to determine their pros and cons and make a choice in favor of one of them.

Criteria by which you need to choose an organization:

- Profitability . Each pension fund invests savings in certain assets: stocks, metals, and so on. How savings in the fund grow, and whether the return exceeds inflation, can be found out from the reports of the Bank of Russia.

- Reliability . This criterion is formed from two factors: the direction of investment and the operating time of the non-state pension fund. The longer an organization exists, the more reliable it is. Also, you should not transfer savings to funds that invest in unreliable assets (digital currencies, oil).

- Reputation . On independent resources you can find reviews of all non-state pension funds. Based on their ratio, you can draw certain conclusions about the fund’s performance and decide whether you are ready to transfer your pension savings there.

There are two options for transferring to a non-state pension fund:

- Urgent : after the end of the calendar year, another 4 years pass, only then the savings are transferred from the Pension Fund.

- Early : savings are transferred before March of the next calendar year, while the insured person loses part of the investment income.

Attention! From 2020, you can transfer to a non-state pension fund only by contacting the Pension Fund in person or through State Services. To transfer, you must submit an application before December 1 of the current year, while the right to withdraw it and refuse to transfer savings is retained until December 31.

Is there a pension savings program currently running?

Until 2005, of the 22% allocated by the employer from the employee’s wage fund, 6% was intended for the formation of savings. After the law on insurance pensions came into force in 2015, the entire amount of contributions is allocated to the formation of the insurance part. Currently, the formation of savings is possible with additional voluntary contributions from citizens or using maternity capital funds.

The program worked for citizens born after 1967. They had the right to choose: the savings and insurance parts are formed or all deductions go to the insurance part.

The employer contributed 6% of the salary to the funded part of the pension

Today, all employer insurance payments are directed to the insurance portion. A citizen, at his own request, can entrust the management of funds to one of the organizations:

- A management company that is selected by the Pension Fund through a competition and enters into an agreement with the Pension Fund. The company carries out trust management of citizens' pension savings.

- A licensed non-state pension fund. There are more than 100 officially authorized funds.

Selecting a company can be done annually, but moving funds frequently may result in loss of investment returns. At the same time, the Pension Fund sends a report on the state of finances annually, and the Non-State Pension Fund with any chosen frequency.

It is allowed to change NPF once a year

Is it worth translating?

The question of the advisability of transferring to a non-state pension fund is acute for those who are thinking about transferring savings to a non-state pension fund. You can decide whether to switch by weighing all the pros and cons. In addition to transferring your pension to a private pension organization, there are two more options:

- Formation of a second pension in the NPF . An agreement is concluded, the insured person contributes funds at will and forms his future “second pension”, while the fund ensures their safety through investment.

- Transfer only the funded pension to the NPF . If you have some amount in the Pension Fund aimed at forming the funded part of your pension, you can transfer it to a non-state pension fund and continue investing. At the same time, you don’t have to switch completely to a private fund.

On the one hand, the state fund seems safer to us. But if you look at it, insurance and investment of funds occurs in both public and private funds according to the same system. That is, the degree of protection of funds is approximately the same.

In addition, NPFs are not registered just like that: they are subject to very serious requirements, and after registration they are controlled by government agencies and periodically provide reports.

In addition, private pension funds have their own advantages :

- the ability to independently form a future pension and determine the amount of contributions paid;

- protection from reforms by the state;

- the ability to inherit savings, which is very important, because the Pension Fund does not provide such a right.

Is it profitable to accumulate a pension in a non-state pension fund?

The advantages of transferring savings to non-state funds include:

- Obtaining additional income from the investment activities of the fund.

- Compensation for losses by the fund upon receipt of income below the inflation rate of the current financial year.

- Flexibility of the fund's investment programs based on changes in the current market situation.

- Possibility to receive a pension without limiting its amount. Today, the maximum payment from the Pension Fund has been set at 40% of the average wage of Russians. When calculating pension benefits from a commercial fund, this restriction does not apply.

Relative disadvantages include instability of investment income; it is difficult to predict the performance of the fund’s investments.

The 2014 reform tightened the requirements for non-state pension funds, so over the subsequent years larger and more reliable companies remained on the market. This made it possible to reduce the risks of the insured in terms of loss of income if the company’s license was revoked or it went bankrupt.

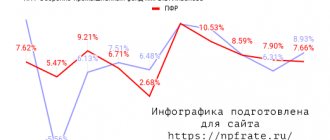

When choosing a company that manages savings, it is important to consider that the profitability of the Pension Fund is about 5% per annum, while the Non-State Pension Fund provides an increase of up to 10% annually.

Currently, all transfers from wages go only to the insurance part

Disadvantages of NPF

Naturally, non-state funds also have disadvantages:

- It is often not possible to withdraw funds early. NPFs usually provide the opportunity for early withdrawal of savings only in exceptional cases: death of the insured person (withdrawal by heirs), transfer to a state pension fund.

- Only national currency. Private pension funds of the Russian Federation can only store funds in Russian currency. This is a significant disadvantage for those who do not trust the ruble and prefer to ensure the safety of their savings by converting them into international currencies.

- There is no guarantee of profitability. The profitability of savings in NPFs is not guaranteed, so there is a possibility of losing part of your savings due to inflation, crisis, and so on.

- Commissions. Private pension funds charge fees for managing depositor funds. Sometimes they can be extremely disadvantageous for future retirees.

- Inability to influence investment directions. Non-state pension funds independently form an investment portfolio and choose investment directions. The investor can only either agree to the terms and transfer savings, or refuse and choose another fund.

How to return the funded part of your pension to the Pension Fund

To return to the service of the Pension Fund from a non-state pension fund, you need to fill out an application to a government agency. It is submitted by the pensioner personally to the nearest branch. You need to take your passport and SNILS with you. The application to the Pension Fund is drawn up approximately as described above. Fund employees will advise you on all actions.

You can view the list and contacts of all PFR branches in the territory on the official PFR resource. There you can take the manager's phone number to get advice.

How to transfer from the Pension Fund to the Non-State Pension Fund: transition procedure

To transfer to a non-state pension fund, you need to take several steps.

Firstly, enter into an agreement with the selected fund.

It is concluded in accordance with the provisions of No. 75-FZ and contains the following information:

- NPF name.

- Full name of the insured person.

- Subject of the agreement (what actions the organization will take with savings).

- Number in the personalized accounting system.

- Basic rights and obligations of the parties, conditions for termination of the contract.

- Procedure and conditions for making contributions and paying pensions.

Secondly, you must submit a corresponding application to the Pension Fund. This can be done by personally visiting the territorial office, or through the State Services portal.

Thirdly, you need to wait for the decision of the Pension Fund on the application. The Pension Fund is obliged to consider it before March 1 of the next year (in case of early transfer). And within 30 days, if a positive decision is made, the savings will be transferred to the NPF.

They may refuse in the following cases:

- the procedure for completing or submitting an application has been violated;

- The NPF specified in the application has been deprived of its license.

When deciding to refuse, the Pension Fund sends a corresponding notification.

Stayed with their own

When choosing a pension fund for transferring savings, you need to evaluate its profitability for five years, and not for a year. Photo: iStock

Starting this year, applications for the transfer of savings under compulsory pension insurance (OPI) are accepted only until November 30 inclusive, and only through the government services portal (with a confirmed account and qualified electronic signature) or Pension Fund branches. The ability to change insurers under compulsory insurance coverage was limited in order to protect people from losing income accrued through savings during an early transition (more often than once every five years between the dates of income fixation). NPF agents—banks and pension brokers—attracted clients, primarily “silent ones” (those who had never changed insurers while remaining in the Pension Fund), with high returns, keeping silent about the loss of already accumulated income since the last fixing. The funds were pushed to aggressively attract clients by the freeze on the formation of pension savings.

In just the last five years, citizens have lost more than 100 billion rubles in this way. This year, “silent people” risk losing investment income for a maximum period (four years). But now, in addition to complicating the transition, the client must be warned about losses, and throughout December there is a “cooling off period” when they can declare their refusal to change insurers.

Over the past three years, there has been a clear trend toward a significant reduction in the number of applications to change insurers. If in 2016 about 12 million such applications were submitted, then in 2017 this number decreased by almost half, and in 2020 - to 2 million applications (while only 1.6 million applications were satisfied). This year, the number of applications will be reduced to 300-500 thousand (that is, approximately another 4-6 times compared to 2020), the National Association of Non-State Pension Funds (SRO NAPF) predicts. At the same time, the transitional traffic of clients between non-state pension funds is most noticeably reduced, while the number of returns of insured persons from non-state funds to the Pension Fund of the Russian Federation remains stable from year to year - around 70-80 thousand, as noted by the National Pension Fund.

According to the forecast of the President of the Association of Non-State Pension Funds (ANPF) Sergei Belyakov, the reduction will be even more radical, and the number of applications will not exceed 150 thousand. “This corresponds to the position of the majority of market participants on the need to refuse incentives for citizens to make early transitions as the main tool for attracting customers,” he says.

However, Belyakov sees the risk of a multiple increase in applications for transitions at the last moment of the 2020 campaign. This will lead to large losses for citizens and will indicate the dishonest behavior of players who are aware of the attentive attitude of the regulator, but hold back on completing applications, while other market participants have actually refused to make early transitions, says Belyakov. “We hope that this will not happen, and the interests of developing the entire market, as well as building the trust of citizens, will prevail over the interests of attracting customers in any way,” concludes Belyakov.

The record low results of the transition campaigns in 2020 (+40.4 billion rubles) and even more so in 2020 protected citizens from losses, but lead to stagnation of the market, since it has no new sources of growth - the formation of savings has been frozen, and the introduction of a guaranteed pension product (alternatives) savings within the framework of compulsory pension insurance) is planned only for 2021. Therefore, the dynamics of NPF assets still depends on profitability indicators. They are influenced by favorable market conditions: since the beginning of the year, the pension savings market index (balanced, RUPMI) has grown by almost 13%. Thus, at the end of 2020, the weighted average return on pension savings may well exceed 10%, predicts Artem Afonin, junior director for insurance and investment ratings. At the end of 2020 (in the absence of significant external shocks), the weighted average return on pension savings will be in the range of 7-8%, he believes. Since the impact of the 2020 transition campaign on market growth will be minimal, at the end of 2020 the volume of NPF assets, according to Expert RA estimates, will increase 6-7% and amount to about 4.7 trillion rubles (at the end of 2020 - 4.4 trillion rubles, or +9%).

The number of statements from “silent people” will increase in 2020, when, when transferring savings, they will retain all investment income

Next year we can expect a relative increase in the number of transitions of “silent” people to non-state pension funds. The fact is that 2020 is the last year of that same 5-year interval between fixings for the “silent people”. That is, by submitting an application to transfer from the Pension Fund to the Non-State Pension Fund from January 1 to November 30, 2020, the “silent” during the transition in 2021 will retain all of their investment income accumulated over 5 years, the National Pension Fund notes.

As for transfers between non-state pension funds and from non-state funds to the Pension Fund of Russia, their number next year will either be close to the values of 2020, or, in the event of a “freezing” of early transfers (it is being discussed by the Ministry of Finance and the Bank of Russia), will be reduced to absolute minimums, they believe in NAPF.

The ANPF also notes that if early transfers are frozen, there is a high probability of a complete suspension of the transition campaign next year, with the exception of a small proportion of insured persons who have chosen the Pension Fund of Russia as their pension insurer (transfer of savings from the APF to the Pension Fund).

Which NPF to choose

In order to select a specific non-state pension fund, it is necessary to collect information about organizations existing on the market. Let's look at a brief description of some of them.

- "Surgutneftegaz". The fund began its work in 1995. The return on investment is, according to 2020 data, 13% per annum (one of the highest). By 2020, NPF "Surgutneftegas" has about 95,000 clients, of which a third are already receiving pensions.

- "Opening" . The return on savings is almost 12% per annum. As of 2020, about 60,000 people receive pensions. The fund has not been operating for long, but has managed to establish itself as reliable and successful.

- "Agreement". NPF Soglasie began its activities in 1994. In 2020, the return on savings was 10% per annum.

- NPF Sberbank. Sberbank NPF serves pension savings for more than 7 million clients. Yield for 2020 is 9.89% per annum. More than 100,000 people will receive a pension in 2020.

- "Transneft". In terms of the volume of pension reserves, the fund is the third in the Russian Federation, and in terms of profitability it is in 11th place (10.85% per annum).

- "Volga-Capital". NPF with high yield (11.37% per annum), began operation in 2007.

- National NPF. The fund with a return on savings of 10.83% has been operating since 2007. As of 2020, the number of clients reached 400,000 people.

- "Hephaestus." It has been operating since 1993 and has the highest yield (15.33% per annum) due to large shareholders and proper investment of funds: the company invests in securities of Gazprom, as well as other industrial, OMK JSC).

- "Welfare". Also a fairly old organization, it has a good reputation and a high return on investment (11.68% per annum). The Blagosostoyanie pension fund has been operating since 1996.

- "Evolution". Extensive work experience, high profitability (11.64% per annum) and good reviews - this organization meets all these criteria. NPF Evolution opened in 1999.

If you want to switch from the Pension Fund to a private pension fund, it is better to give preference to one of those listed in the rating above. In this case, it is necessary to take into account reviews, evaluate the investment portfolio and the quality of customer service.

Is it possible to transfer savings?

The funded pension consists of investments from the employer in the amount of six percent of the salary each month. Regulation of the procedure and management of money is coordinated according to Federal Law No. 424 “On funded pensions”.

In this regard, citizens have the right to manage their funds - to invest in non-state structures that have licenses for the right to apply for pension benefits. A transfer can be carried out both from a Russian pension fund to a non-state one, and it is possible to change one non-state pension fund to another or return cash savings back to the control of the state.

On a note. In 2014, the accumulated part was “frozen”, but management of this amount was retained. The transfer of money can be urgent or early.

From a non-state pension fund to the Pension Fund of Russia

It is necessary to write a statement about the validity of the transfer. To do this, you need to personally contact the PF service at your place of residence or send an application with copies of documents through the post office or courier service.

To another NPF

To make contributions to a non-state pension fund, you will first need to contact the local Pension Fund department at your place of residence and write an application for the transfer of funds from the funded part to the Non-State Pension Fund. The application can also be sent by mail or delivery service. All documents will need to be certified by a notary.

Read more about what the funded part of a pension is and whether it is necessary to send it to a non-state pension fund.